-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoK Hikes Rates, China Pushes Common Prosperity Mantra

EXECUTIVE SUMMARY

- CHINA'S COMMUNIST PARTY VOWS TO BOTH GROW AND SHARE ECONOMIC PIE (BBG)

- PBOC TO USE MULTIPLE TOOLS TO ENSURE MARKET LIQUIDITY (NEWS)

- BOK DELIVERS 1ST PANDEMIC-ERA RATE HIKE AMID RISING INFLATION, HOUSEHOLD DEBT (YONHAP)

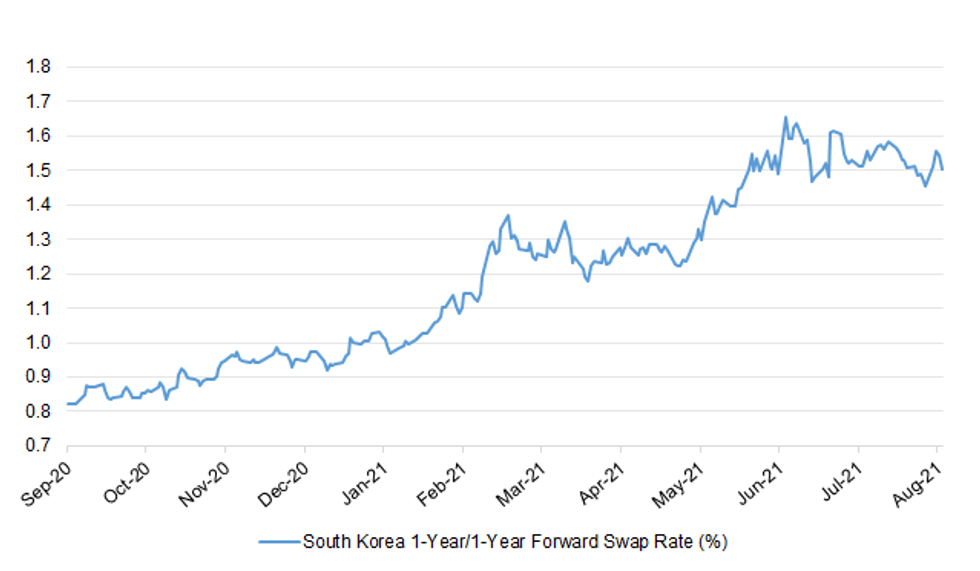

Fig. 1: South Korea 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The NHS has drawn up plans to start vaccinating 12-year-olds from the first week schools go back, The Telegraph can reveal. Health officials have said children would not need parental consent to be jabbed under the programme of vaccination in schools. On Wednesday, NHS trusts were told to prepare for the "possible rollout of a 12 to 15-year-old healthy child vaccination programme commencing Sep 6". Emails sent by NHS England's regional offices, seen by The Telegraph, say trusts should draw up plans by 4pm on Friday. (Telegraph)

BREXIT: MNI INTERVIEW: Chances Rising Of EU-UK Northern Ireland Deal

- Hopes are rising that EU and UK politicians will be able to secure agreement on trade flows between Great Britain and Northern Ireland by the end of September, Sean Kelly, leader of the Fine Gael delegation in the European Parliament and a member of the EP's UK Contact Group, told MNI. Kelly said work been going on in the background between officials and at the technical level during August and that Commissioner Maros Sefkovic and UK counterpart David Frost can pick up the baton from next week - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: Full Return To Work To Hit UK Productivity

- The return to work of employees in services sectors hardest hit by the Covid pandemic looks set to drag on UK productivity growth in coming quarters, Josh Martin, Head of Productivity at the Office for National Statistics, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: UK car production fell sharply last month, marking the worst July performance for the industry since 1956, a trade group has said. The global microchip shortage, staff being affected by the so-called pingdemic, and shutdowns meant just 53,438 cars were built in the month. That was a drop of 37.6% compared to July last year, the Society of Motor Manufacturers and Traders (SMMT) said. It comes as sales of second-hand vehicles are soaring. Overall car production in the year to date is almost a fifth higher than during 2020 at 552,361 vehicles, but that is still 28.7% down on 2019 pre-pandemic levels. SMMT boss Mike Hawes said the July figures "lay bare the extremely tough conditions UK car manufacturers continue to face". (BBC)

FDI: Lord Gerry Grimstone, Britain's investment minister, insisted the UK is not becoming more protectionist, arguing that Chinese investment was welcome provided it is "to our advantage" and defending the private equity industry targeting British companies. Britain will in January introduce sweeping new national security laws covering foreign takeovers, while ministers are looking to reduce the role of Chinese companies in the UK's telecoms and nuclear energy sector. But Grimstone told the FT that foreign investment drove productivity and created well paid jobs; new rules for screening foreign bids for domestic companies would set clear and "efficient" ground rules. (FT)

HOUSING: The housing market is facing an acute shortage of homes for sale after record transactions to beat the end of the stamp duty holiday used up the stock. Zoopla, the property portal, said that Britain was in the midst of its "greatest stock shortage since 2015" as the number of properties for sale in June dropped by 26.4 per cent compared with the 2020 average. With buyer demand firm at 20.5 per cent above the 2020 average and "supply shortages expected to run until 2022", house price growth is forecast to remain strong. (The Times)

EUROPE

PORTUGAL: Portugal posts Jan.-July budget deficit of EU6.84b, narrowing by EU1.63b from the same period in 2020, Finance Ministry says in an emailed statement. Primary spending rises 5.4% Y/y; social security spending climbs 8%. Spending on extraordinary measures to support families and companies reached EU4.2b. Revenue rises 8%; tax revenue climbs 6.4%. (BBG)

U.S.

ECONOMY/FED: Broad inflation expectations remain anchored and supply shocks will be transitory, leading consumer prices to moderate in 2022, said former Federal Reserve chair Ben Bernanke in an online event organized by a Brazilian investment firm. Current Fed chair Jerome Powell has done an "excellent" job, and has been "very proactive and effective" throughout the pandemic. "He's done an excellent job and that's as far as I should go," Bernanke said. There are mismatches in the employment market as people rethink their careers and lives. U.S. fiscal and monetary response to the pandemic was strong and proactive and supported better-than-expected growth. Fiscal situation in emerging markets is not as bad as feared in the beginning of the pandemic. (BBG)

CORONAVIRUS: Federal regulators are likely to approve a Covid-19 booster shot for vaccinated adults starting at least six months after the previous dose rather than the eight-month gap they previously announced, a person familiar with the plans said, as the Biden administration steps up preparations for delivering boosters to the public. Data from vaccine manufacturers and other countries under review by the Food and Drug Administration is based on boosters being given at six months, the person said. The person said approval for boosters for all three Covid-19 shots being administered in the U.S. - those manufactured by Pfizer Inc. and partner BioNTech SE, Moderna Inc. and Johnson & Johnson - is expected in mid-September. (WSJ)

CORONAVIRUS: The Covid outbreak is so bad in Washington state that hospitals are running out of intensive care beds as the delta variant drives cases near record highs, state health officials said Wednesday. At least one woman died while waiting for an ICU bed, Dr. Steve Mitchell, medical director of Harborview Medical Center emergency department at the Seattle Hospital. "This patient who was severely ill, and unfortunately she actually did pass away in this small hospital when after eight hours of trying. We were unable to find an ICU bed that could help sustain her life at that point," Mitchell said at a press conference with state health officials. (CNBC)

CORONAVIRUS: Chicago will require all city workers to be fully vaccinated against Covid-19, Mayor Lori Lightfoot said. "As cases of Covid-19 continue to rise, we must take every step necessary and at our disposal to keep everyone in our city safe and healthy," Lightfoot said in an emailed press release. "Getting vaccinated has been proven to be the best way to achieve that and make it possible to recover from this devastating pandemic." The mandate, effective Oct. 15, applies to all city employees and volunteers. (BBG)

CORONAVIRUS: Pfizer Inc. and BioNTech SE said they're seeking full approval from U.S. regulators for a booster shot of their vaccine for people age 16 and older. The companies announced Wednesday that they had started a rolling Biologics License Application with the Food and Drug Administration for a third-dose booster. Pfizer and BioNTech said they intend to complete submission of the application by the end of the week, bringing them one step closer to clearance for the additional shot. (BBG)

OTHER

CORONAVIRUS: The European Union will discuss on Thursday whether to reimpose curbs on visitors from the U.S. as new coronavirus cases soar. The change was recommended by Slovenia, which holds the EU's rotating presidency and is responsible for triggering an assessment of countries allowed non-essential travel there, according to two officials familiar with the plans. The U.S. had 507 new Covid-19 cases per 100,000 inhabitants in the first two weeks of August, according to the European Centre for Disease Prevention and Control, well above the limit of 75 set out in EU guidelines. Still, a move to bar visitors from the world's largest economy would come as a blow to airlines and travel firms pressing for a full reopening of lucrative transatlantic routes. (BBG)

JAPAN: Japan's ruling Liberal Democratic Party (LDP) will hold an election to pick its president on Sept. 29, party officials said on Thursday, with Prime Minister Yoshihide Suga all but certain to face a challenge for the post. (RTRS)

JAPAN: Budget requests by Japanese ministries and agencies for fiscal 2022 are expected to total over 110 trillion yen ($1 trillion) for the first time due to swelling debt-servicing costs amid the coronavirus pandemic, government sources said Thursday. The requests for the year starting next April, to be filed by next Tuesday, would hit a record high for the fourth straight year. After assessing the requests, the Finance Ministry will draft the initial state budget in December before Diet deliberations. The draft could also reach a record by eclipsing the initial fiscal 2021 budget of 106.61 trillion yen, which included 5 trillion yen in funds reserved for responding to the pandemic. (Mainichi)

JAPAN: Moderna Inc. is holding some doses of its Covid-19 vaccine in Japan after receiving "several complaints" of particulate matter in the vials, a spokesperson said Wednesday. Cambridge, Massachusetts-based Moderna said it put one lot of vaccine and two additional batches on hold. The spokesperson didn't immediately specify how many doses that includes. The company said it believes the manufacturing issue arose at one line of its contract-manufacturing site in Spain. Moderna said it's investigating reports and is working with its Japanese partner, Takeda Pharmaceutical Co Ltd., and regulators to address potential concerns. The company said no safety or efficacy issues have been identified. (BBG)

AUSTRALIA: Three unvaccinated NSW residents have died from Covid-19 as the state detected a record 1,029 cases overnight and Premier Gladys Berejiklian announced new freedoms for those who have had both doses from September 13. The new deaths were men in their 30s, 60s and 80s from west and south-west Sydney. Of the new cases, 61 were infectious in the community and the isolation status of 844 infections is under investigation. (Guardian)

AUSTRALIA: The ABS notes that "payroll jobs fell by 2.0% nationally and by 3.7% in New South Wales in the fortnight to 31 July 2021. The latest fortnight of data coincided with increasing restrictions in the fourth and fifth weeks of the lockdown in New South Wales, including a pause in construction activity. It also included lockdowns in Victoria and South Australia, and travel and border restrictions across all states and territories. Payroll jobs in New South Wales fell by 3.7% in the second half of July, and by 7.1% over the first five weeks since the lockdown began on 26 June. Over those five weeks, payroll jobs fell by 9.2% in Greater Sydney and by 3.9% in the rest of New South Wales. Outside of Sydney, payroll jobs in adjacent regions continued to be the most impacted." (MNI)

AUSTRALIA: Qantas Airways Ltd. said its current target of resuming some overseas services in December "remains in reach," with domestic travel demand expected to surge once Australia reaches vaccination targets and the likelihood of future lockdowns reduces. The airline posted a second consecutive annual loss, as did Air New Zealand, which suspended earnings guidance. (BBG)

NEW ZEALAND: New Zealand has recorded 68 new COVID-19 cases in the community, as the fast-moving Delta variant ripples through the community. Thursday's increase took the cluster's total to 277 associated cases, the Director of Public Health Dr Caroline McElnay said at the daily national briefing on the pandemic response. Prime Minister Jacinda Ardern said the nature of the Delta outbreak has changed its impact on the community. "We can expect the lag time and our numbers to potentially be longer and bigger," she said. However, the fact that the outbreak hasn't spread beyond Auckland and Wellington showed that restrictions were having an effect, Ardern said. "Lockdown is having an impact." (Sydney Morning Herald)

BOK: South Korea's central bank delivered its first pandemic-era rate hike Thursday to fight rising inflation and rein in surging household debts, ending 15 months of record-low interest rates as the economy showed signs of improving. The monetary policy board of the Bank of Korea (BOK) voted to raise its key rate by 0.25 percentage point to 0.75 percent in this year's sixth rate-setting meeting. It marked the first rate move since May last year, when the BOK cut the key rate to a record low of 0.5 percent. It is also the first time since November 2018 that the BOK has lifted the key rate. Raising the key rate, the BOK kept this year's growth outlook at 4 percent, while lifting its 2021 inflation outlook to 2.1 percent from 1.8 percent projected in May. (Yonhap)

SOUTH KOREA: Finance Minister Hong Nam-ki said Thursday the government plans to provide pandemic emergency relief funds to people hit hard by the pandemic before next month's fall harvest Chuseok holiday. The country plans to provide 11 trillion won (US$9.4 billion) to people in the bottom 88 percent income bracket under this year's second extra budget of 34.9 trillion won. Hong said the government has decided to start the provision of cash handouts to the recipients before the Chuseok holiday scheduled for Sept. 20-22. In an effort to support pandemic-hit merchants, the country will also provide 90 percent of the relief aid of 4.22 trillion won to small merchants and the self-employed before the holiday. The move is aimed at accelerating the provision of relief funds to struggling merchants as the country is grappling with the fourth wave of the pandemic. Hong said the government plans to offer some 41 trillion won in financial support to small and medium-sized enterprises, as well as micro business owners, as part of measures to support them in the runup to the holiday. (Yonhap)

NORTH KOREA: North Korea will convene a meeting of its rubber-stamp legislature in Pyongyang next month to discuss adopting laws on youth education and modification to national economic plan, state media said Thursday. The standing committee of the Supreme People's Assembly met in Pyongyang on Tuesday and decided to convene an SPA session on Sept. 28, the official Korean Central News Agency (KCNA) said. The KCNA said the session will discuss the issue of "adopting the law on developing cities and counties and the law on ensuring education of young people, the issue of modification and supplementation of the law on national economic plan, the issue of inspecting and supervising the enforcement of the law on recycling and the organizational issue." (Yonhap)

CANADA: Liberal Leader Justin Trudeau said today a re-elected government led by him would raise the corporate taxes paid by Canada's "largest and most profitable" financial services firms to help pay for his promised multi-billion dollar housing program. Speaking to reporters at a campaign stop in Surrey, B.C., Trudeau said Canada's major banks and insurance companies have recovered from the COVID-19 crisis better than companies in just about any other industry and should pay more to help offset the cost of ambitious post-pandemic programs. The commitment comes during a week when Canada's banks are reporting eye-popping quarterly profits fuelled by drawing down the capital reserves they set aside last year to guard against possible COVID-related loan losses. (CBC)

BRAZIL: Brazil runs the risk of breaching its spending cap rule next year as the government struggles with a 60% increase in court-ordered payments and faster inflation, according to Economy Minister Paulo Guedes. Court rulings against the federal government, and specially in favor of states, will cause such payments to reach 89 billion reais ($17.1 billion) in 2022, exhausting the government's budget, according to the economy ministry. Guedes warned at a news conference on Wednesday that the government may not be able to pay for public servant salaries or boost social programs, as sought by President Jair Bolsonaro ahead of his re- election campaign. (BBG)

BRAZIL: A solution to increasing court-ordered payments known as "precatorios" is for the Supreme Court to modulate decisions, Economy Minister Paulo Guedes said during an event. 2021 fiscal deficit could be below 1.7% of GDP, he said. Economy is booming, but water crisis is cloud on horizon. Water crisis will pressure inflation, which central bank will have to resolve, he said. Government will announce green growth program. Program will be presented at the Climate Conference, COP26. In partnership with the New Development Bank (NDB), we have prepared a plan of more than $1b in green and digital investments, he said. (BBG)

BRAZIL: Brazil's Supreme Court delayed a ruling on the constitutionality of a law granting the central bank its long-sought formal autonomy, a key piece of legislation considered by investors as a victory for monetary policy making in Latin America's largest economy. The justices are discussing a case brought to the court by two opposition parties that claim the original proposal should have been introduced by the nation's president, and not by lawmakers as it was. Two of them had voted -- one against and the other for upholding the law -- when chief Justice Luiz Fux adjourned the session, saying it will resume Thursday. "Congress has made a legitimate choice and the judiciary has to let political decisions be taken by the legislature," Justice Luis Roberto Barroso, one of those who voted, said during an event hosted by XP Investimentos earlier on Wednesday. (BBG)

BRAZIL: Brazil Senate Head Rodrigo Pacheco decided to reject the request for impeachment against Supreme Court Justice Alexandre de Moraes filed by the President Jair Bolsonaro, he said during a speech in Brasilia. In addition to the legal recommendation, there is also a political consideration, Pacheco said. Decision is opportunity to re-establish good relations between branches of government, he said. (BBG)

BRAZIL: Brazil will begin distributing booster shots of Covid-19 vaccines to some groups starting in mid-September. The booster will preferably be from Pfizer Inc., the health ministry said. The effort will focus on people over 70 vaccinated more than six months ago, as well as those who have immunodeficiencies. Johnson & Johnson and AstraZeneca Plc vaccines could be used as alternatives, the ministry said. Authorities made no mention of Sinovac Biotech's CoronaVac, which has been used frequently in Brazil but has lower efficacy rates. (BBG)

AFGHANISTAN: The U.S. knows of about 1,500 Americans who are still in Afghanistan but doesn't believe all are seeking to leave the country, Secretary of State Antony Blinken said Wednesday. He told reporters that the U.S. continues to be "relentless in our outreach," citing 20,000 emails and 45,000 phone calls attempting to reach Americans. (BBG)

AFGHANISTAN: Britons were on Wednesday night told to leave Kabul airport because of the "ongoing and high threat" of a terror attack. (Telegraph)

AFGHANISTAN: Turkey could continue running the country's main airport following the withdrawal of Turkish soldiers if talks underway lead to an agreement, says Ibrahim Kalin, spokesman of Turkish President Recep Tayyip Erdogan. (BBG)

IRAN: President Joe Biden and Israeli Prime Minister Naftali Bennett plan to discuss what both countries consider to be an alarming acceleration of Iran's nuclear program as the leaders meet Thursday at the White House. Biden plans to emphasize his strong support for Israel, U.S. officials said, speaking on condition of anonymity, in a meeting that may reveal divergent approaches on Iran: the U.S. favors a diplomatic pact to halt the Islamic Republic's nuclear program and Israel has said it may use secret attacks to disable Iranian facilities. Bennett is looking to reset Israel's ties with the U.S., after an era dominated by former Prime Minister Benjamin Netanyahu and former President Donald Trump, though the new Israeli government has carried over some policies of its predecessor. (BBG)

COPPER: A union representing workers at the Salvador copper mine in Chile described a final wage offer from owner Codelco as "unacceptable." A union representing workers at the Salvador copper mine in Chile described a final wage offer from owner Codelco as "unacceptable." Members of Workers Union No. 6 are scheduled to vote on the offer Sunday and Monday, with a voluntary mediation session scheduled for Thursday, the union said. (BBG)

CHINA

POLICY: Chinese President Xi Jinping urged the country to strive to achieve its social and economic goals this year as he made a series of comments while touring northern Hebei province, the Xinhua News Agency said. Xi stressed overall disability while seeking progress, wholistic development and prevention of the pandemic, so the country can be off to a good start to the 14th Five Year Plan, Xinhua said. Xi also emphasized protecting ecology, rural development, elderly care and region in his speeches, according to Xinhua. (MNI)

POLICY: China's Communist Party vowed to promote the welfare of all people and redistribute income, underscoring its push to achieve "common prosperity" in the country. Having achieved a goal of building a moderately prosperous society, "we will make the pie bigger and divide it well," Han Wenxiu, a senior official at the party's central financial and economic affairs commission, said at a press briefing in Beijing Thursday. Authorities will push for high-quality development, raise the income of urban and rural residents, gradually reduce the gap in distribution, and "resolutely prevent polarization," he said. (BBG)

PBOC: The PBOC has been cautious in injecting short-term liquidity as it has only increased net injections by month-end during the past three months, the Shanghai Securities News reported citing analysts. The PBOC net-injected CNY40 billion via reverse repos yesterday to fill in the month-end liquidity gap and smoothen the accelerated issuance of local government bonds, the newspaper said citing Ming Ming, research head of CITIC Securities. Analysts noted that though the central bank increased the volume of reverse repos operation, the operating interest rate is kept unchanged, indicating that prudent monetary policy remains, the newspaper said. (MNI)

PBOC: The PBOC is likely to cut banks' required reserve ratios in Q4 to offset the maturing MLFs and may use a new policy tool supporting carbon emission reduction, Yicai.com reported citing Ming Ming, research head of CITIC Securities. The scale of reverse repo operations may not increase significantly, Ming added. Though the Federal Reserve is expected to start tapering by year-end at the earliest and gradually reduce the scale of asset purchases, the PBOC will still focus on domestic goals, the newspaper cited Ming as saying. The PBOC said last week it will increase credit support for the real economy especially SMEs, while the State Council urges to establish green monetary tools in July, the newspaper noted. (MNI)

EQUITIES: A bout of frenzied buying from dip-hunting retail traders over the last couple of days has helped spur a rally in Chinese stocks listed in the U.S. after a prolonged selloff. Net purchases of Chinese technology shares in New York by retail investors in the past five trading sessions topped the $400 million mark, according to Vanda Research. The bargain-hunting helped push The Nasdaq Golden Dragon China Index up more than 13% in the past four days, for its best run since late June when Beijing's increased regulations on technology and education companies added pressure on the shares. (BBG)

OVERNIGHT DATA

JAPAN JUL PPI SERVICES +1.1% Y/Y; MEDIAN +1.3%; JUN +1.3%

AUSTRALIA Q2 PRIVATE CAPITAL EXPENDITURE +4.4% Q/Q; MEDIAN +2.6%; Q1 +6.0%

SOUTH KOREA JUL RETAIL SALES +13.1% Y/Y; JUN +11.4%

SOUTH KOREA JUL DISCOUNT STORE SALES +7.3% Y/Y; JUN -2.4%

SOUTH KOREA JUL DEPARTMENT STORE SALES +7.8% Y/Y; JUN +12.8%

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation injected net CNY40 billion into the market as there is CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.3150% at 09:26 am local time from the close of 2.3265% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday vs 40 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4730 THURS VS 6.4728

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4730 on Thursday, compared with the 6.4728 set on Wednesday.

MARKETS

SNAPSHOT: BoK Hikes Rates, China Pushes Common Prosperity Mantra

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 14.42 points at 27739.22

- ASX 200 down 46.865 points at 7485

- Shanghai Comp. down 17.8 points at 3522.584

- JGB 10-Yr future down 4 ticks at 152.19, yield down 0.3bp at 0.020%

- Aussie 10-Yr future down 2.5 ticks at 98.830, yield up 2.2bp at 1.180%

- U.S. 10-Yr future +0-01 at 133-21, yield down 0.51bp at 1.334%

- WTI crude down $0.51 at $67.85, Gold down $3.05 at $1787.95

- USD/JPY down 7 pips at Y109.95

- CHINA'S COMMUNIST PARTY VOWS TO BOTH GROW AND SHARE ECONOMIC PIE (BBG)

- PBOC TO USE MULTIPLE TOOLS TO ENSURE MARKET LIQUIDITY (NEWS)

- BOK DELIVERS 1ST PANDEMIC-ERA RATE HIKE AMID RISING INFLATION, HOUSEHOLD DEBT (YONHAP)

BOND SUMMARY: Tight Ranges In Asia, Solid 20-Year JGB Auction Seen

A 0-03+ range in play for T-Notes thus far, with the contract last +0-01 at 133-21, while cash Tsys are flat to 1.0bp richer across the curve. Broader news headlines remain on the light side. Looking to the short end, a 5.0K block seller of the EDZ2/Z4 spread dominated on the flow side. Thursday will be headlined by pre-Jackson Hole Fedspeak, with George, Bullard & Kaplan all due to make addresses on CNBC/BBG. Elsewhere, the 2nd Q2 GDP estimate, weekly jobless claims, Kansas City m'fing data and 7-Year supply will be eyed.

- A well-received round of 20-Year JGB supply was seen, as the low price topped the broader expectations, while the price tail narrowed vs. the previous auction as the cover ratio ticked higher. 20s firmed in the wake of supply, with futures moving to the best levels of Tokyo trade, although the latter still prints below yesterday's settlement level, last -4. 30+-Year paper outperforms on the curve, richening by ~1.5bp on the day, with the space generally better bid post-supply. Meanwhile, 7s provided the weak point on the curve for the duration of the session (last 0.5bp cheaper on the day) given the overnight weakness in futures.

- Over in Sydney YM & XM both print 2.0 below settlement levels, with the contracts holding to narrow ranges. Cash ACGB trade saw the 5- to 15-Year sector lead the cheapening. The daily NSW COVID update saw new COVID cases top 1,000 for the first time, although the bond market looked through the headlines, with policymakers now having pivoted the focus of their recent comments to vaccinations and severe cases/hospitalisations. Nonetheless, the broader regional NSW area has extended the period that it will observe lockdown through September 10. Elsewhere, the NSW Premier noted that NSW households with fully vaccinated adults will start to enjoy slightly looser restrictions from mid-Sep, although situations inside and outside of "areas of concern" are slightly different. The Premier also asked the community & businesses to prepare for a wider opening up when NSW hits the 70% double dose vaccination threshold with regards to the eligible population, which she says could come in mid-October. On the data front both headline CapEx and firms' expectations for CapEx for the current FY topped exp., with the latter marked higher vs. the prev. estimate.

JGBS AUCTION: Japanese MOF sells Y974.9bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y974.9bn 20-Year JGBs:

- Average Yield 0.405% (prev. 0.404%)

- Average Price 99.89 (prev. 99.92)

- High Yield: 0.408% (prev. 0.408%)

- Low Price 99.85 (prev. 99.85)

- % Allotted At High Yield: 72.6958% (prev. 9.4094%)

- Bid/Cover: 3.653x (prev. 3.515x)

JAPAN: Foreigners Shed Largest Weekly Net Amount Of Japanese Equities Since Mar

There was little of any real note in terms of the outright size of net flows in the latest round of weekly Japanese international security flow data, outside of the net sales of Japanese equities on the part of foreign investors (which moved to the highest weekly level witnessed since March). This allowed the 4-week rolling sum of the measure to move back into negative territory after 3 consecutive weeks in positive territory.

- Elsewhere, a relatively large, but not atypical, weekly round of net sales of foreign bonds on the part of Japanese investors fell out of the 4-week sample period, which allowed the negative degree witnessed in the 4-week rolling sum of that measure to moderate.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -183.0 | 659.7 | -401.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 55.9 | -86.9 | 394.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -225.2 | 161.5 | 1165.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -550.6 | 199.2 | -243.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Three-Day Rally Fizzles Out

A negative day for equity markets in the Asia-Pac region after a three-day rally. Markets shook off a positive lead from the US where indices hit fresh record highs. In mainland China indices declined by around 1.5% as the tech rebound abates. Other markets are also in the red, though moves are more muted; in Japan the Nikkei 225 is down around 0.1%, in Australia the ASX 200 is down 0.3%, while South Korea saw losses of 0.7% - the BoK hiked rates 25bps during the session, the first major economy to hike rates in Asia. Negative sentiment weighed on US equity futures, e-mini Nasdaq leading the way lower as tech shares in Asia came under pressure. The Jackson Hole meeting, which is due to begin later today, will be key for the direction of risk sentiment, commentary from FOMC Chair Powell on Friday headlines that (now virtual) event.

OIL: Pulls Back In Asia After Three-Day Rally

Oil is slightly lower in Asia-Pac trade on Thursday, impacted by generally negative sentiment in the region after a three-day rally, the dollar index has crept higher which has exerted some extra pressure on crude futures. Worries over the delta variant persist, the EU is scheduled to discuss reimposing restrictions on US visitors later today while restrictions remains in place in many countries, though the prospect of increased demand from India and effective containment policies in China are supportive. Inventory data yesterday showed headline stockpiles fell 2.98m bbls, while downstream products also saw stockpile draws. The Jackson Hole meeting, which is due to begin later today, will be key for the direction of risk sentiment, commentary from FOMC Chair Powell on Friday headlines that (now virtual) event.

GOLD: Little Changed In Asia

Gold nudged lower on Wednesday, even as the broader DXY pulled back from best levels in NY hours, while our weighted U.S. real yield monitor was little changed on net for the day. Spot has consolidated to deal little changed around $1,790/oz during Asia-Pac hours, with the technical lines in the sand remaining well defined. Participants continue to look to Fed Chair Powell's Friday address as the next staging post for direction.

FOREX: Caution Creeps In, Jackson Hole Takes Focus

Caution prevailed in a relatively subdued Asia-Pac session, with participants awaiting fallout from the Fed's annual gathering. Softer crude oil prices applied some pressure to commodity-tied FX.

- Local Covid-19 outbreaks generated headwinds for the Antipodeans as the situation in Sydney deteriorated and NSW declared its first four-digit daily case count, while New Zealand's Director-General of Health said that lowering alert level outside of Auckland below 3 at Friday review was unlikely.

- Safe haven currencies were in demand, with JPY leading gains. The Nikkei reported that we should expect record budget requests across Japanese ministries & agencies for FY22/23.

- ECB Monetary Policy Meeting Accounts and the secondary print of U.S. GDP data are on the docket today, alongside U.S. jobless claims & core PCE as well as comments from ECB's Rehn, Villeroy & Schnabel.

- That being said, the Jackson Hole symposium, which kicks off today, will be key for the direction of risk sentiment during the remainder of this week.

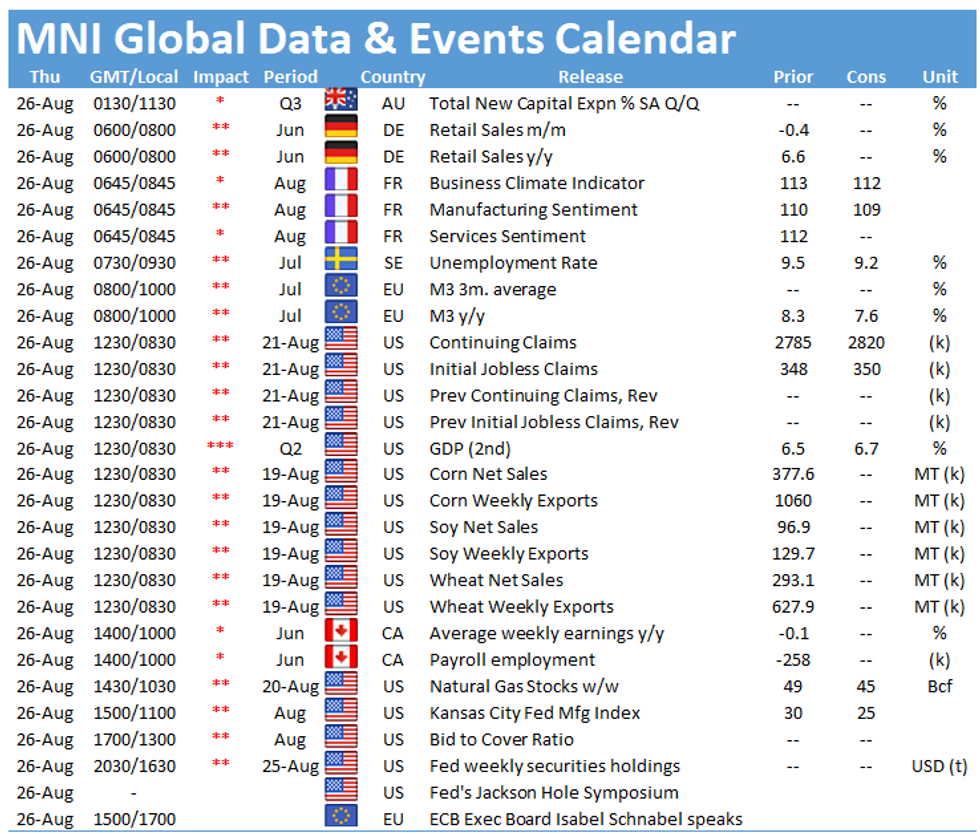

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.