-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI EUROPEAN OPEN: ECB Day: 75bps Expected

EXECUTIVE SUMMARY

- EU TO PROPOSE PRICE CAP ON RUSSIAN GAS, VON DER LEYEN SAYS (RTRS)

- RBA’S LOWE SIGNALS OUTSIZED RATE HIKES MAY BE COMING TO END (BBG)

- BIDEN TO HOST CALL THURSDAY WITH ALLIES ON SUPPORT FOR UKRAINE (BBG)

- NEW UK LEADER LIZ TRUSS FINALIZES HUGE POWER SUBSIDY PLAN (RTRS)

- CHINESE MEGA CITY CHENGDU EXTENDS LOCKDOWN OF MOST DISTRICTS AS COVID SPREADS (RTRS)

- BOK DEPUTY GOVERNOR: TO TAKE POLICY RESPONSE IN FX IF NEEDED (BBG)

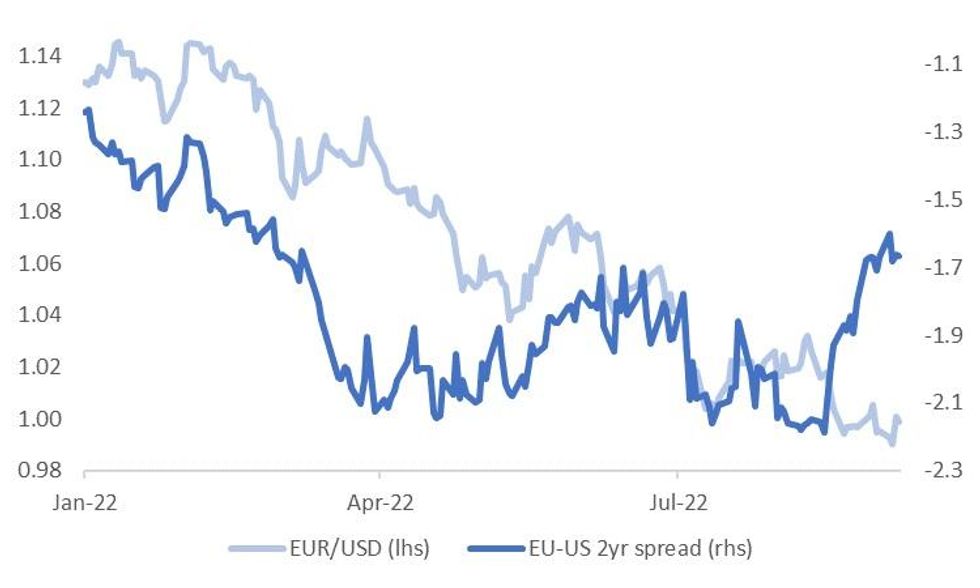

Fig. 1: EUR/USD vs. EU-U.S. 2-Year Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: UK job vacancies grew in August at the slowest pace in 18 months, adding to signs that the labor market is starting to ease. (BBG)

FISCAL/ENERGY: Britain's new Prime Minister Liz Truss on Wednesday readied the final details of a plan to tackle soaring energy bills, which looks likely to cool inflation but add more than 100 billion pounds ($115 billion) to the country's borrowing. (RTRS)

ENERGY: Britons must never again be forced to pay exorbitant energy bills, Liz Truss will declare on Thursday as she promises more North Sea drilling and ditches the fracking ban. (Telegraph)

ENERGY: The British government is expected to announce dozens of new North Sea oil and gas exploration licences in an effort to boost domestic production, two sources familiar with the government's discussions said. (RTRS)

EUROPE

UKRAINE: Ukrainian President Volodymyr Zelenskiy on Wednesday said next year's budget would be a war budget, devoting more than a trillion hryvnias ($27.40 billion) to defence and security spending. (RTRS)

ENERGY: The European Commission will propose a price cap on Russian gas, alongside measures including a mandatory EU cut in electricity use and a ceiling on the revenue of non-gas power generators, the bloc's chief said on Wednesday. (RTRS)

U.S.

FED: High prices and a tight labor market weighed on US economic prospects over the next year, though inflation showed signs of decelerating, the Federal Reserve said. “The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months,” the Fed said Wednesday in its Beige Book report, typically published two weeks before each meeting of the policy-setting Federal Open Market Committee. (BBG)

FED: Federal Reserve officials on Wednesday said they still aren't convinced the worst of the U.S. inflation scare has passed, in comments that teed up a continuation of the central bank's aggressive interest rate increases. (RTRS)

OTHER

GLOBAL TRADE: Senior U.N. and Russian officials met in Geneva on Wednesday to discuss Russian complaints that Western sanctions were impeding its grain and fertilizer exports despite a U.N.-brokered deal to boost Russian and Ukrainian shipments of the commodities. (RTRS)

U.S./CHINA: The U.S. Pentagon has stopped accepting new F-35 jets after it discovered a magnet used in the stealthy fighter's engine was made with unauthorized material from China, a U.S. official said on Wednesday. (RTRS)

U.S./TAIWAN: Taiwan is confident it can sign a "high standard" trade deal with the United States under a new framework, President Tsai Ing-wen told a visiting group of U.S. lawmakers on Thursday. (RTRS)

UK/GERMANY: Britain's new Prime Minister Liz Truss discussed the European energy crisis during a call with Germany's Olaf Scholz on Wednesday, a spokeswoman for Truss said. (RTRS)

BOK: Bank of Korea Deputy Governor Lee SangHyeong says pace of recent won weakness is “fast” and some herd behavior is seen in FX market. BOK is closely monitoring changes in FX market situation and behavior of players; to make policy response if clear herd behavior is seen. (BBG)

RBA: Australia’s central bank chief signaled a potential end to outsized interest rate hikes, saying the case for a slower pace of tightening becomes stronger as the cash rate moves higher. The currency and bond yields fell. (BBG)

BOK: An outflow of foreign investment funds from South Korea is likely to swell if global risks further roil financial markets, the Bank of Korea said, while reiterating its resolve to rein in inflation. (BBG)

SOUTH KOREA: South Korea and the United States have agreed to quickly launch ministerial level talks on ways to minimize damage from the Inflation Reduction Act (IRA) on South Korean carmakers, South Korean Trade Minister Ahn Duk-geun said Wednesday. (Yonhap)

SOUTH KOREA: President Yoon Suk-yeol will meet with U.S. Vice President Kamala Harris in Seoul on Sept. 29 and discuss the bilateral alliance, North Korea and other issues of mutual interest, his office said Thursday. (Yonhap)

NORTH KOREA: South Korea has offered to discuss with North Korea the reunion of families separated by the 1950-53 Korean War, Yonhap news agency reported on Thursday. (RTRS)

BRAZIL: President Jair Bolsonaro toned down his rhetoric during Brazil’s Independence Day celebrations, seeking to woo undecided voters and reinvigorate his campaign less than a month before general elections. (BBG)

RUSSIA: President Joe Biden will host a call with allies on Thursday about next steps in support of Ukraine against Russia’s invasion, according to people familiar with the matter. (BBG)

RUSSIA: Ukrainian forces are making "slow but meaningful progress" on the battlefield and are currently doing better in the south than Russia, a senior Pentagon official said on Wednesday. (RTRS)

RUSSIA: In rare public comments Ukraine's military chief warned on Wednesday of the threat of Russia using nuclear weapons in Ukraine, which would create the risk of a "limited" nuclear conflict with other powers. (RTRS)

COMMODITIES: Ecuador reached a preliminary agreement with indigenous groups to declare a temporary moratorium on 16 oil blocks, Energy and Mining Minister Xavier Vera said on Wednesday, a turning point in negotiations aimed at staving off renewed street protests. (RTRS)

METALS: Brazilian mining company Vale said on Wednesday that global demand for nickel should increase 44% by 2030 compared to that expected for this year, due to high demand for use in batteries that power electric vehicles. (RTRS)

CHINA

CREDIT: China has surged ahead of the US for corporate bond deals in its yuan credit market in recent months, a rare shift that highlights the deepening impact of the two countries’ diverging monetary policies. (BBG)

CORONAVIRUS: Chengdu, capital of the southwestern Chinese province of Sichuan, extended the lockdown of most of its districts on Thursday, hoping to stem further transmission of COVID-19 cases in the city of 21.2 million. (RTRS)

CORONAVIRUS: More Chinese cities advised residents on Wednesday to avoid unnecessary trips for the upcoming holiday long weekend, adding to COVID policies that are keeping tens of millions of people under lockdown and exacting a growing economic toll. (RTRS)

CORONAVIRUS: Authorities in Shenzhen will “temporarily” reduce the city’s daily quarantine quota for Hong Kong arrivals from Thursday before halving it to 1,000 by the start of next week, the Post has learned, amid a resource squeeze during a worsening Covid-19 outbreak. (SCMP)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5373% at 10:01 am local time from the close of 1.4528% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Wednesday vs 47 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9148 THURS VS 6.9160

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9148 on Thursday, compared with 6.9160 set on Wednesday.

OVERNIGHT DATA

JAPAN Q2, F GDP SA +0.9% Q/Q; MEDIAN +0.7%; FLASH +0.5%

JAPAN Q2, F GDP ANNUALISED SA +3.5% Q/Q; MEDIAN +2.9%; FLASH +2.2%

JAPAN Q2, F GDP NOMINAL SA +0.6% Q/Q; MEDIAN +0.5%; FLASH +0.3%

JAPAN Q2, F GDP DEFLATOR -0.3% Y/Y; MEDIAN -0.4%; FLASH -0.4%

JAPAN Q2, F GDP PRIVATE CONSUMPTION +1.2% Q/Q; MEDIAN +1.1%; FLASH +1.1%

JAPAN Q2, F GDP BUSINESS SPENDING +2.0% Q/Q; MEDIAN +2.0%; FLASH +1.4%

JAPAN Q2, F GDP INVENTORY CONTRIBUTION -0.3%; MEDIAN -0.3%; FLASH -0.4%

JAPAN Q2, F GDP NET EXPORTS CONTRIBUTION +0.1%; MEDIAN +0.0%; FLASH +0.0%

JAPAN JUL BOP CURRENT ACCOUNT BALANCE +Y229.0BN; MEDIAN +Y759.0BN; JUN -Y132.4BN

JAPAN JUL BOP CURRENT ACCOUNT ADJUSTED -Y629.0BN; MEDIAN +Y65.3BN; JUN +Y838.3BN

JAPAN JUL TRADE BALANCE BOP BASIS -Y1,212.2BN; MEDIAN -Y1,150.0BN; JUN -Y1,114.0BN

JAPAN AUG BANK LENDING INCL TRUSTS +1.9% Y/Y; JUL +1.7%

JAPAN AUG BANK LENDING EX-TRUSTS +2.2% Y/Y; JUL +2.0%

NEW ZEALAND Q2 M’FING ACTIVITY VOLUME -4.9% Q/Q; Q1 -3.4%

NEW ZEALAND Q2 M’FING ACTIVITY SA -3.8% Q/Q; Q1 +0.9%

UK AUG RICS HOUSE PRICE BALANCE 53%; MEDIAN 60%; JUL 62%

MARKETS

SNAPSHOT: ECB Day: 75bps Expected

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 554.63 points at 27985.18

- ASX 200 up 102.864 points at 6832

- Shanghai Comp. down 4.687 points at 3241.607

- JGB 10-Yr future up 23 ticks at 149.5, JGB 10-Yr yield down 0.3bp at 0.25%

- Aussie 10-Yr future up 14.5 ticks at 96.44, Aussie 10-Yr yield down 15.3bp at 3.553%

- US 10-Yr future up +0-07 at 116-12+, 10-Yr yield down 3.42bp at 3.2293%

- WTI crude up $0.83 at $82.78, Gold down $3.6 at $1714.77

- USDJPY up 21 pips at 143.95

- EU TO PROPOSE PRICE CAP ON RUSSIAN GAS, VON DER LEYEN SAYS (RTRS)

- RBA’S LOWE SIGNALS OUTSIZED RATE HIKES MAY BE COMING TO END (BBG)

- BIDEN TO HOST CALL THURSDAY WITH ALLIES ON SUPPORT FOR UKRAINE (BBG)

- NEW UK LEADER LIZ TRUSS FINALIZES HUGE POWER SUBSIDY PLAN (RTRS)

- CHINESE MEGA CITY CHENGDU EXTENDS LOCKDOWN OF MOST DISTRICTS AS COVID SPREADS (RTRS)

- BOK DEPUTY GOVERNOR: TO TAKE POLICY RESPONSE IN FX IF NEEDED (BBG)

US TSYS: Extending Wednesday’s Rally; Fedspeak Eyed Ahead Of Pre-FOMC Blackout

U.S. Tsys are just shy of session highs, having richened throughout the Asia-Pac session, building on the bull flattening observed in Wednesday’s session.

- Tsys caught a bid in tandem with core FI markets on remarks from RBA Governor Lowe signalling a possible end to larger rate hikes, with Tsy yields across the curve dipping to session lows.

- TYZ2 is +0-07+ at 116-13, a little below best levels, extending a move off of Wednesday’s 12-week lows for the contract at writing. Cash Tsys run 1.0-4.0bp richer across the curve, with the belly leading the bid.

- The recent bid in cash Tsys has unwound much of the bear flattening observed after U.S. markets returned from the long weekend on Tuesday, with nominal 10-Year Tsy yields returning to ranges observed prior to the Labour Day holiday.

- Looking ahead, final wholesale inventories, consumer credit, and weekly jobless claims are due in the NY session.

- Scheduled Fedspeak is headlined by Chairman Powell, Chicago Fed Pres Evans (‘23 voter), and Minneapolis Fed Pres Kashkari (‘23 voter), although the latter is slated to deliver introductory remarks, potentially limiting the scope for comments on monetary policy.

- A reminder that this week’s Fedspeak comes ahead of the pre-FOMC blackout period (Sept. 10-22).

JGBS: Futures Extend Overnight Bid

JGB futures have tracked the wider movements in core FI markets since Wednesday’s Tokyo close, with the contract rallying after the Tokyo lunch break (as RBA Gov. Lowe was speaking), extending their move away from their overnight lows. JBU2 last trades at 149.50, 24 ticks firmer.

- Cash JGBs run flat to 2.0bp richer across the curve, bull flattening.

- The release of a range of Japanese data (Q2 final GDP, BoP, bank lending, and weekly international security flow figures) provoked little by way of a meaningful reaction in JGBs,

- The liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs went very well as spreads firmed from the previous auction, the spread tail width remained narrow, and the cover ratio improved to 4.90x (from 3.63x prev.). Cash JGBs were little moved post-auction.

- Friday will see Japanese money supply for Aug headline the domestic data docket.

JGBS AUCTION: Japanese MOF sells Y3.24285tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.24285tn 6-Month Bills:

- Average Yield: -0.1935% (prev. -0.1763%)

- Average Price: 100.095 (prev. 100.089)

- High Yield: -0.1568% (prev. -0.1387%)

- Low Price: 100.077 (prev. 100.070)

- % Allotted At High Yield: 2.1971% (prev. 38.729%)

- Bid/Cover: 3.673x (prev. 3.955x)

JGBS AUCTION: Japanese MOF sells Y499.1bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.1bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.018% (prev. -0.003%)

- High Spread: -0.016% (prev. -0.002%)

- % Allotted At High Spread: 88.4873% (prev. 57.3502%)

- Bid/Cover: 4.897x (prev. 3.629x)

AUSSIE BONDS: Off Best Levels But Comfortably Richer; Lowe Boosts Bonds

ACGBs are off best levels but sit comfortably richer at writing, with comments from the RBA’s Governor Lowe accelerating a pre-speech move higher (derived from the overnight bid in Aussie bond futures).

- To elaborate, Gov. Lowe signalled a possible end to large rate hikes, stating that the case for slower rate hikes would grow as the cash rate rises, with a dip in the AUD and rally in core global FI markets observed after.

- Cash ACGBs run 13.0-17.5bp richer across the curve, with the belly leading the bid. 3s sit 16.5bp richer at typing, after printing as much as 23bp richer earlier.

- YM is +18.0 and XM is +15.0, with both contracts off their respective session highs but consolidating higher post-Lowe. EFPs are mixed, with 3-Year EFP narrowing and 10-Year EFP little changed, while Bills run 1 tick cheaper to 17 ticks richer through the reds.

- Looking ahead, no domestic data releases of note are scheduled for Friday, with the AOFM’s weekly issuance slate due.

EQUITIES: Mostly Higher In Asia On Lead from Wall St., ASX200 Receives Boost From Lowe

Most major Asia-Pac equity indices are in the green, seeing the MSCI AC Asia Pacific deal >1.0% firmer at typing, with sentiment in high-beta equities across the region lifted by the tech-led rally in Wall St. on Wednesday, benefitting from a continued easing in crude prices as well.

- The Nikkei 225 sits 2.0% firmer, outperforming regional peers, with nearly all of the index’s constituents in the green at writing (218 of 225). Large caps such as Fast Retailing (+1.5%) and Tokyo Electron (+2.4%) contributed the most to gains, adding to broad outperformance in exporters and healthcare names.

- The ASX200 trades 1.6% higher at typing, extending an earlier bid amidst a speech (and Q&A) from RBA Governor Lowe suggesting a case for a slower pace of rate hikes, keeping in mind prevailing uncertainty re: the degree of tightening to be deployed by the RBA in this cycle. Tech equities lead gains, with the S&P/ASX200 All Tech Index hitting fresh one-week highs after adding 2.7%.

- The Hang Seng Index deals 0.4% worse off at writing, off worst levels, but operating just above Wednesday’s six-month lows. The utilities and finance sub-indices lead the way lower, worsening a poor showing from large-cap Tencent Holdings (-2.2%) after the latter offered to double its stake in video game company Ubisoft.

- E-minis sit flat to 0.1% better off at writing, holding on to the bulk of their respective rallies (between 1.3-2.0%) observed on Wednesday.

OIL: Consolidating Above Wednesday’s Eight-Month Lows; EIA Inventory Data Due

WTI and Brent are ~$0.60 firmer apiece, paring a little of Wednesday’s losses at writing, with both benchmarks having shed ~$5 apiece in that session amidst elevated worry re: Chinese crude demand and tighter central bank monetary policy.

- Crude has drawn some support from comments by Russian Pres Putin re: the cessation of energy exports to countries adopting a price cap, that came ahead of an announcement from the European Commission on plans to propose a price cap on Russian gas.

- The recent decline in crude also comes ahead of the ECB’s policy decision later today, with a 50bp vs 75bp hike still in the balance, leaving open some uncertainty re: expectations for economic growth amidst higher rates.

- Elsewhere, the latest round of U.S. API inventory estimates saw reports point to a surprise, significantly large build in crude stockpiles, adding to the surprise build reported last week as well. Distillate stocks increased, unwinding last week’s decline, while gasoline and Cushing hub stocks decreased for another week.

- Looking ahead, U.S. EIA inventory data is due later today, with BBG median estimates calling for a modest drawdown in crude stockpiles.

GOLD: $1,720 Proving Hard To Break Amidst Still-High Yields, Dollar

Gold sits just shy of Wednesday’s best levels, dealing $2/oz weaker to print $1,716/oz at typing as the USD and nominal U.S Tsy yields have largely stemmed their slides.

- To recap, the precious metal closed $16 firmer on Wednesday, rising by the most in over a month amidst a pullback in the USD (DXY) and U.S. real yields from their recent, respective highs.

- A BBG report has pointed to a sharp rise in gold’s inverse correlation coefficient with the USD, suggesting more “pain” ahead for bullion in the case of continued Dollar strength.

- From a technical perspective, gold remains in a clear downtrend after its recent breach of support at $1,727.8 (Aug 22 low) reinforced bearish conditions. Initial support is seen at $1,681.0 (Jul 21 low and bear trigger), with resistance located at $1,726.7 (6 Sep high).

FOREX: EUR Near Parity Ahead Of ECB, Dovish Lowe Weighs On AUD

EUR/USD has not gotten much beyond a 20pip range today, holding between 0.9980/1.0000 for much of the session. All eyes shift to the ECB decision due later today, where a 75bps hike is expected. This is not a uniform expectation though, nor fully priced by the market, so if delivered could aid EUR/USD sentiment, particularly as the currency looks a little low relative to yield spreads.

- More action was evident in EUR/JPY. The pair got to fresh highs around 144.35, but we now sit back at 143.80, mainly due to some JPY stability.

- USD/JPY didn't see much headway beyond 144.50 earlier. Lower UST yields (10yr off to 3.23%), has likely helped. Dips sub 144.00 still appear to be supported.

- AUD/USD is down the most within the G10 space for the session, dipping to 0.6715, now back at 0.6730. The trade surplus was much lower than expected for July, as exports to China suffered.

- Then RBA Governor Lowe gave a dovish speech, stating the case can be made for slowing the pace of rate hikes. The governor stated Australia's lower wages backdrop may mean the RBA doesn't have to follow the experience of some offshore central banks in hiking rates aggressively.

- NZD (0.6045/50) has largely followed AUD's path. The AUD/NZD cross slightly lower at 1.1130.

- Dips sub 1.1500 in GBP have been supported, with UK fiscal plans the likely focus point today.

- ECB will then take centre stage. Scheduled Fedspeak is headlined by Chairman Powell, Chicago Fed Pres Evans (‘23 voter), and Minneapolis Fed Pres Kashkari (‘23 voter).

FX OPTIONS: Expiries for Sep08 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.6bln), $0.9850-65(E1.2bln), $0.9900(E889mln), $1.0000(E2.2bln)

- USD/JPY: Y140.00($1.7bln)

- GBP/USD: $1.1400(Gbp593mln)

- USD/CAD: C$1.3200($540mln)

- USD/CNY: Cny6.8000($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/09/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 08/09/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 08/09/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/09/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 08/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/09/2022 | 1245/1445 |  | EU | ECB Post-Meeting Press Conference | |

| 08/09/2022 | 1310/0910 |  | US | Fed Chair Jerome Powell | |

| 08/09/2022 | 1400/1000 | * |  | US | Services Revenues |

| 08/09/2022 | 1415/1615 |  | EU | ECB President Lagarde's Podcast | |

| 08/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/09/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 08/09/2022 | 1525/1125 |  | CA | BOC Deputy Rogers "Economic Progress Report" speech | |

| 08/09/2022 | 1530/1130 |  | US | New York Fed's Patricia Zobel | |

| 08/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/09/2022 | 1600/1200 |  | US | Chicago Fed's Charles Evans | |

| 08/09/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.