-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Better News From Big Tech Earnings & Latest Regional Bank Deposit Update

EXECUTIVE SUMMARY

- NY FED LIMITS TYPES OF FIRMS THAT CAN ACCESS ITS REVERSE REPO FACILITY (RTRS)

- FIRST REPUBLIC BANK TO WEIGH UP TO $100 BILLION IN ASSET SALES (BBG)

- PACWEST STOCK SURGES 14% AS BANK SAYS DEPOSITS HAVE BEEN BUILDING IN RECENT WEEKS (DJ)

- SENATORS: BIDEN SHOULD SANCTION HUAWEI CLOUD, OTHER CHINESE FIRMS (RTRS)

- VUJCIC: ECB HAS NO CHOICE BUT TO RAISE RATES FURTHER (DELO)

- BRUSSELS SET TO REBUFF GERMAN CALLS FOR TOUGHER DEBT-REDUCTION TARGETS (FT)

- RUSSIA'S LAVROV: TRANSITION TO NON-DOLLAR CURRENCIES 'UNSTOPPABLE' (RTRS)

- CHINA MEDIA FLAG LIKELY EASING ON HOME PURCHASES; DEPOSIT RATES (NEWS)

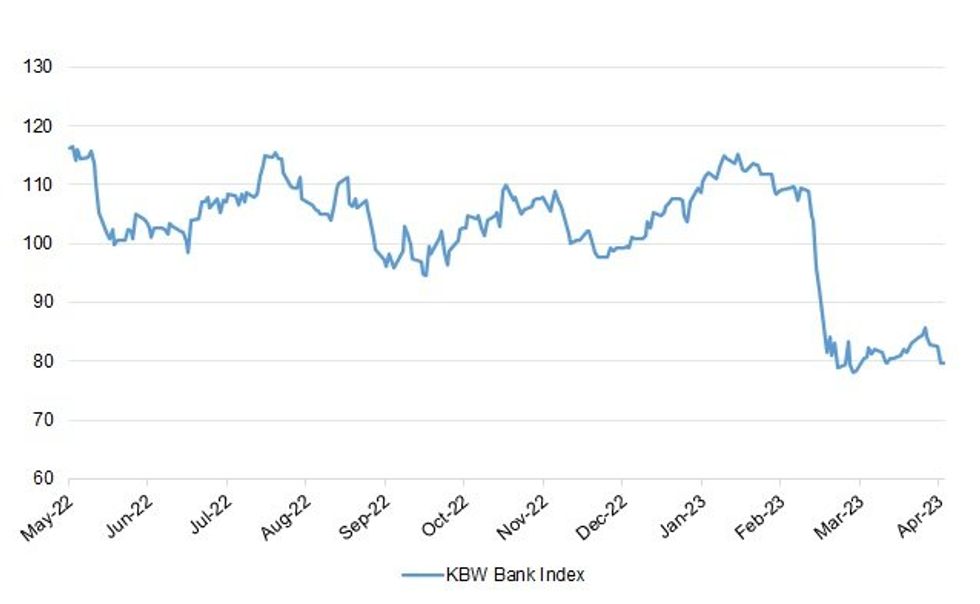

Fig. 1: KBW Bank Index

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England’s independence has withstood 25 years of economic shocks but is not necessarily proof against “political vandals”, two key architects of the UK’s monetary and fiscal framework said on Tuesday. (FT)

EUROPE

ECB: The European Centra Japan’s Financial Services Agency has urged banks to check their readiness to respond to risks from social media and internet banking after the collapse of several US banks, according to people familiar with the regulator’s thinking. l Bank must lift borrowing costs further because inflation pressures remain too high, according to Governing Council member Boris Vujcic. (BBG)

FISCAL: Brussels is preparing to reject a German push for member states to be required to meet annual debt-reduction targets, as the European Commission prepares a sweeping overhaul of the EU’s budget rules. (FT)

U.S.

FED: The Federal Reserve Bank of New York on Tuesday added new limitations to the terms governing who can access a well-used tool it uses to help manage short-term interest rates. (RTRS)

FISCAL: If U.S. President Joe Biden were to be presented with Republican House of Representatives Speaker Kevin McCarthy's spending and debt bill, he would veto it, the White House said on Tuesday. McCarthy floated a plan last week that would pair $4.5 trillion in spending cuts with a $1.5 trillion increase in the $31.4 trillion U.S. debt limit. He has said the House would vote on his bill this week and has also invited Biden to discuss the debt ceiling with him. "House Republicans must take default off the table and address the debt limit without demands and conditions," the White House said on Tuesday. (RTRS)

FISCAL: Senate Republican leader Mitch McConnell calls on President Biden to start talks on the debt-limit with House Speaker Kevin McCarthy. (BBG)

FISCAL: The proposed plan by U.S. House Republicans to cut spending and raise the nation's $31.4 trillion dollar debt ceiling would cut federal deficits by $4.8 trillion over ten years, the Congressional Budget Office said on Tuesday. (RTRS)

FISCAL/RATINGS: The route to resolving the standoff around the US debt limit remains unclear after the Republican and Democratic Party leaderships set out their latest fiscal proposals, Fitch Ratings says. Even if agreement were reached to raise or suspend the limit, the use of debt limit standoffs to extract policy concessions means they may remain confrontational in the future. (Fitch)

BANKS: First Republic Bank is exploring divesting $50 billion to $100 billion of long-dated mortgages and securities as part of a broader rescue plan, according to people with knowledge of the matter. (BBG)

BANKS: CNBC’s David Faber reported Tuesday that the next few days are crucial for First Republic’s future as other banks and federal officials looking for solutions to stabilize the regional bank. One potential path would be for larger banks to buy some of First Republic’s assets and for the regional bank to then raise additional equity, Faber reported, but it is unclear if other banks will be willing to do so. There will not be a full sale to another bank, Faber reported. (CNBC)

BANKS: Shares of PacWest Bancorp were shooting 15% higher in Tuesday's aftermarket trading after the regional bank disclosed a rise in deposits in recent weeks. (Dow Jones)

BANKS: The Federal Reserve said its internal review of the supervision and regulation of failed lender Silicon Valley Bank will be released on Friday at 11 a.m. New York time. (BBG)

BANKS: Two Republican lawmakers are seeking more information on the collapse of Silicon Valley Bank, citing frustration with the Federal Reserve Bank of San Francisco’s initial explanations for the failure. (BBG)

BANKS: Months before Silicon Valley Bank and Signature Bank collapsed, US financial regulators received warnings about how the industry’s mounting unrealized losses had the potential to spark a crisis. (BBG)

EQUITIES: Google parent Alphabet Inc. reported first-quarter results that exceeded analysts’ estimates, as the company’s dominant search business weathered the economic downturn and its cloud unit turned a profit for the first time. (BBG)

EQUITIES: Microsoft Corp.’s third-quarter profit and sales surpassed projections, fueled by resilient corporate demand for its mainstay cloud-computing software and services. Shares jumped 5% in late trading. (BBG)

EQUITIES: Short interest on the Nasdaq rose 0.6% in the first half of April, the exchange said on Tuesday. (RTRS)

OTHER

GLOBAL TRADE: South Korean President Yoon Suk Yeol said on Tuesday the South Korean-U.S. alliance must "leap into a new phase" to overcome complex crises together. Speaking a day before a Washington summit with President Joe Biden, Yoon told an event hosted by the U.S. Chamber of Commerce the bilateral security alliance should "evolve into a supply chain and future-oriented, innovative technology alliance." (RTRS)

GLOBAL TRADE: John Kirby, National Security Council coordinator for strategic communications, said on Tuesday that South Korea and the United States will "coordinate" their chip investments when asked of a Financial Times report that Washington requested Seoul not to fill in any market gap if Beijing bans a US memory chipmaker from selling chips. (Korea Herald)

GLOBAL TRADE: Russian Foreign Minister Sergei Lavrov on Tuesday said the situation related to the Black Sea grain deal had reached a deadlock, adding there were still obstacles blocking Russian exports. (RTRS)

GLOBAL TRADE: Russian Foreign Minister Sergei Lavrov on Tuesday said U.N. Secretary-General Antonio Guterres had sent a letter to President Vladimir Putin regarding the Black Sea grain deal and that there would be a reaction in due course. (RTRS)

U.S./CHINA: A group of nine Republican senators on Tuesday urged the Biden administration to impose sanctions on Huawei Cloud and other Chinese cloud service providers, citing national security concerns, according to a letter seen by Reuters. (RTRS)

U.S./CHINA/TAIWAN: Florida Gov. Ron DeSantis, a potential Republican presidential candidate, said Tuesday that deterrence was the key to preventing a conflict in the Taiwan Strait. (Nikkei)

U.S./CHINA/TAIWAN: Washington is expected to continue its narrative war against Beijing by mobilising allies to portray Taiwan as a global issue, according to observers in mainland China. (SCMP)

CHINA/TAIWAN: China's Taiwan Affairs Office said on Wednesday that authorities will be prepared and will be on high alert for any harm to China's sovereignty and territory, following media reports of EU calls for navy patrols in the Taiwan Strait. (RTRS)

CHINA/TAIWAN: Taiwan's annual Han Kuang military drills this year will focus on combating a blockade of the island and preserving the fighting ability of its forces, the defence ministry said on Wednesday. (RTRS)

GEOPOLITICS: The US and the Philippines fired at a decommissioned ship in the South China Sea as part of their largest military drills to date, in a display of defense capabilities amid heightened tensions with Beijing. (BBG)

GEOPOLITICS: Australian Prime Minister Anthony Albanese said on Wednesday that Sydney will host the 2023 Quad Leaders' summit on May 24, the third in-person meeting of the leaders of Australia, the United States, India and Japan. (RTRS)

BOJ: Bank of Japan Governor Kazuo Ueda said on Wednesday the central bank's response to cost-push inflation would depend on economic conditions. (RTRS)

JAPAN: Japan’s Financial Services Agency has urged banks to check their readiness to respond to risks from social media and internet banking after the collapse of several US banks, according to people familiar with the regulator’s thinking. (BBG)

AUSTRALIA: Inflation is still “unacceptably high,” Treasurer Jim Chalmers said, adding the May 9 budget will provide targeted cost-of-living relief to households, address supply-side problems and invest in future growth. “Our plan for inflation is about providing cost-of-living relief, tackling the supply chain challenges that were left to us and getting wages growing again in a responsible way, while demonstrating spending restraint,” he said. (BBG)

AUSTRALIA: Australia on Wednesday proposed to extend a price cap on natural gas until at least mid-2025 but relax the rule for big producers if they agree on domestic supply commitments and small producers who pump gas only for the local market. (RTRS)

RBA: An overhaul of the Reserve Bank of Australia recommended by an independent review is unlikely to have a significant impact on policy and it’s unclear whether the changes are even required, according to AMP Capital Markets’ Shane Oliver. (BBG)

RBNZ: The Reserve Bank's decided to loosen the loan to value ratio (LVR) restrictions. The move was announced by Deputy Governor and head of financial stability Christian Hawkesby on Wednesday and comes ahead of the release of the central bank's latest six-monthly Financial Stability report next week (May 3). (Interest NZ)

NORTH KOREA: Yoon, a conservative, takes a more hard-line approach to North Korea than his predecessor, Moon Jae-in, and then-President Donald Trump, both of whom tried to engage in diplomacy with North Korean leader Kim Jong Un. Though he has offered North Korea economic incentives in exchange for concrete steps toward denuclearization, Yoon said it was “unrealistic” to expect a deal with the North anytime soon. (NBC)

TURKEY: Turkish President Recep Tayyip Erdogan suffered an unexpected health issue late Tuesday evening during a live television interview, which abruptly stopped broadcasting before he returned to the program for a short period, saying he was experiencing an upset stomach. (BBG)

MEXICO: Mexico’s central bank will consider halting its cycle of interest rate hikes in the next board meeting in May, Governor Victoria Rodriguez Ceja told lawmakers on Tuesday, confirming the bank’s record monetary policy tightening is nearing an end. (BBG)

BRAZIL: Brazil President Luiz Inacio Lula da Silva is seeking advice from Spain’s Labor Minister Yolanda Diaz to increase workers rights and a clamp down on delivery apps, as he mulls employee-friendly changes to the country’s labor laws. (BBG)

BRAZIL: Brazilian Finance Minister Fernando Haddad said on Tuesday that his picks for central bank directors will be submitted to the Senate for approval as soon as President Luiz Inacio Lula da Silva returns to Brazil. (RTRS)

RUSSIA: Russian Foreign Minister Sergei Lavrov on Tuesday said he was not involved in talks on any potential prisoner swap, after he was asked about detained Wall Street Journal reporter Evan Gershkovich. (RTRS)

RUSSIA: No one needs World War Three, Lavrov said, "but it seems someone is ready to go to the very end." (RTRS)

RUSSIA: Russian President Vladimir Putin’s decree, placing Russian subsidiaries of Unipro (indirectly owned by the German government) and Fortum under administrative receivership, has no relation to property rights, the Russian Federal Agency for State Property Management (Rosimushchestvo) has said. "The decree has no relation to ownership, and the owners are not stripped of their assets. The administrative receivership is temporary and it means that the initial owner no longer has the right to take management-related decisions," the governmental agency said on Tuesday. "The administrative receiver will be vested with powers that allow him to ensure the efficacy of the enterprise’s operations, given their importance for the economy of Russia," it said. Rosimushchestvo said the list of companies under external management may be expanded if necessary. (TASS)

RUSSIA/OIL: Russia’s government is considering cutting subsidies to the nation’s oil refineries as it looks for ways to limit spending amid the costly war in Ukraine, according to people familiar with the matter. (BBG)

SOUTH AFRICA: South Africa’s electricity crisis is expected to add materially to headline inflation this year, the central bank said. (BBG)

SOUTH AFRICA: The former head of South Africa’s state power utility said he probably underestimated when he put the amount of money that’s being stolen from the company at 1 billion rand ($55 million) a month. (BBG)

SOUTH AFRICA: South Africa’s governing African National Congress contradicted a statement by President Cyril Ramaphosa that the party had decided the country should withdraw from the International Criminal Court. (BBG)

COLOMBIA: The Colombian lower house’s committee on health, pension and labor issues approved the text of the government’s health reform that lawmakers will discuss in the coming weeks. (BBG)

COLOMBIA: Colombian President Gustavo Petro asked his cabinet to resign ahead of a likely reshuffle, Blu Radio said Tuesday night, without saying how it obtained the information. (BBG)

CHILE/METALS: Chile’s government gave the clearest sign yet that the state will play an active role in deciding how some of the world’s biggest lithium deposits will be developed in partnership with the private sector. (BBG)

ARGENTINA: Argentina's Economy Minister Sergio Massa said on Tuesday the country would use all its tools to put in order an "atypical situation" related to what he described as "rumors and false reports" weighing on financial instruments linked to the dollar. (RTRS)

ARGENTINA/IMF: The International Monetary Fund (IMF) said on Tuesday its technical staff is working with Argentine authorities to strengthen the economic program agreed with country in the context of a severe drought that is hurting the key grains sector. (RTRS)

LATAM: A summit of Latin American and Caribbean leaders to discuss joint measures against inflation, hosted by Mexico and scheduled to take place May 6 to 7, has been postponed. (BBG)

IRAN: Russian Foreign Minister Sergei Lavrov on Tuesday said attempts to add "new requirements" to the original 2015 Iranian nuclear deal were complicating the process of reviving it. (RTRS)

WORLD BANK: World Bank Chief Economist Indermit Gill is calling for new approaches to address the mounting debt crisis facing many countries, including steps to factor domestic borrowing into assessment of a country's debt sustainability. (RTRS)

BANKS/CREDIT: UBS Group AG credit strategists say the pace of lending following March’s banking crisis looks “concerning,” unless issuance of commercial and industrial loans, corporate debt and asset-backed securities improves soon. (BBG)

BANKS/BONDS: Raiffeisen Schweiz became the first Swiss lender to test the euro bond market by selling a riskier class of senior notes since the collapse of Credit Suisse Group AG last month dented the country’s appeal for debt investors. (BBG)

BONDS: Japan's Sumitomo Life Insurance company plans to increase the balance of unhedged foreign bond holdings by several hundreds of billion yen this fiscal year, after reducing its balance last fiscal year, the company’s chief fund manager said on Wednesday, adding changes to the YCC will likely occur in H2 of the fiscal year. (MNI)

ENERGY: About 80 companies have signed up to the EU’s platform for joint natural gas purchases that launched on Tuesday, as senior officials warned the bloc should not accept high prices as a “new normal” for consumers. (FT)

FOREX: Russian Foreign Minister Sergei Lavrov on Tuesday said the transition to non-dollar currencies was "unstoppable". (RTRS)

FOREX: Billionaire investor Stanley Druckenmiller is betting against the US dollar as his only high-conviction trade in what he believes is the most uncertain environment for markets and the global economy in his 45-year career. (FT)

CHINA

ECONOMY: Shandong province Q1 GDP grew by 4.7% y/y, with industrial output expanding strongly at 5.9%, according to the 21st Century Herald. (MNI)

PROPERTY: China has announced it will implement a unified real estate registration and rights system according to Xinhua news agency. (MNI)

FISCAL: China's local governments issued a net 529.9 billion yuan ($76.44 billion) in special bonds in March, the finance ministry said on Wednesday, quickening from the previous month's issuance amid efforts to bolster economic growth. (RTRS)

PROPERTY: The speed of banks’ mortgage approvals has accelerated for both new house and a second-hand house buyers, a sign that China may ease curbs on real estate market, China Business News reported, citing some buyers and unidentified sources in the industry. (BBG)

BANKS: Some medium and small-sized banks in China have lowered their deposit rates recently, and this will help ease pressure on lenders’ net interest margins and aid economic recovery in a long run, the Economic Daily said in a commentary. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY132 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY95 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY63 billion after offsetting the maturity of CNY32 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0459% at 09:28 am local time from the close of 2.0444% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, the same as the close on Monday

PBOC SETS YUAN CENTRAL PARITY AT 6.9237 WEDS VS 6.8847 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9237 on Wednesday, compared with 6.8847 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA Q1 CPI +7.0% Y/Y; MEDIAN +6.9%; Q4 +7.8%

AUSTRALIA Q1 CPI +1.4% Q/Q; MEDIAN +1.3%; Q4 +1.9%

AUSTRALIA Q1 TRIMMED MEAN CPI +6.6% Y/Y; MEDIAN +6.7%; Q4 +6.9%

AUSTRALIA Q1 TRIMMED MEAN CPI +1.2% Q/Q; MEDIAN +1.4%; Q4 +1.7%

AUSTRALIA Q1 WEIGHTED MEDIAN CPI +5.8% Y/Y; MEDIAN +5.9%; Q4 +5.6%

AUSTRALIA Q1 WEIGHTED MEDIAN CPI +1.2% Q/Q; MEDIAN +1.3%; Q4 +1.6%

AUSTRALIA MAR CPI +6.3% Y/Y; MEDIAN +6.5%; FEB +6.8%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 78.0; PREV 77.2

Consumer confidence remained below 80 for the eighth week in a row. This streak represents more weeks of confidence being below 80 than over the whole of 2020-22, revealing the effects of ongoing inflation and the adjustment to restrictive monetary policy. All housing cohorts now have confidence below 80 for the first time since mid-March, after the RBA’s most recent rate hike. Financial confidence was up a little compared to last week, while economic confidence was down. The ‘time to buy a major household item’ subindex jumped 5.6pts but remained below 70 for an 11th week. (ANZ)

NEW ZEALAND MAR TRADE BALANCE -NZ$1.273BN; FEB -NZ$796MN

NEW ZEALAND MAR EXPORTS NZ$6.51BN; FEB NZ$5.06BN

NEW ZEALAND MAR IMPORTS NZ$7.78BN; FEB NZ$5.86BN

NEW ZEALAND MAR 12-MONTH YTD TRADE BALANCE -NZ$16.398BN; FEB -NZ$15.718BN

NEW ZEALAND MAR ANZ TRUCKOMETER HEAVY +2.7% M/M; FEB -0.7%

The Light Traffic Index (LTI) rose 4.6% in March, while the Heavy Traffic Index (HTI) rose 2.7%. Q1 traffic data will be cyclone affected, but it is suggesting a small lift in activity in the quarter, consistent with our forecast. (ANZ)

SOUTH KOREA APR CONSUMER CONFIDENCE 95.1; MAR 92.0

MARKETS

US TSYS: Curve Flattens In Asia

TYM3 deals at 115-22+, -0-03, with a 0-05+ range observed on volume of ~90k.

- Cash tsys sit 2bps cheaper to 1bp richer across the major benchmarks. The curve has twist flattened pivoting on 20s.

- Firmer US Equity Futures which was linked to strong earnings from Alphabet & Microsoft, as well as encouraging deposit stabilisation at PacWest saw tsys cheapen in early dealing.

- Softer than expected CPI data from Australian facilitated a recovery off session lows in tsys.

- Narrow ranges with little follow through on moves were observed for the remainder of the session.

- On the flow side 4 block buys in the FVM3 111.00 calls (+10K in total) headlined.

- In Europe today Riksbank’s Monetary Policy Decision headlines. Further out we have Durable Goods Orders and the latest 5 Year Supply.

JGBS: Futures Pushing Back Towards Overnight Highs After Lunch

JGB futures move back towards Tokyo morning bests, +33 compared to settlement levels, but remain below the overnight high of 148.16. At 148.07, JBM3 sits comfortably above the range of 147.40-147.92, which it has traded in since early April. Moreover, the recent move above the 20-day EMA at 147.65 now draws attention towards the Mar 22 high of 149.53, according to MNI's technical analyst.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments from BoJ Governor Ueda re: the government’s debt servicing costs.

- Cash JGBs are 0.1 cheaper to 3.7bp richer across the curve with the 1-year zone the weakest and the 20-30-year zone the strongest. The benchmark 10-year yield is 1.9bp richer at 0.460%.

- A lack of enticing value and uncertainty re: BoJ monetary policy outlook appears to have weighed on today’s 2-year auction with the cover ratio slipping to its lowest level since August’s auction.

- Swaps twist flattening in the morning session gives way to a curve flattening in the afternoon session. Swap spreads are mixed out to the 10-year zone with spreads wider beyond.

- Looking ahead, the local calendar is light until Friday’s release of Tokyo CPI, Retail Sales and Industrial Production data, ahead of the BoJ Policy Decision on the same day.

JGBS AUCTION: 2-Year JGB Auction Results

The Japanese Ministry Of Finance (MOF) sells Y2.3700tn 2-Year JGBs, opening JB#448:

- Average Yield: -0.042% (prev. -0.063%)

- Average Price: 100.095 (prev. 100.136)

- High Yield: -0.037% (prev. -0.057%)

- Low price: 100.085 (prev. 100.125)

- % Allotted At High Yield: 74.5093% (prev. 6.3374%)

- Bid/Cover: 3.705 (prev. 3.892x)

AUSSIE BONDS: Sharply Stronger After Core CPI Prints Below Estimates

ACGBs are trading strongly higher (YM +18.0 & XM +13.5), just off their intraday highs, after trimmed mean CPI prints below consensus estimates. Although the headline inflation rate was slightly higher than anticipated, the market is likely to interpret the data as a sign that inflation has peaked, reducing the likelihood of the RBA resuming its tightening cycle at the May meeting. However, persistent domestically driven inflation, which indicates excess demand in the economy, implies that further tightening by the RBA may be required down the line.

- Cash ACGBs are 14-19bp richer on the day and 3-6bp stronger than pre-data levels. The 3/10 cash curve is 5bp steeper with the AU-US 10-year yield differential -4bp at -10bp.

- Swap rates are 13-16bp lower with EFPs 2bp wider.

- Bills are 12-21 richer with the strip flatter.

- RBA dated OIS pricing is 4-9bp softer versus pre-data levels with a daily softening of 17-21bp for meetings beyond July.

- The local calendar sees second-tier releases for the remainder of the week with Export and Import Prices tomorrow and Private Sector Credit and PPI data on Friday.

- The local market is therefore expected to concentrate more closely on the fluctuations in US Tsys as it continues to navigate US corporate earnings.

NZGBS: Richer But Underperforms $-Bloc

NZGBs strengthened 10-13bp at the close, resulting in a 3bp steeper 2s10s cash curve. NZGBs caught up with the two-day richening in US Tsys since the local market close before yesterday's ANZAC day holiday. Although morning strength waned, NZGBs rebounded to close near session highs after ACGBs strengthened in response to lower-than-expected core CPI data. However, NZGBs underperformed in comparison to the $-Bloc with the 10-year yield differentials for NZ/US and NZ/AU both 5bp wider compared to Monday's close.

- Swap rates closed 12-13bp lower with implied swap spreads marginally tighter at the long-end.

- RBNZ dated OIS closed with pricing 5-10bp softer for meetings beyond May with terminal OCR expectations at 5.48% versus 5.52% at Monday’s close.

- The local calendar sees ANZ Business scheduled for release tomorrow and Consumer Confidence on Friday.

- The RBNZ proposed changes to the LVR restrictions in a statement on its website saying that house prices have fallen to a level that is more consistent with medium-term fundamentals. Accordingly, the risk to financial stability posed by high-LVR lending has been reduced.

- The NZ Treasury announced that it plans to sell NZ$1.6bn of NZGBs in May with each weekly auction being NZ$400mn.

EQUITIES: Regional Markets Tracking Lower, Firmer US Tech Futures Provide Some Offset

Regional equities are mostly lower, apart from some pockets of strength in HK related to firmer tech related equities. US futures are higher, largely thanks to better earnings guidance from Alphabet and Microsoft late in Tuesday trade in the US. Nasdaq futures lead the way, +1.25%, although we are slightly away from best levels. Eminis are also higher, +0.40% at this stage. Still, regional financial/banking stocks are weaker following sharp falls in this space during the US Tuesday session.

- The HSI is up around 0.60% at this stage, with the tech index up 1.34%. This would be the sub-index's first gain in 7 sessions. Some positive spill over from the US futures move is likely at play. Recent lows also came close to mid-March lows, so technical related support may also be evident.

- Onshore China equities are down modestly, while north bound stock connect flows are +2.27bn yuan, on track for the first lot of inflows since Thursday last week. Onshore media reported that housing curbs may be eased further, and that deposit rate cuts are unlikely to hurt investors. Neither story appeared to shift equity sentiment though.

- Japan stocks have been underperformers, the Topix off 1.15%, with the bank sub-index down as much as 2.4%. This is likely carry over from weakness in US bank stocks on Tuesday.

- The Kospi and Taiex are tracking modestly lower, with some offset likely coming from higher US tech futures.

- Indonesian stocks are higher, +0.55% for the JCI, one of the few bright spots.

GOLD: Bullion Benefiting From Growth Fears

Gold prices are down 0.1% during the APAC session after rising 0.4% on Tuesday on lower US yields. It has benefited this week from global growth related flight to quality flows. Bullion has been trending down today after reaching a peak of $2002.56/oz earlier and are now $1995.54, close to the intraday low. They have been struggling to hold breaks above $2000. The USD index has been trading sideways.

- Resistance remains at $2015.10, the April 17 high.

- The market is waiting on some clarification on what the Fed is likely to do at its May 3 meeting from Q1 GDP (Thursday), PCE data and employment cost index (Friday), all due before the end of the week. Better gold prices indicate that market participants feel that the Fed is close to pausing.

- Later there are preliminary US durable goods orders for March. The headline is expected to rise 0.7% m/m while the core orders should fall slightly.

OIL: Prices Higher, Waiting For Key Information Later In The Week

Oil prices are moderately higher during APAC trading after falling sharply on Tuesday, as growth concerns came to the fore. WTI is up 0.4% to $77.48/bbl and Brent +0.4% to $81.07. The USD index has been trading sideways.

- Almost the entire post-OPEC+ output cut announcement has been unwound on US recession fears and disappointing demand from China. WTI is holding above $77 with today’s intraday low at $77.01 and the high at $77.54. Brent has moved above $81 following an intraday low of $80.57 and is close to its high of $81.14.

- The market is waiting on some clarification on what the Fed is likely to do on May 3 from Q1 GDP, PCE data and employment cost index, all due before the end of the week. Analysts currently expect a further 25bp hike. Also large oil companies report Q1 earnings on Friday.

- Later there is EIA official US inventory data. The API reported a large crude drawdown of 6.1mn barrels, according to Bloomberg. There are also preliminary US durable goods orders for March.

FOREX: AUD Pressured As Inflation Eases

AUD is the weakest performer in the G-10 space at the margins today. Trimmed Mean CPI printed 6.6% Y/Y below the expected 6.7% easing from 6.9% in Q4 2022. March CPI rose 6.3% Y/Y below the expected 6.5% and Q1 Headline CPI was a touch firmer than expected at 7.0% easing from 7.8% in Q4 2022.

- AUD/USD prints at $0.6600/05, down ~0.3% today and the pair currently prints at session lows. Support is seen at support at $0.6590 low from 15 March.

- Kiwi is a touch softer, NZD/USD was up ~0.2% however spillover pressure from the Australian CPI print has seen the NZD pare its gains to sit a touch below yesterday's closing levels.

- Yen is a touch firmer, USD/JPY is ~0.2% softer last printing at ¥133.50/60. Yesterday's lows remain intact for now, we currently sit a touch above the 20-Day EMA (¥133.48) and the next downside support is ¥132.02 the low from Apr 13.

- Elsewhere in G-10 ranges have been narrow with little follow through.

- Cross asset wise BBDXY is little changed today and e-minis are ~0.4% firmer. 2 Year US Treasury Yields are ~2bps higher.

- In Europe today Riksbank’s Monetary Policy Decision headlines. Further out we have US Durable Goods Orders and the minutes from the Bank of Canada's latest meeting.

FX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-55(E2.4bln), $1.0900(E2.7bln), $1.0930-50(E4.8bln), $1.0955-60(E1.2bln), $1.0970-75(E1.2bln), $1.1000(E1.5bln), $1.1035-45(E1.7bln)

- USD/JPY: Y130.00($1.1bln), Y132.25-30($585mln), Y133.00($585mln), Y135.00($1bln), Y135.30-50($747mln)

- GBP/USD: $1.2400-10(Gbp670mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CNY: Cny6.90($558mln), Cny6.9250($553mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/04/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/04/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 26/04/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 26/04/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/04/2023 | 1200/1400 |  | EU | ECB de Guindos Panels Delphi Economic Forum | |

| 26/04/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/04/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/04/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.