-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE day, 25 Or 50? That Is The Question

EXECUTIVE SUMMARY

- FED LEADERS PLEDGE TOUGH FIGHT TO KEEP INFLATION CREDIBILITY (BBG)

- LIZ TRUSS TO LOOK AT CHANGING BANK OF ENGLAND MANDATE ON INFLATION (FT)

- MR. JGB SAYS MARKETS NEED TO PREPARE FOR BOJ BUYING FEWER BONDS (BBG)

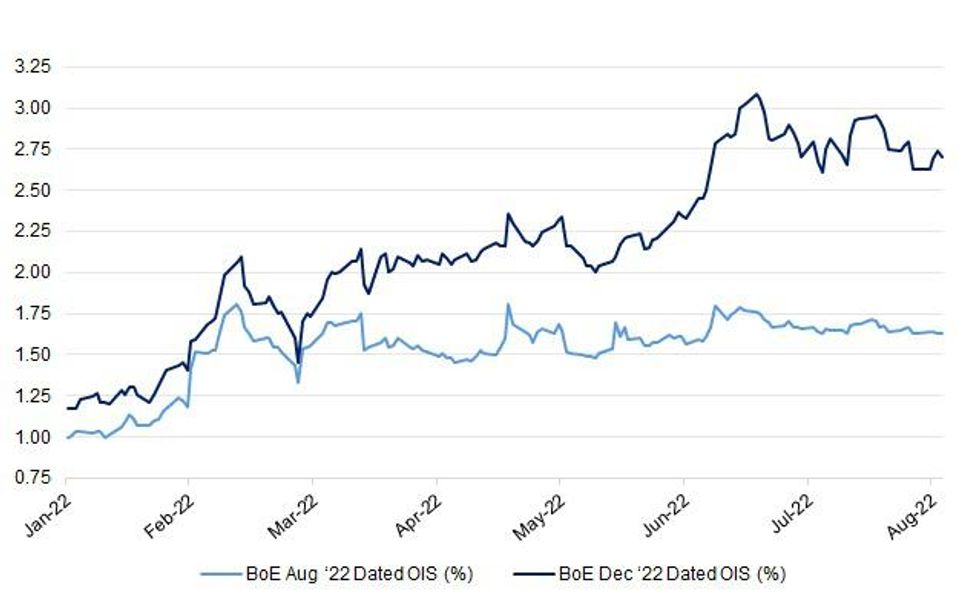

Fig. 1: BoE Aug ‘22 & Dec ‘22 Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Liz Truss has received a fresh boost in her bid to become the next Conservative leader as she and rival Rishi Sunak prepare to face the cameras on Sky News this evening. A second poll in less than 24 hours showed the gap between the foreign secretary and Mr Sunak widening. The new survey of Conservative Party members by ConservativeHome released on Wednesday found Ms Truss is most likely to become the next prime minister - with 58% of those asked backing her. Mr Sunak was found to have the support of 26% - while 12% were undecided. (Sky)

BOE: Foreign secretary Liz Truss, frontrunner in the race to become the next British prime minister, said she would look to change the Bank of England’s mandate to ensure it controlled inflation. (FT)

EUROPE

GERMANY: There may be irregular operations at Uniper’s Staudinger 5 coal-fired plant though Sept. 7 due to a limitation of coal volumes on site, according to notice on EEX’s platform. Supply limitation due to low water levels of the Rhine river. (BBG)

U.S.

FED: “There is a path to getting inflation under control,” Barkin said in his separate speech, to the Shenandoah Valley Partnership in Virginia. “But a recession could happen in the process. If one does, we need to keep it in perspective: No one canceled the business cycle.” Barkin was not specific in describing his desired path of interest rates, but said inflation was unlikely to come down quickly or predictably. (BBG)

FED: Minneapolis Federal Reserve President Neel Kashkari said on Wednesday the possibility that the U.S. central bank will pivot to cutting interest rates next year is extremely unlikely. "Some financial markets are indicating they expect us to cut interest rates next year," Kashkari said at an event held as part of a financial regulation conference in New York. "I don't want to say it's impossible, but it seems like that's a very unlikely scenario right now given what I know about the underlying inflation dynamics. The more likely scenario is we would continue raising (interest rates) and then we would sit there until we have a lot of confidence that inflation is well on its way back down to 2%." (RTRS)

FED: "When you think of 2.5%, that's the longer-run neutral rate of interest, but right now, inflation is high," Daly added. "And there's a lot of demand chasing limited supply, and so of course the neutral rate is elevated. So my own estimate of where that would be right now is around or a little bit over 3%, maybe 3.1%." "So in my judgment, we're not even up to neutral right now," Daly said. (RTRS)

ECONOMY: U.S. employment may have notched a "very modest" increase in July, according to a St. Louis Fed analysis of real-time data from employee scheduling software provider Homebase, bank economist Max Dvorkin told MNI. (MNI)

FISCAL: Kyrsten Sinema is seeking a couple changes to Democrats' climate, health care and tax bill, according to multiple people familiar with the matter. The Arizona Democrat, who has not weighed in on whether she will vote for the legislation, wants to nix language narrowing the so-called carried interest loophole, which would change the way some investment income is taxed. Cutting that provision would ax $14 billion of the bill's $739 billion in projected revenue. (POLITICO)

FISCAL: The Congressional Budget Office said on Wednesday it has estimated that a $430 billion drugs, energy and tax bill proposed by Senate Democrats would result in a net decrease in the deficit of $102 billion over a 10-year period. (RTRS)

OTHER

GLOBAL TRADE: More ships loaded with grain are ready to depart from Ukraine’s seaports following the vessel Razoni, which arrived in Turkey Tuesday, Ukraine’s Foreign Minister Dmytro Kuleba said without elaborating, according to the Interfax news service. “We hope everything will work and the Russian Federation won’t make any steps that would ruin these agreements that have been so difficulty achieved via brokerage from the UN and Turkey,” Kuleba said in a news conference in Kyiv, according to Interfax. (BBG)

U.S./CHINA/TAIWAN: The Biden administration is lobbying Democratic senators to put the brakes on a bill that would alter US policy toward Taiwan, including by designating it as a major non-NATO ally, according to people familiar with the matter. (BBG)

U.S./CHINA/TAIWAN: China's Taiwan affairs office said on Thursday punishment of pro-Taiwan independence diehards and external forces was reasonable and lawful, amidst raised tensions in the Taiwan strait following U.S. House speaker Nancy Pelosi's Taipei visit. Taiwan is not a 'regional' issue but China's internal affair, the Beijing-based Taiwan affairs office added, as the country's military embarks on targeted military drills in a number of zones surrounding Taiwan. On Wednesday a suspected Taiwanese separatist was detained by state security in East China's Zhejiang province on suspicion of endangering national security, state media reported. (RTRS)

U.S./CHINA/TAIWAN: Taiwan's ruling party said on Thursday that Chinese military drills have triggered regional tensions and are illegitimate. (RTRS)

U.S./CHINA/TAIWAN: Taiwan's defence ministry said on Thursday that unidentified aircraft, probably drones, had flown on Wednesday night above the area of its Kinmen islands, which are just off the southeastern coast of China, and that it had fired flares to drive them away. Taiwan has been on alert as China conducts a series of military exercises in response to a visit to the island this week by U.S. House of Representatives Speaker Nancy Pelosi. (RTRS)

NATO: The Senate passed a resolution Wednesday ratifying Finland's and Sweden's applications to join NATO as the Western military alliance seeks to strengthen its resolve against the threat posed by Russia. (NBC News)

BOJ: Bank of Japan officials are more focused on policy cues from a possible U.S. recession and slower global demand than recent solid yen gains against the dollar in July as firms importing goods do not immediately change spending plans based on short-term forex moves, MNI understands. (MNI)

JAPAN: Investors should start preparing for a return to normal Japanese bond trading as the central bank will one day step back from its debt purchases, according to a senior government official widely known as Mr. JGB. (BBG)

AUSTRALIA: SEEK new job ads fell -3.1% m/m in July, the second consecutive month of decline. Last month we noted the decline in new job ads may signal a peak in labour demand at very elevated levels amid difficulty finding suitable labour, although it was too early to tell. The decline in July adds support to that thesis, though the level of job ads is still 60.6% above pre-pandemic levels. (NAB)

NEW ZEALAND: Job ads recovered some lost ground in July, as they rose 1.3% following June’s 5.3% decline. This sees job ads 4.1% below their record level set back in May. But it is still too early to conclusively conclude that job ads have peaked in this cycle. Job ads can bounce around from month to month. That said, it is notable that the trend measure running through them eased 0.4% in July, its first monthly slippage since September last year in the wake of Delta arriving in the country. (BNZ)

ASIA: Southeast Asia's regional bloc ASEAN warned on Thursday that an increase in international and regional volatility could lead to "miscalculation, serious confrontation, open conflicts and unpredictable consequences among major powers". The Association of Southeast Asian Nations made the remarks in a statement from foreign ministers after the bloc's chair Cambodia had called on all sides to de-escalate tensions over Taiwan. (RTRS)

BRAZIL: Brazil’s central bank raised its key interest rate by half a percentage point and indicated another hike is possible next month as greater government spending before October’s elections drive inflation forecasts further above target. (BBG)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Wednesday the government-backed tax reform that has not yet been voted on in the Senate could finance cash handouts of 600 reais in 2023 under the welfare program Auxilio Brasil. Speaking at an event hosted by Brazilian brokerage XP Inc, Guedes also said budget de-indexing can make room for such expenditure under the spending cap. (RTRS)

BRAZIL: Brazil’s President Jair Bolsonaro is increasingly courting Christian evangelicals in the run-up to the October election in a strategy to block inroads made by his leftist challenger into the crucial constituency. (BBG)

RUSSIA: G-7 will continue to explore further measures against Russia to prevent it profiting from war, according to a statement from G-7 foreign ministers on energy security. Will further reduce reliance on civil nuclear and related goods from Russia. Seeks solutions that reduce Russian revenues from hydrocarbons. (BBG)

RUSSIA: Consumer prices in Russia declined for the fourth week running, data showed on Wednesday, as the rouble's appreciation in the past few months and a drop in consumer demand weighed on the pace of price growth. The consumer prices index (CPI) declined 0.14% in the week to Aug. 1 after sliding 0.08% a week earlier, the federal statistics service Rosstat said. (RTRS)

RUSSIA: Russia provided 130b rubles in subsidized loans to Yandex, VK Co and Ozon to help the companies meet obligations to their euro bond holders, Kommersant reports, citing an unidentified person familiar with the government plans. (BBG)

SOUTH AFRICA: South African power utility Eskom said it would escalate scheduled power cuts to "Stage 4" from 4 p.m. until midnight local time (1400 to 2200 GMT) on Thursday due to a shortage of generation capacity. (RTRS)

IRAN: Iran has completed installing three advanced IR-6 centrifuge cascades at its Natanz fuel enrichment plant (FEP), according to an International Atomic Energy Agency report to member states on Wednesday seen by Reuters. Iran has also informed the agency it plans to install an additional six IR-2m cascades at the FEP in a new operating unit, the report said, as top Iranian and U.S. officials headed to Vienna for talks this week on reviving the 2015 nuclear pact. (RTRS)

IRAN: Russia stands ready for constructive talks aimed at salvaging Tehran's 2015 nuclear deal with world powers, Russia's envoy to the talks tweeted on Wednesday, as Iranian and U.S. top negotiators head to Vienna to hold indirect negotiations. (RTRS)

IRAQ: Iraqi populist cleric Moqtada al-Sadr on Wednesday told his supporters to continue their sit-in which occupies the Baghdad parliament until his demands which include early elections and unspecified constitutional changes are met. (RTRS)

COMMODITIES: Guterres, the UN secretary-general, tore into global energy companies, saying it’s “immoral for oil and gas companies to be making record profits from this energy crisis on the backs of the poorest people and communities, at a massive cost to the climate.” (BBG)

METALS: Top global copper producer Codelco reported an accident at its Chuquicamata mine on Wednesday, weeks after a mishap killed a worker there and drew scrutiny to the Chilean state company's safety practices. (RTRS)

GAS: Russia's Gazprom said on Wednesday that Canadian, EU and U.K. sanctions make the delivery of a Siemens engine to the Nord Stream Portovaya compressor station impossible. (RTRS)

GAS: The second-largest U.S. liquefied natural gas (LNG) exporter on Wednesday said it reached an agreement with a federal regulator that will allow it to resume some operations at its Quintana, Texas, plant in October.Freeport LNG shut the plant, which supplies about 20% of U.S. LNG exports, following an explosion and fire on June 8. (RTRS)

GAS: European Union countries are likely to discuss more detailed measures to help energy-vulnerable states such as Germany in the event of a Russian gas shutdown in the autumn, after giving final approval later this week to a new Alert Mechanism allowing for mandatory consumption cuts in an emergency, EU officials said. (MNI)

OIL: The Swiss government said it will match European Union sanctions on Russia and allow for some exemptions in respect to oil payments. The EU introduced measures last month allowing for transactions with some sanctioned entities if they’re deemed essential to supplies of food, agricultural goods and oil to third countries. (BBG)

OIL: Iraqi oil minister Ihsan Abdul Jabbar said that Wednesday’s OPEC+ decision to raise its output target by 100,000 barrels per day (bpd) seeks to achieve balance between supply and demand in global oil markets. (RTRS).

OIL: Caspian Pipeline Consortium (CPC), which connects Kazakh oil fields with Russian Black Sea port of Novorossiisk, said on Wednesday that supplies were significantly down, without providing figures. CPC said that oil offtake was reduced from Kazakh Tengiz field due to maintenance there and oil supply volumes from another Kazakh oil field, Kashagan, were also down as production was suspended there. (RTRS)

FOREX: The dollar's strength has yet to peak, according to a majority of currency strategists polled by Reuters who were however divided on when the currency's advance would come to an end. The greenback slipped from a decade high in mid-July but quickly snapped back when three Fed officials made it clear the central bank was "completely united" on increasing rates to a level that would put a dent in the highest U.S. inflation since the 1980s. With the Fed expected to stay ahead of its peers in the tightening cycle by some measure, and the global economy expected to slow significantly, a path for the dollar to weaken meaningfully or for most other currencies to stage a comeback is difficult to forge. In the Aug. 1-3 poll, a strong majority of more than 70% of strategists, or 40 of 56, who answered an additional question said the dollar's strength hasn't yet peaked. Asked when it would peak, 14 said within three months, 19 said within six months, another six said within a year and one said within two years. Only 16 said it already had. (RTRS)

CHINA

PBOC: The People’s Bank of China is unlikely to cut interest rates in the second half of the year amid the tightening of the global financial environment and rising domestic inflation, though a small cut to the reserve requirement ratio in Q4 cannot be ruled out, wrote Wen Bin, chief economist of Minsheng Bank in an article published by 21st Century Business Herald. The central bank will focus on guiding banks to increase lending, while maintaining ample liquidity and driving down the actual loan interest rate, said Wen. There is still room for the Loan Prime Rate to decrease, especially the five-year maturity, if consumption and investment is weaker than expected, said Wen. (MNI)

FISCAL: Major projects in several provinces including Jiangsu and Zhejiang have received funding support from financial bonds by policy banks to accelerate construction, in a bid to help stabilize economic growth, Securities Daily reported. A total CNY300 billion of financial bonds approved earlier can leverage as much as CNY1.5 trillion supporting funds for project construction, the newspaper said citing Wang Qing, analyst with Golden Credit Rating. Coupled with CNY800 billion credit line of policy banks, this round of financial instruments can drive up to CNY2.6 trillion of incremental funds for projects in H2, the newspaper said citing Wang. Fixed-asset investment this year can be accelerated by about 4.8 percentage points from 2021’s 4.9% should the above policy tools are fully utilized, Wang was cited as saying. (MNI)

YUAN: The Chinese yuan is likely to remain stable by the end of August, with an average forecast of 6.75 against the U.S. dollar, compared with the 6.7434 on July 29, Yicai.com reported citing 17 economists it polled. Major non-U.S. currencies such as the euro and the yen may continue to weaken into August as the Federal Reserve’s aggressive rate hikes will support the dollar in the short term, Yicai said citing Lian Ping, president of Zhixin Investment Research Institute. These economists expect the yuan to strengthen to 6.68 against the dollar by the end of 2022, the newspaper said. (MNI)

INFRASTRUCTURE: China’s infrastructure investment is expected to grow 11% on year in 2022, providing strong support to the domestic economic recovery, China Securities Journal reports Thursday, citing analysts. (BBG)

CORONAVIRUS: The southern Chinese city of Sanya, a tourism hotspot, imposed lockdown measures from Thursday in most parts of the city, ordering residents to reduce their trips outside to shop for daily necessities to once every two days and confining some strictly to their homes. (RTRS)

CORONAVIRUS: Elsewhere, the southwestern megacity of Chongqing locked down neighborhoods in one district after detecting two infections on Wednesday. The manufacturing hub hasn’t seen a major lockdown since early 2020. The eastern city of Yiwu, a wholesale hub for Christmas decorations and other consumer products, is starting mass PCR testing from Thursday after finding 38 cases since Tuesday. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.4844% at 9:51 am local time from the close of 1.3000% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 41 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7636 THURS VS 6.7813

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7636 on Thursday, compared with 6.7813 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA JUN TRADE BALANCE A$17,670BN; MEDIAN A$14,000BN; MAY A$15,965BN

AUSTRALIA JUN EXPORTS +5%; MEDIAN +0%; MAY +9%

AUSTRALIA JUN IMPORTS +1%; MEDIAN +3%; MAY +6%

MARKETS

SNAPSHOT: BoE day, 25 Or 50? That Is The Question

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 163.93 points at 27905.83

- ASX 200 up 7.055 points at 6983.00

- Shanghai Comp. up 4.718 points at 3168.392

- JGB 10-Yr future up 8 ticks at 150.58, yield down 0.8bp at 0.181%

- Aussie 10-Yr future down 5.5 ticks at 96.85, yield up 5.7bp at 3.131%

- U.S. 10-Yr future +0-07+ at 120-10+, yield up 1.27bp at 2.717%

- WTI crude up $0.27 at $90.93, Gold up $6.25 at $1771.58

- USD/JPY down 12 pips at Y133.74

- FED LEADERS PLEDGE TOUGH FIGHT TO KEEP INFLATION CREDIBILITY (BBG)

- LIZ TRUSS TO LOOK AT CHANGING BANK OF ENGLAND MANDATE ON INFLATION (FT)

- MR. JGB SAYS MARKETS NEED TO PREPARE FOR BOJ BUYING FEWER BONDS (BBG)

US TSYS: Narrow Overnight

Tsys lacked anything in the way of meaningful traction overnight, operating shy of their respective Wednesday peaks. The major cash Tsy benchmarks run 1.0-2.0bp cheaper across the curve as a result, sticking to tight ranges. TYU2 is +0-06 at 120-09, 0-01+ off the base of its 0-06+ range, on sub-par volume of 60K lots.

- Given the lack of meaningful major news flow and proximity to Friday’s NFP print, we would suggest that today’s Asia-Pac session has been more of a time to reflect for regional participants. This comes after a ~33bp range for 10-Year yields over the last couple of sessions (peak to trough), with Tuesday’s move representing one of the largest intraday net swings observed over the last decade and included the failure of bulls to meaningfully test the 2.50% yield level (lows of 2.5143% were reached, representing the lowest yield level observed since early April).

- Early Asia trade saw contacts flag real money accounts’ desire to reduce duration exposure, perhaps ahead of event risk later in the week and after Pelosi’s visit to Taiwan came and went.

- Looking ahead, the latest BoE monetary policy decision will provide interest during the London-NY crossover (our full preview of that event is available here), with Challenger job cuts and weekly jobless claims data set to headline the economic releases during the NY session. We will also hear from Cleveland Fed President Mester (’22 voter).

JGBS: Curve Flattens, Futures Coil

JGB futures have been happy to consolidate during the Tokyo afternoon after failing to build on a short and limited look above their overnight high during the Tokyo morning, last dealing +9 vs. yesterday’s settlement level, a little shy of best levels. The major cash JGB benchmarks run 0.5-3.0bp richer across the curve, bull flattening. There hasn’t been much in the way of decisive news flow to digest leaving participants to react to yesterday’s flattening of the U.S. Tsy curve and limited cross-market gyrations observed since the open.

- BBG conducted an interview with “Mr. JGB,” who warned that “investors should start preparing for a return to normal Japanese bond trading as the central bank will one day step back from its debt purchases.” This hasn’t had much in the way of market impact, although the article has generated plenty of interest.

- 10-Year breakevens have moved to the narrowest levels observed since early April. Today’s 10-Year JGBi auction results were mixed. The price component was comfortably firmer than expected, although the cover ratio softened to 3.323x, below the 6-auction average of 3.48x. The pricing suggests there was decent enough demand for inflation protection given the current well-documented global inflationary picture, with some participants willing to pay up for such protection, although the limited nature of the spill over into Japanese prices likely tempered wider demand, limiting the cover ratio. It would seem the market has looked to the softer cover ratio when it comes to subsequent price action.

- Elsewhere, the latest round of Japanese weekly international security flow data suggested that the sizable covering of short JGB positions on the part of international investors resumed last week, after a one-week break, with their net purchases of Japanese bonds comfortably topping the Y1tn mark for the third time in four weeks.

- Wage and household spending data headlines the domestic docket on Friday.

JGBS AUCTION: Japanese MOF sells Y250.0bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y250.0bn 10-Year JGBis:

- High Yield: -0.708% (prev. -0.715%)

- Low Price: 107.35 (prev. 107.60)

- % Allotted At High Yield: 54.0000% (prev. 53.6842%)

- Bid/Cover: 3.323x (prev. 3.618x)

AUSSIE BONDS: Bear Flattening

Aussie bonds have continued to edge lower as we have worked our way through the Sydney session, with the record Australian trade surplus print for June and marginal cheapening in U.S. Tsys helping to pull the space away from best levels. Cash ACGBs run 3.5-6.0bp cheaper across the curve, bear flattening, while YM and XM are -6.0 and -5.5, respectively operating within the lower end of their respective overnight ranges after failing to break above neutral levels earlier in early Sydney dealing.

- Note that the latest round of semi supply from TCV (a ~A$2bn tap of Sep-33 paper) may have added some pressure to XM around the time of pricing.

- Bills run flat to 7 ticks cheaper across the reds, bear steepening.

- Friday will see A$700mn of ACGB Apr-2027 on offer ahead of the RBA’s quarterly Statement on Monetary Policy (SoMP), with the AOFM's weekly issuance slate to follow soon after.

EQUITIES: Off Best Levels

Major Asia-Pac equity indices are broadly off best levels but remain bid as we head towards the end of Asia-Pac dealing, with tailwinds from Wall St's strongly positive lead aiding the overall move higher.

- The Nikkei 225 is 0.6% better off, back from as much as 1.0% higher. Tech and export-focused large caps contributed to the bulk of gains in the Nikkei, with the broader TOPIX trading flat at writing by comparison.

- The ASX200 deals 0.1% firmer at typing, paring initial gains of as much as 0.7% on weakness in the materials (-1.0%) and energy (-1.9%) sub-gauges, neutralising the bulk of gains in tech (S&P/ASX All Tech: +2.7%) and financials (+0.6%).

- The Hang Seng Index sits 1.5% better off at typing, back from session highs as China-based tech equities (HSTECH: +2.2%) have pared their initial bid, while initially decent showings from the financials (+1.0%) and property (+0.8%) sub-indices have moderated as well.

- The CSI300 is 0.3% better off at writing, backing away from session highs at around 1.0% higher as tech-related equities have given up their initial bid (ChiNext: +0.0%). Richly-valued consumer staples and healthcare equities nonetheless lead the way higher, with modest gains observed in utilities as well on the back of reports pointing to China’s State Grid planning to commence work on an increased amount of ultra high-voltage infrastructure in H2 ‘22.

- The Taiex trades 0.8% lower at typing, operating a shade above session lows amidst news that the Chinese military has commenced a five-day series of drills near the island.

- E-minis are flat to 0.2% weaker at writing, sitting a little below their respective U.S. earnings-induced highs made on Wednesday.

OIL: Just Off Multi-Month Lows As U.S. Inventory Data Weighs

WTI and Brent are ~$0.30 firmer apiece, with both benchmarks treading water above their respective worst levels established on Wednesday, placing them firmly back into ranges witnessed before the Russia-Ukraine war.

- To recap, WTI and Brent closed ~$3-4 lower apiece on Wednesday, seeing WTI hit five-month lows after the latest round of U.S. EIA inventory data pointed to a large, surprise build in crude stockpiles, corroborating with prior reports on API inventories. A smaller - but surprise increase in gasoline stocks was observed as well, stoking worry from some quarters re: demand destruction amidst higher energy prices, particularly as the build comes amidst the peak of seasonal demand.

- Demand-related worry surrounding the EIA data release more than offset tailwinds from the earlier OPEC+ announcement to raise collective output targets from Sep by 100K bpd, disappointing expectations for a larger increase in a move that some have said works out to “86 seconds of global demand” on a daily basis.

- Brent’s prompt spread continues to head south, printing ~$1.55 at typing (compared to peaking at ~$2.80 earlier this week), pointing to waning worry re: tightness in global crude supplies.

- Elsewhere, the Caspian Pipeline Consortium (CPC) has reported that crude supply has been significantly reduced at the Tengiz (>600K bpd capacity) and Kashagan (~400K bpd) oilfields without citing reasons nor figures at writing.

GOLD: Little Changed In Asia; Fedspeak Back In Focus

Gold sits ~$2/oz firmer to print $1,767/oz, operating within a tight ~$6/oz trading range across Asia-Pac dealing. The precious metal operates a short distance below Wednesday’s best levels at typing, extending a move off of yesterday’s troughs amidst a downtick in the USD (DXY).

- To recap Wednesday’s price action, gold closed ~$5/oz firmer, paring gains of as much as $12/oz after the marginally higher final U.S. services PMI reading and a stronger-than-expected ISM services print.

- The precious metal remains firmly below four-week highs made on Tuesday (at $1,788.1/oz), with worry surrounding Pelosi’s visit to Taiwan moderating from extremes (note that Chinese drills around Taiwan involving "long-range live ammunition shooting" will only conclude on 8 Aug), while previously-flagged Fedspeak over the past week has contained mostly hawkish undertones.

- From a technical perspective, focus is on initial resistance at ~$1,783.8/oz (50-Day EMA) following gold’s recent bounce higher, a break of which would expose further resistance at $1,807.1/oz (trendline resistance). On the other hand, support is seen at ~$1,748.9/oz (20-Day EMA).

FOREX: Yen Fluctuates, Antipodeans Gain In Quiet Asia Session

USD/JPY wavered between gains and losses, holding a 70-pip range in a catalyst-light Asia session. The pair lost some altitude over the Tokyo fix, but then recovered in sync with U.S. Tsy yields. The spot rate last deals a dozen pips shy of neutral levels, while USD/JPY risk reversal extended Wednesday's upswing.

- Worth pointing to sizeable USD/JPY option expiries coming up today. There is $1.4bn worth of options with strikes at Y133.00 due to roll off at the NY cut, with a further $2.4bn due to expire at Y134.80-00.

- Price action of USD/JPY showed strong correlation with broader greenback strength. The BBDXY index is back to virtually neutral levels and last sits at 1,272, holding yesterday's range in Tokyo trade.

- The Antipodeans took the lead, even as U.S. e-mini contracts struggled to return into positive territory. The AUD shrugged off Australia's widest trade surplus on record, underpinned by an expectation-busting growth in exports.

- The kiwi dollar outperformed at the margin, possibly supported by reflections on the state of New Zealand's labour market ahead of this month's RBNZ policy review. While data released yesterday showed an unexpected uptick in the unemployment rate, wage inflation remained hot.

- Most sell-side analysts expect the BoE to raise the bank rate by 50bp today. Our Markets Team assigns a subjective 70% probability to a half-percentage point hike (with a 25bp hike if not).

- Today's data highlights include German factory orders as well as U.S. jobless claims & trade balance. Fed's Mester will discuss the economic outlook.

FX OPTIONS: Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E691mln), $1.0150-60(E1.9bln), $1.0200-10(E1.bln), $1.0215-30(E1.7bln), $1.0295-00(E1.3bln)

- USD/JPY: Y129.35-45($2.4bln), Y132.00($863mln), Y133.00($1.4bln), Y134.25-31($590mln), Y134.80-00($2.4bln), Y135.05-10($778mln)

- AUD/USD: $0.7000(A$582mln)

- USD/CAD: C$1.2750($745mln)

- USD/CNY: Cny6.75($1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/08/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/08/2022 | 0800/1000 |  | EU | ECB August Economic Bulletin | |

| 04/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/08/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 04/08/2022 | 1130/1230 |  | UK | BOE Press Conference | |

| 04/08/2022 | 1230/0830 | * |  | CA | Building Permits |

| 04/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/08/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/08/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 04/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/08/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.