-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsy Yields & DXY Give Back Part Of Tuesday's Lift

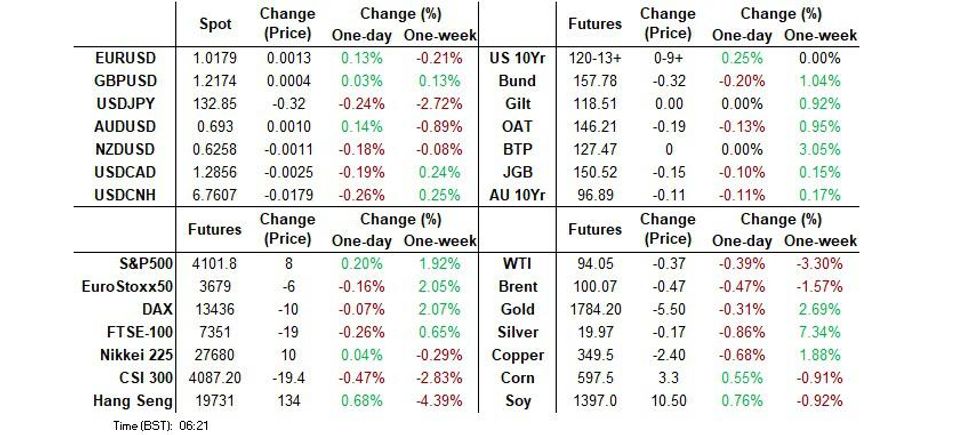

- DXY & Tsy yields nudge lower in Asia.

- E-minis flat, with a lack of fresh military escalation surrounding the Taiwan situation.

- Today's data highlights include U.S. factory orders & final durable goods orders, Eurozone retail sales and a suite of Services PMI readings from across the globe. The central bank speaker slate is dominated by Fed members, with Bullard, Harker, Daly, Barkin & Kashkari all set to make appearances.

US TSYS: A Little Firmer In Asia, Belly Leads Bid

TYU2 deals +0-10+ at 120-14+, 0-01+ off the peak of its 0-13+ range, operating on above average volume of ~140K. Cash Tsys run 2-5bp richer across the curve, with the belly outperforming.

- Asia-Pac trade saw Tsys fade away from Tuesday’s cheapest levels. As a reminder, yesterday’s cheapening came about as some of the more dovish (at least in a historical context) regional Fed Presidents pushed back on the idea that the Fed was nearing a pivot, stressing its commitment to combatting inflation. St. Louis Fed President also chimed in during overnight dealing, Bullard continued to attempt to playdown any recession-related worry, while flagging a more data-dependent round of tightening going forwards, in addition to reiterating his view that the Fed Funds target should be at 3.75-4.00% by year-end.

- The continued verbal jousting re: the Taiwan situation played into the bid. China vowed to enact criminal punishment against “Taiwan-independence diehards” via the major state-run media outlet, Xinhua, while it also levied trade bans on certain Taiwanese goods. Elsewhere, Chinese Foreign Minister Wang Yi has urged the U.S. to stop playing the Taiwan card. Ultimately, the focus of any Chinese reaction to U.S. House Speak Pelosi’s trip to Taiwan remains Taiwan-centric for now, avoiding the worst case scenario for markets (e-minis are a touch above settlement levels).

- A joint press conference between the Taiwanese President Tsai & U.S. House Speaker Pelosi generated the sort of language you would expect i.e. Taiwan noting that won’t back down to China, while it looks to develop its relationship with the U.S. & Pelosi being supportive of Taiwan, flagging the potential for some form of fairly imminent trade agreement between the two countries.

- On the flow side, 2x block buys in TY futures supported the space during the first half of Asia dealing (a cumulative ~$873K in DV01 terms).

- NY hours will see the release of the ISM services survey, final S&P services PMI, factory orders, final durable goods data and weekly MBA mortgage apps. We will also get the quarterly refunding announcement from the Treasury and a raft of Fedspeak (Barkin, Bullard, Harker & Kashkari).

JGBS: Off Lows In Tokyo

JGB futures edged away from their overnight trough during the Tokyo session, although the contract has stuck to a narrow range, -20 vs. settlement into the close.

- Cash JGBs run little changed to 2.5bp cheaper on the day, bear steepening. Much of the long end has stuck to ranges established in early dealing after the initial cheapening adjustment in lieu of Tuesday’s core global FI moves (10s being the exception, although they are off session cheaps).

- There hasn’t been anything in the way of meaningful domestic news flow to digest since the Tokyo open, although there has been confirmation that U.S. House Speaker Pelosi will visit Japan on Thursday, in what will be another leg of her heavily-watched trip to the Asia-Pacific region.

- The breakdown of the latest round of BoJ Rinban operations revealed slight moderations in cover ratios across the 1- to 5- & 10- to 25-Year zones of the curve, although that didn’t have any tangible impact on JGBs.

- 10-Year JGBi supply headlines tomorrow’s docket.

AUSSIE BONDS: Working Away From Lows In Sydney Trade

Aussie bonds have edged further away from their overnight/early Sydney cheaps as we have worked our way through the Sydney day, tracking a bid in U.S. Tsys as core FI markets have unwound a little of Tuesday’s Fedspeak-inspired cheapening. Worry surrounding U.S. House Speaker Pelosi’s visit to Taiwan also aided the move in ACGBs away from worst levels amidst a barrage of sharp Chinese rhetoric and trade embargoes on the island, although the lack of escalation of a military nature meant that the moves away from lows remained fairly shallow.

- Cash ACGBs run 6.0-12.5bp cheaper. YM is -12.5 and XM is -11.0, while Bills are 4 to 18 ticks cheaper through the reds, bear steepening.

- The latest round of ACGB Nov-32 supply went well enough, with the average yield pricing 1.15bp through prevailing mids, although the cover ratio printed 2.44x, coming in below the six-auction average of 2.95x. The recent move away from cycle cheaps in core FI markets and yesterday’s RBA decision likely helped promote firm pricing at the auction, with the cheapness of the line vs. the nearby benchmark 10-Year ACGB May-32 likely aiding in digestion, although overall demand wasn’t overwhelming, per the cover ratio dynamics.

- There was some limited trans-Tasman gyrations surrounding New Zealand’s labour market data, which faded quickly.

- Thursday’s domestic data docket will be headlined by Australian trade balance figures for June, with little else on offer.

FOREX: USD Unwinds Initial Gains, China Caixin Services PMI Beat Aids Sentiment

Initial greenback strength dissipated as U.S. Tsy yields declined across the curve. While hawkish comments from '22 FOMC voter Bullard ("soft landing doesn't require gradualism") generated a fresh buying impulse in early Tokyo trade, the dollar struggled to cling onto those gains. The BBDXY index toped out at 1,276 and turned its tail, pulling back into yesterday's range.

- Risk sentiment in the region improved as China's Caixin Services PMI beat expectations (55.5 versus 53.9 expected), offering some comfort after disappointing data on manufacturing sector released a few days back. Spot USD/CNH posted a leg lower in response to the data, despite continued focus on Sino-U.S. tensions surrounding House Speaker Pelosi's ongoing visit to Taiwan.

- USD/JPY retreated from new weekly highs after the Tokyo fix. Lower U.S. Tsy yields were the likely culprit, as the spread between yields on 10-Year Tsys/JGBs shrank ~7bp from Tuesday's closing levels. Despite that, USD/JPY 1-month risk reversal plumbed a new weekly high.

- The kiwi dollar took a nosedive upon the release of New Zealand's Q2 labour market data and remains the worst G10 performer, albeit it is clawing back losses amid broader recovery in sentiment/USD sales, with NZD/USD sitting at $0.6248 (off session low of $0.6213 & 20 pips below neutral levels) as we type.

- New Zealand's unemployment rate unexpectedly edged higher from record lows, which came on the back of employment growth & participation missing forecasts. On the other hand, wage figures were strong, with the Labour Cost Index posting the steepest annual increase since late 2008.

- Solid wage data coupled with the latest CoreLogic House Price Index, which showed the largest quarterly decline in property prices since the GFC, may have helped prevent the market from boosting RBNZ rate-hike bets.

- Today's data highlights include U.S. factory orders & final durable goods orders, EZ retail sales and a suite of Services PMI readings from across the globe.

- Central bank speaker slate is dominated by Fed members, with Bullard, Harker, Daly, Barkin & Kashkari all set to make appearances.

FX OPTIONS: Expiries for Aug03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0150(E589mln), $1.0193-00(E1.8bln), $1.0245-50(E654mln)

- USD/JPY: Y131.25($530mln), Y131.50($495mln), Y132.25($500mln)

- EUR/JPY: Y135.85-00(E664mln)

- USD/CNY: Cny6.75($1.1bln)

ASIA FX: Rebound In US Yields Could Undermine Recent SEA/INR FX Outperformance

While the near term focus remains on US-China geopolitical tensions and China military exercises around Taiwan, the overnight bounce in US yields has the potential to undermine the recent outperformance in South East Asia (SEA) and INR FX.

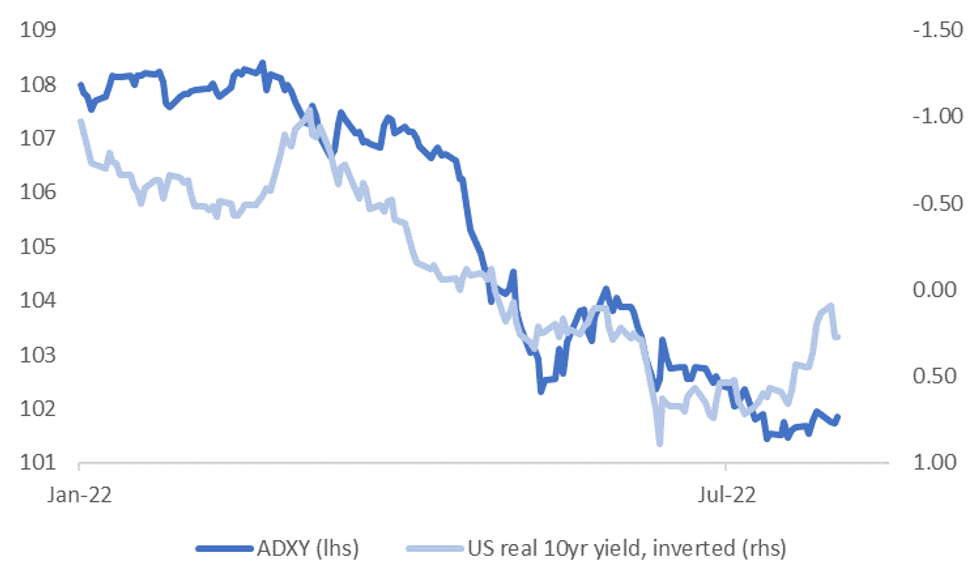

- The chart below updates a recent one we produced of the J.P. Morgan Asian currency index (ADXY) against the real US 10yr yield (which is inverted on the chart). From July 20th to the start of the month we saw a sharp drop in the US real yield from +60bps to +9bps, although this was reversed somewhat overnight (back to +27bps).

- The ADXY didn't rally much with this move lower in real yields, as the index is heavily weighted to CNY, which has arguably been driven more by geopolitics in recent weeks.

Fig 1: ADXY & US Real 10yr Yield

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

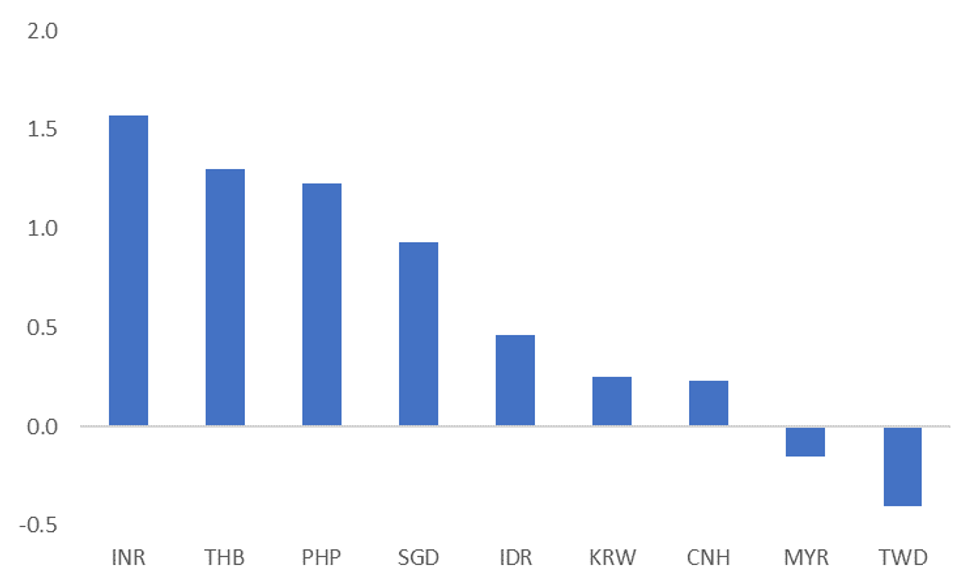

- The benefit was clearer for other Asian FX though, particularly in SEA/INR. The second chart below plots spot returns since that most recent peak in the real 10yr yield (July 20th).

- Stronger gains were seen in economies typically more sensitive to shifts in Fed policy, although this wasn't uniform, whilst TWD underperformance over this period is likely tied to Pelosi's visit.

- Still, gains have slowed in the likes of THB, PHP, IDR and INR today, with higher US yields no doubt a factor. Relative performance trends in Asian FX is something to be mindful of amidst on-going shifts in the US outlook.

- Fig 2: Asian FX Returns Since Recent Peak In US Real Yield (July 20th)

Source: MNI/ Market News/Bloomberg

Source: MNI/ Market News/Bloomberg

EQUITIES: Mostly Higher In Asia; Chinese Developer Sell Off Continues

Most major Asia-Pac equity indices are firmer at typing following the closely-watched joint appearance between U.S. House Speaker Pelosi and Taiwanese President Tsai earlier in the day, although Chinese and Hong Kong benchmarks have pared their initial bids, dragged lower by weakness in Chinese developers.

- The Hang Seng trades 0.6% firmer, paring earlier gains of as much as 1.2% after having opened higher. The loss in momentum comes as the HSTECH (+1.3%) is back from as much as +2.8% higher earlier, although gains in China-based tech equities largely countered continued weakness in the property (-0.8%) and finance (-0.4%) sub-indices.

- The CSI300 sits virtually unchanged at typing, paring gains of as much as 1.1%. Relatively shallow losses across industrials and financials added to gloom in real estate, with the CSI300 Real Estate Index (-1.9%) on track to record a sixth consecutive lower daily close. On the other hand, the healthcare (+1.1%) sub-gauge outperformed, while a broad swathe of defence-related stocks such as Jiangxi Xinyu Guoke (+3.2%) and AECC Aviation Power (+7.8%) were bid for another day.

- The Taiex sits 0.2% worse off at typing, back from as much as 0.5% lower. Weakness in virtually every other equity sector countered outperformance in the heavyweight Semiconductor (+0.7%) sub-gauge, coming as Pelosi had earlier raised the prospect of closer U.S.-Taiwan collaboration re: chips in the Taiwanese Parliament.

- E-minis sit flat to 0.3% better off at typing, operating around the bottom of their respective ranges established on Tuesday.

GOLD: Higher In Asia

Gold sits $6/oz better off, printing $1,767/oz at typing. The precious metal has rebounded from its early Fedspeak-induced lows, rising above neutral levels after the Australia Q2 retail sales print, with a downtick in nominal U.S. Tsy yields aiding the move higher.

- To recap Tuesday’s price action, gold retreated from 4-week highs to close ~$12/oz lower, snapping a four-day streak of gains. The decline tracked a similar move in the USD, with the DXY closing higher on the day after its own four-session streak of losses.

- Gold’s move away from Tuesday’s highs also comes as headlines surrounding U.S. House Speaker Pelosi’s visit to Taiwan remains focused on a widening suite of Chinese trade and business embargoes on Taiwan, with little sign of military escalation from the Chinese observed at present despite the swathe of conflict-tinged warnings prior to Pelosi landing in the country.

- Headline risks from Pelosi’s visit will remain in focus throughout the day as she meets with Taiwanese leaders, although both the White House and her have recently reiterated that the trip does not represent a change in long-standing U.S. policy towards the island.

- From a technical perspective, gold’s recent bounce is still seen as corrective, with focus on initial resistance at ~$1,784.8/oz (50-Day EMA), a break of which would expose further resistance at $1,809.5/oz (trendline resistance). On the other hand, support is seen at ~$1,747.7/oz (20-Day EMA).

OIL: Off Worst Levels; OPEC+ Decision Eyed

WTI is ~-$0.30 and Brent is ~-$0.40, paring earlier losses of as much as ~$1.00-1.20 apiece at typing. Both benchmarks operate a short distance above their respective, recently-made multi-week lows ahead of the OPEC+ decision due later today, with focus centred on a potential output increase from the group.

- To elaborate, WSJ source reports have pointed to OPEC+ considering proposals for output increases at today’s meeting, corroborating earlier, separate source reports re: the matter from both RTRS and a Fox Business news reporter.

- On the sidelines, note that RTRS source reports on Tuesday pointed to the OPEC+ Joint Technical Committee (JTC) lowering their forecasted surplus in global oil markets (from 1.0mn bpd in their July forecast to 800K bpd).

- Brent’s prompt spread continues to moderate, printing ~$1.84 at typing, down from its peak at ~$2.80 just earlier this week.

- Elsewhere, the latest round of U.S. API inventory estimates crossed on Tuesday, with oil prices edging lower after reports pointed to a surprise build in crude stockpiles. Cushing hub stocks rose, while there was a drawdown in gasoline and distillate inventories.

- Looking ahead, U.S. EIA inventory data is due, with WSJ estimates calling for a drawdown in crude stocks.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/08/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/08/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 03/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/08/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/08/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/08/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/08/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/08/2022 | 1430/1030 |  | US | Philadelphia Fed's Patrick Harker | |

| 03/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 03/08/2022 | 1545/1145 |  | US | Richmond Fed's Tom Barkin | |

| 03/08/2022 | 1830/1430 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.