-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Rekindles Memories Of Ghost Of Christmas Past

EXECUTIVE SUMMARY

- BOJ WIDENS YCC BAND TO FACILITATE IMPROVED MARKET FUNCTIONING AFTER CONTINUED PRESSURE (MNI)

- ECB'S NAGEL PLEADS WITH GERMANS FOR PATIENCE IN COMBATING INFLATION (RTRS)

- MINUTES REVEAL RBA CONSIDERED EVERYTHING FROM NO MOVE TO 50BP HIKE IN DEC (MNI)

- HONG KONG PLANS MORE COVID EASING AS LEE HEADS TO XI MEETING (BBG)

- CHINESE BANKS’ RESERVE REQUIREMENT RATIO, LPR CAN BE CUT (CSJ)

- EU WILL SUSPEND GAS PRICE CAP IF RISKS OUTWEIGH BENEFITS (RTRS)

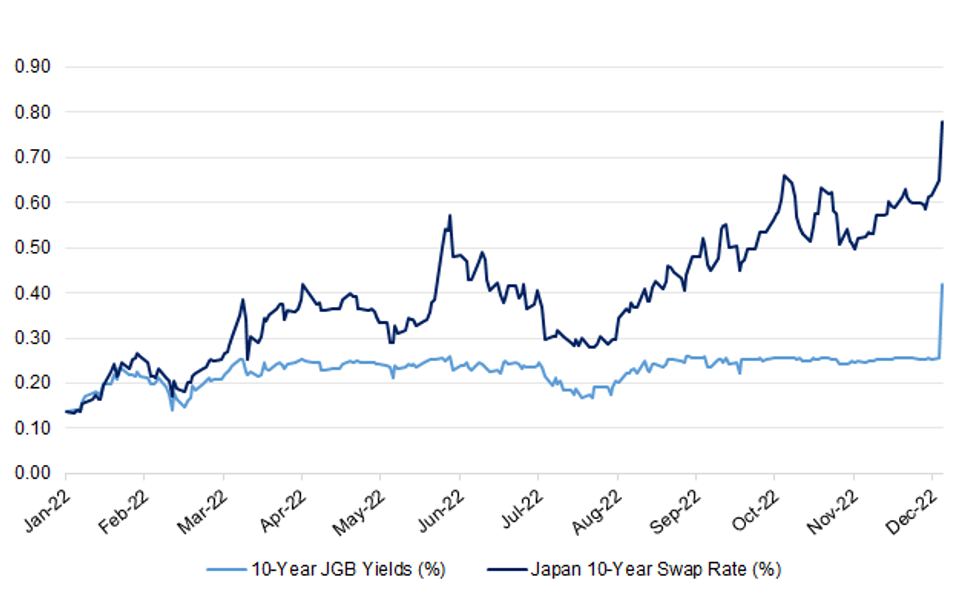

Fig. 1: 10-Year JGB Yields Vs. Japan 10-Year Swap Rate

Source: MNI - Market News/Bloomberg

UK

FISCAL: The government has extended a freeze on alcohol duty for six months. (BBC)

PROPERTY: The UK will extend its mortgage guarantee program, which helps people get on the property ladder, by one year in a bid to support the market through what the government called “difficult times.” (BBG)

EUROPE

ECB: Bundesbank President Joachim Nagel asked the German public for patience in bringing down inflation, warning in an interview with broadcaster N-TV on Thursday that the impact of rate rises could take up to two years to take effect. (RTRS)

ECB: The European Central Bank remains “a long way” from achieving its goal of inflation of 2% over the medium term, according to Governing Council Member and Bundesbank President Joachim Nagel. (BBG)

U.S.

FED: Falling inflationary pressures as supply shocks ease and fiscal stimulus is reduced should allow the Federal Reserve to conclude its tightening cycle before it prompts a recession and any big spike in unemployment, former St. Louis Fed economist David Andolfatto told MNI. (MNI)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) on Monday touted the year-end deal on an omnibus spending package as a victory for Republicans because it will boost defense spending above the rate of inflation and increase nondefense spending at a lower rate than inflation, effectively resulting in a cut. (The Hill)

POLITICS: The Jan. 6 select House committee on Monday referred former President Donald Trump to the Department of Justice for criminal investigation and potential prosecution for his efforts to overturn his loss in the 2020 election. (CNBC)

OTHER

GLOBAL TRADE: The World Trade Organization “is getting itself on very, very thin ice” by ruling that the US violated trade rules with Trump-era steel and aluminum tariffs, Trade Representative Katherine Tai said, adding that the finding “challenges the integrity of the system.” (BBG)

U.S./CHINA: The United States hopes that China can address the current COVID-19 outbreak as the toll of the virus is a concern for the whole world due to the size of the Chinese economy, State Department spokesperson Ned Price said on Monday. (RTRS)

U.S./CHINA: The Republican Party is preparing to create a new committee on China when it takes control of the U.S. House of Representatives in January, scrutinizing the Biden administration's security and economic policy choices. (Nikkei)

BOJ: The Bank of Japan board Tuesday maintained its yield curve control policy but expanded its target band for the 10-year bond yield to between plus and minus 50bp, up from 25bp. (MNI)

JAPAN: Spending by foreign and domestic travelers in Japan is increasing as the central government relaxes COVID-related restrictions. (Nikkei)

RBA: The Reserve Bank board considered pausing the official interest rate and a super-size half-point jump at its final meeting for 2022, suggesting a high degree of uncertainty about the economic outlook. (AFR)

AUSTRALIA/CHINA: Australian Foreign Minister Penny Wong said on Tuesday she will push China to lift trade sanctions, but tempered expectations of any immediate breakthrough ahead of a meeting with her Chinese counterpart as Canberra looks to mend strained diplomatic ties (RTRS)

BOK: South Korea's central bank said on Tuesday the country's consumer inflation would remain around 5% for some time and then gradually ease, but cautioned that domestic and global factors are raising uncertainty about how fast prices will slow. (RTRS)

NORTH KOREA: The sister of North Korean leader Kim Jong-un issued a statement Tuesday criticizing those who question the secretive regime's assertion of having made significant progress in its satellite and long-range missile development. (JoongAng Daily)

NORTH KOREA: North Korea on Tuesday condemned Japan’s planned military build-up outlined in Tokyo’s new security strategy, vowing to show with action how dangerous it is, state media said. (SCMP)

HONG KONG: Hong Kong will further ease social distancing measures including rules on banquets, the city’s leader said before a trip to Beijing. (BBG)

BOC: The Bank of Canada announced Monday that it would increase limits for overnight repo operations to C$1 billion for eligible participants. (BBG)

MEXICO: Mexico’s state oil company Pemex announced in a statement it created a sustainability committee to coordinate and supervise the company’s strategy in sustainability projects. (BBG)

BRAZIL: Brazil’s incoming Lula Administration is willing to negotiate with lawmakers to obtain the approval of its Transition amendment bill, said future Minister of Finance Fernando Haddad to journalists, according to audio shared by his press office. (BBG)

RUSSIA: Russian President Vladimir Putin and his Belarusian counterpart extolled ever-closer ties on Monday as Putin visited Minsk for the first time since 2019, hardly mentioning the war raging in nearby Ukraine at a joint news conference. (RTRS)

RUSSIA: President Vladimir Putin on Monday ordered the strengthening of Russia's borders and instructed special services to keep control of mass gatherings and ensure the safety of people in regions in Ukraine that Moscow claims as its own, agencies reported. (RTRS)

GAS: The European Commission stands ready to suspend a gas price cap agreed by European Union countries, if an analysis by regulators shows the risks of the measure outweigh the benefits, the bloc's energy commissioner said on Monday. (RTRS)

ENERGY: The Intercontinental Exchange said it will assess whether it can continue to operate fair and orderly markets for TTF gas hub trading from the Netherlands after a European Union agreement on a gas price cap. (RTRS)

ENERGY: In a statement, Kremlin spokesman Dimitri Peskov called the cap "unacceptable" and said it was an attack on market pricing. (BBC)

OIL: TC Energy’s restart plan for the shuttered Keystone pipeline is under review, the Pipeline and Hazardous Materials Safety Administration says in an emailed statement Monday. (BBG)

OIL: North Dakota has ~300k b/d of production off-line after a winter storm last week and the recovery from shutdowns will require “a few weeks” because of cold weather, state’s Department of Mineral Resources Director Lynn Helms says in webcast. (BBG)

CHINA

CORONAVIRUS: Asymptomatic Covid patients and mild cases can still go to work, depending on their health conditions, Chongqing city government says in a Weibo post on Sunday. (BBG)

ECONOMY: China picks six cities including Guangzhou and Hangzhou to test more reform and opening up measures in the service sector, according to a statement on the central government website. (BBG)

ECONOMY: The World Bank again cut its forecasts for China’s economic growth for this year and next, saying the outlook is “subject to significant risks, stemming from the uncertain trajectory of the pandemic, of how policies evolve in response to the Covid-19 situation, and the behavioral responses of households and businesses.” (BBG)

PBOC: China's reference lending rate remained unchanged on Tuesday, according to a statement on the People's Bank of China website, which was in line with market expectations after the central bank kept a key policy rate steady last Thursday. (MNI)

PBOC: Liquidity conditions in China’s interbank market are likely to remain tight the rest of 2022 on a range of factors, including tax payments by companies, the Shanghai Securities News reported, citing analysts. (BBG)

PBOC: China can still cut banks’ reserve requirement ratio at a suitable time next year to provide them with long-term funds and send a signal to the market on stabilizing growth, China Securities Journal reported Tuesday, citing MUCFC analyst Dong Ximiao. (BBG)

EQUITIES: Securities regulators in Hong Kong and the mainland have agreed to expand the scope of the Stock Connect program, according to a statement on the China Securities Regulatory Commission (CSRC) website. (MNI)

PROPERTY: China should increase policy efforts and aim to achieve a soft landing in the real estate market next year, and reversing expectations is the key, Yicai.com reported citing Ni Pengfei, director of the Center for City and Competitiveness at the Chinese Academy of Social Sciences. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY144 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY5 billion via 7-day reverse repos, and CNY141 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY144 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operations aim to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8402% at 9:34 am local time from the close of 1.7772% on Monday.

- The CFETS-NEX money-market sentiment index closed at 51 on Monday vs 46 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9861 TUES VS 6.9746 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9861 on Tuesday, compared with 6.9746 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 82.5; PREV 82.9

Consumer confidence declined by 0.4pts last week to 82.5, ending 2022 almost 30pts below the long-term average. Over the past four weeks, confidence has steadied within a narrow range in the low-80s. (ANZ)

NEW ZEALAND DEC ANZ BUSINESS CONFIDENCE -70.2; NOV -57.1

NEW ZEALAND DEC ANZ BUSINESS ACTIVITY OUTLOOK-25.6; NOV -13.7

Well, if the Reserve Bank was going for shock value, they appear to have gotten it. The fall in business confidence is certainly dramatic, but while it’s at a fresh record low, it would be incorrect to read this as an indication that any recession is likely to be unusually severe. (ANZ)

MARKETS

SNAPSHOT: BoJ Rekindles Memories Of Ghost Of Christmas Past

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 799.19 points at 26438.45

- ASX 200 down 109.568 points at 7024.3

- Shanghai Comp. down 27.629 points at 3080.034

- JGB 10-Yr future down 176 ticks at 146.10, yield up 18.7bp at 0.442%

- Aussie 10-Yr future down 20.5 ticks at 96.250, yield up 19.4bp at 3.727%

- U.S. 10-Yr future down 0-22 113-14+, yield up 10.36bp at 3.6882%

- WTI crude up $0.31 at $75.50, Gold up $0.93 at $1788.55

- USD/JPY down 365 pips at Y133.26

- BOJ WIDENS YCC BAND TO FACILITATE IMPROVED MARKET FUNCTIONING AFTER CONTINUED PRESSRE (MNI)

- ECB'S NAGEL PLEADS WITH GERMANS FOR PATIENCE IN COMBATING INFLATION (RTRS)

- MINUTES REVEAL RBA CONSIDERED EVERYTHING FROM NO MOVE TO 50BP HIKE IN DEC

- HONG KONG PLANS MORE COVID EASING AS LEE HEADS TO XI MEETING (BBG)

- CHINESE BANKS’ RESERVE REQUIREMENT RATIO, LPR CAN BE CUT (CSJ)

- EU WILL SUSPEND GAS PRICE CAP IF RISKS OUTWEIGH BENEFITS (RTRS)

US TSYS: BoJ Policy Tweaks Applies Notable Pressure, Triggers Huge Volume

The BoJ’s YCC tweak (outlined elsewhere) has loosened what is arguably the final remaining anchor for global duration, which pressured wider core global FI markets during the Asia-Pac session.

- That leaves the major cash Tsy benchmarks running 1.5-10.0bp cheaper into London hours, bear steepening. TYH3 is -0-18+ at 112-18, 0-06+ off the base of its 0-26 range, on outstanding volume of ~365K.

- Modest two-way gyrations had been observed pre-BoJ as Asia-Pac participants set up for the event and adjusted to Monday’s wider price action.

- A flurry of screen sales dominated post-meeting, with a block sale of TY futures also observed (-2,023).

- BoJ Governor Kuroda’s post-meeting press conference will dominate into London hours. ECB speak will then headline after the London handover, while building permits and housing starts data provides the most notable round of economic data during the NY session.

JGBS: BoJ Stirs Memories Of 1989

JGBs experienced a state of freefall after the BoJ deployed a surprise widening of its permitted 10-Year trading band (to -/+0.50% vs. the previous -/+0.25%) at the end of its latest monetary policy decision.

- The BoJ obviously got to a point whereby enough was enough, noting that market volatility has heightened in recent months, with a modification in the YCC parameters apparently implemented to improve market functioning (the BoJ now holds over 50% of outstanding JGBs for the first time).

- As a countermeasure to the potential for a fairly swift challenge of the BoJ’s new YCC settings it decided to deploy upsized JGB purchases in Jan-Mar ’23., as well as implementing a flurry of unscheduled Rinnban and fixed rate operations during the Tokyo session (with the fixed rate purchases also being deployed outside of the usual 5- to 10-Year zone, covering 1- to 5-Year paper). The deployment of scatter gun purchases during afternoon trade helped stem losses, with futures failing to challenge their cycle low (drawn off a continuation chart).

- JGB futures now sit ~160 ticks lower on the day nearly 80 ticks off worst levels. Cash JGBs run 2-17bp cheaper, with 10s coming under the most pressure, printing just off session cheaps at ~0.42%.

- Swaps spreads have widened across the entirety of the curve, excluding 10s, given the previous limitations placed on 10-Year JGB yields prior to today’s adjustment. There is still a ~35bp differential observable in 10-Year swap rates vs. JGB yields.

- BoJ Governor Kuroda’s post-meeting press conference provides the immediate domestic focal point.

AUSSIE BONDS: Early Weakness Extends On BoJ Policy Move

Aussie bonds were under pressure for the majority of the Sydney session, initially extending weakness on cross-market type flows vs. NZ & U.S. equivalents, before the surprise BoJ policy tweak that we have outlined elsewhere applied pressure to the wider core global FI sphere, allowing the early cheapening & steepening to extend.

- That left YM -11.0 & XM -20.0 at the bell, with a fairly parallel shift observed in the 10+-Year of the cash curve.

- Weakness in bonds drove the move as EFPs narrowed post-BoJ.

- Bills finished flat to 10bp cheaper through the reds, bear steepening. Meanwhile, RBA dated OIS pricing was incrementally higher, albeit ultimately little changed, showing 19bp of tightening for the Feb ’23 decision, alongside a terminal cash rate of ~3.78%.

- The minutes from the latest RBA decision showed that everything from no change to a 50bp hike in the cash rate was discussed earlier this month (ultimately a third consecutive 25bp hike was enacted). The fact that the Bank openly discussed a pause in tightening for the first time this cycle gave some watchers more conviction in their call that we are nearing the end of the current tightening cycle. Still, this had little in the way of meaningful impact on price action, with the cheapening factors dominating.

- Looking ahead, Wednesday’s local docket is headlined by the monthly Westpac leading index print.

NZGBS: Twist Steepening Seen, Shielded From BoJ, Swap Rates Not So Privileged, Shunt Higher

NZGBS were insulated from the fallout from the latest BoJ decision, owing to the closing time of the market. This came after an all-time low headline ANZ business confidence reading, in lieu of the whirlwind round of tightening from the RBNZ, allowed the space to recover from the early session cheaps, which came as local participants reacted to Monday’s wider cheapening in core global FI markets.

- Swap rates weren’t sheltered from the initial post-BoJ impulse, as they pulled away from their session base, finishing 3-11bp higher, with some notable steepening evident, facilitating a further pull away from the post GFC lows in the 2-/10-Year swap spread.

- RBNZ dated OIS pricing was little changed on the day, with ~72bp of tightening priced for the Feb ’23 meeting alongside a terminal OCR of ~5.55%.

- Looking ahead, Wednesday’s local docket will be headlined by monthly trade balance data, the latest consumer confidence print from ANZ and credit card spending readings, although the delayed reaction to the BoJ move will likely dominate local matters.

EQUITIES: Weakness Follows BoJ YCC Shift, Shanghai Property Index Back Below 200-Day MA

Regional equity markets are down across the board, with sentiment weighed by the BoJ surprise YCC shift. US and EU futures are down near -1/-1.2% at this stage across the major bourses.

- The Nikkei 225 is off by over 2.6%. The market was tracking higher prior to the lunch break, but the BoJ's shift on YCC saw push sharply lower when trading resumed. The high to low move was around 3.4%. All eyes will rest on Kuroda's press conference later.

- The HSI is down nearly 2%, with weakness fairly broad based. At 3pm HK time we will have a press conference with a further easing in Covid restrictions to be announced.

- The property sub-indices remain under pressure, as developers continue to raise cash through share placements. Onshore, the Shanghai Property sub-index is down a further 2.43% and is back below its simple 200-day MA.

- The Kospi and Taeix are both lower, with offshore tech leads also weighing in this space.

- The Philippines index is the only regional bourse higher at this stage, +0.35%.

GOLD: Rangebound, As Higher Core Yields Help Offset Weaker USD Post BoJ

Gold spiked post the BoJ announcement but couldn't get much beyond the $1795 level. We last sit close to $1790, only up slightly for the session and lagging broader USD index moves (BBDXY -0.30%).

- In terms of near term levels, Monday session highs were close to $1799, while on the downside dips sub $1785 have been supported. Overall though we remain range bound.

- A firmer yen, to the extent that it spills over to broader USD weakness, should be positive gold. However, the evidence is mixed on this so far, with the USD mostly recovering (ex JPY) post the BoJ.

- The spill over of higher Japan yields to the rest of the world may also work against gold demand. We saw last week gold suffered amidst a more hawkish ECB outlook.

OIL: Early Gains Unwound As Cross Asset Headwinds Dominate

Brent crude has unwound early session gains, last tracking just below $80/bbl. We did get to $80.90/bbl in the first part of the session, but weaker risk appetite post the BOJ decision has weighed on sentiment. WTI has followed a similar path, last around $75.40. Both benchmarks rose by around ~1% for Monday's session.

- Stepping back, crude is still in the middle of recent ranges. For Brent we have been in a rough $75-$83/bbl range in recent weeks.

- On the supply front, TC Energy's restart plan for the Keystone is under review with the US authorities. Elsewhere, North Dakota has 300k barrels per day offline following a blizzard last week and will reportedly take a number of weeks to come back online.

- This evening we have the API weekly report on US oil inventories due.

FOREX: Yen Cross Liquidation Post BoJ

JPY strength has dominated post the BoJ YCC shift. USD/JPY eventually got down to a the 133.00 level, a near 3% gain in yen terms. This is fresh lows for the pair back to mid-August. We have stabilized somewhat, last around the 133.15 level, with Kuroda's press conference the focus early in London.

- The initial impetus was for the rest of G10 to rally post the BoJ, but this quickly reversed as cross asset headwinds materialized. Equities were weaker across the board (US/EU futures down over 1%), while core yields rose. US 10yr are around 10bps higher, last tracking at 3.68%.

- AUD/USD rose above 0.6740 post the BOJ, but is now back at 0.6630/35, 1% down for the session. This leaves AUD/JPY off by 3.66% and back to the 88.35/40 region.

- NZD/USD was initially an underperformer relative to the A$, following poor survey data, but losses have been on par this afternoon. NZD/USD is threatening uptrend channel support, last close to 0.6300.

- EUR/JPY is back sub 141.00, note the simple 200-day MA comes in close to 140.12.

- Outside of Kuroda's press conference, the upcoming focus will be on German PPI, while in the US housing starts are due.

FX OPTIONS: Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350-55(E725mln), $1.0549-50(E518mln), $1.0700-05(E557mln)

- USD/JPY: Y136.32($573mln)

- AUD/USD: $0.6640-60(A$1.4bln), $0.6725(A$649mln), $0.6900(A$679mln)

- NZD/USD: $0.6179-95(N$725mln)

- USD/CNY: Cny7.0000($580mln), Cny7.2000($991mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/12/2022 | 1000/1100 | ** |  | EU | EZ Current Account |

| 20/12/2022 | - | *** |  | JP | BOJ policy announcement |

| 20/12/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/12/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 20/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/12/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.