-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Risks Dominate Asia Headline Flow

EXECUTIVE SUMMARY

- CHINA SAYS U.S. IS 'MAKER OF SECURITY RISKS' AFTER TAIWAN STRAIT SAILING (RTRS)

- RBA SIGNALS STEADY SERIES OF RATE HIKES IN BID FOR SOFT LANDING (BBG)

- RUSSIA EXPECTED TO RESTART NORD STREAM ON SCHEDULE (RTRS)

- PUTIN SAYS NORD STREAM VOLUME COULD FALL AGAIN (BBG)

- CHINA COVID-19 CASES NEAR 1,000 IN TEST OF ZERO-TOLERANCE (BBG)

- CHINA’S LOAN BOYCOTT SPREADS TO PROPERTY INDUSTRY SUPPLIERS (BBG)

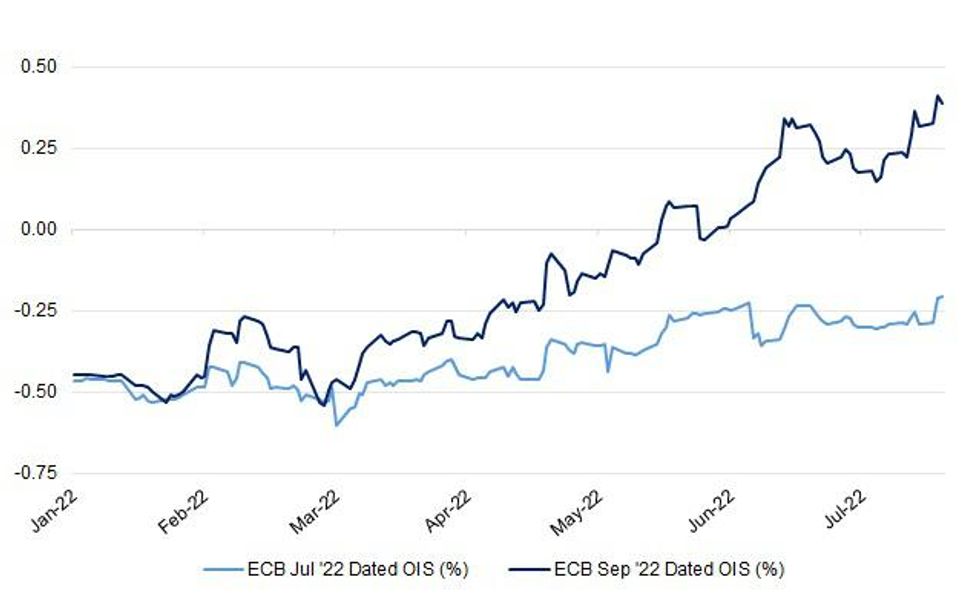

Fig. 1: ECB Jul '22 & Sep ‘22 Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak is within touching distance of making the final two candidates who will face party members in the Tory leadership election – despite a survey showing he would lose heavily to each of his remaining rivals. (Telegraph)

POLITICS: Kemi Badenoch told her supporters to “follow your hearts” as they began to peel off to rival candidates after she was eliminated from the leadership contest. Badenoch and Michael Gove, her most senior ally, are not expected to endorse any of the three remaining candidates in today’s vote, triggering a bidding war, with Liz Truss and Penny Mordaunt vying to pick up Badenoch’s 59 supporters. (The Times)

INFLATION: Britain's biggest public-sector pay increases in nearly 20 years will not fuel inflation, finance minister Nadhim Zahawi said on Tuesday, in a speech where he said fighting inflation was "a moral imperative". (RTRS)

FISCAL: The UK’s biggest trade unions threatened further strikes after the government offered below-inflation pay raises for some 2.5 million public-sector workers, signaling growing unrest over a cost-of-living crisis. Unions representing teachers, doctors and other public sector workers said they will ballot their members about taking industrial action. Unison described the award for National Health Service staff as “short-sighted” and a “big mistake,” while the GMB union called it “another kick in the teeth” for the NHS that will turn the current “staffing black hole” into a “gaping chasm.” (BBG)

ECONOMY: British employers agreed average pay rises of 4% with their staff in the three months to the end of June, the joint-highest since 1992 but falling further behind inflation, industry data showed on Wednesday. (RTRS)

ECONOMY: UK company finance directors are bracing for a recession and a doubling of interest rates in their most pessimistic outlook since 2008, according to a survey conducted by Deloitte. (BBG)

EUROPE

GERMANY: Uniper SE is nearing a bailout deal that may see the German government inject billions of euros and take a direct stake in the energy giant, according to people familiar with the matter. The government may end up with a blocking stake of as much as 30% of Uniper, the people said, asking not to be identified because the information is private. It is discussing the purchase of equity-like hybrid securities in addition to buying common stock at a nominal value in a capital increase, they said. (BBG)

SWEDEN: Swedish home prices fell the most in 14 years last month as the surging costs of living threaten to upend what has been one of Europe’s hottest housing markets. In June, the HOX Sweden housing-price index decreased by 3.8% from the previous month, which is the largest drop since October 2008. Prices in the country’s largest cities continued falling in the first two weeks of July, according to Valueguard, which compiles the index. (BBG)

U.S.

FED: The Federal Reserve risks triggering a sharp and sudden tightening of credit conditions in coming months as it tightens aggressively to make up for lost time, former Kansas City Fed President Thomas Hoenig told MNI. (MNI)

POLITICS: U.S. President Joe Biden's public approval rating fell to 36% this week to tie the lowest rating of his 19 months in the White House as inflation takes its toll on American life, according to a Reuters/Ipsos opinion poll completed on Tuesday. The two-day national poll found that 59% of Americans disapprove of Biden's job performance. (RTRS)

US TSYS: China’s declining holdings of U.S. Treasury bonds are a precautionary measure to deal with the expected adjustments of cross-border U.S. dollar liquidity following the Fed rate hikes, not a move to de-dollarize, said Yicai.com in an editorial. In the past six months to May this year, China has reduced U.S. Treasury holdings by over USD100 billion, which is the first time since May 2010 that the holdings have fallen below USD1 trillion, the newspaper said. U.S. Treasuries act as risk-averse assets and accounted for 32% of China’s foreign exchange reserves by end-June, and there is a need to increase the portfolio of profitable assets, the newspaper said. (MNI)

EQUITIES: Twitter Inc. scored an early win against Elon Musk in its fight to make him complete his $44 billion buyout, as a Delaware judge agreed to fast-track the case with an October trial date. (BBG)

OTHER

GLOBAL TRADE: The leaders of Iran, Russia and Turkey met in Tehran to discuss the conflict in Syria but with the turmoil caused by President Vladimir Putin’s war in Ukraine far more in focus. The leaders also held separate one-on-one meetings Tuesday. Putin thanked Erdogan for his efforts to broker a deal to unblock shipments of grain from the Black Sea disrupted by the war but said “not all the issues have been resolved.” (BBG)

GLOBAL TRADE: Senate Republican leader Mitch McConnell says he won’t vote to proceed the semiconductor funding bill because the final language hasn’t been determined. McConnell tells reporters he’ll decide how to vote as the legislation takes shape. (BBG)

U.S./CHINA/TAIWAN: The United States is a "maker of security risks" in the Taiwan Strait with its frequent provocations there, China's military said on Wednesday after another U.S. warship sailed through the sensitive waterway. (RTRS)

U.S./CHINA: Securities and Exchange Commission Chair Gary Gensler says it’s unclear if American and Chinese authorities will reach a deal to avoid the delisting of some 200 companies from US stock exchanges. (BBG)

U.S./CHINA: The US’s successful collaboration with 37 other nations that’s driven down exports to Russia serves as a blueprint for a new regime on tackling threats from China, the head of the Commerce Department’s Bureau of Industry and Security said. (BBG)

RBA: In a rare discussion of the neutral rate, Lowe said that the Reserve Bank estimates its level is at least 2.5%. Responding later to an audience question, the governor said the RBA is “steadily increasing” its cash rate and at some point will probably get to at least that 2.5% neutral level, with the pace of hikes to be determined by the inflation outlook. (BBG)

RBA: Australia will launch a review of the Reserve Bank of Australia's (RBA) inflation target, monetary tools and board structure, Treasurer Jim Chalmers said on Wednesday, amid criticism over the central bank's interest-rate policies. (RTRS)

SOUTH KOREA: South Korea’s finance ministry and Bank of Korea recently asked National Pension Service for more active FX hedging when investing abroad, as part of efforts to reduce volatility in FX market amid weak won, Maeil Business Newspaper reports, citing an unidentified finance ministry official. (BBG)

MEXICO: The United States will request dispute settlement consultations with Mexico under a regional trade deal over what it considers discriminatory Mexican energy policies, according to two Mexican sources and a draft announcement seen by Reuters on Tuesday. (RTRS)

BRAZIL: Brazil's Petrobras will reduce gasoline prices at its refineries by about 5% on Wednesday, the state-run oil company said in a statement, its first price cut since late 2021, making analysts review projections for the country's inflation. (RTRS)

RUSSIA: Russian President Vladimir Putin on Wednesday said Moscow did see not see any desire from Ukraine to stick to the terms of what he said had been a preliminary peace deal agreed to in March. Putin, speaking to reporters in televised comments after a summit in Tehran, also said that Saudi Arabia and the United Arab Emirates were offering to mediate. (RTRS)

RUSSIA: Russia is laying the groundwork for the annexation of Ukrainian territory and is installing illegitimate proxy officials in areas there under its control as it seeks to exert total control over its gains in the east, the White House said on Tuesday. (RTRS)

UKRAINE: Ukraine is planning to take the first step in restructuring its foreign-owned sovereign debt as the government seeks to preserve cash for a drawn-out war with Russia. The finance ministry will on Wednesday ask foreign private creditors to agree to a delay in debt repayments, according to people with knowledge of the process. (FT)

RUSSIA/IRAN: Russian President Vladimir Putin had talks with Supreme Leader Ayatollah Ali Khamenei in Iran on Tuesday, the Kremlin leader's first trip outside the former Soviet Union since Moscow's Feb. 24 invasion of Ukraine. He said Putin had ensured Russia "maintained its independence" from the United States and that countries should start using their own national currencies when trading goods. (RTRS)

METALS: Vale SA, the world’s No. 2 iron ore supplier, lowered its annual production guidance in a move that should support prices of the steel-making ingredient. The Brazilian mining giant now expects to produce 310-320 million metric tons of iron ore in 2022, compared with a previous forecast of 320-335 million tons. (BBG)

ENERGY: Russian gas flows via the Nord Stream 1 pipeline are seen restarting on time on Thursday after the completion of scheduled maintenance, two sources familiar with the export plans told Reuters.The pipeline, which accounts for more than a third of Russian natural gas exports to the European Union, was halted for ten days of annual maintenance on July 11. The sources, speaking on condition of anonymity because of the sensitivity of the issue, told Reuters the pipeline was expected to resume operation on time, but at less than its capacity of some 160 million cubic metres (mcm) per day. (RTRS)

ENERGY: The Russian president warned that supply volumes of natural gas through the Nord Stream pipeline will drop again if there’s a delay in the return of a turbine sent for repairs to Canada that was held up by sanctions. Volume could drop to around 30 mcm/day if only one turbine is functioning instead of the two that are currently operating, Putin said in a televised briefing after his talks in Iran. He also said that another turbine needs to be sent for regular maintenance around July 26. (BBG)

ENERGY: Russian President Vladimir Putin said on Wednesday that Kremlin-controlled energy giant Gazprom was ready to fulfil its obligations on gas exports. Speaking to reporters after his visit to Tehran, Putin also said that Gazprom is not to blame for the reduction of gas transit capacity, including shutting down one of the routes via Ukraine to Europe by Kyiv. (RTRS)

ENERGY: The European Union is set to propose a voluntary 15% cut in natural gas use by member states starting next month on concern Russia may halt supplies of the fuel. The goal would be embedded in a regulation accompanying a demand-reduction plan the European Commission is scheduled to unveil Wednesday to cope with a potential full cutoff by Moscow. (BBG)

CHINA

ECONOMY: Chinese Premier Li Keqiang signaled a focus on jobs, flexibility on the economic growth rate and a shift toward making its Covid control measures more targeted. The most important thing was to keep employment and prices stable and that slightly higher or lower growth rates were acceptable as long as employment is relatively sufficient, household income grows and prices are stable, according to state media accounts of his comments to global business leaders hosted by the World Economic Forum on Tuesday. (BBG)

YUAN: China should deepen exchange rate marketization reforms and accelerate the development of an onshore FX market to increase the flexibility of the yuan and reduce the dependence on quantitative policy intervention, Guan Tao, a former FX official and now the chief economist of BOC Securities wrote in an article published on the official China Forex magazine. China should expand trading entities, enrich trading products and relax trading restrictions to develop the FX market, and continuously improve the market adaptability of yuan internationalization, said Guan. (MNI)

INFLATION: China’s hog production capacity has returned to the “reasonable range” and pork prices are unlikely to surge in the second half year, according to a briefing by officials from the agriculture ministry. (BBG)

CORONAVIRUS: New Covid-19 cases in China jumped to almost 1,000, with more infectious strains continuing to pressure the country’s goal of eliminating the virus as outbreaks spread beyond major cities. China reported 935 cases for Tuesday, up from 699 Monday, and the highest daily tally since May 21. (BBG)

CORONAVIRUS: China will make Covid control measures more targeted and well-calibrated under the premise of ensuring safety, Chinese Premier Li Keqiang said at the special virtual dialogue with global business leaders hosted by the World Economic Forum on Tuesday, Xinhua reports. (BBG)

PROPERTY: Some suppliers to Chinese real estate developers are refusing to repay bank loans because of unpaid bills owed to them, a sign that the loan boycott that started with homebuyers is starting to spread. Hundreds of contractors to the property industry complained that they can no longer afford to pay their own bills because developers including China Evergrande Group still owe them money, Caixin reported, citing a statement it received from a supplier Tuesday. (BBG)

PROPERTY: Sunac 7% local bond due 2025 halts trading after plunge. Trading of the bond was suspended from 9:44am and will resume from 3:27pm, Shenzhen stock exchange says in a statement. The bond fell 32% to 59.999 yuan before trading halt, according to prices compiled by Bloomberg. (BBG)

EQUITIES: Chinese companies’ overseas listing activities have gradually normalised, with 23 U.S.-listed Chinese companies successfully shifting to Hong Kong for secondary listings to cope with the delisting risk, Yicai.com reported. There are 251 Chinese companies listed in the U.S., mainly technology and consumer firms, with a total market value of USD1.71 trillion. And 42 of them meet the requirements of secondary listing in Hong Kong, accounting for 46% of the total market value, the newspaper said. While many companies are still lining up for Hong Kong, Europe has also become a popular option for going public, as audit requirements in Switzerland are less stringent than in the U.S., the newspaper said. (MNI)

EQUITIES: Chinese authorities are courting European companies to raise funds on the country’s stock exchanges, as they seek to kickstart a program to attract foreign listings, people with knowledge of the matter said. (BBG)

CHINA MARKETS

PBOC INJECTS CNY3 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9725% at 9:27 am local time from the close of 1.5482% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7465 WEDS VS 6.7451

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7465 on Wednesday, compared with 6.7451 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA JUN WESTPAC LEADING INDEX -0.16% M/M; MAY -0.06%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, slowed to 0.40% in June from 0.56% in May. The Leading Index’s growth rate surged in February and March as the benefits to the economy from the reopening in the eastern states gained maximum momentum. Since that time the growth rate in the Leading Index has been sliding. The June Index is capturing the very early impact of central bank tightening cycles. Most notable for the Australian economy has been the Reserve Bank of Australia, where the first move was initiated in early May. (Westpac)

MARKETS

SNAPSHOT: Familiar Risks Dominate Asia Headline Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 666.72 points at 27628.40

- ASX 200 up 103.505 points at 6753.10

- Shanghai Comp. up 21.822 points at 3301.253

- JGB 10-Yr future down 18 ticks at 149.12, yield up 0.5bp at 0.244%

- Aussie 10-Yr future down 4 ticks at 96.41, yield up 4.2bp at 3.553%

- U.S. 10-Yr future -0-01 at 117-30, yield up 0.37bp at 3.025%

- WTI crude down $0.34 at $103.88, Gold down $0.07 at $1711.6

- USD/JPY down 14 pips at Y138.05

- CHINA SAYS U.S. IS 'MAKER OF SECURITY RISKS' AFTER TAIWAN STRAIT SAILING (RTRS)

- RBA SIGNALS STEADY SERIES OF RATE HIKES IN BID FOR SOFT LANDING (BBG)

- RUSSIA EXPECTED TO RESTART NORD STREAM ON SCHEDULE (RTRS)

- PUTIN SAYS NORD STREAM VOLUME COULD FALL AGAIN (BBG)

- CHINA COVID-19 CASES NEAR 1,000 IN TEST OF ZERO-TOLERANCE (BBG)

- CHINA’S LOAN BOYCOTT SPREADS TO PROPERTY INDUSTRY SUPPLIERS (BBG)

US TSYS: Narrow Asia Trade

A muted round of Asia-Pac dealing sees TYU2 futures print -0-02 at 117-29 as we head towards London dealing, with the contract operating in the middle of a very narrow 0-04+ range, on volume of ~43K. Note that TYU2 experienced a brief and shallow show below its Tuesday base in early Asia-Pac trade, before ticking away from session lows. Cash Tsys sit 0.5bp richer to 1.0bp cheaper across the curve, with some light twist steepening observed.

- Hardline headlines out of China surrounding the U.S. naval presence in the Taiwan Strait did little to alter that particular narrative, while the continued uptick in new COVID cases in China failed to generate anything in the way of a meaningful market reaction.

- The proximity to impending central bank decisions, namely the FOMC (next Wednesday) & ECB (this Thursday) seems to be keeping may participants sidelined.

- Looking ahead, existing home sales data and MBA mortgage apps are due to cross on Wednesday, coming on the heels of softer than expected housing starts data and a building permits print that wasn’t quite as soft as expected, but was still negative in M/M terms. 20-Year Tsy supply is also due on Wednesday.

JGBS: Little Steeper Ahead Of BoJ

Cash JGBs run little changed to 1.5bp cheaper across the curve, with a very modest steepening bias apparent in limited dealing (20s provide the weakest point on the curve). Note that swap spreads are a touch narrower across the curve, with most of the major swap rates running marginally lower on the session.

- JGB futures ticked way from overnight lows, as wider global core FI markets nudged away from worst levels of the session, last +10..

- There has been little to note when it comes to local news flow.

- The latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs saw firmer spread results than the previous offering, with the spread tail width remaining constant. However, the cover ratio eased below the 4.00x mark, suggesting that there was little in the way of widespread appetite at today’s auction

- Tomorrow’s domestic docket is headlined by the latest BoJ monetary policy decision. The Bank is set to leave its monetary policy settings as they are, with expectations for a markdown in immediate growth expectations and a mark higher for immediate inflation projections.

JGBS AUCTION: Japanese MOF sells Y1.94130tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y1.94130tn 6-Month Bills:

- Average Yield: -0.2120% (prev. -0.1693%)

- Average Price: 100.107 (prev. 100.085)

- High Yield: -0.1823% (prev. -0.1614%)

- Low Price: 100.092 (prev. 100.081)

- % Allotted At High Yield: 89.0000% (prev. 62.8920%)

- Bid/Cover: 4.265x (prev. 5.172x)

JGBS AUCTION: Japanese MOF sells Y497.9bn of 1-5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.9bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.004% (prev. +0.005%)

- High Spread: -0.002% (prev. +0.007%)

- % Allotted At High Spread: 42.5903% (prev. 39.1222%)

- Bid/Cover: 3.465x (prev. 4.418x)

AUSSIE BONDS: Off Early Cheaps

Aussie bonds have edged away from worst levels observed after RBA Governor Lowe’s speech earlier in the session, with relatively limited trade in U.S. Tsys providing little impetus for the ACGB space. Cash ACGBs have bear flattened, running 3-5bp cheaper across the curve, while Aussie bond futures are off of session extremes. YM is -4.5 while XM is -4.0. Bills run 2 to 9 ticks cheaper through the reds.

- RBA Gov Lowe emphasised the need for a continued path of steady rate hikes in the coming meetings, in order to maintain the anchoring of inflation expectations, with the Governor also reiterating that the neutral cash rate is at least 2.50% (he also acknowledged the uncertainty surrounding such calculations), offering a slightly more conservative assessment of the neutral rate than that offered by Deputy Governor Bullock on Tuesday (albeit Lowe was more caveated with the “at least” and subsequent language surrounding inflation). The Treasurer also outlined the heavily awaited wide-spanning review of the RBA, with the details available here.

- The ACGB May-32 auction went well, seeing the weighted average yield print 0.78bp through prevailing mids (per Yieldbroker), with the cover ratio printing 3.0025x, a shade above the 3.00x handle. The result builds on the recent run of strong ACGB auction results, with the easily-digestible DV01 and benchmark 10-Year status of the line facilitating smooth takedown.

- Tomorrow’s domestic data docket is thin at best.

AUSSIE BONDS: The AOFM sells A$800mn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.25% 21 May ‘32 Bond, issue #TB158:

- Average Yield: 3.5425% (prev. 4.1150%)

- High Yield: 3.5450% (prev. 4.1150%)

- Bid/Cover: 3.0025x (prev. 2.7670x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 84.2% (prev. 100.0%)

- Bidders 41 (prev. 48 ), successful 15 (prev. 1), allocated in full 8 (prev. 1)

EQUITIES: Higher In Asia; Tech Stocks Lead Bid

Virtually all Asia-Pac equity indices are higher in Asia, tracking a strong, positive lead from Wall St. Tech-related equities across the region lead gains, with many reversing steep losses observed on Tuesday (with that move lower catalysed by source reports of Apple Inc planning to slow expansion plans), catching a bid on tailwinds from the previously-flagged bid in Netflix Inc (+7.9% after hours).

- The Nikkei 225 leads gains amongst regional peers, dealing 2.5% firmer at typing, outpacing the broader Topix index (+2.1%). The Nikkei is on track for a fifth consecutive higher daily close on gains observed in >95% of the index’s constituents, with the IT and materials sectors contributing the most to gains.

- The Hang Seng is 1.8% better off, hitting one-week highs on a rally in China-based tech (HSTECH: +2.4%) after a WSJ source report on Tuesday pointed to a possible $1bn fine on ride-hailing giant Didi Chuxing to conclude a year-long regulatory probe, adding to tailwinds from the previously-flagged bid in tech names after Netflix reported earnings.(+0.2%) lagged peers,

- The ASX200 deals 1.8% firmer at typing, with tech and commodity-related names contributing the most to gains. The S&P/ASX All Tech Index has added +3.7%, hitting a seven-week high earlier in the session, while the major miners trade 1.9-5.7% higher apiece on a rally in industrial metals (particularly iron and copper).

- E-minis sit 0.5-0.6% firmer apiece, operating around six-week highs at typing.

OIL: A Little Below One-Week Highs As Tight Supply Outlook Eyed Against China’s COVID Outbreak

WTI is ~-$0.30 and Brent is ~-$0.10, with both benchmarks operating just shy of their respective one-week highs made on Tuesday.

- China reported 935 fresh COVID cases for Tue (vs. 699 for Mon) as case counts in the hotspots of Guangxi (south) and Gansu (northwest) remain elevated. Meanwhile, Shanghai continues to see declining infections (15 for Tue vs. 23 for Mon) amidst a mass testing drive, while Beijing has seen single-digit case counts for over four weeks.

- Crude benchmarks were largely unmoved following the latest round of API inventory estimates on Tuesday. Source reports pointed to a larger-than-expected build in crude stockpiles with an increase in gasoline and Cushing hub stocks as well, while distillate inventories declined.

- Keeping within the U.S., fracking giant Halliburton has stated that oil companies without equipment for new wells are unlikely to secure them for at least the rest of ‘22 due to supply chain issues, limiting the (already scant) outlook for meaningful increases in near-term U.S. crude output.

- Brent remains in steep backwardation, with the prompt spread observed at ~$4.45 at typing.

- Elsewhere, Libya’s El-Feel oilfield has resumed production after three months, with output announced at 40K bpd (against 70K bpd capacity). Note that the new NOC chairman last Friday declared that the country would return to pre-crisis output levels “within a week” (potentially returning >500K bpd to markets).

GOLD: Little Changed In Asia; Dollar Pullback Provides Little Relief

Gold deals a shade below neutral levels to print ~$1,710/oz at typing, operating around the middle of Tuesday’s ~$15 range in fairly directionless Asia-Pac dealing.

- To recap, the precious metal closed marginally higher on Tuesday, with a continued pullback in the USD from last Thursday’s cycle highs (with the DXY recording a third straight lower daily close) countering an uptick in U.S. real yields.

- Gold continues to tread water above $1,700/oz, with daily trading ranges keeping below ~$20 in recent sessions, keeping it within sight of last Thursday’s 11-month lows ($1,697.7/oz, Jul 14). Bullion’s tepid performance comes despite weakness in the Dollar and sideways action in U.S. real yields, with participants likely awaiting the upcoming FOMC (July 26-27) as Fed hawkishness continues to take focus for the space.

- From a technical perspective, gold remains in a downtrend, with moving average studies continuing to point to bearish conditions. Previously-flagged technical levels remain in play, with support located at $1,690.6/oz (Aug 9 ‘21 low), and initial resistance situated at $1,745.4/oz (Jul 13 high).

FOREX: Sentiment Stays Buoyant, Greenback Extends Losses

Participants were keen to take on more risk as post-market surge in Netflix shares and a positive lead from Wall Street supported the broader equity space, outweighing a further increase in China's daily COVID-19 case count.

- Antipodean currencies led gains amid better risk sentiment. RBA Gov Lowe signalled that further hikes to the cash rate target are on the horizon but AUD/NZD ebbed lower.

- The greenback underperformed but the BBDXY Index struggled to penetrate yesterday's lows.

- USD/JPY sales emerged over the Tokyo fix but the rate then recouped the bulk of those losses.

- Inflation data from the UK & Canada as well as U.S. existing home sales & flash EU consumer confidence will hit the wires later today.

- Italy is gearing up for the next episode of its political saga, with PM Draghi expected to address the upper house at 9:30 CET.

FX OPTIONS: Expiries for Jul20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1.1bln)

- USD/JPY: Y137.00($625mln), Y137.75($635mln), Y139.00($1.1bln)

- USD/CAD: C$1.2800-05($510mln), C$1.3285-00($1.0bln)

- USD/CNY: Cny6.6000($3.7bln), Cny6.7000($3.7bln), Cny6.8000(1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/07/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/07/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/07/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.