-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BBDXY All-Time High As White House Plays Down Prospect Of New Plaza Accord

EXECUTIVE SUMMARY

- WHITE HOUSE’S DEESE DOESN’T EXPECT ANOTHER PLAZA ACCORD COMING (BBG)

- WHITE HOUSE MULLING POTENTIAL YELLEN DEPARTURE AFTER MIDTERMS (AXIOS)

- DALY SAYS THE FED DOES NOT WANT TO TIP U.S. ECONOMY INTO DOWNTURN (RTRS)

- IMF SAYS UK FISCAL MEASURES WILL 'LIKELY INCREASE INEQUALITY,' URGES RETHINK (RTRS)

- MOODY'S WARNS UK UNFUNDED TAX CUTS ARE 'CREDIT NEGATIVE' (RTRS)

- YELLEN SAYS MARKETS FUNCTIONING WELL, CONDITIONS NOT DISORDERLY (BBG)

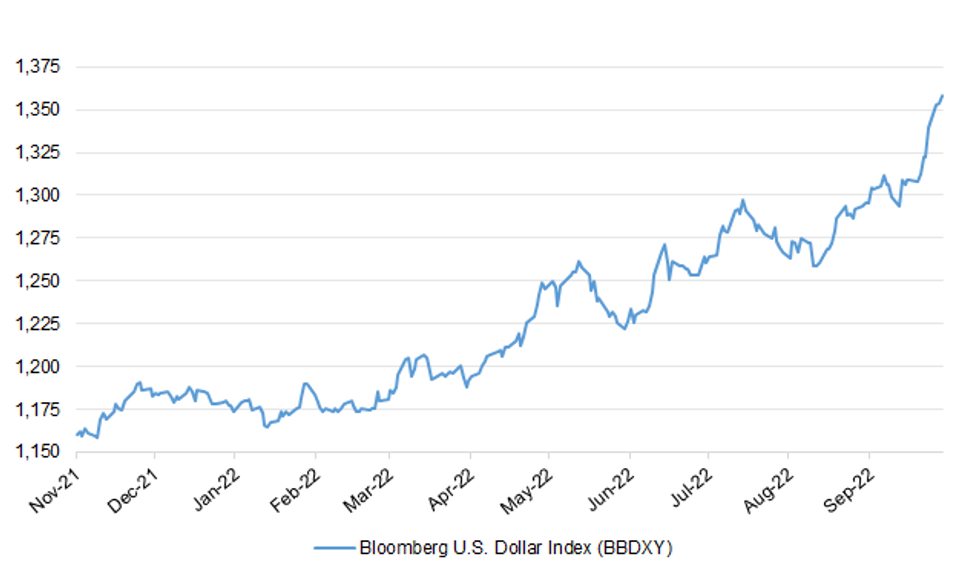

Fig. 1: Bloomberg U.S. Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Liz Truss had to be convinced to issue a government statement yesterday to calm the markets, Sky News understands. (Sky)

FISCAL: Senior government officials warned the Prime Minister and the Chancellor before Friday’s “mini-Budget” that introducing wide-ranging tax cuts funded by borrowing would trigger market volatility and cause a shock to the economy, i has been told. (i)

FISCAL/MARKETS: British Chancellor Kwasi Kwarteng is set to host representatives from top Wall Street firms on Wednesday, part of his outreach to discuss the government’s growth plans, which have caused turmoil in financial markets. (BBG)

FISCAL/GILTS: City chiefs have expressed concern that an unprecedented rise in yields on long-dated government bonds is inflicting huge and sudden cash calls on traditional pension funds that could damage the gilts market. (The Times)

FISCAL/IMF: The International Monetary Fund on Tuesday took aim at new British financial plans that have roiled markets, warning that "large and untargeted fiscal packages" would likely increase inequality in Britain and could undermine monetary policy. (RTRS)

FISCAL/RATINGS: Global ratings agency Moody's has warned the British government that plans for unfunded tax cuts could lead to larger budget deficits and higher interest rates, threatening the country's credibility with investors. (RTRS)

FISCAL/PROPERTY: Kwasi Kwarteng is facing demands from his own party to act within days amid fears millions will face a steep hike in mortgage rates – with one senior Conservative MP describing last week’s mini-Budget as “an unmitigated disaster”. (Independent)

ECONOMY: The UK economy is facing “serious headwinds” that call for additional support for small businesses, according to the British Business Bank, the state-backed economic development investor. (FT)

BREXIT: Brussels believes that a deal on the Northern Ireland Protocol could be struck within a month because of economic turmoil in Britain. (Telegraph)

EUROPE

ECB: The European Central Bank will act with determination and in an orderly manner to tackle inflation that’s become broader and increasingly driven by internal factors, Bank of France Governor Francois Villeroy de Galhau said. (BBG)

GERMANY: Germany said it will keep two nuclear plants in a reserve until April to help limit the threat of winter blackouts in Europe’s biggest economy. (BBG)

IRELAND: Ireland will tap surplus funds not stashed away in its national reserve fund if consumers or businesses need further help with energy bills beyond March next year, Finance Minister Paschal Donohoe said on Tuesday. (RTRS)

U.S.

FED: Federal Reserve Bank of Philadelphia President Patrick Harker said on Tuesday a housing shortage is a key driver of the nation's historic surge in inflation. (RTRS)

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari said the U.S. central bank needs to tighten monetary policy until underlying inflation is declining, and then wait to see whether it has done enough. (WSJ)

FED: San Francisco Federal Reserve Bank President Mary Daly said on Tuesday that the U.S. central bank is “resolute” about bringing down high inflation but also wants to do so “as gently as possible” so as not to drive the economy into a downturn. (RTRS)

FED: It’s too early to say whether U.S. inflation has peaked at near 40-year highs and the Federal Reserve must keep raising interest rates in order to make monetary policy modestly restrictive, St. Louis Fed economist Mark Wright told MNI. (MNI)

FED: The Federal Reserve will hike its key interest rate to a much higher peak than predicted two weeks ago and the risks are skewed towards an even higher terminal rate, according to economists polled by Reuters. (RTRS)

FISCAL: The U.S. Senate voted on Tuesday night to move forward with a stopgap funding bill that would avoid a government shutdown on Saturday, after Senate Majority Leader Chuck Schumer cut a controversial energy-permitting provision from the critical spending bill. (RTRS)

FISCAL: White House officials are quietly preparing for the potential departure of Treasury Secretary Janet Yellen after the midterms, the first and most consequential exit in what could be a broad reorganization of President Biden's economic team, according to people familiar with the matter. (Axios)

POLITICS: U.S. President Joe Biden's public approval rating edged higher this week, though he remains deeply unpopular, with just six weeks to go before the Nov. 8 midterm elections, a Reuters/Ipsos opinion poll completed on Tuesday found. (RTRS)

EQUITIES: The Federal Reserve’s most aggressive pace of tightening since the 1980s is making the majority of Wall Street investors believe stocks will be underwater for longer, according to the new CNBC Delivering Alpha investor survey. (CNBC)

EQUITIES: Apple Inc. is backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed materialize, according to people familiar with the matter. (BBG)

EQUITIES: House Democrats released their bill to ban stock trading by members of Congress, judges and senior government officials as they work to gather enough votes to pass legislation through the House before the midterm elections. (WSJ)

OTHER

JAPAN: Former Bank of Japan Deputy Governor Hiroshi Nakaso says that he “really” hopes that Japan’s current inflation will be translated into higher wages and finally end deflation. (BBG)

BOJ: Bank of Japan (BOJ) board members agreed the inflationary impact of the yen's recent sharp moves must be closely scrutinised, but policymakers reiterated their resolve to keep policy loose even as the currency's rapid fall has unsettled financial markets. (RTRS)

AUSTRALIA: Australia reported a significantly improved budget outcome for fiscal 2022 even as Treasurer Jim Chalmers dismissed prospects for the books to return to the black over the next four years. (BBG)

BRAZIL: Brazil former president Luiz Inacio Lula da Silva said the country’s spending cap rule is an imprisonment imposed by the financial community and declared, once again, that he is against the rule. (BBG)

BRAZIL: Former Brazil president Luiz Inacio Lula da Silva is polling at 46% ahead of the 1st round vote on Oct. 2, while incumbent Jair Bolsonaro is at 33%, according to a Quaest survey commissioned by Genial brokerage firm. (BBG)

RUSSIA: The US is pressing EU countries to speed up and increase financial support for Ukraine as the IMF explores new ways to send cash to Kyiv. (FT)

RUSSIA: The European Union is poised to adopt new sanctions on Russia, even as some member countries are questioning existing restrictions and as the economic pain they are inflicting on EU citizens grows. (WSJ)

RUSSIA: The European Union is considering a German proposal to ban EU nationals from holding high-paying roles in Russian state-owned companies, according to people familiar with the matter. (BBG)

RUSSIA: Turkish state banks are planning to exit a payment system used by Russians, a dramatic example of how US secondary sanctions are forcing countries to distance themselves from Moscow. (BBG)

INDIA: India's long wait to win inclusion in JPMorgan's influential emerging market debt index is set to be pushed out into next year due to a number of issues New Delhi needs to address, four sources familiar with the matter said. (RTRS)

MARKETS: Treasury Secretary Janet Yellen said that financial markets are functioning well, after a tumble in equities and Treasuries and a surge in the dollar unsettled investors. (BBG)

FOREX: White House National Economic Council Director Brian Deese said he didn’t expect another 1985-type agreement among major economies to counter the dollar’s strength. (BBG)

METALS: Chilean regulatory uncertainties that have held up some investments in the biggest copper-producing nation are dissipating, according to top mining company BHP Group. (BBG)

METALS: Peru’s government is working to boost mining oversight, including increasing resources for regulatory agencies to improve efficiency and speed up permitting, Economy and Finance Minister Kurt Burneo told an industry conference Tuesday. (BBG)

ENERGY: A group of European Union countries are pushing Brussels to produce plans this week for a bloc-wide cap on the price of gas, according to a letter seen by Reuters late on Tuesday. (RTRS)

ENERGY: U.S. Secretary of State Antony Blinken said on Tuesday that it would be "in no-one's interest" if attacks or acts of sabotage caused gas leaks detected in the Nord Stream gas pipelines amid an energy standoff between Europe and Russia over gas supplies. (RTRS)

ENERGY: European Commission chief Ursula von der Leyen on Tuesday said the leaks of the Nord Stream pipelines were caused by sabotage, and warned of the "strongest possible response" should active European energy infrastructure be attacked. (RTRS)

ENERGY: Seismologists in Denmark and Sweden on Monday registered powerful blasts in the areas of the Nord Stream gas leaks, Sweden's National Seismology Centre (SNSN) at the Uppsala University told public broadcaster SVT on Tuesday. (RTRS)

ENERGY: Norway will strengthen security at its oil and gas installations in the wake of the gas leaks in the Baltic Sea and the reports of drone activities in the North Sea, the Nordic country's oil and energy minister told news agency NTB on Tuesday. (RTRS)

CHINA

PBOC: The People’s Bank of China is likely to maintain liquidity injections via reverse repo operations to keep month-end liquidity reasonably ample and stabilise money market interest rates, the China Securities Journal reported citing analysts. (MNI)

ECONOMY: China will increase efforts to support firms, especially SMEs and manufacturers by delaying the payment of some administrative fees and deposits, CCTV News reported citing the State Council executive meeting chaired by Premier Li. (MNI)

ECONOMY/PROPERTY: China's commercial hub Shanghai said it will strengthen efforts to promote delivery of residential houses and ensure the steady and sound development of the property market, according to a local government statement of policy support on Wednesday. The COVID-hit city released 22 economic measures to prop up growth, including offering subsidies to film theatres and gyms. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY198 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY133 billion via 7-day reverse repos and CNY67 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY198 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7853% at 09:57 am local time from the close of 1.6931% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Tuesday, flat from the close of Monday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1107 WEDS VS 7.0722 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a ninth trading day at 7.1107 on Wednesday, compared with 7.0722 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA AUG RETAIL SALES +0.6% M/M; MEDIAN +0.4%; JUL +1.3%

SOUTH KOREA AUG RETAIL SALES +15.4% Y/Y; JUL +9.7%

SOUTH KOREA AUG DEPARTMENT STORE SALES +24.8% Y/Y; JUL +31.6%

SOUTH KOREA AUG DISCOUNT STORE SALES +9.9% Y/Y; JUL +0.2%

UK SEP BRC SHOP PRICE INDEX +5.7% Y/Y; AUG +5.1%

MARKETS

SNAPSHOT: BBDXY All-Time High As White House Plays Down Prospect Of New Plaza Accord

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 559.05 points at 26012.82

- ASX 200 down 51.962 points at 6444.2

- Shanghai Comp. down 42.322 points at 3051.54

- JGB 10-Yr future up 6 ticks at 147.86, yield up 0.3bp at 0.256%

- Aussie 10-Yr future down 7.5 ticks at 95.860, yield up 7.5bp at 4.099%

- U.S. 10-Yr future -0-02+ at 110-26, yield up 3.09bp at 3.976%

- WTI crude down $1.03 at $77.47, Gold down $5.12 at $1623.77

- USD/JPY down 12 pips at Y144.68

- WHITE HOUSE’S DEESE DOESN’T EXPECT ANOTHER PLAZA ACCORD COMING (BBG)

- WHITE HOUSE MULLING POTENTIAL YELLEN DEPARTURE AFTER MIDTERMS (AXIOS)

- DALY SAYS THE FED DOES NOT WANT TO TIP U.S. ECONOMY INTO DOWNTURN (RTRS)

- IMF SAYS UK FISCAL MEASURES WILL 'LIKELY INCREASE INEQUALITY,' URGES RETHINK (RTRS)

- MOODY'S WARNS UK UNFUNDED TAX CUTS ARE 'CREDIT NEGATIVE' (RTRS)

- YELLEN SAYS MARKETS FUNCTIONING WELL, CONDITIONS NOT DISORDERLY (BBG)

US TSYS: 10s Probe 4%

Cash Tsys sit 1.0-3.5bp cheaper into London hours, with 7s leading the weakness. TYZ2 sits 0-06+ off the base of its 0-15+ range, with volume nearing 130K.

- 10-Year yields briefly showed above 4.00% for the first time since ’10 overnight, before pulling back as bears failed to force a sustained and meaningful move through the round number.

- We have flagged the 4.00% mark and double top zone drawn off the ‘09/’10 highs (just above the round number) as a key technical area in recent days.

- San Francisco Fed President Daly reiterated the central Fed message re: its resolute approach to taming inflation.

- Elsewhere, White House economic advisor Deese played down the idea of a Plaza-type accord in the FX markets, allowing the broad USD to firm. Meanwhile, Axios suggested that Tsy Secretary Yellen may depart the Biden admin after the mid-terms. These matters may have factored into the cheapening in Tsys.

- We saw a block seller of TY futures (-~3K) which helped the cheapening. There were also block sales of FVX2 106.50 puts (-2.5K) & FVX2 106.75 puts (-2.5K), with the former seemingly partial profit taking and the latter perhaps part of a spread against the remainder of the existing exposure.

- Gilt market moves will continue to be eyed (in light of yesterday’s IMF and ratings agency rhetoric re: UK fiscal matters), with second tier data, 7-Year Tsy supply and Fedspeak from Powell, Bowman, Bullard, Bostic, Evans & Barkin due in NY hours.

JGBS: The Steepening Extends

Curve steepening has extended through the Tokyo day, with 20+-Year JGB yields running 3.0-8.0bp higher, aided by the previously outlined show higher in U.S. Tsy yields and the BoJ’s choice to refrain from deploying another round of off-schedule Rinban purchases.

- Paper out to 10s is little changed, anchored by the BoJ’s YCC mechanism, which promotes a steeper curve in a bearish bond environment.

- JGB futures are a touch lower vs. levels seen at the end of the overnight session, last +4 vs. yesterday’s settlement, hugging a tight range. Participants are seemingly unwilling to test the BoJ’s resolve via a retest of June’s bearish extremes in the contract given the (ultimately successful) BoJ defences deployed at that time.

- 2-Year JGB supply and the weekly international security flow data headline tomorrow’s domestic docket.

AUSSIE BONDS: Steepening Theme Spills Into ACGBS

Wider moves in core global FI markets were at the fore when it came to ACGBs, leaving YM and XM off worst levels after a foray below their respective overnight troughs, -1.5 & -7.5, respectively. The wider ACGB curve has twist steepened, with benchmarks running 1.5bp richer to 8.5bp cheaper, pulling the 3-/10-Year curve further away from cycle flats.

- The 3-/10-Year EFP box has twist steepened, putting an end to the recent consistent flattening pressure.

- Bills sit +5 to -2 through the reds, also twist steepening. RBA dated OIS prices in 43bp of tightening for next week’s decision, little changed on the day, while terminal rate pricing is 5-10bp softer, sitting just below 4.30%.

- There was no tangible reaction to the slightly firmer than expected domestic retail sales data for August (+0.6% M/M vs. BBG Median +0.4%).

- Elsewhere, the final Australian underlying deficit for FY21/22 came in at -A$32.0bn, roughly in line with the positive adjustments flagged by the Treasurer in recent weeks, with fiscal headwinds touted once again.

- Job vacancies data headlines the domestic docket on Thursday.

EQUITIES: Apple Demand Concerns Hits Regional Tech Sentiment

Asia Pac equities are down across the board, particularly in the tech related space. Only Indonesia's JCI has managed to hold gains today within the region. Sentiment was hurt early on a BBG headline, noting that that Apple has “ditched” an iPhone production increase on the back of faltering demand.

- This sent US futures lower across the 3 major contracts. At one stage Nasdaq futures were off by 1.3%. We are away from worst levels but still in the red. The next level of technical support for the S&P 500 contract comes in at the round number of 3,600.

- The spill over to tech plays in Asia has been evident. The Nikkei 225 is off around 2%, while HSI is down over 2.3%, dragged by a 2.76% fall in the etch sub index.

- The Kospi has fared slightly worse, down by close to 3%, the TWSE around 2.15%.

- Mainland China bourses are down, but have outperformed on a relative basis. The Shanghai Composite is off by 0.75%. A China Developer, CIFI Holdings, was down sharply though on fresh debt concerns. The company is the China's 13th largest building.

- Australian stocks are down by 0.7%, with energy related names helping drive outperformance.

OIL: Falters On Cross Asset Headwinds

Brent crude dipped as far as $84.50/bbl in early trade, but we have stabilized somewhat, now back above $85/bbl. We are still off by 1.3% for the session so far. WTI is around $77.50/bbl, down by the same amount since the open. Fresh risk aversion in the equity space, along with cyclical highs in USD FX indices, has weighed.

- We haven't unwound all of oils gains from Tuesday's session. Support came from reports that Russia will propose a 1mln barrel output cut at the next OPEC+ meeting according to Reuters. There was also spill over from higher EU gas prices, which came after leaks were reported at Nordstream pipelines.

- In the US, API reported a +4mln barrel increase in crude inventories, although gasoline stocks fell by just over 1mln. Note we get the EIA weekly report this evening. Around 11% of US Crude production (190k barrels) is off line as Hurricane Ian bares down on the Gulf of Mexico region.

- Finally, some China oil refiners sounded more optimistic on the Q4 outlook for the China economy at the final day of the Asia Pacific Petroleum Conference in Singapore (see this Bloomberg link for more details).

GOLD: Risk Aversion Providing Some Support

Gold is lower for the session, but only by a modest -0.20%. We currently sit around $1625.50, which is still above recent cyclical lows closer to $1621 (from earlier in the week). This comes despite fresh highs in USD FX indices, with the dollar's relentless rise underpinned by the White House pushing back on the need for any fresh Plaza-type FX accord agreement.

- Support for gold appears to have come from the risk aversion channel. Equity markets are off strongly in Asia Pac, particularly in the tech space, while US futures are down as well, albeit away from worst levels.

- Consistent with this theme, the precious metal is also outperforming other commodities so far today (copper, oil and iron ore).

- US yields are also higher, but the 10yr couldn't an earlier break through 4.00%. The real US 10yr yield climbed further overnight to 1.64%. This may cap any upswings in gold, with overnight highs above $1640 a potential resistance point.

FOREX: Risk-Off Takes Hold, Comments From White House's Deese Support Greenback

Risk sentiment was suppressed by Tuesday's round of hawkish Fedspeak and a report noting that Apple is abandoning plans to boost iPhone production, which weighed on the equity space. White House National Economic Council chief Deese played down potential for a new Plaza-like accord, which lent further support to the greenback.

- Gauges of U.S. dollar strength were trending higher. The BBDXY index surged to a new record high of 1,359 and the DXY index topped out at a fresh cyclical high of 114.69. Firmer U.S. Tsy yields facilitated demand for the greenback.

- White House's Deese told attendees of an event hosted by the Economic Club of Washington, DC that a currency pact to counter USD strength was unlikely. His comments seemingly underpinned renewed USD strength, even as there wasn't much prior hope/discussion of such a deal.

- Bloomberg trader sources flagged that leveraged funds were dumping the sterling in response to Deese's remarks. Cable sold off sharply, shedding ~75 pips to erase the entirety of yesterday's gains.

- The yen was the only G10 currency to trade roughly on par with the greenback, benefitting from its safe-haven status and the perception of heightened intervention risk. The Swiss franc was also resilient amid demand for safety.

- The kiwi dollar led high-beta FX bloc lower, with NZD/USD hitting its worst levels since Mar 2020 and AUD/NZD touching its highest point in nine years. A spillover from offshore yuan weakening past CNH7.2 versus the dollar may have added pressure to the Antipodeans.

- On the data front, U.S. pending home sales & flash wholesale inventories take focus from here. The central bank calendar remains busy, a long list of speeches includes comments from ECB Pres Lagarde & Fed Chair Powell.

FX OPTIONS: Expiries for Sep28 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9850-60(E743mln)

- USD/JPY: Y141.80-00($769mln), Y145.00($514mln)

- NZD/USD: $0.5980(N$784mln)

- USD/CNY: Cny7.1000($1.1bln), Cny7.1500($700mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.