-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: KRW The Latest Intervention Case

EXECUTIVE SUMMARY

- ECB COULD HIKE PAST FEBRUARY – KAZAKS (MNI)

- ECB’S HOLZMANN SAYS INFLATION SET TO ACCELERATE EVEN MORE (BBG)

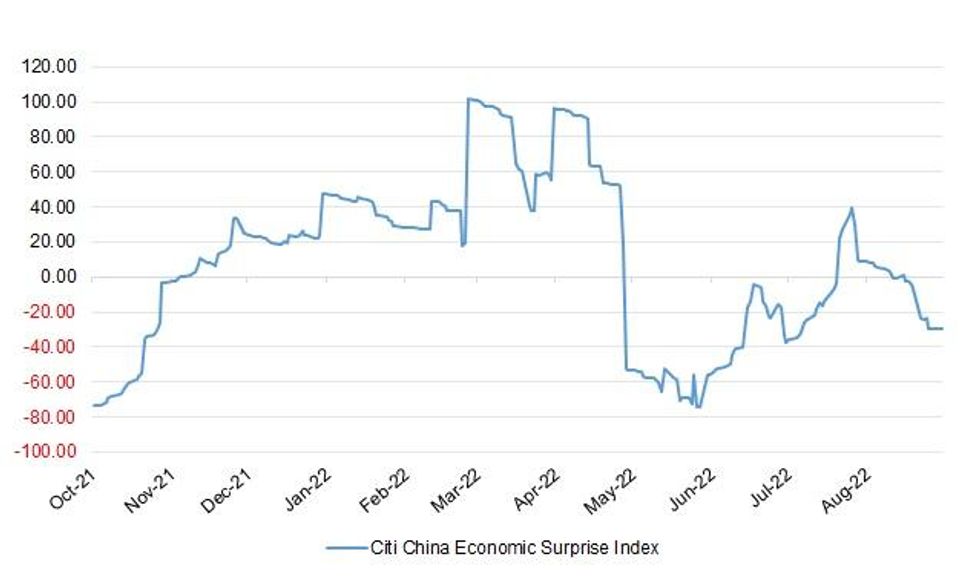

- CHINA’S ECONOMY IS POISED FOR Q3 REBOUND (CSJ)

- PBOC LEAVES MLF RATE UNCHANGED, NET DRAINS LIQUIDITY

- TOUTED INTERVENTION AGAINST FURTHER KRW WEAKNESS FROM KOREAN AUTHORITIES

- PUTIN, XI SET TO MEET ON THURSDAY IN SAMARKAND (RTRS)

Fig. 1: Citi China Economic Surprise Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Details of the UK government's GBP100-billion-plus fiscal package aiming to partially offset the looming spike in energy bills look certain to come too late for the Bank of England to be able to fully factor them into considerations during its September rates-setting meeting. (MNI)

ECONOMY: UK consumer confidence slipped into negative territory for the first time since the pandemic lockdown in the middle of 2020, with homeowners more concerned the value of their property could be at risk. (BBG)

EUROPE

ECB: The European Central Bank may have to continue raising interest rates beyond February, longer than indicated by President Christine Lagarde, in order to bring inflation back to its 2% target, Bank of Latvia Governor Martins Kazaks told MNI. (MNI)

ECB: “Consumer price growth is likely to accelerate even more,” European Central Bank Governing Council member Robert Holzmann tells Austrian state broadcaster ORF. (BBG)

ITALY: Mario Draghi is expected to push through a new energy aid package to families and businesses worth about 13.5 billion euros ($13.5 billion) a week before Italy’s general election. (BBG)

IRELAND: Ireland's finance minister said on Wednesday his department will cut its economic growth forecasts for next year as part of preparations for the government's Sept. 27 budget. (RTRS)

SWEDEN: The head of Sweden's Moderate Party, Ulf Kristersson, said on Wednesday he would begin the work of forming a new government after Prime Minster Magdalena Andersson conceded her Social Democrats had lost the weekend's general election. (RTRS)

U.S.

ECONOMY: One of Washington’s most prominent business groups sent a warning about an impasse in Congress over a corporate tax break for research and development costs. (BBG)

TSYS: Hedge funds would have to start centrally clearing many of their transactions in US Treasuries under a new regulatory plan designed to protect against a market meltdown. (BBG)

EQUITIES: Proposed legislation to address U.S. lawmakers' stock holdings and trades should come together later this month, U.S. House Speaker Nancy Pelosi told reporters at a news conference on Wednesday. (RTRS)

OTHER

GLOBAL TRADE: Senate Republicans failed in a bid to force labor unions and railroads to resolve a fight over contract negotiations, ahead of a strike that threatens to paralyze much of the US rail system. (BBG)

GLOBAL TRADE: Ukraine's foreign minister on Wednesday confirmed that the United Nations had started talks on reopening an ammonia pipeline from Russia to Ukraine's Black Sea port of Odesa. The pipeline has been shut as a result of Russia's invasion of Ukraine. (RTRS)

U.S./CHINA: China’s ambassador to the US warned against the potential risks of trying to cut the country off, using a visit to the Detroit auto show to highlight the “intertwined” interests of the world’s two biggest economies. (BBG)

U.S./CHINA/TAIWAN: A U.S. Senate committee on Wednesday approved legislation that would significantly enhance U.S. military support for Taiwan, including provisions for billions of dollars in additional security assistance, as China increases military pressure on the democratically governed island. (RTRS)

RUSSIA/CHINA: Russian President Vladimir Putin plans to meet Chinese leader Xi Jinping in Uzbekistan early on Thursday afternoon, a schedule distributed by the Russian delegation to media showed. (RTRS)

GEOPOLITICS: Armenia and Azerbaijan negotiated a cease-fire to end a flare-up of fighting that has killed 155 soldiers from both sides, a senior Armenian official said early Thursday. (AP)

JAPAN: Japan lacks effective means to combat the yen's sharp falls, as intervening unilaterally in the currency market will likely have a limited impact in reversing its downtrend, Satsuki Katayama, head of a ruling party panel on financial affairs, said. (RTRS)

JAPAN: The vast majority of Japanese companies expect the yen to firm against the dollar by year-end, a Reuters monthly poll showed on Thursday, suggesting further weakness in the local currency could catch businesses off guard. (RTRS)

JAPAN: Japan will drop a ban on individual tourist visits and remove a cap on daily arrivals, Nikkei has learned, moving closer to pre-pandemic rules as the country looks to ride a global travel rebound. Prime Minister Fumio Kishida is expected to announce the changes in the coming days. (Nikkei)

JAPAN: The Tokyo Metropolitan Government’s panel of experts is considering lowering both of its Covid-19 and medical system strain alert levels by one notch from their current highest level as new infection numbers gradually subside, NHK reports, citing an unidentified person. (BBG)

JAPAN: Japan’s economy ministry is considering calling on households and businesses to conserve electricity this winter amid concerns the country may struggle to procure enough natural gas to meet its needs, public broadcaster NHK reports without attribution. (BBG)

RBA: The issues paper released today by the RBA review panel covers four areas: monetary policy arrangements, performance against objectives (CPI, unemployment rate), governance and the institution. They discuss a range of issues and potential reforms. It aims to adapt the central bank to a new era with different challenges. (MNI)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson says the country is entering a period of tighter spending and targeted investment as it emerges from the pandemic, according to notes for a speech in Auckland Thursday. (BBG)

SOUTH KOREA: South Korea's foreign exchange authority was seen selling dollars to curb the fall in the won after the currency hit its lowest in nearly 13-1/2 years, multiple dealers told Reuters on Thursday. (RTRS)

SOUTH KOREA: South Korea's foreign exchange authority on Thursday issued a verbal warning as the Korean won hit the lowest since March 2009 at 1,397.9 per dollar. "We are closely monitoring the currency market in case of any herd-like behaviour as volatility in Korean won's movement seen increasing," a text message from FX authority showed. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes on Wednesday said that President Jair Bolsonaro would continue privatizing state companies if reelected in October. Speaking at an event promoted by businessmen in Rio de Janeiro, he also said that a new Bolsonaro term would decrease public spending as a proportion of GDP to 15% or 16 from a previous forecast of 18% for the end of this year. (RTRS)

RUSSIA: The Biden administration is discussing with Congress "analogous measures" to impose on Russia in place of those carried by a state sponsorship of terrorism designation, U.S. State Department spokesman Ned Price said on Wednesday. (RTRS)

RUSSIA: Russian President Vladimir Putin "unfortunately" does not seem to have realized yet that the decision to invade Ukraine is a mistake, German Chancellor Olaf Scholz said on Wednesday, commenting on a phone call with Putin a day earlier. (RTRS)

RUSSIA: Russian President Vladimir Putin told United Nations Secretary-General Antonio Guterres on Wednesday that he welcomed "constructive" cooperation with the IAEA nuclear watchdog following its visit to Ukraine's Zaporizhzhia nuclear plant, the Kremlin said. (RTRS)

RUSSIA: The US and EU are stepping up pressure on Turkey to crack down on Russian sanctions evasion amid concerns that the country’s banking sector is a potential backdoor for illicit finance. (FT)

RUSSIA: The US is focusing on Turkish banks that have integrated into Mir, Russia’s domestic payments system, two western officials involved in the plans told the FT, as Brussels prepares a delegation to express its concerns to Turkish officials directly. (FT)

RUSSIA: Russian government plans to impose export duties on coal, Kommersant reports, citing unidentified people familiar with discussions. (BBG)

RUSSIA: Russian consumer prices fell for a 10th straight week, led by a drop in prices for some staple vegetables, data showed on Wednesday, just two days before the central bank is expected to trim interest rates for the sixth time this year. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelensky has emerged with “no serious injuries” from a car collision in Kyiv on Wednesday. (CNN)

IRAN: The Biden administration is considering sanctions targeting entities linked to Iran for encouraging attacks on Salman Rushdie, people familiar with the matter say, after the acclaimed novelist was stabbed last month at a New York event. (WSJ)

COMMODITIES: A potentially catastrophic strike of railroad workers across the US is starting to spook energy and commodities markets, raising the prices of everything from natural gas to corn loaded onto barges for delivery. (BBG)

ENERGY: The US shale industry has warned it cannot rescue Europe with increased oil and gas supplies this winter amid fears that a plunge in Russian exports will send crude prices soaring back above $100 a barrel. (FT)

CHINA

ECONOMY: China’s economic growth is expected to bounce back in 3Q compared to the previous three months, China Securities Journal reported, citing early indicators and economists. (BBG)

YUAN: China needs to ensure it doesn't increase FX reserves to levels greatly more than needed, as increased reserves affect the independence of monetary policy and holding costs increase with diminishing marginal effect, wrote Guan Tao, a former official at the State Administration of Foreign Exchange in a blog post. (MNI)

BANKING: Some of the major banks in China are cutting personal deposit rates starting from Sept. 15, the Securities Times reports, citing multiple staff members of state-owned lenders in Beijing and Shanghai. (BBG)

PROPERTY/CREDIT: Chinese companies are curbing their dollar borrowings at a record pace this year, stung by a property debt crisis on top of rising rates that have dragged down corporate financing in the currency nearly everywhere. (BBG)

PROPERTY: Eastern Chinese city of Suzhou cancels local social insurance payment requirement citywide for first-home buyers with no local residential permit, China Business News reports, citing a local home trading center and a housing agent. (BBG)

CORONAVIRUS: Citywide lockdown in the popular tourist spot on southern Hainan will be lifted from noon Thursday, with supermarkets, malls, and other premises allowed to open, Hainan city government says on its WeChat account. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY200 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos and CNY400 billion 1-year medium-term lending facilities with the rate unchanged at 2.00% and 2.75%, respectively, on Thursday. The operation has led to a net drain of CNY200 billion after offsetting the maturity of CNY2 billion repos and CNY600 MLFs today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6076% at 09:33 am local time from the close of 1.5113% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Wednesday, flat from the close of Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9101 THURS VS 6.9116

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9101 on Thursday, compared with 6.9116 set on Wednesday.

OVERNIGHT DATA

JAPAN AUG TRADE BALANCE -Y2,817.3BN; MEDIAN -2,385.7BN; JUL -Y1,433.9BN

JAPAN AUG EXPORTS +22.1% Y/Y; MEDIAN +24.1%; JUL +19.0%

JAPAN AUG IMPORTS +49.9% Y/Y; MEDIAN +46.9%; JUL +47.2%

JAPAN AUG ADJUSTED TRADE BALANCE -Y2371.3BN; MEDIAN -2,085.1BN; JUL -Y2,155.6BN

JAPAN JUL TERTIARY INDUSTRY INDEX -0.6% M/M; MEDIAN -0.1%; JUN -0.4%

AUSTRALIA AUG EMPLOYMENT CHANGE +33.5K; MEDIAN +35.0K; JUL -40.9K

AUSTRALIA AUG FULL TIME EMPLOYMENT CHANGE +58.8K; JUL -86.9K

AUSTRALIA AUG PART TIME EMPLOYMENT CHANGE -25.3K; JUL +46.0K

AUSTRALIA AUG UNEMPLOYMENT RATE 3.5%; MEDIAN 3.4%; JUL 3.4%

AUSTRALIA AUG PARTICIPATION RATE 66.6%; MEDIAN 66.6%; JUL 66.4%

AUSTRALIA SEP CONSUMER INFLATION EXPECTATIONS +5.4%; AUG +5.9%

AUSTRALIA AUG RBA FX TRANSACTIONS GOV’T -A$690MN; JUL -A$1,065MN

AUSTRALIA AUG RBA FX TRANSACTIONS MARKET +A$658MN; JUL +A$749MN

AUSTRALIA AUG RBA FX TRANSACTIONS OTHER -A$303MN; JUL +A$865MN

NEW ZEALAND Q2 GDP +0.4% Y/Y; MEDIAN +0.0%; Q1 +1.0%

NEW ZEALAND Q2 GDP SA +1.7% Q/Q; MEDIAN +1.0%; Q1 -0.2%

MARKETS

SNAPSHOT: KRW The Latest Intervention Case

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 71 points at 27889.70

- ASX 200 up 18.082 points at 6846.40

- Shanghai Comp. down 35.687 points at 3201.541

- JGB 10-Yr future down 12 ticks at 148.6, JGB 10-Yr yield down 0.3bp at 0.255%

- Aussie 10-Yr future up 0.3 ticks at 96.359, Aussie 10-Yr yield up 2.8bp at 3.662%

- US 10-Yr future -0-05+ at 114.25+, 10-Yr yield up 2.14bp at 3.4257%

- WTI crude down $0.08 at $88.4, Gold down $9.38 at $1687.91

- USDJPY up 46 pips at 143.54

- ECB COULD HIKE PAST FEBRUARY – KAZAKS (MNI)

- ECB’S HOLZMANN SAYS INFLATION SET TO ACCELERATE EVEN MORE (BBG)

- CHINA’S ECONOMY IS POISED FOR Q3 REBOUND (CSJ)

- PBOC LEAVES MLF RATE UNCHANGED, NET DRAINS LIQUIDITY

- TOUTED INTERVENTION AGAINST FURTHER KRW WEAKNESS FROM KOREAN AUTHORITIES

- PUTIN, XI SET TO MEET ON THURSDAY IN SAMARKAND (RTRS)

US TSYS: Modest Cheapening Bias Overnight, Aided By Move In JGBs

A modest cheapening bias was observed in Asia hours, aided by the previously outlined post-auction weakness and steepening on the JGB curve. The move in Tsys has been much more limited, with cash benchmarks running 2bp cheaper across the curve. TYZ2 operates in a fairly limited 0-08 range, last -0-05+ at 114-25+, just off lows on subdued volume of ~40K.

- One market contact noted some regional real-money account interest in selling 30s.

- Regional risk events failed to provide a tangible catalyst for the space.

- Thursday’s U.S. docket sees the release of retail sales, Empire & Philly Fed surveys, industrial production, weekly jobless claims and terms of trade data.

- Focus is squarely on the 75/100bp hike debate re: next week’s FOMC (J.P.Morgan played down the odds of a 100bp move on Wednesday after Nomura called for such a hike post-CPI). ~83bp of tightening is currently priced for next week’s meeting.

- A block sale of SFRU3 (-3.5K) and block flattener in SFRH3/H4 (-9K) headlined on the flow side in Asia.

- The Shanghai Cooperation Organisation gathering gets underway on Thursday, with Chinese President Xi set to meet with Russian President Putin in the afternoon (Uzbekistan time). The Kremlin has already noted that the summit will provide an "alternative" to the Western world.

JGBS: Bear Steepening On Weak 20-Year JGB Auction

JGB futures are -15 ticks last, while the curve has bear steepened in the wake of a soft 20-Year JGB auction which saw a much lower than expected low price and the lowest cover ratio observed at a 20-Year auction in a decade.

- The auction was hindered by the apparent return of international investors for a renewed challenge of the BoJ’s YCC settings (based on weekly international security flow data from the Japanese MoF), which likely limited broader demand alongside a lack of relative value appeal.

- The major cash JGB benchmarks run 0.5-7.0bp cheaper ahead of the bell.

- Futures recovered from Tokyo lows lodged post-auction after failing to test their overnight base, likely as 10-Year JGB yields continue to hover close to the upper limit of the BoJ’s permitted trading band.

- There are no domestic data releases of note scheduled for Friday.

JGBS AUCTION: Japanese MOF sells Y2.83778tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.83778tn 1-Year Bills:

- Average Yield: -0.1437% (prev. -0.1311%)

- Average Price: 100.144 (prev. 100.131)

- High Yield: -0.1338% (prev. -0.1311%)

- Low Price: 100.134 (prev. 100.131)

- % Allotted At High Yield: 17.4028% (prev. 81.7938%)

- Bid/Cover: 3.491x (prev. 3.442x)

JGBS AUCTION: Japanese MOF sells Y984.7bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y984.7bn 20-Year JGBs:

- Average Yield: 0.894% (prev. 0.752%)

- Average Price: 100.09 (prev. 102.55)

- High Yield: 0.945% (prev. 0.755%)

- Low Price: 99.25 (prev. 102.50)

- % Allotted At High Yield: 96.6666% (prev. 67.4224%)

- Bid/Cover: 2.506x (prev. 3.282x)

AUSSIE BONDS: Cheaper On Core Global FI Moves; Gov. Lowe To Testify On Friday

ACGBs sit a little off session cheaps at typing, with a continued downtick in U.S. Tsys & JGBs helping to unwind the twist flattening observed in futures overnight, which spilled over into early Sydney trade.

- Cash ACGBs run 1.5-6.5bp cheaper across the curve, bear flattening. YM is -6.8 and XM is -2.6, with both contracts keeping within their overnight boundaries. Bills run 4 to 8 ticks richer through the reds.

- Aussie bonds saw little by way of a meaningful, lasting reaction to the release of domestic labour market data, with the modest miss in headline employment gains and uptick in unemployment not expected to move the needle re: the RBA’s policy decision in Oct, at least in isolation.

- STIR markets now price in ~39bp of tightening for the RBA’s Oct ‘22 meeting, little changed from levels observed prior to today’s labour market data, consolidating the recent move higher which came on the U.S. CPI print and the subsequent repricing of market expectations re: Fed tightening.

- Friday will see RBA Governor Lowe appear in Parliament for his semi-annual testimony. Following that, A$800mn of ACGB May-32 will be on offer at auction, with the AOFM’s weekly issuance slate due as well.

EQUITIES: Cautiously Higher In Asia; Chinese Developers Outperform On Growing Policy Support

Most major Asia-Pac equity indices sit modestly higher on a positive lead from Wall St., with Chinese and South Korean benchmarks bucked the broader trend of gains.

- The CSI300 deals 0.7% softer at writing, with limited gains in the heavyweight consumer staples sub-index (+0.5%) unable to counter weakness in industrials and consumer discretionary equities.

- China-based property developer shares outperformed on the Hong Kong and Chinese bourses, with the Hang Seng Mainland Properties Index (+4.7%) and the CSI300 Real Estate Index (+2.6%) surging amidst signs of strengthening policy support for the sector, with the latter hitting 6-week highs earlier in the session.

- The ASX200 is 0.2% firmer, with the energy (+3.4%) and financials (+1.0%) sub-gauges offsetting weakness in high-beta healthcare (-0.9%) and tech equities (S&P/ASX All Tech Index: -0.4%)

- The Hang Seng deals 0.5% firmer at writing, with the properties (+2.0%) sub-gauge contributing the most to gains.

- E-minis deal 0.1% firmer apiece at writing, having stuck to the top of their respective ranges established on Wednesday.

OIL: Little Changed In Asia; U.S. Rail Strike Eyed

WTI and Brent are little changed at writing, having traded on either side of neutral levels across Asia-Pac dealing, consolidating around the upper end of their respective ranges established on Wednesday.

- To recap, WTI and Brent briefly rose to their best levels in over a week on Wed after EIA data showed an above-expectations increase in crude inventories, nonetheless rising at a slower pace than last week’s ~8.8mn bbl build. Distillate stockpiles saw a surprise increase, while gasoline and hub stocks fell.

- Both benchmarks operate just shy of best levels for Sep, rallying from eight-month lows observed last Thursday on gains in four of the past five trading sessions.

- A partial easing of COVID curbs in the Chinese city of Chengdu (pop. ~21mn) aided sentiment, coming as China has reported <1K COVID cases daily for a fourth day.

- Elsewhere, the IEA forecast oil consumption from gas-to-oil switching across Oct ‘22 to Mar ‘23 to double from a year prior (to 700K bpd) on increased demand for heating.

- Looking ahead, participants will be keeping an eye on ongoing negotiations to avert rail strikes in the U.S., with the API having previously described a disruption to the rail network as “catastrophic”.

GOLD: Steadying Below $1,700/oz As Dollar Holds Post-CPI Gains

Gold deals ~$3/oz weaker to print $1,695/oz, operating a little above Wednesday’s one-week lows at writing, having left the $1,700/oz mark unchallenged throughout Asia-Pac dealing so far.

- To recap, gold closed $5 lower on Wednesday, ending below $1,700 for the first time in two weeks, with the higher than expected U.S. core PPI reading (+7.3% Y/Y vs. BBG median +7.0%) doing little to lift gloom in the space re: worry over Fed rate hikes amidst persistent, elevated inflation.

- Gold trade around its lowest levels for Sep as the USD has held on to the bulk of its post-CPI rally from Tuesday, with the DXY operating just shy of the 110.00 mark at writing.

- Zooming out, the precious metal sits ~$15 above its lowest levels for ‘22 ($1,681.0, Jul 21 low), with the move lower facilitated by a simultaneous rally in the Dollar and U.S. real yields.

- From a technical perspective, gold remains in a clear downtrend. Initial support is seen at $1,681.0 (21 Jul low and bear trigger), while resistance is located at ~$1,735.1 (Sep 12 high).

FOREX: Antipodean Data Dominate As G10 FX Hold Ranges

Antipodean data took the limelight in the Asia-Pac session, with New Zealand's Q2 GDP beating expectations and Australian Aug labour force figures lacked any major surprises. The Aussie and Kiwi dollars outperform in the G10 FX basket, albeit by very thin margins as overall volatility in the space remained subdued.

- The kiwi dollar turned bid as New Zealand's Q2 GDP growth printed at +1.7% Q/Q after an unrevised 0.2% contraction recorded in Q1. The sequential outturn exceeded the median estimate of +1.0% but falling slightly short of the RBNZ's +1.8% projection. Initial market reaction has been largely unwound as the session progressed. RBNZ pricing is little changed but ASB lifted their terminal OCR level forecast by 25bp to 4.25%.

- The Aussie ticked higher as the latest batch of Australian jobs data lacked any major surprises. Employment growth was marginally softer than forecast (+33.5k vs +35.0k expected), while the unemployment rate nudged up to 3.5% versus 3.4% expected amid slightly wider participation. The report is unlikely to shift RBA views ahead of their October meeting.

- AUD/NZD slipped on the release of NZ GDP data, moving in tandem with Australia/New Zealand 2-Year swap spread. The pair returned to positive territory as participants digested Australian jobs figures, with the swap spread returning to its previous levels. Spot AUD/NZD last operates ~10 pips higher on the day.

- Spot USD/JPY advanced as the yen slipped to the bottom of the G10 pile. Renewed yen weakness could be linked to a RTRS report flagging comments from Japan's ruling party official Katayama, who said that "conducting solo FX intervention likely won't be that effective in stemming sharp yen falls" The record trade deficit reported by Japan may have increased yen vulnerability.

- Focus turns to to U.S. advance retail sales, industrial output, Empire M'fing Survey, Philly Fed Business Outlook & initial jobless claims. ECB's de Guindos and Centeno will speak at conference events.

FX OPTIONS: Expiries for Sep15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.1bln), $1.0015-20(E790mln), $1.0050(E1.1bln)

- GBP/USD: $1.2150(Gbp1.3bln)

- USD/JPY: Y142.00-20($710mln), Y144.00($576mln)

- EUR/GBP: Gbp0.8600(E1.6bln)

- USD/CAD: C$1.3035-50($540mln)

- USD/CNY: Cny7.00($3.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/09/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/09/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/09/2022 | 0915/1115 |  | EU | ECB de Guindos Keynote Speech | |

| 15/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 15/09/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/09/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/09/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/09/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2022 | 1400/1000 | * |  | US | Business Inventories |

| 15/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.