-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI EUROPEAN OPEN: Cautious Optimism Amid US Debt Deal

EXECUTIVE SUMMARY

- BIDEN, MCCARTHY VOICE CONFIDENCE DEBT DEAL WILL PASS IN TIME (BBG)

- DEBT-CEILING RELIEF MAY BE SHORT AS FOCUS TURNS TO T-BILL DELUGE (BBG)

- TURKEY’S ERDOGAN PREVAILS In ELECTION TEST OF HIS 20-YR RULE - RTRS

- CHINA URGES JAPAN TO STOP IMPOSING CHIP EXPORT CONTROLS - RTRS

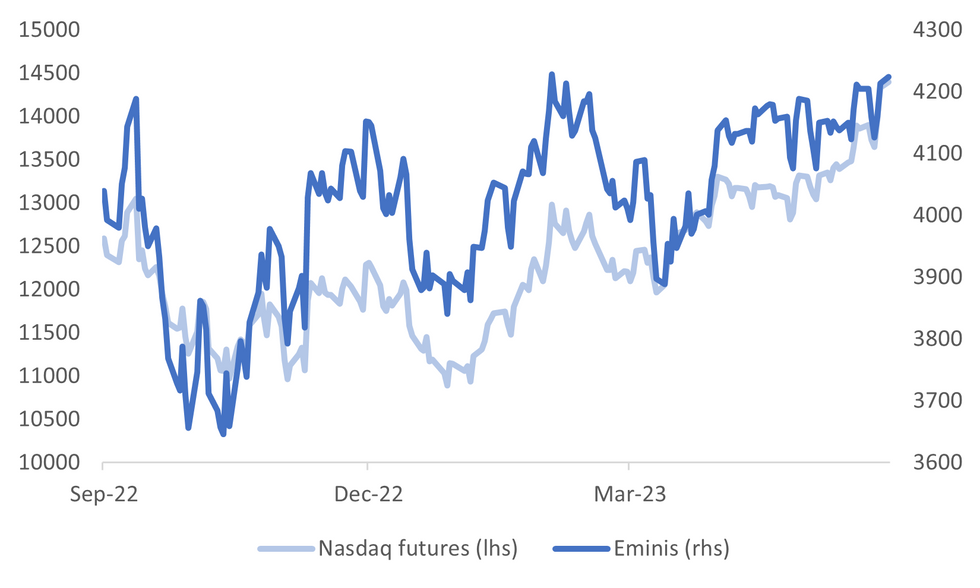

Fig. 1: Eminis & Nasdaq Futures

Source: MNI - Market News/Bloomberg

U.K.

BoE: Hawkish former Bank of England rate-setters warned that interest rates will need to soar as high as 6% to stamp out inflation, a level the central bank has identified as painful for households and businesses. (BBG)

INFLATION: UK Prime Minister Rishi Sunak’s government is seeking an agreement with supermarkets to introduce price caps on basic food items like bread and milk in order to tackle inflation, the Sunday Telegraph reported. (TELEGRAPH)

EUROPE

ECB: The European Central Bank is in the final stretch of its historic cycle of interest-rate increases, according to Governing Council member Gabriel Makhlouf. “Given our current outlook for inflation, we are likely to be close to ‘the top of the ladder,’” he said Saturday in Dubrovnik, Croatia. “So slowing the pace to standard rate steps is appropriate.” (BBG)

POLITICS: Pedro Sánchez’s Socialist party was poised to lose control of several key regions and cities in Spain’s local election on Sunday, complicating the prime minister’s effort to win a new term later this year. Alberto Núñez Feijóo’s conservative People’s Party, joined by the far-right Vox, was on track late Sunday to flip control of the Valencia, Aragón, La Rioja and Balearic regions while the PP solidified its control of the Madrid region, according to preliminary results with most areas reporting more than 80% of the votes. Twelve regions were up for grabs in the ballot and more than 8,000 municipalities. (BBG)

U.S.

DEBT: When Kevin McCarthy was struggling early this year to get enough votes from his own Republicans to become Speaker of the House of Representatives, Democratic President Joe Biden called the prolonged saga a national embarrassment, then had a little fun. "I've got good news for you," Biden said, pointing playfully at a reporter after a speech in Kentucky. "They just elected you speaker.". (RTRS)

DEBT: President Joe Biden and House Speaker Kevin McCarthy expressed confidence that their debt-ceiling deal will pass Congress, averting a historic US default while setting a course for federal spending until after the 2024 election. (BBG)

DEBT: Bond traders look set to pivot from worrying the US wouldn’t raise its debt limit to fretting about what the increase means for money markets. The concern is that with a tentative deal pending, the Treasury will soon replenish its cash balance by selling more than $1 trillion of bills through the end of the third quarter, according to recent estimates. The US cash stockpile currently sits at $39 billion, the lowest since 2017. (BBG)

OTHER

JAPAN: Japan aims to destroy any North Korean missile that violates its territory and is making preparations to do so, its defence ministry said on Monday after North Korea told Japan of a plan to launch a satellite between May 31 and June 11. (RTRS)

NORTH KOREA: North Korea's ruling party will hold a key meeting in early June to review the country's economic plans, state media KCNA reported on Monday. The meeting will review the implementation of the country's national economic plans in the first half of 2023 and discuss "policy issues of weighty significance" in the development of its revolution, the report said. (RTRS)

TURKEY: President Tayyip Erdogan extended his two decades in power in elections on Sunday, winning a mandate to pursue increasingly authoritarian policies which have polarised Turkey and strengthened its position as a regional military power. (RTRS)

AUSTRALIA: Reserve Bank of Australia Governor Philip Lowe has used a briefing with government lawmakers to warn them that implementing generous wage rises for workers could worsen inflation, the Australian Financial Review reported, citing unidentified people familiar with the talks. (BBG)

AUSTRALIA: Australia’s barley sector may be the next beneficiary of the thawing relationship with Beijing, Trade Minister Don Farrell said following another meeting with his Chinese counterpart. (BBG)

THAILAND: Thailand received one million Chinese tourists between January and May 18, a government official said on Sunday, after China's border reopening. The government expects the number of Chinese visitors to meet its target of 5 million this year, with spending of 446 billion baht ($13.18 billion), government spokesperson Anucha Burapachaisri said in a statement. (RTRS)

CHINA

JAPAN/CHINA: Chinese Commerce Minister Wang Wentao urged Japan to correct its "wrongdoing" of imposing chip export controls, according to a statement from the Chinese commerce ministry on Monday. Wang made the comments during talks with Japanese Trade Minister Yasutoshi Nishimura on May 26 at the Asia-Pacific Economic Cooperation (APEC) conference. (RTRS)

US/CHINA: Commerce Secretary Gina Raimondo said the US “won’t tolerate” the recent decision by Chinese authorities to ban chips by Micron Technology Inc. in some critical sectors, using her sharpest language yet to describe Washington’s reaction. (BBG)

EMPLOYMENT: Guangdong province will prioritise graduate employment to boost social stability and people's livelihoods, according to Qiu Kenan, spokesperson for the Guangdong Provincial Department of Education. The Government this year faces a difficult task to support young people, with new graduates in Guangdong expected to reach 970,000 in 2023, up 35.6% y/y, Qiu said. Guangdong has launched more than 864 recruitment activities since January and also boosted technical training services to enhance unemployed graduate skills. (Source: 21st Century Herald)

POPULATION: Authorities should increase social welfare to boost China’s low birth rates, according to Li Chaomin, professor at Shanghai University of Finance and Economics and a senior researcher at Taihe Think Tank. Li said China should guarantee women’s income during maternity leave and boost child support subsidies, tax reductions and social payments to address the decline in population. (MNI)

ECONOMY: China’s automobile market has recovered slower than expected due to uneven subsidy implementation and weak aggregate demand, according to Chen Shihua, deputy secretary-general of the China Association of Automobile Manufacturers (CAAM). Speaking at a recent press conference, Chen said overall demand still lags pre-Covid levels, although the industry had shown positive improvements in 2023. The State Council recently signalled it would enhance macro-economic support which will further boost demand in the auto-market in H2, Chen said. (Source: Yicai)

HOUSING: Chinese cities that experienced a recovery in home prices recently are unlikely to raise their mortgage rates for first-home buyers any time soon, PBOC-backed Financial News reports Monday, citing analysts. (Financial News)

EQUITIES: Chinese state-owned enterprises could seek more listings on the Star board, as the nation rolls out favorable policies to support their development in strategic and emerging industries, China Securities Journal reports Monday. (CSJ)

CHINA MARKETS

PBOC Net Injects CNY23 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted CNY25 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY23 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:23 am local time from the close of 1.9935% on Friday.

- The CFETS-NEX money-market sentiment index closed at 50 on Friday, higher than the close of 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0575 MON VS 7.0760 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0575 on Monday, compared with 7.0760 set on Friday.

MARKETS

US TSYS: Little Changed, Reverses Initial Cheapening On Debt Ceiling Deal News

TYM3 is currently trading at 112-10+, -2+ from NY closing levels, after initially cheapening to 112-03+ in early Asia-Pac trade on news of a debt ceiling deal. However, the ultimate challenge lies in gaining support from lawmakers across the political spectrum.

- Although a deal, if approved by Republican lawmakers, would prevent a default, US tsys will still face the challenge of managing the Treasury's need to replenish its cash balance through T-bill issuance.

- With the Asian calendar light today, local participants are likely to be headlines watch.

- Cash tsys are closed today for the Memorial Day holiday.

JGBS: Futures Weaker, At Cheaps, Rinban Operations Pressure 10-25-Years Zone

JGB futures are at Tokyo session lows in afternoon trade at 148.44, -12 compared to settlement levels as US tsy futures sit slightly weaker in Asia-Pac trade. Cash tsys are closed today for the Memorial Day holiday.

- Cash JGBs cheapen in afternoon trade, primarily driven by the 10-25-year maturity zone. This movement followed BoJ Rinban operations which revealed a higher offer cover ratio and an increased positive spread. However, the cover ratios for the 3-5-year, 5-10-year, and 25-year+ buckets showed a slight decrease.

- Cash JGBs exhibit a mixed trading pattern, displaying yield fluctuations ranging from 0.5bp lower for the 5-year maturity to 1.3bp higher for the 20-year zone. The benchmark 10-year yield has increased by 1.1bp, reaching 0.432%. Meanwhile, the benchmark 2-year yield, ahead of tomorrow's 2-year supply, is trading unchanged lower at -0.063%, showing no sign of concession on the curve.

- The swap curve has twist steepened in afternoon Tokyo trade with rates -0.5bp to +1.8bp and a pivot point at the 4-year zone. Swap spreads are wider beyond the 3-year.

- The local calendar tomorrow sees the Jobless Rate for April released tomorrow ahead of Retail Sales (Apr), IP (Apr P) and Housing Starts (Apr) on Wednesday.

- The MoF plans to sell Y2.9tn of 2-year JGBs tomorrow.

AUSSIE BONDS: Slightly Stronger, Narrow Range, CPI & RBA Lowe’s Testimony On Wednesday

ACGBs are slightly stronger (YM flat & XM +2.0) but off Sydney session's bests as US tsy futures trade slightly lower in a narrow range in Asia-Pac trade. With local headlines and economic data light today, local participants have watched US tsy futures for guidance as the market digests news of a debt ceiling deal.

- Cash tsys are closed today for the Memorial Day holiday. US tsy futures are at 112-10+, -2+ versus Friday’s close, after initially cheapening to 112-03+.

- Cash ACGBs are 1-2bp richer with the AU-US 10-year yield differential -2bp at -9bp.

- Swap rates are 2-3bp lower with the 3s10s curve 1bp flatter and EFPs slightly tighter.

- Bills strip twist flattens with pricing -2 to +2.

- RBA-dated OIS pricing is flat to 2bp firmer for meetings out to October but 1bp softer for meetings beyond.

- The local calendar sees April Building Approvals released tomorrow. Overall, an increase in non-high-rise constructions is expected to contribute to a 2% m/m rise in total dwelling approvals. However, the high-rise sector remains uncertain and poses a significant variable in the equation.

- However, the focus of the week is likely to be RBA Lowe’s appearance and April CPI data on Wednesday.

NZGBS: Closed Richer, At Bests, Headlines Watch

NZGBs finished the session on a high note, experiencing a 2-3bp richening. In the absence of domestic catalysts, local participants have primarily been monitoring US tsy futures and news headlines. In Asia-Pacific trading, US tsy futures are currently trading slightly lower as the market digests the announcement of a bipartisan debt ceiling agreement reached on Saturday. It's important to note that the US market is closed today in observance of the Memorial Day holiday.

- Swap rates are 2-4bp lower with the 2s10s curve 2bp flatter.

- RBNZ dated OIS closed mixed with meetings out to Feb'24 flat to 3bp firmer and meetings beyond 2-3bp softer.

- Westpac’s Monthly Employment Indicator showed a more-than-expected 0.6% m/m rise in-filled jobs to +3.8% y/y, the fastest since January 2022. The series is based on income tax data, which is not only comprehensive but also monthly, whereas Stats NZ labour market data is quarterly.

- On-farm inflation accelerated to 16.3% in the year through March, according to a Beef+Lamb New Zealand report Monday in Wellington.

- The local calendar sees April Building Permits slated for release tomorrow. The number of new dwelling consents rose 7% in March, driven by a large rise in multi-unit consent numbers. A reversal of this strength is expected.

EQUITIES: US Futures Higher, China Shares In HK Close To Bear Market Territory

Regional equities are once again mixed. Tech related plays are outperforming, following strong gains for US indices in Friday trade. US Futures are higher following the debt deal announcement from the weekend between Biden and McCarthy, with both leaders expressing confidence that the agreement with pass both US houses. Futures are away from earlier highs though. Eminis last around 4224, +0.25% (opening highs were just above 4243). Nasdaq futures are +0.42%.

- China markets are mixed, with the CSI 300 off by 0.60% to the break. We did see some support around the 3820 region, which is close to recent lows. Some jitters in the local government debt market are likely weighing. The Shanghai Composite is doing better, up 0.15% at this stage.

- Hong Kong markets have returned today, with the HSI off by 0.26% at the break, while the HS China Enterprise Index down 0.59%. This puts the index close to bear market territory (-19% off late January highs).

- The Topix (+0.70%) and Nikkei 225 (+0.99%) are faring better, with tech related strength spilling over. The Taiex is also higher again, +0.85%. South Korean markets are closed today.

- The ASX 200 is up nearly 1%, with firmer commodity prices in the metals space helping.

- The JCI is Indonesia has struggled, down 0.70% at this stage, lower palm oil prices not helping, while slower bank lending is likely raising question marks over the growth outlook.

FOREX: USD/JPY Hits Fresh Highs Before Reversing, A$ Outperforms Modestly

Earlier USD index gains were not sustained, as US Tsy futures have moved away from their lows, as the market continues to digest the debt ceiling agreement. The BBDXY got to a high of 1246.77, but now sit back around 1245.40. The early move was largely thanks to USD/JPY climbing to fresh highs, just above 140.90, but from there the pair dipped back sub 140.50, which is where we have spent much of the rest of the session.

- AUD/USD has outperformed modestly, we got to highs around 0.6545, but now sit back closer to 0.6530, still +0.20% above NY closing levels from last Friday. Some firmness in commodity prices has helped, with iron ore back above the $100/ton level, although copper is down a touch.

- NZD/USD dips sub 0.6050 have been supported, but the pair has been unable to make much headway above this level.

- EUR and GBP are up from earlier lows but have maintained tight ranges. GBP/JPY got close to 174 in early dealings, fresh highs back to 2016, but we sit back at 173.50/55 now.

- With UK and US markets out, the event/data calendar is very light. ECB's De Cos is due to speak.

OIL: Crude Rallies Further But Continues To Face Significant Uncertainty

Oil prices have risen further during APAC trading following Friday’s rally, supported by better risk sentiment following the US debt agreement. The next stage is passing it through Congress which both Biden and McCarthy were confident would occur. WTI is up 0.8% to $73.26/bbl and Brent +0.7% to $77.55. The USD index is flat.

- Brent closed just below $77/bbl on Friday but has spent Monday above that key level with even the intraday low at $77.31. WTI has held above $73 with the low at $73.06.

- Once the US debt-ceiling deal passes Congress, there will be one less concern for the oil market but others remain. It is still worried about further Fed tightening and the resultant recession risk, and the lacklustre recovery in China. On the supply side, Russia doesn’t seem to have reduced its output, but there is the chance that OPEC will reduce quotas again at its upcoming June 3-4 meeting.

- There is a holiday in the US and UK today, so upcoming events are thin. The ECB is observing the Whit Monday holiday. Liquidity in the oil market is expected to be light.

GOLD: Safe Haven Demand Wanes, Debt Ceiling Deal

Gold is little changed at 1945.63 in the Asia-Pacific session, after touching the lowest level since March 22 on Friday, before closing at 1946.46 (+0.2%).

- Demand for safe havens may continue to wane after news of a bipartisan debt ceiling agreement. The agreement entails the suspension of the debt limit for the next two years, while non-defence spending remains unchanged for the upcoming year (with a subsequent 1% increase in the second year). The announcement was made on Saturday.

- The real challenge lies ahead: garnering enough support from lawmakers on both sides of the political spectrum. According to The New York Times, Republican lawmakers have a track record of employing every possible means to hinder spending deals they oppose. They possess the necessary leverage to potentially derail the agreement since McCarthy's majority stands at a mere nine votes.

- Bullion will also face the challenge of coping with the hawkish re-pricing of the Fed funds path observed last week. This challenge may intensify if this week's jobs report continues to show strong numbers.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/05/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 30/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 30/05/2023 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2023 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 30/05/2023 | 0800/1000 | ** |  | IT | PPI |

| 30/05/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2023 | 1230/0830 | * |  | CA | Current account |

| 30/05/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/05/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/05/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/05/2023 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 30/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.