-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: UK Fiscal Matters Still Resonate As Tory Support Crumbles In Polls

EXECUTIVE SUMMARY

- FED MUST TRY TO AVOID A ‘HARSH RECESSION,’ DALY SAYS (MARKETWATCH)

- BOE’S PILL FLAGS UK-SPECIFIC COMPONENT OF MARKET TURMOIL (SKY)

- LIZ TRUSS TO HOLD EMERGENCY TALKS WITH OBR AFTER FAILING TO CALM MARKETS (GUARDIAN)

- LABOUR SURGE TO HIGHEST-EVER LEAD OVER TORIES IN FOUR RECORD-BREAKING POLLS (MIRROR)

- LANE SAYS ECB WILL TAKE ‘SEVERAL’ MEETINGS TO NORMALIZE POLICY (BBG)

- PMIS REITERATE HEADWINDS FOR CHINESE ECONOMY

- CHINA LOOSENED FX RESTRICTIONS IN RESPONSE TO FED RATE RISE (FT)

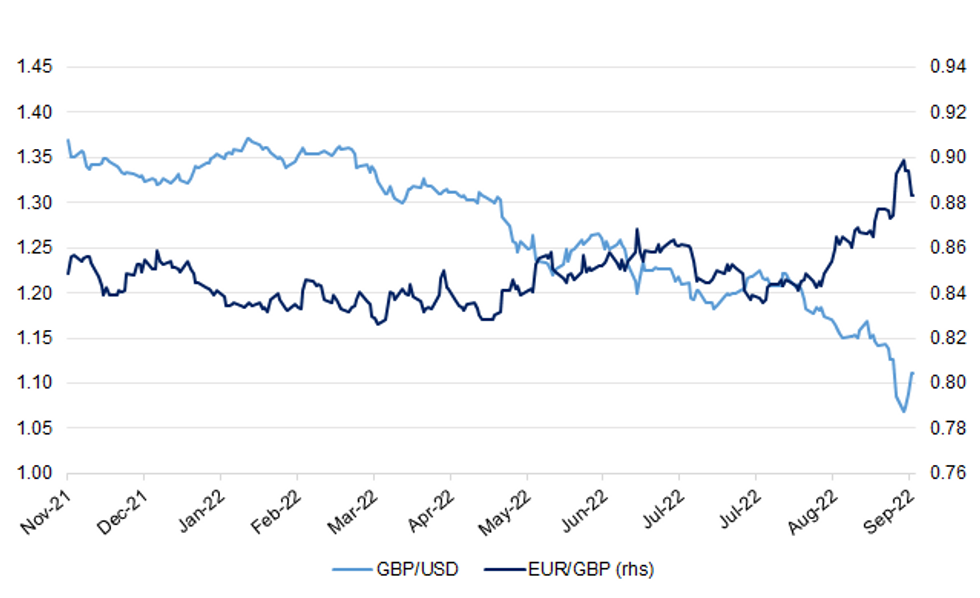

Fig. 1: GBP/USD vs. EUR/GBP

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England's chief economist has contradicted the government by saying there is "undoubtedly a UK-specific component" to the market reaction of the past six days. (Sky)

FISCAL: Liz Truss will hold emergency talks with the head of Britain’s independent fiscal watchdog after failing to dampen panic in the financial markets or shore up support from Tory MPs on her radical economic plan. (Guardian)

FISCAL: A committee of lawmakers in Britain's parliament urged finance minister Kwasi Kwarteng to bring forward his planned Nov. 23 budget statement which will include new forecasts by the country's fiscal watchdog. (RTRS)

FISCAL: Benefits payments are set to fall in real terms under government plans to reassure the City that it will control spending. (Telegraph)

FISCAL/POLITICS: Tory MPs are threatening to block the abolition of the 45p tax rate as Liz Truss faces a rebellion over the mini-Budget. (Telegraph)

POLITICS: Labour have notched up record-breaking leads over the Tories in four separate bombshell polls, all out tonight. Four major polling companies all simultaneously said it was the highest lead they had ever recorded for Keir Starmer's party after turmoil on the markets. A YouGov survey for the Times put the party on a blistering 33-point lead - demolishing Labour's previous 21-year record of 17 points, which was set a few days ago. Survation gave Labour a 21-point lead while Redfield & Wilton Strategies recorded a 17-point lead. And a Deltapoll survey for the Mirror tonight gives Labour a 19-point lead over the Tories. (The Mirror)

ECONOMY: British job vacancies dropped to the lowest level since the COVID-19 pandemic last week, a sign of a further weakening in the labour market that has been cooling since July, according to data from the Recruitment & Employment Confederation (REC). (RTRS)

PROPERTY: The Financial Conduct Authority has contacted UK lenders following the withdrawal of more than 1,600 mortgage products over concerns that millions of borrowers face a sharp rise in interest payments when their existing deals expire. (FT)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane said policymakers will be raising interest rates for “several” more meetings as they normalize euro-zone monetary policy. (BBG)

RATINGS: Potential sovereign rating reviews scheduled for after-hours on Friday include:

- S&P on Poland (current rating: A-; Outlook Stable) & Turkey (current rating: B+; Outlook Negative)

- Moody’s on Italy (current rating: Baa3; Outlook Negative)

- DBRS Morningstar on France (current rating: AA (high), Stable Trend)

BANKS/ENERGY: Loosening capital rules for banks would do little to ease a cash crunch among energy companies due to high gas prices, and risked making lenders less resilient to shocks, the European Union's banking watchdog said on Thursday. (RTRS)

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said Thursday she does not see distress in U.S. financial markets that would alter the central bank's campaign to lower very high levels of inflation through interest rate hikes. (RTRS)

FED: The Federal Reserve does not need to induce a deep recession in order to bring down high inflation, San Francisco Fed President Mary Daly said Thursday. “Inducing a deep recession does not seem warranted by conditions, nor is it necessary to achieve our goals,” Daly said in a speech at Boise State University. (MarketWatch)

FISCAL: A bill to fund U.S. government activities through Dec. 16 gained enough votes in the Senate to pass with voting continuing on Thursday, as Congress faced a midnight Friday deadline with the start of a new fiscal year. (RTRS)

OTHER

GEOPOLITICS: The U.S. on Thursday imposed sanctions on firms in China and other nations that it accuses of helping Iran evade bans on its oil and petrochemical exports, while threatening to further squeeze Tehran’s energy sales if it continues to breach the terms of a 2015 multilateral nuclear agreement. (WSJ)

RBA: Australia's central bank will hike interest rates by another half-point on Tuesday and increase borrowing costs further than previously thought in its most aggressive tightening cycle since the 1990s to arrest red hot inflation, a Reuters poll showed. (RTRS)

AUSTRALIA: The mandatory Covid isolation requirement will be scrapped following the latest meeting of national cabinet, with exemptions for those working in high risk settings such as health or aged care. (Guardian)

RBNZ: New Zealand’s central bank will deliver its fifth half-point interest rate hike on Wednesday and do the same in November in an attempt to stem the tide of rising inflation, a Reuters poll of economists predicted. (RTRS)

SOUTH KOREA: South Korean President Yoon Suk-yeol on Friday called for more sense of urgency in dealing with heightened volatility in financial markets and promised to take contingency measures in a timely manner. (RTRS)

HONG KONG: Hong Kong will give away 500,000 plane tickets to lure visitors back to the financial hub when the government removes all remaining restrictions on inbound arrivals, local media outlet Sing Tao reported in a column, citing people it didn’t identify. (BBG)

MEXICO: The Bank of Mexico hiked its key interest rate on Thursday by 75 basis points to a record 9.25%, in line with forecasts and following in the footsteps of the U.S. Federal Reserve's own recent three-quarter of a percentage point increase. (RTRS)

BRAZIL: Brazil’s Luiz Inacio Lula da Silva appears to be on the cusp of securing the simple majority needed to win Sunday’s presidential vote outright, a new poll from DataFolha shows. (BBG)

BRAZIL: Brazil's central bank chief Roberto Campos Neto said on Thursday that policymakers' calculations show the inflation target will be met taking into consideration projections of monetary easing beginning in June, a date projected by market participants in the Focus weekly survey. (RTRS)

BRAZIL: Brazil's central government should end this year with a primary budget surplus between 30 billion and 40 billion reais ($5.55 billion-$7.40 billion), Treasury Secretary Paulo Valle said on Thursday. (RTRS)

RUSSIA: President Vladimir Putin said on Thursday that "all mistakes" made in a call-up to reinforce Russia's military operation in Ukraine should be corrected, his first public acknowledgment that the "partial mobilisation" he announced last week had not gone smoothly. (RTRS)

RUSSIA: If Russia moves ahead with its plans to annex four Ukrainian regions, it would mark a "dangerous escalation" that would jeopardize the prospects for peace in the region, the United Nations Secretary-General warned on Thursday. (RTRS)

RUSSIA: Russia's central bank said on Thursday it had extended restrictions on transfers of money abroad until March 31. (RTRS)

IRAN: The United States on Thursday planned to announce sanctions targeting Iran's oil exports, a U.S. official said. (RTRS)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 100 basis points to 10% on Thursday, as inflation pressures and robust domestic consumption endure and central banks around the world boost rates. (RTRS)

ENERGY: Russian President Vladimir Putin on Thursday said the "unprecedented sabotage" against the Nord Stream gas pipelines was "an act of international terrorism," the Kremlin said in a statement. (RTRS)

OIL: Record exports of Norway’s Johan Sverdrup crude oil are set to help meet European refineries’ needs as a deadline to phase out Russian supplies draws closer. (BBG)

ENERGY: European Union countries are split over whether to cap gas prices, which they will discuss at a meeting of the bloc's energy ministers on Friday, a senior EU diplomat said. (RTRS)

CHINA

YUAN: The renminbi’s sharp fall over the past week started after regulators told traders they were relaxing informal foreign exchange trading limits, according to people familiar with the matter. (FT)

CAPITAL FLOWS: China’s current account will maintain a reasonably sized surplus and the resilience of the balance of payments will support the stability of the yuan and the foreign exchange market, the Securities Daily reported citing Wang Chunying, deputy director of the State Administration of Foreign Exchange. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY184 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY128 billion via 7-day reverse repos and CNY58 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY184 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0395% at 09:27 am local time from the close of 2.1321% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday vs 47 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.0998 FRI VS 7.1102 THU

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0998 on Friday, compared with 7.1102 set on Thursday.

OVERNIGHT DATA

CHINA SEP OFFICIAL MANUFACTURING PMI 50.1; MEDIAN 49.7; AUG 49.4

CHINA SEP OFFICIAL NON-MANUFACTURING PMI 50.6; MEDIAN 52.4; AUG 52.6

CHINA SEP OFFICIAL COMPOSITE PMI 50.9; AUG 51.7

CHINA SEP CAIXIN MANUFACTURING PMI 48.1; MEDIAN 49.5; AUG 49.5

At present, major problems in the economy are insufficient employment, sluggish demand, and unstable expectations. In view of this, policy implementation should focus on promoting employment, granting subsidies, boosting demand, and fostering market confidence by sending policy signals. (Caixin)

JAPAN AUG UNEMPLOYMENT RATE 2.5%; MEDIAN 2.5%; JUL 2.6%

JAPAN AUG JOB-TO-APPLICANT RATIO 1.32; MEDIAN 1.30; JUL 1.29

JAPAN AUG, P INDUSTRIAL PRODUCTION +2.7% M/M; MEDIAN +0.2%; JUL +0.8%

JAPAN AUG, P INDUSTRIAL PRODUCTION +5.1% Y/Y; MEDIAN +1.8%; JUL -2.0%

JAPAN AUG RETAIL SALES +1.4% M/M; MEDIAN +0.2%; JUL +0.7%

JAPAN AUG RETAIL SALES +4.1% M/M; MEDIAN +2.8%; JUL +2.4%

JAPAN AUG DEPARTMENT STORE & SUPERMARKET SALES +3.8% M/M; MEDIAN +4.8%; JUL +2.8%

AUSTRALIA AUG PRIVATE SECTOR CREDIT +0.8% M/M; MEDIAN +0.6%; JUL +0.8%

AUSTRALIA AUG PRIVATE SECTOR CREDIT +9.3% Y/Y; MEDIAN +9.0%; JUL +9.1%

NEW ZEALAND SEP ANZ CONSUMER CONFIDENCE 85.4; AUG 85.4

The ANZ-Roy Morgan Consumer Confidence Index was unchanged in September at subdued levels. Living costs are rising, house prices are falling, and mortgage rates are going up. However, the big win for households is the still super-tight labour market, which is contributing to strong job security and solid wage growth. (ANZ)

NEW ZEALAND AUG BUILDING PERMITS -1.6% M/M; JUL +4.9%

SOUTH KOREA AUG INDUSTRIAL PRODUCTION -1.8% M/M; MEDIAN -0.8%; JUL -1.3%

SOUTH KOREA AUG INDUSTRIAL PRODUCTION +1.0% Y/Y; MEDIAN +1.0%; JUL +1.5%

SOUTH KOREA AUG CYCLICAL LEADING INDEX CHANGE -0.2 M/M; JUL -0.2

UK SEP LLOYDS BUSINESS BAROMETER 16; AUG 16

MARKETS

SNAPSHOT: UK Fiscal Matters Still Resonate As Tory Support Crumbles In Polls

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 520.53 points at 25901.52

- ASX 200 down 69.468 points at 6485.5

- Shanghai Comp. down 8.099 points at 3033.08

- JGB 10-Yr future up 17 ticks at 148.27, yield down 0.4bp at 0.251%

- Aussie 10-Yr future unch. at 96.030, yield up 0.6bp at 3.941%

- U.S. 10-Yr future -0-06+ at 112-08, yield down 1.14bp at 3.7742%

- WTI crude down $0.27 at $80.93, Gold up $4.28 at $1664.94

- USD/JPY up 8 pips at Y144.52

- FED MUST TRY TO AVOID A ‘HARSH RECESSION,’ DALY SAYS (MARKETWATCH)

- BOE’S PILL FLAGS UK-SPEIFIC COMPONENT OF MARKET TURMOIL (SKY)

- LIZ TRUSS TO HOLD EMERGENCY TALKS WITH OBR AFTER FAILING TO CALM MARKETS (GUARDIAN)

- LABOUR SURGE TO HIGHEST-EVER LEAD OVER TORIES IN FOUR RECORD-BREAKING POLLS (MIRROR)

- LANE SAYS ECB WILL TAKE ‘SEVERAL’ MEETINGS TO NORMALIZE POLICY (BBG)

- PMIS REITERATE HEADWINDS FOR CHINESE ECONOMY

- CHINA LOOSENED FX RESTRICTIONS IN RESPONSE TO FED RATE RISE (FT)

US TSYS: Modest Twist Flattening In Asia

Cash Tsys have seen some light twist flattening in Asia-Pac hours, with a lack of meaningful headline flow to trade off, leaving the major benchmarks running 1.5bp cheaper to 0.5bp richer across the curve, pivoting around 20s.

- TYZ2 trades within the confines of a narrow 0-06 range established early in Asia-Pac dealing, operating around the midpoint of Thursday’s range.

- Fedspeak from Daly (’24 voter) didn’t move the needle, as she flagged her support for the higher for longer mantra adopted at the Fed, alongside its resoluteness in the fight against inflation.

- Elsewhere, mixed Chinese PMI data failed to impact wider markets.

- Gilt trade will once again be eyed as a probable tone-setter during the London morning, as fiscal (and related BoE) matters in the UK continue to dominate.

- NY hours will see PCE readings, the latest MNI Chicago PMI print and the final UoM survey for Sep. Fedspeak will consist of addresses from Brainard, Bowman, Williams & Barkin.

JGBS: Early Flattening Gives Way As Super-Long End Struggles In Wake Of Rinban Details

The early bull flattening on the JGB curve unwound during the Tokyo afternoon, after an early bid in the long end faded in the wake of the publishing of the details of the latest round of BoJ Rinban operations (the offer/cover ratios in the operations covering 10+-Year JGBs weren’t standout, but some desks flagged the operations as potential catalyst nonetheless). Cash JGBs run 1bp richer to 1bp cheaper across the curve, with 7s outperforming on a bid in futures and the 20- to 30-Year zone providing the weak point.

- The early bid was seemingly aided by speculation surrounding the potential upsizing of BoJ bond buying guidance in the quarterly Rinban plan, which will be released after hours today (some expect larger buys in the 10- to 25-Year zone).

- 10-Year JGB yields hover just below the upper limit of the BoJ’s permitted trading band.

- Participants looked through a familiar upsized round of 5- to 25-Year BoJ Rinban ops on Friday.

- Futures held a relatively tight range after showing above their overnight high during the Tokyo morning, before fading to last deal +12.

- The aforementioned Rinban plan will likely set the tone for JGB trade early next week, with the summary of opinions from the BoJ’s latest monetary policy meeting and the quarterly Tankan survey headlining Monday’s docket.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.56007tn 3-Month Bills:

- Average Yield: -0.2327% (prev. -0.1913%)

- Average Price: 100.0638 (prev. 100.0535)

- High Yield: -0.2061% (prev. -0.1716%)

- Low Price: 100.0565 (prev. 100.0480)

- % Allotted At High Yield: 98.8823% (prev. 65.1557%)

- Bid/Cover: 3.173x (prev. 2.803x)

AUSSIE BONDS: Tight Ranges In Play Ahead Of Long Weekend & RBA, Curve Steeper

The ACGB space has held onto the twist steepening impetus derived from overnight futures trade, with generally limited activity observed ahead of the long Sydney weekend.

- That leaves YM +1.5 & XM -1.5, with wider cash ACGBs running 2bp richer to 2bp cheaper, pivoting around 7s.

- Bills run -1 to +2 through the reds.

- The 3-/10-Year EFP box has bear steepened, with 3-Year EFP narrower and 10-Year EFP little changed.

- Participants were seemingly unwilling to deploy fresh risk ahead of Monday’s lower liquidity session (which includes the closure of cash ACGBs owing to a NSW & ACT holiday) and Tuesday’s RBA decision (with ~44bp of tightening priced into OIS and 13/17 surveyed by BBG looking for a 50bp hike).

- A lack of meaningful headline flow also limited participation.

- Participants looked through mixed Chinese PMI data, as well as the latest round of domestic private sector credit readings.

- The latest round of ACGB Nov-28 passed smoothly,, while the AOFM weekly issuance slate was fairly vanilla on the ACGB front, albeit with a bit of an upsizing in Note issuance.

AUSSIE BONDS: ACGB Nov-28 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 2.75% 21 November 2028 Bond, issue #TB152:

- Average Yield: 3.7893% (prev. 1.9903%)

- High Yield: 3.7925% (prev. 1.9925%)

- Bid/Cover: 2.7429x (prev. 3.1100x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 44.3% (prev. 40.3%)

- Bidders 41 (prev. 41), successful 15 (prev. 19), allocated in full 9 (prev. 12)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 5 October it plans to sell A$800mn of the 1.25% 21 May 2032 Bond.

- On Thursday 6 October it plans to sell A$500mn of the 16 December 2022 Note, A$1.5bn of the 10 February 2023 Note & A$1.0bn of the 10 March 2023 Note.

- On Friday 7 October it plans to sell A$700mn of the 0.25% 21 November 2025 Bond.

NZGBS: NZGB Steepening Extends Through The Session

The bear steepening pressure derived from Thursday’s Tsy cheapening extended through the NZ session, with the major NZGB benchmarks running 8-15bp cheaper across the curve at the close.

- Local data had no real impact on the space.

- RBNZ OIS continues to more than fully price a 50bp hike at next week’s decision (albeit with a slight pullback to 51bp of tightening from the 54bp seen early on), with terminal rate pricing continuing to hover around the 4.80% mark.

- Westpac became the latest sell-side to up their terminal rate call, and now expect the OCR to peak at 4.50% in the current cycle, with the RBNZ set to hit that level in February, in their view.

- A quick reminder that all of those surveyed by BBG & RTRS look for the RBNZ to deploy a 50bp hike next week, so the tone of the statement that accompanies the decision will be key (assuming the fully priced and expected 50bp hike is delivered).

EQUITIES: Few Positives Outside Of China Housing Related Stocks

Regional equities are ending the week on a softer note, in line with US losses overnight and with futures struggling to stay in positive territory today (last around -0.25-0.30% for Eminis). Losses haven't been as large as earlier this week, in aggregate terms.

- The Nikkei 225 is off 1.9% at this stage, while Taiwan stocks are down by around 1%. Larger tech losses in the US have weighed, with concern around the demand outlook, given recent company announcements (Apple, Micron etc).

- The Kospi is away from worse levels, last (-0.35%). Earlier, President Yoon called for greater vigilance around market volatility and stated stabilization moves could be implemented.

- China main indices are down slightly, the Shanghai composite -0.20%. The property sub-index has rebounded +2% on reports that around 20 cities will be able to cut interest rate on loans for primary residences. Note China markets are closed for all next week due to Golden Week celebrations.

- HSI is around flat, the tech index is right around lows from March of this year.

- The ASX 200 is off by 1.4%. Note that it is a long weekend for this market, with Sydney having a public holiday on Monday.

OIL: Brent Set To Post Largest Quarterly Drop Since Q1 2020, OPEC+ Meeting Next Week

Brent crude is down slightly from NY closing levels. Last around $88.30, after we couldn't hold above $89/bbl through the NY session. Whilst key USD FX indices were lower, slumping equities and rebounding yields dented risk appetite. Brent is still set for a weekly gain (currently +2.6%), the first for September. However, we are comfortably down for the month and quarter (-23%). WTI is holding above $81/bbl, running out of steam above $82/bbl overnight.

- Amidst the largest quarterly drop in Brent since Q1 2020, next week's OPEC+ meeting (October 5), will be in focus around the supply outlook into year end.

- A Bloomberg survey of 19 traders/analysts indicated all but one expected a drop in production. The likes of UBS and J.P. Morgan expect a cut of at least 500k barrels per day, while RBC looks for a drop potentially as big as 1 million barrels.

- On the demand side, US data continues to defy tighter financial conditions.

- While today's China PMI updates were disappointing, in aggregate, and continue to cast a shadow over the growth outlook. Activity in the services/SME sector eased noticeably.

- Still, with the Chengdu lockdown behind, momentum may improve in September. Driving activity in the city has picked up through tail end of this month (see this link for more details).

GOLD: Set For Weekly Gain Despite Higher US Real Yields

Gold is mostly following broader USD direction. We currently sit close to $1664, not far from recent highs. A break above $1665 could pave the way for a move towards $1680, highs from last week. On the downside, yesterday's lows just under $1642 should offer some support, beyond that is Wednesday's lows around $1615.

- If the precious metal holds around current levels, it would put weekly gains at +1.2%, the best performance since mid August.

- Gold is looking a little elevated relative to US real yields, with the 10yr rebounding overnight to 157bps, versus 139bps on Wednesday.

- This may be a constraint in terms of how far the current rebound can extend, but it isn’t driving sentiment today.

FOREX: Sterling Volatile Amid Fiscal Plan Turmoil, Greenback Outperforms

Sterling was volatile on the final trading day of the week in Asia, with eyes still on the turmoil caused by the UK government's tax-cut plans. PM Truss refused to walk back on her fiscal proposals, but the press reported that she would hold emergency talks with the fiscal watchdog today, while some speculated that growing backlash among Tory backbenchers and a drop in support for the Conservatives might force the government to change tack.

- These musings put a bid into GBP crosses in early Asia trade, prompting cable to briefly erase its post-mini budget losses. Sterling strength proved short-lived and the pound retreated in the absence of fresh headlines. GBP/USD trades ~20 pips below neutral levels, with EUR/GBP barely changed as we type.

- The greenback regained composure after an initial spell of weakness and took the lead in G10 FX space, with month-/quarter-end flows seen playing a supportive role. Slightly higher U.S. Tsy yields facilitated the move higher in USD.

- USD/JPY climbed over the final Tokyo fix of the month. Worth noting that it was a Gotobi day in Japan. The spreads on U.S./Japan yields were slightly wider, with the BoJ boosting bond purchases at its regular operation.

- Official PMI reading suggested that China's manufacturing sector returned to expansion last month, but the Caixin index tracking smaller, export-oriented enterprises unexpectedly deteriorated. Spot USD.CNH crept higher as the data crossed the wires, before trimming gains.

- Final UK GDP, flash EZ CPI, German unemployment, as well as U.S. PCE readings, MNI Chicago PMI & final Uni. of Mich. Sentiment will take focus after Asia hours.

- The central bank speaker slate features Fed's Barkin, Brainard, Bowman & Williams, ECB's Elderson, Visco & Schnabel and Riksbank's Ingves & Jansson.

FX OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9600(E758mln), $0.9700(E1.1bln), $0.9800(E1.1bln), $0.9850(E644mln), $0.9900(E1.4bln)

- USD/JPY: Y140.00($1.8bln), Y143.00($509mln), Y144.00($645mln), Y144.95-00($1.1bln)

- EUR/GBP: Gbp0.8800(E530mln)

- USD/CAD: C$1.3500($515mln)

- USD/CNY: Cny7.0000($3.0bln), Cny7.0500($851mln), Cny7.1000($1.1bln), Cny7.1500($1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.