-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Brexit, OPEC & Sino-U.S. Relations, What's New?

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- ECB'S LAGARDE: EURO ZONE ECONOMY SUFFERING EVEN AS INFECTIONS EASE (RTRS)

- ECB'S KAZAKS BACKS LONGER BOND-BUYING IN STIMULUS BOOST (BBG)

- SOURCE REPORTS PLAY DOWN BREXIT TALKS ENTERING TUNNEL, BARNIER TO HOLD CALL WITH EU AMBDRS ON WEDNESDAY

- BIDEN: WON'T IMMEDIATELY REMOVE CHINA PHASE 1 TARIFFS (NYT)

- MUTED MARKETS IN ASIA, TSYS EDGE AWAY FROM LOWS, E-MINIS TICK AWAY FROM HIGHS

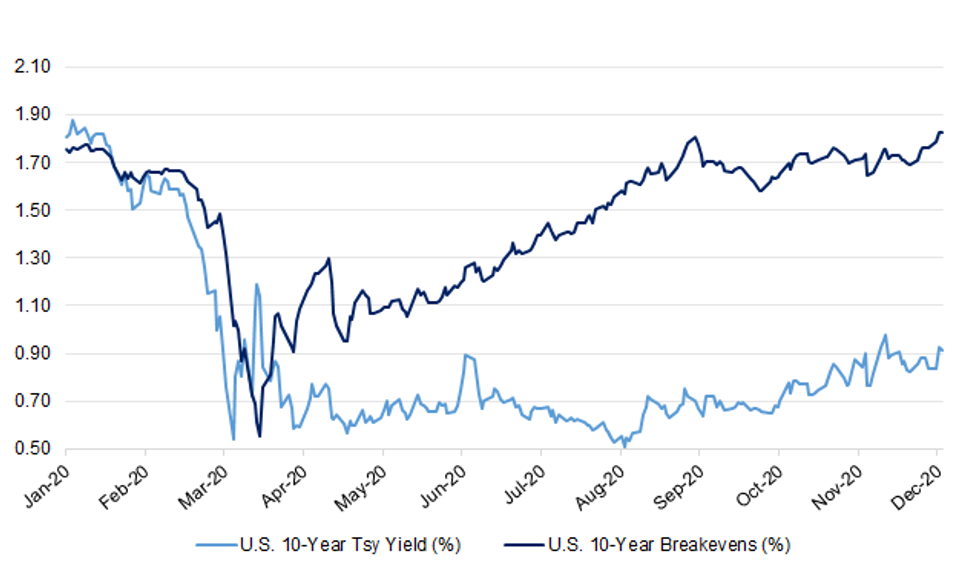

Fig. 1: U.S. 10-Year Tsy Yield vs. U.S. 10-Year Breakevens

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: A Sky reporter tweeted the following on Tuesday: "Sources from both UK and EU Brexit teams tell me they are bemused by idea that talks have "entered the tunnel". One says "negotiations cannot become any more intense." (MNI)

BREXIT: Michel Barnier will on Wednesday hold talks with EU ambassadors, amid growing disquiet from France that he is preparing to give too much away to Britain in the Brexit trade talks. The EU's chief negotiator will give an online briefing to ambassadors in Brussels from London, where talks continue. It is aimed at reassuring the diplomats that he is not about to cave to British demands on fishing and other issues. The 7.30am meeting was called after France and other member states warned their European Commission negotiators to hold firm to their red lines in the endgame of trade negotiations with Britain. One EU diplomat said the Commission received a "serious warning" from France that it was making dangerous concessions on key negotiating lines "that risked dividing member states". (Telegraph)

BREXIT: British and European Union negotiators are racing to strike a post-Brexit trade deal before next week, with officials on both sides saying the outcome is still too close to call. While intensive, round-the-clock talks in London are making progress, genuine disagreement remains on the two biggest obstacles to an agreement, meaning it's impossible to predict an outcome with any certainty, people with knowledge of the discussions said. However, two officials said the general mood on both sides is one of optimism. (BBG)

BREXIT: RTE reporter tweeted the following on Tuesday: "European Commission source plays down talk of a "tunnel". Says member states and the European Parliament will still be briefed on progress in the Brexit negotiations, although not perhaps as often as they would like." (MNI)

BREXIT: ITV's Peston tweeted the following on Tuesday: "EU source says "If [Boris Johnson's] taxation bill violates the Withdrawal Agreement, how could EU ever approve new deal." (MNI)

CORONAVIRUS: England's new tiered system of coronavirus restrictions has been approved by MPs, although more than 50 Tory MPs rebelled against the measures. The result means that the COVID-19 measures will come into effect when England's second lockdown ends tomorrow. (Sky)

EUROPE

ECB: A second wave of coronavirus cases may be slowing down in Europe but the economy is stil bearing the brunt of the containment measures taken to address it, European Central Bank President Christine Lagarde said on Tuesday. "The second wave is underway and by the way in Europe (it) is beginning to slow down and reduce in intensity because of the new containment measures that have been taken but which indeed are affecting the economy as we speak," Lagarde said. "All the latest developments that we're seeing are showing the economy is still suffering." (RTRS)

ECB: European Central Bank policy maker Martins Kazaks said an expansion of the institution's emergency bond-buying program by 500 billion euros ($603 billion) would be "reasonable" and he's ready to support an extension until mid 2022. The resurgence of the coronavirus pandemic in the euro area and the likely negative impact on economic growth next year mean that the ECB needs to continue to provide support, the governor of Latvia's central bank said in an interview from Riga. Officials are set to decide on how to boost stimulus on Dec. 10. (BBG)

U.S.

FED: Federal Reserve Governor Lael Brainard said Tuesday that more government fiscal aid is needed to prevent deeper damage to a U.S. economy coping with a fresh surge in coronavirus cases. The central bank is "committed to providing sustained accommodation" through ultra-low interest rates and asset purchases, Brainard said in the text of a speech. At the same time, "additional fiscal support is essential to bridge past Covid's second wave in order to avoid labor market scarring, reductions in crucial state and local services, and bankruptcies," she said. (BBG)

FED: The U.S. central bank is already doing "quite a lot" to boost the economy and has little scope to do much more, Chicago Federal Reserve Bank President Charles Evans said on Tuesday, calling again for more fiscal help from the U.S. Congress. "This is a real economic downturn, it's a public health safety crisis, and so that screams out for remedies other than monetary policy," Evans said in an interview aired Tuesday on CNN International. "There are very useful arguments that much of the country could stand to have additional relief during the current increased virus spread and the risks that the economy faces." (RTRS)

FED: MNI POLICY: Fed's Daly Says QE Program 'In Good Place'

- San Francisco Federal Reserve President Mary Daly said Tuesday that while offering more guidance on QE would be the next natural step for monetary policy, the recent rise in Covid cases doesn't justify aggressive economic stimulus when people are being encouraged to stay home instead of going out to spend on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI POLICY: Fed's Logan: IOER Hike Would Offset Falling Rates

- The Federal Reserve will offset downward pressure on its benchmark short-term interest rate by hiking the interest rate on excess reserves if needed, New York Fed's market chief Lorie Logan said Tuesday, noting that the extraordinary factors supporting market rates this year are likely to moderate on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Directors at all 12 of the Federal Reserve's regional reserve banks favored holding the discount rate at 0.25% in meetings from Sept. 24 through Oct. 22, citing ongoing uncertainty associated with the Covid-19 pandemic. "Overall, directors were cautious about the pace of future improvements in the economy, given continued uncertainty about the evolution of the pandemic and the potential implications for the outlook," said minutes of the directors' discount-rate meetings released Tuesday in Washington. (BBG)

FED: The Senate is set to vote Wednesday to advance the nomination of Christopher Waller to the Federal Reserve Board, but Majority Leader Mitch McConnell hasn't indicated he'll try to revive the confirmation of President Donald Trump's other Fed nominee, Judy Shelton. The procedural move, which was expected, is a prelude to a likely confirmation later this week on the Senate floor for Waller, research director at the Federal Reserve Bank of St. Louis. He is less controversial than Shelton, whose nomination was blocked from advancing on Nov. 17. McConnell can bring her nomination up for reconsideration, but he's given no indication whether he plans to do so.

ECONOMY: MNI INTERVIEW: Absenteeism Hurts US Factory Recovery-ISM Chief

- U.S. factory managers are paying special bonuses just for showing up to work amid fears of the second Covid-19 wave, but it's not enough to keep staffing needed for sustaining the industry's expansion, Institute for Supply Management chair Tim Fiore told MNI Tuesday - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Treasury Secretary Steven Mnuchin on Tuesday contended that he was required by law to move $455 billion in unspent emergency pandemic relief money into an account that would lock it away from President-elect Joe Biden's administration. "It is my intent to completely follow the law, and the law requires the amounts transferred," Mnuchin said during a Senate Banking Committee hearing in Washington. (BBG)

FISCAL: The pressure on congressional leaders to pass a new coronavirus stimulus bill is rising. A group of bipartisan lawmakers released a $908 billion pandemic relief framework. The biggest chunk of $288 billion would go to small business aid. The measure would send $160 billion to state and local governments. It includes a $300 per week enhanced unemployment benefit, $16 billion for Covid-19 testing, tracing and vaccine distribution and $17 billion for airlines. It would not send a second direct payment to Americans. (CNBC)

FISCAL: Senate Majority Leader Mitch McConnell rejected a proposed bipartisan virus relief package, pushing instead for what he calls a "targeted relief bill," CNBC's Jacob Pramuk reports. The $908 billion plan was put together by members of the GOP-controlled Senate and Democratic-held House. McConnell said he earlier spoke to White House officials about what President Donald Trump would sign into law and plans to offer potential solutions to GOP senators in an effort to get their feedback. (CNBC)

FISCAL: President-elect Joseph R. Biden Jr. on Tuesday introduced the economic team he will rely on to help rebuild the U.S. economy at a perilous moment, with coronavirus cases soaring, the Federal Reserve chair warning of challenging months ahead and lawmakers in Congress still struggling to reach agreement on a rescue package. Mr. Biden, speaking in Delaware, called on Congress to pass a substantial relief package to help keep businesses, households and local governments afloat while his Treasury secretary nominee, Janet L. Yellen, called the damage done so far "an American tragedy" that could lead to long-term devastation if not quickly corrected. (New York Times)

FISCAL: President-elect Joe Biden signaled Tuesday that he would support additional COVID-19 relief beyond any aid package Congress could pass before the end of the year. "Right now, the full Congress should come together and pass a robust package for relief to address these urgent needs," Biden told reporters in Delaware. "But any package passed in a lame-duck session is likely to be, at best, just a start." (FOX Business)

FISCAL: On Tuesday, Pelosi and Treasury Secretary Steven Mnuchin spoke for the first time since late October. After the call, Pelosi said Mnuchin told her he would review a proposal she and Senate Minority Leader Chuck Schumer, D-N.Y., sent to Republicans on Monday. She did not specify what the plan includes. Mnuchin also said he would look over the bipartisan plan put out Tuesday, according to Pelosi. "Additional COVID relief is long overdue and must be passed in this lame duck session," she said in a statement. (CNBC)

FISCAL: Sources caution ABC that getting any sort of relief hammered out in the remaining days before the holiday break will be an uphill battle. Time is running out in the session, and there remain other priorities, including government funding and the National Defense Authorization Act that must be tackled. (ABC)

CORONAVIRUS: The first shipments of Pfizer's coronavirus vaccine will be delivered on December 15, according to an Operation Warp Speed document obtained by CNN on Tuesday. The document, provided to governors ahead of a call with the Vice President Monday, also estimated the first shipment of Moderna's vaccine will be delivered on December 22. (CNN)

CORONAVIRUS: The United States is likely to see a "surge upon a surge" of Covid-19 cases following Thanksgiving and heading into Christmas as crowds of shoppers and holiday parties threaten to fuel an already raging outbreak, White House coronavirus advisor Dr. Anthony Fauci said on Tuesday. "If you look across the United States, we are really in a public health crisis right now," Fauci told Colorado Gov. Jared Polis during a livestream session on Tuesday. "Now that we're in the mid to late-fall, merging on into the winter, we've seen, because a variety of circumstances, a surge that has really surpassed the others." (CNBC)

CORONAVIRUS: The overwhelming majority of Americans could be vaccinated against Covid-19 by the second quarter of next year, leading to herd immunity by the fall, Anthony Fauci, the U.S. government's top infectious disease doctor, said Tuesday. (BBG)

CORONAVIRUS: Moncef Slaoui, chief science advisor for the Trump administration's Operation Warp Speed, said that the entire U.S. population could be vaccinated against the coronavirus by June, and there could be enough doses to immunize the rest of the nearly 8 billion people in the world by early to mid-2022. (CNBC)

CORONAVIRUS: The Centers for Disease Control and Prevention told President Donald Trump's coronavirus task force on Tuesday that its new guidance would cut quarantine time for individuals exposed to the virus by as much as half, according to two people familiar with the matter. The new recommended quarantine would be seven days for those who test negative after exposure to Covid-19, and 10 days for those who do not take a test, said the people, who were granted anonymity to discuss information that has not been made public. (BBG)

CORONAVIRUS: In San Francisco, Mayor London Breed said that more- stringent measures may be coming as soon as this week. The city, already in California's purple tier requiring widespread restrictions, is considering further capacity limits on businesses and outdoor gatherings, as well as requiring people to self-quarantine if they travel. "Our dangerous winter has arrived," Breed said Tuesday in a press briefing. "What we're seeing now is a spike unlike anything we've seen since the beginning of this pandemic. We are in trouble." (BBG)

CORONAVIRUS: A Centers for Disease Control and Prevention panel voted 13-1 on Tuesday to give health-care workers and long-term care facility residents the first coronavirus vaccine doses once it's cleared for public use. (CNBC)

POLITICS: The U.S. Department of Justice has not found evidence of large-scale ballot fraud that would reverse President-elect Joe Biden's projected win over President Donald Trump in the election, Attorney General William Barr said in a new interview Tuesday. (CNBC)

EQUITIES: The Federal Aviation Administration (FAA) has issued its first airworthiness certificate for a Boeing 737 MAX built since March 2019, the agency said on Tuesday. The FAA on Nov. 18 lifted a 20-month-old grounding order on the MAX after two fatal crashes in five months killed 346 people. The FAA is requiring a series of software changes and new pilot training requirements before planes can return to service. (RTRS)

EQUITIES: U.S. President Trump tweeted the following on Wednesday: "Section 230, which is a liability shielding gift from the U.S. to "Big Tech" (the only companies in America that have it - corporate welfare!), is a serious threat to our National Security & Election Integrity. Our Country can never be safe & secure if we allow it to stand. Therefore, if the very dangerous & unfair Section 230 is not completely terminated as part of the National Defense Authorization Act (NDAA), I will be forced to unequivocally VETO the Bill when sent to the very beautiful Resolute desk. Take back America NOW. Thank you!" (MNI)

OTHER

U.S./CHINA: On China, Biden said he would not act immediately to remove the 25 percent tariffs that Trump imposed on about half of China's exports to the United States — or the Phase 1 agreement Trump inked with China that requires Beijing to purchase some $200 billion in additional U.S. goods and services during the period 2020 and 2021 — which China has fallen significantly behind on. "I'm not going to make any immediate moves, and the same applies to the tariffs," he said. "I'm not going to prejudice my options." He first wants to conduct a full review of the existing agreement with China and consult with our traditional allies in Asia and Europe, he said, "so we can develop a coherent strategy." "The best China strategy, I think, is one which gets every one of our — or at least what used to be our — allies on the same page. It's going to be a major priority for me in the opening weeks of my presidency to try to get us back on the same page with our allies." (New York Times)

U.S./CHINA: U.S. government surprise raids targeting members of the Communist Party of China on arriving Chinese ships and airplanes are "McCarthyist" and justify a reciprocal response from China, the English-language China Daily said in an editorial. The outgoing Trump administration is creating difficulties for the incoming administration and hopes to make the aggressive U.S. approach to China irreversible, the newspaper said. The 90-million-member CPC holds a legitimate leadership role in China, and it seeks a constructive China-US relationship, the newspaper said. (MNI)

CORONAVIRUS: A Roche Holding AG test that detects the presence and level of coronavirus antibodies was cleared by the U.S. Food and Drug Administration for emergency use. (BBG)

HONG KONG: More than 150 parliamentarians from 18 countries have called on Hong Kong leader Carrie Lam to intervene to ensure justice for 12 people, the youngest of who is 16, who have been detained in mainland China while trying to flee the city by boat. (RTRS)

BOJ: MNI POLICY: BOJ Amamiya's Calls for Firm but Easy Policy

- Bank of Japan Deputy Governor Masayoshi Amamiya has said that the BOJ must be firm in conducting the current easy policy through its three key measures and the bank will extend them beyond the due expiry of March 31, 2021, if necessary on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

RBA: Australian central bank chief Philip Lowe said the nation's economy has turned a corner from its pandemic-inducted downturn, while reiterating that the recovery is likely to be a bumpy one. Economic growth is expected to be "solidly positive" in the third and fourth quarters of this year and then expand 5% next year, the Reserve Bank of Australia governor told a parliamentary panel in Canberra Wednesday. Yet, unemployment is set to remain above 6% at the end of 2022, keeping wage and price pressures subdued, he said. (BBG)

TAIWAN: The director of the de facto U.S. embassy in Taiwan should be confirmed by the Senate to bolster ties with the self-ruled island, a congressional advisory panel said Tuesday, as it warned of a growing threat of China potentially employing military means to pursue unification. The move would place the director of the American Institute in Taiwan on a similar level as an ambassador. The report's recommendations are expected to color President-elect Joe Biden's policies concerning China. (Nikkei)

CANADA: MNI INTERVIEW: Canada Fiscal Guardrail a Distant Goal: Antunes

- Canada's pledge to restore "fiscal guardrails" may not be fulfilled soon and end up being weak, leaving doubts about long-term debt sustainability, government adviser and Conference Board of Canada chief economist Pedro Antunes told MNI on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

BONDS: Weaknesses that emerged in the bond market at the height of the pandemic-induced market ructions in March must be "dealt with" and bankers' pay is due an "adjustment", Paul Tucker has said. Speaking at the Financial Times Global Banking Summit, Sir Paul — the former Bank of England deputy governor who now chairs the Systemic Risk Council, an advisory body — said the turmoil in the US government bond market this spring showed that trades which rely on heavy levels of borrowing remain a serious issue. (FT)

EQUITIES: SoftBank Group Corp. is quietly winding down its controversial derivatives strategy after a sustained backlash from investors, according to people familiar with the matter. The Japanese conglomerate is letting its options expire, instead of maintaining its positions, the people said, who declined to speak publicly. About 90% of the contracts will close out by the end of December because they are short-term, according to one of the people. SoftBank will hold on to its underlying portfolio of big tech stocks, which included Amazon.com Inc. and Facebook Inc., the person said. (BBG)

OIL: The United Arab Emirates came out of OPEC heavyweight Saudi Arabia's shadow this week by demanding better adherence with oil supply cuts, effectively delaying the latest strategy decision by OPEC and its allies by a few days, sources told Reuters. The unusual move highlights the UAE's growing role within OPEC as it seeks to boost production in the years ahead to gain market share. It also underscores Abu Dhabi's growing political independence from Riyadh, which became obvious this year when the UAE became the first country in the Gulf to normalise relations with Israel. (RTRS)

OIL: Mexico will cash in its oil price insurance policy this year for the fourth time only in the last two decades, receiving a payout of about $2.5 billion from its 2020 sovereign oil hedge, people familiar with the transaction said. In an ironic turn of events, Mexico is making a hedging profit just as the OPEC+ deal the Latin American country walked away from earlier this year is threatened by infighting over production levels. (BBG)

CHINA

BONDS: China is likely to maintain the amount of special debt to be issued in 2021 given the recovery is well underway, the China Securities Journal reported citing analysts. Local governments have issued CNY138 billion in bonds by November, with none under new quotas, the Journal reported citing data from Wind. Special bonds will still be needed to support infrastructure investment while fiscal policies will remain positive next year, so the scale of issuance is likely to be the same level as 2020, the newspaper reported citing Sun Binbin, an analyst from Tianfeng Securities. Newly added local government bond issuance next year should be at just over CNY 1 trillion if the target deficit ratio is set back at 3%, said Sun. (MNI)

REAL ESTATE: China's banking regulator fined banks a record of over CNY1 billion in the first 11 months, with many fines for illegal loans to the real estate industry, the Economic Information Daily said citing research based on regulatory data. Regulators are likely to continue their tough measures on real estate and the related shadow lending activities, the newspaper said citing Tao Jin, an analyst with the Suning Institute of Finance. (MNI)

OVERNIGHT DATA

JAPAN NOV MONETARY BASE Y605.9TN; OCT Y608.3TN

AUSTRALIA Q3 GDP +3.3% Q/Q; MEDIAN +2.5%; Q2 -7.0%

AUSTRALIA Q3 GDP -3.8% Q/Q; MEDIAN -4.4%; Q2 -6.4%

NEW ZEALAND Q3 TERMS OF TRADE INDEX -4.7% Q/Q; MEDIAN -3.8%; Q2 +2.4%

SOUTH KOREA NOV CPI +0.6% Y/Y; MEDIAN +0.7%; OCT +0.1%

SOUTH KOREA NOV CORE CPI +1.0% Y/Y; MEDIAN +0.6%; OCT +0.1%

SOUTH KOREA NOV CPI -0.1% M/M; MEDIAN -0.1%; OCT -0.6%

UK NOV BRC SHOP PRICE INDEX -1.8% Y/Y; MEDIAN -1.3%; OCT -1.2%

CHINA MARKETS

CHINA SETS YUAN CENTRAL PARITY AT 6.5611 WEDS VS 6.5921 TUES

On July 21, 2005, China switched to a managed-float formula against a basket of currencies, weakening the yuan's peg to the dollar.

PBOC NET DRAINS CNY110 BILLION VIA OMOS WED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This resulted in a net drain of CNY110 billion given the maturity of CNY120 billion repos today, according to Wind Information.

MARKETS

BOND SUMMARY: Asia Happy To Buy The Dip In Tsys, Again

Wednesday's Asia-Pac session was light on news, but that didn't stop regional investors from dipping their toes into long U.S. Tsy positions on the back of Tuesday's dip.

- Desks cited solid demand from real money a/cs in the 10-Year zone as the curve saw some light bull flattening (cash Tsys trade up to 1.0bp richer at typing), with T-Notes +0-05+ at 137-19+ at typing, holding to a 0-05+ range on volume of ~110K. Eurodollar futures are unchanged to +1.5K through the reds, with the highlight on the flow side coming in the form of an EDU2/U4 steepener (which saw 5.5K lots trade in 1 clip) although outright and spread flow was generally mixed in nature.

- It was a narrow session for JGB futures, with the contract operating a touch off the overnight lows, -13 last. Cash JGBs were cheaper across the curve but generally traded within 1.0bp of settlement levels. Today's BoJ Rinban operations saw the Bank leaves the size of its 1-5 Year JGB purchases unchanged, with little in the way of notable movement in the offer/cover ratios. Elsewhere, we heard from BoJ's Amamiya, but he didn't add to the policy debate as he went over old ground.

- Aussie bonds are steeper on the day, YM -1.5, with XM -7.0 and have given back their early outperformance vs. Tsys (at least as observed by the AU/U.S. 10-Year yield spread). The Australian GDP reading was stronger than median expectations. Elsewhere, RBA Governor Lowe & Deputy Governor Debelle are making an appearance in front of the Economic Standing Committee in Canberra, which has generated little in the way of surprise with debate. The impact of flows vs. stock of QE, relative bond yield dynamics, direction of the AUD (with AUD TWI at the fore), focus on unemployment as opposed to the risk of excessive borrowing levels, housing prices, infrastructure investment and the Bank's economic outlook dominate the lines of questioning. It is worth noting that Lowe pointed to an open mind re: the potential extension of QE beyond the already outlined A$100bn level, with that particular thought process to focus on economic performance, relative central bank stances and the functioning of markets. The latest ACGB '31 offering saw a soft cover ratio, at least by recent standards, perhaps the recent cheapening scared off a chunk of the potential bidders even against the upcoming Christmas break for AOFM issuance. Still, average yields managed to stop ~0.6bp through prevailing mids at the time of auction (per BBG pricing).

EQUITIES: Asia Little Changed, E-Minis Edge Lower After New Wall St. Records

The major regional indices struggled for any meaningful sense of direction during Wednesday's Asia-Pac session, operating either side of unchanged, while U.S. e-minis edged lower after their cash equivalents backed away from fresh record highs (in the case of the S&P 500 and NASDAQ 100) into the Wall St. close. This came in the wake of a solid rally lining up with the resumption of fiscal stimulus discussions in DC and a decent ISM m'fing print.

- Macro headline flow was generally light during the Asia-Pac session, although Donald Trump continued his battle against "big tech" friendly regulations.

- Nikkei 225 +0.1%, Hang Seng -0.1%, CSI 300 +0.2%, ASX 200 unch.

- S&P 500 futures -11, DJIA futures -133, NASDAQ 100 futures -24.

GOLD: Back Above $1,800

The latest round of USD weakness has supported bullion over the last 24 hours, even with Tsys struggling/stagnant U.S. real yields and ETFs continuing to shed their gold holdings (which still sit just shy of historically elevated levels in the grand scheme of things). Spot last deals around the $1,810/oz mark. From a technical perspective bulls look to force a break above the Nov 26 high at $1,818.3/oz which would allow them to turn their focus higher.

OIL: API Inventories Add Fresh Pressure

WTI & Brent sit ~$0.40 below their respective settlement levels, building on yesterday's losses.

- OPEC+ production matters continue to dominate. OPEC delegates continue to err on the optimistic side re: reaching a broad consensus re: future production ahead of the OPEC+ ministerial gathering, although the market is a little more uncertain. There appears to be 3 potential scenarios that are being discussed among some of the major players.

- Extend the current production cut by 3 months, which the Saudis seem to be behind.

- Raise output from Jan, but in a more gradual manner and by less than previously planned 2mn bpd, which seems to be Russia's preference.

- Raise output by 2mn bpd from Jan as previously planned, which Kazakhstan favours.

- Elsewhere, a surprise, sizeable headline crude stock build in the latest round of weekly API inventory data provided a further source of pressure.

FOREX: US Dollar Weakens Again in Mild Risk-On Conditions

FOREX: Another fairly quiet FX session for Asia-Pac, the main driver of price action was again a weaker US dollar as risk on sentiment prevailed and equity indices moved mostly higher. E-Minis were a touch weaker after Wall Street hit record highs on Tuesday, but this did little to dampen broadly positive sentiment.

- Yen crosses were slightly weaker as safe haven currencies fell out of favour. USD/JPY last at 104.37 after touching highs of 104.46 earlier. EUR/JPY charged through the 126 handle with chatter of momentum accounts active around the handle, pair last at 126.06

- AUD has strengthened slightly vs. the US dollar, the pair last at 0.7381. Risk on tone in Australia was supported by a 2% jump in gold prices, and a positive assessment on the domestic economy from the OECD who expect a 3.2% rebound in 2021 GDP figures. Markets shrugged off stronger than expected Q3 GDP figures.

- NZD has seen a similar move higher, currently hovering around the highest level in 30-months. Market participants will look ahead to the speech from RBNZ Governor Orr at 0630GMT/1730AEDT, his recent comments have moved away from speculation that the RBNZ is contemplating negative rates, in a speech last week he said that it would only be used if absolutely necessary.

- The yuan continued to grind higher against the US dollar. The PBOC set the USD/CNY reference rate at 6.5611, higher than the 6.5572 from sell-side model estimates. The 39pip difference was the third-largest miss since the PBOC announced that it was phasing out its counter-cyclical adjustment for the fixing in October. Markets shrugged off this discrepancy, USD/CNH last trades at 6.5451, just off session lows.

FOREX OPTIONS: Expiries for Dec2 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865-80(E1.9bln), $1.2050(E435mln), $1.2235-50(E620mln-EUR calls)

- USD/JPY: Y104.00-05($656mln), Y104.45-60($1.2bln), Y105.90($680mln), Y106.20($1bln)

- EUR/JPY: Y125.00-22(E514mln-EUR calls)

- GBP/USD: $1.3150(Gbp610mln), $1.3300(Gbp600mln)

- EUR/GBP: Gbp0.8800(E799mln-EUR puts)

- USD/CHF: Chf0.9170($1.0bln-USD calls)

- EUR/NOK: Nok10.56(E580mln)

- AUD/USD: $0.7250(A$1.2bln), $0.7325-40(A$612mln-AUD puts),

$0.7350-60(A$573mln), $0.7400(A$878mln-AUD calls) - NZD/USD: $0.6960(N$733mln-NZD calls), $0.7068(N$1.1bln-NZD calls)

- USD/CAD: C$1.2900($475mln), C$1.2950($1.0bln-$990mln USD puts), C$1.2975($1.3bln-USD puts), C$1.3000($668mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.