-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: CHINA CPI TICKS LOWER

EXECUTIVE SUMMARY

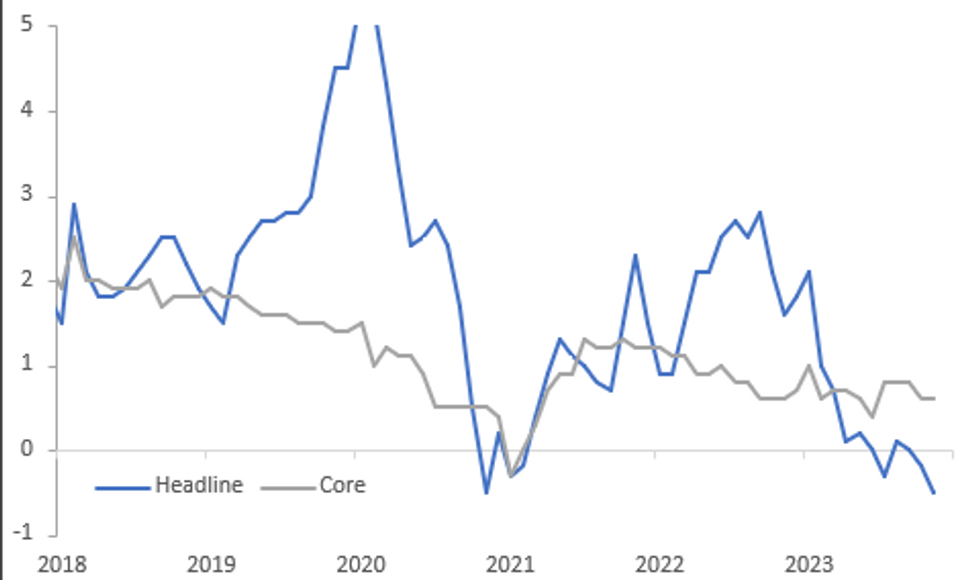

- China's CPI fell by 0.5% y/y in November to mark the steepest decline since Nov 2020 - MNI

- Oil steadies after worst run since 2018 - BBG

- Battle continue to rage across Gaza - BBG

Fig. 1: China CPI

Source: MNI - Market News/Bloomberg

U.K.

HOUSING (BBC): In a report, UK Finance said higher interest rates and household costs, will make it harder for people to access mortgage credit, which is based on affordability.

POLITICS (BBG): The photo captures Rishi Sunak at the height of his popularity during the pandemic: after months of punishing lockdown, Britain’s then finance minister grins as he carries two katsu curries to waiting diners. In that restaurant in July 2020, it’s unlikely anyone needed his “Rishi” name tag.

CRYPTO (BBG): The asset management arm of pensions giant M&G Plc said it had invested $20 million into a UK crypto derivatives trading platform, marking a step forward in returning institutional confidence in digital assets after the collapse of FTX last year.

EUROPE

ECB (BBG): Investors betting on an early start to the European Central Bank’s interest-rate cutting cycle risk getting derailed by Christine Lagarde this week.

UKRAINE (BBC): President Volodymyr Zelensky has had a brief - but intense-looking - conversation with the man threatening to block Ukraine's EU aspirations. He met Hungary's Prime Minister Viktor Orban at the inauguration of Argentina's new president on Sunday.

POLAND (BBC): Monday is the deadline for Prime Minister Mateusz Morawiecki to present his cabinet for a vote of confidence by deputies.

AI (BBC): European Union officials have reached a provisional deal on the world's first comprehensive laws to regulate the use of artificial intelligence.

U.S.

FOMC (MNI): Smaller rent increases alone can see core inflation fading to 2.1% by the second half of 2024, creating a path for the Fed to slowly dial back interest rates as soon as March, former Fed Board research director David Wilcox told MNI, and market bets on five reductions next year is plausible.

UKRAINE (BBG): Ukraine’s Volodymyr Zelenskiy is headed to Washington for talks with President Joe Biden and US congressional leaders, signaling a push to energize support among his country’s allies almost two years into Russia’s invasion.

OTHER

COP (BBG): The controversial oil executive presiding over global climate talks in Dubai is stepping up efforts to get a deal to curb all fossil fuels for the first time. Sultan Al Jaber, president of the United Nations-backed COP28 summit, held a special meeting of ministers from nearly 200 countries, in a bid to break the deadlock over the future of oil and gas.

ARGENTINA (BBG): Javier Milei took office as Argentina’s president Sunday, promising to eradicate inflation and rescue the nation’s troubled economy with a shock-therapy program based on drastic cuts to public spending.

OIL (BBG): Oil steadied after its longest weekly losing streak in five years, driven by signs that supply is starting to run ahead of demand.

MIDDLE EAST (BBG): Battles raged across Gaza on Sunday as Israel indicated it was prepared to fight for months or longer to defeat the territory's Hamas rulers, and a key mediator said willingness to discuss a cease-fire was fading.

CHINA

POLITBURO (YICAI): China will adopt more active pro-growth policies next year in line with the Politburo's meeting last week which emphasised "progress while maintaining stability," said Ming Ming, chief economist at CITIC Securities. The group's goal to "moderately increase the intensity" of fiscal policy may mean setting the budget deficit-to-GDP ratio at about 3.5%, a rise of 0.5 pp from 2023, as well as keeping the scale of new local government special bonds at about CNY4 trillion to uplift infrastructure investment and offset the impact of the real-estate downturn, adding CNY200 billion from the previous year, said Wang Qing, chief macro analyst at Golden Credit Rating. Monetary policy, meanwhile, will focus on improved effectiveness, such as guiding the pace and maturity requirements of credit supply to better match market entities' capital needs, said Liang Si, researcher at Bank of China Research Institute.

SINGAPORE (MAS): Authorities in Singapore and China plan to boost cooperation in new digital finance and capital markets, according to the Monetary Authority of Singapore. During the recent 19th Joint Council for Bilateral Cooperation in Tianjin, leaders from both sides agreed to pilot a scheme allowing the use of e-CNY for tourism spending in Singapore and China. Additionally, JCBC participants cited recent developments including an MOU between the Singapore Exchange and the Guangzhou Futures Exchange, plus the launch of exchange-traded funds between both markets as examples of increased collaboration.

SMEs (Sec Daily): China’s SME Development Index (SMEDI) reached 89.3 in November, a 0.2 point increase from October, ending a two-month consecutive decline, according to the China Association of SMEs. Firms’ confidence has been boosted, with most sub-indexes increasing, but the headline index remained below the critical value of 100 that indicates prosperity, the association said. China’s economy continues to recover but faces challenges and authorities should make efforts to ensure overdue payments to SMEs are cleared to safeguard their legitimate rights, and interests.

CPI (MNI): China's Consumer Price Index fell by 0.5% y/y in November to mark the steepest decline since November 2020, while the Producer Price Index -- a measure of factory-gate inflation -- dropped further to a three-month low, data from the National Bureau of Statistics showed Saturday.

CHINA MARKETS

MNI:PBOC Injects Net CNY218 Bln Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY285 billion via 7-day reverse repo on Monday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY218 billion after offsetting the maturity of CNY67 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8125% at 09:47 am local time from the close of 1.8442% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 53 on Friday, compared with the close of 54 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1163 Monday vs 7.1123 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1163 on Monday, compared with 7.1123 set on Friday. The fixing was estimated at 7.1668 by Bloomberg survey today.

MARKET DATA

JAPAN NOV M2 MONEY SUPPLY 2.3% Y/Y; PRIOR 2.4%

JAPAN NOV M3 MONEY SUPPLY 1.7% Y/Y; PRIOR 1.8%

JAPAN Q4 BSI LARGE ALL INDUSTRY 4.8 Q/Q; PRIOR 5.8

JAPAN Q4 BSI LARGE MFG 5.7 Q/Q; PRIOR 5.4

UK DEC RIGHTMOVE HOUSE PRICES -1.9% M/M; PRIOR -1.7%

MARKETS

US TSYS: Muted Session In Asia

TYH4 deals at 1110-08+, unchanged from Friday's settlement level, a 0-04+ range has been observed on volume of ~87k.

- Cash tsys sits ~1bp cheaper across the major benchmarks.

- Tsys have observed narrow ranges in a muted Asian session, there has been little follow through on moves and little meaningful macro newsflow has crossed.

- Flow wise a FV (3.4k lots)/ WN (750 lots) flattener was the highlight flow wise.

- The docket is thin on Monday.

- The highlight of the week's data docket is the November CPI print on Tuesday, headline CPI is expected to hold flat in November. 10- and 30-Year Supply are also due this week.

JGBs: Holding Cheaper But Off Worst Levels, PPI Data & 5Y Supply Tomorrow

In Tokyo afternoon dealings, JGB futures are cheaper, -15 compared to settlement levels, but slightly above the session’s worst level.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Money Stock data and the Q4 BSI Survey for Industries. Flash November Machine Tool Orders are due later.

- US tsys are holding 1-2bps cheaper across benchmarks in today’s Asia-Pac session but ranges have been tight. Little meaningful macro newsflow has crossed so far, with Friday's post-NFP lows intact.

- Bloomberg has reported that Nomura Securities Co. economists have moved up their forecast for when the Bank of Japan will end its negative interest rate policy to January 2024, citing positive economic signs and official comments. (See link)

- The cash JGB curve has bear-steepened, with yields 0.2bp to 3.3bps higher. The benchmark 10-year yield is 1.9bps higher at 0.785% versus the morning’s high of 0.802%.

- Swap rates are little changed across the curve out to the 30-year. The 40-year rate is 2.3bps higher at 1.61%. Swap spreads are tighter.

- Tomorrow, the local calendar sees PPI data for November, along with 5-year supply.

ACGBs: Cheaper, Sitting Mid-Range, Light Local Calendar

In future roll-impacted dealings, ACGBs (YM -5.0 & XM -4.8) sit cheaper and in the middle of today’s Sydney session ranges. There have been no domestic data or events today. Accordingly, local participants have likely sought guidance from US tsys in today’s Asia-Pac session following Friday’s post-payrolls sell-off.

- US tsys are holding 1-2bps cheaper across benchmarks in today’s Asia-Pac session but ranges have been tight. Little meaningful macro newsflow has crossed so far, with Friday's post-NFP lows intact.

- Cash ACGBs are 4-5bps cheaper, with the AU-US 10-year yield differential 5bps tighter at +10bps.

- Swap rates are 3-4bps higher, with EFPs 1bps narrower.

- Bills strip pricing is -1 to -5, with late reds leading.

- RBA-dated OIS pricing is 2-4bps firmer for meetings beyond May’24, with late 2024 leading.

- Tomorrow, the local calendar sees a speech by RBA Governor Bullock at the AusPayNet Summit. The other focal point for the market this week will be employment data on Thursday.

- The highlight of this week's US data docket is the November CPI print on Tuesday, ahead of the Fed’s final rate decision of the year the following day. 10- and 30-year US tsy supply is also due this week.

NZGBS: Cheaper, Subdued Start To The Week, Q3 GDP On Thursday

NZGBs closed flat to 3bps cheaper, with the 2/10 curve steeper, after a subdued start to the week. With the domestic calendar empty today, local participants have likely eyed US tsys in today’s Asia-Pac session for guidance after Friday’s post-payrolls sell-off.

- US tsys are holding cheaper in the Asia-Pac session so far, however, ranges have been narrow, and the downtick has not yet followed through. Friday's post-payroll lows remain intact. Little meaningful macro newsflow has crossed today. Cash tsys sit ~1bps cheaper across the major benchmarks.

- Bloomberg has reported that the NZ Treasury said that stripping the RBNZ of its dual mandate and returning it to a single focus on price stability may improve its effectiveness by influencing inflation expectations. (See link)

- Economists see 2023-24 annual average GDP growth of 1.2% versus 0.4% in the September survey, according to the latest NZIER survey.

- Swap rates are 1-2bps higher, with the short-end implied swap spread wider.

- RBNZ dated OIS pricing is slightly mixed across meetings.

- Tomorrow, the local calendar sees Card Spending Retail and Net Migration data. However, the highlight of the local docket this week is likely to be Q3 GDP on Thursday. A rise of 0.2% q/q is expected.

OIL: Oil Prices Hold Onto Gains, Key Market Events This Week

Oil prices have continued climbing during APAC trading today. They rose over 2% on Friday and are up a further 0.6% today on better demand news with robust US data helping to ease recession concerns, continued refilling of the US SPR and China’s Politburo recommending further fiscal stimulus at “an appropriate pace”. The USD index is 0.1% higher.

- Brent broke above $76 during today’s session and is up 0.7% to $76.34/bbl, close to the intraday high. WTI has mainly traded above $71 and is currently 0.6% higher at $71.65. Both benchmarks remain down about 6% in December though, as expectations of a market surplus grew. The key events for oil this week will be Tuesday’s US CPI and Wednesday’s Fed decision.

- The US Energy Department has put out a tender for 3mn barrels of crude for March delivery to continue refilling the SPR.

- Last week OPEC+ members tried to calm the market by voicing their commitment to the latest cuts and to stabilising the market. This week monthly IEA, EIA and OPEC reports should provide more information on the outlook for crude.

- Timespreads in the futures market continue to point to a market surplus as later dated contracts are trading at a premium, according to Bloomberg.

- The calendar is very light today with only US NY Fed 1-year inflation expectations.

GOLD: Ended Last Week On A Poor Note After Hitting An All-Time High On Monday

Gold is 0.4% lower in the Asia-Pac session, after closing 1.2% lower at $2004.67 on Friday.

- Bullion was lower on Friday after stronger-than-expected US jobs data reduced expectations of US interest-rate cuts early next year.

- The change in Nonfarm Payrolls was +199k vs. 183k estimate and +150k prior, while the Unemployment Rate dipped to 3.7% vs. 3.9% estimate. Moreover, Average Hourly Earnings growth was hotter than expected (+0.4% m/m vs. +0.3% est. & +0.2% prior).

- The US Treasury 2-year finished 13bps cheaper at 4.72%, while the 10-year yield increased 8bps to 4.23%.

- Investors will be watching US inflation data on Tuesday, ahead of the Fed’s final rate decision of the year the following day.

- According to MNI’s technicals team, gold pushed through support at $2007.5 (20-day EMA) to open $1975.0 (50-day EMA). It is worth noting that last week started with a spike to an all-time high of $2135.39.

EQUITIES: APAC Equities Mixed, Disappointing China CPI Weighed On Stocks

Equities are mixed during APAC trading after they rose in the US and Europe on Friday. The MSCI APEX 50 is down 1.3% driven by China/HK as the deterioration in China’s inflation situation weighed on stocks as it signalled continued weak demand in the region’s largest economy. The US S&P e-mini is little changed but the Nasdaq is down 0.3% and both are off their intraday highs. The USD index is 0.2% higher.

- The Hang Seng has traded lower for almost the whole session and is now down 2%, close to the intraday low, and the tech index is -2.6%. Li Ning sportswear fell 16%. China’s CSI 300 is down 0.9% but off the day’s lows early in the session.

- Korea’s KOSPI is flat but the KOSDAQ is up 0.6%. The TAIEX is only slightly higher.

- Australia’s ASX 200 is flat but down 0.4% from the high early in trading. The energy sector performed well but miners weighed on the index. The NZX 50 fell 0.4%.

- India’s Nifty 50 is up 0.2% with the strong economy and increased foreign buying supporting the market. Indian benchmarks are heading to new highs.

- ASEAN is mainly weaker with Indonesia’s Jakarta comp down 0.6%, Singapore’s Straits Times -0.8%, Philippines PSEi -0.8% but the Malay KLCI is flat and SE Thai up 0.2%.

FOREX: Greenback Tick Higher In Asia, BBDXY's Post-NFP High Intact

The USD has ticked higher in Asia today as participants digested Friday's NFP print. BBDXY is up ~0.2%, however the post-NFP highs remain intact for now. Cross asset wise; The Hang Seng is ~2% lower and US Equity futures are a touch lower. There has been little in the way of meaningful macro newsflow today.

- Yen is the weakest performer in the G-10 space at the margins, USD/JPY is up ~0.5% and last prints at ¥145.65/70. An uptick in US Tsy Yields has weighed on the Yen. USD/JPY remains well below resistance at ¥146.23, low from Dec 4.

- AUD/USD is down ~0.4%, post NFP lows have been breached. The pair sits at $0.6550/55, and sits on the 20-Day EMA ($0.6553).

- Kiwi is also lower, NZD/USD is down ~0.2% and is holding above the $0.61 handle. Support comes in at the 20-Day EMA ($0.6088).

- Elsewhere in G-10, EUR is unchanged and GBP is down ~0.1%.

- The docket is thin for the rest of Monday's session.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/12/2023 | 0700/0800 | *** |  | NO | CPI Norway |

| 11/12/2023 | - | *** |  | CN | Money Supply |

| 11/12/2023 | - | *** |  | CN | New Loans |

| 11/12/2023 | - | *** |  | CN | Social Financing |

| 11/12/2023 | 1600/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 11/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/12/2023 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.