-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: China CPI Edges Up, Driven By Food Prices

EXECUTIVE SUMMARY

- FED’S SCHMID SUPPORTS RATE CUT IF INFLATION STAYS LOW - MNI

- GOOLSBEE WARNS FED STAYING TOO TIGHT, TOO LONG - MNI BRIEF

- TRUMP AND HARRIS TO DEBATE ON ABC; TRUMP SAYS HE WANTS TWO MORE - RTRS

- US CALLS FOR GAZA CEASE-FIRE TALKS AUG 15 WITH QATAR, EGYPT - BBG

- CHINA JULY CPI HITS FIVE MONTH HIGH AT 0.5% Y/Y - MNI BRIEF

- HOLD LIKELY, BUT MPC TO CONSIDER CUTS - MNI RBNZ WATCH

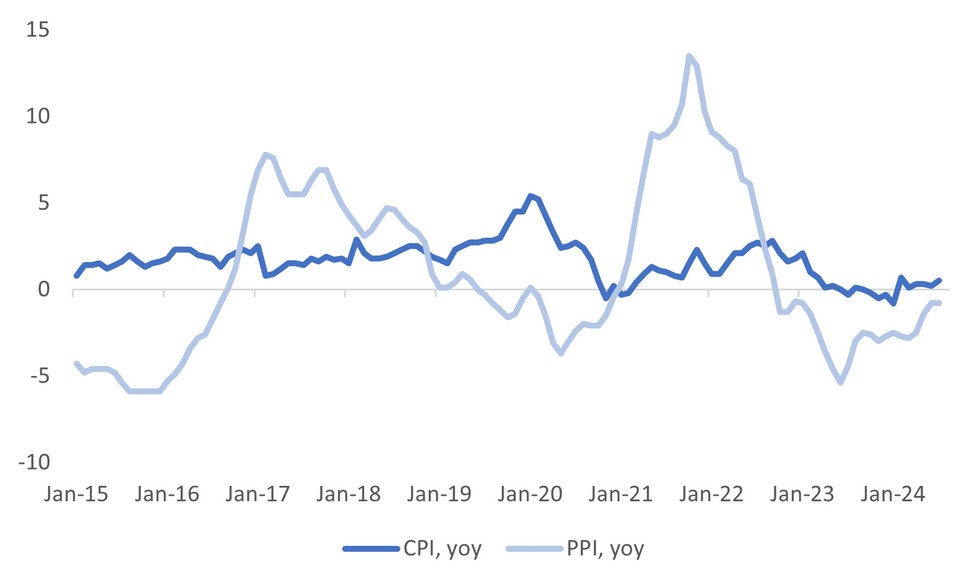

Fig. 1: China Inflation Edges Higher, But Still Low By Historical Standards

Source: MNI - Market News/Bloomberg

UK

BOE (MNI INTERVIEW): Fast Rates Transmission Argues For BOE Caution

EUROPE

GERMANY (MNI INTERVIEW): German Growth Weak Despite Wages- GCEE's Werding

RUSSIA (BBG): “Russian army chief Valery Gerasimov faces growing criticism after Ukrainian troops mounted their biggest incursion into Russian territory since the Kremlin started its war more than two years ago.”

POLAND (BBG): “ A Polish central banker said interest-rate cuts are likely in the first half of next year, the latest dissent against Governor Adam Glapinski’s prediction that the benchmark will remain on hold until 2026.”

US

FED (MNI): Federal Reserve Bank of Kansas City President Jeff Schmid said Thursday he's growing more confident that inflation is on a path to 2% and signaled his support for lowering interest rates if progress continues.

FED (MNI BRIEF): Federal Reserve Bank of Chicago President Austan Goolsbee warned Thursday central bank policymakers may be keeping interest rates too high for too long, noting the Fed may need to respond to any weakness in the U.S. economy threatening the Fed's maximum employment and stable prices goals.

FED (MNI BRIEF): Richmond Fed President Thomas Barkin said Thursday there is time for the Fed to wait and assess whether the healthy U.S. economy is gently cooling in a way that would allow for a steady, deliberate normalization of interest rates, or in a way that would require the Fed to "lean into" easing.

FED (BBG): “Republican nominee Donald Trump said that the president should have some say over interest rates and monetary policy, a move that would go against the longstanding practice of the US Federal Reserve being independent of political actors.”

LABOUR MARKET (MNI BRIEF): U.S. filings for jobless claims fell 17,000 to a seasonally adjusted 233,000 in the week ended July 27, lower than the 240,000 analysts expected, and allaying concerns that the labor market is deteriorating quickly. Claims in the previous week were revised up by 1,000 to 250,000 and the four-week average rose to 240,750, the highest since August 2023, the Labor Department said Thursday. Continuing claims were 1.875 million in the week to July 27.

POLITICS (RTRS): “U.S. Republican presidential candidate Donald Trump and Democratic opponent Kamala Harris will debate on Sept. 10 on ABC, setting up the first face-to-face match-up between the rivals in what polls show is a close race.”

OTHER

MIDEAST (BBG): “The US, Qatar and Egypt are calling for a new round of cease-fire talks on Aug. 15, the latest attempt by the Biden administration to end the war in Gaza even as the region braces for an expected Iranian attack on Israel.”

MEXICO (MNI BRIEF): Mexico's central bank reduced its overnight interbank interest rate by 25 basis points to 10.75% Thursday, citing expectations that core inflation will continue to fall. The vote was 3-2 with deputy governors Irene Espinosa and Jonathan Heath dissenting in favor of holding rates.

NEW ZEALAND (MNI RBNZ WATCH): The Reserve Bank of New Zealand's monetary policy committee is likely to hold the official cash rate at 5.5% when it meets next week, but it will debate a cut and inject greater dovish language into its communications as it prepares for reductions later this year.

BRAZIL (RTRS): “ Brazil's central bank will do "whatever is necessary" to control inflation, monetary policy director Gabriel Galipolo said on Thursday, adding that risks appeared to be to the upside of its 3% target.”

SOUTH KOREA (BBG): "The Bank of Korea may wait until after October to cut its key interest rate as housing inflation in Seoul threatens to ripple across the country, a former board member said, suggesting economists may need to keep pushing back their timelines for a policy pivot."

CHINA

INFLATION (MNI BRIEF): China's Consumer Price Index rose 0.5% y/y in July to hit a five-month high, quickening from June’s 0.2% and beating the 0.3% consensus, data from the National Bureau of Statistics showed Friday. Food prices remained flat from the same time last year, reversing June’s 2.1% fall. Pork prices rose by 20.4% while vegetables and eggs also increased amid hot and rainy weather. Non-food prices rose 0.7% due to base effects.

BONDS (BBG): “China widened its battleground against bond speculators, targeting everything from fund companies to rural banks to one of traders’ favorite parts of the debt market.”

BONDS (SECURITIES TIMES): “Authorities are supporting central bank efforts to maintain a normal sloping yield curve by intensifying investigations into illegal treasury bond trading, Securities Times reported, citing analysts. Employees at small and medium-sized financial institutions conspired to take advantage of expected treasury yield declines, the news outlet noted.”

AUTO (CAAM): “China's domestic retail car sales hit 1.7 million units in July, down 2.8% y/y and 2.6% m/m, according to the China Association of Automobile Manufacturers.”

FISCAL (YICAI): “China needs institutional reforms to help increase central government responsibility for fiscal spending, Yicai.com reported, citing Yuekai Securities' Chief Economist Luo Zhiheng. The central government should directly take on more employees and tasks from local governments rather than relying on transfer payments.”

CHINA MARKETS

MNI:PBOC Net Injects CNY11.73 Bln via OMO Friday

The People's Bank of China (PBOC) conducted CNY12.9 billion via 7-day reverse repo on Friday, with rate unchanged at 1.70%. The operation has led to a net injection of CNY11.73 billion after offsetting the CNY1.17 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7765% at 09:50 am local time from the close of 1.7731% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Thursday, compared with the close of 50 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1449 on Friday, compared with 7.1460 set on Thursday. The fixing was estimated at 7.1679 by Bloomberg survey today.

MARKET DATA

CHINA JULY CPI Y/Y 0.5%; MEDIAN 0.3%; PRIOR 0.2%

CHINA JULY PPI Y/Y -0.8%; MEDIAN -0.9%; PRIOR -0.8%

JAPAN JULY MONEY STOCK M2 Y/Y 1.4%; PRIOR 1.5%

MARKETS

US TSYS: Tsys Futures Edge Higher Through Asia Session, Volumes Light

- Treasury futures have edged higher throughout the session, slowly clawing back the weakness made overnight after lower-than-expected jobless claims. There has been some block buying in the FV contract, and a block steepener trade a moment ago.

- TUU4 is +0-01¾ at 103-09 while TYU4 + 08 at 112-29.

- The cash treasury curve has bull-steepened today with yields 2-4bps lower. The 2yr is -3.3bps at 4.005%, while the 10yr is -2.5bps at 3.963%.

- The moves lower in yields could have also been helped by dovish comments from the Fed's Schmid & Goolsbee.

- Overnight the recent 30-year Treasury bond auction drew a yield of 4.314%, which was 3.1bps higher than the pre-sale yield of 4.283%, the tail is outside the normal range for long-bond auctions since 2020, marking it as the 7th worst monthly long-bond auction since the start of COVID-19. This follows a similarly poor outcome in the previous day's 10-year note auction.

- Projected rate cut pricing into year end off early morning levels (*): Sep'24 cumulative -40.5bp (-44.8bp), Nov'24 cumulative -71.5bp (-77.6bp), Dec'24 -103.2bp (-109.3bp).

- Today, it is a very empty calendar with no data or fed speak.

JGBS: Cash Curve Twist-Flattener, BoJ Weighs On Short-End, Holiday On Monday

JGB futures are holding weaker, -32 compared to the settlement levels, but near Tokyo session highs.

- Outside of the previously outlined Money Stock data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 2-3bps richer in today’s Asia-Pac session, after yesterday’s jobless claims-induced sell-off.

- Given the lack of domestic data today and the strength in US tsys, today’s price action in JGBs appears to reflect a realisation that the BoJ intends to continue to tighten policy notwithstanding the BoJ Deputy Governor’s recent dovish comments.

- (Bloomberg) “The mixed BoJ communications will only spook more volatility,” said Charu Chanana, head of currency strategy at Saxo Markets. “If only they keep their communication aligned, at least that may spare them from panic moves and unnecessary volatility both in yen and equities.” (See link)

- The cash JGB curve has twist-flattened, with yields 3bps higher to 4bps lower, pivoting at the 30s. The benchmark 10-year yield is 1.5bps higher at 0.865% versus the cycle high of 1.108%.

- The swap curve has bull-flattened, with rates flat to 5bps lower. Swap spreads are tighter.

- Next week, the local market is closed on Monday for the Mountain Day holiday, ahead of PPI data on Tuesday.

AUSSIE BONDS: Slightly Cheaper, Narrow Ranges On A Data-Light Session

ACGBs (YM -2.0 & XM -0.5) are slightly weaker after dealing in relatively narrow ranges in today’s data-light Sydney session.

- The AOFM’s sale of A$700mn of the 4.75% 21 April 2027 bond went well, with pricing comfortably through mids and the cover ratio printing a robust 3.3929x, although lower than last auction’s 3.8375x (10 April).

- The line’s inclusion in the YM basket and improved sentiment towards global bonds likely proved supportive. The RBA’s relatively hawkish stance at this week’s policy meeting didn’t appear to deter today’s bid.

- Cash ACGBs are 1-2bps cheaper, with the AU-US 10-year yield differential at +11bps. Cash US tsys are 2-3bps richer in today’s Asia-Pac session.

- Swap rates are flat to 1bp higher.

- The bills strip is slightly mixed, with pricing -1 to +1.

- RBA-dated OIS pricing is 1-3bps firmer across meetings. As a result, pricing is 5-20bps firmer across meetings than pre-RBA levels on Tuesday. A cumulative 22bps of easing is priced by year-end versus 30bps before the RBA decision.

- Next week, the local calendar will see a speech by Andrew Hauser, RBA Deputy Governor on Monday followed by Consumer and Business Confidence and the Wage Price Index on Tuesday.

- The AOFM plans to sell A$800mn of the 3.50% 21 December 2034 bond on Wednesday and A$700mn of the 2.25% 21 May 2028 on Friday.

NZGBS: Bull-Steepener Ahead Of Next Wednesday’s RBNZ Policy Decision

NZGBs closed on a positive note, with benchmark yields 2-5bps richer and the 2/10 curve steeper.

- Swap rates closed flat to 4bps lower.

- Next week, the local calendar is empty on Monday, ahead of Net Migration data on Tuesday and the RBNZ Policy Meeting on Wednesday.

- (MNI) The RBNZ's monetary policy committee is likely to hold the official cash rate at 5.5% when it meets next week, but it will debate a cut and inject greater dovish language into its communications as it prepares for reductions later this year.

- The economy has slowed and inflation moved towards the RBNZ’s 1-3% target faster than expected in Monetary Policy Statement (MPS) forecasts in May. However, the Reserve’s past comments and its reduced mandate, which no longer requires it to target employment, suggest it will take a cautious approach to any rate adjustment and may wish to examine Q3 inflation and GDP before cutting the OCR.

- RBNZ dated OIS pricing closed little changed across meetings. The market has attached a 66% chance of a 25bp cut at the August Policy Meeting versus 43% before yesterday’s RBNZ inflation expectations data. A cumulative 90bps of easing is priced by year-end.

- (Bloomberg) "Finance Minister Willis may ask the RBNZ to ease its regulation on banks if it would improve competition in the industry, the NZ Herald reports." (See link)

FOREX: USD Softer, As Equity Recovery Continues, But Less Volatility

G10 FX trends have been biased against the USD in the first part of Friday trade, although overall moves have been fairly modest. The BBDXY USD index was last near 1246, off 0.15% for the session.

- USD/JPY was volatile early but couldn't get to fresh weekly highs above 147.90. We topped out at 147.82, but haven't breached 147.00 back on the downside. We were last near 147.10 little changed for the session.

- Yen is tracking 0.40% weaker for the week, with dips in the pair supported since Monday, as global equity sentiment has recovered and market recession fears have eased somewhat.

- The A$ is a touch higher, but isn't racing above 0.6600 (with a large option expiry at this level for NY cut later a potential constraint). Still we were are +1.4% for the week, led by the broader risk recovery and the hawkish RBA backdrop. There isn't much in the way of resistance to 0.6700 (outside of the 50-day EMA near 0.6615).

- NZD/USD has outperformed so far today, up 0.30%, the pair last near 0.6035, fresh highs back to the second half of July.

- US yields sit lower across the benchmarks, led by the front end, with the 2yr near -3bps lower. This unwinds some of Thursday's gains in the yield space.

- Comments from Kansas City President Schmid stated the labour market was cooling but still healthy. If inflation continues to cool Schmid said this would support a policy adjustment.

- Looking ahead, event risks are very light for the offshore session to round out the week. The Canadian labour force survey is likely to be the main data focus point.

ASIA EQUITIES: China & HK Equities Track Global Markets High, CPI Beats Estimates

China & Hong Kong equities are tracking global equities higher today, Hong Kong is outperforming mainland stocks, with tech and property sectors the top performers. Focus has been on China's CPI & PPI beat, while the MSCI Asia Pacific Index climbed as much as 1.9%, although still on track for a 0.60% loss.

- China's largest semiconductor maker SMIC had strong earnings results after reporting better-than-expected net income for 2Q, equity was up 4.9%.

- China's CPI rose by 0.5% y/y in July, driven mainly by a pick up in food price, core inflation weakened to 0.4% from 0.6% the weakest number since January. PPI was -0.8% vs -0.9% est.

- Property stocks are higher following new of Shenzhen purchasing apartments towers, with hopes other Tier 1 cities will then follow suit

- The HSI is up 1.77% today and on track to finish the week slightly higher, while the CSI 300 is 0.14% today and trades down 2.44% for the week.

- Looking at sectors, the Mainland Property Index is 2.30% higher and on track for a 2.50% weekly gains, HSTech Index is 2.30% higher today and is on track for a 2.40% weekly gain.

- Next week we have China's Industrial Production & Retails sales on Wednesday and Hong Kong's GDP on Thursday/

ASIA PAC STOCKS: Asian Equities Higher As Recession Fears Ease, Tech Outperforming

Asian markets extended their rebound, buoyed by positive signals from both Chinese inflation data and U.S. jobless claims, which eased recession fears. The Hang Seng Index rose for the third consecutive day, with tech stocks leading gains. Japan's Nikkei 225 and Topix indices also advanced, driven by a weaker yen and strong earnings reports from major companies like Tokyo Electron. South Korea's KOSPI gained, led by large-cap stocks, as investor sentiment improved following the global market rout earlier in the week. Overall, the region's markets benefited from a stronger outlook and increased investor confidence.

- Japanese stocks rose, with the Nikkei 225 and Topix indices both gaining 1.5%, as the yen weakened and positive earnings reports lifted market sentiment. Technology firms like Hitachi and Tokyo Electron led the advance, buoyed by a strong performance in the Nasdaq. The market rebounded from earlier losses, recovering about half of the decline since the BoJ's recent interest rate hike. Additionally, individual investors continued to buy stocks, marking the fourth straight week of net buying, as optimism returned to Japan's export-driven economy. Banks are the worst performing sector over the past week with the Topix Bank Index down 7.30%, verse the TOPIX & Nikkei down just 1.50% for the same period, both major benchmarks remain in a downtrend after breaking below all key moving averages on Monday.

- South Korean equities are higher today, with the small-cap KOSDAQ up 2.90% while the KOSPI is 1.90% higher. Foreign investors remain better sellers of Korean stocks today with a net outflow of $100m although local retail investors have snapped those stocks up. Equities still trade about 5% lower for the week after Monday saw the KOSPI largest 1-day drop since 2008. Next week we have Korean's unemployment rate due on Wednesday.

- Taiwanese equities have jumped higher today, leading the way in Asia with the Taiex up 3.30% after the Philadelphia SE Semiconductor Index rallied 6.86% overnight, while TSMC is expected to release July sales figures later today.

- Australian equities are higher with metals & miners the top performers after falling the past couple of sessions, the ASX 200 is 1.40%. New Zealand equities are slightly higher with the NZX 50 up 0.40%

- In Asia EM is all higher today, Indonesia's JCI is 0.85%, Thailand's SET is 0.90% higher, Philippines PSEi is 1% higher, Malaysian KLCI is 0.80% higher and Singapore's Strait Times is closed for National day.

OIL: Holding Close To Thursday Highs, Comfortably Higher For The Week

Oil prices have drifted higher today but haven't broken above late Thursday levels from US trade. Brent was last $79.25/bbl. WTI was around $76.30-35/bbl. Both benchmarks are tracking comfortably higher for the week.

- Earlier in the week saw speculation growing that an escalation in tensions in the Middle East supported oil prices.

- Overnight the Biden administration called for a new round of cease fire talks on August 15. Qatar and Egypt echoed this call as the region becomes increasingly concerned that Iran would attack Israel.

- A broader recovery in equity risk appetite, as recession fears have eased somewhat, has also supported the oil price rebound over the last few sessions.

- Next week will see OPEC release their monthly market outlook on Monday and during the week, the US will release its key inflation data which will have input into the Federal Reserve’s interest rate decision for September.

GOLD: Sharp Rally On Jobless Claims Data

Gold is 0.3% lower in today’s Asia-Pac session, after closing 1.9% higher at $2427.53 on Thursday, its first gain in six sessions.

- Thursday’s move came as the latest US data relieved concerns over a hard landing for the world’s biggest economy and helped support a broader market rally.

- US initial jobless claims fell 17k last week to 233k, a larger drop than the market expected while continuing claims were in line at 1875k. Nevertheless, it was a surprisingly large hawkish reaction from US tsys to data, which showed little improvement in underlying terms. However, the data did at least rule out a further deterioration in the labour market.

- The US 10-year yield returned to around 4%, 4bps higher on the day. The US 2-year finished 8bps cheaper at 4.04%.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the recent weakness in gold appears to be a correction. A resumption of gains would open $2,483.7, the Jul 17 high, while support is seen at the 50-day EMA, at $2,377.4.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 09/08/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 09/08/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 09/08/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 09/08/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.