-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Property Policy Support Once Again In Focus

EXECUTIVE SUMMARY

- CHINA’s HOUSING MARKET SET FOR RESTRICTION RELAXATIONS - MNI

- CHINA SIGNALS MORE ECONOMIC AID AFTER PROPERTY DEBT RELIEF - BBG

- CHINA PROPERTY SHARES RISE ON FINANCIAL SUPPORT POLICY - RTRS

- UK RETAILERS SAY SALES GROWTH ACCELERATES WITH JUMP IN FOOD COST- BBG

- AUSTRALIAN FIRMS SHOW RESILIENCE AS CONSUMERS STILL PESSIMISTIC - BBG

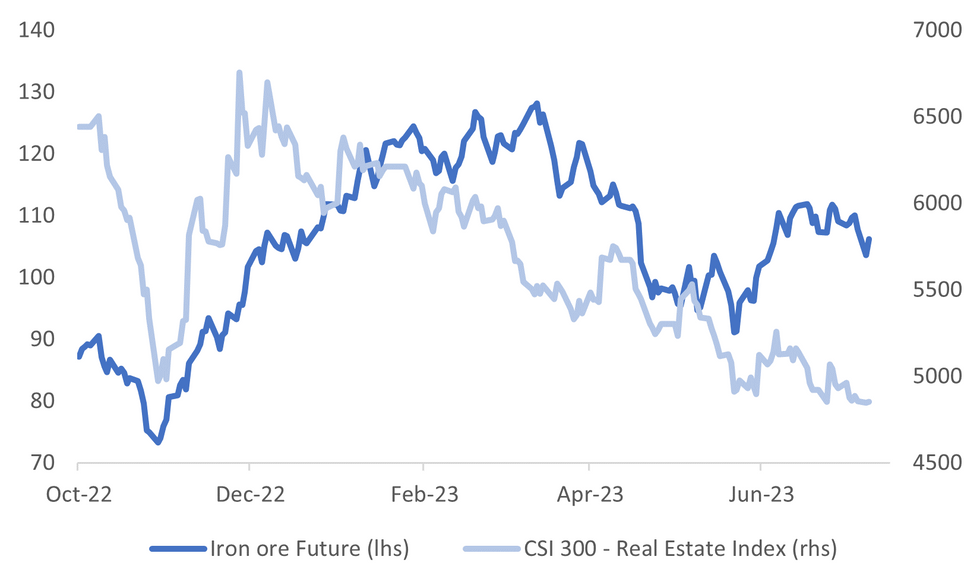

Fig. 1: China CSI 300 Real Estate Index Versus Iron Ore Prices

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: British retailers said activity picked up in June as rising prices forced consumers to pay more for food and warmer weather spurred purchases of leisure items from swim wear to barbecues. (BBG)

EUROPE

UKRAINE: NATO leaders gather for a summit in Vilnius on Tuesday seeking to overcome divisions on Ukraine's membership bid after a deal to lift Turkey's block on Sweden joining the military alliance. (RTRS)

U.S.

FED: After an extended battle against stubbornly high inflation, the US central bank is at a critical juncture. And as president of the New York Federal Reserve, John Williams is a pivotal figure in discussions about the next phase of the Fed’s historic monetary tightening campaign. (FT)

FISCAL: More than 20 U.S. House Republican hardliners warned Speaker Kevin McCarthy on Monday that they will try to block their party's fiscal 2024 appropriations bills unless spending levels are cut below levels that McCarthy and Democratic President Joe Biden agreed to in May. The hardliners, including members of the House Freedom Caucus, also called on McCarthy to delay appropriations votes in the House of Representatives until all 12 government funding bills have been finalized and can be subjected to a side-by-side review. (RTRS)

OTHER

AUSTRALIA: Australia’s business conditions showed ongoing resilience in June, defying the Reserve Bank’s more than yearlong tightening cycle and warnings of slower economic growth, while consumer confidence remained in “deeply pessimistic” territory. (BBG)

AUSTRALIA: Australian consumer confidence slipped again last week even as the country's central bank's decision to hold interest rates gave homeowners some respite from rising borrowing costs. Consumer confidence decreased by 0.8 of a point over the week, keeping it near lows plumbed during the early months of the Covid-19 pandemic in 2020, according to a survey by ANZ Bank and pollster Roy Morgan. (BBG)

AUSTRALIA: Australia and the European Union’s negotiations to conclude a free-trade agreement are at an impasse over Canberra’s concerns that the bloc is offering insufficient access to the nation’s agricultural export. (BBG)

COMMODITIES: Iron ore and other metals rose as Beijing stepped up relief measures for property developers, although there was skepticism on whether they were enough to support a sustained rally. (BBG)

INDIA: Taiwan's Foxconn has withdrawn from a $19.5 billion semiconductor joint venture with Indian metals-to-oil conglomerate Vedanta, it said on Monday, in a setback to Prime Minister Narendra Modi's chipmaking plans for India. (RTRS)

SOUTH KOREA: The Bank of Korea (BOK) will keep its key policy rate unchanged at 3.50% on Thursday and for the rest of the year as inflation continued to ease, a Reuters poll of economists predicted, but rate cut forecasts were pushed back by a quarter to early 2024. (RTRS)

CHINA

PROPERTY: MNI (Beijing) - China will likely further relax property-market restrictions to prop up the weakening sector in the second half, though the depth of support will depend on growth pressures and any major stimulus should wait until after July’s politburo meeting, policy advisors and market analysts told MNI. (MNI)

PROPERTY: Authorities have extended 16 property-sector support measures introduced last November until the end of 2024, according to a notice on the People's Bank of China website. Analysts interviewed by Yicai said the real-estate sector will benefit from reduced financial pressure, allowing banks to lend more due to reduced risk exposure. Wang Qing, chief macro analyst at Dongfang Securities, predicted the sector could stabilise and achieve a soft landing with a continuation of support measures, which include extension on loan repayments. (Yicai)

PROPERTY: China signaled more economic support measures are imminent after authorities took a small step toward supporting the ailing property market by extending loan relief for developers. Top state-run financial newspapers ran reports Tuesday flagging the likely adoption of more property supportive policies, along with measures to boost business confidence. (BBG)

POLICY: China may quickly roll out measures to boost business confidence among private, state-owned and foreign firms following government officials’ recent meetings with company executives, China Securities Journal reports, citing analysts. (CSJ)

POLICY: China’s fiscal policies need to play a bigger role in helping the economy since cutting interest rates would likely encourage people to save rather than spend, according to a former central bank official. (BBG)

INFLATION: China should adopt loose monetary policy and proactive fiscal policy to promote economic recovery and tackle low inflation, wrote Ming Ming, chief economist at CITIC Securities in a commentary. CPI came in at 0% y/y in June as low pork and vegetable prices, and weak recovery in consumer goods amid rising precautionary savings weigh on consumer prices. Policymakers should take targeted measures to improve market expectations, including increasing consumers’ disposable income and offering refinancing tools, tax and fee reductions to businesses. While monetary policy should meet credit needs and maintain stable liquidity while avoiding liquidity traps, said Ming. (21st Century Business Herald)

NDRC: The National Development and Reform Commission will promote macro policies to support the private sector's recovery, following an exchange session between private firm chiefs and Zheng Shanjie, director at the NDRC. Zheng said the NDRC in future would coordinate with other departments to create a strong policy environment for private enterprises to develop, and continue engaging with, the sector to better understand concerns. Private company leaders from different sectors were invited including Baidu Group and Longji Green Energy. (21st Century Herald)

PROPERTY: Shares of Chinese property developers rose on Tuesday after Chinese regulators extended some policies in a rescue package introduced in November to shore up liquidity in the real estate sector. (RTRS)

CHINA MARKETS

PBOC Conducts CNY3 Bln Via OMOs Tues; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Tuesday, with the rates at 1.90%. The operation has led no change to the liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:27 am local time from the close of 1.6978% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday, the same as the close on Friday.

PBOC Yuan Parity Lower At 7.1886 Tuesday Vs 7.1926 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1886 on Tuesday, compared with 7.1926 set on Monday. The fixing was estimated at 7.2152 by BBG survey today.

OVERNIGHT DATA

UK JUNE BRC SALES Y/Y 4.2%; PRIOR 3.7%

JAPAN JUNE MONEY STOCK M2 Y/Y 2.6%; PRIOR 2.6%

JAPAN JUNE MONEY STOCK M3 Y/Y 2.1%; PRIOR 2.1%

SOUTH KOREA JULY 1-10 EXPORTS Y/Y -14.8%; PRIOR +1.2%

SOUTH KOREA JULY 1-10 IMPORTS Y/Y -26.9%; PRIOR -20.7%

SOUTH KOREA JULY 1-10 TRADE BALANCE -$2.28bn; PRIOR -$1.41bn

AUSTRALIA JUNE CBA HOUSEHOLD SPENDING M/M -1.7%; PRIOR 3.1%

AUSTRALIA JUNE CBA HOUSEHOLD SPENDING Y/Y 2.4%; PRIOR 4.7%

AUSTRALIA JULY WESTPAC CONSUMER CONFIDENCE M/M 2.7%; PRIOR 0.2%

AUSTRALIA JULY WESTPAC CONSUMER CONFIDENCE INDEX 81.3; PRIOR 79.2

AUSTRALIA JUNE NAB BUSINESS CONFIDENCE 0; PRIOR -3

AUSTRALIA JUNE NAB BUSINESS CONDITIONS 9; PRIOR 9

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 111-08, +0-03+, a touch off the top of the 0-05 range on volume of ~76k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys were marginally pressured in early dealing, participants perhaps using Monday's richening as an opportunity to close out long positions/add fresh shorts.

- A recovery off session loss was seen alongside pressure on the greenback, as an offer in USD/JPY spilled over into broad USD weakness.

- Block buyers in FV (1.5k lots) and UXY (1,737 lots) have also added a layer of support.

- Fedspeak from NY Fed President William's crossed, he noted that a recession is not in his forecast for the US economy. More here.

- In Europe today we have the latest UK jobs data and the final print of German CPI. Further out NFIB Small Business Optimism crosses as does Fedspeak from St. Louis Fed President Bullard. We also have the latest 3-Year supply.

JGBS: Futures Holding Richer, 5-Year Supply Sees Very Strong Demand

In the Tokyo afternoon session, JGB futures are holding firmer, +14bp compared to settlement levels, after today’s supply of 5-year bonds was very well-received. The auction's low price beat dealer expectations, while the cover ratio improved dramatically to 4.680x compared to 3.850x in the previous month's auction. Additionally, the tail decreased to its shortest since February.

- There haven't been many noteworthy domestic factors to highlight, except for the previously mentioned M2 and M2 money stock data, which are unlikely to have had a significant impact on the market. June preliminary machine tool orders are out later today.

- US tsys have extended the strength seen in the NY session in Asia-Pac trading. Cash US tsys are 1-2bp richer than NY closing levels across the benchmarks.

- Cash JGBs are dealing mixed in the Tokyo afternoon session with the belly of the curve outperforming. The benchmark 10-year yield is 0.5bp lower at 0.457%, below the BoJ's YCC limit of 0.50%. The 30-40-year zone is underperforming with yields 1.4-1.7bp cheaper.

- The 5-year benchmark is the outperformer with its yield dealing 2.0bp lower at 0.101%, after today’s supply.

- The swap curve twist steepens, pivoting at the 20-year. Swap spreads are tighter across the curve apart from the 7-year.

- Tomorrow the local calendar sees PPI (Jun) and Core Machine Orders (May) data.

AUSSIE BONDS: Tracking US Tsys Richer

ACGBS are dealing stronger (YM +9.0 & XM +9.5), just off Sydney session highs as US tsys extend the strength seen in the NY session in Asia-Pac trading. Cash US tsys are 1-2bp richer than NY closing levels across the benchmarks.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Westpac consumer sentiment and NAB business confidence data.

- Cash ACGBs are 9bp richer with the AU-US 10-year yield differential -1bp at +21bp.

- Swap rates are 9-11bp lower with the 3s10s curve steeper.

- The bills strip is richer with pricing +4 to +10, early reds leading.

- RBA-dated OIS pricing is 2-8bp softer across meetings. The market attaches a 54% chance of a 25bp hike at the August meeting.

- Tomorrow the local calendar's highlight is RBA Governor Lowe’s speech to the Economic Society of Australia in Brisbane, titled ‘The Reserve Bank Review and Monetary Policy”. Investors will be hoping to gain insights into the central bank's level of concern regarding inflation after the policy pause this month.

- Tomorrow the AOFM plans to sell A$700mn of the 2.25% 21 May 2028 bond.

NZGBS: Closed At Bests, RBNZ Expected To Be On Hold Tomorrow

NZGBs ended the session on a positive trajectory, as benchmark yields witnessed a decline of 11-14bp, while the 2/10 curve steepened by 3bp. This movement aligns with the trend observed in US tsys, as their strength from the NY session extended into the Asia-Pac session. The NZ/US 10-year yield differential closed -2bp at +79bp.

- Swap rates are 11bp lower.

- Tomorrow the local calendar sees the release of Net Migration ahead of the RBNZ Policy Decision. In May the RBNZ hiked rates 25bp to be in line with its updated but unchanged Q2 2023 OCR forecast of 5.5%. This last hike gave the Committee confidence that it had done enough to contain inflation and with that, it shifted to a neutral stance.

- With the data since then generally showing slowing activity, survey measures of inflation gradually easing, and rates in line with the RBNZ forecast, The RBNZ is likely to be on hold for the first time since August 2021. See the MNI RBNZ Preview here.

- Markets have a 12% chance of a 25bp hike priced for tomorrow’s policy meeting. However, it is important to note that terminal OCR expectations have shifted 10bp firmer since last week and currently sit at 5.75%.

EQUITIES: China's Real Estate Stocks Higher On Fresh Support Talk

Regional equity market sentiment is mostly positive today. We did have modest positive leads from US & EU markets during Monday trade. US futures are a touch higher (Eminis last near 4446), but the main focus has been on fresh China policy support/stimulus, particularly in the property segment.

- Onshore China media has been focused on further property market support after the authorities urged local financial institutions to extend credit support to the troubled developer sector. The MNI policy team notes that property market restrictions may be eased in H2 (most likely after the July Politburo meeting).

- Other focus points are on boosting business confidence and consumption, see this link for more details.

- The CSI 300 is 0.63% higher at the break, last near 3870 in index terms. The CSI 300 real estate sub index surged at the open but is now up only a modest 0.12%. A Bloomberg measure of real estate owners and developers is doing better at +1.29%. The HSI is +1.53% at the break, the tech sub-index +2.06%.

- Elsewhere, Japan stocks are struggling for positive traction. The Topix last down slightly, while the Nikkei 225 was around flat.

- The ASX 200 is up over 1.10% with banks and mining related names leading the move higher.

- The Kospi is +1.34% firmer, while the Taiex has rallied by a similar amount. In SEA most markets are higher, but gains are more modest at this stage.

FOREX: Yen Firmer In Asia

The Yen is the strongest performer in the G-10 space at the margins in Asia on Tuesday. USD/JPY has fallen ~0.3% and sits below the ¥141 handle.

- USD/JPY prints at ¥140.75/85, and is at its lowest level since mid-June. There was no obvious headline driver for the move with technical flows and a continuation of Monday's price action weighing. Support comes in at the 50-Day EMA (¥140.30).

- AUD/USD is ~0.2% firmer, reflecting the broader USD weakness seen in Asia. The pair still sits below the $0.67 handle, and resistance comes in at $0.6721. Business Conditions were steady in June, with Business confidence ticking higher to sit flat.

- Kiwi is a touch firmer, NZD/USD is up ~0.1%. Gains have been capped at the 200-Day EMA ($0.6223) which is emerging as a key level for bulls.

- Elsewhere in G-10 EUR and GBP are ~0.2% firmer. NOK is up ~0.3% however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is ~0.2% lower and US Tsy Yields are ~1bp softer across the curve.

- In Europe today we have UK jobs data and the final read of German CPI.

EQUITIES: China's Real Estate Stocks Higher On Fresh Support Talk

Regional equity market sentiment is mostly positive today. We did have modest positive leads from US & EU markets during Monday trade. US futures are a touch higher (Eminis last near 4446), but the main focus has been on fresh China policy support/stimulus, particularly in the property segment.

- Onshore China media has been focused on further property market support after the authorities urged local financial institutions to extend credit support to the troubled developer sector. The MNI policy team notes that property market restrictions may be eased in H2 (most likely after the July Politburo meeting).

- Other focus points are on boosting business confidence and consumption, see this link for more details.

- The CSI 300 is 0.63% higher at the break, last near 3870 in index terms. The CSI 300 real estate sub index surged at the open but is now up only a modest 0.12%. A Bloomberg measure of real estate owners and developers is doing better at +1.29%. The HSI is +1.53% at the break, the tech sub-index +2.06%.

- Elsewhere, Japan stocks are struggling for positive traction. The Topix last down slightly, while the Nikkei 225 was around flat.

- The ASX 200 is up over 1.10% with banks and mining related names leading the move higher.

- The Kospi is +1.34% firmer, while the Taiex has rallied by a similar amount. In SEA most markets are higher, but gains are more modest at this stage.

GOLD: Steady Ahead Of US CPI Data Tomorrow

Gold is slightly firmer in the Asia-Pac session, following a relatively unchanged closing on Monday. Traders are carefully assessing the support provided by declining US Treasury yields and a weaker dollar against expectations the Federal Reserve will pursue additional monetary tightening.

- US tsys finished near their best levels of the NY session, with benchmark yields 1-12bp lower, ahead of US CPI data later this week and the start of the US earnings season.

- US tsys received a boost thanks to the New York Fed's survey on inflation expectations, which showed a decrease in the one-year outlook for inflation. In June, the outlook fell to 3.83% from the previous month's 4.07%, marking the third consecutive decline and reaching its lowest level since April 2021.

- Less hawkish headlines from Fed Daly, Mester and Barr further supported the downward movement in yields. Barr expressed the belief that there is still "more work to do but close to the end," while Daly emphasised that risks are becoming less imbalanced, making decisions more challenging and reliant on additional data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/07/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/07/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 11/07/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/07/2023 | 1500/1100 |  | US | New York Fed's John Williams | |

| 11/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 11/07/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.