-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Targets 2024 Growth At Around 5%

EXECUTIVE SUMMARY

- BOSTIC SEES 2 FED CUTS IN ‘24, WANTS QT LONG AS POSSIBLE - MNI

- CHINA TARGETS “AROUND 5%” GROWTH FOR 2024 - MNI BRIEF

- CHINA TO ISSUE CNY1 TRILLION ULTRA-LONG TREASURIES - MNI BRIEF

- PBOC TO MAINTAIN AMPLE LIQUIDITY, TARGET IDLE FUNDS - MNI BRIEF

- JAPAN FEB TOKYO CPI RISES 2.5% VS. JAN 1.8% - MNI BRIEF

- STRONGER CAPEX TO PUSH UP JAPAN Q4 GDP REVISION - MNI BRIEF

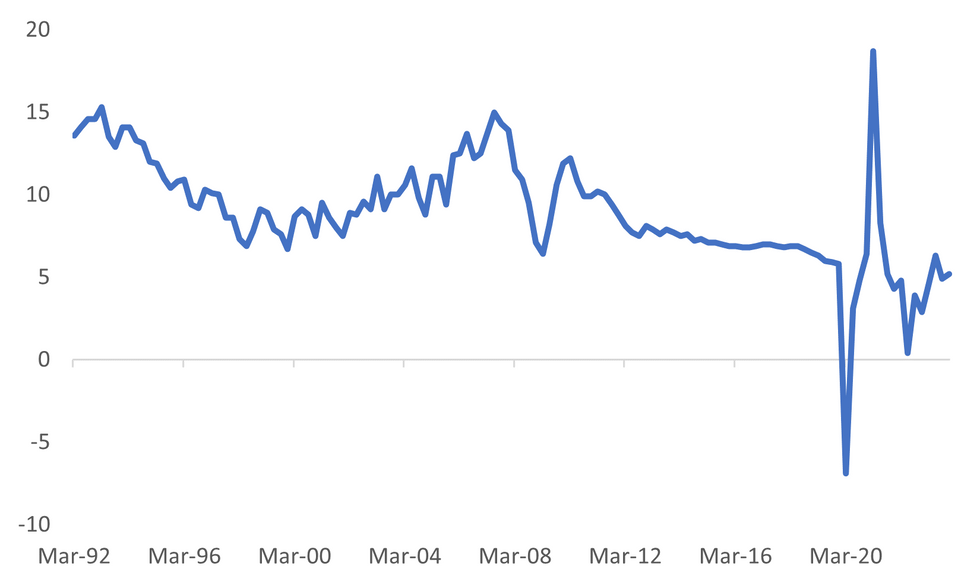

Fig. 1: China GDP Y/Y

Source: MNI - Market News/Bloomberg

EUROPE

CORPORATE (BBG): Apple Inc. was hit Monday with a €1.8 billion ($2 billion) penalty from the European Union over an investigation into allegations it shut out music-streaming rivals, including Spotify Technology SA, on its platforms.

FRANCE (BBG): French Finance Minister Bruno Le Maire criticized the European Commission’s approach toward climate targets, saying the European Union’s executive arm focuses too much on renewable energy while overlooking other technologies like nuclear power in the fight against global warming.

UKRAINE (ECONOMIST): Fresh from his latest foreign-policy controversy, Emmanuel Macron arrives in Prague on Tuesday. Mr Macron also said that France would take part in a Czech-run emergency effort to source ammunition for Ukraine from outside the European Union. This will be discussed during his visit.

U.S.

FED (MNI): Atlanta Federal Reserve President Raphael Bostic said Monday his base case remains for two rate cuts this year, likely starting in the third quarter, and does not anticipate reductions at back-to-back meetings, adding he would like quantitative tightening to continue at the current pace for as long as possible.

US/CHINA (BBG): Advanced Micro Devices Inc. hit a US government roadblock in attempting to sell an artificial intelligence chip tailored for the Chinese market, according to people familiar with the matter, part of Washington’s crackdown on the export of advanced technologies to the country.

CORPORATE (BBG): New York Community Bancorp tumbled for a second straight day after a pair of rating downgrades threatened to boost the beleaguered bank’s borrowing costs. Shares of the company fell 23% to close at the lowest level since 1996, after plunging 26% on Friday.

POLITICS (RTRS): The U.S. Supreme Court handed Donald Trump a major victory on Monday, barring states from disqualifying candidates for federal office under a constitutional provision involving insurrection and reversing Colorado's exclusion of him from its ballot.

POLITICS (RTRS): Donald Trump won the North Dakota Republican presidential caucuses on Monday, according to a projection by Edison Research, ahead of a slew of contests known as Super Tuesday when he is expected to further strengthen his grip on the party's presidential nomination.

OTHER

JAPAN (MNI BRIEF): Japan's economy in the October-December period grew at a faster pace than initially estimated which will push up capital investment and GDP estimates, economists predicted in the wake of a key government survey.

JAPAN (MNI BRIEF): The year-on-year rise in the Tokyo core inflation rate accelerated to 2.5% in February from January's 1.8%, the first acceleration in four months after falling below the 2% target in January, data released by the Ministry of Internal Affairs and Communications showed on Tuesday.

TAIWAN (RTRS): China also officially adopted tougher language against Taiwan as it released the budget figures, dropping the mention of "peaceful reunification" in a government work report delivered by Premier Li Qiang at the opening of the National People's Congress (NPC), China's rubber-stamp parliament, on Tuesday.

CHINA

GROWTH (MNI BRIEF): China has set its GDP target at “around 5%” for 2024 as expected, to help boost employment and prevent risks, said Premier Li Qiang in the Government Work Report delivered at the opening ceremony of the National People's Congress on Tuesday.

FISCAL (MNI BRIEF): China will issue CNY1 trillion of ultra-long special treasury bonds in 2024 and lower the deficit-to-GDP ratio to 3%, said Premier Li Qiang when releasing the government work report during the opening ceremony of the National People’s Congress on Tuesday.

PBOC (MNI BRIEF): Chinese monetary policy will aim to maintain ample liquidity while putting idle funds to good use, and enhance the stability of capital markets, Premier Li Qiang said when releasing the government work report during the opening ceremony of National People’s Congress on Tuesday.

DEBT (MNI BRIEF): China will focus on defusing risks in real estate, local-government debt, and small and medium financial institutions to maintain overall economic and financial stability, the government said in its annual work report released on Tuesday.

CORPORATE (BBG): Funds to repay its 5.35% dollar bond due March 11 are ready and the payment is being arranged orderly, China Vanke says in a response to Bloomberg.

CHINA MARKETS

MNI: PBOC Drains Net CNY374 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY374 billion reverse repos after offsetting CNY384 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8540% at 09:45 am local time from the close of 1.8327% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Monday, compared with the close of 48 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1027 on Tuesday, compared with 7.1020 set on Monday. The fixing was estimated at 7.1985 by Bloomberg survey today.

MARKET DATA

UK FEB. BRC LIKE-FOR-LIKE RETAIL SALES RISE 1% Y/Y; EST. 1.6%; PRIOR 1.4%

AUSTRALIA JUDO BANK FEB. COMPOSITE PMI 52.1; PRIOR 49

AUSTRALIA JUDO BANK FEB. SERVICES PMI 53.1; PRIOR 49.1

AUSTRALIA 4Q NET EXPORTS ADD 0.6% PTS TO GDP; EST. +0.2%; PRIOR -0.6%

AUSTRALIA 4Q CURRENT ACCOUNT SURPLUS A$11.8B; EST. +A$5.0B; PRIOR +A$1.3B

AUSTRALIAN PUBLIC SECTOR DEMAND TO ADD 0.1%-PT TO 4Q GDP; PRIOR 0.3%

NZ FEB. ANZ COMMODITY EXPORT PRICES RISE 3.5% M/M; PRIOR 2.1%

CHINA FEB. CAIXIN SERVICES PMI 52.5; PRIOR 52.7

CHINA FEB. CAIXIN COMPOSITE PMI UNCHANGED AT 52.5

JAPAN TOKYO FEB. CORE CONSUMER PRICES RISE 2.5% Y/Y; EST. 2.5%; PRIOR 1.8%

JAPAN TOKYO FEB. OVERALL CONSUMER PRICES RISE 2.6% Y/Y; EST. 2.5%; PRIOR 1.8%

JAPAN TOKYO FEB. CPI EX-FRESH FOOD, ENERGY RISES 3.1% Y/Y; EST. 3.1%; PRIOR 3.3%

JAPAN JIBUN BANK JAPAN FEB. COMPOSITE PMI 50.6; PRIOR 50.3

JAPAN JIBUN BANK JAPAN FEB. SERVICES PMI 52.9; PRIOR 52.5

S. KOREA 4Q GDP EXPANDS 0.6% Q/Q, SAME AS PREVIOUS ESTIMATE

S. KOREA 4Q GDP EXPANDS 2.2% Y/Y, SAME AS PREVIOUS ESTIMATE

S. KOREA 2023 GDP EXPANDS 1.4% Y/Y, SAME AS PREVIOUS ESTIMATE

MARKETS

US TSYS: Treasury Futures Edge Higher, Ranges Tight, Volumes Low

JGBS: Futures Stronger After A Smooth Absorption Of 10Y Supply

JGB futures are holding an uptick, +2 compared to settlement levels, after 10-year supply was smoothly absorbed, with the low price matching wider expectations and the tail shortening. The cover ratio however declined to 3.239x from 3.648x at February’s auction. It is worth noting that today’s cover ratio remains higher than December’s, which was the lowest seen at a 10-year auction since 2021.

- With an outright yield similar to the February outing, growing expectations that the BoJ could remove NIRP as early as this month (18-19 March) possibly weighed on the bid at today’s auction.

- It was also notable that the relative affordability of 10-year JGBs compared to futures, as indicated by the spread between the 7- and 10-year JGBs, was around its highest point since 2015.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Tokyo CPI.

- Cash JGBs are dealing mixed, with yields 1.2bps lower (20-year) to 1.3bps higher (30-year). The benchmark 10-year yield is 1.0bp lower at 0.709% versus the Nov-Dec rally low of 0.555%.

- Swaps are richer, with the belly of the curve slightly outperforming (rates 1bp lower). Swap spreads are tighter apart from the 10-20-year zone.

- Tomorrow, the local calendar is empty.

AUSSIE BONDS: Cheaper, Subdued Session, Q4 GDP Tomorrow

ACGBs (YM -1.0 & XM -0.5) sit slightly cheaper after dealing in narrow ranges during today’s Sydney session. Once again, the domestic data drop (Q4 Net Exports, Current Account Balance and Government Consumption & Capex) failed to move the market as it awaits Fed Chairman Powell's policy testimony to Congress Wed-Thu and the Payrolls Report Friday.

- Cash US tsys are dealing little changed in today's Asia-Pac session after yesterday's bear-flattening. Tuesday’s US data calendar includes S&P Final PMIs, ISM Services and Factory Orders.

- (AFR) A sharp decline in the number of Australians travelling overseas and a large fall in imports of consumer goods like toys, clothes, cars and appliances may have prevented the economy from contracting in December. (See link)

- Cash ACGBs are flat to 1bp cheaper, with the AU-US 10-year yield differential 1bp lower at -11bps.

- Swap rates are 1bp higher to 1bp lower, with the 3s10s curve flatter.

- The bills pricing is -1 to -2.

- RBA-dated OIS pricing is little changed.

- Tomorrow, the local calendar sees Q4 GDP.

- Tomorrow, the AOFM plans to sell A$800mn of 2.75% Nov-29 bond.

NZGBS: Cheaper, Tracking US Tsys Ahead Of Fed Chair Powell’s Testimony (Wed)

NZGBs closed at or near the session’s worst levels, with benchmark yields 1-3bps higher.

- With the domestic calendar relatively light, local participants appear to have been content to monitor US tsys for directional guidance ahead of Fed Chairman Powell's policy testimony to Congress Wed-Thu and the Payrolls Report Friday.

- US tsys are currently dealing flat to 1bp cheaper in today’s Asia-Pac session.

- NZ Finance Minister Nicola Willis said “Lower-than-expected tax revenue is consistent with the economy being weaker than forecast in the half-year update” in response to questions in parliament.

- (Bloomberg) -- NZ population growth is masking weakness in consumer demand, the Treasury Dept. says in Fortnightly Economic Update. Per capita retail trade volumes fell 2.6% q/q in Q4. (See link)

- NZ’s commodity export prices rose 3.5% m/m in February versus a revised +2.1% in January, according to ANZ Bank.

- Swap rates finished with a twist-flattening. Rates closed 1bp higher to 1bp lower.

- RBNZ dated OIS pricing closed flat to 5bps firmer, with Feb-25 leading. A cumulative 48bps of easing is priced by year-end.

- Tomorrow, the local calendar sees the Volume of All Buildings for Q4.

FOREX: USD Index A Touch Higher, AUD & NZD Weighed By Weaker Equity Trends

The USD index sits marginally higher in recent dealings, last near 1242. Overall though it has been a muted session for G10 FX.

- Cross asset moves have been supportive in the equity space, with US futures sitting lower at this stage, with Nasdaq underperforming (-0.30%). US yields are down, but only a touch.

- We have had a number of data releases across Japan, Australia and NZ, but sentiment hasn't been shifted. To be fair these have mostly been second tier data outcomes with Tokyo CPI arguably the most significant print, but that was close to expectations.

- The China NPC headlines around aggregate growth were on expectations ("around 5% for 2024"). Again sentiment hasn't moved much. China equities sit higher on potentially state support (Rtrs), but HK markets are down quite sharply.

- AUD and NZD sit marginally lower, in line with the weaker regional equity tone for the most part. AUD/USD last near 0.6500, while NZD/USD tracks just under 0.6090. Overall ranges have been fairly tight though.

- USD/JPY is near 150.50, little changed for the session. Earlier dips to 150.36 were supported.

- Looking ahead, the Fed’s Barr speaks and February services ISM/PMI and final January durable goods orders print. European PMIs are also released.

ASIA STOCKS: China Equities Out-Perform, Tech Stocks Lower After AMD Ban

Hong Kong and China equities plummeted on the open down 1-3%, however there was a sharp reversal especially in China Large Cap equities, with the CSI300 now 0.50% higher, after being down 0.60%. The market is focused on the NPC meeting in Shanghai. So far, major headlines indicate China's GDP growth target for this year is around 5%, a budget deficit of 3% of GDP, an increase in urban jobs by 12 million, targeting an urban unemployment rate of 5.5%, boosting defense spending by 7.2%, and setting a CPI growth target at 3%.

- Hong Kong Equity are underperforming with the HSTech Index the worst performing area of the market down 3.18% after the US Commerce Department announced it will bar exports of powerful AI processors made by AMD to China, the Mainland Property Index is down 2.10%, while the HSI is off 2.10%. China's National Team may have supporting the local markets today as equity markets gapped lower on the open only to be bid back up very quickly, while large cap are out-performing smaller cap indices in line with what National Team mandates. The CSI300 up 0.45%, the smaller cap CSI1000 is down 0.60%.

- China Northbound flows were -7.1b yuan on Friday, with the 5-day average now 3.5b, while the 20-day is at 2.66b yuan.

- Country Garden's sales drop the most in seven years amid wind-up fears, while contracted sales plunged 85% from the same period a year earlier verses 75% fall in January. Meanwhile, Vanke, China's 2nd largest developer by sales has seen their equities and bonds plunge in value as investors grow concerned over their ability to continue servicing their debts.

- Goldman was out earlier noting that they expect China's three pillars (Property, Infrastructure and Exports) of growth will weaken over the next decade and caution investors from adding to exposure in the region.

- Earlier Hong Kong had S&P Global PMI at 49.7 a decline from the prior month of 49.9., while Caixin China PMI Composite was unchanged at 52.5, and Caixin China PMI Services was 52.5 vs 52.9 expected

- Looking ahead, the NPC meeting will continue over the next few days although there is no set time frame, although expected to last about a week.

ASIA PAC EQUITIES: Equities Mixed, Japan Banks Outperform on Higher CPI, Eyes On NPC

Regional Asian Equities are mixed today. The focus in the Asia region today has been on the NPC meeting in Shanghai, however there have been some economic data out regionally with Tokyo CPI increasing to 2.6% vs 2.5% expected up from 1.60% in Jan, while SK 4Q GDP inline with expectations at 2.2% and Australia BoP Current Account Balance was A$11.8b vs A$5.0b expected.

- Japan equities opened lower but have pushed higher since mid morning, Tokyo CPI increased more than expected and has helped Banking stocks today with the Topix Banks Index up 1.37%, while construction names push higher after general contractor Obayashi's surprise plan to hike its ROE and dividend targets with the TOPIX up 0.60%. The Nikkei 225 is back above 40,000 and up 0.20% after breaking back below earlier, tech stocks are leading the move higher.

- South Korean equities are lower today, giving back some of the gains made yesterday, after researchers behind LK-99 claimed to have synthesized a new material showing superconducting behavior at room temperature. GDP data was out earlier and was in line with expectations, while Monday saw a $743m of equities inflows the highest since Feb 2. The Kospi is down 0.50%

- Taiwan Equities are higher today as TSMC again leads the way higher up 1.20%. Taiwan saw $1.15b of foreign equity inflows on Monday, the Taiex is up 0.60%.

- Australian equities closed down 0.15%, with financials and consumer discretionary stocks are weighing on performance. The market will be closely watching the NPC meeting for signs of a push to boost demand for Australia's natural resources.

- Elsewhere in SEA, most markets are trading lower with the expectation of New Zealand closing up 0.25% while Malaysia down 1.00%, Indonesia down 0.30%, Singapore down 0.35% and India down 0.50%

OIL: Oil Markets Subdued As Concerned About Demand From China

Crude continued to trend lower during the APAC session today after falling sharply yesterday on supply concerns. Commodities in general have struggled. Brent is down 0.2% to $82.62/bbl but is off the intraday low of $82.50. WTI is 0.4% lower at $78.46 after a low of $78.37. The USD index is flat.

- China’s NPC announced a 5% growth target for 2024, close to 2023’s outturn, with 3% for CPI. Monetary policy will be flexible and fiscal policy proactive. There are also plans to reduce energy intensity. The news didn’t support markets as they continue to be concerned re demand from the world’s largest oil importer and will watch for measures to stimulate growth.

- Energy markets will continue to monitor developments in the US with the focus on Fed comments and Friday’s February payrolls. There have also been a number of large US crude inventory builds in recent weeks while product stocks have declined. Last week’s data as reported by the API is released later today.

- Crude continues to get support from ongoing tensions in the Middle East with ceasefire talks showing no progress and vessels still being attacked off Yemen.

- Later the Fed’s Barr speaks and February services ISM/PMI and final January durable goods orders print. European PMIs are also released.

GOLD: Steady After Another Solid Gain On Monday

Gold is slightly lower in the Asia-Pac session, after closing 1.5% higher at $2114.48 on Monday.

- Monday’s move continued the surge higher after punching through the latest resistance at $2100. The all-time high is $2135.4 (Dec 4 high).

- Bullion’s move came despite US Treasuries paring much of Friday’s post-ISM Manufacturing’s gain. US Treasury yields finished the NY session 3-7bps higher, with the curve flatter.

- Traders are now likely to look ahead to Fed Chairman Powell's policy testimony to Congress Wed-Thu and the US Payrolls Report Friday.

- Bloomberg quoted TD on the yellow metal: “We still think it could go higher as well,” said Ryan McKay, senior commodity strategist at TD Securities. That’s because some discretionary macro traders are underinvested in the metal “relative to historical norms heading into a Fed cutting cycle.”

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 05/03/2024 | 0900/1000 | *** |  | IT | GDP (f) |

| 05/03/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/03/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/03/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/03/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/03/2024 | 1700/1200 |  | US | Fed Governor Michael Barr | |

| 05/03/2024 | 2030/1530 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.