-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN OPEN: China Exports Off Lows, But CPI Weaker

EXECUTIVE SUMMARY

- FED’S POWELL SET TO SPEAK OCT 19 AHEAD OF BLACKOUT PERIOD - RTRS

- HIGHER YIELDS REDUCE NEED FOR FED TIGHTENING - COLLINS - MNI

- SCALISE ENDS HOUSE SPEAKER BID, DEEPENING REPUBLICAN TURMOIL - BBG

- ISRAEL TELLS PEOPLE IN NORTHERN GAZA TO RELOCATE IN 24H, UN SAYS - BBG

- CHINA WEIGHS NEW STABILIZATION FUND TO PROP UP STOCK MARKET - BBG

- CHINA CPI FLAT IN SEPTEMBER, LOWER THAN EXPECTED - MNI BRIEF

- CHINA TRADE SHOWS POSITIVE SIGNS IN SEP - CUSTOMS - MNI BRIEF

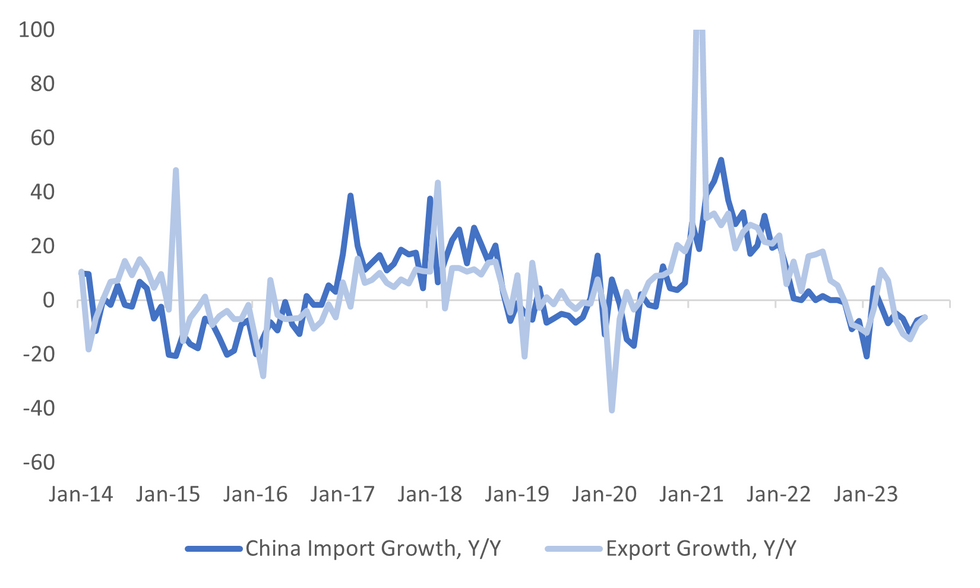

Fig. 1: China Export & Import Growth (Y/Y)

Source: MNI - Market News/Bloomberg

EUROPE

POLAND: “Polish opposition leader Donald Tusk said his party and its partners will win Sunday’s general election by a landslide after a new opinion poll showed strengthening support for a possible three-way coalition.” (BBG)

EU/CHINA: “The European Union’s top diplomat has warned China to address the gaping bilateral trade imbalance, or face more protectionist policies in Europe.” (SCMP)

U.S.

FED: “Federal Reserve Chair Jerome Powell will speak on Oct. 19 before the Economic Club of New York, just before the U.S. central bank's blackout period begins ahead of its next interest-rate decision.” (RTRS)

FED: The rise in the 10-year Treasury yield, corporate bond yields and mortgage rates are tightening financial conditions and if it persists that will reduce the need for further Federal Reserve policy tightening, Boston Fed President Susan Collins said Thursday, striking a less hawkish tone than the day before. (MNI)

FED: Boston Fed President Susan Collins said Thursday there has been no determination on whether to extend the Fed's Bank Term Funding Program beyond next March. (MNI)

POLITICS: “Representative Steve Scalise abandoned his short-lived campaign Thursday to become US House speaker following days of contentious meetings among fellow Republicans.” (BBG)

US/CHINA: “The Biden administration is considering closing a loophole that gives Chinese companies access to American artificial intelligence (AI) chips through units located overseas, according to four people familiar with the matter” (RTRS)

OTHER

ISRAEL: “UN was informed by Israeli military that the entire population of Gaza north of Wadi Gaza should relocate to southern Gaza within the next 24 hours, a UN spokesperson says in emailed statement to Bloomberg.” (BBG)

IRAN: “Some Western officials have asked me if there is an possibility of a new front being opened against the Israeli regime. Of course in the case of the continuation of war crimes and the humanitarian blockade of Gaza and Palestine, every possibility and decision by the other currents of the resistance is likely,” Iranian Foreign Minister Hossein Amirabdollahian says in Lebanon." (BBG)

JAPAN: “Japan’s life insurers are expected to flag further selling of foreign bonds including Treasuries when they start outlining investment plans next week for the fiscal second half through March.” (BBG)

TAIWAN: “Taiwanese chipmaker TSMC (2330.TW) has received from the United States a waiver extension to supply U.S. chip equipment to the company's factories in China, Taiwan Economy Minister Wang Mei-hua said on Friday.” (RTRS)

NEW ZEALAND: “New Zealand’s third-quarter spending on credit and debit cards rose at the slowest pace in two years as high interest rates and rising prices weighed on households.” (BBG)

CHINA

STOCK MARKET: “China is considering forming a state-backed stabilization fund to shore up confidence in its $9.5 trillion stock market, according to people familiar with the matter.” (BBG)

INFLATION: China's Consumer Price Index was flat in September, while the Producer Price Index measuring factory-gate inflation saw annual declines slow for a third month, data from the National Bureau of Statistics showed Friday. (MNI)

TRADE: China foreign trade jumped to its highest level this year in September, expanding 5.5% m/m in yuan term , the second consecutive monthly gain, Lv Daliang, spokesman ar General Administration of Customs, told reporters on Friday in a brief. (MNI BRIEF)

TRADE: China's exports decreased by 6.2% y/y in September, marking the fifth monthly fall after August's 8.8% y/y drop, despite beating consensus of a 7.5% y/y fall. The drop was mainly due to the shrinking external demand, data from Customs showed Friday. (MNI BRIEF)

INVESTMENT: “China will continue to reduce reasonably the negative list for foreign investment access and study the feasibility of further canceling or relaxing restrictions on foreign equity ratios, said He Yadong, spokesman at the Ministry of Commerce.” (Securities Daily)

LOCAL GOVERNMENT: “Local governments have begun to prepare special bond projects in 2024 and they are allowed to expand the use of such bonds to invest in urban village renovation and affordable housing.” (21st Century Business Herald)

CHINA MARKETS

MNI: PBOC Injects Net 95 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY95 billion via 7-day reverse repo on Friday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY95 billion as no reverse repos matures today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8908% at 09:56 am local time from the close of 1.9525% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Thursday, compared with the close of 41 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1775 Friday Vs 7.1776 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1775 on Friday, compared with 7.1776 set on Thursday. The fixing was estimated at 7.3172 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND SEP BUSINESSNZ MANUFACTURING PMI 45.3; PRIOR 46.1

NEW ZEALAND SEP CARD SPENDING RETAIL M/M -0.8%; PRIOR 0.6%

NEW ZEALAND SEP CARD SPENDING TOTAL M/M -0.1%; PRIOR 0.8%

SOUTH KOREA SEP UNEMPLOYMENT RATE 2.6%; MEDIAN 2.6%; PRIOR 2.4%

JAPAN SEP MONEY STOCK M2 Y/Y 2.4%; PRIOR 2.5%

JAPAN SEP MONEY STOCK M3 Y/Y 1.8%; PRIOR 1.9%

CHINA SEP CPI Y/Y 0.0%; MEDIAN 0.2%;PRIOR 0.1%

CHINA SEP PPI Y/Y -2.5%; MEDIAN -2.4%; PRIOR -3.0%

CHINA SEP EXPORTS Y/Y -6.2%; MEDIAN -8.0%; PRIOR -8.8%

CHINA SEP IMPORTS Y/Y -6.2; MEDIAN -6.3%; PRIOR -7.3%

CHINA SEP TRADE BALANCE $77.71BN; MEDIAN $70.6BN; PRIOR $68.20BN

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 107-16+, +0-08+, a 0-07+ range has been observed on volume of ~77K.

- Cash tsys sit 2-3bps richer across the major benchmarks, the belly is marginally outperforming.

- Tsys have ticked higher through today's Asian session as Thursday's post CPI losses are trimmed with gains extending a touch in recent trade.

- The move higher in tsys has been seen alongside the USD trimming Thursday's gains and e-minis ticking higher.

- Reuters have reported early in the session that "Fed Chair Powell will deliver prepared remarks and respond to questions from a moderator at the midday event in New York, according to senior Fed officials' weekly event schedule updated each Thursday."

- In Europe today the docket is thin, further out we have Terms of Trade and UofMich Consumer Sentiment. Fedspeak from Philadelphia Fed President Harker crosses.

JGBS: Futures Cheaper But At Tokyo Session Bests

JGB futures remain weaker, -16 compared to settlement levels, but are at Tokyo session highs.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined offshore M2 & M3 money stock and international investor flows.

- Given that, local participants appear to have been also interested in Asia-Pac dealings for US tsys after yesterday's heavy post-CPI NY session. US tsys have moved away from lows seen in yesterday's NY session in Asia-Pac dealings. This leaves cash tsys 2-3bps richer across the major benchmarks.

- The cash JGB curve has seen a twist-steepening, pivoting at the 3s, with yields 0.5bp lower to 1.1bps higher. The benchmark 10-year yield is 0.5bps higher at 0.763%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.814% set late last week.

- The swaps curve is dealing mixed, with rate movement bounded by 0.1bp lower (10-year) and 2.5bps higher (40-year). Swap spreads are tighter out to the 30-year.

- On Monday, the local calendar sees Industrial Production and Capacity Utilisation for August, along with BOJ Rinban Operations covering 1-10-year and 25-year+ JGBs.

AUSSIE BONDS: Dealing Near Session Cheaps, New Jun-54 Bond Via Syndication Next Week

ACGBs (YM -7.0 & XM -12.0) are trading weaker and are either at or close to the lowest levels of the Sydney session. Given the limited domestic events on the calendar today, it's likely that local participants have been primarily monitoring news headlines and observing developments in US tsys.

- US tsys have moved away from lows seen in yesterday's NY session in Asia-Pac dealings. This leaves cash tsys 1-3bps richer across the major benchmarks.

- Cash ACGBs are 6-12bps cheaper, with the AU-US 10-year yield differential 1bp higher at -19bps.

- Swap rates are 4-10bps higher, with the 3s10s curve steeper and EFPS ~2bps tighter.

- The bills strip has bear-steepened, with pricing -2 to -5.

- RBA-dated OIS pricing is 1-4bp firmer across meetings, with Nov’24 leading.

- On Monday, the local calendar sees a speech by RBA Assistant Governor (Financial System) Jones at the AFR Cryptocurrency Summit, ahead of the RBA Minutes for the October meeting on Tuesday.

- Today the AOFM announced that a new 21 June 2054 Treasury Bond is planned to be issued via syndication in the week beginning 16 October 2023, subject to market conditions. Joint lead managers are: Barrenjoey Markets; Commonwealth Bank of Australia; J.P. Morgan Securities Australia; UBS Australia and Westpac.

NZGBS: Closed Cheaper, Election Tomorrow, Q3 CPI On Tuesday

NZGBs closed 5-9bps cheaper but off the session’s worst levels. The previously outlined manufacturing PMI and card spending data failed to provide a market-moving event. Indeed, local participants appeared to be more interested in Asia-Pac dealings for US tsys after yesterday's heavy post-CPI NY session.

- US tsys have moved away from lows seen in yesterday's NY session as losses are trimmed in Asia-Pac trade on Friday. Perhaps participants are using the opportunity to close short positions. This leaves cash tsys 1-2bps richer across the major benchmarks. TYZ3 deals at 107-13+, +0-06 versus NY closing levels.

- Swap rates are 3-9bps higher, with the 2s10s curve steeper and implied swap spreads tighter at the short end.

- RBNZ dated OIS is flat to 3bps firmer across meetings, with Oct’24 leading. Terminal OCR expectations sit at 5.70%.

- Tomorrow, NZ holds a general election, with opinion polls indicating the main opposition National Party will be best placed to form a centre-right government with the support of the libertarian ACT Party and the nationalist NZ First Party.

- Next week, the local calendar is empty on Monday, ahead of Q3 CPI on Tuesday. Bloomberg consensus expects +1.9% q/q and +5.9% y/y versus +1.1% and +6.0% in Q2.

FOREX: Greenback Trims Post-CPI Gains

The USD has trimmed some of its post CPI gains in Asia, BBDXY is down ~0.1%. US Tsy Yields are 1-2bps lower across the major benchmarks and E-minis are a touch firmer.

- AUD/USD is up ~0.2%, the pair has ticked higher through the session trimming some of yesterdays ~1.5% loss. Technically The trend remains bearish, support comes in at $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance is at $0.6445, high from Oct 11.

- Kiwi is the weakest performer in the G-10 space at the margins and is down ~0.2%, last printing at $0.5915/20 the lowest level since 5 Oct. Business NZ PMI ticked lower to 45.3 in September, this was the lowest print since August 2021.

- Yen is little changed and USD/JPY is consolidating yesterday's gains this morning. The pair is still in an uptrend, key support is at ¥147.43 the low from Oct 3 and resistance is at ¥150.16 high from Oct 3 and bull trigger.

- Elsewhere in G-10 the Scandies are leading the bid however liquidity is generally poor in Asia.

- The docket is thin for the remainder of Friday's session.

EQUITIES: Regional Markets Lower, China Stabilization Headlines Only Briefly Aid Sentiment

Regional Asia Pac equity sentiment is weaker across the board in terms of the major indices. This follows weakness in US equity markets during Thursday trade, as US yields spiked following the US CPI print. We have seen some modest retracement in US yields today, but this hasn't imparted positive sentiment on the region. US equity futures sit a touch higher at this stage, albeit away from best levels. Eminis last near 4386, +0.12% higher for the session.

- There was a brief round of positive impetus as headlines crossed that China is considering launching a market stabilization fund (see this BBG link). However, this hasn't had a lasting impact on sentiment.

- At the break, the HSI is off by over 2%, while the mainland's CSI 300 is down 1.1% (these losses were curbed to -0.70% when the above headlines crossed). This puts the index back sub the 3700 level.

- On the data front, China CPI was weighed down by lower food prices, while exports were slightly better than forecast. Imports were close to expectations, but commodity import volumes were down in the month.

- Elsewhere, tech sensitive plays are mostly down, despite related indices doing better in Thursday US trade. The Topix is off ~1.40%, the Taiex 0.50%, and the Kospi around 0.90%.

- In SEA, we are seeing modest outperformance from the Philippines (+0.25%) and Indonesia (+0.15%). Losses are evident elsewhere, although are under 1%.

OIL: Tracking Higher For The Week

Brent crude is tracking modestly higher in the first part of Friday trade. The benchmark last near $86.50/bbl, +0.60% higher versus NY closing levels on Thursday. At this stage we are ~2.30% higher for the week. WTI was last near $83.60/bbl, up 0.80% so far today and nearly +1% for the past week.

- Market focus is likely to rest on Israel/Gaza developments. Fears of a broader Middle East conflict have receded somewhat, but the UN has reported that Israel has advised the people in Northern Gaza to relocate in the next 24 hours, which could be a precursor to an escalation in the conflict (see this BBG link).

- Earlier highs in Brent were near $86.70/bbl. Support has been evident in the benchmark on moves sub $85.50/bbl in recent sessions. Thursday highs were around $87.65/bbl. Sentiment was weighed down on Thursday by rising inventory levels. EIA Weekly US Petroleum Summary - w/w change week ending Oct 06: Crude stocks +10,176 vs Exp -431, Crude production +300.

- The IEA Monthly Oil Market Report revised up global oil demand growth for this year by 100kbpd to 2.3mbpd to reach 101.9mbpd in 2023, driven by growth in China, India and Brazil.

- China September trade data showed oil imports down in the month, but still remain 14% higher in y/y terms.

GOLD: Weaker On Thursday As Market Reassesses Fed Tightening After US CPI Data

Gold is 0.3% higher in the Asia-Pac session, after closing 0.3% lower at 1868.90 on Thursday.

- Thursday’s weakness, after solid multi-day gains earlier in the week, can be attributed to higher US Treasury yields following the release of US CPI data for September.

- While headline CPI beat by only 0.1% and core printed in line, the services component, excluding housing and energy, rose 0.6% m/m. Moreover, the Cleveland Fed’s mean and trimmed mean measures and the Atlanta Fed’s sticky CPI measure all showed a pick-up for the second consecutive month.

- US Treasuries bear steepened, with yields finishing 9-16bps higher. Meanwhile, US STIR saw the odds of another 25bp hike back to around 40% from 30% yesterday.

- According to MNI’s technicals team, the bearish theme in gold was put on pause Monday after a second session of gains. Monday’s bounce put prices back above $1850. Nonetheless, the recent sell-off resulted in a break of support at $1901.1 and this was followed by a breach of $1884.9, the Aug 21 low. This confirmed a resumption of the downtrend that started in early May. The focus is on $1804.9, the Feb 28 low and a key support. On the upside, firm resistance is at $1878.2, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 13/10/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/10/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/10/2023 | 0800/0900 |  | UK | BoE's Bailey speaks at Institute of International Finance Annual Membership Meeting | |

| 13/10/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/10/2023 | - | *** |  | CN | Trade |

| 13/10/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/10/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 13/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 13/10/2023 | 1300/1500 |  | EU | ECB's Lagarde participates in IMF seminar | |

| 13/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/10/2023 | 1630/1730 |  | UK | BoE's Cunliffe speaks at Institute of International Finance |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.