-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Looks To Curb Yield Rise, Yen Underperforms

EXECUTIVE SUMMARY

- BOJ SLOWS RISE IN BOND YIELDS WITH UNSCHEDULED BUYING OPERATION - BBG

- CHINA’S FACTORY ACTIVITY EXTENDS DECLINE, FIRMING CASE FOR STIMULUS - RTRS

- CHINA’S BIG CITIES MAY EASE PROPERTY RESTRICTIONS SOON: PAPER - BBG

- ECB COULD HIKE AGAIN EVEN AFTER PAUSE, LAGARDE TELLS LE FIGARO - BBG

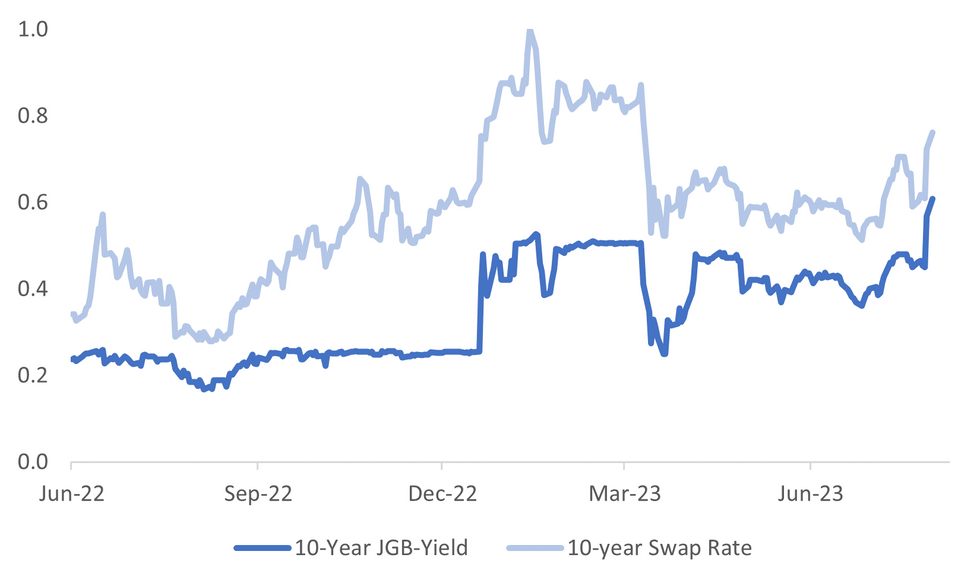

Fig. 1: Japan 10-Year JGB Yield Vs. 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

U.K.

ENERGY: UK Prime Minister Rishi Sunak will outline plans to bolster energy security on a visit Monday to Scotland amid growing disagreement over the government’s broader environmental policies. (BBG)

EUROPE.

ECB: Any pause at an European Central Bank monetary-policy meeting could be followed by another increase in interest rates, according to President Christine Lagarde. At the next meeting in September, “there could be a further hike of the policy rate or perhaps a pause,” she told Le Figaro newspaper. “A pause, whenever it occurs, in September or later, would not necessarily be definitive.” (BBG)

RUSSIA/UKRAINE: Former Russian President Dmitry Medvedev, who has sometimes raised the spectre of a nuclear conflict over Ukraine, said on Sunday that Moscow would have to use a nuclear weapon if Kyiv's ongoing counter-offensive was a success. (RTRS)

U.S.

ECONOMY: The Teamsters said on Sunday that the union was served a notice that Yellow Corp is ceasing operations and filing for bankruptcy. "Yellow has historically proven that it could not manage itself despite billions of dollars in worker concessions and hundreds of millions in bailout funding from the federal government," Teamsters General President Sean M O’Brien said in a statement. (RTRS)

OTHER

JAPAN: The Bank of Japan waded into the market Monday with an unscheduled bond-purchase operation as yields on benchmark 10-year debt climbed to a fresh nine-year high following last week’s policy adjustment. (BBG)

JAPAN: Japan industrial output rose 2.0% m/m in June, the first rise in two months, following a 2.2% decline in May due to higher production for motor vehicles, electronic parts and devices, and general-purpose and business oriented machinery, data released by the Ministry of Trade and Industry showed on Monday. (MNI)

JAPAN: Japan’s spot power price rose 15% from a week earlier as hot weather was seen prevailing throughout the week, raising demand for cooling and putting pressure on generation. (BBG)

NEW ZEALAND: NZ Treasury comments in consultation paper on the funding approach to the deposit insurance scheme.Says appropriate size of insurance fund should be 0.5 - 1.1% of protected deposits, or NZ$600m - NZ$1.4b. (BBG)

CHINA

ECONOMY: China's manufacturing activity fell for a fourth straight month in July, albeit at a slower pace, an official factory survey showed on Monday, reinforcing the need for further policy support to boost domestic demand. The official purchasing managers' index (PMI) was at 49.3 from 49.0 in June, according to data from the National Bureau of Statistics, staying below the 50-point mark that separates expansion from contraction. The outcome also just beat a forecast of 49.2. (RTRS)

POLICY: China will guide financial institutions to boost support for sectors including hospitality and catering, tourism and healthcare while for reasonable increase in consumption credit, according to a plan issued by the pushing State Council. (BBG)

PROPERTY: First-tier cities will release detailed measures soon to prop up the property market in response to top policymakers’ call to adjust housing policies. Tier-one cities including Beijing, Shenzhen and Guangzhou said during the weekend they will support home purchases to meet essential dwelling demand and needs for better housing. Analysts expect tier-one cities may adopt “one district one policy” rules to relax local housing markets gradually as the principle of “housing is for living, not for speculation” remains. (Yicai)

PROPERTY: Authorities in cities including Beijing and Shenzhen have vowed to follow through on the Politburo’s pledge to optimize China’s property policies, suggesting easing measures are on the way, the Securities Times reports Monday. (BBG)

MARKETS: There “isn’t a big possibility in the short term” for Ant Group’s listing, state-backed China News Service reported Saturday, citing unidentified people close to the regulators. (BBG)

CAPITAL MARKETS: Authorities should focus on strengthening investment by developing capital market, following the Politburo meeting’s latest call to “activate the capital market and boost investor confidence”, said China Securities Journal in a front-page commentary. (MNI)

NDRC: Policymakers will accelerate the use of investment funds to increase the country’s physical workload to deal with insufficient domestic demand, hidden risks and a complex external environment, according to the National Development and Reform Commission. At a recent NDRC meeting, leaders said policy support in future will focus on expanding consumption and investment and reactivating private investment while utilising the guiding role of government investment. (MNI)

CHINA MARKETS

PBOC Net Injects CNY17 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted CNY31 billion via 7-day reverse repos on Monday with the rate unchanged at 1.90%. The operation has led to a net injection of CNY17 billion after offsetting the maturity of CNY14 billion reverse repo today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9607% at 10:27 am local time from the close of 1.8152% on Friday.

- The CFETS-NEX money-market sentiment index closed at 50 on Friday, compared with the close of 44 on Thursday.

PBOC Yuan Parity At 7.1305 Monday Vs 7.1338 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1305 on Monday, compared with 7.1338 set on Friday. The fixing was estimated at 7.1532 by BBG survey today.

OVERNIGHT DATA

JAPAN JUNE RETAIL SALES M/M -0.4%; MEDIAN -0.7%; PRIOR 1.4%

JAPAN JUNE RETAIL SALES Y/Y 5.9%; MEDIAN 5.4%; PRIOR 5.8%

JAPAN JUNE DEPARTMENT STORE SALES Y/Y 4.1%; PRIOR 3.4%

JAPAN JUNE P INDUSTRIAL PRODUCTION M/M 2.0%; MEDIAN 2.4%; PRIOR -2.2%

JAPAN JUNE P INDUSTRIAL PRODUCTION Y/Y -0.4%; MEDIAN 0.3%; PRIOR 4.2%

JAPAN JULY CONSUMER CONFIDENCE 37.1; MEDIAN 36.2; PRIOR 36.2

JAPAN JUNE HOUSING STARTS Y/Y -4.8%; MEDIAN -0.5%; PRIOR 3.5%

NEW ZEALAND JULY ANZ ACTIVITY OUTLOOK 0.8; PRIOR 2.7

NEW ZEALAND JULY ANZ BUSINESS CONFIDENCE -13.1; PRIOR -18.0

AUSTRALIA JULY MELBOURNE INSTITUTE INFLATION M/M 0.8%; PRIOR 0.1%

AUSTRALIA JULY MELBOURNE INSTITUTE INFLATION Y/Y 5.4%; PRIOR 5.7%

AUSTRALIA JUNE CREDIT M/M 0.2%; MEDIAN 0.4%; PRIOR 0.4%

AUSTRALIA JUNE CREDIT Y/Y 5.5%; PRIOR 6.2%

CHINA JULY MANUFACTURING PMI 49.3; MEDIAN 48.9; PRIOR 49.0

CHINA JULY NON-MANUFACTURING PMI 51.5; MEDIAN 53.0; PRIOR 53.2

CHINA JULY COMPOSITE PMI 51.1; PRIOR 52.3

MARKETS

US TSYS: Cheaper In Asia

TYU3 deals at 111-06+, -0-04+, a touch off the base of the 0-10 range on volume of ~78k.

- Cash tsys sit 2-3bps cheaper across the major benchmarks, the belly is marginally leading the cheaps.

- Tsys were pressured in early dealing as spillover from JGBs weighed, losses were briefly pared after an unscheduled bond buy from the BOJ.

- Through the session tsys continued to tick lower however ranges were narrow as follow through remained limited.

- On Sunday Federal Reserve Bank of Minneapolis President Kashkari said the base case for the US was a slowing economy but avoidance of a recession.

- Eurozone CPI headlines in the European session today, further out we have Dallas Fed Mfg Activity and MNI Chicago PMI. Fedspeak from Chicago Fed President Goolsbee is also due.

JGBS: Cheaper, Sitting Just Off Worst Levels, As Market Adjusts To Tweaked YCC

In Tokyo afternoon trade, JGB futures are weaker, just off session lows, -61 compared to the settlement levels.

- In addition to retail sales that beat and industrial production that missed, housing starts data surprised to the downside with a print of -4.8% y/y in June versus +3.5% in May.

- Morgan Stanley expects “the 1y+ JGB index to extend by 0.003y in July, compared to an average month’s extension range of ~0.02-0.06y. A total of ~¥3 trillion of issuance will affect the extension and ¥3.03 trillion worth of JGBs will be reinvested.”

- The cash JGB curve has bear steepened with yields 0.8bp (1-year) to 10bp (30-year) higher in Tokyo afternoon trading as the market continues to adjust to Friday’s surprise decision to tweak YCC.

- The benchmark 10-year yield is 3.5bp higher at 0.603%. In line with the tweaked YCC, the BoJ announced bond-purchase operations of ¥300b of 5-to-10-year notes at market today.

- The swap curve also bear steepens with swap spreads tighter out to the 7-year wider beyond.

- Tomorrow the local calendar sees Jobless Rate and Jibun Bank PMI data along with 10-year supply.

AUSSIE BONDS: Richer But Pressured By JGBs Ahead Of RBA Decision Tomorrow

ACGBs (YM +2.0 & XM +3.5) sit richer but near Sydney session lows as global yields see spillover selling from another session on weakness in JGBs. JGB yields are 4-10bp cheaper beyond the 5-year zone after the BoJ surprisingly tweaked yield curve control (YCC) on Friday. While maintaining the target of 0% +/- 50bp for the 10-year JGB, the BoJ announced that the 50bp was no longer rigid up to 1%.

- US tsys are holding cheaper in today's Asia-Pac session with yields 3-4bps higher across the major benchmarks.

- Cash ACGBs are 3-4bp richer with the AU-US 10-year yield differential -1bp at +4bp.

- Swap rates are 2-3bp lower.

- The bills strip has twist flattened with pricing -2 to +3.

- RBA-dated OIS pricing is flat to 2bp firmer across meetings. The market attaches a 27% chance of a 25bp hike at tomorrow’s meeting. Terminal rate expectations currently sit at 4.33% versus 4.75% in early July.

- Tomorrow the local calendar sees the RBA Policy Decision. Bloomberg consensus expects a 25bp hike to 4.35%, but the decision is generally seen as a line ball.

NZGBS: Richer But Off Bests, Spillover From JGB Cheapening

NZGBs closed 3-5bp richer, but well off session best levels, as $-bloc yields grind higher through the session in line with another post-BoJ decision cheapening in JGBs.

- US tsys are holding cheaper in today's Asia-Pac session with yields 3-4bps higher across the major benchmarks. TYU3 deals at 111-06 (-0-05).

- Swap rates are 2-4bp lower but 5bp higher than early session lows.

- RBNZ dated OIS pricing closed flat to 4bp firmer across meetings with mid’24 leading. Terminal OCR expectations closed at 5.67%.

- The Business confidence index rose to -13.1 in July from -18 in June, according to ANZ Bank. Business confidence read is highest since September 2021. The business activity outlook index fell to 0.8 from 2.7 in June. Inflation expectations ease to 5.14% vs. 5.29%. A net 82% expect to raise wages over the next 12 months.

- Tomorrow the local calendar sees June Building Permits with tighter financial conditions still likely to weigh.

- Tomorrow's antipodean highlight however will likely be the RBA Policy Decision. Bloomberg consensus expects a 25bp hike to 4.35%, but the decision is generally seen as a line ball.

FOREX: Yen Pressured, Antipodeans Firm In Asia

The Yen is pressured in Asia, after an scheduled bond buy from the BOJ coupled with better risk sentiment in regional equities, weighed. The Antipodeans are outperforming in the G-10 space, benefitting from the aforementioned better risk sentiment.

- USD/JPY is ~0.4% firmer and has breached Friday's post BOJ highs, the pair sits at ¥140.70/80 rising ~0.8% from trough to peak in Asia.

- Kiwi is up ~0.4%, NZD/USD sits at $0.6180/85, a touch off session highs. The $0.62 handle is intact for now, the 20-Day EMA is at $0.6211.

- AUD/USD prints at $0.6670/75 up ~0.3% on Monday. Private Sector Credit grew at 0.2% M/M in June slower than the expected 0.4%.

- Elsewhere in G-10, CHF is down ~0.2%. EUR and GBP are little changed dealing in narrow ranges in Asia.

- Cross asset wise; Hang Seng is up ~1.5% and CSI300 is up ~0.8%. E-minis are down ~0.2% and BBDXY is up ~0.1%.

- In Europe today the Eurozone preliminary inflation print provides the highlight. Tomorrow in Asia we have the latest monetary policy decision from the RBA.

EQUITIES: HK Equities & China Related Bourses Higher On Further Stimulus Talk

Regional markets are mostly tracking higher, with focus again on China stimulus measures. Hong Kong markets lead the region higher. Taiwan markets have faltered, while US futures are in the red, which has likely curbed regional enthusiasm to some degree. Eminis were last just under 4600, earlier highs were at 4618, as markets tried to build on Friday's late rally in NY. Nasdaq futures are down around 0.30%, underperforming Eminis slightly.

- The HSI sits up nearly 1.5% at the break. Note we had a surge of nearly 7% in the Golden Dragon Index in Friday US trade. This followed earlier reports of the authorities reportedly asking large tech companies to provide case studies of their most successful start ups. Note the HS TECH index is up +3.24% to the break. The China Enterprise Index is +2.29% higher.

- The CSI 300 is +0.83%, with the real estate sub index up 1.29%, building on Friday's +4.38% gain. Onshore analysts stated that the authorities may ease property restrictions in large cities in the aftermath of the recent Politburo meeting. Further consumption support measures will also be announced at 3pm local time today.

- Elsewhere, Japan stocks are around 1% higher, while the Kospi is +0.80% higher. The Kosdaq is +2%. The Taiex is underperforming though in Taiwan down -0.85% at this stage. Australian stocks are also down, off around 0.30% at this stage, reversing earlier gains.

- In SEA markets are mostly higher, with Thai stocks firmer (+0.85%), playing catch up after onshore markets were closed on Friday.

OIL: Crude Down But July Was A Very Strong Month

Oil has unwound almost all of Friday’s gains in the APAC session. It is down around 0.5% with WTI at $80.14/bbl, close to its intraday low at $80.13, but holding above the important $80 level. Brent is 0.6% lower at $83.93, having only recently broken below $84. The USD is up 0.2%.

- Crude initially rose on the better-than-expected China manufacturing PMI but after WTI reached $80.57 and Brent $84.38 prices have been declining since as the composite PMI disappointed. This is despite Goldman Sachs saying that demand is at a record high. Measures to boost China’s consumption are scheduled to be announced later today.

- Brent is currently up 11.5% in July and WTI +13.3% as tighter supply and improved demand optimism have driven the rally this month.

- The Fed’s Goolsbee speaks later and the senior loan officer survey is published. The July MNI Chicago PMI and Dallas Fed surveys print. Euro area Q2 GDP & July inflation are also released. Friday’s US non-farm payroll report is the key event for crude this week.

GOLD: Slightly Softer In Asia-Pac After Strengthening on Friday After US Wage & Price Data

Gold experienced a 0.3% decline during the Asia-Pacific trading session, following a 0.7% gain that brought it to $1959.49 on Friday. The market reacted to mixed US price data, which created uncertainty about the Federal Reserve's potential rate adjustments. There are speculations about whether the US economy is overheating or experiencing a slowdown.

- There was an immediate bid for US tsys after a lower-than-estimated gain in the Employment Cost Index (1.0% vs. 1.1% est). However, rates quickly reversed the gap move as markets deemed it an overreaction to near-in-line data. Core PCE printed in line at 4.1%, with core non-housing services, the Fed’s preferred indicator, easing a tenth to 0.22% m/m.

- China also said it will announce new measures to boost consumption, which could boost gold purchases from one of the world’s biggest importers.

- The strong climb in bullion came against a background of modest USD weakness. Nonetheless, it only reversed about half of Thursday’s post-US data slump. According to MNI’s technicals team, Thursday’s low of $1942.7 now forms initial support. Resistance remains at a bull trigger of $1987.5 (Jul 20 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/07/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/07/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/07/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/07/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/07/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/07/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.