-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China/HK Property Stocks Rally On Policy Support

EXECUTIVE SUMMARY

- ‘NO SIGN’ OF TERRORISM SEEN IN CAR BLAST AT US-CANADA BORDER - BBG

- INCREASED UK LINKER SALES NOT INFLATION PLAY - MNI INTERVIEW

- FAR-RIGHT LEADER WILDERS SCORES SHOCK VICTORY IN DUTCH ELECTION - BBG

- GOV’TS FUELLING INFLATION - EX-RBA BOARD MEMBER - MNI

- CHINA RACES TO END PROPERTY PANIC, FILL $446BILLION FUNDING GAP - BBG

- YUAN TO RALLY ON PBOC SUPPORT, EXPORTER DEMAND -ADVISOR - MNI

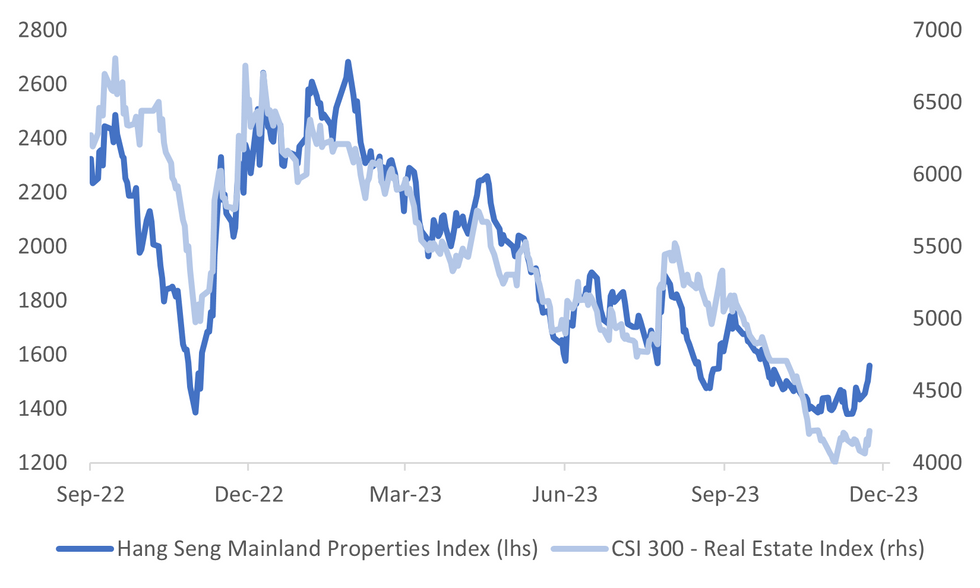

Fig. 1: China Property Equities Rebound

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (MNI INTERVIEW): Upgraded plans for 2023/24 index-linked gilt issuance are not an inflation play but a reflection of demand and increased sales across all maturities, a leading UK debt management official said on Wednesday. “Was increased linker issuance a (DMO) view on inflation? Most definitely not. If you look across the board, issuance was up in all categories -- shorts, mediums, longs and linkers -- against the April remit revisions,” Robert Stheeman, CEO of the UK Debt Management Office, told MNI in an interview.

FISCAL (BBG): Chancellor of the Exchequer Jeremy Hunt will provide a £21 billion ($26.2 billion) stimulus to the UK economy in the run-up to the next election, threatening to fuel inflation and prompt the Bank of England to keep interest rates in painfully high territory.

EUROPE

FISCAL (MNI BRIEF): The European Union is “closer to a deal than ever before” on new fiscal rules, Germany’s Chancellor Olaf Scholz said on Wednesday in a press conference alongside Italian Prime Minister Giorgia Meloni in Berlin. “We are working intensively,” Scholz said, adding that some progress was made during the last ECOFIN meeting of finance ministers, though issues remain to be agreed.

GERMANY (MNI INTERVIEW): Last week’s Constitutional Court decision to prevent Germany’s government from redirecting EUR60 billion of Covid emergency measures will reduce GDP by around 0.5% next year, a leading economist told MNI.

GERMANY (GOVERNMENT): "The Federal government has decided to withdraw from the market for inflation-linked bonds: From 2024, no further inflation-linked Federal securities will be issued, nor will already outstanding securities be reopened." "The currently outstanding inflation-linked Federal securities will continue to be tradable on the market. The remaining programme comprises four securities with a current total volume of EUR 66.25 billion and remaining maturities between 2.5 to 22.5 years" Press release.

NETHERLANDS (BBG): Far-right lawmaker Geert Wilders won the Dutch elections and said he plans to lead the country’s next government, in a shock result that will resound across Europe.

NETHERLANDS (BBC): Veteran anti-Islam populist leader Geert Wilders is heading for a dramatic victory in the Dutch general election, according to an Ipsos exit poll. After 25 years in parliament, his Freedom party (PVV) is heading for 35 seats, according to the poll, well ahead of his nearest rival, a left-wing alliance.

ECB (BBG): Bundesbank President Joachim Nagel said the European Central Bank is near peak for its borrowing costs, though another bout of inflation may require more tightening.

U.S.

SECURITY (BBG): New York Governor Kathy Hochul said there is no sign of terrorism so far in the vehicle explosion that killed two people at the Rainbow Bridge, a busy crossing between the US and Canada at Niagara Falls. The assessment is based on briefings that Hochul received from officials with the Federal Bureau of Investigation, Homeland Security and Customs and Border Protection.

OTHER

CANADA (MNI BRIEF): Bank of Canada Governor Tiff Macklem said Wednesday minutes from the Oct. 25 rate decision showing policymakers split over whether to hike again referred to a more forward-looking discussion, and there was agreement on the immediate decision to maintain the 5% the policy rate.

ISRAEL (RTRS): The release of hostages under a temporary truce between Israel and Hamas militants will not happen before Friday, Israel's national security adviser said on Wednesday night.

MIDEAST (BBG): Israel and Hamas braced for a short-term cease-fire that would allow for the release of dozens of hostages, as they prepared to begin implementing a complex agreement that would mark the first halt in fighting since their war began.

NORTH KOREA (KCNA/BBG): North Korea’s defense ministry announces a decision to revive all military actions against South Korea and revoke measures to reduce tensions and conflicts in the region agreed under the inter-Korean military accord, its state media KCNA reports.

OIL (BBG): Occidental Petroleum Corp, W&T Offshore Inc and Talos Energy are among oil drillers that shut offshore production following an oil spill that’s shaping up to be the largest in the US since the Deepwater Horizon disaster. Producers halted about 62,000 barrels of daily oil output Thursday after a subsea pipeline ruptured and leaked 26,000 barrels of oil — equivalent to two Olympic-size swimming pools — into the Gulf of Mexico near Louisiana.

AUSTRALIA (MNI): Australian state and federal governments must do more to constrain inflation, such as by pulling back capital investment plans, increasing taxes and lowering immigration, otherwise the Reserve Bank of Australia may have to hike the cash rate above 5%, a former board member has told MNI.

CHINA

HOUSING (XINHUA/BBG): China’s Shenzhen rolled out two new homebuying measures in the same day as authorities seek to arrest a slump in the property market. The technology hub in southern China connecting Hong Kong will lower the down-payment ratio for second homes to 40% from as much as 80% effective Thursday, the state-run Xinhua News Agency reported, citing a notice from the local branch of China’s central bank.

PROPERTY (BBG): Chinese leaders are making their most forceful push yet to end the nation’s property crisis, ramping up pressure on banks to plug an estimated $446 billion shortfall in funding needed to stabilize the industry and deliver millions of unfinished apartments.

PROPERTY (BBG): China’s banks should step up funding for property developers to reduce the risk of additional defaults and ensure completion of housing projects, members of the country’s top lawmaking body said.

BANKING (BBG): One of China’s largest shadow banks warned it’s “severely insolvent,” with a debt pile more than two times higher than assets, according to a letter seen by Bloomberg News.

HEALTH (RTRS): The World Health Organization (WHO) on Wednesday officially requested that China provide detailed information on an increase in respiratory illnesses and reported clusters of pneumonia in children.

YUAN (MNI): The yuan looks set to rally further thanks to U.S. dollar weakness and year-end demand for cash in China, while the PBOC will continue to shore up the currency and react to firmer tone by narrowing the differential between its stronger daily fix and the market price, policy advisors and traders told MNI.

CHINA MARKETS

PBOC Injects Net CNY142 Bln Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY519 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY142 billion after offsetting the maturity of CNY377 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9260% at 09:56 am local time from the close of 2.0378% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Wednesday, compared with the close of 55 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1212 Thursday vs 7.1254 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1212 on Thursday, compared with 7.1254 set on Wednesday. The fixing was estimated at 7.1508 by Bloomberg survey today.

MARKET DATA

AUSTRALIA NOV P JUDO BANK PMI MFG 47.7; PRIOR 48.2

AUSTRALIA NOV P JUDO BANK PMI SERVICES 46.3; PRIOR 47.9

AUSTRALIA NOV P JUDO BANK PMI COMPOSITE 46.4; PRIOR 47.6

CHINA OCT SWIFT GLBOAL PAYMENTS CNY 3.60%; PRIOR 3.71%

MARKETSUS TSYS: TY Marginally Firmer In Light Trade, Cash Closed Today

TYZ3 deals at 108-29, +0-03, a 0-04 range was observed on volume of 22k.

- A reminder that cash tsys are closed today due to the observance of the US Thanksgiving Holiday.

- TY ticked higher in early trade, the move was seen alongside a fall in Oil prices as Asian participants digested Wednesday's news of a delayed OPEC meeting.

- The move higher didn't follow through and TY sat in a narrow range for the most part.

- Technically the bullish theme remains intact; resistance is at 108-08+ high from Nov 17, support comes in at 108-05 the 50-Day EMA.

- The docket is thin for the reminder of today's session.

AUSSIE BONDS: Cheaper, Narrow Ranges, AU-US10Y Spread Too Low

ACGBs (YM -6.0 & XM -4.0) are cheaper, but off the worst levels, after dealing in narrow ranges during the Sydney session ahead of the US Thanksgiving holiday. Japan was out today in observance of their Labour Thanksgiving holiday.

- The local calendar provided few domestic drivers, with the previously outlined flash Judo Bank PMI data as the sole release.

- Accordingly, today’s heavy price action can be largely attributed to RBA Governor Bullock’s relatively hawkish speech after-market yesterday. In summary, the Governor noted that the final stretch of reducing inflation to target will take longer than the initial leg. Additionally, she stated that “the remaining inflation challenge we are dealing with is increasingly homegrown and demand-driven”.

- Cash ACGBs are 4-6bps cheaper, with the AU-US 10-year yield differential 5bps higher at +8bps. A simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 12bps too low versus its fair value. (See link)

- Swap rates are 4-6bps higher, with the 3s10s curve flatter.

- The bills strip is cheaper, with pricing -4 to -8.

- Tomorrow, the local calendar is empty, with the next key release being Retail Sales on Tuesday.

NZGBS: Closed With A Bear-Flattening Ahead Of US Thanksgiving

NZGBs closed 2-9bps cheaper, with the 2/10 curve at the session’s flattest level. Today’s move is consistent with developments in other $-Bloc markets ahead of the US Thanksgiving holiday.

- The US finished yesterday’s session with a bear flattening following stronger-than-expected initial jobless claims and higher-than-expected U of M inflationary expectations.

- The ACGB curve has bear-flattened today following a relatively hawkish speech from RBA Governor Bullock after-market yesterday. The Governor noted that “the remaining inflation challenge we are dealing with is increasingly homegrown and demand-driven…a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand”.

- The NZ 10-year underperformed its US counterpart by 3bps, but the NZ-AU 10-year yield differential closed 2bp tighter.

- Swap rates closed 3-8bps higher, with the 2s10s curve flatter and implied swap spreads little changed.

- RBNZ dated OIS pricing closed 2-7bps firmer for meetings beyond Feb’24. Terminal OCR expectations closed unchanged at 5.54%.

- Tomorrow, the local calendar sees Q3 Retail Sales Ex-Inflation.

- Bloomberg reported that negotiations to form NZ’s next government have concluded, with details to be announced tomorrow, Prime Minister-elect Christopher Luxon said. (See link)

EQUITIES: Mixed Trends, Better China Property Sentiment Doesn't Aid Aggregate Indices

Regional Asia Pac equities are mixed. There has been focus on China property related stocks, given announcements over the past 24 hours, but this hasn't done much for aggregate indices in China or Hong Kong into the break. US equity futures sit close to flat for both Eminis and the Nasdaq. Proximity to the Thanksgiving holiday coming up in the US may be keeping liquidity and interest lighter. Note Japan markets are also closed today.

- At the break, the CSI 300 real estate sub index sits +2.91% firmer, not too far off session highs. Late yesterday the authorities released a draft of property developers to be included in terms of funding support, with troubled names such as Country Garden included in the list, while Shenzhen has also eased second home buying rules (BBG).

- Still, the CSI aggregate index sits around flat at the break. More concerns in the shadow banking sector may be presenting a headwind (see this BBG link). The HSI is off 0.37% at the break, although the mainland properties index is outperforming at +4.26% higher.

- Elsewhere, South Korea (Kospi -0.10%) and Taiwan markets (Taiex -0.30%) are down modestly.

- For the ASX 200, we are off 0.61% at this stage, with miners underperforming. A sharp pull back has been evident in iron ore prices, as China's NDRC stated it would increase supervision in the sector.

- In SEA, trends are mixed. Indonesia stocks are outperforming, up +1.3%. Thailand's SET is underperforming, down -0.60%.

FOREX: Kiwi Standout Performer In Asia

The Kiwi is the strongest performer in the G-10 space at the margin today. The greenback has ticked lower amid thin holiday trade, US and Japanese cash markets are closed, BBDXY is down ~0.1%. Oil has ticked lower, as Asian participants digested Wednesday's news of a delayed OPEC meeting. US Equity futures are little changed. A firmer than expected Yuan fixing by the PBOC weighed on the USD with losses marginally extending through the session.

- NZD/USD prints at $0.6045/50, the pair is ~0.5% firmer today. Bulls remain focus on the 200-Day EMA ($0.6062). PM-Elect Luxon noted today taht he is aiming to be sworn in as PM on Monday as government formation talks have concluded.

- AUD/USD is up ~0.2% however a $0.6040/60 range has been observed for the most part. Judo Bank PMIs remain in contractionary territory, flash November prints were 47.7 (mfg) 46.3 (Services) and 46.4 (Composite) with all three ticking lower from the October reads.

- Yen is firmer and has ticked away from yesterday's session highs, however the ¥149 handle remains intact. Technically the recent weakness looks like a correction, resistance comes in at ¥149.75 high from Nov 22. Support comes in at ¥147.15, low from Nov 21.

- Elsewhere in G-10 SEK is ~0.3% higher however liquidity is generally poor in Asia.

- Flash PMIs from Europe and the UK provide the highlight today.

OIL: Biased Lower On OPEC Meeting Delay

* corrected title

Oil has spent the first part of the Thursday session under pressure, although much of the damage was done at the open, as Asia Pac markets digested Wednesday's news of a delayed OPEC meeting. Brent fell sharply to a low of $80.55/bbl after opening at $81.60/bbl. We have recovered some ground since then but have been unable to get back above $81/bbl (last near $80.85/bbl). We sit 1.35% weaker at this stage, with WTI off by 1.20% and last near $76.20/bbl.

- Focus will be on the delayed OPEC + meeting, now scheduled for November 30th (instead of November 26th). Analysts from Citi note this is unlikely to change the outcome around Saudi Arabia rolling its 1mln barrel cut into 2024 (see this BBG link).

- Other indicators suggest reduce tightness in the market though, the Brent prompt spread back close to flat, after being above $2 at the end of October. This is consistent with rising inventory levels in the US.

- Note subdued trading may be evident in the US session, given the Thanksgiving holiday.

- For WTI, moving average studies are in a bear-mode position, highlighting bearish sentiment. The focus is on $70.96, a Fibonacci retracement. Key resistance is at $79.65, the Nov 14 high.

- For Brent, it is a similar backdrop. Note the 20-day EMA is around $83.30/bbl, while on the downside Nov 16 lows rest at $76.60/bbl.

IRON ORE: Space Pressured On Thursday

SGX Iron Ore futures are down ~2.5% on Thursday, the NDRC in China have noted today that they would increase supervision, crack down on illegal activities, and maintain the normal order of the market (BBG).

- The December last prints at $131.60/tonne, a low of $130.15/tonne was printed before losses were pared.

- Technically support comes in at $130/tonne, then the 20-Day EMA ($126.55).

GOLD: Slightly Stronger After Wednesday’s Drop On The Back Of A Stronger USD & Higher Yields

Gold is +0.4% in the Asia-Pac session, after closing 0.4% lower at $1990.17 ahead of the US Thanksgiving holiday.

- The stronger greenback weighed on the precious metal at the margin, with spot gold consolidating back below the 2,000/oz mark for now.

- A bear-flattening of the US tsy curve, with yields flat to 3bps higher, also pressured bullion. US jobless claims and UofM inflation expectations data were not US Treasuries-friendly, sending yields higher led by the 5s.

- According to MNI’s technicals teams, the trend condition in gold remains bullish and this week’s gains reinforce this condition. The move higher signals scope for a test of key short-term resistance at $2009.4, the Nov 7 high. Clearance of this hurdle would confirm a resumption of the uptrend and pave the way for a climb towards $2022.2, the May 15 high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 23/11/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/11/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 23/11/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/11/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.