-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Kashkari Happy With Market Reaction To Powell's Address

EXECUTIVE SUMMARY

- NEEL KASHKARI ‘HAPPY’ TO SEE THE STOCK MARKET’S REACTION AFTER JACKSON HOLE (BBG)

- BIDEN ADMINISTRATION TO ASK CONGRESS TO APPROVE $1.1B ARMS SALE TO TAIWAN (POLITICO)

- EU HEAD SAYS REFORM OF BLOC ELECTRICITY MARKET MUST BE DONE NEXT YEAR (RTRS)

- IRAN STEPS UP UNDERGROUND URANIUM ENRICHMENT, IAEA REPORT SAYS (RTRS)

- PBOC LEANING HEAVILY AGAINST CNY WEAKNESS

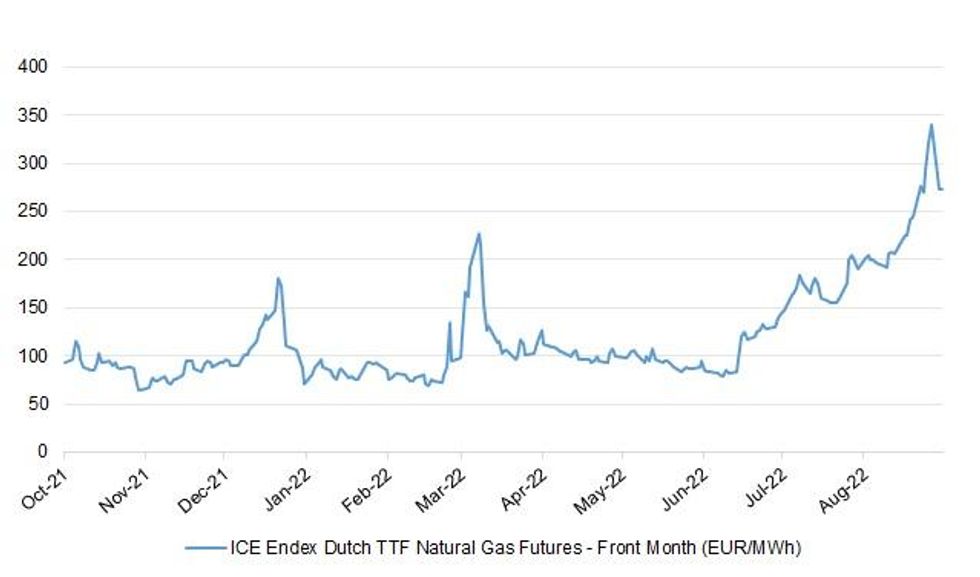

Fig. 1: ICE Endex Dutch TTF Natural Gas Futures - Front Month

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Liz Truss was facing a backlash on Monday for what critics called “regressive” proposals by her allies for a big cut in VAT intended to tackle inflation and ease the cost of living crisis. (FT)

FISCAL/ENERGY: Handouts for only the most vulnerable people will not be enough, senior Tories have said, because Britain faces a “social and economic catastrophe” without swift intervention on energy bills. Conservatives MPs have said that the candidate who becomes prime minister should support the middle class as well as people on the lowest incomes. (The Times)

FISCAL/ENERGY: Pubs and brewery bosses have written to the government to ask for support with their towering energy bills this winter. (BBC)

EUROPE

GREECE: Greek lawmakers voted Monday for a parliamentary investigation into the tapping by the country's secret service of an opposition party leader's phone. (AP)

U.S.

FED: Sharp stock-market losses show investors have got the message that Jerome Powell and his colleagues are serious about tackling inflation, said Minneapolis Fed President Neel Kashkari. “I was actually happy to see how Chair Powell's Jackson hole speech was received,” Kashkari said in an interview with Bloomberg’s Odd Lots podcast on Monday, reflecting on the steep drop after Powell spoke. “People now understand the seriousness of our commitment to getting inflation back down to 2%.” (BBG)

FED: The Federal Reserve is unlikely to cut interest rates shortly after it stops raising them as many in financial markets still seem to think, ex-Fed Vice Chair Alan Blinder told MNI on the sidelines of this year’s Jackson Hole conference. (MNI)

FED: The U.S. Federal Reserve will launch its instant payments system for banks between May and July 2023, Fed Vice Chair Lael Brainard said on Monday. The "FedNow" service, announced in 2019, will allow banks to instantly transfer payments across the financial system. Brainard said the system will help Americans better manage their money, and urged banks to develop internal capacity to deliver instant payments. (RTRS)

OTHER

GLOBAL TRADE: Ukraine's agricultural exports could rise to 6 million-6.5 million tonnes in October, double the volume seen in July, as its sea ports gradually reopen, the country's agriculture minister said on Monday. (RTRS)

GLOBAL TRADE: A turnaround in Canada’s wheat crop may help boost world supplies. Output from the world’s seventh-largest wheat exporter will rise 55% to 34.6 million metric tons this year as yields improve amid better moisture and more moderate temperatures, Statistics Canada said Monday in a report. That makes 2022 the third best harvest in records dating to 1908, falling just short of 2020’s bounty and the record 37.6 million tons gathered in 2013. (BBG)

GLOBAL TRADE: The Canadian government said on Monday it challenged U.S. softwood lumber duties under the United States-Mexico-Canada Agreement (USMCA), calling the duties "unwarranted" and "unfair." (RTRS)

U.S./CHINA: American companies' business outlook for China has sunk to a record low, according to a new survey released on Monday, driven by tense diplomatic relations and regulatory crackdowns. (Nikkei)

U.S./CHINA/TAIWAN: The Biden administration plans to formally ask Congress to approve an estimated $1.1 billion arms sale to Taiwan that includes 60 anti-ship missiles and 100 air-to-air missiles, according to three sources with direct knowledge of the package. (POLITICO)

UK/CHINA: Chinese observers on Monday slammed the reported campaign pledge made by British prime ministerial candidate Liz Truss, saying the wording used in classifying China as a "threat" to national security was an irresponsible vote-puller, and warning that it would not help solve UK's own problems and would only damage the prospects for improving China-UK relations. (Global Times)

JAPAN: Japan's government respects the Bank of Japan's independence in guiding monetary policy, Finance Minister Shunichi Suzuki said on Tuesday. The government will monitor U.S. monetary policy trends and market moves, Suzuki said, when asked about market fluctuations following a speech by Federal Reserve Chair Jerome Powell at the annual Jackson Hole symposium. Foreign exchange rates change from time to time and are determined by fundamentals, Suzuki told the regular news conference. (RTRS)

JAPAN: Japan’s Ministry of Finance will set a higher provisional level for a key rate used to calculate Japan’s interest payments to reflect the recent rise in bond yields, according to people with knowledge of the matter. (BBG)

AUSTRALIA: Australia pushing for wage growth to outpace current elevated levels of inflation would be a “big mistake” unless it was accompanied by productivity gains, the head of the nation’s largest business network said. (BBG)

SOUTH KOREA: South Korea said on Tuesday it would cut annual government spending for the first time in over a decade next year, as it seeks to curb its pandemic-era stimulus and help the central bank rein in a red-hot economy. (RTRS)

BOK: The head of South Korea's central bank said on Tuesday his bank's monetary policy stance would not change after a speech last week by Federal Reserve Chair Jerome Powell who said the U.S. economy will need tight monetary policy "for some time". (RTRS)

NORTH KOREA: Recent satellite imagery suggest that work to repair North Korea's main nuclear test site in Punggye-ri may have been suspended due to flood damage, a U.S. monitor said Monday. (Yonhap)

TURKEY: Turkey’s main opposition parties want prosecutors to investigate allegations of corruption against the former chief of the capital markets board and a senior adviser to President Recep Tayyip Erdogan that have been made by a fugitive crime boss (BBG)

MEXICO: It is "very, very premature" to start thinking of ending the current interest rate-hiking cycle in Mexico, one of the Mexican central bank's board members said on Twitter on Monday. "The Federal Reserve will continue to go higher for a while until starting to see results and we will have to do practically the same," board member Jonathan Heath said. (RTRS)

BRAZIL: Brazil's Luiz Inacio Lula da Silva maintains a 12-percentage-point lead over far-right incumbent President Jair Bolsonaro ahead of the October election, according to a new poll published on Monday. (RTRS)

RUSSIA: Ukrainian troops mounting a counter-offensive have broken through Russian defences in several sectors of the front line near the city of Kherson, a senior advisor to President Volodymyr Zelenskiy said on Monday. (RTRS)

RUSSIA: The White House said on Monday that Russia should agree to a demilitarized zone around the Ukrainian nuclear plant that has become a dangerous frontline in the ongoing war. (RTRS)

SOUTH AFRICA: South Africa’s governing party is likely to win the country’s next national elections in 2024 even as its support slips further in major cities, a survey showed. (BBG)

IRAN: Iran has started enriching uranium with one of three cascades, or clusters, of advanced IR-6 centrifuges recently installed at its underground enrichment plant at Natanz, a report by the U.N. atomic watchdog to member states seen by Reuters said on Monday. (RTRS)

IRAQ: The White House said on Monday that unrest in Iraq after powerful Shi'ite Muslim cleric Moqtada al-Sadr quit politics was "disturbing" and called for "dialogue" to ease the country's political problems. White House National Security Council spokesperson John Kirby told reporters that Washington sees no need to evacuate staff in its Iraqi embassy at this time. (RTRS)

CHILE: The International Monetary Fund's (IMF) executive board approved a flexible credit line of around $18.5 billion for Chile to give the world's leading copper miner greater flexibility to confront risks from commodities price shocks to financial tightening. (RTRS)

ENERGY: European Commission President Ursula von der Leyen said a full reform of the European electricity market has to be done properly and technically at the beginning of next year. (RTRS)

ENERGY: The US is concerned about an energy shortage in Europe and will work to alleviate that potential threat as the European Union faces soaring power prices ahead of winter, a top White House aide said. (BBG)

GAS: Germany faces the "bitter reality" that Russia will not restore gas supplies to the country, the German economy minister said on Monday, ahead of planned halt by state energy giant Gazprom of exports to Europe via the Nord Stream 1 pipeline. (RTRS)

GAS: Eastbound gas flows via the Yamal-Europe pipeline to Poland from Germany rose further on Monday, data from pipeline operator Gascade showed. (RTRS)

OIL: Ecuador’s state oil company told commodity trader Trafigura Group to avoid importing Russian fuels into the Latin American nation amid concerns the country may get entangled in sanctions. (BBG)

OIL: Liz Truss will approve a series of oil and gas drilling licences in the North Sea in one of her first acts as prime minister as part of a long-term plan to secure Britain’s energy security. (The Times)

OIL: For the second time in less than a year, Canada invoked a 1977 treaty with the US, which covers crossborder pipelines, to defend Enbridge Inc.'s Line 5 corridor. (Dow Jones)

CHINA

YUAN: The yuan is expected to continue to depreciate against the U.S. dollar in H2 2022, though it is likely to be a moderate, orderly and controllable process, wrote China Finance 40 Forum, a prominent think tank, citing market analysts. (MNI)

FISCAL: China will strive to stabilise employment and prices in the second half of the year, said the country's finance ministry in a statement published on its website on Tuesday. China will make good use of local government special bonds in the second half and strictly curb new local government hidden debt, the ministry said. (RTRS)

MONEY MARKETS: Liquidity conditions in the interbank market are expected to remain ample in September, against the backdrop of limited, incremental pro-growth policies and a subdued economic recovery, the Shanghai Securities News wrote, citing analysts. (MNI)

EQUITIES: China is drafting rules governing IPO investment value research produced by underwriters as well as communications between analysts writing the reports and investment bankers, Shanghai Securities News says in a front-page report Tuesday, citing industry sources. (BBG)

PROPERTY: Chinese residential property owners are rushing to pay off their mortgages early, heaping pressure on commercial banks that were already struggling to identify attractive lending opportunities. Several state bank managers told the Financial Times that branches in Beijing and Shanghai had experienced a 20 per cent increase in mortgage prepayments this year. (FT)

BANKING: China arrested hundreds of people allegedly involved in the nation’s largest ever bank fraud and started repaying more victims of the $5.8 billion scandal, in a bid to maintain social stability ahead of this year’s twice-a-decade Communist Party congress. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8648% at 9:31 am local time from the close of 1.6159% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8802 TUES VS 6.8698

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8802 on Tuesday, compared with 6.8698 set on Monday.

OVERNIGHT DATA

JAPAN JUL JOBLESS RATE 2.6%; MEDIAN 2.6%; JUN 2.6%

JAPAN JUL JOB-TO-APPLICANT RATIO 1.29; MEDIAN 1.27; JUN 1.27

AUSTRALIA JUL BUILDING APPROVALS -17.2% M/M; MEDIAN -3.0%; JUN -0.7%

AUSTRALIA JUL PRIVATE SECTOR HOUSES +0.7% M/M; JUN +1.2%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 85.0; PREV 85.6

Consumer confidence was almost unchanged with a slight drop of 0.7% last week. But there was quite a mix in the detail. There was a sharp fall in the sub-index that captures whether it is a ‘good time to buy a major household item’, and a moderate drop in the ‘future financial conditions’ sub-index. In contrast, ‘current financial conditions’ and sentiment about current and future economic conditions all rose. Lower inflation expectations may have helped sentiment toward ‘current financial conditions’. All sentiment sub-indices remain weak, however, with only ‘future financial conditions’ in positive territory. Consumers are likely to stay cautious in outlook until there is better news about real wages. Though it is important to remember that this caution hasn’t actually been reflected in a pullback in spending – at least not yet. (ANZ)

GERMANY AUG NRW CPI +8.1% Y/Y; JUL +7.8%

GERMANY AUG NRW CPI +0.3% M/M; JUL +1.1%

MARKETS

SNAPSHOT: Kashkari Happy With Market Reaction To Powell's Address

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 338.34 points at 28216.74

- ASX 200 up 48.816 points at 7014.60

- Shanghai Comp. down 18.451 points at 3222.277

- JGB 10-Yr future up 21 ticks at 149.43, yield down 1.5bp at 0.233%

- Aussie 10-Yr future up 6 ticks at 96.38, yield down 5bp at 3.619%

- U.S. 10-Yr future +0-08+ at 117-09+, yield down 3.36bp at 3.069%

- WTI crude down $0.34 at $96.67, Gold down $1.19 at $1735.9

- USD/JPY down 23 pips at Y138.49

- NEEL KASHKARI ‘HAPPY’ TO SEE THE STOCK MARKET’S REACTION AFTER JACKSON HOLE (BBG)

- BIDEN ADMINISTRATION TO ASK CONGRESS TO APPROVE $1.1B ARMS SALE TO TAIWAN (POLITICO)

- EU HEAD SAYS REFORM OF BLOC ELECTRICITY MARKET MUST BE DONE NEXT YEAR (RTRS)

- IRAN STEPS UP UNDERGROUND URANIUM ENRICHMENT, IAEA REPORT SAYS (RTRS)

- PBOC LEANING HEAVILY AGAINST CNY WEAKNESS

US TSYS: Richer, Aided By Regional German CPI

The Monday move off of session cheaps extended in Asia-Pac hours, with the modest early richening getting further traction on the back of a slowing in the regional NRW CPI M/M print out of Germany.

- That leaves cash Tsys 3.0-3.5bp richer across the curve.

- TYZ2 prints +0-09 at 117-12+, 0-01 off the peak of its 0-09+ range on volume of ~65K, with ~18K of residual futures roll activity aiding volume.

- A downtick in the major Hong Kong & Chinese equity indices also helped at the margin.

- E-minis have firmed to best levels in recent trade, with the 3 major contracts running 0.3-0.5% firmer on the day.

- Note that the richening move even came after Minneapolis Fed President Kashkari (’23 voter) told BBG that he “was actually happy to see how Chair Powell's Jackson hole speech was received” i.e. pleased that the hawkish messaging got through, via a podcast on Monday.

- Looking ahead, further German state and national CPI data will be eyed on Tuesday, particularly with the debate re: the need for a 75bp ECB hike in Sep stepping up and some arguing that the degree of hawkishness priced into EUR money markets at present is perhaps near the viable extreme. Various ECB speakers will also cross throughout the day.

- The NY docket will be headlined by JOLTS jobs data, various house price metrics and the Conference Board consumer confidence print. Elsewhere, NY Fed President Williams (permanent voter) and Richmond Fed President Barkin (’24 voter) will speak.

JGBS: Curve Twists Steeper, Futures Lead Richening

JGB futures tracked the wider core FI impetus observed since Monday’s Tokyo close, which allowed them to extend further away from their overnight base, last +24, while cash JGBs saw some twist steepening, with 40s marginally cheaper on the day (although the super-long end is off session cheaps on the broader bid), while 7s lead the bid on the rally in futures.

- 2-Year JGB supply passed smoothly, with the low-price printing above wider exp., although the cover ratio wasn’t anywhere near as strong, likely owing to the steepness of the domestic curve.

- Elsewhere, Finance Minister Suzuki offered little new in his latest address outside of noting that Japan is watching moves in the financial markets.

- Domestic labour market data provided nothing by the way of meaningful surprises.

- Elsewhere, BBG source reports flagged a 0.1ppt uptick for Japan’s accumulated interest rate, which is used to calculate the country’s debt servicing costs.

- Looking forward, industrial production and retail sales data headlines domestically on Wednesday, with the latest round of BoJ Rinban operations also due.

JGBS AUCTION: Japanese MOF sells Y2.2703tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.2703tn 2-Year JGBs:

- Average Yield: -0.083% (prev. -0.074%)

- Average Price: 100.177 (prev. 100.159)

- High Yield: -0.079% (prev. -0.072%)

- Low Price: 100.170 (prev. 100.155)

- % Allotted At High Yield: 0.4242%% (prev. 62.1910%)

- Bid/Cover: 3.612x (prev. 4.332x)

AUSSIE BONDS: Building On Early Gains

Aussie bonds have richened throughout the Sydney session, hitting fresh session highs on the release of German regional NRW CPI, with tailwinds from a slowing in the M/M print adding to the earlier bullish impetus derived from a recovery in wider core global FI markets from Monday’s lows.

- Cash ACGBs run 4.5-9.0bp richer across the curve, bull steepening.

- YM is +9.5 and XM is +4.5, with both contracts operating just shy of session highs. The 3-/10-Year EFP box is steeper, with 3-Year EFP a little narrower and 10-Year EFP little changed, while Bills run 2 to 11 ticks richer through the reds.

- ACGBs were little changed on a large miss in headline building approvals data for July (-17.2% M/M vs. BBG median -3.0%), likely as the decline was driven by a plunge in the historically volatile large apartment dwellings component.

- Wednesday will see A$1.0bn of ACGB Nov-32 on offer at auction, followed by the release of Jul private sector credit and Q2 construction work.

EQUITIES: Mixed In Asia; Chinese PMIs Await

Major regional equity indices are mixed at writing, with Chinese and Hong Kong stocks struggling as participants await the release of official PMI data on Wednesday following well-documented challenges to the Chinese economy in August.

- The Hang Seng (-1.3%) leads the way lower on losses across ~85% of its constituents. China-based tech has borne the brunt of the selling pressure (HSTECH: -2.1%), with the likes of Bilibili (-5.1%) and Trip.com (-4.6%) struggling.

- A note that the stocks of Chinese companies with listings in the U.S. have declined despite the announcement of a Sino-U.S. audit deal last week, with evident caution amongst investors amidst historically elevated bilateral tensions.

- The CSI300 is 0.5% worse off, with losses in high-beta consumer staples and healthcare posing the most drag. Elsewhere, developer stocks bucked the broader downtrend, with the CSI300 Real Estate Index (+1.5%) rallying after hitting two-week lows on Monday.

- The Nikkei 225 is 1.1% better off on gains in over 90% of its constituents, although the move higher comes nowhere close to unwinding Monday’s 2.7% lower close. IT stocks outperformed, led by gains in index heavyweight Tokyo Electron (+1.6%).

- E-minis sit 0.2-0.3% better off at writing, consolidating a little above their respective one-month lows established on Monday.

OIL: Holding On To Recent Gains Amidst Supply Worry

WTI is ~-$0.20 and Brent is ~-$0.50, with both benchmarks keeping to tight <$1 ranges so far, consolidating a little below their respective Monday’s peaks at writing.

- To recap, WTI and Brent closed ~$4 firmer apiece on Monday, aided by an escalation in supply-related worry particularly around Libyan political unrest and potential OPEC+ supply cuts.

- On the former, Libya stated on Monday that crude production remains >1.2mn bpd despite a recent spike in politically-related violence.

- Looking to OPEC+, several members such as Iraq, Venezuela, and Kazakhstan have signalled support for future production cuts, with participants eyeing the group’s next meeting on Sep 5.

- Elsewhere, International Energy Agency (IEA) Chief Birol pointed out that western sanctions are likely to crimp Russian production later this year, even as Russian crude exports have declined by less than expected so far.

- Dr. Birol also observed that the ongoing release of crude from the strategic reserves of IEA members is due to expire, although further releases may be discussed, citing a “substantial amount of stocks” held by members.

- The prompt spreads for WTI and Brent have risen in recent sessions to ~$0.85 and ~$1.95 respectively, pointing to an uptick in worry re: supply tightness.

GOLD: Slightly Lower In Asia; Technical Outlook Remains Bearish

Gold deals ~$3/oz weaker to print $1,734/oz, operating around session lows and extending a pullback from Monday’s best levels at writing.

- To recap, gold ended virtually unchanged on Monday after a limited rebound from one-month lows (at $1,720.5/oz), tracking a pullback in the USD from fresh cycle highs, with the DXY ending little changed on the day as well.

- The precious metal remains on track for a fifth consecutive lower monthly close amidst persistent weakness in some measures of investor interest, with ETF holdings of gold recording its 11th straight weekly decline last Friday.

- From a technical perspective, gold remains in a short-term downtrend following the recent breach of support at $1,727.8/oz (Aug 22 low). Initial support is seen at $1,711.0/oz (76.4% retracement of the Jul21-Aug10 upleg), and a break of that level will expose further support at $1,700.0/oz (round number support). On the other hand, initial resistance is seen at ~$1,765.5/oz (Aug 25 high).

FOREX: Yen Gains Amid Lower U.S. Tsy Yields, PBOC Repeats Pushback Against Yuan Depreciation

The yen took the lead, extending gains over the Tokyo fix, in a slight correction of yesterday's rout. Its outperformance was not disturbed by the fact that e-mini futures turned bid, albeit China tech equities were softer. A tad lower U.S. Tsy yields likely provided some support to the yen, given the strong correlation between U.S./Japan yield gap and USD/JPY price action.

- In the latest round of jaw-boning, Japanese FinMin Suzuki said that the authorities will monitor moves in U.S. monetary policy and markets.

- Weak iron ore prices and domestic construction data weighed on the Aussie dollar. Building approvals in Australia shrank 17.2% M/M, missing the consensus call for a 3.0% contraction by a notable margin.

- The kiwi dollar was the second-worst G10 performer, taking its cue from the Antipodean cousin. AUD/NZD extended its move away from recent cyclical highs and tested the NZ$1.20 mark.

- The PBOC delivered another pushback against yuan depreciation via a stronger than expected fixing of the USD/CNY mid-point (~250-pip error). Offshore yuan got only brief reprieve and USD/CNH bounced back shortly after.

- German CPI, EZ sentiment gauges and U.S. Conf. Board Consumer Confidence take focus on the data front today.

- Comments are due from Fed's Williams & Barkin, ECB's Vasle, Holzmann, Stournaras, Wunsch & Muller as well as Riksbank's Ingves.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/08/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/08/2022 | 0700/0900 |  | ES | Retail sales | |

| 30/08/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/08/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/08/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/08/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/08/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/08/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/08/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/08/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/08/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 30/08/2022 | 1230/0830 | * |  | CA | Current account |

| 30/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/08/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/08/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/08/2022 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/08/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/08/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 30/08/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 30/08/2022 | 1500/1100 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.