-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN OPEN: Groundhog Day For Europe As ECB Meets, Draghi Is Set To Quit & Nord Stream Flows Resume

EXECUTIVE SUMMARY

- MARIO DRAGHI FACES THE END AFTER ITALY’S COALITION REFUSES TO BACK HIM (POLITICO)

- NORD STREAM GAS PIPELINE FLOWS RESUME, NOMINATIONS RUNNING AT ~30% OF CAPACITY

- BIDEN SEES XI CALL IN ‘NEXT 10 DAYS’ AS US WEIGHS EASING TARIFFS (BBG)

- U.S. HOPES FOR GLOBAL PRICE CAP ON RUSSIAN OIL BY DECEMBER (RTRS)

- CHINA TO REPAY MORE VICTIMS NEXT WEEK IN BIGGEST BANK SCAM (BBG)

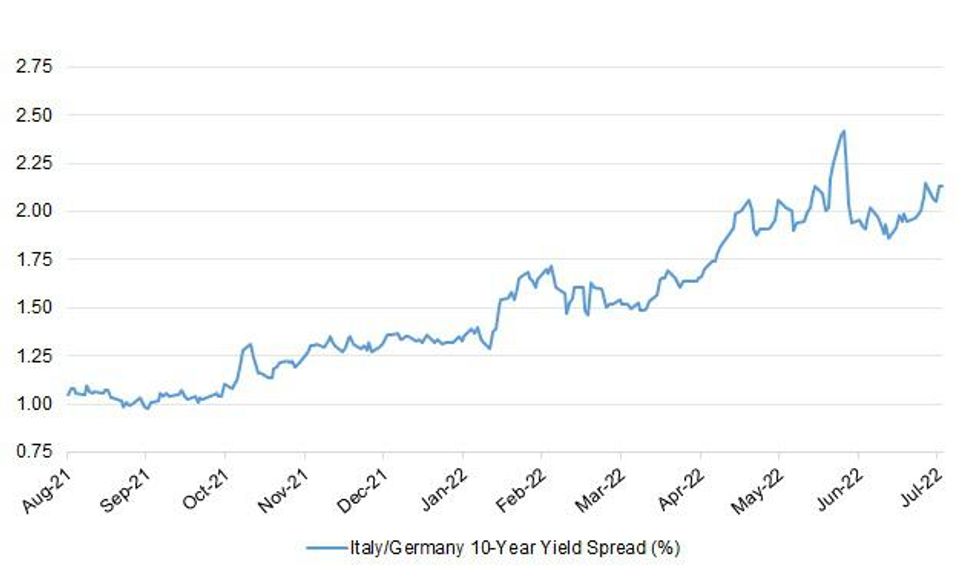

Fig. 1: Italy/Germany 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Tory leadership candidates Rishi Sunak and Liz Truss have agreed to take part in a head-to-head debate on Sky News. The event - which will be in front of a live audience - will be on Thursday 4 August at 8pm and is to be hosted by Kay Burley. (Sky)

POLITICS: Liz Truss cannot win the next general election, Rishi Sunak declared last night as he prepared a policy blitz in an attempt to win over Tory members and reach No 10. (The Times)

POLITICS: Liz Truss today vows to beat Labour by 'governing as a true tax-cutting, freedom-loving Conservative'. (Daily Mail)

POLITICS: Rishi Sunak faces an uphill struggle to convince grassroots Conservative members to back him over Liz Truss, a Tory strategist has warned. Despite coming top in the ballot of MPs, the former Chancellor underperforms in polls of party members, coming significantly behind Truss. (The Times)

POLITICS: Rishi Sunak’s team fears that Boris Johnson will try to interfere in the Conservative leadership election to prevent his former chancellor succeeding him in Downing Street. (The Times)

INFLATION: There will be little in the way of a cost-of-living respite for UK consumers in coming months, with any major easing in inflation unlikely until base effects kick in in April 2023, the Office for National Statistics told MNI Wednesday, (MNI)

INFLATION: British Prime Minister Boris Johnson will meet with senior business leaders on Thursday to discuss what more can be done to help families struggling with the rising cost of living, his office said. (RTRS)

EUROPE

ITALY: Mario Draghi is facing the end of his premiership, after he failed to win enough support from right-wing parties in his coalition to carry on leading Italy’s government. In a speech on Wednesday, Draghi indicated he was willing to stay on as prime minister if his feuding coalition partners could guarantee “sincere and concrete support” for him to continue. But although he won a confidence vote in parliament on Wednesday evening, it was without the backing of key parties in the power-sharing administration. (POLITICO)

U.S.

FED: The U.S. Federal Reserve will opt for another 75 basis point rate hike rather than a larger move at its meeting next week to quell stubbornly-high inflation as the likelihood of a recession over the next year rises to 40%, a Reuters poll of economists found. Inflation hit 9.1% in June, another four-decade high, stoking expectations the Fed, having only just shifted gears from 50 to 75 basis points at the last meeting, would act even more forcefully and go for a 100 basis point hike. But some of the more hawkish Fed officials in public remarks have favored a 75 basis point hike, tempering those expectations in recent days. Last month's 75 bps hike was the first of that size since 1994. The July 14-20 Reuters poll found 98 of 102 economists expect the Fed to hike rates by 75 basis points at the end of the July 26-27 meeting to 2.25%-2.50%. The remaining four said they expected a 100 basis point hike. (RTRS)

ECONOMY: Commerce Secretary Gina Raimondo warned on Wednesday that the country’s current dependence on foreign computer chip fabrication puts it at risk of a recession if it’s ever cut off. Her comments come as Congress nears key votes on a bill to fund U.S. semiconductor manufacturing, While many computer chips are designed in the U.S. by companies like Intel, Raimondo told CNBC’s Sara Eisen on “Closing Bell” Wednesday, that the location of the manufacturing is just as important. (CNBC)

POLITICS: More Americans now think President Joe Biden is doing a bad job than at any prior point in his presidency, according to a major public opinion poll released Wednesday. Just 31% of American adults said they approve of the way Biden is handling his job, while 60% disapproved of it, the Quinnipiac University poll found. (CNBC)

EQUITIES: With recession fears mounting—and inflation, the war in Ukraine and the lingering pandemic taking a toll—many tech companies are rethinking their staffing needs, with some of them instituting hiring freezes, rescinding offers and even starting layoffs. Microsoft Corp., Google and Lyft Inc. are some of the latest companies to pull back. Microsoft said Wednesday it was eliminating many job openings. Google is pausing hiring for the next two weeks, while Lyft is shutting down a division and trimming jobs. (BBG)

EQUITIES: Ford Motor Co. is preparing to cut as many as 8,000 jobs in the coming weeks as the automaker tries to boost profits to fund its push into the electric-vehicle market, according to people familiar with the plan. (BBG)

OTHER

U.S./CHINA: President Joe Biden says he expects to speak to Chinese leader Xi Jinping “within the next 10 days,” as the US considers whether lifting some tariffs on Chinese imports would help stem rampant inflation. (BBG)

BOJ: The Bank of Japan left its rock-bottom interest rates unchanged Thursday as it put concern over the economy ahead of any potential implications for the yen for now, further cementing its outlier stance compared with inflation-fighting central banks overseas. Supporting its view that the recovering economy needs continued support even as the impact of the pandemic softens, the BOJ lowered its economic growth forecast for this year. At the same time, though, it raised its price forecast for this year by more than expected, a sign that Japan too is not immune to inflationary pressure. (BBG)

JAPAN: Tokyo is set to raise its Covid-19 warning for the medical system to the highest level on its four-tier scale, local broadcaster FNN reports, as a sharp rebound in infections strains hospitals. (BBG)

ASIA: Developing Asia is expected to grow more slowly than initially predicted this year, as the prolonged war in Ukraine has pushed commodity prices higher and triggered monetary tightening, the Asian Development Bank said in a report published Thursday. (Nikkei)

BOC: As Canadians continue to feel the squeeze from an increased cost of living, Bank of Canada Governor Tiff Macklem says Canada's inflation rate is set to remain "painfully high" for the rest of the year. In an exclusive interview with CTV News' Evan Solomon, Macklem said the inflation rate is "unfortunately… probably going to start with a seven for the rest of the year." (CTV News)

MEXICO: Mexico’s Economy Ministry said in a statement it has received Canada’s request for consultations over its energy policies under the USMCA trade deal and will work on the country’s defense. Request is similar to the one presented by the US, according to the statement. “Mexico will seek to maintain a coordinated process with both USMCA trade partners in order to discuss the scope of such requests”. (BBG)

BRAZIL: President Jair Bolsonaro intends to further cut taxes in the second half of the year as part of a strategy to lure foreign investment and boost growth in Latin America’s largest economy, according to a government official with direct knowledge of the plans. (BBG)

BRAZIL: Ciro Gomes, a left-of-center former governor, kicked off Brazil's presidential election season on Wednesday, becoming the first candidate to officially announce his candidacy for the Oct. 2 vote. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Wednesday dismissed as inadequate a seventh round of European Union sanctions against Russia, which is currently being finalized. "This is not enough and I am telling my partners this frankly. Russia must feel a much higher price for the war to force it to seek peace," he said in a late-night video address. (RTRS)

RUSSIA: Consumer prices in Russia declined 0.17% in the week to July 15 after sliding 0.03% a week earlier, data showed on Wednesday, keeping the door open for the central bank to consider cutting rates as soon as this week. The rouble's strengthening and a drop in consumer demand have helped Russia rein in inflation, which soared to 20-year highs in annual terms after Moscow sent tens of thousands of troops into Ukraine on Feb. 24. So far this year, consumer prices have risen 11.41% compared with a 4.51% increase in the same period of 2021, data from the Federal Statistics Service Rosstat showed. Prices on nearly everything, from vegetables and sugar to clothes and smartphones, have risen sharply since Feb. 24. (RTRS)

METALS: Chile's state-owned Codelco, the world's top copper producer, said on Wednesday it was temporarily halting construction of all mining projects after reporting the death of two workers in less than a month. (RTRS)

ENERGY: Russia started sending gas through its biggest pipeline to Europe after a 10-day maintenance period. Flows via the Nord Stream link connecting Russia to Germany restarted on Thursday, a spokesperson for the pipeline operator said by phone. Restoring flows to the levels requested will take some time. Supplier Gazprom PJSC declined to comment. (BBG)

ENERGY: The head of Germany's energy regulator on Wednesday said that Russia's Gazprom had renominated gas flows and that the pipeline would resume only at around 30% of its full capacity after its maintenance period finishes on July 21. Writing on Twitter, Klaus Mueller also said that further changes were possible to the gas nominations. (RTRS)

OIL: The United States hopes to see a global price cap on Russian oil introduced by December, U.S. Deputy Treasury Secretary Wally Adeyemo said on Wednesday. "We are following on what the Europeans have done," he told the Aspen Security Forum in Colorado. "They introduced the idea of looking to do a price cap but they also said by December, they plan to put in place their insurance ban. (RTRS)

OIL: Russia will not export its oil if any global price cap is set that is below production costs, Tass says, citing comments Russia’s Deputy PM Alexander Novak made to state TV. (BBG)

OIL: Libya's National Oil Corp (NOC) said on Wednesday crude production has resumed at several oilfields, after lifting force majeure on oil exports last week. (RTRS)

CHINA

PBOC: The benchmark Loan Prime Rate for five-year maturity and above, which lenders base their mortgage rates, still has downward space in Q3 to help boost the property market and stabilise economic growth, the Shanghai Securities News reported citing analysts. Considering the expected monetary tightening overseas, the People’s Bank of China will focus on keeping policy rates such as the rate of Medium-term Lending Facility stable while guiding actual loan interest rates down to lower the financing cost of the real economy, the newspaper said citing analysts. The one-year and five-year LPR was kept unchanged at 3.7% and 4.45% on Wednesday, respectively. (MNI)

INFLATION: China should continue with expansionary fiscal and monetary policies even as inflation rises to maintain relatively high economic growth to address the unemployment issue, wrote Yu Yongding, former advisor to the People’s Bank of China in an article published on the WeChat account of China Finance 40 Forum. Inflation is very likely to rise as demand rebounds and the pandemic eases. The rising pork price cycle may also come into play, said Yu. China should tolerate a higher inflation rate, though it is more of a social and political issue arather than an economic one, said Yu, without specifying the possible ceiling. (MNI)

INFRASTRUCTURE: China’s infrastructure investment may be lifted to double-digit growth in 2022 with sufficient supporting funds kicking in in the second half of the year, Yicai.com reported citing analysts. As of July 17, a total CNY4.08 trillion of local government bonds was sold, including CNY3.43 trillion of infrastructure-back special bonds, the newspaper said. A considerable part of the funds will be used in H2, in addition to CNY800 billion credit line of policy banks and CNY300 billion financial bonds to support the financing of major projects, Yicai said. Infrastructure investment is expected to grow 8-10% by year-end from H1’s 7.1%, the newspaper said citing Luo Zhiheng, chief economist of Yuekai Securities. (MNI)

BANKS: Chinese authorities will repay more victims of the nation’s biggest bank scam as it seeks to placate angry customers who have been denied access to tens of billions of yuan of deposits for months. Clients from the four rural banks in the central province of Henan and one in Anhui with deposits of up to 100,000 yuan ($14,800) will be repaid from July 25, according to the local offices of the China Banking and Insurance Regulatory Commission. (BBG)

PROPERTY: China South City dollar bonds were on pace for their biggest advances in months Thursday, after the developer asked creditors to approve amendments that include extended maturities. If approved, the Shenzhen entity which in May bought a 29% stake in China South City will enter into a type of credit protection called a keepwell deed involving all the builders’ dollar bonds, according to exchange filing. (BBG)

BONDS: Overseas investors cut holdings of Chinese sovereign bonds for a fifth month in June, the longest string of outflows on record, as rising US Treasury yields reduce the attractiveness of yuan-denominated debt. (BBG)

CAPITAL FLOWS: China’s sovereign wealth fund is merging a unit overseeing billions of dollars in private equity and infrastructure investments into its main operations, according to people familiar with the matter, seeking to boost efficiency after a talent exodus and as offshore investing grows more complex. (BBG)

CHINA MARKETS

PBOC INJECTS CNY3 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8650% at 9:30 am local time from the close of 1.5677% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 48 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7620 THURS VS 6.7465

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7620 on Thursday, compared with 6.7465 set on Wednesday.

OVERNIGHT DATA

CHINA JUN SWIFT GLOBAL PAYMENTS CNY 2.17%; MAY 2.15%

JAPAN JUN TRADE BALANCE -Y1,383.8BN; MEDIAN -Y1,559.7BN; MAY -Y2,385.8BN

JAPAN JUN EXPORTS +19.4% Y/Y; MEDIAN +17.0%; MAY +15.8%

JAPAN JUN IMPORTS +46.1% Y/Y; MEDIAN +46.3%; MAY +48.9%

JAPAN JUN TRADE BALANCE ADJUSTED -Y1,928.9BN; MEDIAN -Y2,124.9BN; MAY -Y1,888.6BN

AUSTRALIA Q2 NAB BUSINESS CONFIDENCE +5; Q1 +15

AUSTRALIA JUN RBA FX TRANSACTIONS MARKET +A$3,135MN; MAY +A$846MN

AUSTRALIA JUN RBA FX TRANSACTIONS GOV’T -A$3187MN; MAY -A$847MN

AUSTRALIA JUN RBA FX TRANSACTIONS OTHER +A$555MN; MAY -A$442MN

NEW ZEALAND JUN TRADE BALANCE -NZ$701MN; MAY +NZ$263MN

NEW ZEALAND JUN EXPORTS NZ$6.42BN; MAY NZ$6.95BN

NEW ZEALAND JUN IMPORTS NZ$7.12BN; MAY NZ$6.69BN

NEW ZEALAND JUN TRADE BALANCE 12 MTH YTD -NZ$10,509MN; MAY -NZ$9,521MN

NEW ZEALAND JUN CREDIT CARD SPENDING +3.5% Y/Y; MAY +2.2%

NEW ZEALAND JUN CREDIT CARD SPENDING +1.3% M/M; MAY +1.8%

SOUTH KOREA JUL 1-20 TRADE BALANCE -$8,102.0MN; MAY -$7,642.0MN

SOUTH KOREA JUL 1-20 EXPORTS +14.5% Y/Y; MAY -3.4%

SOUTH KOREA JUL 1-20 IMPORTS +25.4% Y/Y; MAY +21.1%

MARKETS

SNAPSHOT: Groundhog Day For Europe As ECB Meets, Draghi Is Set To Quit & Nord Stream Flows Resume

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 74.62 points at 27756.36

- ASX 200 up 5.592 points at 6764.80

- Shanghai Comp. down 13.949 points at 3290.795

- JGB 10-Yr future up 15 ticks at 149.34, yield down 1.2bp at 0.234%

- Aussie 10-Yr future up 0.5 ticks at 96.42, yield down 0.2bp at 3.543%

- U.S. 10-Yr future +0-03+ at 117-28+, yield down 0.74bp at 3.0191%

- WTI crude down $0.99 at $98.91, Gold down $3.57 at $1693.02

- USD/JPY down 5 pips at Y138.16

- MARIO DRAGHI FACES THE END AFTER ITALY’S COALITION REFUSES TO BACK HIM (POLITICO)

- NORD STREAM GAS PIPELINE FLOWS RESUME, NOMINATIONS RUNNING AT ~30% OF CAPACITY

- BIDEN SEES XI CALL IN ‘NEXT 10 DAYS’ AS US WEIGHS EASING TARIFFS (BBG)

- U.S. HOPES FOR GLOBAL PRICE CAP ON RUSSIAN OIL BY DECEMBER (RTRS)

- CHINA TO REPAY MORE VICTIMS NEXT WEEK IN BIGGEST BANK SCAM (BBG)

US TSYS: Tight Pre-ECB Trade

Tsys stuck to a narrow range in Asia-Pac dealing, initially nudging higher on a modest downtick in e-mini futures (aided by Microsoft becoming the latest tech giant to pullback on hiring plans).

- That was before the confirmation of the resumption of gas flows through the Nord Stream 1 pipeline running between Russia & Europe, which took place on time after the end of the line’s maintenance period. That news flow sees the space back from best levels, with e-minis back to neutral levels.

- Still, TYU2 operates in a very narrow 0-05+ range, printing +0-03+ at 117-28+ ahead of London hours, on light volume of ~50K as the proximity to the ECB decision keeps many sidelined. Cash Tsys run 0.5-1.0bp richer across the curve.

- Italian political matters (with PM Draghi’s official resignation seemingly due on Thursday) & the ECB monetary policy decision will shape early trade today (with the 25/50bp rate hike decision and details surrounding the ECB’s anti-fragmentation tool providing the two key points of focus for the latter). Meanwhile, Thursday’s NY docket is headlined by the latest Philly Fed survey, weekly jobless claims data & 10-Year TIPS supply.

- Also remember that comments/developments surrounding the Nord Stream pipeline present headline risk after the aforementioned resumption of flows.

JGBS: A Little Firmer, No Surprises From BoJ

JGBs futures extended on a modest morning uptick after the BoJ provided no surprises, leaving its monetary policy settings unchanged, alongside a mark higher in its inflation expectations, mark lower in immediate GDP forecast and changes to language that reflected those dynamics e.g. inflation expectations have risen. Note that the central mantra of the Bank’s monetary policy outlook remains unchanged, as it reiterated its forward guidance (including the dovish bias within), while it flagged the risks that commodity prices and swings in FX movements pose to inflation.

- Elsewhere, local press reports pointed to PM Kishida reshuffling his cabinet in September, which isn’t a new idea.

- JGB futures have nudged away from best levels ahead of the close, aided by the resumption of gas flows through the Nord stream 1 pipeline that runs between Russia & Europe. The contract is +!0 last, while cash JGBs run little changed to 2bp richer on the day, bull flattening.

- National CPI data and a liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs.

AUSSIE BONDS: Off Best Levels

Aussie bonds have pared an earlier bid heading into European hours, with a lack of domestic headline flow and a limited uptick in U.S. Tsys providing little directional impetus for ACGBs (keeping in mind that the ECB’s impending monetary policy decision may be keeping participants on the sidelines). Cash ACGBs run 0.5-1.5bp richer across the curve, with the belly underperforming at the margin. YM is +1.5, a little below best levels after testing its overnight lows while XM is +0.5, coming nowhere near to testing the boundaries of its overnight session range. Bills run 1-3 ticks richer through the reds.

- STIR markets continue to price in ~56bp of tightening for the RBA’s Aug meeting after speeches by RBA Gov Lowe and Reserve Gov Bullock on Tue and Wed, sitting little changed from levels observed at the beginning of the week.

- Friday will see the Australian composite and services flash PMIs for July headline the data docket, while A$700mn of ACGB Sep-26 will be on offer ahead of the release of the AOFM’s weekly issuance slate.

EQUITIES: Mostly Lower In Asia; Chinese Chip Makers Sidestep Carnage In Developers

Most major Asia-Pac equity indices are lower at typing, bucking a positive lead from Wall St., with the MSCI Asia Pac index on track to break a three-day streak of losses.

- The Nikkei sits 0.2% better off at writing, bucking the broader trend of losses and narrowly building on Wednesday’s 2.7% higher close. Financials and real estate equities pared losses in the wake of the BoJ’s monetary policy announcement, adding to earlier gains in industrials and major exporters.

- The Hang Seng brings up the rear amongst regional peers, dealing 1.4% weaker at typing. The financials (-2.1%) and property (-2.3%) sub-indices contributed the most to drag in the index, coming under pressure from the latest round of worry surrounding Chinese real estate, with suppliers and homeowners across hundreds of projects continuing to withhold payment of bills and mortgages.

- The CSI300 sits 0.5% weaker at typing, with shallow losses across most sectors dragging the index lower (although the CSI300 Real Estate index predictably leads losses at -2.7%). Chinese tech stocks outperformed (particularly chipmakers), seeing the STAR50 index trade 2.0% higher, with participants eyeing an upcoming Biden-Xi call, and progress towards the lifting of U.S. tariffs.

- The ASX200 is virtually unchanged at typing, with gains in tech and healthcare equities neutralised by losses in commodity-related sectors. While the S&P/ASX All Tech Index deals 2.7% firmer at typing, a decline in major crude benchmarks and industrial metals has seen the likes of the major miners trade 1.7-3.3% lower, with the energy sub-index (-3.2%) leading losses.

- E-minis are off worst levels, sitting 0.1-0.3% weaker apiece at typing.

OIL: Lower In Asia As Growth Worry Edges Ahead

WTI and Brent are ~$0.70 worse off apiece, edging away from their respective session lows made after China reported fresh COVID case counts that have remained around two-month highs (826 for Wed vs. 935 for Tue), raising lockdown fears from some quarters.

- Looking into the details, although COVID hotspots are centred away from major cities, Shenzhen has enacted lockdowns in some neighbourhoods, while Shanghai continues to find cases outside of quarantine.

- Contributing to wider growth worry, the Asian Development Bank (ADB) cut ‘22 growth forecasts for “Developing Asia” (includes China and India) from 5.2% to 4.6%, citing Fed tightening, issues stemming from China’s pandemic control measures, and fallout from the ongoing war in Ukraine.

- To recap Wednesday’s price action, WTI and Brent rose from session lows after the release of EIA inventory data on Wed, with crude and distillate stockpiles posting surprise declines, while there was a build in Cushing hub stocks. Both benchmarks failed to make headway above neutral levels however, with debate re: demand destruction doing the rounds after a much larger-than-expected build in gasoline stocks was observed (also larger than Tuesday’s reports of API estimates), raising worry re: demand destruction despite a decline in pump prices.

- Elsewhere, the International Energy Agency (IEA) released their monthly Electricity Market Report on Wednesday, sharply lowering their forecast for electricity demand growth in ‘22 on “slower economic growth” and “higher energy prices”.

GOLD: Fresh Cycle Lows In Asia; ETF Outflows Add To Gloom

Gold deals ~$3/oz weaker, printing ~$1,693/oz at typing. The precious metal sits a little above 15-month lows ($1,690.2/oz) recorded earlier in the session, with a limited downtick in the USD (DXY) and nominal U.S. Tsy yields likely helping to put a floor on the move lower for now.

- To recap, gold closed ~$15/oz weaker on Wednesday amidst a rise in U.S. real yields and the DXY, with the latter snapping a three-session streak of lower daily closes.

- Known ETF holdings of gold compiled by BBG points to approx. four weeks of outflows so far, taking the measure to levels last witnessed in early-Mar ‘22, while gold holdings in SPDR’s GLD ETF has fallen to six-month lows.

- From a technical perspective, gold appears to be approaching a zone that has acted as support since Apr ‘20 (approx. $1,670/oz to $1,690/oz) after a breakout from its COVID-induced trough.

- Looking to technical levels, gold’s earlier move lower has breached initial support at $1,690.6/oz (Aug 9 ‘21 low), exposing further support at $1,680.5/oz (1.764 proj of the Mar8-29-Apr18 price swing). On the other hand, resistance is situated at $1,745.4/oz (Jul 13 high).

FOREX: European FX Space Back On Its Feet

G10 FX space saw some unwinding of yesterday's price action, with the European FX bloc finding poise. Headline flow was sparse and did not provide anything to diffuse concerns related to Italy's political turmoil and Europe's energy crisis.

- Shipment orders data published by Nord Stream AG showed that gas flows through the pipeline will resume at ~40% of capacity, slightly more than expected, with the planned maintenance due to finish at 06:00 CET. Still, actual volumes remain clouded by uncertainty until realised, while the risk of further weaponisation of gas shipments by Russia remains.

- Yen volatility briefly spiked (USD/JPY seesawed within a 50-pip range) as the BoJ kept its monetary policy settings and forward guidance unchanged, but tweaked economic forecasts to reflect stronger headwinds to growth and upside risks to inflation. The Bank flagged concern with sharp fluctuations in FX and commodity markets. As the dust settles, JPY is roughly where it was before the announcement.

- Traditional safe havens were out of favour despite questionable performance from regional stock markets. The greenback and yen were broadly softer, while the CHF lagged its European peers.

- The kiwi dollar landed at the bottom of the G10 pile, despite the lack of any obvious domestic catalysts. Correction of yesterday's outperformance may have played a role here.

- Central bank activity will remain in high gear, with the ECB preparing to announce its monetary policy decisions & BoE Chief Economist Pill due to speak. In the EM space, rate reviews are due in Indonesia, Turkey and South Africa.

- On the data front, focus turns to U.S. initial jobless claims & Philadelphia Fed Business Outlook.

FX OPTIONS: Expiries for Jul21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.2bln), $1.0200-10(E1.8bln)

- NZD/USD: $0.6300(N$500mln)

- USD/CAD: C$1.2900($885mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/07/2022 | 0800/0900 |  | UK | BOE Pill Intro at BOE & ECB Conference | |

| 21/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 21/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 21/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/07/2022 | 1245/1445 |  | EU | ECB Press Conference | |

| 21/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/07/2022 | 1515/1715 |  | EU | ECB Lagarde Presents Policy Decision via Podcast | |

| 21/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.