-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China/HK Equities Firm On PBoC Policy Pledge

EXECUTIVE SUMMARY

- US GOVERNMENT SHUTDOWN NEARS AS LAWMAKERS MAKE INCREMENTAL GAINS - BBG

- ECB’S HOLZMANN SAYS UNCLEAR WHETHER RATE PEAK HAS BEEN REACHED - BBG

- CHINA’S CENTRAL BANK TO USE ‘PRECISE, FORCEFUL’ POLICY TO BOLSTER RECOVERY - RTRS

- MOST MEMBERS WANT MORE FLEXIBILITY - BOJ MINUTES - MNI BRIEF

- AUSSIE MONTHLY CPI RISES TO 5.2% - MNI BRIEF

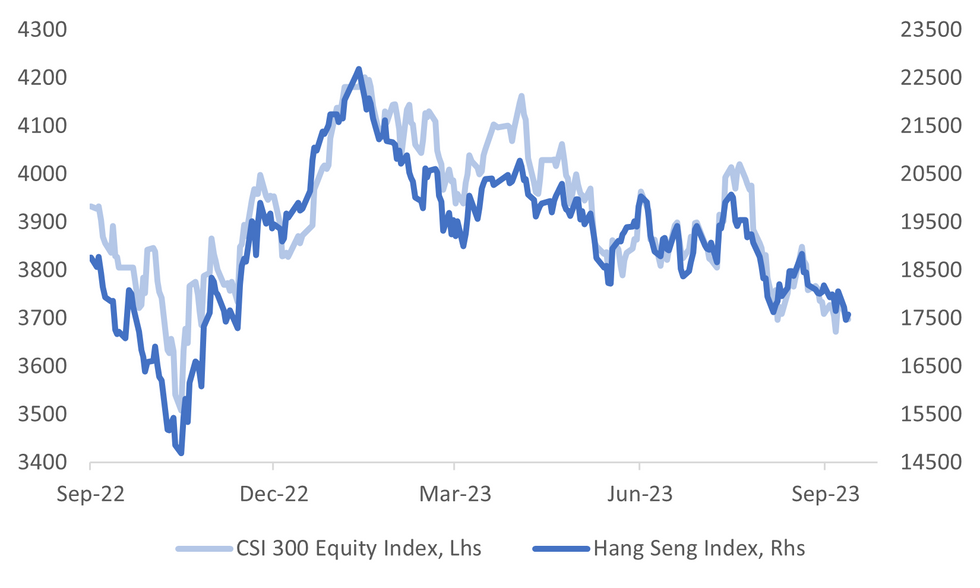

Fig. 1: China CSI 300 Equity Index & Hang Seng Index

Source: MNI - Market News/Bloomberg

U.K:

HOUSING: First-time buyers have all but abandoned the London housing market over the last decade after a surge in mortgage rates and high deposit requirements price more out of the market. Mortgage lender Halifax said only 24,323 Londoners bought a house for the first time between January and August 2023, a 9% drop from the same period in 2013. The capital is the only UK region with fewer first-time buyers than a decade ago. Elsewhere, cheap borrowing and government aid post-Covid have fueled double-digit growth over the last 10 years. (BBG)

EUROPE:

ECB: It’s unclear whether the European Central Bank has lifted borrowing costs to their peak, with the persistence of inflation meaning further hikes can’t be excluded, according to Governing Council member Robert Holzmann. The hawkish Austrian official listed threats to the retreat in euro-zone consumer prices including wage negotiations and the rising cost of oil. (BBG)

U.S.

FISCAL: The US is on track for an Oct. 1 government shutdown despite incremental progress late Tuesday in the House and Senate on rival spending bills. Senate leaders introduced their own bill to avert a shutdown and cleared a procedural vote, while House Speaker Kevin McCarthy was able to start House debate on a series of conservative full-year spending bills. (BBG)

ECONOMY: The Writers Guild of America (WGA) said its members could return to work on Wednesday while a ratification vote takes place on a new three-year contract with Hollywood studios. Union leaders "voted unanimously to lift the restraining order and end the strike as of 12:01 am PT/3:01 am ET on Wednesday, September 27th," the WGA said in a statement. (RTRS)

POLITICS: A New York judge found Donald Trump and his family business fraudulently inflated the value of his properties and other assets, in a major defeat for the former U.S. president that could severely hamper his ability to do business in the state. The scathing decision by Justice Arthur Engoron of New York state court in Manhattan will make it easier for state Attorney General Letitia James to establish damages at a scheduled Oct. 2 trial. (RTRS)

US/CHINA: The United States restricted imports from three more Chinese companies on Tuesday as part of an effort to eliminate goods made with the forced labor of Uyghur minorities from the U.S. supply chain. (RTRS)

OTHER

JAPAN: Most Bank of Japan board members believe the Bank should allow greater flexibility in the conduct of yield curve control to sustain monetary easing amid high uncertainty for prices, according to the July 27-28 meeting minutes released Wednesday. “Some members were of the view that, if upward movements in prices continued, allowing to some extent a rise in long-term interest rates would enable the BOJ to maintain the positive effects of monetary easing through the channel of real interest rates, while alleviating, for example, a decline in the functioning of bond markets,” the minutes showed. (MNI BRIEF)

JAPAN: Several Bank of Japan board members noted wages will likely rise next year, however, they stressed the Bank needed to clarify its wage-hike outlook, according to the July 27-28 meeting minutes released on Wednesday. “Members shared the recognition that, in projecting future price developments, it was important to determine whether changes in firms' wage- and price-setting behaviour would progress and wage hikes would continue next year and beyond,” the minutes showed. (MNI BRIEF)

SOUTH KOREA: US may announce indefinite waivers of chip export controls for South Korean chipmakers as early as this week that will allow Samsung Electronics and SK Hynix to get chipmaking equipment to their plants in China, Yonhap News reports, citing multiple sources. (Yonhap)

AUSTRALIA: Australia’s monthly consumer price index (CPI) indicator rose 5.2% y/y in August, in line with market expectations and up from July’s 4.9%, according to Australian Bureau of Statistics data released Wednesday. (MNI)

AUSTRALIA: A planned overhaul of Australia’s central bank will dramatically dilute the governor’s authority and put the institution’s future at “huge risk,” former Reserve Bank chief Ian Macfarlane told The Australian newspaper. Macfarlane, who helmed the RBA from 1996-2006, said the changes would see the governor’s stature “reduced out of all proportion to what any other central bank has done,” the newspaper reported Wednesday. “No other central bank puts the governor in such a weak position.” (The Australian)

NEW ZEALAND: Employment confidence index fell 7.4 points to 98.3 in 3q, Westpac Banking Corp. and McDermott Miller Ltd. say in emailed statement. Gauge below 100 for first time since early 2021, indicating households now have a negative view of labor market. (BBG)

CHINA

POLICY: China's central bank said on Wednesday it would step up policy adjustments and implement monetary policy in a "precise and forceful" manner to support an economy whose recovery was improving with "increasing momentum". The People's Bank of China (PBOC) will keep liquidity reasonably ample and maintain stable credit expansion, the bank said in a statement after a quarterly meeting of its monetary policy committee. (RTRS)

LIQUIDITY: China’s central bank is expected to continue keeping liquidity stable by adding cash or conducting more reverse repos of longer tenors in open market operations, China Securities Journal reports Wednesday, citing analysts. (CSJ)

INFRASTRUCTURE: Infrastructure construction in China will pick up in 4Q as some local governments have recently kicked off major projects, the Securities Daily reports, citing analysts. (Securities Daily)

DEBT: Local-government debt remained within the approved limit at the end of August, the Ministry of Finance noted in a recent report. National local-government debt stood at CNY38.7 trillion in August, within the approved limit of CNY42.1 trillion set by the National People's Congress. Central University of Finance and Economics Professor Bai Yanfeng said local governments can safely manage debt with the gradual improvement of the economy and the lowering of interest rates. (SECURITY DAILY)

MARKETS: The Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) plan to regulate shareholding reduction activities further. According to a notice issued on Tuesday, if a listed company experiences a breach of the issuance price or net asset value, or it has not paid cash dividends in the past three years or the cumulative cash dividends amount to less than 30% of the average net profit over the past three years, the controlling shareholder or actual controller will not be able to sell the company's shares through the secondary market. (21st Century Business Herald)

CHINA MARKETS

PBOC Injects Net 412 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY200mbilion via 7-day reverse repo and CNY417 billion via 14-day reverse repo on Wednesday, with the rate unchanged at 1.80% and 1.95%, respectively. The operation has led to a net injection of CNY412 billion after offsetting the maturity of CNY205 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8300% at 09:34am local time from the close of 2.2019% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Tuesday, compared with the close of 46 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1717 Wednesday Vs 7.1727 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1717 on Wednesday, compared with 7.1727 on Tuesday. The fixing was estimated at 7.3071 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCTOBER BUSINESS SURVEY MANUFACTURING 67; PRIOR 69

SOUTH KOREA OCTOBER BUSINESS SURVEY NON-MANUFACTURING 77; PRIOR 76

AUSTRALIA AUGUST CPI Y/Y 5.2%; MEDIAN 5.2%; PRIOR 4.9%

CHINA AUGUST INDUSTRIAL PROFITS Y/Y 17.2%; PRIOR -6.7%

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 108-09+, +0-06, a 0-06 range has been observed on volume of ~63K.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening has been observed.

- Tsys extended the move seen late in Tuesday's NY session as participants faded the recent cheapening, perhaps using the opportunity to close out short positions/add fresh longs.

- Gains were marginally extended as regional equities firmed after the PBOC noted that they will implement monetary policy in a precise and forceful manner, as well as focus on expanding domestic demand.

- Tsys pared gains and observed narrow ranges for the remainder of the session.

- Europe's docket is thin today, further out we have Durable Goods. Fedpseak from Gov Bowman and Minneapolis Fed President Kashkari will cross. We also have the latest 5-Year Supply

JGBS: Futures Are Holding Uptick, Mid-Range, 2Y Supply Tomorrow

JGB futures are holding in the middle of the Tokyo session range, +3 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined BOJ Minutes for the July meeting. Of note, many members said hitting the BOJ’s inflation target was not yet in sight.

- Leading and Coincident Indices and Machine Orders are due soon.

- The cash JGBs are dealing mixed, with yields 1.4bps higher to 0.4bp lower. The benchmark 10-year yield is 0.2bp lower at 0.739%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.756%, set prior to the recent BOJ decision.

- The swaps curve has twist-steepened, pivoting at the 7s, with rates 0.5bp lower to 1.4bps higher. Swap spreads are wider beyond the 3-year.

- Tomorrow the local calendar sees International Investment Flow data, along with 2-year supply.

- Later today sees US Durable Goods. Fedspeak from Gov Bowman and Minneapolis Fed President Kashkari will cross. There is also 5-year US tsy supply.

AUSSIE BONDS: Slightly Richer, Post-CPI Rally Unwound, Retail Sales Tomorrow

ACGBs (YM +2.0 & XM +2.0) sit in the middle of the Sydney session range. While the CPI Monthly for August printed in line with expectations at 5.2% y/y, the domestic market managed to firm 2bps in the aftermath. That move was assisted by a strengthening in US tsys in early Asia-Pac trade. At the time of writing, the post-CPI strength in ACGBs has been unwound, despite US tsys holding 1-3bps richer across the major benchmarks.

- (AFR) Inflation has accelerated for the first time in four months, as expensive fuel and cost pressures in labour-intensive services pushed up annual consumer prices by 5.2 per cent to keep alive the chance of another interest rate rise. (See link)

- Cash ACGBs are 2bps richer on the day, with the AU-US 10-year yield differential at -14bps.

- Swap rates are 2-3bps lower on the day.

- The bills strip is richer, with pricing flat to +2.

- RBA-dated OIS pricing is flat to 3bp softer across meetings.

- Tomorrow the local calendar sees Job Vacancies (Q3) and Retail Sales (Aug).

NZGBS: Closed At Best Levels, Tracking Tsys, Business Confidence Tomorrow

NZGBs concluded the session on a positive note, witnessing a 4bp drop in benchmark yields. In the absence of domestic catalysts, recent shifts in the local market have been primarily influenced by developments in US tsys. Notably, the NZ-US and NZ-AU 10-year yield differentials were relatively stable throughout the day.

- US tsys are holding richer in Asia-Pac trade. Ranges remain narrow, with little meaningful macro news flow crossing. This leaves cash tsys 1-3bps richer across the major benchmarks.

- Swap rates are 4-5bps lower, with implied swap spreads slightly tighter.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations steady at 5.76%.

- Bloomberg reports that the RBNZ announced that it bought a net NZ$84m in August, after a net sale of NZ$3.96bn in July.

- Tomorrow the local calendar sees ANZ Business Confidence.

- Later today sees US Durable Goods. Fedspeak from Gov Bowman and Minneapolis Fed President Kashkari will cross. There is also 5-year US tsy supply.

EQUITIES: China/HK Equities Higher On PBoC Policy Pledge

Regional equities are mixed in the first part of Wednesday Asia Pac trade. There have been pockets of strength, most notably in HK and China markets. Losses elsewhere haven't been as large as implied by US weakness in Tuesday trade. US equity futures are a touch higher at this stage. Eminis near 4323, +0.18%, while Nasdaq futures are up by close to the same amount. Eminis are only a touch above fresh lows going back to mid June.

- In the cross-asset space, US nominal yields are touch lower, which is potentially aiding US equity futures, but overall moves are modest. USD dips are being supported though.

- HK and China equities enjoyed early positive momentum, but we sit off session highs for major indices. At the break the HSI is +0.64%, the CSI 300 +0.31%.

- Early positive momentum reflected PBoC headlines, where the central bank stated it will use 'precise, forceful policy' to boost the recovery. August profit data also showed some improvement, with profits up 17.2% y/y (prior -6.7%), although base effects played a role.

- Real estate jitters persist, following reports that the Evergrande Chair was under police watch. The CSI 300 real estate sub index is down slightly in the first part of trade.

- Japan markets are down modestly, the Nikkei 225 off 0.35%. The Taiex is off 0.12%, despite a sharp dip in the SOX during US Tuesday trade. The Kospi is down further, off 0.30%. Local news wire Yonhap reported that key chipmakers (including Samsung) may get an indefinite waiver over chip export controls to China.

- In SEA, Indonesian and Philippine stocks are higher, while modest losses are evident elsewhere.

FOREX: USD Marginally Firmer In Asia

The greenback has marginally extended recent gains in Asia on Tuesday, BBDXY is up ~0.1% and sits above yesterdays highs. The advance in the USD was seen alongside Tsys and US Equity Futures retreating from session highs.

- Kiwi is the weakest performer in the G-10 space at the margins, NZD/USD is down ~0.3% last printing at $0.5925/30. The pair now sits below the 20-day EMA, bears target low from Sep 21 ($0.5896) and $0.5859 (6 Sep low).

- AUD is also pressured, AUD/USD was unable to hold early gains above the $0.64 handle and sits at $0.6380/85. The trend condition remains bearish, support comes in at $0.6357, low from Sep 6 and bear trigger.

- Yen sits a touch above the ¥149 handle, there has been no follow through on moves today thus far. The trend continues to be bullish, resistance comes in at ¥149.10, High from Oct 25 2022, and ¥147.71, high from Oct 24 2022. Support is at ¥147.29, the 20-Day EMA.

- Elsewhere in G-10, EUR and GBP are following the broader USD trend and are down ~0.1%.

- There is a thin docket in Europe today.

OIL: Recovery Extends Further, As Supply Fears Dominate, US Inventories Eyed Later

Oil has continued to recover, building on Tuesday's gains. Brent sits near $94.90/bbl, comfortably above late Asia Pac Tuesday lows sub $92/bbl. The benchmark contract is up a further ~1%, following Tuesday's +0.72% gain. WTI was last near $91.35/bbl, up by a similar magnitude in Tuesday trade to date.

- Supply side concerns appear to be trumping broader risk jitters/USD strength.

- Official data on inventories, due later in US trade may see another draw in crude inventories. This follows API data suggesting as much, which were released on Tuesday, per Bloomberg reports.

- Near term spreads in WTI contracts also continue to highlight a very tight supply backdrop.

- The recent recovery in Brent is bringing recent YTD highs back into play. Resistance is seen at $95.96 (Sep 19 high) and support at $91.12 (20-day EMA).

GOLD: Steady After Being Down Sharply On Tuesday

Gold is little changed in the Asia-Pac session, after closing -0.8% at $1900.65 on Tuesday, off a low of $1899.24. Bullion’s decline appeared attributable to the combination of a stronger USD and yields hovering at cycle highs.

- US tsys gave up early gains to finish slightly mixed. The fear of a higher-for-longer policy stance by global central banks continued to weigh and was exacerbated after JPMorgan's Dimon noted the potential for a 7% rate as a worst-case scenario. Additionally, the threat of a government shutdown this weekend and Moody's ratings warning probably left bond buyers sidelined.

- The US Treasury 10-year yield finished at 4.54%, just below its highest level since 2007, after being 8bps lower in early trade.

- From a technical standpoint, Tuesday’s low for gold tested $1901.1 (Sep 14 low) after which lies the bear trigger at $1884.9 (Aug 21 low).

- The market for bullion in China has surged this month, at times commanding a record premium over international prices of more than $100 an ounce, compared with an average over the past decade of less than $6. (See link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/09/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/09/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/09/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 27/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/09/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/09/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.