-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: "A Few" Looked For a 50bp Fed Hike

EXECUTIVE SUMMARY

- 'A FEW' FOMC MEMBERS SOUGHT 50BP HIKE - MINUTES (MNI)

- FED IS 'ABSOLUTELY' COMMITTED TO 2% INFLATION TARGET, WILLIAMS SAYS (RTRS)

- WHITE HOUSE CONSIDERS TWO ECONOMISTS FOR FED VICE CHAIR (WSJ)

- NI PROTOCOL DEAL UNLIKELY TO BE REACHED UNTIL NEXT WEEK, SAY SENIOR SOURCES (GUARDIAN)

- BIDEN SAYS PUTIN'S DECISION DOESN'T SHOW HE'S THINKING OF USING NUCLEAR WEAPONS (RTRS)

- BOK FLAGS MORE HIKES BUT WARY ON GROWTH (MNI)

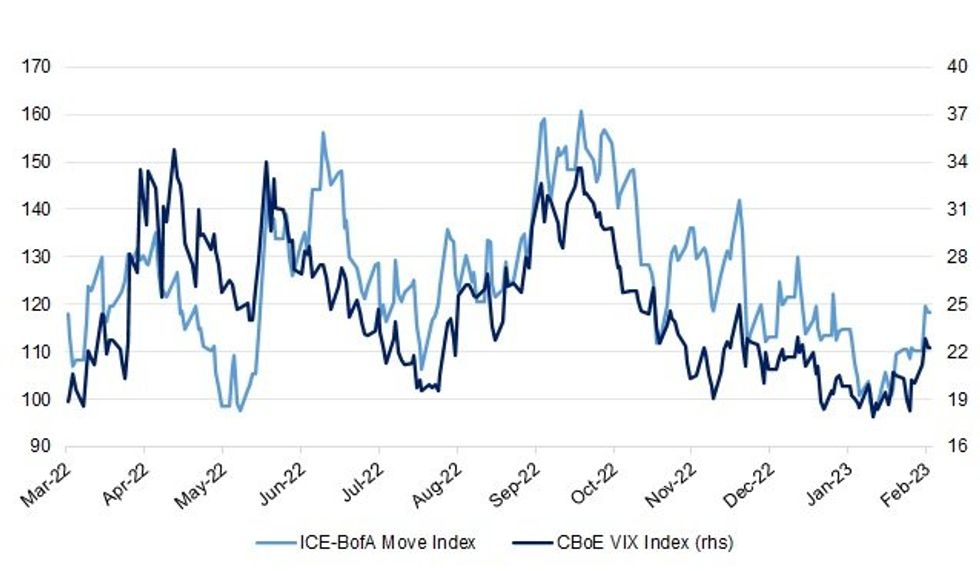

Fig. 1: ICE-BofA MOVE Index Vs. CBoE VIX Index

Source: MNI - Market News/Bloomberg

UK

FISCAL/ECONOMY/POLITICS: Ministers have been given the freedom to talk to unions about pay settlements that could include backdated or one-off payments as ways to end the escalating series of public sector strikes. (Guardian)

BREXIT: Rishi Sunak’s plan to get a deal on the Northern Ireland protocol over the line this week has suffered a setback as further talks with Brussels failed to reach agreement and frustration among his Conservative allies with hardline Brexiters bubbled over. (Guardian)

BREXIT: Rishi Sunak was accused by the Labour party of being at the mercy of “malcontent” Tory MPs on Wednesday, as the prime minister’s efforts to land a Brexit deal on Northern Ireland hit further problems. (FT)

U.S.

FED: Almost all Federal Reserve officials agreed it was time to step down the pace of rate hikes to a quarter point at their Jan 31-Feb.1 meeting but "a few" wanted to hike by 50 basis points to get sufficiently restrictive more quickly, minutes from the gathering published Wednesday showed. (MNI)

FED: Federal Reserve officials are signaling that a resilient U.S. economy could lead them to raise interest rates somewhat higher than they had anticipated to conquer high inflation. (WSJ)

FED: New York Federal Reserve Bank President John Williams on Wednesday said the U.S. central bank is "absolutely" committed to bringing inflation back down to its 2% target over the next few years, by bringing demand down in line with constrained supply. "Our job is clear: our job is to make sure we restore price stability, which is truly the foundation of a strong economy," Williams said at a conference hosted at the bank. (RTRS)

FED: The Federal Reserve will need to tighten more than investors or policymakers believe, raising interest rates to at least 5.6% and possibly above 6% to subdue inflation, Fed academic consultant Ricardo Reis told MNI. (MNI)

FED: The White House is considering two economists who worked in the Obama administration as candidates to become the Federal Reserve’s vice chair, according to people familiar with the matter. (WSJ)

POLITICS: Former President Donald J. Trump’s daughter Ivanka and his son-in-law Jared Kushner have been subpoenaed by the special counsel to testify before a federal grand jury about Mr. Trump’s efforts to stay in power after he lost the 2020 election and his role in a pro-Trump mob’s attack on the Capitol on Jan. 6, 2021, according to two people briefed on the matter. (New York Times)

EQUITIES: Justice Department antitrust lawyers are homing in on yet another Google target: the company’s vast mapping business. (POLITICO)

EQUITIES: Nvidia stock rose more than 8% in extended trading on Wednesday after the company reported slightly higher revenue and net income than Wall Street expected, despite a year-over-year decrease in both categories. (CNBC)

OTHER

GLOBAL TRADE: Apple has for the first time tapped a Chinese supplier to help develop the iPhone maker's long-awaited augmented reality devices, Nikkei Asia has learned. (Nikkei)

NATO: Hungary's parliament will start debating the ratification of Finland and Sweden's NATO membership next Wednesday, the agenda of next week's parliamentary session showed on Wednesday. (RTRS)

RBA: Australia’s government is seeking expressions of interest from potential candidates to join the Reserve Bank’s rate-setting board — the first time the role has been advertised — as the terms of two existing non-executive members are due to expire soon. (BBG)

RBNZ: New Zealand’s central bank would need to see a significant upside inflation surprise to return to more aggressive interest-rate hikes, Governor Adrian Orr said. (BBG)

RBNZ: There would be international precedents for the Government to introduce a “levy” to help pay for the rebuild from Cyclone Gabrielle, Reserve Bank governor Adrian Orr has told a select committee. However, he said he was “completely neutral” on the fiscal decisions the Government made, saying they were not in his hands. (Stuff NZ)

RBNZ: Reserve Bank of New Zealand Assistant Governor Karen Silk warned on Thursday that borrowers could be spending up to 22% of their disposable income on servicing mortgages as they are repriced higher. (MNI)

BOK: The Bank of Korea on Thursday flagged the possibility of additional hikes to tame inflation running well above target as it kept its Base Rate steady at 3.5% on concerns about weaker growth following seven consecutive rate increases. (MNI)

TURKEY: Turkey appoints Furkan Metin, Serdar Oz and Aydin Keskin Kadioglu as vice presidents to The Turkish Statistical Institute, according to presidential decision published in official gazette. The positions were vacant. (BBG)

MEXICO: Mexico's Senate approved on Wednesday a controversial electoral reform known as 'Plan B', which President Andres Manuel Lopez Obrador lobbied heavily for and critics have warned could undermine democracy. (RTRS)

BRAZIL: Brazil economists raised their 2023 and 2024 inflation forecasts for the fifth-straight week even after the central bank chief defended holding the interest rate steady and moved to defuse tensions with President Luiz Inacio Lula da Silva’s government. (BBG)

RUSSIA: Russian Foreign Minister Sergei Lavrov and China's top diplomat Wang Yi did not discuss a reported Chinese plan to resolve the conflict in Ukraine when they met on Wednesday, Moscow said. (RTRS)

RUSSIA: Russia will continue to pay increased attention to boosting its nuclear forces and will begin mass deliveries of Zircon sea-launched hypersonic missiles, President Vladimir Putin said on Thursday. (RTRS)

RUSSIA: The Biden administration is considering releasing intelligence it believes shows that China is weighing whether to supply weapons to support Russia’s war in Ukraine, U.S. officials said. (WSJ)

RUSSIA: President Joe Biden said on Wednesday he did not read into Vladimir Putin's decision to temporarily suspend participation in a nuclear arms treaty as a signal the Russian president was considering using nuclear weapons, even though the U.S. leader called it a "big mistake." (RTRS)

RUSSIA: Britain has begun to "warm up" its production lines to replace weapons sent to Ukraine and increase production of artillery shells to try to help Kyiv push back Russian forces, defence minister Ben Wallace said on Wednesday. (RTRS)

RUSSIA: Poland has asked the US to move its military equipment to storage facilities in the country, President Andrzej Duda said on Wednesday. (BBG)

RUSSIA: The Group of Seven nations are set to create a new tool to coordinate their enforcement of existing sanctions on Russia, an effort to tighten the screws and improve compliance, according to people familiar with the matter. (BBG)

RUSSIA: Russia is increasingly relying on the ruble and the yuan for cross-border payments, financing and more about a year since it invaded Ukraine, with Western sanctions limiting access to the dollar and euro. (Nikkei)

SOUTH AFRICA: Andre de Ruyter, the chief executive of South Africa's state power utility Eskom, will leave the company with immediate effect, Eskom said on Wednesday. (RTRS)

WORLD BANK: The World Bank board expects to select a new president by early May and on Thursday will open a five-week period for nominations to succeed President David Malpass, days after he announced his early departure from the anti-poverty lender. (BBG)

MARKETS: A week after JPMorgan Chase & Co.’s Marko Kolanovic issued a “Volmageddon 2.0” warning on the explosive rise in short-dated options, Bank of America Corp. strategists are pushing back. (BBG)

BONDS: The post-pandemic rebound in world growth and inflation last year meant the amount of debt sloshing around the global economy saw its first annual fall in dollar terms since 2015, a widely tracked study has shown. (RTRS)

OIL: Russia plans to cut oil exports from its western ports by up to 25% in March versus February, exceeding its announced production cuts in a bid to lift prices for its oil, three sources in the Russian oil market said. (RTRS)

OIL: A record amount of Russian diesel is afloat on the sea as European Union sanctions force the nation’s cargoes to find new buyers. (BBG)

CHINA

ECONOMY: The flow of people and logistics since the Spring Festival has rebounded rapidly, indicating the rebound in domestic demand is gathering pace, according Shanghai Securities News. (MNI)

ECONOMY/FISCAL: China aims for faster pace in growth of total profit of centrally administered state-owned companies than the nation’s GDP this year, state broadcaster CCTV reports, citing a briefing held by the state-asset watchdog Sasac. (BBG)

FISCAL: Government in eastern Chinese city of Hangzhou plans to give families with a second or third baby a one-off cash subsidy as much as 20,000 yuan ($2,902) to help them cover some expenses, Zhejiang Daily reports. (BBG)

PROPERTY: China’s real estate market is heating up as a recovery in property sales is being seen in multiple cities, according to the Securities Daily. (BBG)

PROPERTY: Chinese mortgages need more flexibility by allowing market mechanisms to determine interest rates, which would help overcome recent problems with prepayments, according to Liu Xiaochun, Vice President of Shanghai New Finance Research Institute. (MNI)

PROPERTY: New rules on private equity investment in the real estate industry will expand the use of high quality investment including REITs, according to analysts interviewed by Yicai.com. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY187 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY300 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY187 billion after offsetting the maturity of CNY487 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable towards the end of month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1481% at 9:28 am local time from the close of 2.1761% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday, compared with the close of 40 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9028 THURS VS 6.8759 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9028 on Thursday, compared with 6.8759 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA Q4 PRIVATE CAPITAL EXPENDITURE +2.2% Q/Q; MEDIAN +1.1%; Q3 +0.6%

SOUTH KOREA JAN PPI +5.1% Y/Y; DEC +5.8%

MARKETS

US TSYS: Narrow Ranges For Futures, Cash Re-opens In London

TYH3 deals at 111-07, +0-00+, operating in a narrow 0-03+ range on volume of ~83K.

- Cash Tsys remain closed due to the observance of a national holiday in Japan, re-opening in the London session.

- NY Fed President Williams was on the wires early in the session, he noted that the Fed is absolutely committed to a 2% inflation target, bringing little new to the policy debate as he cautioned that any moderation in inflationary pressure may not be as swift as hoped in the coming months.

- There was some very modest Asia-Pac pressure as cross-market flows from Antipodean rates spilled over, however there was little follow through, with liquidity hampered due to the cash closure.

- Ranges remained tight with little follow through on moves.

- This came after the minutes of the February FOMC meeting pressured Tsys off of best levels late Wednesday. The minutes noted that "a few" members supported hikes greater than 50bp. Rhetoric surrounding financial conditions provided a hawkish tinge.

- Eurozone GDP headlines the docket during the London morning. Further out we have U.S. GDP and Initial Jobless Claims. Comments from Atlanta Fed President Bostic and SF Fed President Daly will cross. We also have the latest 7-Year Tsy supply.

AUSSIE BONDS: Soft Wages Vs. Global Factors

A second-half reversal leaves YM -2.0 and XM -1.0 by the close after follow-up selling from the release of the FOMC minutes & weakness in NZGBs guided ACGBs lower early. Cash ACGBs close 1-2bp weaker with the 3/10 curve 1bp flatter.

- Swap rates are 2-3bp higher with 3-year underperforming.

- Bills close mid-range, 1-5bp weaker through the reds.

- RBA-dated OIS strip unwinds a part of yesterday’s soft WPI-induced move, firming 5-7bp for meetings beyond July with November leading. Terminal rate pricing pushes back to 4.27%. March meeting pricing remains at a 95% chance of a 25bp hike.

- On the local docket, Q4 Capex spending and investment intentions print stronger but fails to sustain an impact. Translation of this data into a market move tends to be more difficult during periods of high inflation because the price/volume split is unknown.

- Next week sees the local calendar deliver a batch of quarterly partials leading up to Q4 GDP on Wednesday. January reads on Retail Sales and Private Sector Credit are also due early in the week.

- Until then, the market is likely to be guided by abroad, with today's session throwing up a few questions about the longevity of yesterday's WPI-induced rally. ACGBs nonetheless delivered another 12bp outperformance versus NZGBs.

NZGBS: Upsized NZGB Supply & RBNZ Higher For Longer Talk Weighs

NZGBs weakened through Thursday's session, closing at cheaps, as the market comes to terms with the hawkish messaging from yesterday’s RBNZ policy decision and the bank’s subsequent communique. The overhang of potential supply resulting from the Government’s post-cyclone response also appears to have weighed on NZGBs with bonds underperforming swaps on the day.

- NZGBs close 13-14bp weaker across the curve versus a +5-9bp move in swaps.

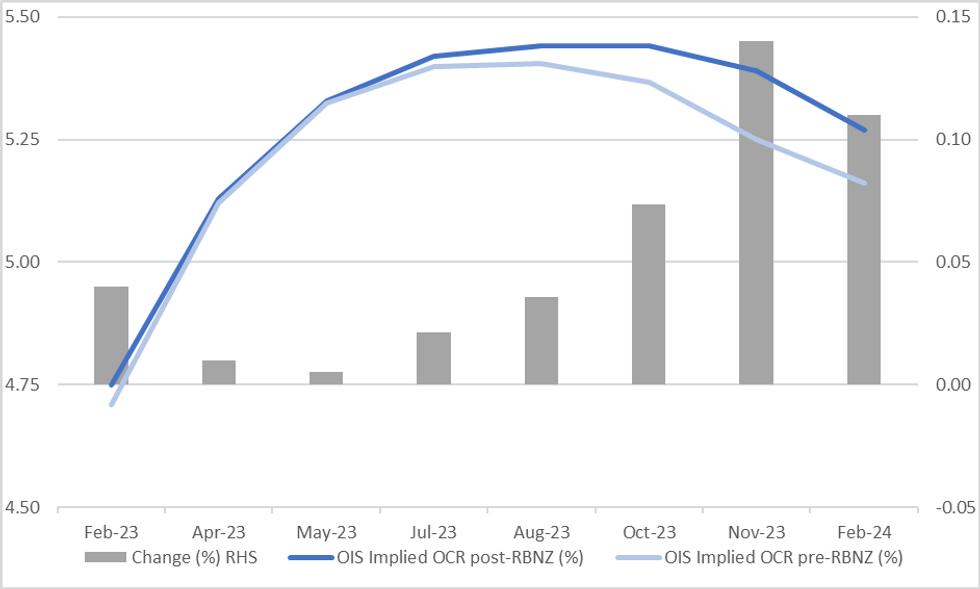

- RBNZ-dated OIS's reaction to yesterday’s policy decision has centered on pricing for the late-23 meetings. With the RBNZ deciding to keep its peak OCR projection at 5.50% (albeit reached slightly later), highlighting the inflationary impact of Cyclone Gabrielle, alongside the chance of higher for longer rates (per comments from Governor Orr in a BBG interview). The market has lifted terminal OCR pricing to 5.45%, while scaling back easing expectations for later in the year. Pricing for the October and November meetings firmed 7bp and 13bp, respectively versus pre-RBNZ levels with the latter now only pricing in ~5bp of easing from 23bp a week ago and ~40bp at the start of February.

- With little on the local calendar until next week’s Q4 Retail Sales release, the market will have to find its direction from abroad, RBNZ communications and/or government announcements on its natural disaster recovery strategies.

EQUITIES: Tech Firms, Mixed Trends Elsewhere

Tech related plays in terms of the Kospi and Taiex have been the standout performers today. This followed strong earnings guidance from Nvidia in the US, which has also boosted US futures. Not surprisingly, the Nasdaq is leading the way, just off session highs currently, last +0.86%, while Eminis are +0.45%. Elsewhere the trends are more mixed, although note Japan markets are closed today.

- The HSI is up around 0.50% at this stage, with some positive spill over from tech moves elsewhere. The underlying tech index is +2%.

- China shares are close to flat. The CSI 300 last just above 4100. There wasn't much market impact from the headline that the authorities will push faster SOE profit growth this year, relative to GDP growth. Also note a number of schools halted classes due to covid clusters at the start of this week. This story was flagged at the beginning of the week.

- The Kospi is currently +1.1%, with offshore investors still modest sellers so far today (-$37.6mn), while the Taiex is +1.33%. Nvidia's upbeat outlook, particularly in the AI space is giving hope for the tech space amid weak chip demand elsewhere.

- India equities are struggling to stay in positive territory, while the ASX 200 fell by 0.37%.

GOLD: Bullion Close to 2023 Lows On US Rate Tightening Prospects

Gold prices fell by a moderate 0.5% on Wednesday. They were already falling in the lead up to the FOMC minutes which revealed that “a few” members called for a 50bp hike and the USD strengthened as a result. During APAC trading, bullion has been range bound and is up 0.1% to $1827.90/oz, close to the intraday high. The USD index is down 0.2%.

- Gold prices remain above support at $1819.00, the February 17 low, but are close to this 2023 low. They are trading between the 50-day and 100-day simple moving averages.

- Later the Fed’s Bostic and Daly speak. The Kansas and Chicago Fed indices and initial jobless claims print. There is also a revised estimate of Q4 US GDP.

OIL: Crude Higher As Increased China Demand Hopes Resurface

Oil prices have been gradually trending up during APAC trading after falling by around 3% on Wednesday after FOMC minutes revealed that “a few” members called for a 50bp hike and tightening fears grew. WTI is up 0.5% to around $74.35/bbl and Brent 0.5% to $81.00, both close to their intraday highs. The USD index is down 0.2%.

- Brent has been outperforming WTI on the back of growing US crude stockpiles and hawkish Fed repricing. WTI cleared support of $75.32, the February 17 low, on Wednesday and the next level to watch is $72.25, the February 6 low. Brent also broke through its support of $81.80 and the next level is at $79.10, the February 6 low.

- API reported a further build in US crude inventories of 9.895mn barrels after 10.507mn the previous week. Gasoline stocks rose 0.89mn and distillate 1.37mn. The official EIA data is out later today. Refining maintenance is resulting in crude being stockpiled.

- The market continues to hope for prices to rise on increased demand from China but forecasts are being revised down, as it appears that Russia is meeting much of additional Chinese consumption and a more hawkish Fed is being priced in.

- Later the Fed’s Bostic and Daly speak. The Kansas and Chicago Fed indices and initial jobless claims print. There is also a revised estimate of Q4 US GDP.

FOREX: Greenback Pressured, US Equity Futures Boost Risk Sentiment

The USD has been pressured in the Asian session, a bid in US Equity futures driven by Nvidia issuing a strong revenue outlook for the current quarter spilled over into a wider risk appetite.

- Kiwi is the strongest performer in the G10 space at the margins, extending gains through the session. NZD/USD is ~0.5% firmer, last printing at $0.6245/50. RBNZ Gov Orr was on the wires this morning, he noted that it would take a significant inflation shock to return to 75bps and that he is confident of a return to low, stable inflation.

- AUD/USD is up ~0.4% and last dealt $0.6830/35. The pair has ticked away from lows seen late in yesterday's session having found support below $0.68. Q4 Private CapEx data printed at 2.2% above the 1.1% estimate, rising from -0.6% prior.

- USD/JPY is marginally softer, last printing at ¥134.75/85. Japanese markets are closed for the observance of a public holiday, which limited liquidity in JPY pairs.

- EUR and GBP are both ~0.1% firmer, benefiting from the moderate pressure on the greenback.

- US Equity futures sit higher in Asia, NASDAQ futures are up ~0.9% and S&P500 futures are ~0.5% firmer. BBDXY is down ~0.2%.

- In Europe today Eurozone GDP headlines the docket. Further out we have US GDP and Initial Jobless Claims. Atlanta Fed President Bostic and SF Fed President Daly will cross.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.