-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A Lot Of Monetary Tightening To Digest This Week

- Major currency pairs treaded water with the market in a waiting mode ahead of a marathon of central bank meetings this week. The greenback slipped in early trade as U.S. e-minis crept higher in the wake of a positive Wall Street session, but clawed back losses as equity index futures trimmed gains.

- ACGBs squeezed higher on positive budget developments in Australia, while U.S. Tsys twist flattened and JGBs bear steepened.

- Looking ahead, U.S. housing starts/building permits, Canadian CPI, comments from ECB's Lagarde & Muller, as well as Riksbank's monetary policy review take focus from here.

CENTRAL BANKS: More Tightening This Week, Ex Japan; Fed 75bp

EXECUTIVE SUMMARY

- It is a busy week for the world’s central banks with most except the Bank of Japan expected to hike rates further. While different banks started tightening at different times, this cycle is fairly synchronised (again apart from Japan) and many who started late are catching up with outsized moves.

- The Fed is the focus for the week and it is projected to raise rates 75bp on Wednesday 21 September. The Riksbank should hike 75bp on Tuesday 20 September. Wednesday could see the final hike in Brazil (+25bp). On Thursday 22 September, the BoE, SNB and Norges Bank should all increase rates 50bp, while Indonesia should see 25bp and the Bank of Japan is expected to remain on hold. See Central Banks: More Tightening This Week, Ex Japan, Feb 75bp (includes links to MNI Central Bank Previews).

- There is more tightening to come across the OECD and Asia as markets are not expecting terminal rates to be reached until the first half of 2023. And central banks have made it clear that they are committed to reducing inflation even at the risk of recession.

Source: MNI - Market News, Refinitiv

MNI Riksbank Preview - September 2022: Upside risks to 75bp

EXECUTIVE SUMMARY

- We would be inclined to expect a 75bp rather than a 100bp hike for two related reasons: first the passthrough is faster in Sweden to households than in most other markets (due to the higher proportion of mortgages with shorter-term fixes). Second, the Swedish housing market is already looking more vulnerable than other property markets across the developed world.

- With Floden already having said that he could have favoured an end to reinvestments in Q4 at the June meeting and Skingsley having left the Executive Board, we think there is a good chance that the Riksbank decides to stop bond reinvestments in Q4-22.

- We have read through and summarized 14 sell side previews, with 12/14 looking for a 75bp hike (the remaining two look for a 100bp hike). While OIS markets price around a 60% probability of a 100bp hike (with 75bp fully priced).

- Full document:MNI Riksbank Preview - 2022-09.pdf

US TSYS: Curve Flattening Maintained As Asia Looks Ahead To FOMC

Cash Tsys run 0.5 bp cheaper to 1.0bp richer across the curve into London hours, with twist flattening evident as the 7- to 10-Year zone leads the bid in 5+-Year paper, while TYZ2 deals in the middle of a narrow 0-06 range on limited volume of ~39K.

- It would seem that the proximity to Wednesday’s FOMC meeting and a lack of macro news flow kept many Asia-Pac participants sidelined.

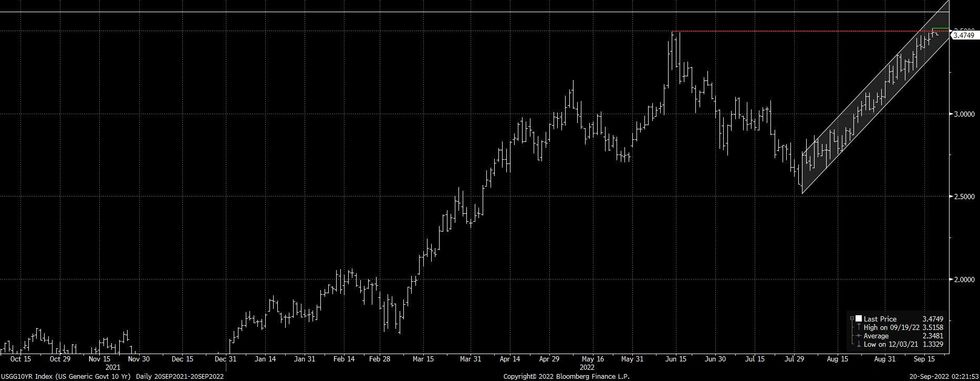

- 10-Year Tsy yields continue to operate within the uptrend channel drawn off the August lows (as flagged here).

- This month’s Chinese LPR fixings were unch., matching wider expectations.

- Housing starts and building permits data headline the NY docket on Tuesday, with 20-Year Tsy supply also due.

- Note that the Riksbank is set to kick off this week’s monetary tightening, with no fewer than 9 central banks that we cover expected to deliver 487.5bp of cumulative tightening through Thursday, with the Fed headlining.

US TSYS: 10-Year Yields Stick To Uptrend Channel Into Fed

10-Year U.S. Tsy yields continue to operate within the confines of the uptrend channel established since the August low was registered. There was a marginal extension beyond the previous cycle highs during Monday’s session, before a pullback from best levels. A break beyond Monday’s high would open the way towards the upper limit of the uptrend channel and horizontal resistance drawn off the April ’11 high (3.6093%/3.6132%).

- The latest FOMC decision presents the key event risk for broader markets and U.S. yields this week. Our Fed preview highlighted that along with a 75bp hike at the September meeting, the FOMC will attempt to cement “higher for longer” rate pricing.

- The dot plot provides the first chance for a formal depiction of the Fed’s broader thinking on the matter post-Jackson Hole.

- A hawkish surprise from the Fed may be a pre-requisite to facilitate a challenge of the aforementioned technical resistance levels, although we cannot completely rule out the idea of a pre-Fed meeting test.

Fig. 1: US. 10-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS: Futures Struggle To Make Decisive Move, Curve Steepens

JGB futures are back from session highs observed after the Tokyo lunch break, dipping back into negative territory, -3 ticks as we move towards the close.

- Cash JGBs are little changed to 2bp cheaper across the curve, with super-long JGBs leading the weakness.

- The limited cheapening in paper out to 10s comes as 10-Year JGB yields continue to probe the BoJ’s yield cap, with participants seemingly mindful of the possibility of an unscheduled round of BoJ bond purchases.

- Japanese national CPI data printed 0.1 ppt above expectations on all three Y/Y metrics, incrementally raising the chances of the BoJ stepping in to defend its YCC settings via unscheduled methods (which hasn’t happened yet). The central bank is still expected to leave its major monetary policy settings unchanged at the end of its upcoming meeting (which concludes on Thursday).

- Japanese Finance Minister Suzuki noted that initial fiscal measures to combat inflation will be drawn from reserve funds, while subsequent action will require additional funding via a supplementary budget.

- Wednesday will see a liquidity enhancement auction for off-the-run 1-5 Year JGBs, while the domestic economic data docket is light at best.

AUSSIE BONDS: Firmer On Narrower Fiscal Deficit

ACGBs sit a little below session highs, having richened after Australian Treasurer Chalmers delivered a preview of Australia’s final 21/22 budget results.

- Chalmers highlighted that the budget deficit for 21/22 will improve by “almost A$50bn” vs. projections made in March, although he suggested that the bulk of the improvement was “driven by temporary factors.” The March forecasts projected a A$79.8bn deficit for 21/22, with Chalmers alluding to a wider deficit in 22/23 vs. actual 21/22 levels (March’s projections looked for a deficit of A$78.0bn in 22/23).

- Cash ACGBs run 4.5-6.5bp richer across the curve, with the super-long end leading the way higher. YM is +5.5 and XM is +3.5. EFPs are little changed, while Bills run 2 to 6 ticks richer through the reds.

- ACGBs looked through the release of the RBA’s Sep meeting minutes.

- RBA Oct dated OIS now price in ~42bp of tightening, unwinding the uptick to ~45bp that came after Westpac’s call for a 50bp Oct hike from the RBA (made late Monday).

- The Westpac leading index and a speech by RBA Deputy Gov. Bullock will headline the domestic docket on Wednesday.

FOREX: Kiwi Lags Behind With G10 FX Holding Tight Ranges

Major currency pairs treaded water with the market in a waiting mode ahead of a marathon of central bank meetings this week. The greenback slipped in early trade as U.S. e-minis crept higher in the wake of a positive Wall Street session, but clawed back losses as equity index futures trimmed gains.

- The kiwi underperformed for the second consecutive day, as NZ 2-Year swaps extended their move away from three-month highs, despite the absence of notable local catalysts. Spot NZD/USD shed a handful of pips, falling short of testing cycle lows printed Monday at $0.5930.

- AUD/NZD breached the NZ$1.1300 mark on its way to NZ$1.1328, the highest point since Mar 2016. The move in the spot rate was out of sync with a moderation in AU/NZ 2-Year swap spread, with the differential paring yesterday's advance.

- The yen ignored above-forecast Japanese inflation data released earlier. Core CPI accelerated to +2.8% Y/Y in Aug from +2.4% prior, exceeding the median estimate of +2.7%.

- USD/CNH held above CNH7.0 as the PBOC kept its Loan Prime Rates unchanged. The People's Bank also set a stronger-than-expected yuan reference rate for the 19th straight day.

- U.S. housing starts/building permits, Canadian CPI, comments from ECB's Lagarde & Muller, as well as Riksbank's monetary policy review take focus from here.

FX OPTIONS: Expiries for Sep20 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.5bln), $1.0000(E654mln), $1.0050(E546mln), $1.0100(E632mln)

- GBP/USD: $1.1425(Gbp647mln)

- EUR/JPY: Y138.00(E626mln)

- AUD/USD: $0.6719-25(A$580mln)

ASIA FX: Resilience Outside Of CNH

Outside of USD/CNH, most USD/Asia pairs are lower today, bucking the higher beta trend in G10 FX. Moves have been fairly modest though. Still to come is Taiwan export orders data for August. Tomorrow South Korea first 20-days trade data for September is due. Note Thursday delivers central bank meetings across Indonesia, the Philippines and Taiwan.

- USD/CNH dips have been supported. The pair is back above 7.01. As expected, the LPR rates were left unchanged. Onshore equities are higher, but underperforming the rest of the region. Hong Kong has fared better, aided by the authorities lowering covid restrictions related to hotel quarantine.

- USD/KRW has edged down slightly, but has tracked tight ranges overall, currently sitting at 1388 in the 1 month NDF. The Kospi is higher at +0.60%.

- USD/TWD is away from highs around 31.40. Onshore equities are up around 0.8%, but as we noted earlier tech headwinds persist.

- USD/INR is back to 79.60 (-0.20% for the session), well within recent ranges. Onshore equities are higher, with the NIFTY eyeing another test of the 18000 level (last 17855).

- USD/SGD is also within recent ranges. Moving away from a break above 1.4100 (last 1.4070/75). The MAS noted earlier there is a high degree of uncertainty surrounding the outlook. The SGD NEER is still generally trending higher though.

- Spot USD/IDR trades close to unchanged at 14977, as participants eye Bank Indonesia & Fed monetary policy reviews this week. Bank Indonesia is expected to raise the 7-Day Reverse Repo Rate by 25bp this Thursday, with some calling for a 50bp rate rise.

- USD/PHP is back under 57.40, with the peso slightly firmer on the day. 57.40 has been a resistance level this week. Bangko Sentral ng Pilipinas will announce its monetary policy review this Thursday, with most analysts expecting a 50bp hike to the key policy rate. Monthly budget balance will be published on the same day.

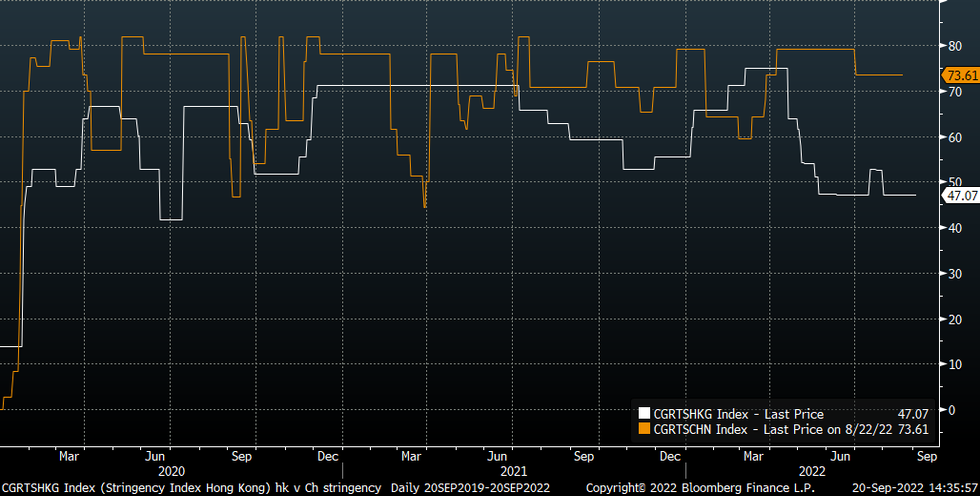

CHINA: Likely Too Soon To Turn More Optimistic On China Covid Settings

Hong Kong equities are higher, led by travel related stocks, on reports hotel quarantine restrictions around Covid will be lifted for the city. Still, it may be too early for market optimism around easing restrictions in mainland China to lift meaningfully.

- The chart below plots the Oxford Stringency indices for Hong Kong and China. See CGRTSHKD <Index> on Bloomberg for more details on how this index is created and what it measures. Essentially though, higher readings mean tighter restrictions to control the spread of Covid.

- Since the start of the pandemic both measures have remained elevated, particularly for China. Other major economies have much lower readings for their stringency readings currently (US is sub 30, while the UK is at 11.1 for example).

- Today’s announcement by the Hong Kong authorities is the latest in a series of measures designed to make international travel to the city easier.

- The rough sell-side consensus though is that mainland China Covid restrictions won't be dramatically eased before early 2023. Indeed, the recent success of the Chengdu lockdown (at least relative to the Shangahi lockdown earlier in 2022), which only lasted a few weeks, may leave the authorities comfortable with the current strategy.

- In any case, the market will be on the watch for shifts in China policy around Covid as this is one key factor driving growth expectations.

Fig 1: China & Hong Kong Oxford Stringency Indices

Source: Oxford/MNI - Market News/Bloomberg

Source: Oxford/MNI - Market News/Bloomberg

EQUITIES: Following Wall St Higher; Easing Of Hong Kong COVID Rules Eyed

Major Asia-Pac equity indices deal between 0.3-1.3% firmer on a positive lead from Wall St., with the MSCI APEX 50 Index (+1.2%) of large caps unwinding virtually all of Monday’s losses at writing, and on track to snap a four-session streak of losses.

- The Hang Seng is 1.5% better off, rebounding from Monday’s six-month lows on gains across every sub-index. China-based tech outperformed (HSTECH: +2.5%), mirroring the bid in the NASDAQ Golden Dragon China index on Monday (+1.6%).

- Travel-related stocks extended Monday’s gains as SCMP sources pointed to Hong Kong leaders reaching consensus on lifting hotel quarantines. While no official announcement re: concrete measures has been made, China’s HK & Macau Affairs Office has stated that they have “no problem” with an adjustment in the city’s COVID rules.

- The ASX200 deals 1.3% firmer, with commodity and financials equities contributing the most to gains, offsetting a relatively lacklustre showing from tech stocks (S&P/ASX All Tech Index: +0.5%). Major miners sit between 0.9-5.5% better off, while the “Big 4” banks trade 1.2-1.7% firmer apiece.

- E-minis deal 0.2-0.3% apiece, off best levels, but holding on to the bulk of their Monday’s gains at typing.

GOLD: Steadying Below $1,680/oz; Busy Central Bank Week Eyed

Gold deals $1/oz softer to print ~$1,675/oz at writing, edging away from best levels after failing to breach Monday’s session highs earlier.

- To recap, gold closed little changed on Monday, having pared losses throughout the session after falling by as much as $15, inversely tracking a move in the USD, with the DXY closing virtually unchanged after a brief show above the 110.00 mark.

- The precious metal has struggled to break above $1,680 in recent sessions and remains a short distance from recent 29-month lows ($1,654.2 Sep 15 low), with caution evident as this week will see various central banks around the world raise rates

- The week’s round of central bank action will begin with the Riksbank later on Tuesday, although focus for gold will likely centre around the Fed’s policy decision on Wednesday.

- From a technical perspective, gold remains in a clear downtrend, with last week’s extension lower reinforcing the bearish theme. Attention will be on support at $1,640.9 (Aug 8 2020 low), while initial resistance is seen at $1,688.9 (Sep 1 low).

OIL: Little Changed Ahead Of Central Bank Policy Decisions

WTI and Brent are $0.20 firmer apiece at writing, having struggled to breach Monday’s best levels in Asia-Pac dealing as worry re: central bank-led economic slowdowns remains elevated heading into a host of central monetary policy decisions due this week.

- Focus for the week will be on the FOMC on Wed, with recent Dollar strength providing headwinds for crude as the DXY continues to hover near recent cycle highs.

- Hope surrounding a U.S.-Iran nuclear deal remains scant, with France saying on Monday that there would “not be a better offer”, highlighting that no parallel efforts were underway to advance the talks, echoing remarks from the EU’s Borrell that he did not see a better solution.

- BBG source reports have pointed to the UAE bringing forward plans to raise crude output capacity to 5mn bpd by 2025 (from 2030 prev). The UAE’s current output is estimated at ~3.4mn bpd.

- Elsewhere, the U.S. announced the sale of 10mn bbls of crude from the SPR for delivery in Nov, representing an extension in the schedule for existing plans re: a 180mn bbl release from the SPR.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2022 | 2330/0830 |  | JP | Natl CPI | |

| 20/09/2022 | 0115/0915 |  | CN | PBoC Rate Decision | |

| 20/09/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 20/09/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/09/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/09/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 20/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/09/2022 | 1700/1900 |  | EU | ECB Lagarde Lecture in Frankfurt | |

| 20/09/2022 | 1930/1530 |  | CA | BOC Deputy Beaudry speech "Pandemic macroeconomics: What we’ve learned, and what may lie ahead." |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.