-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Feb Activity Mixed, Property Still Weak

EXECUTIVE SUMMARY

- PATIENTLY ON HOLD BUT CUTS TO COME THIS YEAR - MNI FED WATCH

- ECB'S DE COS SAYS FIRST INTEREST RATE CUT COULD COME IN JUNE - BBG

- BOJ TO LIFT SHORT_TERM RATE TO 0%-0.1% RANGE ON TUESDAY - KYODO

- BOJ WILL CONTINUE TO BUY BONDS AFTER LIFTING RATES, NIKKEI SAYS - NIKKEI

- CHINA JAN-FEB INVESTMENT REBOUNDS, CONSUMPTION SLOWS - MNI BRIEF

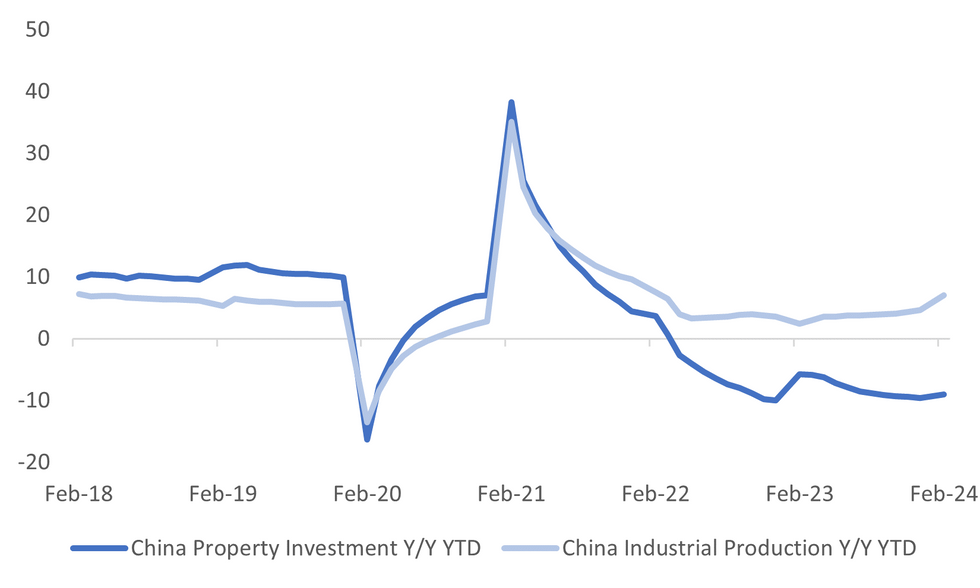

Fig. 1: China Industrial Production & Property Investment YTD Y/Y

Source: MNI - Market News/Bloomberg

EUROPE

ECB (BBG): The European Central Bank Governing Council member Olli Rehn sees conditions emerging that will allow several reductions in borrowing costs this year, with the first such move due “near summer.” “My view is that near the summer is the time to start easing the foot off the monetary-policy brake,” he told YLE TV1 in an interview on Saturday.

ECB (BBG): European Central Bank Governing Council member Pablo Hernandez de Cos said he expects interest rates to be cut in June if inflation continues to moderate as anticipated. “The announcement last week that we have completed our goal of getting inflation to 2% is compatible with a cut in interest rates soon, and that could probably happen in June,” the Bank of Spain governor told El Periodico in an interview published on Sunday.

MIGRATION (AP): The European Union on Sunday announced a 7.4 billion-euro ($8 billion) aid package for cash-strapped Egypt as concerns mount that economic pressure and conflicts in neighboring countries could drive more migrants to European shores.

RUSSIA (RTRS): President Vladimir Putin won a record post-Soviet landslide in Russia's election on Sunday, cementing his already tight grip on power in a victory he said showed Moscow had been right to stand up to the West and send its troops into Ukraine.

RUSSIA (BBC): Russia's defence ministry says its forces have destroyed dozens of drones in several regions across the country, including Moscow. The biggest attack happened in the southern Russian region of Krasnodar, where an oil refinery was targeted.

SPAIN (DW): Thousands of Spanish farmers once again protested with tractors in Madrid on Sunday, demanding better prices for their produce and denouncing European Union agricultural policies. The farmers argue that the EU's policies on the environment and other matters are a financial burden and make their products more expensive than non-EU imports.

U.S.

FED (MNI FED WATCH): The Federal Reserve is expected to hold its benchmark overnight rate at a 23-year high for a fifth straight meeting Wednesday, and reaffirm plans to begin lowering borrowing costs later this year if inflation sustains its downward trend.

POLITICS (WSJ): Influential economic advisers to Donald Trump presented the former president with a shortlist of potential candidates to lead the Federal Reserve during a meeting at his Mar-a-Lago club in Florida last week, according to people familiar with the matter.

OTHER

ISRAEL (BBG): Israel’s military made its deepest incursion into Gaza City in about two weeks, saying its troops were undertaking a “precise operation” targeting the main hospital in the northern metropolis that bore the brunt of the first weeks of fighting in the conflict.

JAPAN (NIKKEI): The Bank of Japan will leave its bond-purchase mechanism in place to control sudden rises in interest rates and avoid market turmoil, the Nikkei newspaper reported without saying where it obtained the information.

JAPAN (KYODO): The Bank of Japan is set to raise its key interest rate for the first time in 17 years on Tuesday following its two-day monetary policy meeting, Kyodo reported.

AUSTRALIA (MNI RBA WATCH): The Reserve Bank of Australia board is likely to hold the cash rate at 4.35% when it meets next week and delivers its decision on March 19, as the economy continues to slow and demand falls as expected.

NEW ZEALAND (BBG): New Zealand Prime Minister Christopher Luxon comments at post-cabinet press conference Monday in Wellington. "What we see is a deteriorating set of economic conditions in New Zealand. We’ve got inflation, we’ve got high interest rates, we’ve got a slowing economy, we’ll see GDP numbers out later this week, and we’ve obviously got a risk of rising unemployment. That’s the situation we’ve inherited”

CHINA

ACTIVITY (MNI BRIEF): China investment rebounded more than expected at the beginning of the year, with declines narrowing in the real-estate sector, though consumption failed to increase over the Luna New Year holiday, data released by the National Bureau of Statistics on Monday showed.

POLICY (SECURITIES DAILY): The People’s Bank of China will likely cut the rate of the medium-term lending facility by 10-20 bps in Q2, despite keeping the rate unchanged last week, said Wang Qing, chief macro analyst at Golden Credit Rating.

TRADE (YICAI): The impact of the expanded trade surplus on the economy should not be overestimated, as the widening trade services deficit could offset it, noted Guan Tao, a former official at the State Administration of Foreign Exchange in an article published by Yicai.

PBOC (PBOC): The People’s Bank of China will explore paths to help China become a greater financial power, including measures to build a modern central bank system, a strong international financial centre and steadily promote the internationalisation of the yuan, according to a statement on its website Saturday.

STOCKS (SECURITIES NEWS): Foreign funds are growing more upbeat on China’s A-share market, due to attractive valuations and expectations of interest rate cuts by the Fed this year, according to a report in the Shanghai Securities News.

STOCKS (SHANGHAI SECURITIES NEWS): Chinese brokerages are upbeat about stocks after the regulator rolled out a series of guidelines and as investor confidence increases, the Shanghai Securities News says in a report that cited notes from CICC, China Merchants Securities and others.

CHINA MARKETS

MNI: PBOC Conducts CNY10 Bln OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The operation has led no change to the liquidity after offsetting CNY10 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8044% at 09:28 am local time from the close of 1.8961% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Friday, compared with the close of 46 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0943 on Monday, compared with 7.0975 set on Friday. The fixing was estimated at 7.1993 by Bloomberg survey today.

MARKET DATA

NZ FEB. BNZ SERVICES PSI RISES TO 53; PRIOR 52.2

NZ FEB. GOVT. BONDS HELD BY FOREIGNERS RISE TO 62.6%; PRIOR 61.6%

JAPAN JAN CORE MACHINERY ORDERS -1.7% M/M; EST. -0.7%; PRIOR +1.9%

JAPAN JAN CORE MACHINERY ORDERS -10.9% Y/Y; EST: -10.5%; PRIOR -0.7%

CHINA JAN.-FEB. RETAIL SALES RISE 5.5% Y/Y; EST. 5.6%; DEC. 7.2%

CHINA JAN.-FEB. INDUSTRIAL OUTPUT RISES 7% Y/Y; EST. 5.2%; DEC. 4.6%

CHINA JAN.-FEB. FIXED INVESTMENT RISES 4.2% Y/Y; EST. 3.2%; DEC. 3.0%

CHINA JAN.-FEB. PROPERTY DEV. INVESTMENT -9.0% Y/Y; EST. -8.0%; DEC. -9.6%

CHINA END-FEB. SURVEYED JOBLESS RATE AT 5.3%; EST. 5.1%; DEC. 5.1%

MARKETS

US TSYS: Treasury Futures Unchanged, Trade In Tight Ranges

- Jun'24 10Y futures briefly traded below the lows from Friday of 109-31 touching 109-30+, before reversing course to make new highs for the day of 110-04+, ranges have remained well within Friday's as we trade at 110-03 unchanged from NY closing levels.

- Looking at technical levels, initial support is 109-25+ (Feb 23 and the bear trigger), below here 109-14+ (Nov 28 low). While to the upside, initial resistance is 110-30+ (Mar 14 high) above here 111-03+( 50-day EMA).

- Treasury curve is flatter today, after initially opening 1-2bps higher yields now trade flat to 1bps lower across the curve. The 2Y is -0.8bp to 4.719%, 10Y -0.6bp to 4.300, while the 2y10y is +0.253 at -42.086 .

- Looking ahead the US calendar is empty today, with Building Permits & Housing starts on Tuesday main focus this week will be on the FOMC on Thursday

JGBS: Futures Sharply Higher Ahead Of BoJ Policy Decision Tomorrow

JGB futures are sharply higher and at session highs, +31 compared to settlement levels, ahead of the BoJ Policy Decision Tomorrow.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Core Machine Orders.

- (Bloomberg) What the End of Japan’s Negative Interest Rates Means: QuickTake (See link)

- (Bloomberg) Investors who have piled into JGB shorts this year could be forgiven for some nerves as the BoJ’s ¥3t of repo liquidity underscores the central bank’s determination to avoid sharp bond-market losses. (See link)

- Regarding the decision tomorrow the primary question revolves around whether the central bank will immediately terminate its negative interest rate policy (NIRP) or postpone such action for another month and a half. While a move in March is not set in stone, we anticipate the BoJ to announce the attainment of its 2% price stability target and exit NIRP. (See MNI BoJ Preview here)

- The cash JGB curve has bull-flattened beyond the 1-year (2.8bps cheaper), with yields 1-3bps lower. The benchmark 10-year yield is 2.5bps lower at 0.761% versus the year’s high of 0.801% set on Friday.

- The swaps curve has also bull-flattened, with rates 1-5bps. Swap spreads are tighter.

AUSSIE BONDS: Little Changed Ahead Of RBA Policy Decision Tomorrow

ACGBs (YM -0.4 & XM +1.0) sit little changed and near Sydney session highs. With the domestic calendar light today, local participants have been content to sit on the sidelines ahead of the RBA Policy Decision tomorrow.

- The RBA is unanimously expected to leave rates at 4.35%. We expect some form of tightening bias to be retained as the data since the last meeting has been broadly in line with the RBA’s projections, while the significant uncertainties discussed last month have not dissipated and the risks are still “broadly balanced”. Thus, the meeting statement will probably be little changed compared with February.

- Cash ACGBs are flat to 1bp richer with the AU-US 10-year yield differential 3bps lower at -18bps.

- The swaps curve has twist-flattened, with rates 1bp higher to 1bp lower.

- The bills strip has slightly bear-steepened, with pricing flat to -2.

- RBA-dated OIS pricing is little changed across meetings. Despite this stability, the market still reflects expectations of a total easing of 35bps by year-end. This projection has, however, been reduced from nearly 50bps of anticipated easing recorded just a week ago.

- The shift follows a notable recalibration of easing expectations for the FOMC during the same period following unexpectedly high February US CPI and PPI data.

NZGBS: Closed On A Strong Note, PM Downbeat On NZ Economy

NZGBs closed with a bull-steepening despite the negative lead from US tsy dealings on Friday. Benchmark NZGBs closed at the session’s best levels, with yields 1-3bps lower.

- With the domestic calendar fairly light (Performance Services Index and Non-Resident Bond Holdings), today’s move appears more likely linked to downbeat comments on the NZ economy from PM Luxon. “What we see is a deteriorating set of economic conditions in New Zealand. We’ve got inflation, we’ve got high interest rates, we’ve got a slowing economy, we’ll see GDP numbers out later this week, and we’ve obviously got a risk of rising unemployment. That’s the situation we’ve inherited.” It is however worth noting that the comments were similar to those made by the Finance Minister on Friday. (See link)

- US tsys are dealing little changed in today’s Asia-Pac session. The US calendar is empty today.

- Swap rates closed little changed.

- RBNZ dated OIS pricing closed is unchanged across meetings. A cumulative 57bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

- In Australia, the RBA hands down its Policy Decision. Consensus among Bloomberg analysts is unanimous in expecting a status quo decision.

FOREX: Dollar Steady Ahead Of Key Central Bank Meetings

It has been a fairly muted start for G10 FX markets in Monday trade to date. Of course we have key central bank meetings tomorrow in terms of the BoJ and the RBA. Later in the week is the Fed.

- The BBDXY sits unchanged, last at 1235.70. Earlier highs (close to 1236.50) weren't sustained with UST yields slightly lower. This has likely curbed USD upside to a degree. US equity futures have firmed as well, which has likely aided higher beta FX performance as well.

- NZD and AUD sit modestly higher, with regional equities mostly higher. China activity figures were slightly better than forecast, although property indicators remained weak. AUD/USD was last near 0.6570, with iron ore back above $100/ton.

- NZD/USD is slightly outperforming, last back close to 0.6095. NZ PM Luxon presented a downbeat view of the economy and NZ front end rates have not risen in line with the US over the past few sessions. Still the better equity tone has likely provided some offset to these headwinds.

- USD/JYP dips sub 149.00 have been supported. The pair was last near 149.10. Earlier highs were at 149.33, which came after the BoJ announced an unscheduled repo operation. The flurry of media articles post last Friday's stronger than expected wages outcome points to a BoJ shift tomorrow.

- Still a tightening cycle which is unlikely to be aggressive, coupled with reports of continued BoJ bond buying, is likely dampening any sentiment this is a dramatic game changer for yen.

- Looking ahead it is a fairly quiet start to the week data wise, with the NAHB index printing in the US, the main data print of note.

ASIA STOCKS: China & Hong Kong Equities Push Higher, Property Lags As Sales Drop

Hong Kong and China equities opened mixed today, however are mostly higher now. China mainland equities are outperforming after earlier data showed industrial production rose to 7.0% y/y vs 5.2% expected, fixed assets rose to 4.2% y/y vs 3.2% expected, although retail sales slightly missed, coming in at 5.5% vs 5.6% expected. The Property space continues to under-perform after Longfor reported a drop in sales by 60% from a year earlier, while Yuexiu Property pulled their bond issuance.

- In Hong Kong, equities are mixed today, with property names being the worst-performing sector. The Mainland Property Index is down 1.88% as property investment fell to 9% vs 8% expected. The HSTech Index is up 1.00%, while the Biotech Index is now unchanged for the day after being down as much as 2.2% earlier, the wider HSI is up 0.20%. In China, equities are faring a bit better, the CSI300 is up 0.75%, small cap and growth stocks are the top performing with the CSI1000 up 0.90%, while the ChiNext is 2.00% higher.

- China Northbound flows were 10.32 billion yuan on Friday, with the 5-day average at 6.56 billion, while the 20-day average sits at 3.19 billion yuan.

- In the Property space, Longfor Group shares fell over 4% after Feb contracted sales fell by more than 60% from a year earlier. Yuexiu Property shares also fell over 4% after their parent company Guangzhou Yuexiu canceled the issuance of 500m 10yr and 500m 15yr bonds blaming recent significant market fluctuations.

- China's bank loans expanded at a historically slow pace in February, with yuan loans growing 9.7% year-on-year, the lowest since 2003, indicating weak borrowing demand despite central bank efforts to ease policy. Sluggish borrowing demand poses challenges for Beijing's economic growth target of around 5%, compounded by weak or negative price growth across the economy and signals from policymakers to align credit growth with growth and inflation targets.

- The CSRC plans to tighten listing requirements and increase scrutiny on publicly traded firms to restore confidence in the stock market, amidst recent declines attributed to various economic factors and regulatory concerns. The measures include re-evaluating listing standards, enhancing oversight of IPO processes, and cracking down on financial fraud, which may further slow IPO activity in a market already impacted by regulatory scrutiny and economic challenges, with IPO proceeds dropping significantly compared to previous years.

- Looking ahead, Hong Kong has unemployment data due out later today, while next up in China is the Loan Prime Rates on Wednesday

ASIA PAC EQUITIES: Asian Equities Push Higher Ahead Of A Busy Central Bank Week

Regional Asian equities are higher today, with Japanese equities being the best-performing region, while tech is the top performing sector, the Bloomberg APAC Index is up 1.27%. Eyes will be on central banks this week, with the BoJ being the major focus as the likelihood of a rate rise increased again after the Rengo wages results showed an increase of over 5% compared to 3.8% the year prior. The RBA also meets on Tuesday; however, it is widely expected to keep rates on hold while Taiwan's central Bank meets on Thursday.

- Japanese equities rose as a weak yen supported exporters, fueled by speculation that the Bank of Japan would lift its key interest rate for the first time in 17 years during its two-day meeting, following reports of strong wage deals and reduced uncertainty, leading to expectations of higher stock prices, particularly in defensive sectors such as electric power and gas, land transportation, materials, non-ferrous metals, and steel. The Nikkei 225 is up 2.41%%, while the Topix is 1.80% higher.

- South Korean equities snapped a three-day winning streak on Friday as foreign investors sold equities at the largest rate since March 2023. The market gapped lower right on the close Friday, and we now trade at the levels prior to that late move. Tech names are the top-performing sector today. The Kospi is up 0.50%.

- Taiwanese equities have opened higher, while Taiwanese officials are growing increasingly concerned about the surging equity market, indicating that regulators may look into ways to control the market. Later this week we have the Central Bank rate decision, expected to remain unchanged at 1.1875%. Currently, the Taiex is up 0.35%.

- Australian equities have recovered earlier loses to trade mostly unchanged for the day real estate names have been the worst-performing sector offsetting gains in financials and mining names. The major focus this week will be on the RBA tomorrow; however, it's widely expected to keep rates on hold. The ASX200 closed Monday up 0.06%.

- Elsewhere in SEA, New Zealand equities closed down 0.33% after the NZ Institute of Economic Research published forecasts showing lower expected GDP growth, while Prime Minister Luxon made comments about the deteriorating economic conditions. Singapore equities are unchanged after with Non-oil Domestic Exports fell to -0.1% in Feb from 4.7% in Jan, Philippines equities are 1.60% higher and Indonesian equities up 0.14%.

OIL: Crude Continues To Climb As Market Tightens & Geopolitical Risks Persist

Oil prices have rallied around 0.5% during APAC trading as risk appetite has improved and China’s IP and fixed asset investment rose more than expected in January-February. WTI is up 0.4% to $81.39/bbl, close to the intraday high, and Brent +0.4% to $85.65/bbl breaking above resistance at $85.53 opening up $86.52. The USD index is flat.

- The market remains nervous re attacks on energy infrastructure in key producing countries. Last week the Ukraine struck a major Russian refining facility and over the weekend Russia’s defence ministry said it had destroyed drones targeting refineries in a number of regions, but according to Bloomberg a number were hit. These strikes are putting upward pressure on diesel prices.

- Given oil’s move higher on the back of continued geopolitical issues and the IEA’s upward revision to global demand, Morgan Stanley has revised up its Q3 Brent forecast by $10 to $90/bbl. Brent’s timespread has widened signalling further tightening of the market.

- The focus of the week for oil markets will be Wednesday’s Fed meeting. There is also the CERAWeek conference in Houston, comments from speakers will be watched closely.

- The key data release later is euro area February CPI but there are also US NY Fed services and NAHB housing. The ECB’s Buch speaks.

GOLD: Weaker Ahead Of This Week’s FOMC Meeting

Gold is 0.4% lower in the Asia-Pac session, after closing 0.3% lower at $2155.90 on Friday.

- Friday’s move left the yellow metal 1.0% lower on the week, the first weekly decline in four.

- US bonds and equities had another heavy session on Friday ahead of this week’s FOMC meeting. The 2-year US Treasury yield finished 3bps higher at 4.73% while the 10-year yield ended up 2bps at 4.31%. These yields now stand over 20bps higher than their levels at the beginning of last week, driven by concerns surrounding persistent inflation. These inflationary pressures have raised questions about the extent of potential monetary easing that policymakers might signal at the forthcoming FOMC meeting.

- According to MNI’s technicals team, the trend condition is still bullish despite the recent pullback from its all-time high of $2195.15. The break above resistance at $2135.4, the Dec 4 high, signals scope for $2206.6 next, a Fibonacci projection. Firm support is at $2108.4, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2024 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/03/2024 | 1000/1100 | *** |  | EU | HICP (f) |

| 18/03/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/03/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 18/03/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/03/2024 | 1530/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 18/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.