-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: UK Collects Another Negative Rating Outlook In Wake Of Mini-Budget

EXECUTIVE SUMMARY

- FED'S BOSTIC PUSHES BACK ON MARKET HOPES OF 2023 CUTS (MNI)

- FITCH ADJUST UK SOVEREIGN RATING OUTLOOK TO NEGATIVE

- NORTH KOREA TEST-FIRES MISSILE AFTER CRITICIZING US CARRIER MOVE (BBG)

- WHITE HOUSE: IT'S CLEAR THAT OPEC+ IS ALIGNING WITH RUSSIA (RTRS)

- VON DER LEYEN PROPOSES GAS PRICE CAP AS EU ENERGY FEARS RISE (BBG)

- WORLD CURRENCY RESERVES SHRINK BY $1 TRILLION IN RECORD DRAWDOWN (BBG)

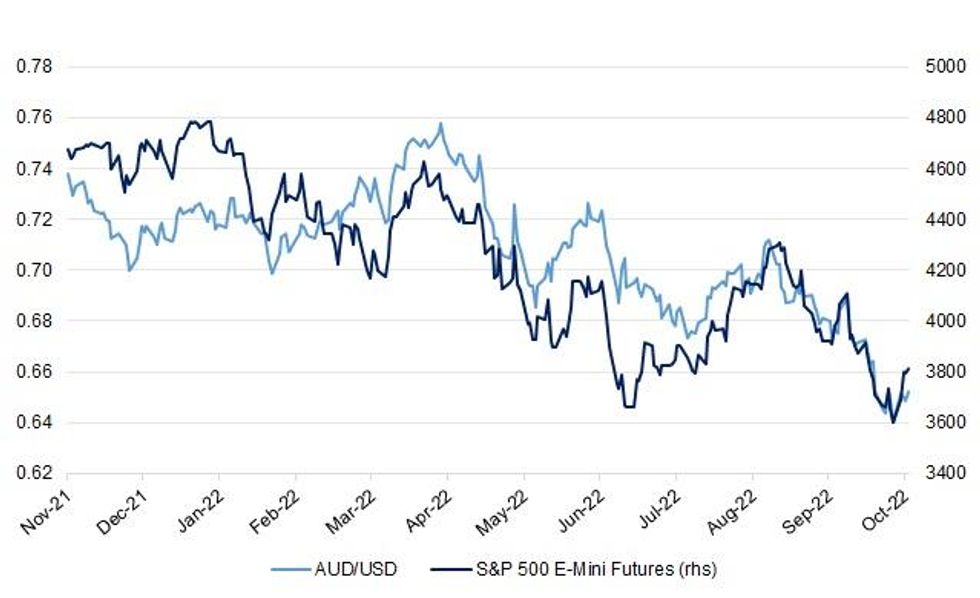

Fig. 1: AUD/USD V. S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England's buying of long-dated UK gilts looks set to end as scheduled on Oct 14 as debt markets return to relative calm with yields higher than in the days leading up to the bout of undefined “dysfunction” which prompted the announcement of emergency purchases on Sept 28, but no sign that such extreme conditions persist. (MNI)

FISCAL: The average household will be £1,450 a year worse off after Liz Truss’s “tax-cutting” mini-budget as a result of an additional £21 billion of stealth income taxes, according to a detailed analysis. (The Times)

FISCAL/POLITICS: Conservative rebels are increasingly confident of forcing a Government climbdown on benefits even as Liz Truss seeks to impose discipline on her warring party after a chaotic conference. (The i)

POLITICS: The Conservative Party faces a landslide defeat at the next election unless Liz Truss changes course, a former cabinet minister and close ally of Boris Johnson has warned. (The Times)

POLITICS: The Tories face being wiped out in Scotland as voters desert them in the wake of Liz Truss's mini-Budget, according to two opinion polls that reduced them to "minnow" status. (Telegraph)

BREXIT: The "mood music" has changed in discussions over the Northern Ireland Protocol, the Irish foreign minister has said. Simon Coveney made the comments ahead of a meeting with Foreign Secretary James Cleverly on Thursday. On Wednesday, government minister Conor Burns said he was "pretty bullish" about getting a deal with the EU. (BBC)

BREXIT: Britain and the European Union are to restart Brexit negotiations and try to resolve the long-running dispute over the Northern Ireland protocol. (The Times)

ENERGY: Ministers have stepped back from mooted plans to launch a public information campaign to encourage households to reduce their energy use this winter. (Guardian)

RATINGS: Fitch affirmed the United Kingdom at AA-; Outlook changed to Negative

PENSIONS/ASSETS: Goldman Sachs is among a group of investors seeking to buy cut-price private assets from UK pension funds, which are rushing to raise cash after last week’s crisis in the government bond market. (FT)

U.S.

FED: Atlanta Fed President Raphael Bostic said Wednesday the central bank must remain vigilant in its inflation fight, seeing interest rates on a path to 4%-4.5% by year-end and staying there, pushing back on the notion of rate cuts in 2023. (MNI)

ECONOMY: The White House announced Biden would visit IBM’s campus along Route 9 in Poughkeepsie Thursday to “deliver remarks on creating jobs in the Hudson Valley, lowering costs, and ensuring the future is made in America.” (News10)

ECONOMY: U.S. employment may have declined substantially in September, according to a St. Louis Fed analysis of real-time data from employee scheduling software provider Homebase, economist Max Dvorkin told MNI. (MNI)

ECONOMY: Institute for Supply Management services chair Anthony Nieves told MNI OPEC production cuts present a fresh headwind to the sector but he continues to expect moderate growth through the end of the year, while closely watching manufacturing as a lead indicator of a contraction. (MNI)

POLITICS: Pennsylvania isn’t the only Senate race that has gotten better for Republicans in the past couple of weeks, though: Wisconsin and Nevada look better for the GOP as well. As a result, Democrats’ chances of keeping control of the Senate, which was steadily rising since July, has leveled off and even dipped, from a high of 71 in 100 on Sept. 20 to 67 in 100 today. To be sure, Democrats are still favorites to win Pennsylvania’s Senate seat and the Senate overall. But if Republicans are looking for reasons for optimism, they’re starting to become visible. (FiveThirtyEight)

OTHER

GLOBAL TRADE: When the US government blacklisted Huawei Technologies Co. as a national security threat, it cut the Chinese company off from buying American semiconductors and other critical technologies. Now Huawei may have a path around those restrictions. (BBG)

GLOBAL TRADE: Huawei, the Chinese technology group, is planning to relaunch 5G phones by as soon as next year to overcome the stranglehold of US sanctions and win back market share. (FT)

GLOBAL TRADE: Alchip Technologies has fully cooperated with Taiwanese authorities to strictly comply with all regulations, including export controls, it said in a statement Wednesday. Co. has not received order prohibiting exports. (BBG)

GLOBAL TRADE: South Korea’s semiconductor output fell for the first time in more than four years in a sign chipmakers are bracing for a slowdown in global demand. (BBG)

BOJ: Bank of Japan officials are concerned smaller companies may not be able to lift wages as much as major corporates, potentially undermining the delivery of a "virtuous cycle" of rising wages and prices viewed as key to any shift away from its easing policy, MNI understands. (MNI)

NEW ZEALAND: New Zealand can avoid a recession during the central bank’s rapid policy tightening to slow inflation as its economy remains resilient, Deputy Prime Minister Grant Robertson said. (BBG)

NORTH KOREA: North Korea fired two suspected short-range ballistic missiles toward waters off its east coast Thursday, adding to one of its biggest barrage of tests under leader Kim Jong Un that included its first launch of a rocket over Japan in five years. (BBG)

NORTH KOREA: The United States accused China and Russia on Wednesday of enabling North Korean leader Kim Jong Un by protecting Pyongyang from attempts to strengthen U.N. Security Council sanctions imposed over its nuclear weapons and ballistic missile programs. (RTRS)

BRAZIL: Brazil's leftist presidential candidate Luiz Inacio Lula da Silva maintains a clear lead over right-wing President Jair Bolsonaro, a poll showed on Wednesday, as the candidates scrambled to win over voters ahead of an Oct. 30 runoff. (RTRS)

BRAZIL: Centrist Brazilian Senator Simone Tebet, who finished third in the presidential race, on Wednesday said she was supporting leftist Luiz Inacio Lula da Silva against far-right incumbent Jair Bolsonaro when they face off in an Oct. 30 runoff vote. (RTRS)

RUSSIA: Weekly consumer prices in Russia rose for the second week running, data published on Wednesday showed, after nearly three months of weekly deflation and as the central bank appears to have finished its interest rate-cutting cycle at 7.5%. (RTRS)

METALS: Antofagasta's chief executive for Chile, Ivan Arriagada, voiced concern on Wednesday that a more recessionary context could depress copper prices, adding he expects any global downturn to be temporary. (RTRS)

METALS: The London Metal Exchange will restrict new deliveries of copper and zinc from Russia’s Ural Mining & Metallurgical Co. and one of its subsidiaries, after the UK sanctioned co-founder Iskandar Makhmudov. (BBG)

ENERGY: European Commission President Ursula von der Leyen is proposing that the bloc intervene in the gas market to cap the rise in prices that is threatening to push the region into recession. (BBG)

ENERGY: Russia is ready to supply gas via the undamaged branch of the Nord Stream 2 gas pipeline, Russian Deputy Prime Minister Alexander Novak told reporters following the OPEC+ meeting held in Vienna on Wednesday. (Urdu Point)

ENERGY: German Chancellor Olaf Scholz said on Wednesday he did not have the impression France had ruled out building a gas pipeline across the Pyrenees and said he firmly believed Europe needed more energy connections. (RTRS)

OIL: Russian Deputy Prime Minister Alexander Novak said on Wednesday that Russia may cut oil production in order to offset negative effects from price caps imposed by the West over Moscow's actions in Ukraine. (RTRS)

OIL: Saudi Arabia’s top oil official warned that US-led plans for a price cap on Russian exports are fanning the uncertainty that drove OPEC+ to its biggest production cut in two years. (BBG)

OIL: Iraq's oil minister Ihsan Abdul Jabbar said on Wednesday that his country hopes that the OPEC+ decision to cut production by 2 million barrels per day will contribute to world market stability and support crude prices, the state news agency reported. (RTRS)

OIL: Kuwait's acting oil minister Mohammed Al-Fares on Wednesday said the OPEC+ decision to cut production by 2 million barrels per day will have positive ramifications on oil markets, the state news agency reported. (RTRS)

OIL: The decision by OPEC+ to cut production by 2 million barrels per day makes clear that the group is aligning itself with Russia, White House spokeswoman Karine Jean-Pierre said on Wednesday. Pierre called the decision a "mistake" and said it was "misguided." (RTRS)

OIL: President Joe Biden called on his administration and Congress to explore ways to boost U.S. energy production and reduce OPEC's control over energy prices after the cartel's "shortsighted" production cut, the White House said on Wednesday. (RTRS)

OIL: The boss of Europe’s second-largest oil company said a Group of Seven plan to cap the price of Russian oil is a “bad idea,” the most direct criticism of the idea from a senior industry official. (BBG)

OIL: France has tapped its strategic fuel reserves to resupply petrol stations that have run dry, the government said on Wednesday, amid strikes by workers at refineries and depots that have stunted production and blocked deliveries. (RTRS)

OIL: The Biden administration has no plans to change its sanctions policy toward Venezuela without positive actions from President Nicolas Maduro’s government, the National Security Council said after a report that the US would scale down restrictions affecting Chevron Corp. (BBG)

FOREX: Global foreign-currency reserves are falling at the fastest pace on record, as central banks from India to the Czech Republic intervene to support their currencies. (BBG)

FOREX: The unstoppable dollar, which is already having a banner year, is likely to extend its dominance beyond 2022, according to a Reuters poll of foreign exchange strategists who said the currency was still some distance from an inflection point. (RTRS)

EMERGING MARKETS: Central bank intervention via U.S. dollar sales won't strengthen emerging market currencies against an ever-dominant greenback, a Reuters poll found, and many analysts expected authorities to sit this round out or hike rates more aggressively. (RTRS)

CHINA

CORONAVIRUS: China’s Covid-19 tally climbed to the highest in about a month, driven by people traveling during the week-long National Day holiday and sparking a fresh round of lockdowns aimed at controlling the outbreaks ahead of the Party Congress. (BBG)

MARKETS: Societe Generale SA cut its exposure to counterparties on trades in China by about $80 million in the past few weeks as global banks seek to guard against any potential fallout from rising geopolitical risks in the world’s second-largest economy. (BBG)

OVERNIGHT DATA

JAPAN SEP TOKYO AVERAGE OFFICE VACANCIES 6.49; AUG 6.49

AUSTRALIA AUG TRADE BALANCE A$8,324MN; MEDIAN A$10,000MN; JUL A$8,967MN

AUSTRALIA AUG EXPORTS +3% M/M; MEDIAN +2%; JUL -10%

AUSTRALIA AUG IMPORTS +4% M/M; MEDIAN -1%; JUL +5%

NEW ZEALAND SEP ANZ COMMODITY PRICE -0.5% M/M; AUG -3.4%

The ANZ World Commodity Price Index fell 0.5% in September, continuing the downward trend since April. But in local currency terms the index appreciated 3.3% as the NZD depreciated by 2.5% against the Trade Weighted Index. (ANZ)

MARKETS

SNAPSHOT: UK Collects Another Negative Rating Outlook In Wake Of Mini-Budget

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 259.44 points at 27389.19

- ASX 200 up 7.423 points at 6809.50

- Chinese markets are closed.

- JGB 10-Yr future down 14 ticks at 148.84, JGB 10-Yr yield down 0.1bp at 0.251%

- Aussie 10-Yr future down 16 ticks at 96.19, Aussie 10-Yr yield up 16bp at 3.79%

- US 10-Yr future +0-02 at 112-19, 10-Yr yield down 0.77bp at 3.7448%

- WTI crude up $0.15 at $87.9, Gold up $5.77 at $1722.95

- USDJPY down 10 pips at 144.55

- FED'S BOSTIC PUSHES BACK ON MARKET HOPES OF 2023 CUTS (MNI)

- FITCH ADJUST UK SOVEREIGN RATING OUTLOOK TO NEGATIVE

- NORTH KOREA TEST-FIRES MISSILE AFTER CRITICIZING US CARRIER MOVE (BBG)

- WHITE HOUSE: IT'S CLEAR THAT OPEC+ IS ALIGNING WITH RUSSIA (RTRS)

- VON DER LEYEN PROPOSES GAS PRICE CAP AS EU ENERGY FEARS RISE (BBG)

- WORLD CURRENCY RESERVES SHRINK BY $1 TRILLION IN RECORD DRAWDOWN (BBG)

US TSYS: Little Changed In Asia

Cash Tsys run little changed to 1bp richer into London dealing, with marginal flattening of the curve observed. TYZ2 operated within a 0-07 range during Asia hours, last dealing in the middle of that tight band, +0-02 at 112-19, on ~79K lots.

- An early Asia uptick in Tsys was facilitated by a couple of block buys in TY futures (+3.0K & +2.5K), with a weaker dollar alongside a move higher in e-minis seen at the same time.

- We then moved back from best levels of the day in Tsys.

- Outside of the previously outlined block buying in TY futures, we saw some mixed block flow in that contract (-1.6K & +1.6K), while downside expressions in FVZ2 via 107.25 puts (2x +1,875) were also executed via blocks.

- Asia headline flow was light at best, with nothing in the way of notable movement stemming from the latest North Korean missile test.

- The mix of a Chinese hioliday, lack of meaningful headline flow and proximity to Friday’s NFP release left most on the sidelines.

- Looking ahead, weekly jobless claims data, the latest challenger job cuts reading and a deluge of Fedspeak (headlined by Governors Waller & Cook) provide the highlights of Thursday’s NY docket.

JGBS: Curve Runs Steeper

The combination of Wednesday’s weakness in core global FI markets and the BoJ’s relative lack of control over yields beyond the 10-Year point allowed the JGB curve to steepen on Thursday, with the major benchmarks running 1bp richer to 3bp cheaper, pivoting around 3s. JGB futures print -17, operating in the lower end of their overnight range during Tokyo hours.

- The super-long end has recovered from worst levels of the session, with 10-Year JGB yields hovering around the upper limit of the BoJ’s permitted trading band.

- A liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs went well.

- The latest round of regional assessments from the BoJ saw it upgrade its economic assessment of 1 region, while the remaining 8 assessments were unchanged.

- Participants now await an address from BoJ Governor Kuroda after the conclusion of the branch managers’ meeting.

- Looking ahead to Friday, household spending and wage data provide the highlights of the domestic docket.

JGBS AUCTION: Japanese MOF sells Y3.24289tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.24289tn 6-Month Bills:

- Average Yield: -0.1712% (prev. -0.1935%)

- Average Price: 100.085 (prev. 100.095)

- High Yield: -0.1591% (prev. -0.1568%)

- Low Price: 100.079 (prev. 100.077)

- % Allotted At High Yield: 72.2400% (prev. 2.1971%)

- Bid/Cover: 3.971x (prev. 3.673x)

JGBS AUCTION: Japanese MOF sells Y498.9bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.9bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.001% (prev. -0.018%)

- High Spread: +0.003% (prev. -0.016%)

- % Allotted At High Spread: 23.8297% (prev. 88.4873%)

- Bid/Cover: 6.391x (prev. 4.897x)

AUSSIE BONDS: Holding Cheaper

YM pushed below its overnight base in the second half of Sydney dealing, with XM lacking any real conviction after a brief and shallow look below its own overnight low. That leaves the former -16.0 and the latter -16.5 ahead of the bell (both off lows), with wider cash ACGBs running 13-16bp cheaper across the curve, with 10s providing the weakest point.

- Aussie bonds looked through a modest richening in U.S. Tsys (which faded) and narrower than expected Australian trade surplus in August. The latter saw a more meaningful upside surprise in imports than in exports (the headline trade surplus remains elevated in a historical sense).

- Bills run 9-20bp cheaper through the reds, with dated OIS pricing of the RBA’s terminal rate moving back up to 3.80%.

- Looking ahead, A$700mn of ACGB Nov-25 supply is due on Friday, along with the release of the AOFM’s weekly issuance slate.

NZGBS: NZGBs Off Worst Levels But Comfortably Cheaper On Broader Impetus

NZGBs held on to the bulk of their early cheapening (derived from wider core FI moves on Wednesday), running 10-12bp cheaper across the major benchmarks at the close, with light bear flattening seen.

- A brief round of support in the U.S. Tsy space helped NZGBs off of session cheaps,

- Today’s weekly NZGB supply passed smoothly enough (cover ratios on the May-28, Apr-33 and May-51 auctions all printed above 2.50%, aided by the move away from recent outright cheaps), with yields pulling further away from session highs post-auction.

- Comments from NZ Finance Minister Robertson failed to move the needle, as he pointed to NZ’s ability to avoid a recession (despite clear challenges), a focus on boosting worker availability via improving Visa processing , while underscoring the responsible fiscal approach that NZ has undertaken, sticking with previous forecasts re: a return to budget surplus (with any quickening of that timeline requiring austerity).

- Robertson also played down any sense of long-term worry re: the NZD, while noting that debt usage should be geared towards financing longer term projects (with some focus on productivity), stressing that he is comfortable with borrowing costs.

- A modest uptick in RBNZ terminal rate pricing has come alongside the move higher in yields, with dated OIS pricing a peak rate of 4.65%.

EQUITIES: Equity Rally Extends; Chip Stocks Outperform

Most Asia-Pac equity indices are firmer at writing, bucking a mildly negative lead from Wall St. (major cash benchmarks closed ~0.1-0.3% softer on Wednesday), with a gauge of Asian stocks on track for a third straight higher daily close (MSCI Asia APEX 50: +0.3%).

- The TAIEX (+0.3%) was lifted by outperformance in semiconductors (+0.5%), reflecting a region-wide bid in semiconductor stocks ahead of heavyweight Samsung Electronics’ earnings on Friday (likely also benefiting from tailwinds after a Morgan Stanley note earlier in the week expressed bullishness on South Korean and Taiwanese chip stocks).

- South Korean equities have rallied for a third day, with the tech-heavy KOSDAQ (+2.7%) outpacing the benchmark KOSPI (+1.4%), reflecting the session’s chipmaker-led bid.

- The Nikkei 225 (+0.9%) is on track for a fourth consecutive higher daily close, operating a little below freshly-made three-week highs at typing, with the Information Technology sector (+1.8%) leading gains.

- The Hang Seng (-0.4%) bucked the broader trend of gains amongst regional peers, dragged lower by underperformance in China-based tech (HSTECH: -0.9%).

- E-minis deal 0.4-0.6% firmer apiece at writing, reversing earlier losses, but have failed to meaningfully break above their respective best levels established on Wednesday.

OIL: Just Off Multi-Week Highs As OPEC+ Output Cut Lifts Sentiment

WTI and Brent are ~$0.20 firmer apiece, having struggled to stage a meaningful break above their respective Wednesday’s highs in Asia as the bullish impetus from OPEC+’s production quota cuts has moderated.

- To elaborate on the latter, both benchmarks notched fresh highs on Wednesday after OPEC+ announced a 2mn bpd cut to output quotas for November, closing ~$1.50-2.00 firmer apiece for a third straight higher daily close.

- WTI and Brent later hit session highs after U.S. crude inventory data pointed to a surprise drawdown in crude stocks (corroborating reports on API inventories on Tuesday). Gasoline and distillate stocks declined as well, while there was a small build in Cushing hub stocks.

- A note that despite the 2mn bpd headline cut in the OPEC+ target production quota, the actual decrease in output is likely to be significantly smaller, with the group continuing to miss collective output targets ahead of Wednesday’s meeting.

- Elsewhere, the White House has denied an earlier WSJ source report of the U.S. preparing to relax sanctions on Venezuela, potentially allowing energy giant Chevron to resume oil production in the country.

GOLD: Steadying Above $1,700/oz

Gold deals ~$4/oz firmer to print ~$1,721/oz at writing, operating towards the upper end of its range established on Wednesday.

- To recap, the precious metal closed ~$10 lower on Wednesday, paring gains from its recent two-day rally after above-expectations U.S. ISM services and ADP employment data contributed to a limited rally in the USD (DXY) and U.S. real yields.

- The recent rise in the DXY and nominal U.S. Tsy yields comes as sentiment re: a “Fed pivot” has moderated from its extremes following softer-than-expected JOLTS job data on Tuesday.

- Atlanta Fed Pres Bostic (‘24 voter) weighed in on the matter late on Wednesday, stating that the “inflation battle is likely still in early days”, reiterating that weaker economic data would not deter further Fed rate hikes.

- Looking ahead, a swathe of Fedspeak is due later on Thursday, ahead of the U.S. NFP print on Friday.

- From a technical perspective, gold has established a short-term bull cycle. Initial resistance is seen at ~$1,729.5 (Oct 4 high), with further resistance located at $1,735.1 (Sep 12 high and key resistance). On the other hand, initial support is seen at $1,695.2 (former trendline resistance).

FOREX: Risk-On Flows Sap Strength From USD & JPY

The BBDXY almost halved yesterday's advance amid broad-based aversion to the greenback. General risk sentiment improved, with e-mini futures posting gains in a promising sign after U.S. equity benchmarks closed in the red on Wednesday. U.S. Tsy yields were slightly weaker, facilitating the dip in the U.S. dollar.

- Safe-haven currencies fell out of favour. The yen generally outperformed the greenback, but only by a narrow margin. U.S./Japan yield differentials were little changed.

- The Antipodeans benefitted from better sentiment, with the kiwi leading gains after the RBNZ's hawkish monetary policy review yesterday.

- The Aussie dollar was unfazed by an unexpected contraction in Australia's trade surplus, driven by a surprise 4% M/M jump in imports.

- Spot USD/CNH posted a 0.5% drop. Financial markets in mainland China remained closed for a public holiday.

- German factory orders, EZ retail sales and U.S. initial jobless claims take focus on the data front today. There is central bank rhetoric galore, as BoJ, Fed and BoE members will speak, while the ECB will publish the minutes from its September monetary policy meeting.

FX OPTIONS: Expiries for Oct6 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-02(E1.3bln)

- USD/JPY: Y142.00($1.1bln), Y144.00($800mln), Y145.00($836mln), Y145.50($1.2bln), Y145.90-00($855mln)

- EUR/GBP: Gbp0.8700(E649mln), Gbp0.8850(E695mln)

- AUD/USD: $0.6475(A$590mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/10/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/10/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/10/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/10/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/10/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/10/2022 | 1230/0830 | * |  | CA | Ivey PMI |

| 06/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/10/2022 | 1250/0850 |  | US | Cleveland Fed's Loretta Mester | |

| 06/10/2022 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/10/2022 | 1535/1135 |  | CA | BOC Governor Macklem speech | |

| 06/10/2022 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 06/10/2022 | 1700/1300 |  | US | Chicago Fed's Charles Evans | |

| 06/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/10/2022 | 2100/1700 |  | US | Fed Governor Christopher Waller | |

| 06/10/2022 | 2230/1830 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.