-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Summer Market Feeling

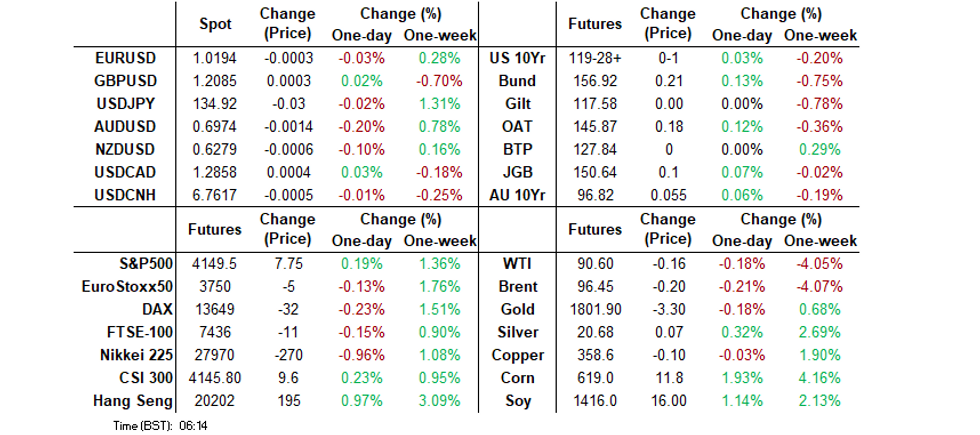

- G10 FI and FX markets coiled in Asia, with a holiday in Singapore limiting liquidity

- The Hang Seng saw some mild outperformance when it came to equity trade.

- Tuesday's broader docket is headlined by second tier releases.

US TSYS: Nothing To See Here

A very tight round of Asia-Pac trade for Tsys leaves TYU2 +0-02 at 119-29+, with the contract sticking to the confines of a narrow 0-04 range, operating just shy of Monday’s peak on vert limited volume of ~35K. Note that a lack of meaningful macro headline flow, lower than usual liquidity owing to a public holiday in Singapore and the proximity to Wednesday’s CPI print would have given many reason to stay on the sidelines overnight. Cash Tsys are little changed to 1bp richer across the curve.

- Looking ahead, NFIB small business optimism and unit labour cost data headline the NY economic data docket on Tuesday, with 3-Year Tsy supply also due.

JGBS: Flatter, Even As 30-Year Auction Presents A Soft Outcome

Tuesday provided a relatively subdued round of trade for the JGB space.

- The JGB curve has bull flattened, initially playing catch up to Monday’s move in Tsys, with the flattening impetus extending through the day. The major cash benchmarks run little changed to ~4bp richer across the curve.

- Meanwhile, JGB futures have coiled, last +12, sticking to a tight range since the Tokyo re-open, failing to challenge their overnight session peak.

- Local headline flow has been limited, outside of speculation surrounding the impending government cabinet reshuffle.

- A soft round of 30-Year JGB supply saw the low price miss wider expectations, with the width of the tail widening a touch and cover ratio moving to the lowest level observed at a 30-Year JGB auction since October ’21. It would seem that the degree of the move away from outright cycle cheaps and pre-action richening provided enough of a reason for the lifer & pension community to stay on the sidelines. 30s saw some incremental cheapening post-auction, while JGB futures move a couple of ticks lower, before a bid came back in.

- Looking ahead, PPI data and BoJ Rinban operations covering 1- to 10-Year JGBs headline the domestic docket on Wednesday.

AUSSIE BONDS: Flatter, In Confined Two-Way Trade

Sydney participants were happy to try and force an extension of the overnight U.S. Tsy-driven richening in futures during the early rounds of the session, although there wasn’t much in the way of a meaningful break higher observed.

- YM and XM then traded to session cheaps in the wake of the latest NAB business survey (with the front end leading the move), which saw the confidence reading push higher to 7 (prev. 2) and conditions move higher to 20 (from 14). When it came to the write up the survey collators noted “a marked rally in the face of headwinds from inflation and rising interest rates, as well as a deteriorating global economic outlook.” The rise in labour costs accelerated further in July, with NAB suggesting that “overall, the survey suggests that despite global and domestic economic headwinds, demand has remained strong - and inflationary pressure continues to build suggesting that inflation is yet to peak.”

- The space then regained some poise, with a lack of meaningful RBA repricing evident post-data, owing to the fact that much of the inflationary and wage rhetoric fell in line with existing RBA thinking.

- Note we also saw a couple of soft rounds of domestic consumer confidence data.

- YM last deals +3.5 on the day, with XM +5.5. Cash ACGB trade sees the major benchmarks running 3-7bp richer on the day, with the broader bull flattening still intact. Bills sit 1-4bp richer through the reds.

- Looking ahead, A$800mn of ACGB Nov-31 supply headlines Wednesday’s domestic docket.

FOREX: Tight Ranges

Volatility across G10 FX space was subdued in Asia as participants continued to assess Fed rate-hike outlook in the interim between the release of the expectation-beating NFP report last Friday and the upcoming U.S. CPI data due Wednesday. The BBDXY index mostly held below neutral levels.

- USD/JPY traded on a marginally softer footing, with 1-month risk reversal oscillating near two-month highs printed on Monday.

- The Aussie dollar paced losses as participants parsed high-frequency local data. Consumer confidence deteriorated in August, even as business sentiment rebounded in July.

- The global economic docket is very light through the rest of the day.

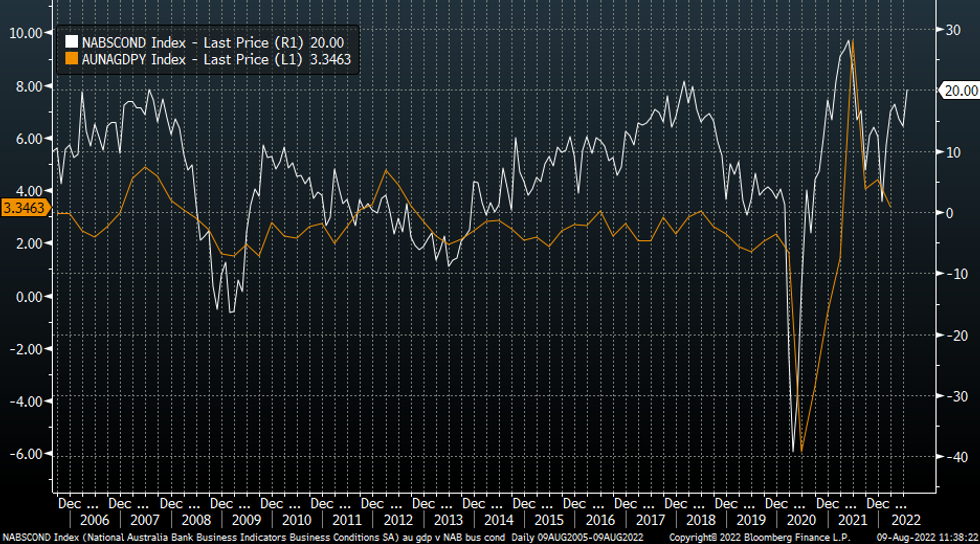

AUD: AUD/USD Up As NAB Business Survey Defies Gloomy Outlook

AUD/USD has edged back up towards 0.6980 post the NAB business survey print. We got close to 0.6970 prior to the data print. Still, the range for the day is not beyond 25pips, so still a quiet session to date.

- The NAB business survey tends not to be a huge market mover, but the headline conditions index shares a reasonable correlation with Australian YoY GDP momentum, see the chart below.

- Conditions rose to +20, versus a revised +14 in June. Confidence also rebounded to +7 from +2 in June.

- The detail of the survey looks fairly solid across the board, with price/cost pressures continuing to firm. Labor costs rose to 4.6% from 3.1%, a fresh record high. Note next Wednesday Q2 wages data prints.

- The AU-US 2yr spread has nudged higher to -52/-53bps from -55bps earlier.

- This result continues to highlight the divergence between business sentiment outcomes and consumer sentiment, recall the earlier Westpac-Consumer Sentiment result dipped further to 81.2, -3% in August. It also defies the gloomier sentiment in major business surveys elsewhere.

- In terms of crosses, AUD/NZD is edging higher, back close to 1.1120. Highs late yesterday were just below 1.1130. AUD/JPY is away from worst levels, last just under 94.00, versus 93.90 earlier.

Fig 1: NAB Business Conditions & Australian YoY GDP

Source: NAB, MNI/Market News/Bloomberg

Source: NAB, MNI/Market News/Bloomberg

ASIA FX: THB Outperforms, PHP Lags

Asia FX has been mixed today. USD/CNH has tracked very tight ranges, remaining above 6.7600. THB has outperformed on renewed tourism hopes and calls for caution around BoT intervention. PHP has been a laggard though on disappointing domestic data. Singapore and Indian markets are closed today.

- CNH: USD/CNH is range bound once again. We are holding close 6.7600, with an earlier high above 6.7650 not sustained. The CNY fixing was weaker than expected but hasn't had a lasting impact on sentiment. China equities are firmer but gains are less than 0.30% at this stage.

- KRW: USD/KRW has probed higher, but within recent ranges. Local shares have shrugged off the sales warning from Nvidia in the US, with the Kospi up 0.4% at this stage. The 1 month NDF got as high as 1307, but we are now back sub 1305.

- TWD: USD/TWD has drifted back below 30.00 in terms of spot and the 1 month NDF. Local shares are higher, with the Taiex at +0.20% at this stage. Rhetoric around China's continued military drills remains high but market concern around tensions is not ratcheting higher.

- IDR: Spot USD/IDR trades -12.5 figs at IDR14,865, which sees bears set their sights on the 50-DMA/Jul 29 low at IDR14,843/14,833. Palm oil futures have extended yesterday's gains this morning. The contract for October delivery trades +MYR111/MT at MYR4,182/MT. Note that Indonesia lowered the minimum taxable export price of crude palm oil to $680/ton from $750/ton, which takes effect today.

- THB: The baht cements its early gains, comfortably outperforming all of its regional peers. Spot USD/THB last deals -0.27 at THB35.495, consolidating below its 50-DMA (35.54). FinMin Arkhom's called for a modest pace of monetary policy normalisation, while also cautioning against aggressive baht intervention. These latter comments, along with renewed optimism around the tourism outlook, have aided the baht. We saw just over $126mn in net equity inflows yesterday.

- PHP: The Peso has been a laggard, hit by the double headwinds of the GDP miss and wider than expected trade deficit. The Philippines economy registered a surprise quarterly contraction in Q2, shrinking 0.1% Q/Q versus BBG median estimate of a 0.4% expansion. The trade deficit widened to $5.843bn in June versus BBG median estimate of $5.427bn. The USD/PHP 1 month NDF is back to 55.65/70, +0.30% on the day.

EQUITIES: Japan Underperforms, While Hong Kong Leads The Way

Asia-Pac equities lacked a coherent direction on Tuesday. The Nikkei 225 was the underperformer when it came to the major regional benchmarks, shedding the best part of 1%, with the communications and IT sectors leading the weakness after Tokyo Electron provided a disappointing earnings report. At the other end of the spectrum, the Hang Seng outperformed, adding 1%, with a Hong Kong city official flagging a desire to move to a zero-quarantine status for international travellers by November and the potential for a waiving of the double stamp duty covering home purchases on the part of mainland Chinese buyer supporting the broader index. Elsewhere, the benchmark Chinese CSI 300 and U.S. e-mini futures (all +0.2% at typing) struggled for meaningful direction, with focus remaining on questions surrounding the height/length of the current Fed tightening cycle, the COVID situation in China and ongoing tensions re: Taiwan, which proved to be limiting factors

GOLD: Close To 50-Day MA, US CPI In Focus

Gold has drifted lower, meeting resistance above $1790, last tracking at $1786. This is below the 50-day MA, which comes in at $1786.7, which continues to be a near term resistance point. Having said that, gold is holding most of its overnight gains, we are comfortably +$10 above lows from yesterday.

- Gold got a boost from weaker USD sentiment overnight, as the DXY corrected lower. US real yields edged down overnight as well, back to +29bps. Today nominal US yields have been fairly steady.

- Tomorrow's US CPI print shapes up as a key event risk for the precious metal this week. Recent upside surprises in inflation have coincided with sharp downside moves in gold.

- Such event risk may keep us range bound to a degree in terms of spot prices.

- The position slate is arguably cleaner compared to earlier in the year. CFTC positioning has only nudged back into a net long, after dipping into negative territory in late July. Still, ETF positioning in gold continues to trend lower.

OIL: At The Top End Of Recent Ranges

Oil prices have been range bound today, with Brent crude dips back $96/bbl supported, but unable to make a push towards $97/bbl. We are just off NY closing levels for both Brent and WTI. We currently sit at the upper end of the range for the past few sessions though, with dips sub $94/bbl supported for Brent. WTI is just under $90.50/bbl currently, behaving in a similar fashion.

- The near term focus will be on the US Energy Information Association, which will release a report later today on the short term outlook. This will be followed by OPEC and IEA reports on Thursday.

- US gasoline demand is generally lagging 2021 summer trends, even as pump prices continue to trend down, which are now their lowest level in 5 months.

- Another focus point is that the degree of tightness in oil markets continues to moderate, at least looking at the prompt spread (the difference between the two nearest contracts for Brent). We are now back to +$1.53/bbl, which is fresh lows back to mid-May. This measure got close to +$3.40/bbl in early July.

- Finally, talks have concluded in Vienna on reviving the US-Iran nuclear deal. Both sides now have a few weeks to decide whether or not to re-enter the deal, which could see the return of Iranian oil flows.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.