-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China/HK Equity Gains Soothe Broader Risk Appetite

EXECUTIVE SUMMARY

- JEREMY HUNT COULD BE ASKED TO DELAY FISCAL STATEMENT (Times)

- CHINESE STATE BANKS SOLD DOLLARS TO SUPPORT YUAN LATE ON TUESDAY (RTRS)

- JAPAN’S FX CZAR KANDA: YELLEN RESPECTS JAPAN’S INTERVENTION NON-DISCLOSURE (BBG)

- CHINESE STOCKS RALLY AS AUTHORITIES SEEK TO BOOST CONFIDENCE (BBG)

- DETAILS OF POST-MARKET EARNINGS REPORTS FROM MICROSOFT AND ALPHABET DISAPPOINT

- MUSK SIGNALS $44BN TWITTER DEAL ON TRACK TO CLOSE THIS WEEK (FT)

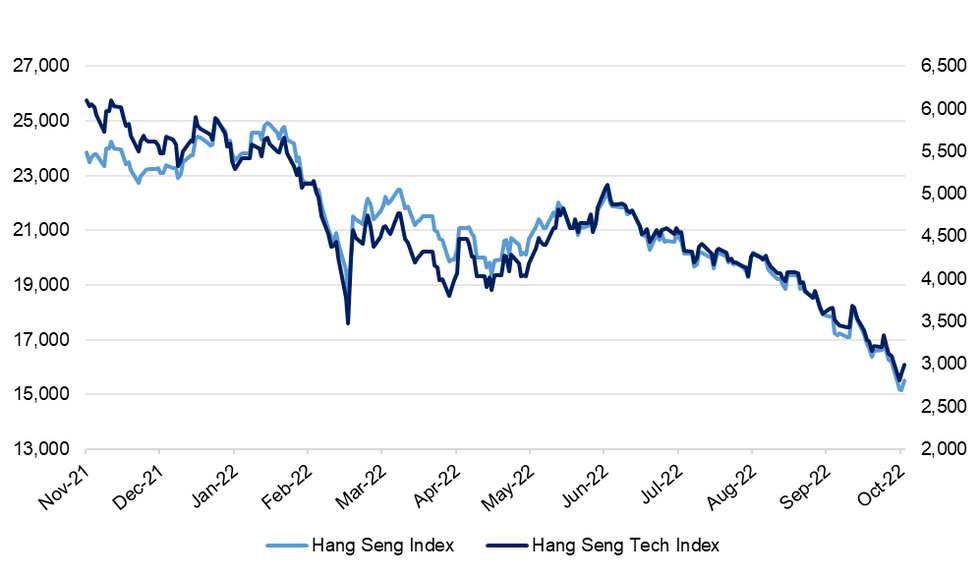

Fig. 1: Hang Seng Index vs. Hang Seng Tech Index

UK

FISCAL: Rishi Sunak is considering a delay to next week’s planned statement setting out how the government will close a £40 billion black hole in the country’s finances, The Times understands. (Times)

POLITICS: Rishi Sunak has made the first appointments of his cabinet reshuffle by keeping Jeremy Hunt as chancellor and appointing Dominic Raab as deputy prime minister and justice secretary, after the departure of nearly a dozen cabinet ministers. (Guardian)

POLITICS: Rishi Sunak on Tuesday became Britain’s third prime minister in the space of two months and immediately started to assemble a “unity cabinet” to tackle “the profound economic crisis” facing the country. (FT)

UK/US: President Biden and U.K. Prime Minister Rishi Sunak discussed policy on Russia, Ukraine, China and outstanding issues over Northern Ireland and the European Union Tuesday, the White House said. (Axios)

POUND: Investors in UK companies can expect to receive an additional £5.7bn of dividends this year because of the pound’s slide against the US dollar. (FT)

EUROPE

GERMANY/FRANCE: Relations are now so icy between Emmanuel Macron and Olaf Scholz, the leaders of the EU’s two economic powerhouses, that they are even struggling to agree on whether to be seen together in front of the press. (POLITICO)

ITALY: Italian Prime Minister Giorgia Meloni won her first confidence vote in the Lower House of parliament with a solid majority, in a sign that she’ll be able to drive through her agenda as long as her coalition remains united. (BBG)

U.S.

POLITICS: The White House has lowered its earlier optimism about the midterm elections and is now worried that Democrats could lose control of both chambers of Congress, administration officials say. (RTRS)

ECONOMY: There has been a lot of talk about looming layoffs, and by some recent surveying, as many as half of large employers are thinking about labor cost cuts as the economy slows. But U.S. Department of Labor Secretary Marty Walsh doesn’t see the recent job gains reversing, according to an interview at CNBC’s Work Summit on Tuesday. (CNBC)

EQUITIES: Sales at the tech giants Alphabet and Microsoft have slowed sharply, adding to fears of a downturn in the economy. (BBC)

EQUITIES: Elon Musk has confirmed on a video call with his advisers that he intends to close his $44bn acquisition of Twitter on Friday, potentially bringing an end to the turbulent acquisition process, according to people briefed about the matter. (FT)

EQUITIES: Is Twitter dying?" billionaire Elon Musk mused in April, five days before offering to buy the social media platform. The reality, according to internal Twitter (TWTR.N) research seen by Reuters, goes far beyond the handful of examples of celebrities ghosting their own accounts. Twitter is struggling to keep its most active users - who are vital to the business - engaged, underscoring a challenge faced by the Tesla (TSLA.O) chief executive as he approaches a deadline to close his $44 billion deal to buy the company. (RTRS)

EQUITIES: Google parent Alphabet Inc's (GOOGL.O) disappointing ad sales sparked worries across the digital media sector on Tuesday as advertisers cut back on their spending in the face of an economic slowdown. (RTRS)

OTHER

JAPAN: US Treasury Secretary Janet Yellen respects Tokyo’s decision not to disclose whether it has intervened in foreign exchange markets, according to Japan’s top currency official. (BBG)

NEW ZEALAND: The country’s largest bank now expects house prices to fall 18% from their 2021 peak, an increase from the 15% it expected previously. (Stuff)

SOUTH KOREA: President Yoon Suk-yeol voiced regret Wednesday after the main opposition party boycotted his budget speech, saying the party has left a bad precedent that could weaken public confidence in the National Assembly. (Yonhap)

NORTH KOREA: The United States will make full use of its military capabilities, “including nuclear, conventional and missile defence”, to defend its allies Japan and South Korea, US Deputy Secretary of State Wendy Sherman said as she warned North Korea against escalating its provocations. (SCMP)

NORTH KOREA: Senior diplomats of South Korea, the United States and Japan held consultations Wednesday on regional and global security issues amid concerns over the possibility of a North Korean nuclear test. (Yonhap)

RUSSIA: House progressives are doing damage control after retreating from a letter that stirred outrage among Democrats by questioning President Biden’s handling of the Russia-Ukraine war two weeks before the midterm elections. (Hill)

RUSSIA: President Joe Biden warned Russia against using a nuclear or radioactive weapon in Ukraine and said he’s been in discussions Tuesday about the possibility. (BBG)

RUSSIA: The likelihood that Russia would resort to using a nuclear weapon in its war on Ukraine was “higher than a couple of months ago” and “requires full attention”, a top European spy chief has warned. (FT)

RUSSIA: Ukraine’s nuclear energy operator said Tuesday that Russian forces were performing secret work at Europe’s largest nuclear power plant, activity that could shed light on Russia’s claims that the Ukrainian military is preparing a “provocation” involving a radioactive device. (AP)

RUSSIA: Russian forces are digging in for the "heaviest of battles" in the strategic southern region of Kherson, a senior Ukrainian official said, as the Kremlin prepares to defend the largest city under its control from Ukraine's counter-offensive. (RTRS)

ENERGY: International Energy Agency Executive Director Fatih Birol warned emerging and developing countries are most vulnerable to soaring energy prices. (CNBC)

OIL: Saudi Arabia’s energy minister has signalled a willingness to pump more oil if the global energy crisis worsens, while describing this month’s decision by the Opec+ cartel to cut crude supply during a period of high prices as a “mature” decision. (FT)

GAS: The spot price of natural gas in west Texas has fallen below zero, effectively forcing producers to pay to unload it, even as Europe contends with sky-high costs for the fuel. (FT)

CHINA

PBOC: The People’s Bank of China and the State Administration of Foreign Exchange said they will strengthen departmental collaboration to maintain the healthy development of the stock, bond and property market, and stabilise the yuan at a reasonable and balanced level, according to a statement on the PBOC website late Tuesday. The China Banking and Insurance Regulatory Commission said on its website on Tuesday that financial risks are generally restrained and the financial system is generally stable, and the capital market has long-term investment value. The China Securities Regulatory Commission called for increased confidence in the sound development of China’s economy in the long run, according to a statement on its website. (MNI)

PBOC: The PBOC has increased net injections of liquidity by lifting reverse repos to more than CNY200 billion a day to cushion the impact of the traditional tax season and government bond issuance, the China Securities Journal reported. Tax payments will drain liquidity mainly on Wednesday and Thursday, though liquidity will gradually become looser in early November, the newspaper said citing analysts. The PBOC is expected to keep using open market operations and structural monetary policy tools to maintain reasonably ample liquidity through the end of the year, the newspaper said citing analysts. (MNI)

ECONOMY: Chinese stocks in Hong Kong extended their rebound from the historic rout earlier this week, as authorities sought to bolster investor confidence in one of the world's worst-performing markets this year. (BBG)

ECONOMY: China's economic growth is hitting an early speed bump in the fourth quarter as COVID-19 curbs and anxieties further tapped the brakes on travel and shipping, constraining consumption and commerce in the world's second-largest economy. (RTRS)

CORONAVIRUS: Universal Studios’ Beijing theme park, Universal CityWalk and two affiliated hotels halt operations Wednesday to conduct Covid prevention work, according to a statement from their operators. (BBG)

EQUITIES: China will support qualified foreign-funded enterprises to raise funds by listing on the Main Board, the Science and Technology Innovation Board, the ChiNext Board, the Beijing Stock Exchange, as well as issuing corporate bonds, Caixin reported, citing a document released by the National Development and Reform Commission and five other departments late Tuesday. There is no legal obstacle to their listing in China as only a few among the 168 listed foreign-funded companies are directly controlled by foreign institutions, Caixin reported. The new rules seek to expand the inflow of foreign capital and stabilise the scale of foreign investment, Caixin added. (MNI)

YUAN: Major Chinese state-owned banks sold U.S. dollars in both onshore and offshore markets in late trade on Tuesday to prop up the weakening yuan, two sources with direct knowledge of the matter told Reuters. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY278BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY280 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY278 billion after offsetting the maturity ofCNY2 billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and government bond issuance, and keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0268% at9:33 am local time from the close of 1.9195% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday vs 66 on Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1638 on Wednesday, compared with 7.1668 set on Tuesday

OVERNIGHT DATA

JAPAN SEP SERVICES PPI +2.1% Y/Y; MEDIAN +2.1%; AUG 2.0%

AUSTRALIA Q3 CPI +7.3% Y/Y; MEDIAN +7.0%; Q2 +6.1%

AUSTRALIA Q3 CPI +1.8% Q/Q; MEDIAN +1.6%; Q2 +1.8%

AUSTRALIA Q3 CPI TRIMMED MEAN +6.1% Y/Y; MEDIAN +5.5%; Q2 +4.9%

AUSTRALIA Q3 CPI TRIMMED MEAN +1.8% Q/Q; MEDIAN +1.5%; Q2 +1.6%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +5.0% Y/Y; MEDIAN +4.8%; Q2 +4.3%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +1.4% Q/Q; MEDIAN +1.5%; Q2 +1.4%

AUSTRALIA SEP CPI +7.3% Y/Y; MEDIAN +7.1%; AUG +6.9%

AUSTRALIA SEP CORE CPI +6.8% Y/Y; AUG +6.2%

NEW ZEALAND OCT ANZ BUSINESS CONFIDENCE -42.7; SEP -36.7

NEW ZEALAND OCT ANZ ACTIVITY OUTLOOK -2.5; SEP -1.8

Business confidence fell 6 points in October to -43, while expected own activity dipped 1 point to -3. Most forward-looking activity indicators slipped a little, though residential construction intentions lifted. Responses received after the unexpectedly strong CPI data were weaker on average. Inflation pressures remain intense. Pricing intentions are gradually easing but are not yet indicating a meaningful fall in inflation. (ANZ)

SOUTH KOREA NOV BUSINESS SURVEY M'FING 73; OCT 75

SOUTH KOREA NOV BUSINESS SURVEY NON-M'FING 78; OCT 81

MARKETS

SNAPSHOT: China/HK Equity Gains Soothe Broader Risk Appetite

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 281.15 points at 27531.43

- ASX 200 up 12.282 points at 6810.9

- Shanghai Comp. up 36.909 points at 3013.267

- JGB 10-Yr future up 32 ticks at 148.32, yield down 0.5bp at 0.250%

- Aussie 10-Yr future up 13 ticks at 96.035, yield down 13.5bp at 3.940%

- U.S. 10-Yr future +0-02 at 110-20, yield down 2.05bp at 4.084%

- WTI crude down $0.52 at $84.8, Gold up $3.28 at $1656.46

- USD/JPY up 23 pips at Y148.16

- JEREMY HUNT COULD BE ASKED TO DELAY FISCAL STATEMENT (Times)

- CHINESE STATE BANKS SOLD DOLLARS TO SUPPORT YUAN LATE ON TUESDAY (RTRS)

- JAPAN’S FX CZAR KANDA: YELLEN RESPECTS JAPAN’S INTERVENTION NON-DISCLOSURE (BBG)

- CHINESE STOCKS RALLY AS AUTHORITIES SEEK TO BOOST CONFIDENCE (BBG)

- DETAILS OF POST-MARKET EARNINGS REPORTS FROM MICROSOFT AND ALPHABET DISAPPOINT

- MUSK SIGNALS $44BN TWITTER DEAL ON TRACK TO CLOSE THIS WEEK (FT)

US TSYS: T-Notes Round Trip, Cash Curve Continues To Bull Flatten

T-Notes round tripped from a session high of 110-24 as headwinds for U.S. tech shares lent support to core FI, while spillover from Australia's expectation-beating CPI data kept a lid on gains.

- NASDAQ 100 e-minis led U.S. equity-index futures lower on the back of post-market slumps in Alphabet and Microsoft. Google's parent company reported weaker-than-expected revenue, while Windows provided an underwhelming revenue forecast. Still, Asia-Pac equity benchmarks were broadly firmer, with stabilisation in Chinese indices aiding sentiment.

- The release of Australia's Q3 CPI figures reverberated across markets, sealing the case for a 25bp cash rate target next week, which is now fully priced by the swaps market.

- The market still sees the FOMC raising the fed funds rate by 75bp next month, pricing is little changed on the day.

- T-Notes last deals +0-01 at 110-19, with eurodollar future running +0.5 to -1.0 tick through the reds. Cash Tsy curve bull flattened, building on overnight impetus generated by weaker than expected U.S. house price & consumer confidence data. Yields last sit 0.6-4.0bp lower across the curve.

- U.S. 5-Year/30-Year spread returned to inversion territory, last sitting at -2.91bp; 2-Year premium over 10-Year debt has tightened at the margin.

- Local data highlights include wholesale inventories and new home sales, with 5-Year Tsy auction also coming up.

JGBS: Benchmark Futures Unwind Upswing Driven By Upsized Rinban Purchase Sizes

JGBs turned bid into the Tokyo lunch break as the BoJ increased purchase sizes in a scheduled round of Rinban operations, signalling its determination to defend its YCC framework ahead of a monetary policy review this Friday.

- The central bank boosted the sizes of its bond-purchase operations by Y100bn in the 10-25 Year basket & by Y50bn in the 25+ Year basket. Purchase sizes across the 3-5 Year & 5-10 Year baskets had already been revised higher versus the planned amounts last Friday. Today's operations drew the following offer/cover ratios:

- 3-5 Year JGBs: 1.36x (prev. 1.89x)

- 5-10 Year JGBs: 2.61x (prev. 3.00x)

- 10-25 Year JGBs: 2.55x (prev. 1.58x)

- 25+ Year JGBs: 2.28x (prev. 4.04x)

- 10-Year futures lost ground after the lunch break, erasing all earlier gains. JBZ2 last changes hands at 148.33, 33 ticks above previous settlement. The pullback in benchmark JGB futures coincided with a rebound in Japan's 10-Year swaps amid the ongoing debate on the sustainability of BoJ policy course.

- Cash JGB curve shifted lower and runs flatter, even as the earlier bull-flattening impetus moderated to a notable extent. The yield on 10-Year JGB targeted by the BoJ's YCC framework remained in the vicinity of the 0.25% cap.

AUSSIE BONDS: Aussie Bonds Firm On Above-Forecast CPI Data, Curve Flattening Deepens

Aussie bonds went offered on the release of expectation-beating Q3 CPI data, which cemented the case for a 25bp hike to the cash rate target next week. Headline consumer inflation accelerated to a 32-year high of +7.3% Y/Y, beating the +7.1% median estimate. Trimmed mean CPI also rose faster than forecast, printing at +6.1% Y/Y versus the +5.5% consensus forecast.

- The data inspired a light boost to hawkish RBA rate-hike bets for next week's meeting. Swaps now fully price a scenario, whereby policymakers would raise the cash rate target by 25bp.The follow through to terminal rate pricing was negligible.

- Australia's Q3 CPI report helped mitigate the impact of tech-led weakness in U.S. equity-index futures & overnight sell-off in U.S. Tsys. Cash ACGBs trimmed their opening losses as a result and the RBA-sensitive 3-Year yield returned to neutral levels, yet the flatter yield structure remained, with 3-Year/10-Year tightening post-CPI. Cash ACGB yields sit unch. to -12.8bp as we type.

- Aussie bond futures showed a similar response to the data, taking nosedives as CPI figures crossed. YM last trades +1.0 & XM +10.5, both off reaction lows as e-minis still operate in the red. Bills run -7 to +5 ticks through the reds.

EQUITIES: HK/China Gains Offset Weaker Lead From US Futures

Regional equities are higher, led by gains in HK/China. Markets in the region are outperforming a negative lead from US futures, particularly in the tech space, after disappointing earning updates post the NY close. Nasdaq futures are off close to 1.9% at this stage, Eminis near -0.90%.

- The HSI is up around 2.2%, with dips buyers likely supporting sentiment. Gains have been led by the tech sector, which is up by 4% at this stage.

- Comments from China regulators, including PBoC, SAFE, CBIRC and CSRC around ensuring a healthy development of China's financial markets, from late yesterday, has likely aided moves. The CBIRC stated local capital markets have 'long-term investment value’, as reported by Bloomberg.

- The CSI 300 is up 1.60%, while the Shanghai Composite is up 1.40%.

- South Korean shares have shrugged off a negative US tech lead to be up close to 1% for the Kospi. Samsung posted better than expected earnings, while SK Hynix disappointed, although shares in the company were still higher, as the market embraced investment cut plans for next year. The Taiex is up 0.60%, led by TSMC gains.

- The ASX 200, is up smalls (+0.10%), lagging better regional sentiment.

OIL: Prices Continue To Range Trade As Demand And Supply Uncertainties Continue

Oil prices dropped during today’s session after US API data showed an increase in crude oil stocks of 4.52mn barrels. They have now edged back towards session highs on better sentiment in Asian equity markets.

- Oil continues to range trade with WTI now trading just under $85 after falling to $84.38 and Brent is around $93 after reaching $92.33. Both benchmarks are off their closing levels overnight.

- The details of the API report on US inventories are published tonight and should shed some light on distillate stocks, which are very low.

- The spread between the two nearest Brent contracts, the prompt spread, has declined to $1.71/bbl from over $2 on Monday. This is still indicates a bullish market but less so than it was.

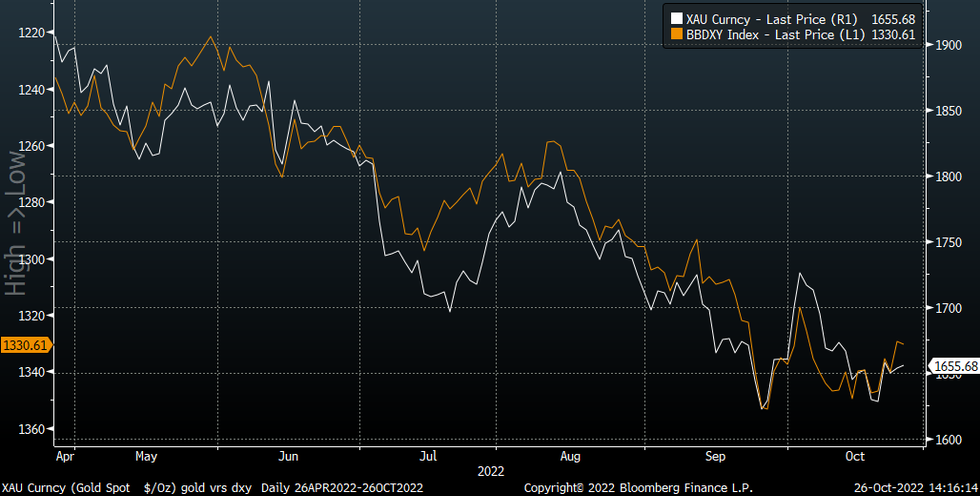

GOLD: Catching Up With Lower USD Levels

Gold is up modestly versus NY closing levels. The precious metal was last at $1655.70, +0.15% for the session, despite the USD finding some stability (BBDXY +0.10%).

- Today's resilience in gold may reflect some catch up with overnight USD weakness. On a short term chart basis, gold should be at higher levels based off the dollar correction overnight. Still, the disconnect is not large by historical standards, see the chart below (note the BBDXY is inverted on the chart).

- Flows may be benefiting higher beta risk assets as well, with regional equities doing better today, led by China/HK.

- Gold remains comfortably within recent ranges, with recent highs between $1660/1670 still intact. Further downside in US real yields should help keep dips to $1640 supported though.

Fig 1: Gold & BBDXY (Inverted) Trends

Source: MNI - Market News/Bloomberg

FOREX: Antipodeans Outperform On Firmer Equities/AU CPI Beat

The tone in FX markets has seen modest outperformance from the antipodeans relative to the majors, particularly the yen. This largely owes to a more resilient equity picture in the region, particularly relative to the sharp falls in US futures. Overall ranges have been quite modest though, the BBDXY up slightly to 1330.00/50.

- AUD/USD is back above 0.6400, so above the 20-day EMA (0.6386) and threatening recent highs above 0.6410. Q3 CPI came out stronger than expected, boosting local yields. The 3yr spiked towards 3.62%, but we are now back to 3.55%. The impact was limited on the A$ though initially. The currency has also received some support from the better regional equity tone, particularly China/Hong Kong. Iron ore prices have also firmed, but remain sub $90/tonne.

- NZD/USD is back to 0.5750, trailing A$ performance, the AUD/NZD cross back towards 1.1150. The ANZ activity outlook slipped to -2.5 from -1.8 last month, while confidence fell to -42.7 (against -36.7). Note RBNZ Governor Orr speaks early tomorrow.

- USD/JPY is back above 148.00, last 148.15, +0.15%, seeing slight underperformance against AUD & NZD.

- GBP/USD is near 1.1455, while EUR/USD is just above 0.9950.

- The offshore data calendar is fairly quiet, with just US wholesale inventories and new home sales on tap.

FX OPTIONS: Expiries for Oct26 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9850(E740mln), $0.9890-00(E1.7bln), $0.9910-20(E1.3bln), $0.9950(E624mln), $1.0000(E1.1bln)

- USD/JPY: Y148.00-15($835mln)

- GBP/USD: $1.1500(Gbp773mln)

- EUR/GBP: Gbp0.8400(E500mln)

- AUD/USD: $0.6200(A$802mln), $0.6300(A$656mln)

- NZD/USD: $0.5720-35(N$912mln)

- USD/CNY: Cny7.1500-10($2.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.