-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN OPEN: China Y/Y PPI At Weakest Pace Since 2016

EXECUTIVE SUMMARY

- CHINA MAY CPI HIGHER, PPI DIPS - MNI

- CHINA’S DEFLATION RISK FUELS CALLS FOR INTEREST RATE CUTS - BBG

- SIGNS OF STRONGER CONSUMER PRICE INDEX - BOJ’s UEDA - MNI

- BLINKEN’S LONG-DELAYED BEIJING TRIP NOW IN PLANNING FOR NEXT WEEK - POLITICO

- TRUMP INDICTED IN MAR-A-LAGO CLASSIFIED DOCUMENTS INVESTIGATION- WP

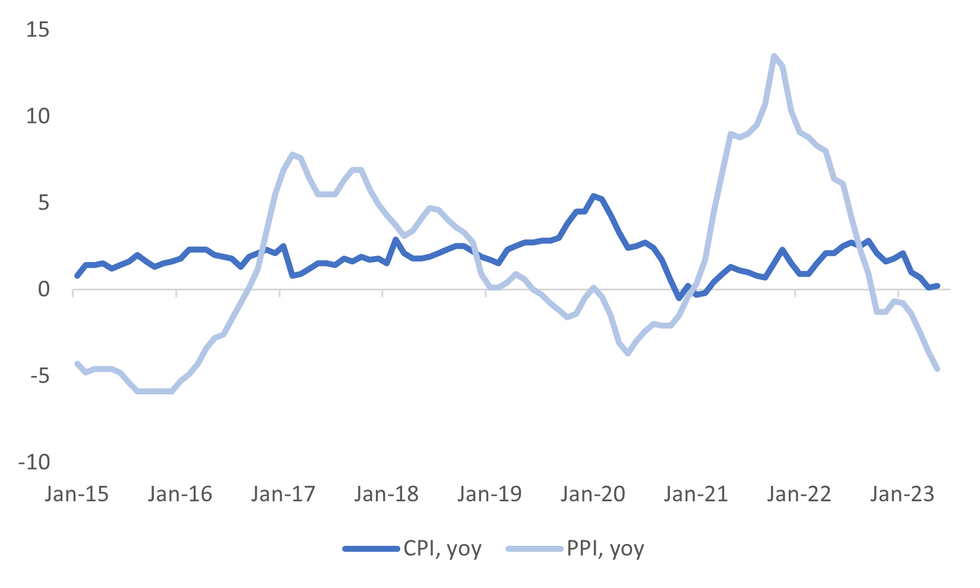

Fig. 1: China PPI At Weakest Y/Y Pace Since 2016, CPI Y/Y A Touch Above Flat

Source: MNI - Market News/Bloomberg

U.K.

UK/US: Britain and the United States backed a new "Atlantic Declaration" on Thursday for greater cooperation on pressing economic challenges in areas like clean energy, critical minerals and artificial intelligence. The joint declaration described the partnership as the "first of its kind" in covering the broad spectrum of the two countries' economic, technological, commercial and trade relations. (RTRS)

UK/US: UK Prime Minister Rishi Sunak leaves Washington after a two-day visit, armed with President Joe Biden’s backing for his efforts on artificial intelligence and agreements for closer economic cooperation to shore up green industries and supply chains. The two leaders agreed to start work on an accord that could ultimately give British-based manufacturers access to the massive package of US subsidies and tax breaks enshrined in Biden’s signature Inflation Reduction Act. And the UK will be designated a “domestic source” for defense contractors, opening up US investment to British companies. (BBG)

EUROPE

ECB: The European Central Bank will neither raise interest rates too far nor stop lifting them too early, according to economists surveyed by Bloomberg who see borrowing costs peaking in July. Following two quarter-point moves this month and next, the deposit rate is expected to remain at 3.75% for nearly a year to ensure inflation — still more than three times the target — retreats sustainably. Only seven of 42 respondents anticipate a third hike to 4% in September. (BBG)

FISCAL: Germany’s finance minister has warned that EU states are failing to bridge their differences in contentious talks over reform of the bloc’s fiscal rules, denting hopes of a deal by the end of the year. Christian Lindner’s remarks to the Financial Times suggest he is not backing down from demands for a steeper reduction in public debt, setting the stage for a showdown with countries like France and Italy that want a more flexible regime. (FT)

U.S.

POLITICS: Former president Donald Trump said Thursday night that he’s been charged by the Justice Department in connection with the discovery that hundreds of classified documents were taken to his Mar-a-Lago home after he left the White House — a seismic event in the nation’s political and legal history. Trump, who is the frontrunner for the 2024 Republican presidential nomination, said he has been summoned to appear in federal court in Miami on Tuesday at 3 p.m. Several Trump advisers confirmed the charges. (WASHINGTON POST)

US/CHINA: The White House pushed back on a report that the Chinese government cut a deal with Cuba to set up a spy base on the island that would target US military bases and communications. “I’ve seen that press report. It’s not accurate,” White House National Security Council spokesman John Kirby said in an interview on MSNBC. (BBG)

US/CHINA: Secretary of State Antony Blinken is planning to travel to Beijing as soon as next week, two people familiar with the scheduling told POLITICO. The trip — for which the State Department is still finalizing details — will mark the highest-level visit of a U.S. official to China since that of then-Secretary of State Mike Pompeo in 2018. (POLITICO)

US/CHINA: Legislation to strip China of its status as a "developing nation" at some international organizations was passed by a U.S. Senate committee on Thursday, as members of the U.S. focus on competing with the Asian power. The Senate Foreign Relations Committee approved the "Ending China's Developing Nation Status Act" without dissent. The bill would require the Secretary of State to pursue changing China's status as a developing nation in international organizations. (RTRS)

OTHER

JAPAN: Bank of Japan Governor Kazuo Ueda said on Friday there are signs the consumer price index is stronger than expected. Ueda told lawmakers that there are uncertainties over the outlook for prices, but he pointed out stronger corporate price-setting activity and high wage hikes this year. He added policymakers will carefully watch various data to examine price moves ahead of the July meeting when the board members review their medium-term economic growth and price views. (MNI)

OIL: Last fall, President Biden vowed to impose “consequences” on Saudi Arabia for its decision to slash oil production amid high energy prices and fast-approaching elections in the United States. In public, the Saudi government defended its actions politely via diplomatic statements. But in private, Crown Prince Mohammed bin Salman threatened to fundamentally alter the decades-old U.S.-Saudi relationship and impose significant economic costs on the United States if it retaliated against the oil cuts, according to a classified document obtained by The Washington Post.(Washington Post)

AUSTRALIA: Australia’s risk of an economic downturn jumped to the highest level since the pandemic, a Bloomberg survey showed, with the Reserve Bank now expected to raise interest rates again to try to gain control over inflation. The chances of a recession in the next 12 months climbed to 50% this month, up from 35% in May, Friday’s survey showed. Outside the first half of 2020, when Australia’s economy was driven into reverse by Covid lockdowns, the nation has avoided a recession for 32 years. (BBG)

CHINA

INFLATION: (MNI)Beijing - China's Consumer Price Index gained 0.2% y/y in May, matching consensus and up from April’s 0.1% y/y print, data from the National Bureau of Statistics showed on Friday. Food costs increased 1.0% y/y in May, up from April's 0.4% y/y and contributing 0.34pp to CPI growth. Pork prices, the main CPI driver, declined 3.2% y/y, compared to a 4.0% rise in April. (MNI)

POLICY: China’s inflation remained close to zero in May as the economy’s recovery weakened, giving the central bank scope to ease monetary policy to spur growth. The consumer price index rose 0.2% from a year earlier, the National Bureau of Statistics said Friday, in line with forecasts and up from 0.1% in April. Producer prices declined 4.6% on the back of lower commodity prices and weak domestic and foreign demand. Economists had expected a 4.3% decrease. (BBG)

MARKETS: Overseas investors are increasingly optimistic about A shares despite current weak market sentiment, as evidenced by growing foreign fund inflows, according to a report in the Financial News, which is backed by the People’s Bank of China. (Financial News)

POLICY: Policymakers should deepen the reform and opening of economic and social systems to revitalise the financial system and the economy, according to an editorial by Yicai. China’s system creates high real interest rates which represses the private economy, while powerful state-owned firms benefit from lower interest rates. The banking sector shows signs of asset shortages as deposit and loan spreads have narrowed. Looking forward, financial firms will face pressure from increased non-performing loans, as the economy’s macro-leverage ratio increased by 8.6pp in Q1 2023. (MNI)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Fri; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation kept the liquidity unchanged after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8695% at 10:09 am local time from the close of 1.7966% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 47 on Thursday, compared with the close of 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1115 FRI VS 7.1280 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1115 on Friday, compared with 7.1280 set

OVERNIGHT DATA

SOUTH KOREA APR BoP GOODS BALANCE $581mn; PRIOR -$1234.8

SOUTH KOREA APR CURRENT ACCOUNT BALANCE -$792.6mn; PRIOR -$1234.8

SOUTH KOREA MAY BANK LENDING TO HOUSEHOLD TOTAL KR1056.4t; PRIOR KR1052.2t

JAPAN MAY MONEY STOCK M2 Y/Y 2.7%; PRIOR 2.6%

JAPAN MONEY STOCK M3 Y/Y 2.1%; PRIOR 2.1%

CHINA CPI Y/Y 0.2%; MEDIAN 0.2%; PRIOR 0.1%

CHINA PPI Y/Y -4.6%; MEDIAN -4.3%; PRIOR -3.6%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-20+, -0-03, a 0-05 range has been observed on volume of ~63k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys cheapened in early dealing as local participants faded Thursday's richening, perhaps using the opportunity to close out longs/enter fresh shorts.

- Little meaningful macro news flow crossed through the session, and tsys dealt in a narrow range. The proximity to Tuesday's CPI print and Wednesday's FOMC meeting may be keeping participants on the sidelines.

- FOMC dated OIS price ~7bps of hikes into the June meeting with a terminal rate of ~5.30% in July. There are ~25bps of cuts priced for 2023.

- There is a thin calendar on Friday, the Canadian Labour Force survey provides the highlight.

JGBS: Futures Holding Gains, Narrow Range, Few Domestic Drivers

In the Tokyo afternoon session, JGB futures sit mid-range at 148.76, +14 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments from Governor Ueda in parliament re: seeing various uncertain elements over prices and fiscal management at the time of an exit from monetary easing. (link ICYMI)

- Cash JGBs are trading mixed in the Tokyo afternoon session with yield movements ranging from +0.8bp (1-year) to -0.8bp (20-year). The benchmark 10-year yield is 0.1bp lower at 0.437%.

- The swap curve has twist steepened with a 10-year pivot. Swap spreads are mixed, generally narrower out to the 5-year zone but wider beyond.

- The local calendar next week sees PPI (May) and Machine Tool Orders (May P) on Monday, BSI Large Manufacturing (Q2) on Tuesday, Trade Balance (May) and Core Machine Orders (Apr) on Wednesday and Weekly Investment Flows (June 9) on Thursday. The calendar highlights undoubtedly will be the BoJ Policy Decision on Friday.

AUSSIE BONDS: Richer, Narrow Range, Journalists Are In The Hawks Nest

In futures roll-impacted trading, ACGBs are richer (YM +4.8 & XM +6.7) after trading in a narrow range in the Sydney session. With the local calendar light today, local participants have likely been monitoring US tsys, which are 0.7-1.5bp cheaper in Asia-Pac trade.

- Cash ACGBs are 5-7bp richer with the AU-US 10-year yield differential +2bp at +22bp.

- Swap rates are 7-8bp lower with EFPs little changed.

- The bills strip is flatter with pricing +2 to +9.

- RBA dated OIS are 1-4bp softer across meetings with an expected terminal rate of 4.46%.

- James Glynn (Dow Jones) - It is looking more likely that the answer to Australia's stubborn inflation woes will be the onset of a recession. (link)

- Christopher Joye writes an AFR article titled “Why the cash rate could hit 5pc before the RBA is done”. (link)

- Note that Monday is a public holiday for most parts of Australia. The next key data is on Tuesday with the release of Westpac Consumer Confidence (June) and NAB Business Confidence (May). Next week’s highlight undoubtedly will be the May Employment Report on Thursday.

- The AOFM announced there will be no conventional bond tenders next week. They do plan to sell A$150mn of the 0.25% Nov-32 index-linked bond on Tuesday, 13 June.

NZGBS: Closed On A Low Note But Richer On the Day

NZGBs closed on a low note but with the benchmarks 2-5bp richer on the day. NZ/US 10-year yield differential is 1bp higher.

- NZGBs have shown stronger performance compared to ACGBs, with the NZ/AU 10-year yield differential -1bp. At +57bp, the NZ/AU differential is back near its tightest level since mid-February. The 10-year differential hit a 20-year+ high in March at around +100bp.

- Swap rates closed 5-6bp lower with the implied short-end swap spread tighter.

- RBNZ dated OIS are 1-3bp softer across meetings with the expected terminal rate at 5.63%.

- Not surprisingly given how much they've risen over the past 18 months or so, a growing number of New Zealanders are worried about interest rates, market research company Roy Morgan says.

- Next week sees Retail Card Spending (May) on Monday, Net Migration (Apr) on Tuesday, Balance of Payments (Q1) on Wednesday and GDP (Q1) on Thursday.

- The global calendar is light today. Accordingly, market participants will be keen to see if US tsys can hold yesterday’s gains sparked by the larger-than-expected jump in US initial jobless claims.

EQUITIES: Japan Stock Rally Extends To 9th Week, China Indices Close To Flat

Most regional equity markets are tracking higher as we approach the end of the week. Japan stocks are leading the way, the Nikkei 225 up around 1.80% at this stage. China stocks are around flat, while US futures are down slightly at this stage. Eminis last near 4293.

- The rebound in Japan stocks follows a ~2.6% correction in the Nikkei Wed/Thurs. The index is back above 32000 but we are below intra-session highs form earlier in the week. The index is tracking higher for the 9th straight week.

- Tech related names have led the move, while BoJ Governor Ueda appeared before parliament. Ueda's comments didn't suggest any surprises at next Friday's BoJ meeting.

- China stocks are around flat at the break, the CSI 300 sitting close to 3817.50. Inflation data for May suggests a weakish domestic demand backdrop, which should keep easing calls as part of the market narrative. The CSI 300 property sub index is down 2.27%, the first drop since Monday. News outlets reported US Secretary of State Blinken may visit China next week.

- The HSI is +0.20% higher at the break, with tech up 0.59%. The index tracking slightly higher for the week.

- The Taiex (+0.80%) and Kospi (+1.00%) are tracking higher in line with tech related gains in US trade on Thursday.

- In SEA trends are mixed, Thai equities are down around 0.50% at this stage, pulling back a degree after yesterday's 1.71% gain.

FOREX: Greenback Ticks Higher In Asia

The USD has pared some of Thursday's losses as US Treasury Yields tick higher, aiding a mild bid in the greenback.

- Yen is the weakest performer in the G10 space at the margins. USD/JPY has firmed above the ¥139 handle, last printing ¥139.25/35. On the wires early in the session M2 Money Supply rose 2.7% Y/Y in May and M3 Money Supply rose 2.1%.

- AUD/USD is also pressured, the pair is now dealing below the $0.67 handle. The pair was unable to break recent highs in early dealing and ticked away from session highs marginally extending losses as we approach the London session.

- Kiwi is a touch lower however ranges have been narrow with little follow through. NZD/USD has dealt in a narrow ~15pip range for the most part of today's Asian session.

- Elsewhere in G-10 EUR and GBP are both down ~0.1% reflecting the broader USD move.

- Cross asset wise; 10 Year US Treasury Yields are up ~1bp and e-minis are ~0.1% softer. BBDXY is ~0.1% firmer.

- The data calendar is thin today, the latest Canadian employment report provides the highlight.

OIL: Tracking Lower, China Crude Oil Inventories Hit 2yr High

Brent crude has spent most the session on the back foot, albeit well within Thursday's volatile ranges. Dips sub $75.40/bbl have been supported, with latest moves just above this level. This puts us down 0.70% from Thursday closing levels in NY. We are also tracking lower for the week (-0.92% at this stage). WTI is tracking a similar trajectory, last around the $70.75/bbl level and slightly worst week to date, -1.37%.

- Both Brent (low of ~$73.60 from Thursday) and WTI (low of ~$69) benchmarks remain well above intra-session lows from Thursday, when Middle East news reports of a possible US/Iran deal (which would bring fresh oil supply to the global market) sent prices sharply lower. We rebounded though as the US denied the reports.

- Elsewhere, China's crude stockpiles reportedly hit a 2yr high in May, with expectations import demand will ease in June (see this link for more details). This will heighten demand concerns, as Saudi's supply cut hasn't been able to materially lift sentiment so far.

GOLD: Bounces With The Lift In US Initial Jobless Claims

Gold in the Asia-Pac session is experiencing a slight decline after bouncing back from its lowest closing level since mid-March. The surge in US unemployment claims dampened expectations of further Fed tightening, leading to increased interest in gold. The precious metal closed 1.3% higher at 1965.46.

- According to a report from the US Labor Department released on Thursday, initial jobless claims climbed to 261,000 last week. This figure marked the highest level since October 2021 and significantly surpassed the median economist forecast.

- The rise in US jobless claims resulted in reduced expectations for upcoming Federal Reserve rate hikes over the next three meetings. FOMC-dated OIS pricing attaches a 27% chance of a 25bp hike next week, with July and September receding to a cumulative chance of 80% and 68% respectively.

- The dollar extended a drop following the data print, boosting gold.

- In recent weeks, the price of the precious metal has remained relatively stable in a range centred on $1,950 per ounce, as investors eagerly await clearer signals regarding the future direction of US monetary policy.

FX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0695-00(E1.1bln), $1.0720-25(E759mln), $1.0750-60(E697mln), $1.0800(E622mln)

- USD/JPY: Y139.00($996mln), Y140.00($972mln)

- USD/CAD: C$1.3350-65($837mln), C$1.3390-00($1.0bln), C$1.3450($1.7bln), C$1.3500($2.1bln)

- USD/CNY: Cny7.10($990mln), Cny7.20($644mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 09/06/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 09/06/2023 | 0800/1000 |  | EU | ECB de Guindos in Capital Requirements Seminar at EU Parliament | |

| 09/06/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/06/2023 | 1400/1000 | * |  | US | Services Revenues |

| 09/06/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/06/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.