-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: No PBoC Pushback Against Weaker Yuan

EXECUTIVE SUMMARY

- ‘TOO LITTLE, TOO LATE’ CHINA RATE CUT SPURS CALL FOR MORE MOVES (BBG)

- CHINA SANCTIONS SEVEN TAIWANESE OFFICIALS FOR SUPPORTING TAIWAN INDEPENDENCE (XINHUA)

- IRAN SENDS EU NUCLEAR DEAL RESPONSE AND SIGNALS PACT IS NEAR (BBG)

- JPMORGAN, BOFA ARE AMONG BANKS MOVING BACK INTO RUSSIAN BOND TRADING (BBG)

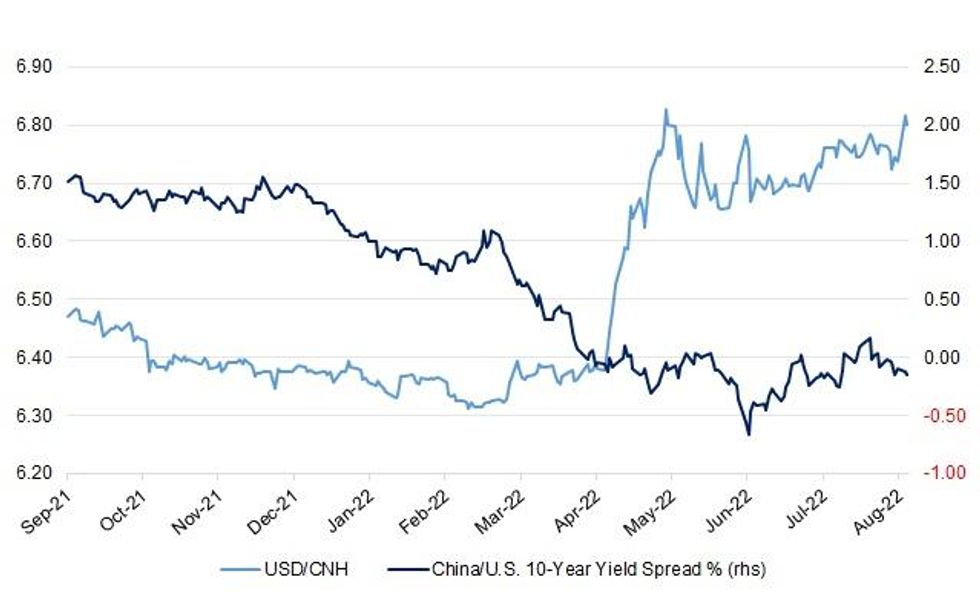

Fig. 1: USD/CNH Vs. China/U.S. 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS: Liz Truss favours giving targeted support to those who need the most help with their energy bills rather than increasing the £400 grant for every household. (The Times)

EUROPE

GERMANY: Germany’s government said households will face additional annual costs of about 290 euros ($296) to pay for natural gas as the burden of Russia’s squeeze on energy flows to Europe is redistributed. (BBG)

OTHER

CHINA/TAIWAN: China has sanctioned seven Taiwanese officials for supporting Taiwan independence, its state media reported on Tuesday. (RTRS)

BOJ: Bank of Japan officials see a risk that private sector spending could slow in Q3 as the cost-of-living crisis and a fresh rise in Covid cases weigh on sentiment, impeding the recovery from the pandemic after the economy started to pick up in the second quarter, MNI understands. (MNI)

AUSTRALIA: Australia to start monthly CPI release from Oct. 26. The first release will be alongside the quarterly report, the Australian Bureau of Statistics said in a statement on its website. The monthly report will be released four weeks after the end of the reference month. Each report will include updated prices for 62-73% of the weight of the quarterly CPI basket. (BBG)

RBA: Australia’s central bank signaled further interest-rate increases would come in the period ahead, while restating it will be guided by incoming economic data and the inflation outlook. (BBG)

RBA: The Reserve Bank of Australia named Penelope Smith as Head of International Department in the Financial Markets Group from the position of Deputy Secretary. The central bank also named Andrea Brischetto Head of Financial Stability Department in the Financial System Group from Deputy Head of the Domestic Markets Department. (BBG)

BRAZIL: Brazil's Luiz Inacio Lula da Silva reached a 12 percentage points lead over far-right incumbent President Jair Bolsonaro ahead of the October election, according to a new poll published on Monday. The survey by IPEC, formerly known as IBOPE, showed Lula with 44% of voter support against 32% for Bolsonaro in the first round of the election schedule for Oct 2. (RTRS)

RUSSIA: Any mission undertaken by the U.N.'s nuclear agency to inspect Ukraine's Zaporizhzhia plant cannot pass through the capital Kyiv as it is too dangerous, a senior Russian diplomat was quoted by Russian news agencies as saying on Tuesday. (RTRS)

RUSSIA: A growing number of Wall Street banks are willing to trade Russian bonds that were once viewed as untouchable. JPMorgan Chase & Co. and Bank of America Corp. are among several banks that have offered to facilitate transactions in corporate and sovereign debt on behalf of clients, according to people familiar with the matter who asked not to be identified. (BBG)

RUSSIA: Germany's Bayer said it has decided to continue supplying Russia with essential agricultural inputs, reversing course from comments made in March that supplies for 2023 would be contingent on Russia stopping its attacks on Ukraine. (RTRS)

IRAN: The United States will provide its views on the European Union's final draft to save a 2015 nuclear deal privately and directly to the bloc's High Representative Josep Borrell, State Department spokesperson Ned Price said on Monday. Price, speaking at a daily press briefing, said that the only way to achieve a mutual return to the Iran nuclear deal was for Tehran to abandon "extraneous demands." (RTRS)

IRAN: Iran sent the European Union its official response to the bloc’s proposal for reviving the 2015 nuclear accord after signaling it may be nearer a deal with the US that could restore Iranian oil exports to global markets. The semi-official Iranian Students’ News Agency, citing an “informed source,” said Tehran’s position on the latest draft text had been sent to the EU’s top envoy, Josep Borrell. The Islamic Republic expects a reply in the next two days, ISNA said, without giving any more details. (BBG)

GAS: Norway is delivering all the gas it can to Germany, Norwegian Prime Minister Jonas Gahr Stoere said on Monday. (RTRS)

OIL: Oil output in the Permian in Texas and New Mexico, the biggest U.S. shale oil basin, is due to rise 79,000 barrels per day (bpd) to a record 5.408 million bpd in September, the U.S. Energy Information Administration (EIA) said in its productivity report on Monday. Total output in the major U.S. shale oil basins will rise 141,000 bpd to 9.049 million bpd in September, the highest since March 2020, the EIA projected. (RTRS)

CHINA

POLICY: In a front-page report Tuesday, the central-bank backed Financial News said Beijing should introduce new pro-growth policies at the appropriate time to keep growth within a reasonable range, citing Wen Bin, chief economist at China Minsheng Bank. The Securities Times said in a separate report the People’s Bank of China’s surprise rate cut may be the first in a series of policies to stabilize growth. (BBG)

POLICY: China’s economic planning agency will strengthen policy options in the second half of the year, in order to boost the economic recovery, Yuan Da, an official at the NDRC, says at a press conference. (BBG)

PBOC: China’s benchmark Loan Prime Rates are likely to be driven lower next week following the PBOC’s 10 bps cut to the interest rate applied to the medium-term lending facility and the recent rapid decline in capital costs, the Securities Daily reported, citing analysts. The five-year LPR, that many lenders base their mortgage rate on, could see a reduction of more than 10 bps in an effort to boost mortgage demand amid a cooling housing market, the newspaper noted, citing Wang Qing, analyst with Golden Credit Rating. The PBOC is set to release August's LPR quotations next Monday, with the one-year and five-year LPRs currently sitting at 3.70% and 4.45%, respectively. (MNI)

YUAN: China’s foreign exchange market will continue to operate in a smooth manner, with domestic FX supply and demand remaining basically balanced, said Wang Chunying, deputy director of the State Administration of Foreign Exchange, according to a statement on the SAFE website issued late Monday. In July, the amount of cross-border receipts and payments by companies and individuals stood at USD514.3 billion and USD525.5 billion, respectively, representing a small deficit stemming from seasonal dividend distributions, said Wang. (MNI)

BONDS: Foreign institutional investors brought a net ~CNY6.6 billion of yuan bonds in July, after four consecutive months of net sales, the China Securities Journal reported, citing data released by the China Foreign Exchange Trade System. Foreign investors brought ~CNY518.8 billion of yuan bonds in July, selling ~CNY512.3 billion, as the China-U.S. interest spread rebounded, and the yuan remained generally stable, the newspaper said, citing analysts. Foreign investors will steadily increase their holdings of yuan bonds in the long-term, with demand supported by Chinese economic fundamentals, the analysts said. They currently hold a total of CNY3.51 trillion of bonds purchased in the interbank market, accounting for only ~3% of China’s bond market, the newspaper said. (MNI)

PROPERTY: Dollar bonds of Chinese developers including CIFI and Country Garden jumped Tuesday morning after REDD reported they are among builders whose may issue yuan bonds guaranteed and underwritten by state-owned firms. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY598 BILLION VIA OMOS

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos with the rate lowered to 2.0% on Tuesday. This led to a net drain of CNY598 billion after offsetting the maturity of CNY2 billion repos and CNY600 billion MLF today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5708% at 9:28 am local time from the close of 1.3350% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday vs 42 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7730 TUES VS 6.7410

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7730 on Tuesday, compared with 6.7410 set on Monday.

OVERNIGHT DATA

JAPAN JUN TERTIARY INDUSTRY INDEX -0.2% M/M; MEDIAN +0.4%; MAY +0.8%

AUSTRALIA JUL CBA HOUSEHOLD SPENDING +1.1% M/M; JUN +0.6%

AUSTRALIA JUL CBA HOUSEHOLD SPENDING +12.2% Y/Y; JUN +8.7%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 84.2; PREV 80.3

ANZ-Roy Morgan weekly consumer confidence rose by 4.9% last week, with the survey collator noting that “there was a notable recovery in consumer confidence over the past week, with the loss in the week of the RBA’s August rate hike more than completely reversed. It was notable that sentiment about ‘future financial conditions’ is now in positive territory, if only just, for the first time since late May. In our view this speaks to the strength of the labour market, which we expect to be confirmed by the data due later this week. But we aren’t getting carried away. Sentiment toward ‘future financial conditions’ is still well below average and overall confidence is deeply negative. (ANZ)

NEW ZEALAND JUL NON-RESIDENT BOND HOLDINGS 58.6%; JUN 58.4%

MARKETS

SNAPSHOT: No PBoC Pushback Against Weaker Yuan

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 7.14 points at 28864.25

- ASX 200 up 40.461 points at 7104.60

- Shanghai Comp. up 7.782 points at 3283.869

- JGB 10-Yr future up 24 ticks at 150.57, yield down 1.5bp at 0.175%

- Aussie 10-Yr future up 14 ticks at 96.755, yield down 13.1bp at 3.233%

- U.S. 10-Yr future +0-03+ at 119-26, yield down 0.9bp at 2.779%

- WTI crude down $0.53 at $88.87, Gold up $1.79 at $1781.6

- USD/JPY up 11 pips at Y133.43

- ‘TOO LITTLE, TOO LATE’ CHINA RATE CUT SPURS CALL FOR MORE MOVES (BBG)

- CHINA SANCTIONS SEVEN TAIWANESE OFFICIALS FOR SUPPORTING TAIWAN INDEPENDENCE (XINHUA)

- IRAN SENDS EU NUCLEAR DEAL RESPONSE AND SIGNALS PACT IS NEAR (BBG)

- JPMORGAN, BOFA ARE AMONG BANKS MOVING BACK INTO RUSSIAN BOND TRADING (BBG)

US TSYS: Very Modest Richening In Asia

Asia-Pac hours saw another round of fairly inconsequential Tsy trade which failed to provide much in the way of fresh, meaningful information, with Monday’s richening move consolidated and tight ranges observed.

- Speculation surrounding further support for the Chinese economy garnered most of the attention, with little in the way of alternative, meaningful macro headlines observed.

- That left TYU2 to trade in a 0-06 range, last +0-03 at 119-25+, with volume sitting at ~49K as the contract stuck within the confines of Monday’s range.

- Cash Tsys sit 0.5-1.5bp richer across the curve, with only the 2- & 3-Year tenors having a look through Monday’s richest levels during Asia dealing, with those moves being limited in nature.

- Looking ahead, Tuesday’s NY docket sees the release of housing starts and building permits data, as well as industrial production.

JGBs: Firmer, With Long End Leading The Way

JGB futures added to overnight session gains during the Tokyo afternoon after a fairly limited round of morning trade saw the contract consolidate its overnight advance, last dealing +23 on the session, a touch shy of best levels.

- Cash JGBs are 0.5-3.5bp richer on the day, flattening, while 7s outperform surrounding tenors on the bid in futures.

- There wasn’t much in the way of actionable domestic headline flow to latch on to, which left the spill over from Monday’s richening in U.S. Tsys (and subsequent, modest richening in Asia-Pac hours) at the fore.

- The latest round of 5-Year JGB supply received lukewarm demand, with the low price missing wider dealer expectations. The price tail remained narrow (having widened a little from a tail of zero at the previous auction), while the cover ratio eased to 3.40x from the previous auction’s 3.92x, coming in a little below the six-auction average of 3.46x. As flagged in our preview, the lack of meaningful outright and relative value for 5s likely contributed to reduced demand at today’s auction.

- Looking ahead, monthly trade balance data and core machine orders are due Wednesday, in addition to the latest round of BoJ Rinban operations.

JGBS AUCTION: Japanese MOF sells Y2.0259tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0259tn 5-Year JGBs:

- Average Yield: -0.007% (prev. 0.039%)

- Average Price: 100.06 (prev. 99.83)

- High Yield: -0.003% (prev. 0.039%)

- Low Price: 100.04 (prev. 99.83)

- % Allotted At High Yield: 42.2300% (prev. 97.0236%)

- Bid/Cover: 3.399x (prev. 3.917x)

AUSSIE BONDS: Firmer On Tuesday, No Headwinds From RBA Minutes

Aussie bonds ticked higher through the Sydney day, building on an overnight bid in futures which stemmed from Monday’s moves in core global FI markets (a product of wider worry re: slowdowns in global growth following disappointing U.S. and China data prints). There was little by the way of major macro headline flow observed during the session.

- Cash ACGBs run 10.5-14.0bp richer across the curve, with the 7- to 12-Year zone leading the bid. YM is +12.5 and XM is +14.0, comfortably through their respective overnight highs, while Bills run 7 to 15 ticks richer through the reds. EFPs are narrower on the day, with the 3-/10-Year box steepening a touch.

- ACGBs looked through the release of the RBA’s August monetary policy meeting minutes, with nothing by way of fresh, meaningful information noted. The release saw members emphasise that the central bank is “not on a pre-set path,” in addition to further colour re: its thoughts on the narrow path that it finds itself on when it comes to striking the correct balance between fighting inflation and allowing the economy to advance on an even keel. STIR markets currently price in ~40bp of tightening for the RBA’s Sep meeting, virtually unchanged from levels observed before the release of the minutes.

- Wednesday will see the release of the Westpac Leading Index for July followed by the Q2 wage price index. Elsewhere, there will be A$800mn of ACGB May-2032 on offer via auction.

EQUITIES: Mixed In Asia; ASX200 Hits 10-Week High

Major Asia-Pac equity indices are broadly off their extremes, operating little changed to 0.5% better off at writing, with a positive lead from Wall St. mostly taking a back seat to domestic developments in the respective markets.

- Chinese developers drew a bid after several source reports pointed to regulators acting to secure onshore bond issuance guarantees for specific private property developers, with the Hang Seng Mainland Properties Index (+6.4%) surging by as much as 10.5% earlier.

- The main Hang Seng Index is +0.1%, operating around session lows as a strong showing in the Properties (+2.5%) sub-index was countered by underperformance in the finance and consumer/industrial sub-gauges.

- The Nikkei 225 sits a shade below neutral levels at writing, facing headwinds above the 28,900 mark. Softbank Group (-2.0%) contributed the most to losses in the index, sliding to session lows after FT source reports pointed to U.S. hedge fund Elliott Management selling off nearly all of its positions in the company earlier this year, adding to negative showings from industrials and energy-related equities.

- The Australian ASX200 is 0.5% better off, sitting a little below freshly-made 10-week highs. CSL Ltd (+1.3%) and BHP Group (+4.5%) contributed the most to gains, with the latter rallying after reporting its second-highest annual profit on record, while announcing its highest dividend payout ever.

- E-minis are flat to 0.1% weaker at writing, operating shy of their respective, recently made multi-month highs.

OIL: Lower On Demand Worry, Supply Outlook Improvements

WTI is ~-$0.50 and Brent is ~-$0.80, operating within the lower end of their respective ranges established on Monday, with WTI remaining below the $90 mark at typing.

- To recap, WTI and Brent closed lower for a second consecutive session on Monday, shedding ~$3 apiece amidst rising worry re: softer global growth after disappointing economic data prints out of the U.S. and China (note that Chinese oil demand was shown to have fallen ~10% Y/Y as well), with WTI recording fresh six-month lows during the session.

- Optimism surrounding a U.S.-Iran nuclear deal has surged after a source report by the Iranian Students’ News Agency stated that Iran’s position on the EU’s “final draft” had been sent to the EU, with a reply expected later this week. Elsewhere, the Iranian FM stated that an agreement could be reached within days, dependent on the U.S. (note that this does not differ from official statements in prior months before negotiations were effectively halted).

- Iranian crude output prior to U.S. sanctions in ‘17 suggests that a lifting of sanctions could return >1mn bpd of crude to global markets.

- Brent’s prompt spread sits at ~$0.73 at typing, having closed below the $1.00 mark on Monday for the first time since Apr ‘22, reflecting easing worry re: tightness in near-term global crude supplies.

GOLD: A Little Higher In Asia

Gold sits ~$2/oz firmer to print ~$1,782/oz at typing, steadying a little above one-week lows made on Monday amidst a limited downtick in nominal U.S. Tsy yields and the USD (DXY).

- To recap, the precious metal closed ~$23/oz weaker on Tuesday, declining by the most in a month. The move lower was facilitated by a rise in the USD (DXY), with the DXY hitting fresh one-week highs as disappointing U.S. economic data added to prevailing global growth worries, after soft Chinese economic activity indicators printed earlier in the Asian session.

- Gold has so far seen little relief from rising worry surrounding China’s restart of military drills in the Taiwan Strait (in response to an unannounced visit to Taiwan by a U.S. Congressional Delegation), with the scale of the Chinese exercises so far appearing to be more limited than during the visit of U.S. House Speaker Pelosi, with a seeming step down in the intensity of official rhetoric as well.

- Focus for gold will likely remain on the Fed’s July meeting minutes, due for release on Wednesday.

- Looking to technical levels, initial support is seen at ~$1,771.2/oz (20-Day EMA), while a break of that level will expose further support at $1,754.4/oz (Aug 3 low, key short-term support). On the other hand, resistance is located at $1,807.9/oz (Aug 10 high and the bull trigger).

FOREX: Tight Ranges

G10 currency pairs respected tight ranges in muted Asia-Pac trade, with participants assessing the economic outlook in light of latest data.

- Light selling pressure hit USD/JPY in early hours but the pair recouped losses over the Tokyo fix, returning to neutral levels.

- The rebound in USD/JPY coincided with an uptick in U.S. Tsy yields. The pair clung onto gains even as yields pulled back and sit in negative territory across the curve.

- USD/JPY one-year risk reversal oscillated within a narrow range, holding above par.

- The kiwi dollar underperforms its G10 peers ahead of tomorrow's Monetary Policy Statement from the RBNZ.

- AUD/NZD remained above its 100-DMA after probing the water below that moving average on Monday.

- German ZEW Survey, UK jobs data, U.S. industrial output & housing starts as well as Canadian CPI take focus from here.

FX OPTIONS: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.3bln), $1.0048-50((E563mln), $1.0070-75(E1.3bln), $1.0100-10(E1.0bln), $1.0125-40(E1.3bln), $1.0250(E932mln), $1.0300(E949mln)

- USD/CNY: Cny6.89-90($859mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/08/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.