-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN OPEN: BoJ Talk Gets Busy Central Bank Week Underway

EXECUTIVE SUMMARY

- FED DEBATES WHETHER WAGES OR LOW UNEMPLOYMENT WILL DRIVE INFLATION (WSJ)

- GENTILONI SAYS EU INFLATION HAS PEAKED, SEES SHORT CONTRACTION (BBG)

- JEREMY HUNT: I WILL BOOST BUSINESS TO FIX ECONOMY (THE TIMES)

- UK MOBILISES TOP OFFICIALS AS PROGRESS MADE IN NORTHERN IRELAND PROTOCOL TALKS (FT)

- KEY PANEL URGES BOJ TO MAKE 2% INFLATION TARGET LONG-TERM GOAL (RTRS)

- BIDEN WINS DEAL WITH NETHERLANDS, JAPAN ON CHINA CHIP EXPORT LIMIT (BBG)

- ISRAEL STRIKES IRAN AMID INTERNATIONAL PUSH TO CONTAIN TEHRAN (WSJ)

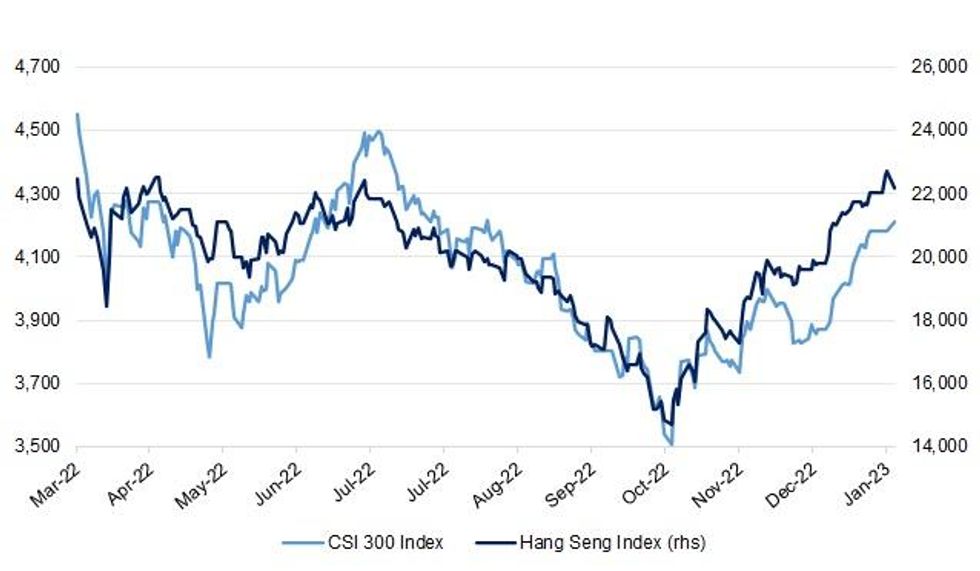

Fig. 1: CSI 300 Vs. Hang Seng Index

Source: MNI - Market News/Bloomberg

UK

FISCAL: Tax cuts for businesses will be prioritised over those for workers before the next general election to boost Britain’s “long-term prosperity”, Jeremy Hunt has said. (The Times)

FISCAL: Chancellor of the Exchequer Jeremy Hunt told UK cabinet colleagues that getting inflation below 5% this year will be difficult, insisting the government has to hold the line on fiscal discipline at his budget in March. (BBG)

FISCAL: The amount people can save into their pensions tax-free could be increased to encourage over-50s to get back to work. (Telegraph)

FISCAL/POLITICS: Britain’s under-pressure National Health Service will publish a plan on Monday setting out how it will cut ambulance and accident and emergency waiting times this year, people familiar with the plans said. (BBG)

BREXIT: UK prime minister Rishi Sunak has mobilised two of his top officials in a final push to resolve the dispute over post-Brexit Northern Ireland trade arrangements, with hopes rising in London after insiders reported significant progress in talks this week. (FT)

POLITICS: Nadhim Zahawi has been sacked from government after an inquiry by Rishi Sunak's ethics adviser criticised how he handled his tax affairs. (BBC)

POLITICS: Rishi Sunak has been warned that his government risks being “sunk by Tory sleaze” in the same way as Sir John Major’s premiership. (Telegraph)

EQUITIES: The number of profit warnings from UK-listed companies rose 50 per cent in 2022 to a total of 305, as a combination of rising costs and falling consumer confidence hit British business. (FT)

EUROPE

INFLATION: Inflation in the European Union has peaked and is headed for a slow decrease, according to Economy Commissioner Paolo Gentiloni. (BBG)

FISCAL: Germany should support new debt issuance by the European Union to help support economies under strain from high energy prices and rising competition from China and the US, said EU Economy Commissioner Paolo Gentiloni. (BBG)

SPAIN: Spain’s biggest banks will challenge the country’s controversial windfall tax after they have made the first payment next month, according to people familiar with their plans. (FT)

AUSTRIA: The senior party in Austria’s ruling coalition lost votes to right-wing nationalists in a key provincial election, signaling that support for Chancellor Karl Nehammer’s government may be fading. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- Fitch upgraded Greece to BB+; Outlook Stable

- Moody's affirmed the Netherlands at Aaa; Outlook Stable

- S&P downgraded Hungary to BBB-; Outlook Stable

- DBRS Morningstar confirmed Portugal at A (low), Stable Trend

U.S.

FED: Stubbornly high inflation is finally easing as supply chain disruptions fade and interest rates at 15-year highs put the brakes on demand. Now, Federal Reserve officials have voiced unease that prices could reaccelerate because labor markets are so tight. At issue is what’s the right way to forecast inflation: a bottoms-up analysis of recent readings on prices and wages that puts more weight on pandemic-driven idiosyncrasies—or a traditional top-down analysis of how far the economy is operating above or below its normal capacity. Some inside the Fed, including its influential staff, put more weight on the latter, which would argue for tighter policy for longer. Others prefer the former, which could argue for a milder approach. (WSJ)

INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in December was 4.4 percent. According to the BEA, the overall PCE inflation rate was 5.0 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.4 percent on a 12-month basis. (Dallas Fed)

FISCAL: President Joe Biden will ask House of Representatives Speaker Kevin McCarthy if he will meet his "Constitutional obligation" to prevent a U.S. default when he hosts the Republican leader at the White House on Wednesday, according to the White House. (RTRS)

FISCAL: U.S. House of Representatives Speaker Kevin McCarthy said on Sunday that he will meet with President Joe Biden on Wednesday to discuss raising the federal debt ceiling while controlling government spending, adding that Republicans will not allow a U.S. debt default. (RTRS)

FISCAL: A group of two dozen Republican senators warned President Joe Biden that they won’t support a debt ceiling increase without “structural” changes to US spending, a shot across the bow as the parties stake out their positions. (BBG)

FISCAL: Treasury Secretary Janet Yellen told Axios she is “nervous” about the U.S. defaulting on its debt and cautioned that Americans likely will face a scary and spiraling recession if Congress doesn’t raise the debt ceiling this summer. (Axios)

FISCAL: Wall Street banks including JPMorgan and Goldman Sachs are warning that Washington is heading for the riskiest debt ceiling confrontation since 2011, when the US lost its risk- free credit rating. (FT)

FISCAL/ECONOMY: Consumer sentiment climbed to the highest since April but is likely to cool as Washington debates raising the debt ceiling and risking a crisis, says Joanne Hsu who leads the University of Michigan's Survey of Consumers. (MNI)

POLITICS: Former President Donald Trump is tapping outgoing New Hampshire GOP Chair Stephen Stepanek to help oversee his operation in the first-in-the-nation primary state as he pushes back against criticism that his campaign is off to a slow start. (POLITICO)

BONDS: For some of America’s biggest bond buyers, the soft-versus-hard-landing debate on Wall Street might be a sideshow. They’re getting ready to swoop in with as much as $1 trillion, no matter what happens. (BBG)

OTHER

GLOBAL TRADE: President Joe Biden’s administration secured an agreement with the Netherlands and Japan to restrict exports of some advanced chipmaking machinery to China in talks that concluded Friday in Washington. (BBG)

GLOBAL TRADE: Japanese Economy and Trade Minister Yasutoshi Nishimura told reporters on Saturday that Japan will "respond accordingly based on restrictions adopted by other nations." (Nikkei)

GLOBAL TRADE: The Mercosur trade group and the European Union will reach a trade agreement soon, Argentine President Alberto Fernandez said Saturday in Buenos Aires, during German Chancellor Olaf Scholz’s visit to the South American nation. (BBG)

GLOBAL TRADE: Chancellor Olaf Scholz is hoping his trip to Latin America this weekend will help Germany secure additional supplies of the lithium that car giants like Mercedes-Benz Group AG and Volkswagen AG need for their electric-vehicle batteries. (BBG)

U.S./CHINA: The House Foreign Affairs Committee plans to hold a vote next month on a bill aimed at blocking the use of China's popular social media app TikTok in the United States, the committee confirmed on Friday. (RTRS)

U.S./CHINA: China’s top nuclear-weapons research institute has bought sophisticated U.S. computer chips at least a dozen times in the past two and half years, circumventing decades-old American export restrictions meant to curb such sales. (WSJ)

U.S./CHINA/TAIWAN: A U.S. Air Force general issued a memo instructing officers to prepare for a possible military conflict with China over Taiwan in 2025, a U.S. official confirmed to Nikkei. (Nikkei)

CHINA/TAIWAN: Kinmen Kaoliang Liquor Inc. and 62 other food companies have completed registration for import to China, Taipei-based United Daily News reports, citing Ma Xiaoguang, a spokesman for China’s Taiwan Affairs Office. (BBG)

GEOPOLITICS: A growing number of Japanese businesses are strengthening their intelligence gathering as the country finds itself increasingly exposed to the mounting tensions between the US and China. (FT)

NATO: President Recep Tayyip Erdogan said that Turkey may ratify only Finland’s bid to join NATO, in a move that could delay Sweden from gaining membership. (BBG)

NATO: Finland’s foreign minister hinted that Russia may have been involved in last week’s Koran-burning protest that threatens to derail Sweden’s accession to NATO. (BBG)

JAPAN/CHINA: China has resumed the issuance of ordinary visas for Japanese citizens travelling to the country, the Chinese embassy in Japan said on Sunday, in a move that could ease a diplomatic row. (RTRS)

JAPAN: Japanese voters want an election before any hike in taxes to fund Prime Minister Fumio Kishida’s plans for a record increase in defense spending and providing more support for families with children, according to two polls. (BBG)

JAPAN: With Japan on track to wind down its crisis response to COVID-19, businesses across the country face the challenge of easing measures like mask recommendations for a public still worried about infection risk. The government decided Friday to downgrade COVID-19 to a Class 5 infectious disease, effective May 8, putting it in the same tier of severity as the seasonal flu. Details of the change will be announced in early March. (Nikkei)

BOJ: A panel of academics and business executives on Monday urged the Bank of Japan to make its 2% inflation target a long-term goal, instead of one that must be met as soon as possible, in light of the rising cost of prolonged monetary easing. In the proposal, the panel also called for the need to have interest rates rise more in line with economic fundamentals, and normalise Japan's bond market function. The panel includes members such as Yuri Okina, who is considered as among candidates to become next BOJ deputy governor. (RTRS)

BOJ: The Bank of Japan's decision in December to widen its target band for long-term interest rates could well be followed by an end to its negative-rate policy, Mizuho Financial Group CEO Masahiro Kihara said. The surprise move has been seen by some as the central bank laying the groundwork for a pivot away from years of ultraloose monetary policy. Banks that have struggled to make money in that environment could get a boost from higher interest rates, with big banking groups like Mizuho poised to benefit the most. (Nikkei)

BOJ: Bank of Japan Governor Haruhiko Kuroda on Monday repeated his view that the year-on-year rise in the core Consumer Price Index would fall below 2% around the middle of next fiscal year. (MNI)

BOJ: Bank of Japan officials are closely watching banks unable to dispose of bond losses triggered by December's shock widening of the 10-year yield target to gauge whether their ability to lend or serve their intermediation role has been impaired, MNI understands. (MNI)

JAPAN/SOUTH KOREA: Japan is considering relaxing controls on exports to South Korea as President Yoon Suk-yeol seeks to improve bilateral ties amid a strained East Asian security environment, the Sankei newspaper reported on Saturday. (RTRS)

AUSTRALIA/RATINGS: S&P Affirmed Australia At AAA; Outlook Stable (MNI)

NEW ZEALAND: He’s been prime minister less than a week, and so far, it seems New Zealanders are willing to give Chris Hipkins a go. That’s according to the latest 1News Kantar Public Poll, which shows Hipkins, sworn in on January 25, has attracted a net approval rating of 36 points, while Christopher Luxon trails on nine points. The poll has also shown a surge of support for Labour, with the party gaining five percentage points on its last poll result. It now sits at 38%, which translates to 49 seats if Rawiri Waititi holds Waiariki. That is Labour's best result since January 2022. (1News)

NORTH KOREA: A senior North Korean official on Sunday rejected alleged weapons transactions with Russia, warning the United States of an “undesirable result” if it continues to spread such rumors. (Yonhap)

BOC: The Bank of Canada is announcing a change to the pricing of the securities repo operations (SRO). The maximum bid rate in the SRO will be set at 15 bps below the Bank’s target for the overnight rate, effective Monday, January 30, 2023. This change follows a previous increase of the SRO maximum bid rate (to 10 bps below the target rate), which took place in January 2021 during a period of increased specialness in the repo market for Government of Canada (GoC) securities. (Bank of Canada)

MEXICO: Mexico's government will provide further support to state-run oil company Petroleos Mexicanos (Pemex) and has a plan to ensure that pending bond payments in 2023 are met, President Andres Manuel Lopez Obrador said on Friday. (RTRS)

BRAZIL: Brazil Treasury Secretary Rogerio Ceron on Friday said the Finance Ministry will propose a neutral tax reform, meaning the government does not intend to raise taxes. Speaking at a news conference, he stressed that neutrality will be defined in relation to a certain level of revenue. (RTRS)

RUSSIA: Olaf Scholz, German chancellor, has warned against a bidding war among western allies over military aid to Ukraine, as he firmly ruled out sending fighter jets and ground troops to Kyiv. (FT)

RUSSIA: The U.S. Treasury Department's top sanctions official on a trip to Turkey and the Middle East next week will warn countries and businesses that they could lose U.S. market access if they do business with entities subject to U.S. curbs as Washington cracks down on Russian attempts to evade sanctions imposed over its war in Ukraine. (RTRS)

SOUTH AFRICA: Eskom, the country’s struggling power utility announced that stage four load shedding will continue until further notice. (The Citizen)

SOUTH AFRICA: President Cyril Ramaphosa wants the ANC two-day national executive committee (NEC) lekgotla to draft a realistic plan to fix Eskom, boost the economy and deliver basic services ahead of the 2024 elections. (Mail & Guardian)

IRAN: The EU is exploring legal options to designate Iran’s Revolutionary Guards as a terrorist organisation, in a big policy shift that would risk ending any hopes of restoring an international agreement aimed at preventing Tehran from developing the capacity to produce a nuclear weapon. (FT)

MIDDLE EAST: Israel carried out a clandestine drone strike targeting a defense compound in Iran, as the U.S. and Israel look for new ways to contain Tehran’s nuclear and military ambitions, according to U.S. officials and people familiar with the operation. (WSJ)

MIDDLE EAST: A massive fire broke out at an oil refinery in northwestern Iran on Saturday, the semi-official Fars News Agency reported. (CNN)

MIDDLE EAST: Israel appears to have been behind an overnight drone attack on a military factory in Iran, a U.S. official said on Sunday. (RTRS)

MIDDLE EAST: Israeli Prime Minister Benjamin Netanyahu vowed on Saturday a vigorous and targeted response to deadly Palestinian attacks on Israeli civilians over the past two days, suggesting that soaring tensions were unlikely to ease soon. (BBG)

SAUDI ARABIA: A U.S. review of relations with Saudi Arabia is not aimed at rupturing ties, the White House said on Friday. (RTRS)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 75 basis points to 12.75% on Friday, a softer increase than expected by a majority of analysts, in what many predict will mark a final hike in a long tightening cycle. (RTRS)

EQUITIES: Chinese firms are beating their US and European peers early in the year on equity financing, aided by optimism about the nation’s reopening while the developed world grapples with rising interest rates and recession fears. (BBG)

EQUITIES: Hindenburg Research said on Sunday that Adani Group’s 413-page response to its report “largely confirmed” the short-seller’s findings. (RTRS)

EQUITIES: Japanese automaker Nissan Motor and its French partner Renault have reached an agreement to reduce the latter's stake in Nissan, Nikkei learned Monday. (Nikkei)

METALS: Chinese copper miner MMG Ltd said on Monday its Las Bambas mine in Peru would likely have to halt production from Feb. 1 due to a shortage of "critical supplies" leading to a slowdown of operations. (RTRS)

OIL: The U.S. House of Representatives passed a bill on Friday limiting the ability of the energy secretary to tap the strategic oil reserve without developing plans to increase the amount of public lands available for oil and gas drilling. (RTRS)

OIL: The U.S. and its allies are discussing the levels for two price caps on Russian petroleum products, which the Western nations are preparing to impose on Feb. 5 in an expansion of their sanctions on Russia’s oil industry. (WSJ)

OIL: Russian refineries have been processing crude at elevated rates this month to meet robust demand from the European Union, just days before the bloc imposes a ban on imports of the nation’s fuel. (BBG)

OIL: The new world created by Vladimir Putin’s invasion of Ukraine has spawned a new oil trading hub: the town of Ceuta – a tiny Spanish enclave that sticks out of Morocco into the Mediterranean Sea like a thumb. (BBG)

OIL: The White House on Friday launched a fresh attack against U.S. oil companies, accusing them of using profits to pay shareholders instead of boosting supply, after Chevron Corp said its annual profit doubled for 2022. (RTRS)

OIL: Chevron Corp Chief Executive Officer Michael Wirth on Friday said the recent shift in U.S. sanctions on Venezuela allowed its local joint venture to raise short-term production in the country by 50,000 barrels of oil per day (bpd) to 90,000 bpd. (RTRS)

CHINA

POLICY/ECONOMY: Chinese Premier Li Keqiang called for efforts to accelerate the recovery of consumption as the main driver of the economy, while continuously promoting opening-up and stabilising foreign trade, according to a State Council executive meeting last Saturday. (MNI)

PBOC: The People’s Bank of China will extend three relending policy tools in a bid to provide cheap funding for key sectors, the central bank said in a statement on Sunday. (MNI)

PBOC: The maturity of large amounts of reverse repos after the lunar new year holiday is unlikely to have any major impact on market liquidity as cash tends to return to the banking system after the festival and China’s central bank seeks to keep liquidity steady, Shanghai Securities News reports, citing analysts. (BBG)

YUAN: The optimistic market sentiment on the accelerated restart of China's economy, boosted by the lifting of pandemic controls and relaxed real estate regulation, will provide favorable conditions for a yuan rally in 2023, Global Times reported citing Guan Tao, the global chief economist at BOC International (China). (MNI)

ECONOMY: China's Lunar New Year holiday saw a big travel and spending jump as authorities played down fears of a massive COVID-19 outbreak during what has traditionally been the world's biggest annual migration. (Nikkei)

ECONOMY: China’s economy showed a few signs of improvement in January as the country charted a path through its second month without Covid Zero curbs, though a major holiday season kept a lid on some activity. (BBG)

PROPERTY: Many major Chinese cities have cut mortgage rates for first-time homebuyers and more may follow suit as authorities seek to prop up the flagging housing market, China Securities Journal reported, citing analysts. (BBG)

CORONAVIRUS: China reported a sharp drop in new Covid-related deaths during the Lunar New Year holiday, even as a spike in travel increased the likelihood of more infections across the country. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY99 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday conducted CNY173 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY99 billion after offsetting the maturity of CNY74 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:29 am local time from the close of 1.8343% before 7-day Chinese New Year holiday.

- The CFETS-NEX money-market sentiment index closed at 40 on Monday, compared with the close of 50 before Chinese New Year holiday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7626 MON VS 6.7702 PRE-LNY

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7626 on Monday, compared with 6.7702 set before Chinese New Year holiday.

OVERNIGHT DATA

NEW ZEALAND DEC TRADE BALANCE -NZ$475MN; NOV -NZ$2.180BN

NEW ZEALAND DEC EXPORTS NZ$6.72BN; NOV NZ$6.34BN

NEW ZEALAND DEC IMPORTS NZ$7.19BN; NOV NZ$8.52BN

NEW ZEALAND DEC YTD TRADE BALANCE -NZ$14.464BN; NOV -NZ$14.978BN

UK JAN LLOYDS BUSINESS BAROMETER +22; DEC +17

MARKETS

US TSYS: Cross-Market Moves At The Fore, A Touch Richer Into London Trade

TYH3 heads into London trade 0-01 shy of the peak of its 0-07+ Asia-Pac range, dealing +0-03+ at 114-23, running on about average volume of ~89K. Cash Tsys are flat to 1bp richer, with the intermediate zone leading the modest richening.

- Cross-market gyrations seemed to aid the ultimate direction of travel in Asia, with oil more than reversing its early gains (after an early bid was seen on a seeming ratcheting up of Israeli-Iranian tensions, as Israel seemed to be the most likely perpetrator of drone strikes on Iranian facilities), a bid in JGBs and weakness in Hong Kong equities observed.

- Elsewhere, weekend news flow saw U.S. Tsy Sec. Yellen continue to highlight her worry re: fiscal matters and the threat of default, while WSJ Fed watcher Timiraos flagged a debate within the central bank re: whether wages or low unemployment will drive inflation.

- The Dallas Fed m’fing activity release headlines the domestic docket on Monday. Further out, a slew of global central bank decisions, headlined by the FOMC, present the major risk events this week, while the ISM surveys, NFPs, quarterly refunding announcement and ECI data will also filter out during the coming the days.

JGBS: Curve Twist Steepens, Comments From Potential BoJ Deputy Get Some Airtime

JGB futures are 25 ticks firmer on the day into the bell, a touch off highs, after closing the Tokyo CPI gap lower to the tick.

- Early afternoon trade saw some pressure on comments from Japan Research Institute Chair Yuri Okina, who noted that there needs to be a rethink of the BoJ-government accord, as she outlined her preference for the Bank’s inflation target to be shifted to a longer-term goal (as press reports have suggested will be the case). Okina also identified a desire to foster bond market normalisation and a recovery in the function of interest rates within the monetary policy framework. Note that there is speculation Okina could become a Deputy Governor at the Bank after the impending leadership reshuffle. She then stressed that wage growth and fiscal sustainability are pre-requisites for monetary policy normalisation (in line with the BoJ’s central tone).

- JGB futures firmed to fresh session highs after a blip lower, while the super-long end of the curve cheapened, resulting in twist steepening of the curve. Swap rates out to 10s were lower, although swap spreads there widened, while 20+-Year swap spreads also widened, as moves higher in those rates outstripped yields.

- This came after BoJ Governor Kuroda reiterated well-trodden themes.

- The space also drew support from some light richening in U.S. Tsys and subdued offer to cover ratios at today’s BoJ Rinban operations.

- A reminder that the BoJ will issue its Rinban plan for the month of February after hours.

- Further out, flash industrial production, retail sales and labour market data headline the domestic docket on Tuesday.

AUSSIE BONDS: A Touch Richer On Wider Impetus

A move away from lows in U.S. Tsys and oil more than unwinding its early uptick supported ACGBs ahead of the close, allowing them to overturn their overnight/early Sydney cheapening.

- That left YM +2.0 & XM +2.5bp at the bell, after overnight session lows were respected on tests by both contracts. Cash ACGBs were 1.5-3.0bp richer, with the long end leading the bid.

- EFPs were essentially unchanged on the day.

- Bills finished 2-5bp richer through the reds, tracking gyrations in bonds, while RBA-dated OIS saw a steady 23-24bp of tightening priced into next month’s meeting, as terminal cash rate pricing edged back below 3.80% after showing above the level.

- Also note that S&P’s affirmation of Australia’s AAA rating, with a stable outlook, would not have harmed the (modest) rally.

- ACGB May-41 supply passed smoothly.

- Deutsche Bank updated their RBA call. They now look for a terminal cash rate of 4.10% by August, pointing to Q4 CPI and an apparent resilience in household spending as the primary drivers for the view change. Deutsche previously had a terminal rate of 3.35% pencilled in (which they expected to be registered next month).

- Looking ahead, private sector credit and retail sales data headline the domestic docket on Tuesday.

AUSSIE BONDS: ACGB May-41 Auction Results

The Australian Office of Financial Management (AOFM) sells A$300mn of the 2.75% 21 May 2041 Bond, issue #TB156:

- Average Yield: 3.9341% (prev. 2.4864%)

- High Yield: 3.9375% (prev. 2.4900%)

- Bid/Cover: 2.9500x (prev. 2.1440x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 52.5% (prev. 23.4%)

- Bidders 54 (prev. 69), successful 25 (prev. 35), allocated in full 18 (prev. 25)

NZGBS: A Touch Cheaper, Impact Of Floods Eyed

Benchmark NZGB yields were ~2bp higher across the major benchmarks on Monday, as the space extended on Friday’s cheapening, even as JGBs firmed and U.S. Tsys ticked away from session cheaps.

- Swap rates were 2-5bp higher, leaving swap spreads flat to wider across the curve, suggesting that payside swap flow aided the cheapening in NZGBs, particularly given the timing of the moves.

- While it is easy to point to holiday-thinned markets (the Auckland area was closed), it is worth highlighting a domestic issue as a driver of the (still limited) price action. Heavy weekend rainfall and flooding in the Auckland region will no doubt exacerbate supply chain issues that are already well-documented, while creating some demand-pull price pressures as well. Could this impact the RBNZ’s Feb decision, even after Q4 CPI printed below the central bank’s assumptions? RBNZ dated OIS is currently showing ~60bp of tightening for the event, or just under a 50/50 chance of a 75bp step, little changed from late Friday levels, while terminal rate pricing continues to hover around 5.35%.

- The Q4 labour market report provides the domestic highlight of the week, with ANZ consumer confidence, building permits and CoreLogic house price data filling out the domestic docket at different points.

EQUITIES: China Re-Opening Not As Positive As Hoped

Asia Pac equities are a mixed bag, with the return of China markets not proving to be as supportive as was hoped. The CSI 300 opened up above 2%, but is now back to +1.15%. Hong Kong and South Korea stocks are down noticeably. A generally negative tone to US equity futures, -0.20%/-0.34% across the major indices, hasn't helped either.

- Despite economic optimism around the China outlook, with strong anecdotes positive post the LNY break (in terms of travel and leisure spending), housing remains a source of weakness. Sales were down over the LNY break, while the Shanghai Property sub index is down 0.60% at this stage (the main index is +0.72%).

- The HSI is off by 1.62% so far, with the tech sector down 2.73%. Curbs on technology exports to China may be a factor, after Japan and the Netherlands agreed to join the US, although this was likely known on Friday.

- The Kospi is off by 1.30%, with Samsung profit results due tomorrow. Offshore investors has sold -$40.3mn so far in the session. In contrast, the Taiex has rallied by 3.2%, largely playing catch up as the markets return from the LNY break.

- Indian shares opened sharply lower, but have recovered back to flat. Fallout from the Adani saga remains a focus point.

GOLD: Bullion Trading Sideways As Major US Events Due Later In The Week

Gold prices ended last week slightly higher supported by easing US inflation pressures but is flat during the APAC session at around $1927.80/oz. It reached a high of $1931.07 earlier followed by a low of $1924.53. The USD DXY index is flat.

- Gold remains in a bullish trend and any pullback is considered corrective. Moving average studies reflect the uptrend. $1963 is the next level to watch and $1893.70, the 20-day EMA, should provide support.

OIL: Prices Range Trading Ahead Of Key Events This Week

Oil prices ended last week down around 1.5% but are trading down slightly and in a range of around a dollar today, as the market awaits signs of increased Chinese demand, the impact of sanctions on Russian exports and Wednesday’s Fed & OPEC decisions. The USD is down slightly.

- WTI is below $80/bbl again at $79.52 around the intraday low and in line with the 100-day simple moving average. Brent is $86.45, also at its low. Resistance remains at $82.66 for WTI; it approached it on Friday but couldn’t break through. Initial support is $78.45, the January 19 low.

- In China, Sinopec said that petrol sales were up 20% y/y over the Lunar New Year holiday week. (bbg) Some analysts believe that crude markets are yet to price in the impact of China’s reopening on oil demand.

- Troubles in the Middle East over the weekend have provided some support to crude.

FOREX: Yen Firms, But With Little Follow Through, Tight Ranges Elsewhere

USD indices are lower, largely in part to a firmer yen through the afternoon session. The BBDXY is back to the 1221.50 region, which is -0.06% sub NY closing levels from Friday. The JPY is the +0.20% higher at this stage, while other pairs are more subdued. AUD/USD is the weakest performer, down close 0.15% to 0.7090.

- Yen has had a volatile session, getting close to 130.30 before comments from a potential future Deputy Governor (Yuri Okina) sparked a yen rebound. We got close to 129.20 before support emerged, the pair last at 129.60/65. Okina stated that there needs to be a rethink of BoJ and government cooperation, as she outlined her preference for the Bank’s inflation target to be shifted to a longer-term goal.

- AUD/USD was firmer early doors, but ran out of steam around the 0.7120 level. Not much follow through to the China equity rebound at the open, may have seen some profit taking flows emerge. In the commodity space, copper slipped to $421.25 (CMX basis), but iron ore firmed to $128.25/ton, +1.50%.

- NZD/USD couldn't sustain moves above 0.6500, last around 0.6495/00, close to flat for the session.

- Looking ahead, the calendar remains quiet in the northern hemisphere later with the highlight the EC survey for January and only the Dallas Fed manufacturing index in the US.

FX OPTIONS: Expiries for Jan30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E581mln), $1.0950(E783mln), $1.1315(E529mln)

- USD/JPY: Y130.00($785mln), Y131.40($1.3bln), Y133.50($801mln)

- USD/CAD: C$1.3400($841mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/01/2023 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2023 | 1000/1100 | ** |  | IT | PPI |

| 30/01/2023 | 1000/1100 |  | EU | Consumer / Economic Confidence Indicators | |

| 30/01/2023 | 1500/1000 |  | US | Treasury Quarterly Financing Estimates | |

| 30/01/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.