-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: Equities Regain Poise As Taiwan Steps In, U.S. CPI On Deck

- Light risk-on flows took hold in the FX space as the Asia-Pac session progressed, with the regional equity space supported by Taiwan's announcement that it will activate its stock stabilisation fund. The lack of new COVID-19 cases outside of quarantine facilities in Shanghai may have also helped prop up market sentiment.

- U.S. Tsys coiled ahead of the impending U.S. CPI print.

- Other points of note today include a rate decision from Canada's central bank, final German & French CPIs, as well as comments from Fed's Waller, ECB's Centeno & BoC's Macklem.

MNI US CPI Preview: Core Inflation Seen Easing, Just A Bit

EXECUTIVE SUMMARY

- Consensus has headline CPI inflation rising +1.1% M/M in June after an equally rampant +1.0% M/M as energy accelerated even further on a large rise in gasoline as well electricity price increases.

- Core inflation is seen dipping to a ‘large’ +0.5% M/M (av. 0.54% M/M) after surprisingly accelerating from 0.57% to 0.63% in May for the strongest since Jun’21.

- The report comes with a 75bp hike on Jul 27 seen as locked in and would likely require a very large surprise to change this. However, as in the approach to last week’s strong payrolls, large market moves have opened sizeable two-sided risk to expectations for both the Sep FOMC and meetings further out.

- PLEASE FIND THE FULL NOTE HERE:USCPIPrevJul2022.pdf

US TSYS: No Conviction Ahead Of CPI, Options Flow Noted

TYU2 trades just above the middle of its 0-10+ Asia-Pac range heading into London hours, -0-01+ at 118-19+, on sub-par volume of 75K. Cash Tsys run -/+0.5bp across the curve, with very modest twist steepening in play.

- Tsys meandered through Asia-Pac dealing, lacking anything in the way of meaningful conviction ahead of Wednesday’s CPI report.

- An uptick in equities reversed the early carry over bid in Tsys (which spilled over from Tuesday’s light richening), before the space regained some poise to trade away from cheaps.

- There hasn’t been much in the way of wider macro headline flow to digest, with the RBNZ & BoK delivering the widely expected 50bp rate hikes, while Shanghai noted that there were no new cases of COVID discovered outside of quarantine.

- Market flow provided the focal point with 4x block buys of the FV 112.75 calls lodged throughout the session (4x +5.0K blocks), with a block buyer of TYU2 futures (+1.3K) also observed.

- The aforementioned CPI print headlines domestic matters on Wednesday (see our full preview of that release here), with 30-Year Tsy supply also due (hot on the heels of Tuesday’s poorly received 10-Year auction). The latest BoC monetary policy decision will provide some interest across the border.

- A quick reminder that a falsified “leak” of the CPI print did the rounds on social media late yesterday (indicating a headline print above +10% Y/Y), with the Labour Department subsequently acknowledging the existence of the tweet and stressing that it was a fake.

JGBS: Firmer & Flatter

JGB futures nudged higher at the Tokyo re-open, as local participants reacted to Tuesday’s richening in wider core global FI markets, before the contract eased back towards late overnight session levels, hugging a tight range, last +11.

- Cash JGBs sit little changed to ~4bp richer across the curve, with super long end demand evident (domestic life insurers may be at work further out the curve) during the Tokyo morning, allowing a bull flattening theme to develop.

- BoJ Rinban operations revealed a downtick in the offer/cover ratios covering 1- to 3-, 5- to 10- & 25+-Year paper, which probably provided some incremental support to the space during the Tokyo afternoon.

- Note that the richening in JGBs came even as swap rates moved higher, pulling swap spreads wider from both sides of the equation.

- Looking ahead, 20-Year JGB supply headlines Thursday’s local docket.

AUSSIE BONDS: Limited By Impending Event Risk

Futures coiled through Sydney trade, with participants lacking anything in the way of meaningful conviction.

- Across the Tasman, the latest RBNZ decision saw the Bank deliver the widely expected 50bp rate hike (see earlier bullets for more details/colour on the matter), although there wasn’t anything much in the way of surprises when it came to the tone of the accompanying statement, leaving participants with little to trade off as we work towards the U.S. CPI print. YM deals +1.5, with XM +3.5 at typing. A similar degree of bull flattening has been observed on the wider cash ACGB curve, with the 7- to 12-Year zone providing the firmest point on the curve. EFPs have narrowed for a second day. The IR strip runs 1-6bp firmer through the reds, bull steepening.

- The latest ACGB Nov-32 auction was digested smoothly, with the weighted average yield pricing 0.73bp through prevailing mids, while the cover ratio topped the 2.50x mark, just. As we noted in our preview, prevailing market conditions meant that a solid auction was likely, although the cover ratio was likely limited by the proximity to the impending U.S. CPI print (and perhaps even the RBNZ decision), in addition to a continued lack of meaningful foreign demand.

- Looking ahead, the aforementioned U.S. CPI release provides the immediate headline risk event, while Thursday will see the release of the monthly Australian labour market report.

FOREX: Yen Loses Shine Amid Better Risk Backdrop, Kiwi Slips Post-RBNZ

Light risk-on flows took hold as the Asia-Pac session progressed, with the regional equity space supported by Taiwan's announcement that it will activate its stock stabilisation fund. The lack of new COVID-19 cases outside of quarantine facilities in Shanghai may have also helped prop up market sentiment.

- The kiwi dollar underperformed the likes of AUD and CAD which capitalised on risk-on impetus, as participants parsed the RBNZ's monetary policy review. The Reserve Bank delivered a widely expected 50bp rate rise but signalled marginally deeper concern about economic headwinds and said it was comfortable with the current OCR forecast, with NZ 2-Year swaps ticking lower as a result.

- Spot USD/JPY turned bid over the Tokyo fix, running as high as to Y137.25 before trimming gains. The yen remains the worst G10 performer, with U.S./Japan 10-Year yield spread widening a tad.

- The greenback lost its initial allure, even as U.S. Tsys cheapened across the curve. That said, the dollar index (BBDXY) sits within touching distance from two-year highs, while EUR/USD oscillates ~35 pips above parity, as focus turns to U.S. CPI data, due for release in NY hours.

- Other points of note today include a rate decision from Canada's central bank, final German & French CPIs, as well as comments from Fed's Waller, ECB's Centeno & BoC's Macklem.

FX OPTIONS: Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0195-00(E1.0bln)

- GBP/USD: $1.2035(Gbp1.2bln)

- USD/JPY: Y134.40-55($1.1bln), Y136.00($830mln)

- EUR/JPY: Y137.00(E936mln), Y138.00(E641mln), Y139.00(E823mln)

- NZD/USD: $0.6180(N$794mln)

- USD/CAD: C$1.3000($1.6bln)

- USD/CNY: Cny6.7500($615mln)

MNI BoC Preview, Jul'22: Eyeing A "More Forceful" 75bp Hike

EXECUTIVE SUMMARY

- The Bank of Canada is widely expected to hike its overnight rate 75bps to 2.25% on Wednesday in precedent set by the Fed last month as it again ramps up the pace of rate hikes.

- The statement and following Monetary Policy Report press conference are expected to continue the hawkish language from June when it first opened the option of acting “more forcefully”.

- However, with a 75bp hike more than fully priced and with some analysts not ruling out a 100bp hike, the Bank will have to be particularly hawkish to satisfy markets, focusing more on rampant increases in inflation, high measures of surveyed inflation expectations and household balance sheet resilience to hikes and less so on slowing economic growth and the rolling over in housing market activity in particular.

- PLEASE FIND THE FULL NOTE HERE:BOCPreviewJul2022.pdf

ASIA FX: Modest Appreciation As Equity Sentiment Stabilizes

Most of Asian FX is higher, in line with firmer equities. Outside of KRW though, moves have been modest. INR is still struggling to rebound and remains close to record lows.

- CNH: The bounce in USD/CNH above 6.7400 in early trade was faded by the market. We had a slightly stronger than expected CNY fixing, while June export growth was reportedly stronger than expected in CNY terms according to Bloomberg calculations (US$ estimates still haven't printed though). We got to the low 6.7200 region before support kicked in. A headline that a US warship had entered China waters helped push the pair higher, although there wasn't much follow through. The US Navy stated the ship in question obeyed international law. China equities are higher.

- KRW: The BoK hiked by 50bps to 2.25%, as expected. More hikes are expected, with tackling inflation the critical goal for the central bank. USD/KRW didn't react a great deal. The Kospi has traded firmer today, up 0.7%, aided by positive spill over from Taiwan markets. USD/KRW got to the low 1302 level, but we have edged back to 1304 now.

- TWD: Taiwan stocks have surged +2.85%. The National Financial Stabilization Fund received authorization to support local equities at the conclusion of a meeting yesterday. This is the first time such support has been enacted since the pandemic in 2020. USD/TWD is slightly lower at just under 29.88.

- INR: Spot USD/INR tried to push lower in early trade but has since rebounded back above 79.60. Onshore bond yields are down slightly, the 10yr just below 7.37%. Yesterday CPI for June printed slightly weaker than expected at 7.01%, versus 7.10% expected. IP growth was +19.6%, versus forecasts of +20.8%.

- IDR: Spot USD/IDR operates within a range that has defined the scope of price action during the last week or so. Spot remains just below 14990, while the 1 month NDF has edged back above 15000 from earlier lows. Indonesia's 5-Year CDS (one of the rupiah vulnerability indicators monitored by Bank Indonesia) keeps widening, reaching a new cyclical high of nearly 158bp today.

- PHP: Spot USD/PHP hit a new cycle high on Tuesday, as the Philippines reported a record trade deficit. The pair eased off this morning and is now trading slightly firmer at PHP56.35. Next resistance is at PHP56.500, an all-time high printed in 2004. The Philippines detected 60 new cases of Omicron subvariant BA.5 between Jul 7 and 11 but the Dept of Health said the situation remains under control.

EQUITIES: Intervention In Taiwan Stocks Helps Stabilise Asia-Pac Equities

A rally in Taiwan equities, after the country confirmed that it will deploy its stock stabilisation fund after hours on Tuesday, coupled with the Chinese city of Shanghai finding 0 COVID cases outside of quarantine helped stabilise wider equity markets in Asia-Pac dealing, with focus squarely on the impending U.S. CPI report. The major regional equity benchmarks sit little changed to 0.5% firmer on the day, with e-minis running 0.1-0.2% above settlement levels. The TAIEX is the best part of 3% higher on the day, albeit operating off of best levels.

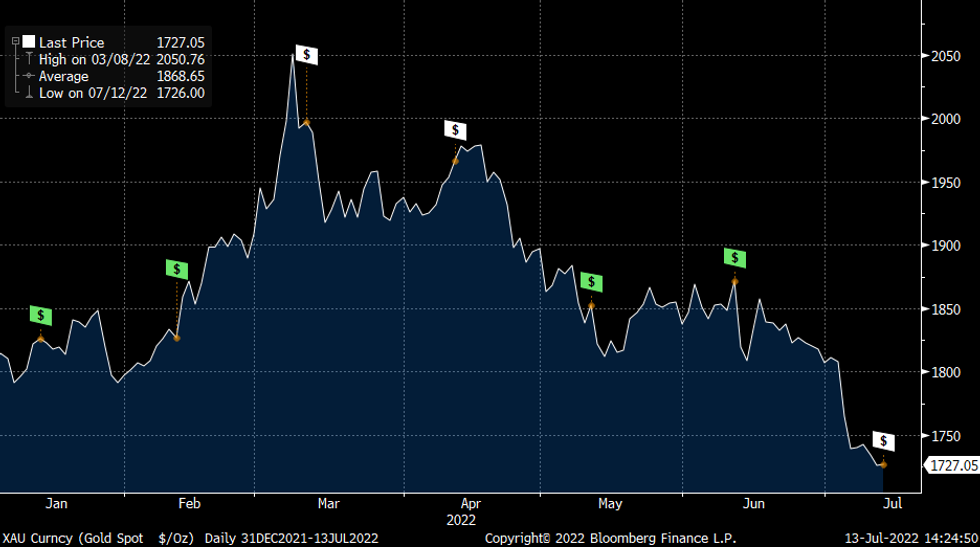

GOLD: Slightly Up From Recent Lows, US CPI Eyed

Gold dipped below $1725 in early trade, but we recovered from there and now sit back above $1727. This follows a volatile overnight session, where the precious metal ultimately lost just under 0.50%. Current levels are slightly above the NY close.

- Support is still evident for gold in the low $1720 region. This coincides with lows from late September last year. As we noted yesterday beyond that is the $1690 low from August last year.

- Cross asset drivers have been mixed today. The USD has lost a little ground against higher beta plays, with firmer equities evident in the region and in terms of US futures.

- Overall moves are modest though. US yields are relatively steady. Overnight , the US real yield edged down a touch to 64bps, although it remains fairly close to recent highs.

- No doubt the market is waiting for tonight's US CPI report. Recent upside surprises on CPI have produced downside momentum in gold, see the chart below.

- This chart plots spot gold prices against US CPI release dates, with green dollar symbols representing months where inflation has surprised on the upside relative to expectations.

Fig 1: Gold & US CPI Releases In 2022

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

OIL: Steadies After Sharp Overnight Drop

Oil is modestly higher from earlier lows. Brent is just $100/bbl (versus earlier low of $98.30), while WTI is back close to $96/bbl from sub $94/bbl at the start of the session. This comes after yesterday's ~7% drop. Risk appetite is a little firmer through the Asian region today. Equities are higher, although so in tech sensitive markets. US futures are modestly higher. Other commodities have also firmed a touch.

- Demand concerns were at the forefront of the overnight fall in oil, as recession fears continue to play out in the major economies. Also, the American Petroleum Institute reported that US crude stockpiles rose by 4.76mn barrels last week. The Energy Information Administration (EIA) will report more data tonight in the US.

- The EIA also cut its gasoline demand estimate for July through to October by -2.2% versus the June forecast. This follows weaker demand conditions in the US during the summer driving season, relative to seasonal norms.

- Elsewhere, Libya has lifted force majeure at two ports according to a Bloomberg report. Ecuador has also officially lifted force majeure on oil exports, although this was seen as a formality following an earlier agreement, which ended domestic protests at the end of June.

- More broadly, OPEC's first 2023 outlook suggests little relief in terms of the supply/demand balance. The group expects demand to exceed supply by 1mn barrels per day next year.

- Finally, note US President Biden's trip to the Middle East kicks off today. He is expected to be in Saudi Arabia on Friday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/07/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/07/2022 | - | *** |  | CN | Trade |

| 13/07/2022 | 1230/0830 | *** |  | US | CPI |

| 13/07/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/07/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1500/1100 |  | CA | BOC press conference | |

| 13/07/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2022 | 1800/1400 |  | US | Federal Reserve Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.