-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Equities Higher Again, Australian CPI Falls

EXECUTIVE SUMMARY

- PBOC CUT MTLF RATE 30BP - MNI

- IMF SAYS US ON TRACK FOR SOFT LANDING - BBG

- EU WON’T ALLOW CHINA TO FLOOD ITS MARKET WITH EVs - BBG

- AUSTRALIA CPI MODERATES - MNI

- ISRAEL CARRIES OUT MORE STRIKES IN LEBANON - BBG

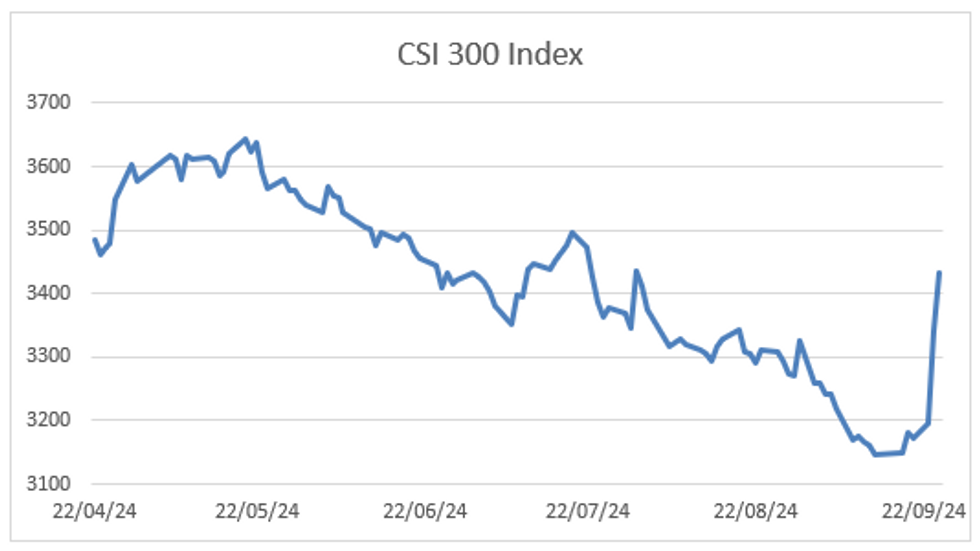

Fig. 1: CSI 300 Index Soars On Stimulus Hopes

Source: MNI - Market News/Bloomberg

UK

GEOPOLITICS (BBC): “The prime minister has told British nationals in Lebanon "now is the time to leave".”

UKRAINE (FRANCE24): “British foreign minister David Lammy said Tuesday he was working to put Ukraine in the "strongest position" in its war with Russia ahead of the winter months.”

EU

ECB (BBG): “European Central Bank Governing Council member Klaas Knot said he expects gradual interest-rate cuts “in the near future” and in the first half of next year.”

EU (BBG): “The European Union will not allow China to threaten its industry by flooding the market with cheap products during the transition to a cleaner economy, according to the bloc’s climate chief. “We do face a China problem,” Wopke Hoekstra, the EU’s climate commissioner, said Tuesday in an interview with Bloomberg Television.”

GERMANY (MNI): “Germany is grappling with a number of well-known structural challenges that have seen its unquestioned status as Europe’s economic powerhouse, but the country is not in decline, Bundesbank president Joachim Nagel said in a speech Tuesday.”

GERMANY (RTRS): “U.S. President Joe Biden will travel to Germany and Angola Oct. 10-15, the White House said on Tuesday, in what will be his first visit to Africa as president. Biden's first stop will be Germany, where he will express appreciation to Germany for supporting Ukraine's defense against Russia, among other issues, according to the White House.”

SWITZERLAND (MNI): “The SNB is expected to cut its policy rate again, with a 25bp cut to 1.00% most likely, as reflected by analyst and market expectations - but there is a risk of a larger cut.”

UKRAINE (FRANCE24): “Ukrainian President Volodymyr Zelensky on Tuesday told a special UN Security Council session that Russia "can only be forced into peace", claiming that Moscow is insincere in its calls for dialogue and denouncing Iran and North Korea as “accomplices” in Russia's war on Ukraine.”

BUSINESS (BBG): “Meta Platforms Inc. is spurning the European Union’s voluntary artificial intelligence safety pledge that’s planned as a stopgap measure before the bloc’s AI Act rules take full force in 2027.”

GERMANY (BBG): "Volkswagen AG and unions start negotiations over wide-ranging cost cuts on Wednesday including possible worker retrenchment, with tensions between both sides higher than they’ve been in years."

US

FED (MNI INTERVIEW): “The Federal Reserve could keep shrinking its balance sheet even after it begins interest rate cuts that investors expect to start later in the year, Victor Valcarcel, a former Kansas City visiting scholar with new research on QT2 told MNI.

FED (MNI): “A top Federal Reserve Bank of New York staffer said Tuesday that reserves are still above the ample level and don’t appear to be close to the point when the Fed will end its program to roll off assets from its balance sheet.”

FED (MNI INTERVIEW): “Federal Reserve policymakers see interest rates as too high for the current environment and may take rapid steps to bring them closer to 4% before becoming more data-dependent, former St. Louis Fed President James Bullard told MNI.”

IMF (BBG): “The US economy looks on track for a soft landing as monetary policy cooled inflation without tipping the economy into recession, according to the chief of the International Monetary Fund, who also credited the world’s biggest economy for helping support global growth as other nations slowed.”

BUSINESS (BBG): “Boeing Co. backed down from a Friday night deadline for striking workers to approve its latest contract offer after union leaders refused to schedule a vote.”

BUSINESS (BBG): “German software developer SAP SE, product reseller Carahsoft Technology Corp. and other companies are being probed by US officials for potentially conspiring to overcharge government agencies over the course of a decade.”

POLITICS (RTRS): “Some of Donald Trump's advisers are meeting foreign officials on the sidelines of the United Nations General Assembly where U.S. allies are seeking to get a grasp on what a Trump win in the Nov. 5 election would mean for U.S. foreign policy.”

OTHER

JAPAN (MNI): “Japan’s services producer price index rose 2.7% y/y in August, unchanged from July’s revised 2.7%, showing that corporate pass-through of cost increases remained solid but the pace is slowing, preliminary data released by the Bank of Japan on Wednesday showed.”

AUSTRALIA (MNI): “Australia’s monthly consumer price index indicator printed at 2.7% y/y in August, in line with market expectations, while annual trimmed mean was 3.4%, down from July’s 3.8%, Australian Bureau of Statistics data showed Wednesday.”

CANADA (MNI): “Bank of Canada Governor Tiff Macklem said Tuesday that while he's happy inflation has returned to target it's been a long journey and "we need to stick the landing" while reiterating that after three quarter-point rate cuts officials are weighing whether they can move faster or slower.”

MIDDLE EAST (BBG): Israel’s plan, at least for now, appears to be to stop short of a ground invasion, although officials say that hasn’t been ruled out. On Tuesday, Israel’s defense chief made a conspicuous show that its forces are ready to go there if needed.”

MIDDLE EAST (BBG): “Israel carried out more air strikes on Hezbollah targets in its heaviest and deadliest bombardment on Lebanon since 2006, when the two sides fought a devastating war.”

MIDDLE EAST (BBG): “Iran’s President Masoud Pezeshkian warned that Israeli attacks on Lebanon “cannot go unanswered,” raising the risk of further escalation with Israel and its allies, while also urging western nations to come back to a nuclear accord and lift sanctions.”

UN (POLITICO): “A number of world leaders sharply condemned Israel, and by extension the United States, on Tuesday as the U.N. General Assembly held its first major session since the war in Gaza began nearly a year ago.”

MEXICO (MNI): “Banxico is expected to cut the overnight interbank interest rate by 25bp to 10.50%, supported by further progress on the disinflation front and amid ongoing concerns surrounding growth.”

IRAN (BBG) “Iranian President Masoud Pezeshkian said plans are underway to discuss a nuclear deal that has been stalled for years following a “positive” meeting with French leader Emmanuel Macron.”

OPEC (BBG): “OPEC doubled down on forecasts that global oil demand will keep growing to the middle of the century, an outlier view that scientists say would lead to climate catastrophe.”

CHINA

PBOC (MNI): “The People’s Bank of China cut the one-year medium-term lending facility rate by 30 basis points on Wednesday, draining a net of CNY291 billion from the interbank market, according to a statement on its website.”

FX (BBG): “The yuan rallied past the 7 per dollar milestone for the first time in 16 months as investors digested a raft of measures to support the Chinese economy and the recent Federal Reserve rate cut kept the dollar on the back-foot.”

BUSINESS (XINHUA): China’s top securities watchdog will support the merger, acquisition and reorganisation of listed companies in strategic emerging industries, Xinhua News Agency reported, citing a guideline released by the China Securities Regulatory Commission.

INVESTMENT (SECURITIES DAILY): China’s outward direct investment (ODI) reached USD177.3 billion in 2023, up 8.7% y/y and accounting for 11.4% of the global share, rising 0.5 percentage points over the previous year, data from the National Bureau of Statistics showed.

MARKETS (SECURITIES TIMES): Analysts expect the Chinese stock market to rebound strongly following the PBOC's new funding support for A-shares, Securities Times reported.

TRADE (BBG): “Nio Inc. founder William Li hit out at the European Union and the US, saying their moves to level tariffs on electric cars are unreasonable and urged them to cooperate with, rather than fight, China.”

CHINA MARKETS

The People's Bank of China (PBOC) conducted CNY196.5 billion 14-day reverse repos, with the rate at 1.85%. The operation led to a net drain of CNY371.7 billion after offsetting maturities of CNY568.2 billion today. The PBOC also conducted CNY300 billion via 1-year MLF with rate lowering to 2.0% from previous 2.3%, the operation has led to a net drain of CNY291 billion after offsetting the maturities of CNY591 billion in August, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8871% at 09:29 am local time from the close of 1.9173% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Tuesday, compared with the close of 50 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0202 on Wednesday, compared with 7.0510 set on Tuesday. The fixing was estimated at 7.0206 by Bloomberg survey today.

MARKET DATA

AUSTRALIA AUG. CONSUMER PRICES +2.7% Y/Y; EST. +2.7%; PRIOR +3.5%

AUSTRALIA AUG. TRIMMED MEAN CPI +3.4% Y/Y; PRIOR 3.8%

CHINA 1-YR MTLF VOLUME CNY300B; EST. CNY 300B; PRIOR CNY300B

CHINA 1-YR MTLF RATE 2.0%; EST. 2.0%; PRIOR 2.3%

JAPAN AUG. SERVICES PRODUCER PRICES +2.7% Y/Y; EST. +2.6%; PRIOR +2.7%

SOUTH KOREA SEPT CONSUMER CONFIDENCE 100.0; PRIOR 100.8

MARKETS / UP TODAY (TIMES GMT/LOCAL)

US TSYS: Tsys Futures Steady, Ranges Tight Ahead Of More Fed Speak

- Tsys futures have done very little throughout the session, ranges have been tight and we hold near the overnight highs. Investors will be focused on a speech from Fed Gov Kugler later today. TU is unch at 104-12¾, while TY is -0-01 at 114-26.

- Cash tsys curves have seen selling through the belly of the curve, yields are 0.5-1.5bps higher with the 2yr trading +0.6bps at 3.544%, while the 10yr +1.1bps at 3.739%. The 2s10s curve continues to make new highs climbing to intraday high of 21.884.

- Projected rate cuts into early 2025 gain traction, latest vs. Tuesday morning levels (*) as follows: Nov'24 cumulative -39.8bp (-38.5bp), Dec'24 -79.7bp (-74.4bp), Jan'25 -114.0bp (-108.0bp).

- Looking ahead to Wednesday's session: MBA Mortgage apps, New Home Sales. Auctions $28B 2Y FRN, $62B 17W bill & $70B 5Y.

JGBS: Cash Bonds Dealing Mixed, BoJ July MPM Minutes & 40Y Supply Tomorrow

JGB futures are weaker, -8 compared to settlement levels.

- Outside of the previously outlined PPI Services, there hasn't been much by way of domestic drivers to flag.Nationwide Dept Sales data is due later today.

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session after yesterday’s bull-steepener. Today's US calendar will see MBA Mortgage apps, New Home Sales, $28B 2Y FRN, $62B 17W bill auctions and $70B 5Y.

- Cash JGBs are dealing mixed across benchmarks with yield swings bounded by +2.4bps (1-year) and -2.9bps (40-year). The benchmark 10-year yield is 0.1bp lower at 0.815% versus the cycle high of 1.108%.

- Swap rates are little changed out to the 10-year and 2bps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see BoJ Minutes of the July Meeting alongside 40-year supply. Machine Tool Orders data is also due.

ACGBS: Post-RBA Rally Pared After CPI Data

ACGBs (YM -4.0 & XM -3.0) are cheaper and at/near Sydney session lows following the release of CPI data for August.

- Headline CPI eased in August to 2.7% y/y from 3.5%, in line with expectations, though the RBA noted in its September statement that temporary factors are influencing the current figures.

- The moderation in the underlying measure should offer some reassurance to the RBA, although the decline in services inflation was modest, and it remains elevated. As Governor Bullock emphasized yesterday, services inflation remains the “crux of the matter”.

- The RBA continues to prioritise the more comprehensive quarterly CPI data, with the Q3 report set for release on October 30.

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session after yesterday’s bull-steepener.

- Cash ACGBs are 3bps cheaper, with the AU-US 10-year yield differential +18bps. ACGBs remain 4-6bps richer than yesterday’s pre-RBA levels.

- Swap rates are 2-3bps higher.

- The bills strip has bear-steepened, with pricing -2 to -5.

- RBA-dated OIS pricing is firmer after the data but remains 5-9bps softer than pre-RBA levels yesterday for 2025 meetings. A cumulative 16bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Job Vacancies data and the release of the RBA's Financial Stability Review.

NZGBS: Played Catch-Up To Post-RBA ACGB Rally

NZGBs ended the day stronger, with benchmark yields down 1-4bps, though slightly above their intraday lows.

- With an empty domestic calendar and cash US tsys ~1bp cheaper in today’s Asia-Pac session, today’s rally appeared to be a delayed spillover from yesterday’s post-RBA rally in ACGBs. The local market was closed when the RBA delivered its policy decision yesterday.

- Nevertheless, the NZ-AU 10-year yield differential finds itself 3bps wider than yesterday’s close, despite a paring of yesterday’s rally by ACGBs.

- Swap rates closed 2-5bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 5-7bps softer across 2025 meetings. A cumulative 87bps of easing is priced by year-end.

- The local calendar is again empty tomorrow, with ANZ Consumer Confidence on Friday and ANZ Business Confidence on Monday.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 3.00% Apr-29 bond, NZ$225mn of the 4.50% May-35 bond and NZ$25mn of the 2.75% Apr-37 bond.

GOLD: Buoyed By Weak US Data & China Stimulus

Gold is 0.2% higher in today’s Asia-Pac session, after closing 1.1% at $2657.10, a fresh all-time closing high, on Tuesday.

- Bullion was buoyed by Chinese stimulus measures announced yesterday, which created an optimistic backdrop for risk sentiment and a favourable reaction across the commodities complex.

- Weak US data bolstered the case for deeper rate cuts. Lower rates are typically positive for gold, which doesn’t pay interest.

- US Consumer confidence fell to 98.7 (cons 104.0), a sizeable slip after an upward revised 105.6 (initial 103.3) in Aug. Declines were seen in both the present situation and expectations components. The difference between those saying jobs were plentiful and those saying jobs were hard to get narrowed for an eighth month.

- According to MNI’s technicals team, gold has pierced resistance at $2,642.7, with attention on $2,660.9 next, a Fibonacci projection. After that, focus will shift to the $2,700 level.

OIL: Crude Holds Onto Most Of Tuesday’s Gains, Focus On Middle East & China

After rising strongly on Tuesday, oil prices are moderately lower during APAC trading. Continued tensions in Israel/Lebanon and China’ monetary easing as well as hurricane activity in the Gulf of Mexico are currently supporting prices. The softer greenback has also helped (BBDXY USD index -0.1%).

- WTI is down 0.3% today to $71.32/bbl off the intraday low of $71.15. It rose to $71.72 following the 30bp cut in China’s MTLF rate. Brent has also traded in a narrow range and is currently 0.2% lower at around $75.00/bbl after a low of $74.82 and a high of $75.35.

- Israel reported today a missile from Lebanon over Tel Aviv was intercepted. Israel continued its major strike on Hezbollah targets in Lebanon on Tuesday, killing a commander, and until now Hezbollah hasn’t used its longer range missiles on Israel. The UN has called for de-escalation, while Iran’s President Pezeshkian has said the attacks “cannot go unanswered”.

- Bloomberg reported a 4.34mn barrel drawdown US crude inventories, according to people familiar with the API data. Gasoline fell 3.44mn and distillate 1.12mn barrels. The official EIA data is released today.

- Later the Fed’s Kugler speaks on the economic outlook and US August new home sales and French September consumer confidence print. BoE’s Greene also appears.

ASIA STOCKS: China & Hong Kong Equities Surge Again On Stimulus Hopes

- Asian markets rallied for a second consecutive day, driven by optimism over China’s wide-ranging stimulus package aimed at revitalizing its sluggish economy. The onshore CSI 300 Index rose by 3.2% at one point, nearly erasing its year-to-date losses, while the offshore yuan strengthened past 7 against the dollar for the first time since May 2023. Investors are betting that the People’s Bank of China’s latest measures, which include liquidity support and interest rate cuts, will stabilize China’s stock market and boost regional equities. The stimulus has also bolstered emerging Asian currencies, with the Malaysian ringgit and Thai baht leading gains.

- Despite positive sentiment, investors remain somewhat cautious warning that the measures may not fully address China’s structural economic challenges.

- Key Hong Kong & China benchmarks are trading 1-3% higher, with HSI +2%, CSI 300 +2.30%. In Japan, the Nikkei is +0.30%, while the broader Topix trade flat with Banks offsetting gains In Materials & Industrials stocks. South Korean equities are lower today as foreign investors continue to offload local stocks, predominately tech stocks although large -cap names Samsung & SK Hynix trade higher on the day, banks have weighed on the wider market.

ASIA STOCKS: Foreign Investors Continue Buying Asian Equities

Philippines saw its largest inflow since May, while Thailand continues to see above average flows.

- South Korea: Saw outflows of $213m yesterday, with the past 5 sessions reaching -$2.26b, while YTD flows are +$11.12b. The 5-day average is -$452m, below both the 20-day average of -$339m and the 100-day average of -$21m.

- Taiwan: Saw inflows of $294m yesterday, with the past 5 sessions netting +$1.84b, while YTD flows are -$13.01b. The 5-day average is +$367m, above the 20-day average of -$247m but below the 100-day average of -$129m.

- India: Saw inflows of $243m Monday, with the past 5 sessions netting +$2.76b, while YTD flows are +$23.99b. The 5-day average is +$599m, above both the 20-day average of +$444m and the 100-day average of +$108m.

- Indonesia: Saw inflows of $1m yesterday, with the past 5 sessions netting +$347m, while YTD flows are +$3.76b. The 5-day average is +$69m, below the 20-day average of +$142m but above the 100-day average of +$31m.

- Thailand: Saw inflows of $78m yesterday, with the past 5 sessions totaling +$270m, while YTD flows are -$2.44b. The 5-day average is +$54m, above the 20-day average of +$50m and the 100-day average of -$6m.

- Malaysia: Saw outflows of $14m yesterday, with the past 5 sessions netting -$17m, while YTD flows are +$952m. The 5-day average is -$3m, below both the 20-day average of +$30m and the 100-day average of +$15m.

- Philippines: Saw inflows of $53m yesterday, with the past 5 sessions totaling +$152m, while YTD flows are -$85m. The 5-day average is +$30m, above both the 20-day average of +$13m and the 100-day average of -$1m.

Table 1: EM Asia Equity Flows

FOREX: USD Moderately Lower, European FX Outperforming

Movements in G10 currencies during APAC trading have been limited with little new information. The BBDXY USD index is down 0.1% but has been range trading through the session after Tuesday’s 0.5% drop. European currencies are around 0.1% stronger while Aussie and Kiwi are about 0.1% weaker.

- USDJPY is little changed after falling briefly below 143.0 and then testing 143.50. It is currently around 143.27.

- AUDUSD is down 0.1% to 0.6889, close to the intraday low that followed underlying CPI printing close to the top of the band. It rose above 69c early in the session peaking at 0.6908 as the rally following China’s monetary easing continued. AUDJPY is down slightly to 98.70 even though iron ore prices are higher again.

- NZDUSD is also 0.1% lower at 0.6334 despite stronger HK/China equities. It rose to a high of 0.6356 earlier. AUDNZD is off its post-Aussie CPI low of 1.0850 to be up slightly at 1.0877.

- USDCHF is down 0.1% to 0.8422 and EURUSD is up 0.1% to 1.1196 leaving EURCHF at 0.9429. GBPUSD is little changed at 1.3417.

- Later the Fed’s Kugler speaks on the economic outlook and US August new home sales and French September consumer confidence print. BoE’s Greene also appears.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 25/09/2024 | 0600/0800 | ** |  SE SE | PPI |

| 25/09/2024 | 0600/1400 | ** |  CN CN | MNI China Liquidity Index (CLI) |

| 25/09/2024 | 0645/0845 | ** |  FR FR | Consumer Sentiment |

| 25/09/2024 | 0700/0900 | ** |  ES ES | PPI |

| 25/09/2024 | 0730/0930 | *** |  SE SE | Riksbank Interest Rate Decison |

| 25/09/2024 | 0800/0900 |  GB GB | BOE's Greene Speech on Consumption | |

| 25/09/2024 | 0900/1000 | ** |  GB GB | Gilt Outright Auction Result |

| 25/09/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 25/09/2024 | 1300/1500 |  EU EU | MNI Connect Video Conference on ‘The EU and Global Trade Challenges’ | |

| 25/09/2024 | 1400/1000 | *** |  US US | New Home Sales |

| 25/09/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 25/09/2024 | 1530/1130 | ** |  US US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/09/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.