-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN OPEN: Dollar Dips Ahead Of EU Energy Meeting

EXECUTIVE SUMMARY

- YELLEN OPTIMISTIC INFLATION TO EASE FURTHER, BUT RISKS REMAIN (BBG)

- WHITE HOUSE WEIGHS ORDER TO SCREEN U.S. INVESTMENT IN TECH IN CHINA, OTHER COUNTRIES (WSJ)

- BOJ'S KURODA WARNS RAPID YEN MOVES UNDESIRABLE, AFTER MEETING WITH PM KISHIDA (RTRS)

- BRUSSELS FACES BIG OPPOSITION TO CAP PRICE ON RUSSIAN GAS (FT)

- U.S. EVALUATING NEED FOR FURTHER SPR OIL RELEASES AFTER OCTOBER - GRANHOLM (RTRS)

- CHINA RESTRICTS DOMESTIC TRAVEL AS COVID OUTBREAKS GROW (BBG)

- CHINA AUG. CONSUMER PRICES RISE 2.5% Y/Y; EST. +2.8% (BBG)

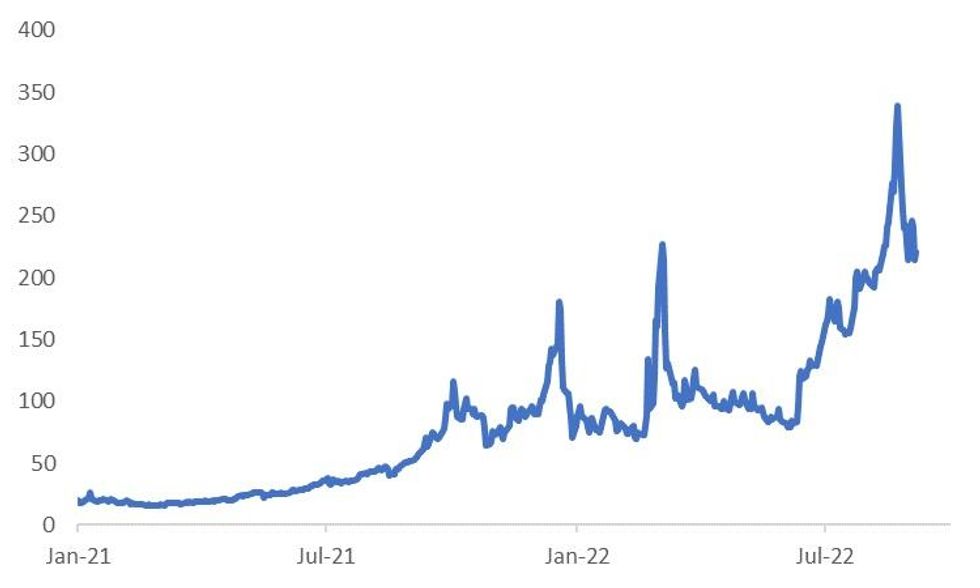

Fig. 1: Dutch Natural Gas Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British retailers saw the slowest growth in sales since the end of COVID-19 lockdowns last year as shoppers tightened their belts in the face of soaring inflation, business consultancy BDO said on Friday. (RTRS)

EUROPE

ECB: The European Central Bank (ECB) said on Thursday it would start paying interest on government deposits, easing fears that euro zone countries would shift the cash into government bonds, worsening a shortage of key market collateral. (RTRS)

UKRAINE: Ukrainian President Volodymyr Zelenskiy on Thursday said Kyiv's forces had liberated than 1,000 square km (390 square miles) of territory since Sept. 1 and recaptured dozens of settlements as part of a counteroffensive against Russia. (RTRS)

ENERGY: EU energy ministers will gather for emergency talks in Brussels on Friday to thrash out common measures in an effort to counter a gas and electricity price crisis that threatens to make energy bills unaffordable for households and businesses and tip Europe into recession. (Guardian)

ENERGY: Brussels is facing pressure from at least 10 EU countries to implement a cap on gas prices for all suppliers, with some governments warning that singling out Russia could push Vladimir Putin to cut supplies to Europe completely. (FT)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+; Outlook Stable) and the Netherlands (current rating: AAA; Outlook Stable)

- S&P on Norway (current rating: AAA; Outlook Stable), Portugal (current rating: BBB; Outlook Stable), and Malta (current rating A-; Outlook Stable)

U.S.

FED: Federal Reserve Bank of Chicago President Charles Evans said Thursday he's "open-minded" about the size of the September interest rate hike while awaiting CPI data next week, but added he expects rates to top out at around 4% "before too long" next year. (MNI)

ECONOMY: U.S. Treasury Secretary Janet Yellen declared on Thursday that President Joe Biden's agenda has made the economy stronger than before the COVID-19 pandemic, but said more work was needed to protect the gains, especially by tackling inflation. (RTRS)

INFLATION: Treasury Secretary Janet Yellen said she was optimistic that US inflation will decelerate further but warned that uncertainty remains. “Gas prices have been falling for 80 days in a row, which is certainly good news,” Yellen told reporters Thursday. “It caused headline inflation to actually go into negative territory in July, and I think there will be some further impetus in the next report.” (BBG)

POLITICS: Former U.S. President Donald Trump's team may not have returned all the classified records removed from the White House at the end of his presidency even after an FBI search of his home, U.S. prosecutors warned on Thursday, calling it a potential national security risk that needs investigation. (RTRS)

EQUITIES: The White House on Thursday outlined six principles to reform Big Tech platforms and said it was encouraged to see bipartisan interest in Congress to rein in major U.S. tech companies. (RTRS)

OTHER

GLOBAL TRADE: The Biden administration is weighing an executive order to screen and possibly restrict U.S. overseas investment in cutting-edge technology development in China and other potentially hostile countries. (WSJ)

GLOBAL TRADE: The United States sees no indication that a U.N.-brokered Ukrainian grain export deal is unraveling, the White House said on Thursday, after President Vladimir Putin triggered fears that Russia could withdraw support. (RTRS)

GLOBAL TRADE: Chip delivery times shrank again in August, a sign the global shortage is easing further, but some types of semiconductors remain hard to find. (BBG)

GLOBAL TRADE: India banned exports of broken rice and imposed a 20% duty on exports of various grades of rice on Thursday as the world's biggest exporter of the grain tries to augment supplies and calm local prices after below-average monsoon rainfall curtailed planting. (RTRS)

CHINA/INDIA: Indian and Chinese troops have begun disengaging from the Gogra-Hotsprings border area in the western Himalayas, both sides said, two years after clashes at the frontier strained diplomatic ties. The disengagement comes ahead of a meeting in Uzbekistan next week that Chinese President Xi Jinping and Indian Prime Minister Narendra Modi are expected to attend. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday he discussed currency market moves at a meeting with Prime Minister Fumio Kishida, and warned that rapid yen moves were undesirable. "When the yen is moving 1 to 2 yen per day, that's a rapid move," Kuroda said, when asked about recent moves in the Japanese currency. "We will watch exchange rate moves carefully," he told reporters after the meeting. Kuroda said the meeting was among the occasional catch-ups the two sides hold to discuss broad economic and financial matters. (RTRS)

BOJ: The Bank of Japan should adjust its grip on yields that’s helping create an “abnormally” weak yen, according to the bank’s former chief economist. “The BOJ’s peg for long-term rates is causing the yen to weaken so much,” Hideo Hayakawa said in an interview Wednesday. “They should make it more flexible to reduce volatility in foreign exchange rates.” (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday that the government would not rule out any options on foreign exchange moves, stepping up his verbal intervention against the yen's recent precipitous falls. (RTRS)

JAPAN: Japan should take advantage of its plunging currency to encourage more foreign tourists, Tokyo Governor Yuriko Koike told Bloomberg News in an interview late on Thursday local time, adding she would like to open the country’s doors “tomorrow.” (BBG)

JAPAN: Japan’s governing party said Thursday that an internal survey found that nearly half of its national lawmakers had ties to the Unification Church, in a widening controversy that emerged after the assassination of former Prime Minister Shinzo Abe. (AP)

NEW ZEALAND: Fonterra Cooperative Group, the world’s biggest dairy exporter, raised its earnings forecast on the basis of higher prices for cheese and protein products. (BBG)

HONG KONG: A coalition of airlines has warned Hong Kong could be left out of their plans for next year unless the government provides a clear timeline of when Covid-19 quarantine rules will be lifted, noting that 48 carriers no longer fly to the city. (SCMP)

NORTH KOREA: North Korea passed a law enshrining the right to use preemptive nuclear strikes to protect itself, a move leader Kim Jong Un said makes its nuclear status "irreversible" and bars any denuclearisation talks, state media reported on Friday. (RTRS)

CANADA: The head of Canada’s main banking-industry regulator said his agency won’t bow to pressure to loosen mortgage-underwriting standards in response to rising interest rates that are boosting homebuying costs. (BBG)

MEXICO: Mexican economic growth is expected to hit 3% in 2023, up from 2.4% this year, amid cooling inflation, the federal government's budget document showed on Thursday, above the Bank of Mexico's growth forecast of 1.6% for the coming year. (RTRS)

MEXICO: Mexico's government and financial institutions will propose a bill this month to change current rules, aiming to attract companies to the country's stock exchange by making it easier to access debt and equities markets, the head of the country's stock market association told Reuters. (RTRS)

BRAZIL: Brazil’s presidential front-runner Luiz Inacio Lula da Silva pledges that, if elected, he will undo labor market reform made by former president Michel Temer, arguing that the reform took away workers’ rights. (BBG)

BRAZIL: Opposition proposals to roll back the initial privatizations of Brazilian refineries would run into stiff resistance from their new owners, with sale contracts offering no room for reversal, three people with knowledge of the matter told Reuters. (RTRS)

PERU: Peru’s central bank delivered a smaller-than-expected increase to its benchmark interest after inflation eased for two consecutive months. (BBG)

PERU: Peru can achieve economic growth of 4.3% in 2023, beating official forecasts that are already optimistic, thanks to a new economic package, Finance Minister Kurt Burneo said on Thursday. (RTRS)

RUSSIA: The US offered $2.8 billion in weapons and military financing to Ukraine and its neighbors, as the Biden administration sought to shore up allied unity in the face of Russian threats to cut off fossil fuel exports and a looming energy crisis. (BBG)

RUSSIA: Russia demanded at the United Nations on Thursday that the United States and Britain provide evidence to support their allegations that Moscow was seeking drones from Iran and rockets and artillery shells from North Korea to use in Ukraine. (RTRS)

IRAN: The United States on Thursday imposed sanctions on an Iranian company it accused of coordinating military flights to transport Iranian drones to Russia as well as three companies it said were involved in the production of Iranian drones. (RTRS)

IRAN: The United States is imposing sanctions on four companies and one individual from Iran, the Treasury Department said on its website on Thursday. (RTRS)

EM BONDS: India has the biggest bond market among emerging economies that’s not covered by global indexes, but bankers say that may change soon, potentially drawing in billions of dollars in inflows. Russia’s recent exclusion is one reason why. (BBG)

OIL: U.S. President Joe Biden's administration is weighing the need for further releases of crude oil from the nation's emergency stockpiles after the current program ends in October, Energy Secretary Jennifer Granholm told Reuters on Thursday. (RTRS)

OIL: India says Russian oil now accounts for 12% of its overall purchases of the commodity, with the ratio surging six-fold in the past few months, as Asia’s third-largest economy seeks to slow inflation back to target. (BBG)

CHINA

PBOC: China’s efforts to stem the yuan’s weakness are spurring bets that it may refrain from boosting liquidity in the banking system in the near term, even as Covid lockdowns and a property slowdown undermine its growth prospects. (BBG)

SUPPLY CHAIN: China’s silicon industry group stopped releasing prices of a key solar material after surging costs threatened the country’s ambitious renewables plan and led to a government crackdown. (BBG)

PROPERTY: Chinese real estate stocks jump after a report said at least 24 Chinese cities have allowed parents to fund their children’s home purchase in an effort to expand housing demand. (BBG)

CORONAVIRUS: China is stepping up its Covid defenses as a key Communist Party meeting looms, restricting internal travel further as swathes of the country remain under tight lockdowns. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5414% at 09:45 am local time from the close of 1.4538% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 50 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9098 FRI VS 6.9148

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9098 on Friday, compared with 6.9148 set on Thursday.

OVERNIGHT DATA

CHINA AUG CPI +2.5% Y/Y; MEDIAN +2.8%; JUL +2.7%

CHINA AUG PPI +2.3% Y/Y; MEDIAN +3.2%; JUL +4.2%

JAPAN AUG M2 MONEY STOCK +3.4% Y/Y; MEDIAN +3.4%; JUL +3.4%

JAPAN AUG M3 MONEY STOCK +3.0% Y/Y; MEDIAN +3.0%; JUL +3.0%

NEW ZEALAND AUG ANZ TRUCKOMETER HEAVY +7.0% M/M; JUL -1.5%

NEW ZEALAND AUG CARD SPENDING TOTAL +0.7% M/M; JUL -0.2%

NEW ZEALAND AUG CARD SPENDING RETAIL +% M/M; JUL -0.2%

MARKETS

SNAPSHOT: Dollar Dips Ahead Of EU Energy Meeting

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 173.81 points at 28206.39

- ASX 200 up 45.032 points at 6886.3

- Shanghai Comp. up 21.699 points at 3258.209

- JGB 10-Yr future up 80 ticks at 149.86, JGB 10-Yr yield down 0.3bp at 0.248%

- Aussie 10-Yr future down 0.5 ticks at 96.419, Aussie 10-Yr yield down 0.3bp at 3.568%

- US 10-Yr future down 0-00+ ticks at 115-30+, 10-Yr yield down 2.26bp at 3.294%

- WTI crude up $0.44 at $83.74, Gold up $11.75 at $1720.38

- USDJPY down 133 pips at 142.8

- YELLEN OPTIMISTIC INFLATION TO EASE FURTHER, BUT RISKS REMAIN (BBG)

- WHITE HOUSE WEIGHS ORDER TO SCREEN U.S. INVESTMENT IN TECH IN CHINA, OTHER COUNTRIES (WSJ)

- BOJ'S KURODA WARNS RAPID YEN MOVES UNDESIRABLE, AFTER MEETING WITH PM KISHIDA (RTRS)

- BRUSSELS FACES BIG OPPOSITION TO CAP PRICE ON RUSSIAN GAS (FT)

- U.S. EVALUATING NEED FOR FURTHER SPR OIL RELEASES AFTER OCTOBER - GRANHOLM (RTRS)

- CHINA RESTRICTS DOMESTIC TRAVEL AS COVID OUTBREAKS GROW (BBG)

- CHINA AUG. CONSUMER PRICES RISE 2.5% Y/Y; EST. +2.8% (BBG)

US TSYS: Modestly Bid; Pre-FOMC Blackout Beckons

U.S.Tsys have richened as we have worked our way through the Asia-Pac session, unwinding a little of Thursday’s cheapening in the process.

- The move higher comes amidst softness in the USD (DXY), as the JPY has strengthened on fresh warnings from the likes of BoJ Gov. Kuroda and FinMin Suzuki re: yen weakness, adding to

- TYZ2 is -0-01 at 115-30 last, just shy of session highs, but coming nowhere near to approaching its peak on Thursday (116-23).

- Cash Tsys run 1.5-3.0bp richer across the curve, with the belly leading the bid. The bid in Tsys has seen 2-Year Tsy yields slip below the 3.50% mark at writing, but remain a little below recent 15-year highs observed on Sep 1 (~3.55%).

- Looking ahead, final July wholesale inventories data is due, with a final round of scheduled Fedspeak by Chicago Fed Pres Evans (‘23 voter), Gov. Waller (voter), and Kansas City Fed Pres George (voter) due ahead of the pre-FOMC blackout period (Sept. 10-22).

- Note that Pres Evans is due to speak on”career opportunities in economics”, and is unlikely to cover comments on monetary policy.

JGBS: Futures Extend Bid

JBU2 futures were bid throughout the session, tracking the wider movements in core FI markets, with a rally in the JPY (on previously-flagged comments re: recent yen weakness from BOJ Gov. Kuroda and Japanese FinMin Suzuki) after the Tokyo lunch break accelerating the move higher, taking JBU2 above the 150 mark, with the contract printing +76 ticks at 150.20 last.

- Cash JGBs run 2bp cheaper to 5bp richer across the curve, with 7s leading the way higher.

- While USD/JPY has made fresh lows below 143.00 at typing in the wake of aforementioned comments, it is worth noting that there was little by way of fresh language deployed.

- Monday will see preliminary data for machine tool orders headline the domestic data docket.

JGBS AUCTION: Japanese MOF sells Y4.54001tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.54001tn 3-Month Bills:

- Average Yield: -0.1154% (prev. -0.1098%)

- Average Price: 100.0288 (prev. 100.0274)

- High Yield: -0.1102% (prev. -0.1062%)

- Low Price: 100.0275 (prev. 100.0265)

- % Allotted At High Yield: 59.2911%% (prev. 74.5250%)

- Bid/Cover: 2.949x (prev. 3.239x)

AUSSIE BONDS: Back From Early Cheaps

Aussie bonds sit a little above best levels, having unwound the bulk of their earlier losses (derived from the overnight cheapening in Aussie bond futures) throughout the Sydney session, aided by a similar move higher in Tsys.

- Cash ACGBs run 1.5bp cheaper to 2.0bp richer across the curve, twist flattening, and pivoting around 5s.

- YM is -0.5 and XM is +0.5, with both contracts operating a little below their respective overnight peaks. EFPs are little changed, while Bills run 4 ticks cheaper to 4 ticks richer through the reds.

- Little by way of a meaningful reaction was observed in ACGBs on the release of the AOFM’s weekly issuance slate. Next week will see a smaller A$800mn of ACGBs and A$1.5bn of Notes on offer (as well as A$100mn in indexed bonds), compared to A$1.1bn in ACGBS and A$2.0bn of Notes previously announced for this week.

- No economic data releases of note are scheduled for Monday.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 13 Sep it plans to sell A$100mn of the 1.00% 21 February 2050 Indexed Bond.

- On Thursday 15 Sep it plans to sell A$1.0bn of the 27 January 2023 Note* & A$500mn of the 24 February 2023 Note.

- On Friday 16 Sep it plans to sell A$800mn of the 1.25% 21 May 2032 Bond.

EQUITIES: Higher In Asia; Chinese Developers Gain On Latest Policy Move

Virtually all Asia-Pac equity indices are firmer at writing, largely tracking a positive lead from Wall St.

- Chinese and Hong Kong stocks have outperformed ahead of the long weekend (both stock markets will be closed for a holiday on Monday), aided by the better-than-expected Chinese CPI beat that added to expectations from some quarters for increased policy support.

- The Hang Seng leads peers, trading 2.2% higher, on track to snap a six-session streak of lower daily closes, coming after the benchmark had recorded fresh eight-month lows on Thursday. The property (+2.8%) sub-gauge leads the way higher, adding to a strong showing from China-based tech (HSTECH: +2.3%).

- The bid in Chinese developers comes on the back of a Securities Daily report detailing that at least 24 Chinese cities have allowed parents to fund home purchases for their children with their provident funds. The Hang Seng Mainland Properties Index accordingly sits 5.3% better off at writing.

- The Nikkei 225 deals 0.6% firmer, recording fresh two-week highs after building on yesterday’s 2.3% higher close. Virtually every industry sector is in the green at writing, with gains in healthcare and utilities equities countering uniformly shallow losses observed across the index’s losers.

- E-minis sit 0.2-0.4% better off, just off their respective, freshly made one-week highs at writing.

GOLD: Working Away From Thursday’s Lows; $1,700/oz Holds As 75bp Fed Hike Increasingly Priced

Gold deals ~$7/oz firmer to print $1,716/oz at typing, extending a move off of Thursday’s trough at writing (~$1,704.1/oz, following the ECB’s policy decision and Powell’s speech).

- Gold has largely kept above $1,700/oz in recent sessions as pricing for a 75bp hike at the Sep FOMC has continued to firm, with yesterday’s better-than expected weekly jobless claims data marginally contributing to the case for a 75bp move.

- Chicago Fed Pres Evans (‘23 voter) on Thursday stated that the Fed could “very well do 75 in September”, adding to the market’s firmer expectations for such a move after Fed Chair Powell earlier did little to push back against the idea at the upcoming FOMC.

- Total known ETF holdings of gold are on track for a 13th consecutive weekly decline, taking the measure to levels last witnessed in mid-Feb, pointing to persistent weakness in investor interest for bullion.

- From a technical perspective, previously-identified technical levels remain in play for gold, with a clear break of initial resistance at $1,726.7 (6 Sep high) eyed, while support is located at $1,681.0 (Jul 21 low and bear trigger).

OIL: On Track For Lower Weekly Close; OPEC+ Reaction Eyed As Crude Dips Below $90

WTI and Brent deal ~$0.40 firmer apiece, operating just shy of their respective Thursday peaks at writing.

- Both benchmarks however sit a short distance above recently made eight-month lows, remaining on track for a second consecutive lower weekly close amidst an uptick in wider worry re: energy demand and increases in U.S. crude stockpiles.

- Looking ahead, some will be watching for reactions from OPEC+ as WTI and Brent have dipped below $90 this week, keeping in mind their recent 100K bpd cut to production quotas - a numerically insignificant decrease, that served more to signal the group’s intent to defend higher crude prices.

- The latest round of U.S. inventory data saw a significantly large, surprise build in crude stockpiles, more than unwinding the large decline observed last week, and corroborating prior reports of API estimates.

- There was a marginal, surprise build in gasoline and distillate stockpiles, while Cushing hub stocks declined.

- The White House on Thursday stated that it is “too early to say” if SPR releases will continue past the original 180mn bbls earmarked. WTI and Brent nudged lower after but ultimately failed to record fresh lows, likely owing to the lack of details surrounding the remarks.

FOREX: USD Continues To Lose Ground, JPY Plays Catch Up

The USD continues to lose ground, the DXY is now sub 109.00, fresh lows back to the start of the month. Losses for the dollar have been broad based, but this afternoon JPY has played catch up. The yen was a laggard in the first half of the session, but is now around 1% firmer versus NY closing levels. The pair is back to 142.75, (the low was just under 142.50).

- Outside of comments from Japan officials on FX (notably Kuroda), we are seeing UST yields edge lower. The 2yr is down close to 2bps on the session (to 3.485%), which is likely helping at the margin.

- From a level’s standpoint in USD/JPY, we have the high 141 region, then around 140.80, the high from September 2.

- EUR/USD is above 1.0070, but has lost ground against the yen this afternoon, ahead of the key energy ministers meeting later today.

- AUD/USD is up over 1.10% to 0.6825/30, only trailing NOK as best performer on the day. Higher commodity prices (copper and iron ore) are helping the A$. China's equity property sub-index is up over 3% so far today (see this link for more details on some optimism around the sector).

- NZD/USD has tracked AUD gains, albeit with a slight lag, the pair last just above 0.6100.

- GBP/USD is just under 1.1590 matching EUR gains.

- Looking ahead, the EU energy ministers meeting will be a key focus today. Expect lighter activity in the UK as the country mourns the passing of the Queen. In the US, Fedspeak from Evans, Waller and George is all on tap. Evans won't cover monetary policy though.

FX OPTIONS: Expiries for Sep09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-10(E2.2bln), $0.9950(E1.2bln), $1.0000(E1.2bln), $1.0075-00(E1.3bln)

- USD/JPY: Y139.00($1.0bln)

- USD/CAD: C$1.3100($616mln)

- USD/CNY: Cny7.00($2.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/09/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 09/09/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 09/09/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup & informal Ecofin Meetings | |

| 09/09/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/09/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 09/09/2022 | 1400/1000 |  | US | Chicago Fed's Charles Evans | |

| 09/09/2022 | 1600/1200 |  | US | Kansas City Fed's Esther George | |

| 09/09/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.