-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Asia Pauses For Breath Pre-BoJ

EXECUTIVE SUMMARY

- ECB’S DE COS: ‘SIGNIFICANT’ RATE HIKES TO CONTINUE (BBG)

- ECB'S LANE: NEED TO RAISE RATES MORE (FT)

- NEW BOJ GOVERNOR NOMINEE LIKELY TO BE PRESENTED TO DIET FEB 10 (RTRS SOURCES)

- TOP CONTENDER FOR NEXT BOJ CHIEF KEEPS UP GUESSING GAME OVER INTENTIONS (NIKKEI)

- BANK OF CANADA NAMES ECONOMICS PROFESSOR NEW, NON-EXECUTIVE DEPUTY GOVERNOR (RTRS)

- EUROPE CAN LEARN FROM BIDEN’S INFLATION REDUCTION ACT, SPAIN’S PM SAYS (CNBC)

- CHINA Q4 GDP TOPS EXPECTATIONS

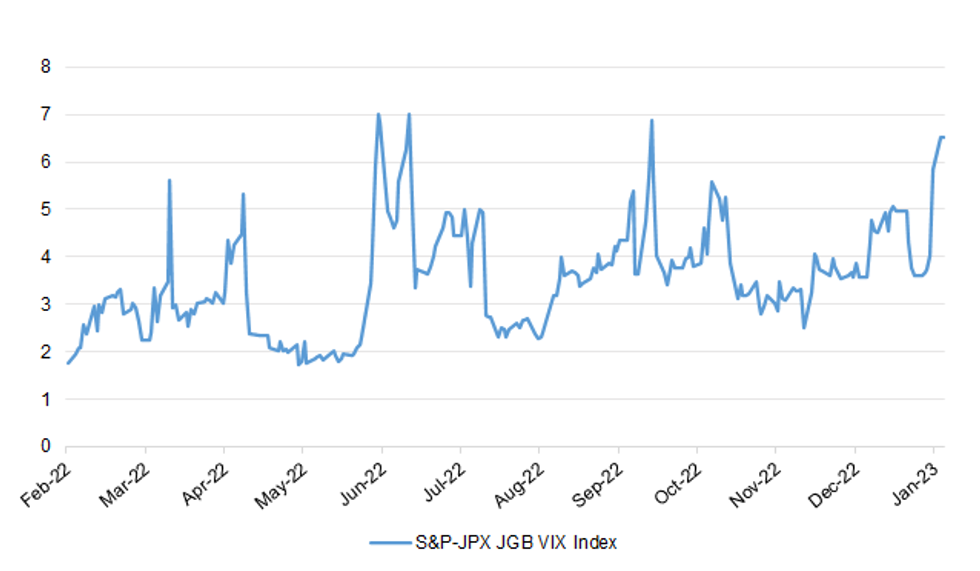

Fig. 1: S&P-JPX JGB VIX Index

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Governor Andrew Bailey said on Monday that inflation looks set to fall markedly this year as energy prices decrease, but a shortage of workers in the labour market poses a "major risk" to this scenario. (RTRS)

ECONOMY: ll health among working-age people is costing the economy about £150 billion a year, the equivalent of 7 per cent of GDP, according to an analysis for the Times Health Commission. (The Times)

FISCAL/POLITICS: A controversial anti-strike bill has moved a step closer to becoming law - hours after teachers and nurses announced fresh walkouts. (Sky)

EUROPE

ECB: Inflation has come back and so, inevitably, has tighter monetary policy. The European Central Bank, the second most important central bank in the world, has a particularly difficult task in managing this period of monetary tightening. This is not just because the “low for long” period, in which the challenge had been to raise inflation towards the 2 per cent annual target, came to an abrupt end in 2021. It is also because the eurozone has been disrupted by huge real shocks, notably Russia’s invasion of Ukraine.(FT)

ECB: European Central Bank Governing Council member Pablo Hernandez de Cos said big increases in borrowing costs will continue as officials look to further bring down euro-zone inflation. (BBG)

FISCAL/ITALY: Top European Union officials are confident that Italy will soon approve a reform of the euro-area bailout fund, but the optimism may be premature in light of divisions within Prime Minister Giorgia Meloni’s ruling coalition. (BBG)

MARKETS: Euronext has agreed a deal to move part of its clearing business from a subsidiary of the London Stock Exchange Group, reducing its reliance on its British rival in a controversial area of Europe’s capital markets. (FT)

OTHER

GLOBAL TRADE: Spanish Prime Minister Pedro Sanchez told CNBC Monday that the European Union has something to learn from Washington and its new policies to fight inflation, saying he hopes that a trade war between the two sides can be avoided. (CNBC)

GLOBAL TRADE: The top Dutch trade official said the Netherlands will not summarily accept new U.S. restrictions on exporting chip-making technology to China, and is consulting with European and Asian allies. (RTRS)

BOJ: The Japanese government is likely to present its nominees for the next central bank governor and two Bank of Japan (BOJ) deputy governors on Feb. 10, four government and ruling party officials with knowledge of the matter told Reuters. There is a chance the date could be pushed forward by several days depending on developments in parliament, which convenes on Jan. 23, one of the officials said on condition of anonymity due to the sensitivity of the matter. (RTRS)

BOJ: With Bank of Japan Gov. Haruhiko Kuroda's term set to end in April, the question of who will succeed the longtime central bank chief has taken on greater urgency -- and more mystery. Deputy Gov. Masayoshi Amamiya is viewed as a leading contender. Amamiya has been at the forefront of the BOJ's fight against deflation since the current Bank of Japan Act, which guarantees the political independence of the central bank, took effect in 1998. (Nikkei)

JAPAN: Japan will strive to maintain market confidence by conducting appropriate debt management, Finance Minister Shunichi Suzuki said on Tuesday, as the 10-year government bond yields broke above the upper cap of 0.5% set by the central bank. Asked whether the Bank of Japan should take any steps to rein in rising bond yields and correct market distortion, Suzuki told reporters that such a decision must be left up to the central bank to decide as an independent institute. (RTRS)

JAPAN: Growing speculation that the Bank of Japan will change its yield-curve control policy again is driving up borrowing costs, prompting a raft of scuppered bond deals. (BBG)

JAPAN: This year is pivotal for the Japanese economy to move away from decades of deflationary thinking toward sustained real wage growth, according to the head of the country’s largest labor union. (BBG)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a deterioration in business sentiment and activity. The survey was open from 28 November 2022 to 9 January 2023 and captured the effects of the more hawkish than expected November Monetary Policy Statement (MPS) on 24 November. In this MPS, the Reserve Bank of New Zealand (RBNZ) indicated that it would take interest rates higher than initially expected to rein in inflation. (NZIER)

HONG KONG: Hong Kong’s leader John Lee is optimistic he can remove the last pandemic curbs including mask wearing this year. (BBG)

BOC: The Bank of Canada said on Monday it has appointed a professor of applied economics at HEC Montreal as its new external, non-executive deputy governor for a term of two years, starting in March. The bank named Nicolas Vincent to take on its fourth deputy governor role. In August, the bank said it would seek an external candidate for the revamped post in order to find "fresh and diverse perspectives." (RTRS)

MEXICO: Mexico’s central banker Jonathan Heath says Banxico still needs to raise its key interest rate at least once more and he expects to see it held at its peak for a minimum of six months to ensure inflation subsides. (BBG)

BRAZIL: Brazil Finance Minister Fernando Haddad said on Monday that the government of President Luiz Inacio Lula da Silva wants to vote on a tax reform in the first half of the year after reaching a consensus text based on two proposals that are already in Congress. (RTRS)

BRAZIL: Govt staff says that the Lula Administration is mulling increasing the minimum wage beyond the 1,320 reais provided for in the 2023 budget, says local newspaper Estado. (BBG)

BRAZIL: Banco do Brasil is a major financier of agribusiness, but it also has to finance small rural producers, said President Luiz Inacio Lula da Silva this Monday during the inauguration of the bank’s new CEO Tarciana Medeiros. (BBG)

SOUTH AFRICA: South Africa has a plan to improve energy provision that will end the need for any power cuts within the next 12-18 months, ITS Finance Minister Enoch Godongwana said on Monday. (RTRS)

SOUTH AFRICA: Opposition politicians and South Africa’s biggest labor union say they’re readying a lawsuit against the head of the state-owned power company and a government official that oversees it as blackouts cripple the nation. (BBG)

IMF: A severe fragmentation of the global economy after decades of increasing economic integration could reduce global economic output by up to 7%, but the losses could reach 8-12% in some countries, if technology is also decoupled, the International Monetary Fund said in a new staff report. (RTRS)

EQUITIES: Confidence among companies in their growth prospects has dropped the most since the 2007-08 global financial crisis due to rising inflation, macroeconomic volatility and geopolitical conflicts, a survey by PricewaterhouseCoopers showed. (RTRS)

COMMODITIES: Commodities have the strongest outlook of any asset class in 2023, with a perfect macroeconomic environment and critically low inventories for almost every key raw material, according to the head of commodities research at Goldman Sachs Group Inc. (BBG)

METALS: - Rio Tinto (RIO.AX) on Tuesday said that China's reopening from COVID-19 restrictions is set to raise near-term risks of labour and supply-chain shortages, while it also flagged a strong start to iron ore shipments for 2023. (RTRS)

CHINA

PBOC: China could cut interest rates and banks’ reserve requirement ratio around the first quarter as domestic demand remains insufficient and export prospects weaken, the Shanghai Securities News reports, citing China Everbright Bank Co. analyst Zhou Maohua. (BBG)

FISCAL: China should issue about CNY1.5 trillion of special treasury bonds to support the economic recovery after pandemic controls eased, reported Financial News, which is run by the People’s Bank of China. Citing advisors, it said there is policy room for the issuance as the government leverage ratio is not high, and the funds could be used to subside consumption via handing out consumption coupons and to help small businesses and key sectors. (MNI)

ECONOMY: China's employment situation is "generally stable" and the economy is likely to improve in 2023, said Kang Yi, head of China's National Bureau of Statistics, at a news briefing on Tuesday. (RTRS)

YUAN: The Chinese yuan is expected to rally and may jump to 6.3 against the dollar by the end of the year, China Business Network reported. (MNI)

INFLATION: Measures are needed to increase pork prices to a reasonable and stable level as soon as possible, as weak demand and increases in supply have seen prices fall from CNY26.01/kg on January 3 to CNY23.12/kg on January 13, the National Development and Reform Commission (NDRC) told hog producers during a recent meeting, according to China Securities News. (MNI)

PROPERTY: China will work to keep housing supply and demand balanced, make home prices stable and strictly curb speculation, China Construction News cited the housing regulator as saying on Tuesday, after a flurry of government moves to support the crisis-hit sector. (RTRS)

PROPERTY: China Evergrande Group, the developer at the heart of the nation’s property crisis, has been discussing a restructuring proposal with creditors that includes two options for extending payment deadlines on unsecured offshore debt, people familiar with the matter said. (BBG)

EQUITIES: Activist investor Ryan Cohen has built a stake in Alibaba worth hundreds of millions of dollars and is privately pushing the Chinese e-commerce giant to accelerate and further boost its share-repurchase program, according to people familiar with the matter. (WSJ)

CHINA MARKETS

PBOC NET INJECTS CNY504 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday conducted CNY205 billion via 7-day reverse repos and CNY301 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY504 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to hedge the impact of tax paying and cash injection peak to keep banking system liquidity stable before Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1650% at 9:36 am local time from the close of 2.1849% on Monday.

- The CFETS-NEX money-market sentiment index closed at 59 on Monday, compared with the close of 57 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7222 TUES VS 6.7135 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7222 on Tuesday, compared with 6.7135 set on Monday.

OVERNIGHT DATA

CHINA Q4 GDP 0.0% Q/Q; MEDIAN -1.1%; Q3 +3.9%

CHINA Q4 GDP +2.9% Y/Y; MEDIAN +1.6%; Q3 +3.9%

CHINA Q4 GDP +3.0% YTD Y/Y; MEDIAN +2.7%; Q3 +3.0%

CHINA DEC INDUSTRIAL PRODUCTION +1.3% Y/Y; MEDIAN +0.1%; NOV +2.2%

CHINA DEC INDUSTRIAL PRODUCTION +3.6% YTD Y/Y; MEDIAN +3.7%; NOV +3.8%

CHINA DEC RETAIL SALES -1.8% Y/Y; MEDIAN -9.0%; NOV -5.9%

CHINA DEC RETAIL SALES -0.2% YTD Y/Y; MEDIAN -0.8%; NOV -0.1%

CHINA DEC FIXED ASSET INVESTMENT EXCL. RURAL +5.1% YTD Y/Y; MEDIAN +5.0%; NOV +5.3%

CHINA DEC SURVEYED UNEMPLOYMENT RATE 5.5%; MEDIAN 5.8%; NOV 5.7%

JAPAN NOV TERTIARY INDUSTRY INDEX -0.2% M/M; MEDIAN +0.1%; OCT +0.5%

AUSTRALIA JAN WESTPAC CONSUMER CONFIDENCE INDEX 84.3 DEC 80.3

The Westpac Melbourne Institute Consumer Sentiment Index increased by 5%, from 80.3 in December to 84.3 in January. This is the largest increase in the Index since April 2021, and prior to that, since October 2020 when consumers were responding to positive news around the pandemic. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 87.7; PREV 87.4

Consumer confidence increased very slightly by 0.3pts to 87.7 in the second week of the year. Confidence about ‘current economic conditions’ fell slightly, while households became more optimistic about their finances. The ‘financial situation next year’ sub-index rose toits highest since late April 2022, before increases in the cash rate began. It is worth noting, that stronger confidence is not necessarily a leading indicator of stronger spending. ANZ-observed spending data shows weaker spending in the first week of 2023 compared to the previous year. Household inflation expectations jumped 0.4ppt, but are still 0.5ppt lower than the end of last year. (ANZ)

SOUTH KOREA NOV L MONEY SUPPLY +0.4% M/M; OCT +0.4%

SOUTH KOREA NOV M2 MONEY SUPPLY +0.7% M/M; OCT +0.4%

MARKETS

US TSYS: Yields Firm As Curve Bear Steepens

TYH3 deals at 114-20, -0-04+, in the middle of its 0-08+ Asia-Pac range on volume of ~61K.

- Cash Ysys have bear steepened, running 1-5bps cheaper across the major benchmarks.

- Tsys were modestly richer in early trade as an offer in USD/JPY pressured the greenback in early dealing aiding the space, after an initial adjustment cheaper, catching up to futures moves after the elongated weekend.

- Later as Chinese cash markets opened, the USD was bid, U.S. equity futures reversed early gains and Tsys cheapened albeit without any overt headline driver.

- The cheapening marginally extended as Chinese Q4 GDP was firmer than expected, as were monthly economic activity readings.

- The flow side was highlighted by a block seller in UXY (901 lots).

- In Europe today national CPI data from Germany provides the highlight. Further out we have Empire Manufacturing as well as CPI data from Canada. Elsewhere, Fedspeak from NY President Williams is on the wires late in today's NY session.

JGBS: Mixed, Pre-BoJ Adjustments Dominate, Long End Firms Again

JGB futures were more contained than in recent sessions on Tuesday, consolidating the overnight session uptick after a pull back from best levels, heading into the bell +15, with pre-BoJ position adjustments front and centre.

- Yields are mixed across the curve, running 1bp cheaper to 4bp richer, with a flattening element apparent as the long end outperforms for a second consecutive session (albeit after last week’s dramatics).

- Swap rates are lower across the curve with 7s leading that move.

- Note that there are signs of JGB futures basis trades being deployed given the well-documented market dislocations.

- Unlike JPY FX implied vol., JGB implied vol. (as observed via the S&P-JPX JGB VIX metric), although elevated, has not breached its post-COVID peak in the run up to the BoJ’s monetary policy meeting,.

- The latest liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs was smoothly digested, likely aided by pre-BoJ short cover.

- Comments from Japanese Finance Minister Suzuki failed to move the needle as he went over old ground re: debt financing costs, purposefully steering clear of meaningful comments re: the BoJ.

- The aforementioned BoJ decision provides the major macro risk event on Wednesday (see our full preview of that event here). Elsewhere, final industrial production readings and core machine orders data round out Wednesday’s local docket.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 5- To 15.5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y499.8bn of 5- to 15.5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.002% (prev. -0.003%)

- High Spread: +0.001% (prev. -0.001%)

- % Allotted At High Spread: 20.3101% (prev. 43.1263%)

- Bid/Cover: 4.672x (prev. 5.495x)

AUSSIE BONDS: Light Twist Steepening

Aussie bonds failed to provide any meaningful movement on Tuesday, and were subjected to some light twist steepening pressure, leaving YM +1.0 & XM -1.0 at the close, while wider cash ACGBs ran 1.5bp cheaper, pivoting around the 7-Year zone.

- An early, light bid seemed to be aided by receiver side flow in swaps as EFPs tightened a little vs. yesterday’s closing levels, before a pre-Chinese data cheapening move in U.S. Tsys saw the space off best levels.

- The Chinese data deluge saw beats across the board, headlined by firmer than expected Q4 GDP data, then applied some modest pressure.

- ACGBs then edged off of cheaps ahead of the close.

- A$ denominated supply, from both offshore and onshore names continued to tick over, focused on the belly of the curve.

- Bills were -2 to +1 through the reds as the strip twist flattened, with RBA-dated OIS continued to show ~20bp of tightening for next month’s meeting, alongside a terminal OCR somewhere below 3.70-3.75%.

- Looking ahead, tomorrow’s local docket is empty, with the broader macro focus set to fall on the latest BoJ decision given the recent, well-documented challenge of the Bank’s YCC parameters (which were only tweaked last month, in a move that caught most off guard).

NZGBS: Little Changed Come The Bell After Chinese Data Unwound Early Richening

An early bid in NZGBs, which seemed to be linked to receiver side swap flows out to 5s, some gloomy details in the latest QSBO from the NZIER and some light richening in U.S. Tsys, has faded, with a firmer than expected round of Chinese data, headlined by the Q4 GDP reading, the reason for the pull back from best levels. NZGBs had been stickier when it came to the pre-data bid, with Tsys pulling away from best levels into the release.

- That left the major NZGB benchmarks running 0.5bp richer to 1.0bp cheaper at the bell, with the curve twist steepening as it pivoted around 5s.

- The twist steepening on the swap curve was a little more pronounced, with benchmark rates there running 2.5bp lower to 2bp higher, leading to mixed swap spread performance.

- Major near-dated RBNZ OIS pricing was little changed, leaving ~62bp of tightening showing for next month’s gathering, alongside a terminal OCR of just over 5.40%.

- Looking ahead, REINZ house price readings and card spending data headline the local docket on Wednesday.

EQUITIES: Lower US Futures Weigh, Better China Data Fails To Inspire

Asia Pac equities have traded mixed through Tuesday's session. A negative US futures backdrop hasn't helped sentiment, with major indices off by -0.30 to -0.50% at this stage, with the Nasdaq underperforming. Better than expected China data didn't have a lasting positive impact on sentiment.

- The CSI 300 is down slightly, -0.16% at this stage, while the Shanghai Composite is off by -0.25%. Of course, this follows strong gains yesterday (CSI 300 +1.56%), while northbound inflows have slowed back to +4.82bn yuan, from yesterday’s heady +15.84bn yuan pace.

- The HSI is tracking weaker, down 1% at this stage, with the Tech sub index down by 0.64%.

- Japan stocks are firmer, with the Nikkei 225 up close to 1.30% at this stage, with Toyota gaining after the company stated 2023 production will exceed pre-pandemic levels.

- The Kospi is off 0.70%, moving away from a test of the 2400 level. Offshore investors have sold -$88.3mn of local equities so far today, trimming week to date net inflows. The Taiex is up slightly, +0.05%.

- In SEA we are seeing contrasting fortunes, with the JCI outperforming, +1.28% at this stage, while Philippines' stocks are off by 1.20%.

GOLD: Gold Prices Lower But Not Too Far Off Recent Highs

MNI (Australia) - Gold prices are off slightly (-0.3%) on higher UST yields, despite the USD being softer during the APAC session. Bullion range traded during Monday’s northern hemisphere session. Gold is currently around $1910.20/oz, close to the intraday low, after reaching an intraday high of $1919.11 earlier.

- Conditions for gold remain in a bullish uptrend with higher highs and higher lows. The reopening of China’s economy should mean increased physical demand for the yellow metal.

- There is no data scheduled in the US today but the Canadian December CPI is released. Later there is also UK labour market data. On Wednesday, the BoJ meets and US December retail sales & PPI print.

OIL: Oil Prices Trend Higher On Positive Economic News From China

MNI (Australia) - China optimism and global pessimism continue to pull oil prices in opposite directions. During the the APAC session, they have been trending up, as the USD softened and Chinese economic data exceeded expectations. WTI is currently up 0.7% to around $79.30/bbl, close to its intraday high of $79.39. Brent is up only 0.2% to about $84.60, also close to its intraday high of $84.81.

- The short-term bull trend remains in place for WTI. If it continues, then $81.50 could open up, the January 3 high and bull trigger. The key level for Brent is $87.00.

- Today OPEC publishes its monthly oil market report, which should help to quantify the demand and supply outlook. Last week Russian exports rose 30%, its highest since April 2022, with India the biggest customer. However, on February 5 the G7, including the EU, plans to cap the price of Russian fuel exports.(ANZ)

FOREX: USD Sticks To Familiar Ranges, JPY Underperforms Against NZD & AUD

The BBDXY has tracked recent ranges through today's session. We got above 1229 but found selling interest at this level, which is consistent with recent sessions. We are back at 1226.70 now, little changed for the session. Yen has underperformed slightly, particularly against AUD and NZD.

- USD/JPY got to 129.15, which was above Monday's high, but we are now back to 128.60/65, slightly higher for the session. US cash Tsy yields are firmer, mostly at the back end, +2.9bps for the 10yr to 3.53%, as cash trading resumed following the US MLK holiday.

- US equity futures are weaker, but at this stage this hasn't weighed on AUD and NZD materially. AUD/USD is back to 0.6970, slightly down on session highs, which came after China data beat expectations. The better data hasn't inspired Asian FX though, while commodity prices are mixed. Iron ore is steady, close to $120/ton, but copper is off 2% from Friday closing levels to $413 (CMX basis).

- NZD/USD is back to 0.6400, +0.30% firmer, but has run out of momentum above this level in recent session.

- EUR/USD was supported towards 1.0800, now back at 1.0830. The ECB's Lane said in the FT that a policy rate around 2% is in the ballpark from a neutral standpoint.

- Looking ahead, UK employment figures will cross before US traders return and Canadian CPI will be published.

FX OPTIONS: Expiries for Jan17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0645-50(E608mln), $1.0675-80(E1.1bln), $1.0730-50(E771mln), $1.0800-05(E802mln), $1.0825(E825mln), $1.0850(E1.5bln), $1.0900(E798mln)

- GBP/USD: $1.2225-50(Gbp1.4bln)

- USD/JPY: Y127.85-00($665mln), Y129.00($612mln), Y130.00-22($1.0bln)

- AUD/USD: $0.6800(A$2.5bln), $0.7210(A$1.4bln)

- USD/CAD: C$1.3350($555mln), C$1.3400($1.0bln)

- USD/CNY: Cny6.8400-50($540mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/01/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 17/01/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 17/01/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.