-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Core FI A Touch Softer In Asia, Another Soft Chinese PMI Seen

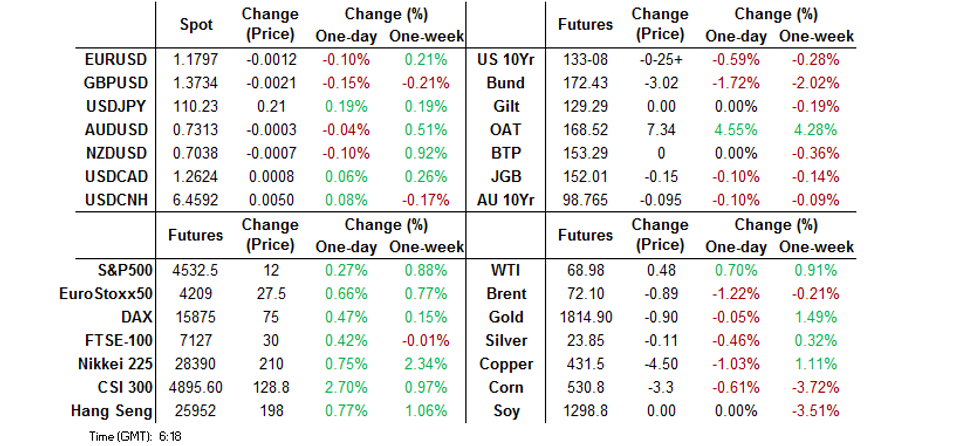

- Core FI markets extended Tuesday's cheapening in Asia-Pac hours, with little in the way of broader impact seen in the wake of a softer than expected Caixin manufacturing PMI survey out of China.

- The USD nudged higher in Asia.

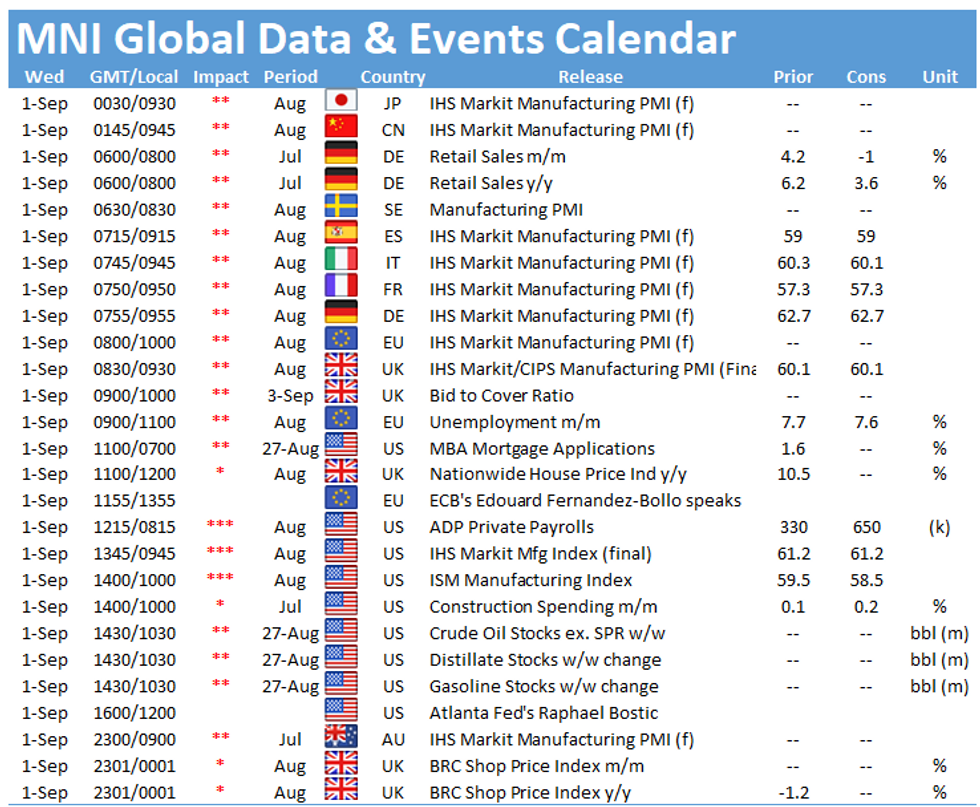

- Final manufacturing PMI readings from across the globe are due on Wednesday, but it will be the U.S. ADP print & ISM m'fing survey that grabs most of the attention. Elsewhere, we will hear from Fed's Bostic & ECB's Weidmann.

BOND SUMMARY: Tuesday's Momentum Spills Into Asia Trade

Momentum from Tuesday's session spilled over into Asia-Pac trade, allowing core FI markets to cheapen. A softer than expected Caixin manufacturing PMI survey out of China (which saw the first contractionary headline print since April '20) had little impact on the space.

- T-Notes have traded through Monday's low, with some weakness in the ACGB space adding to the pressure during a news-light round of Asia-Pac trade. The contract last deals -0-07+ at 133-07, representing worst levels of the session, while cash Tsys trade 0.5-2.0bp cheaper across the curve, with 10s leading the way lower. Looking ahead to Wednesday's NY docket, the ISM m'fing survey and ADP employment prints headline, with the latter serving as a warm up to Friday's NFP release. We will also hear from Fed's Bostic.

- Aussie bond futures were under pressure from the get-go in Sydney, although there weren't any fresh headlines to prompt the latest leg lower. Some modest pressure was then seen on the back of the firmer than expected Australian GDP data for Q2 (+0.7% Q/Q, +9.6% Y/Y), which would have taken a fair chunk of the sell-side community by surprise given relatively widespread acknowledgement of downside risks ahead of the print. Still, the post-data move hasn't been violent, given the weakness already seen during the morning. YM -4.0 & XM -9.0 at typing, with the latter hovering just above its Aug 12 low, which forms key support.

- JGB futures also moved lower as domestic participants reacted to the overnight downtick, while a bid in local equity markets applied further pressure to the space. The contract last trades -13. The major cash JGB benchmarks deal little changed to ~1.0bp cheaper across the curve, with 7s leading the weakness. Super-long end swap spread widening has been evident as footprints of long end swap paying show up in the 30- & 40-Year tenors.

FOREX: Disappointing Caixin M'fing PMI Shrugged Off, Safe Havens Lose Ground

The yuan showed limited reaction to the first contractionary print of China's Caixin Manufacturing PMI since April '20, with spot USD/CNH posting a mere short-lived blip higher. The rate had registered some gains earlier, in tandem with an uptick in the DXY. The PBOC also failed to give any directionality to the redback, as the daily fixing of their USD/CNY mid-point fell in line with sell-side estimate.

- Traditional safe haven currencies traded on the back foot, as most Asia-Pac equity benchmarks advanced in sync with U.S. e-mini futures. USD/JPY extended gains over the Tokyo fix before stabilising around Y110.20.

- Australian Q2 GDP came in stronger than expected, but AUD was rather unfazed and AUD/USD continued to stick to its narrow range.

- Mild selling pressure hit the sterling after cable rejected its 200-DMA on Tuesday. Participants kept an eye on the descending 50-DMA, which came into contact with that 200-DMA, in what may soon result in the formation of a death cross.

- A deluge of PMI readings from across the globe, U.S. ADP employment and construction spending take focus on the data front, while Fed's Bostic & ECB's Weidmann are set to speak.

FOREX OPTIONS: Expiries for Sep01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E795mln), $1.1825(E648mln)

- USD/JPY: Y109.00($500mln), Y109.40($1.2bln), Y110.00-05($625mln)

- USD/CAD: C$1.2635-45($818mln)

- USD/CNY: Cny6.4750($520mln)

ASIA FX: Won Outperforms On Robust Exports

The greenback rose in Asia on Wednesday, the dollar index rising above Tuesday's high briefly, risk sentiment was mostly positive which helped temper Asia EM losses.

- CNH: Offshore yuan is slightly weaker, the yuan showed limited reaction to the first contractionary print of China's Caixin Manufacturing PMI since April '20, with spot USD/CNH posting a small blip higher.

- SGD: Singapore dollar is flat, sticking to a narrow range through the session. On the coronavirus front there were 156 new cases in the past 24 hours, above 100 for the eighth consecutive day.

- KRW: Won is stronger, the best performer in Asia. Data earlier showed the trade surplus widened more than expected, exports grew for the tenth straight month in August driven by sales of chips and automobiles.

- TWD: Taiwan dollar is stronger, on track to gain for the seventh session of the past eight, data earlier showed Markit Taiwan manufacturing PMI slipped slightly to 58.5 from 59.7.

- MYR: Ringgit gained, the Finance Ministry released its first-ever pre-budget statement yesterday, noting that the 2022 federal budget will focus on the "recovery from the pandemic, rebuilding of national resilience and catalysing reforms".

- IDR: Rupiah dipped slightly, Indonesia's manufacturing sector remained deep in contraction in August, even as its pace decreased a tad, with Markit M'fing PMI edging higher to 43.7 from 40.1. CPI rose in line with estimates at 1.59% Y/Y.

- PHP: Peso is weaker, the Philippine manufacturing sector has plunged into contraction in August, according to the latest Markit PMI survey. The index fell to 46.4 from 50.4 recorded in July.

- THB: Baht is lower, nationwide count of new Covid-19 infections registered below 15,000 for the second straight day. As a reminder, Thailand is relaxing some of its mobility curbs from today.

ASIA RATES: China Futures Rise After Weak Data

- INDIA: Yields higher in early trade. GDP was robust yesterday, putting India on track for the highest growth rate in the world. Markets also digest a speech from RBI Governor Das yesterday, Das said that the RBI plans to conduct fine-tuning operations to manage unanticipated liquidity flows. Das also said that Variable Rate Reverse Repo (VRRR) auction will remain the main instrument to absorb excess liquidity from the banking system. Das also outlined plans to enable international settlement of transactions in Indian government bonds which would enhance access of non-residents and allow inclusion on global bond indices.

- SOUTH KOREA: Futures lower for a second day. Data earlier showed the trade surplus widened more than expected, exports grew for the tenth straight month in August driven by sales of chips and automobiles. Exports rose 34.9%, shipments to China rose 26.8% while US exports rose 38%. Manufacturing PMI data was also released, the August figure printed 51.2 compared to 53.0 in July. The slow down represents the impact of lockdowns during the survey period. On the coronavirus front new cases rose to 2,025, back over 2,000 after 1,372 on Tuesday due to fewer tests.

- CHINA: The PBOC drained a net CNY 40bn of liquidity today, halting its run of injections at August month-end. Repo rates fell, though the overnight rate and the 7-day rate remain inverted at 2.1243% and 2.0858% respectively. Bond futures are sharply higher today, 10-year contract up 34 ticks at 100.37 to hit a fresh contract high. Data earlier showed Caixin manufacturing PMI drop into contractionary territory, the August print came in at 49.2, below estimates of 50.1. Yesterday's official PMI saw both the manufacturing and non-manufacturing measure slip. The weak data has reinforced the view that there could be another RRR cut forthcoming from the PBOC.

- INDONESIA: Curve twist flattens, 2-/30-Year spread some 2bps tighter. Data showed CPI rose 1.59% Y/Y, in line with estimates, while Indonesia's manufacturing sector remained deep in contraction in August, even as its pace decreased a tad, with Markit M'fing PMI edging higher to 43.7 from 40.1 recorded in July. IHS Markit noted that "the Indonesian manufacturing sector continued to be affected by the second COVID-19 wave in August, and to a severe extent," but "things appear to be improving from July in line with the decline in COVID-19 cases in Indonesia". Elsewhere Moody's warned late Tuesday that the recent virus wave will weigh on economic recovery and undermine the government's plan to trim fiscal deficit, which will be "a credit negative".

EQUITIES: China Tech Stocks Extend Rally

Equity markets in the Asia-Pac region were mostly higher on Wednesday, shaking off a negative lead from the US. In China the CSI 300 is up over 1.75%, while the Hang Seng has gained around 0.75%, tech stocks have rallied for a third day. Caixin PMI data slipped into contractionary territory, increasing speculation of another RRR cut in the coming months. Bourses in Japan are higher, data earlier showed capex rose more than expected in Q2 at 5.3%. Other markets in the region have fluctuated between minor gains and minor losses. In the US futures are higher, major indices gaining around 0.3% heading into the European open after slipping on Tuesday. PMI surveys are due later today while August US ISM Manufacturing data is also on the docket Wednesday. ECB's Weidmann and Fed's Bostic are both due to speak.

GOLD: Still Above $1,800/oz

Tuesday's uptick in U.S. real yields failed to produce a lasting impact when it came to gold, with spot sticking above $1,800/oz before consolidating in Asia-Pac hours to last trade little changed around $1,813/oz, leaving the technical picture as was. U.S. labour market data (in the form of Wednesday's ADP print and Friday's NFP release) provide the major inputs for participants during the remainder of the week.

OIL: Crude Futures Higher Ahead Of OPEC+ Meeting

Oil is higher in Asia-Pac trade, retracing most of Tuesday's decline. Oil markets saw support into last week's close as Hurricane Ida threatened production across the Gulf of Mexico. This continued to abate throughout the Tuesday session with WTI and Brent futures in modest negative territory. Despite the weakness, WTI remains bullish and traded to a fresh high Monday. The recovery from the Aug 23 low has defined a key short-term support at $61.74, Aug 23 low where a break is required to reinstate a bearish theme. Data from API yesterday showed headline crude stocks fell 4.045m bbls, but stocks at Cushing rose 2.128m bbls. Focus now switches to the OPEC+ meeting today, the group will assess the impact on demand from the spread of the delta variant and its implications for plans to return 400k bpd of supply to the market.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.