-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Chinese Liquidity & Regulatory Matters Headline Again

EXECUTIVE SUMMARY

- FED CHAIR POWELL GETS UNLIKELY BOOST WITH HIS LIBERAL CRITICS IN DISARRAY (BBG)

- PBOC WILL ADDRESS SEPTEMBER FUNDING GAP (CSJ)

- CHINESE REGULATORS SUMMON 11 RIDE-HAILING FIRMS, INCLUDING DIDI, OVER 'ILLEGAL BEHAVIOR' (CNBC)

- OPEC+ ALLIANCE KEEPS GRADUAL PRODUCTION INCREASES, DESPITE U.S. REQUEST (WSJ)

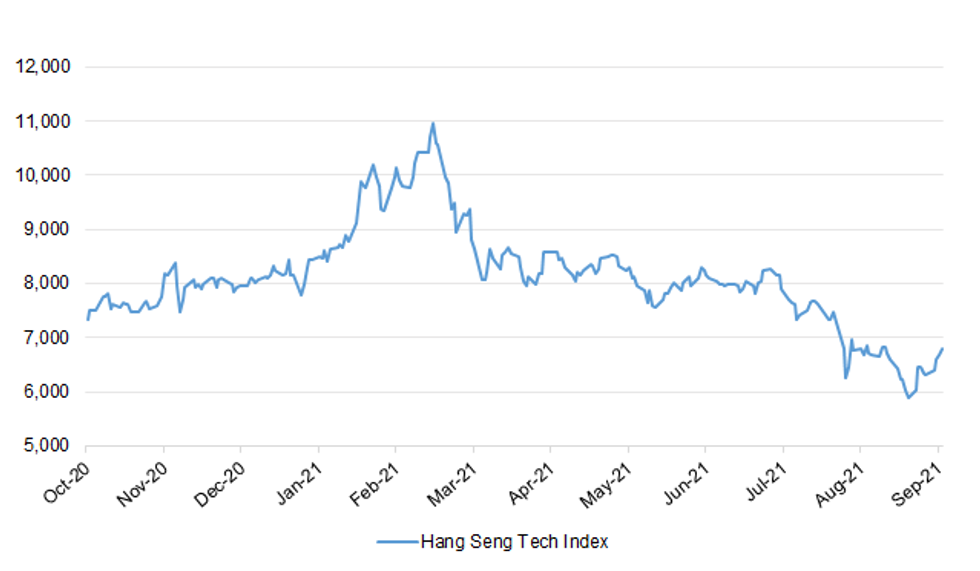

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: About 500,000 people in the UK with severely weakened immune systems will be offered a third dose of a Covid-19 jab in an effort to protect them from the virus ahead of the winter months, UK health secretary Sajid Javid said on Wednesday. He said the decision was based on the recommendations of the UK's Joint Committee on Vaccination and Immunisation, but stressed the move was not the beginning of the long-awaited booster campaign. Ministers and scientists are still working on plans to roll out that out soon. "This is not the start of the booster programme — we are continuing to plan for this to begin in September to ensure the protection people have built from vaccines is maintained over time and ahead of the winter," he said. (FT)

ECONOMY: The number of shoppers hitting Britain's high streets, shopping centres and retail parks continued to improve in August, with the gap on the same month in 2019 reducing to -18.6% from -24.2% in July, footfall data compiled by Springboard showed. Footfall in central London, which has been hit by an absence of foreign tourists and a reduced numbers of commuters, was 38% below the 2019 level, Springboard said on Thursday, considerably better than -50.4% recorded in July. In large cities outside of the capital, the improvement in footfall in August was nearly double that in smaller high streets, putting them at a comparable level versus 2019 for the first time, Springboard said. (RTRS)

FISCAL: One hundred groups have pleaded with the prime minister to abandon a planned cut to universal credit and working tax credit. Axing the £20-a-week uplift, which was a temporary measure to help claimants through the pandemic, would cause "immense, immediate and avoidable hardship", the group says. They include six former Work and Pensions secretaries, charities, think tanks, teachers and MPs from across the political spectrum. In an open letter to Boris Johnson, they wrote: "We are rapidly approaching a national crossroads which will reveal the true depth of the government's commitment to improving the lives of families on the lowest incomes. (Sky)

BREXIT: New post-Brexit rules for moving goods from Northern Ireland to the rest of the UK have been delayed. They were due to have been implemented by the end of this year but the government says that will not now happen. The rules concern the definition of which goods qualify for "unfettered access" when moving from NI to GB. The definition of qualifying goods is currently very wide and the government has always intended to narrow it. Unfettered access for Northern Ireland goods was a central Brexit promise from the UK government. (BBC)

EUROPE

ECB: The European Central Bank is stepping up pressure on lenders to prepare for stress tests next year that will show just how vulnerable the industry is to climate change, according to people familiar with the process. The ECB, which earlier this year voiced displeasure over finance industry efforts to respond to climate risks, has sent out confidential documents to banks stating they'll need to provide data on how their balance sheets might fare through 2050, the people said. The regulator also plans to study the link between profits and carbon risk in banks' portfolios, they said. (BBG)

CORONAVIRUS: The global debate over COVID-19 vaccine boosters is continuing, with Europe's health agency now saying there is no need to rush another round of shots even as multiple countries are doling out additional doses. The evidence on real-world effectiveness shows that all vaccines authorized in the region are highly protective against COVID-19-related hospitalization, severe disease and death, the European Centre for Disease Prevention and Control (ECDC) said on Wednesday. But the agency also noted extra doses can be considered for people who experience a limited response to the standard regimen, adding that these shots should be treated differently from booster doses. That proclamation comes as multiple countries around the world are pursuing some form of booster programs, including Germany, France, the U.K., Israel, the U.S. and parts of Canada. (CBC)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Wednesday that ending protections against evictions and a slow rollout of aid for renters owing money to landlords could create problems for the economic recovery. "The eviction moratorium has been very helpful to date in preventing people from being moved out of their homes in the middle of a pandemic," Mr. Bostic said in a virtual appearance, referring to a recently ended eviction ban that shielded financially distressed renters. (WSJ)

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "We hoped fall would bring clarity on our economic recovery. But ask any parent and they'll tell you the picture is still cloudy. Childcare and school infrastructure like buses and aftercare are strained. Parents are a key part of our workforce and they're still struggling." (MNI)

FED: Liberal Democrats are publicly assailing Federal Reserve Chairman Jerome Powell's record in an effort to persuade President Joe Biden not to give him a second term, but they aren't yet lining up behind any one alternative to run the central bank. New York Representative Alexandria Ocasio-Cortez, Michigan Representative Rashida Tlaib and other vocal House progressives, as well as nearly two dozen liberal groups, wrote separate memos this week criticizing Powell's Fed without endorsing a replacement. Their silence on an alternative only serves to bolster Powell's chances of renomination because it gives him more space to quietly campaign for the job without a clear opponent. (BBG)

ECONOMY: MNI INTERVIEW: Supply Jams Could Linger For Years - ISM Chief

- The international supply chain crunch now looks likely to persist well into next year and could linger for years as the surging Delta variant clogs ports critical to global trade and forces factory shutdowns in parts of Asia, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday. Still, strong U.S. demand leaves room for further growth in the manufacturing sector over coming months, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Matthew Calamari Jr., the director of security for the Trump Organization and the son of its chief operating officer, is expected to testify this week before a Manhattan grand jury investigating former President Donald Trump's company, a source told CNBC on Wednesday. Calamari Jr. was served a subpoena for his testimony earlier this week, a source with direct knowledge of the matter said. He is expected to testify Thursday, said the source, who declined to be named in order to discuss the secret grand jury proceedings. (CNBC

EQUITIES: U.S. antitrust officials are preparing a second monopoly lawsuit against Alphabet Inc.'s Google over the company's digital advertising business, according to a person familiar with the matter, stepping up the government's claims that Google is abusing its dominance. The Justice Department has accelerated its investigation of Google's digital advertising practices and may file a lawsuit as soon as the end of the year, said the person, who declined to be named because the investigation is ongoing. No final decisions have been made and the timing could be pushed back. (BBG)

OTHER

GLOBAL TRADE: President Joe Biden's administration is considering a quota system as it prepares a proposal for the European Union to resolve a dispute over steel and aluminum imported from the bloc. The Office of the U.S. Trade Representative and the Commerce Department also are looking at increased monitoring of the origins of the metals produced in the EU as a potential part of the solution, according to people familiar with the administration's internal discussions, who asked not to be named because they're private. The U.S. hasn't yet made the proposal formally to the EU, the people said. The so-called tariff-rate quotas allow countries to export specified quantities of a product to other nations at lower duty rates, but subject all imports of the product above a pre-determined threshold to a higher duty, according to the USTR's website.

U.S./CHINA: The U.S. must understand that its cooperation with China on climate change cannot be detached from the general environment of China-U.S. relations, Foreign Minister Wang Yi said during a video call with U.S. climate envoy John Kerry, who is on a visit to China's Tianjin, southwest of Beijing. The U.S. should stop seeing China as a threat and adversary, and stop besieging and suppressing China, but actively respond to terms proposed by China, Wang said. Bilateral relations have undergone a sharp decline mainly due to the U.S. having made a major strategic misjudgment against China, said Wang. (MNI)

CORONAVIRUS: The World Health Organization asked world leaders again to hold off on administering Covid-19 boosters for at least another month to give poorer nations the chance to inoculate more of their populations with first doses. More than 5 billion Covid vaccine shots have been administered globally, with 75% of them administered in just 10 countries, according to the WHO. "That's why I have called for a moratorium on boosters, at least until the end of this month to allow those countries that are furthest behind to catch up," WHO Director-General Tedros Adhanom Ghebreyesus said in a briefing Wednesday. (CNBC)

CORONAVIRUS: Moderna Inc. said that it had filed initial data with the U.S. Food and Drug Administration for clearance of a third-dose booster shot of its Covid-19 vaccine. In a statement on Wednesday, the company said the booster shot, using a reduced dose of 50 micrograms that is half the dose used in the existing vaccine, raised antibody levels against the delta variant by more than 40-fold in a clinical trial. The company also said it planned to submit the data to regulators in Europe and elsewhere in the coming weeks. A panel of expert advisers to the FDA plans to hold a meeting on booster shots on Sept. 17, according to people familiar with the planning. (BBG)

CORONAVIRUS: Moderna and its Japanese partner Takeda said there is currently no evidence linking the deaths of two men in Japan to stainless steel particles found in vials of the Moderna vaccine. (BBG)

BOJ: MNI BRIEF: BOJ Kataoka: Downside Risk To Spending Increases

- Downside risks are growing on private consumption spending in Japan on the expanded and extended measures to stem Covid-19, infections, Bank of Japan board member Goushi Kataoka said on Thursday, adding that the central bank could take additional monetary step if warranted - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: The Japanese government plans to extend the operation of large vaccination sites operated by the Self-Defense Forces by ~2 months to end-Nov., public broadcaster NHK reports, citing an unidentified person. Certain number of bookings at the sites will be allocated to those under 40 to accelerate vaccination of younger age groups. (BBG)

AUSTRALIA: Australia's Covid-Zero strategy is under unprecedented pressure with some states seeking to remain isolated from Sydney and Melbourne, where attempts to eliminate the highly-contagious delta variant have been abandoned. The surge of coronavirus cases in the nation's most-populous southeastern region, including its largest cities Sydney and Melbourne, has seen some states with Labor party leaders balk at conservative Prime Minister Scott Morrison's plan to remove ongoing lockdown restrictions. He also wants to reopen domestic and international borders when vaccination rates reach certain thresholds. The outbreak continues to spread from Sydney, the capital of New South Wales, which is preparing to ease stay-at-home orders when 70% of people over 16 years are fully vaccinated. Meanwhile the leaders of Western Australia and Queensland states, which are keeping delta at bay by banning arrivals from southeastern Australia, are now indicating they want to keep isolated indefinitely. Or at least until the nation's wave of delta infections is brought under control. Before delta, Australia avoided the wave of infections that hit most other nations by relying on closed international borders, rigorous testing and lockdowns to eliminate community transmission. (BBG)

NEW ZEALAND: New Zealand reported 49 new infections in the community on Thursday, down from 75 a day earlier, which authorities said was an "encouraging' indicator that lockdowns are working. Total active cases in the current outbreak have risen to 725, Director General of Health Ashley told a news conference. Prime Minister Jacinda Ardern says Northland region moves to Alert Level 3 at midnight tonight, bringing into line with the rest of New Zealand outside Auckland, which remains at Level 4. (BBG)

BOK: South Korea's economic recovery is expected to remain solid as exports have shown signs of a strong rebound, the head of the Bank of Korea (BOK) said Thursday, although a surge in delta variant infections has shaken the nation's containment efforts. "Our economy showed a faster-than-expected growth in the first half, helped by active policy measures and a global economic recovery," BOK Gov. Lee Ju-yeol told a forum on post-pandemic issues. Although the spread of the delta variant has recently continued, the economy's recovery is expected to remain sound due to solid exports and an expansion of vaccinations," Lee said. (Yonhap)

CANADA: Ontario on Wednesday became the fourth Canadian province to announce residents will have to show proof of vaccination against COVID-19 to enter restaurants, theaters, gyms and other indoor public venues. Premier Doug Ford said the vaccination certificate program will take effect Sept. 22. "I know this is what we have to do right now in the face of this fourth wave," Ford told a news conference. (AP)

CANADA: MNI BRIEF: Canada Conservatives Hold Back Platform Costs

- Conservative Party leader Erin O'Toole on Wednesday declined questions about the cost of his campaign promises ahead of Canada's Sept. 20 election, even after Liberal Prime Minister Justin Trudeau laid out a plan to spend an extra CAD78 billion over five years - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japan must compile an economic stimulus package worth "tens of trillions of yen" to combat the coronavirus pandemic, former foreign minister Fumio Kishida, who is challenging Prime Minister Yoshihide Suga in the race for ruling party chief, said on Thursday. The package must be compiled "swiftly" and include cash payouts to non-permanent workers and others who will be affected by steps to contain the flow of people, Kishida said in a news conference. (RTRS)

MEXICO: Mexico's President Andres Manuel Lopez Obrador said in his third state-of-the-union address, the halfway point in a six-year term, that he plans to present a bill revamping the energy sector to congress this month. The proposal of a constitutional amendment giving priority to the state utility company, the Federal Electricity Commission, over private competitors has been discussed by the leader for months, but he used his speech Wednesday to put a timeline on it. The amendment must be approved by congress, where it is expected to face an uphill battle: although the legislature is still stacked with members of the president's own party, that support was watered down by the mid-term elections in June. (BBG)

BRAZIL: Brazil is moving forward with an agenda of structural reforms, Economy Minister Paulo Guedes says at event. Says he believes Congress will back the public sector reform. Supreme court is helping with govt's economic agenda and will be able to come up with a solution for court-ordered payments. (BBG)

BRAZIL: Brazil's Lower House approved the preliminary text of the income tax reform with 398 votes in favor, 77 against and five abstentions. Lawmakers must still vote on amendments that can change the final text. The bill then moves on to the Senate. According to the approved proposal, dividends will be taxed at a 20% rate. Company income tax rate was reduced to 8% from 15%. Exemption range for individual taxpayers raised to BRL2,500 from BRL1,903.98. (BBG)

BRAZIL: Brazil's possible adoption of a central bank-issued digital currency, or CBDC, is still years away with the first pilot tests seen as taking place no sooner than 2023, said Fabio Araujo, who coordinates the central bank's digital currency task force. (BBG)

RUSSIA: Russia's annual inflation has accelerated to a fresh five-year high days before a central bank board meeting, keeping up the pressure to continue raising interest rates after a sharp hike in July. Inflation accelerated to 6.79% year-on-year in the week to Aug. 30 from 6.68% a week earlier, the economy ministry said on Wednesday. Inflation is on the radar of both the central bank, which targets it at 4%, and the market as Russia tries to rein in rising prices that eat into incomes already dented by the COVID-19 crisis and a weak rouble. (RTRS)

RUSSIA: Russia's economy grew by 4.7% in year-on-year terms in July, the economy ministry said on Wednesday. The ministry also revised June GDP growth to 8.9% from a previously reported 8.5%. The January-July GDP growth is seen at 4.8%, compared to the previous year, the ministry said. (RTRS)

RUSSIA: Russia's unemployment rate fell further in July, returning to levels seen in 2019, while rising retail sales and salaries confirmed an economic recovery was underway. (RTRS)

AFGHANISTAN: Secretary of Defense Lloyd Austin said Wednesday it was not yet clear what kind of relationship, if any, the Pentagon would have with the Taliban in Afghanistan after Western forces spent 20 years fighting the Islamist militant group. "It's hard to predict where this will go in the future with respect to the Taliban," Austin told reporters at the Pentagon when asked about the next steps following Monday's complete U.S. military departure from the country. "We don't know what the future of the Taliban is," explained Chairman of the Joint Chiefs of Staff U.S. Army Gen. Mark Milley. (CNBC)

IRAN: In his first remarks about the nuclear standoff since assuming office, Iranian Foreign Minister Hossein Amir-Abdollahian indicated that Iran wants to negotiate with the West, but is in no rush. Four weeks after the inauguration of Iranian President Ebrahim Raisi, it remains unclear if and when the Vienna nuclear talks could resume. (Axios)

COMMODITIES: China should increase its strength in setting prices of global commodities as its futures market opens up, and focus on promoting soybeans, palm oil, PTA and crude oil in Asian trading hours, the Securities Times reported citing a speech by Vice Chairman of China Securities Regulatory Commission Fang Xinghai. China will steadily promote the development and listing of new commodity and financial futures, as well as continue to expand the range of specific open varieties, promote the institutional opening, and strengthen cross-border supervision with overseas regulators, the newspaper cited Fang as saying. (MNI)

COPPER: Union leaders at the Caserones copper mine in Chile are meeting with management in a bid to reach a wage agreement that would end a strike now in its fourth week. Negotiations resumed on Wednesday after workers rejected a revised company proposal last week. (BBG)

COPPER: Mining powerhouse Chile needs $150 billion in investment to hit its goal to nearly double copper output by 2050, part of a bigger plan by the world's top copper producer to ratchet up production while reducing environmental harm, the country's mining minister told Reuters on Wednesday. Energy and Mining Minister Juan Carlos Jobet on Tuesday announced a new national mining blueprint that aims to increase the traceability of copper produced in Chile, slash water use and bolster diversity at mining companies. In a telephone interview the day after the announcement, Jobet, a former corporate financier who attended Harvard, unveiled details of the plan aimed at keeping Chile on the cutting edge of mine production as demand for metals copper and lithium soars globally. (RTRS)

OIL: The Organization of the Petroleum Exporting Countries and a group of Russia-led producers said they agreed to continue increasing oil production in measured steps, resisting for now recent U.S. pressure to open the group's spigots wider. In July, the OPEC-Russian alliance agreed to gradually bring back millions of barrels a day of production that they had bottled up at the start of the Covid-19 pandemic. At a virtual meeting Wednesday, the group chose to continue moving gradually with that plan, boosting output in monthly installments of 400,000 barrels a day through the latter end of 2022. (WSJ)

OIL: Iraq's oil minister said on Wednesday that the OPEC+ policy of gradual crude output hikes will help stabilize global oil markets, the oil ministry said in a statement. Iraq supports agreements inside the group known as OPEC+ that help oil markets stability, the oil minister, Ihsan Abdul Jabbar, said, adding that the alliance of crude-producing countries will keep monitoring the markets to react to any changes in supply and demand. (RTRS)

OIL: Iran is determined to increase its oil exports despite sanctions imposed by the United States on Tehran's crude sales, Iranian Oil Minister Javad Owji said on Wednesday, adding that the use of oil sanctions as a "political tool" would harm the market. "There is strong will in Iran to increase oil exports despite the unjust and illegal U.S. sanctions," Owji told state TV, without elaborating on how Tehran planned to overcome sanctions. (RTRS)

OIL: Kuwait's oil minister said on Wednesday that OPEC and its allies are keen on providing markets with enough supplies, state news agency KUNA reported. Oil Minister Mohammad Abdulatif al-Fares added that the group, known as OPEC+, managed to support the oil industry amid the COVID-19 crisis, bringing balance and stability to the global economy. (RTRS)

OIL: Russia will have rolled back 65% of its oil-output cuts by October, Deputy Prime Minister Alexander Novak said in an interview with Rossiya24 state TV. Russia will increase output by some 100k b/d each month in August, September and October, in line with its quota within the OPEC+ deal. "Russia takes its commitment with the OPEC+ deal responsibly."

OIL: Over 1.4 million barrels per day of oil production and 1.88 billion cubic feet per day of natural gas output were still shut on Wednesday in the U.S. Gulf of Mexico after Hurricane Ida lashed Louisiana's coast, the Bureau of Safety and Environmental Enforcement (BSEE) said. (RTRS)

OIL: Enbridge Inc. is getting ready to ship crude from the oil sands in the first new cross-border oil-sands conduit built between Canada and the U.S. in years. The company is offering 620,000 barrels a day of capacity in its Line 3 oil pipeline in October, according to a notice it sent to shippers. The Line 3 project will replace and older Line 3 that can ship about 390,000 barrels a day. The project is scheduled to go into operation in the fourth quarter, according to an email from Enbridge. "The capacity provided to shippers is still an estimate as there are numerous factors including linefill, system outages for construction and tie in work that need to be completed," Jesse Semko, Enbridge spokesman, said in the email. (BNN BBG)

OIL: China's top oil producer is laying the groundwork to revive output in Venezuela as President Nicolas Maduro finalizes legislation to attract more international investment. Once a major investor in the OPEC nation, China National Petroleum Corp. is sending engineers and commercial staff there and vetting local companies for maintenance work at an oil-blending facility it operates with Petroleos de Venezuela SA, according to people with direct knowledge of the firm's actions, who asked not to be named because the information isn't public. CNPC is also contacting local service providers to potentially boost crude output at five other ventures with the Venezuelan state producer, the people said. (BBG)

CHINA

PBOC: Liquidity in China's money markets is expected to remain "reasonably ample" in September as PBOC support offsets a potential funding gap, according to an article in the China Securities Journal that cited analysts. Medium-term loans come due in September while issuance of special bonds accelerates, the report said. The drop in money market rates on Sept. 1 showed the PBOC's reverse repo operations late last month helped ensure liquidity was ample, the report said. (BBG)

INFRASTRUCTURE: China seeks to expand railways and ports in the western region by 2025 to help boost logistics and the overall economy, according to a five-year plan by the nation's economic planning agency. The provinces and municipality involved include Sichuan, Chongqing, Guangxi and Yunnan. (BBG)

SMES: A new CNY300 billion refinancing initiative announced by the State Council on Wednesday will help banks boost support for SMEs and provide more low-interest loans, the 21st Century Business Herald said. The new refinancing amount approved by the government is about a third of the CNY888 billion outstanding at the end of June, the newspaper said. From 2020 to May 2021, China's banks provided CNY6.3 trillion SME loans, it said. The State Council also urged using local government special bonds to boost investment. However, the economy is likely to maintain a slower pace of growth given the sharp decline in real estate investment, limited rebound in infrastructure spending and more stable growth in social financing, the newspaper said citing Wu Ge, chief economist of Changjiang Securities. (MNI)

EQUITIES: Chinese regulators have summoned and interviewed 11 ride-hailing firms asking them to rectify non-compliant behavior. The Ministry of Transport, along with a number of other regulators including the Cyberspace Administration of China and State Administration of Market Supervision, jointly interviewed the companies including Didi, T3 and Meituan. Chinese regulators alleged that the services are recruiting unapproved drivers and vehicles. "It's required that these platforms should check their own problems, rectify illegal behavior, safeguard market orders of fair competition, and create a sound environment for healthy development of the ride-hailing industry," the Ministry of Transport said. (CNBC)

EQUITIES: China's health-care sector will probably be the next to fall under scrutiny, analysts warn, as the country's regulators crack down on everything from tech to education to data security. Chinese President Xi Jinping this week again reiterated the need to support moderate wealth for all — or the idea of "common prosperity" which he has been promoting for months. That's what's driving the spate of crackdowns on companies, analysts say. (CNBC)

EQUITIES: Amundi Asset Management said on Wednesday investors should use recent declines in Chinese equities to increase their exposure, especially in biotech and clean energy sectors. "On China, we retain our long-term positive call and believe that recent weakness has opened up interesting opportunities," said Pascal Blanque, CIO at Amundi, Europe's largest asset manager with 1.8 trillion euro of assets under management. "Investors could take advantage of the selloff to increase their allocation in Chinese equity in global portfolios and manage the current phase focusing more on the sectors that are insulated by changes in regulation." (RTRS)

CORONAVIRUS: The company behind China's first homegrown mRNA Covid-19 vaccine aims to have efficacy data from late-stage testing of the shot before the end of the year, a key step in the nation's drive to match western use of the cutting-edge technology. The mRNA candidate, developed by Chinese vaccine maker Walvax Biotechnology Co., Suzhou Abogen Biosciences Co. and researchers from the Chinese military, has received approval from regulators in Indonesia and Mexico to start Phase III testing, Walvax Vice-Chairman Huang Zhen said in an interview. (BBG)

OVERNIGHT DATA

JAPAN AUG MONETARY BASE +14.9% Y/Y; JUL +15.4%

JAPAN AUG MONETARY BASE END OF PERIOD Y661.3TN; JUL Y660.9TN

AUSTRALIA JUL TRADE BALANCE +A$12.117BN; MEDIAN +A$10.000BN; JUN +A$11.114BN

AUSTRALIA JUL EXPORTS +5% M/M; MEDIAN +3%; JUN +4%

AUSTRALIA JUL IMPORTS +3% M/M; MEDIAN +2%; JUN +1%

AUSTRALIA JUL HOME LOANS VALUE +0.2% M/M; MEDIAN -0.2%; JUN -1.6%

AUSTRALIA JUL OWNER-OCCUPIER LOAN VALUE -0.4% M/M; MEDIAN -3.0%; JUN -2.5%

AUSTRALIA JUL INVESTOR LOAN VALUE +1.8% M/M; JUN +0.7%

NEW ZEALAND Q2 TERMS OF TRADE INDEX +3.3% Q/Q; MEDIAN +0.3%; Q1 +0.1%

SOUTH KOREA Q2, F GDP +6.0% Y/Y; MEDIAN +5.9%; FLASH +5.9%

SOUTH KOREA Q2, F GDP +0.8% Q/Q; MEDIAN +0.7%; FLASH +0.7%

SOUTH KOREA AUG CPI +2.6% Y/Y; MEDIAN +2.4%; JUL +2.6%

SOUTH KOREA AUG CPI +0.6% M/M; MEDIAN +0.4%; JUL +0.2%

SOUTH KOREA AUG CORE CPI +1.8% Y/Y; MEDIAN +1.6%; JUL +1.7%

CHINA MARKETS

PBOC NET DRAINS CNY40BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation resulted in a net drain of CNY40 billion given the maturity of CNY50 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.0999% at 09:26 am local time from the close of 2.0753% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 54 on Wednesday vs 57 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4594 THURS VS 6.4680

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly lower at 6.4594 on Thursday, compared with the 6.4680 set on Wednesday.

MARKETS

SNAPSHOT: Chinese Liquidity & Regulatory Matters Headline Again

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 73.19 points at 28522.86

- ASX 200 down 63.736 points at 7463.4

- Shanghai Comp. up 19.544 points at 3586.645

- JGB 10-Yr future up 3 ticks at 152.08, yield down 0.1bp at 0.031%

- Aussie 10-Yr future up 4.0 ticks at 98.810, yield down 3.4bp at 1.207%

- U.S. 10-Yr future +0-00+ at 133-15, yield up 0.84bp at 1.300%

- WTI crude down $0.23 at $68.37, Gold down $2.43 at $1811.54

- USD/JPY down 1 pip at Y110.00

- FED CHAIR POWELL GETS UNLIKELY BOOST WITH HIS LIBERAL CRITICS IN DISARRAY (BBG)

- PBOC WILL ADDRESS SEPTEMBER FUNDING GAP (CSJ)

- CHINESE REGULATORS SUMMON 11 RIDE-HAILING FIRMS, INCLUDING DIDI, OVER 'ILLEGAL BEHAVIOR' (CNBC)

- OPEC+ ALLIANCE KEEPS GRADUAL PRODUCTION INCREASES, DESPITE U.S. REQUEST (WSJ)

BOND SUMMARY: Familiar Themes In Play Across The Board In Asian Hours

T-Notes have stuck to the 0-02+ range that was established early on in Asia, last dealing +0-00+ at 133-15, while cash Tsys trade little changed to ~1.0bp cheaper on the day. Asia-Pac hours have been light on both macro headlines and broader market flow, leaving participants on the sidelines. Weekly jobless claims data, challenger job cuts and final durable goods data will hit during NY hours. Elsewhere, we will hear from Fed's Bostic & Daly, while the Tsy will make its mid-month supply announcement. Broader focus remains on Friday's NFP release.

- JGB futures failed to build on their overnight gains, last +2 vs. settlement, a little shy of overnight closing levels. The major cash JGB benchmarks sit little changed to 1.0bp richer after catching up to the overnight move in futures/U.S. Tsys. Swaps generally lagged JGBs, resulting in some very modest swap spread widening from 5-Years to further out the curve. Domestic news flow has seen the political sabre rattling continue. Elsewhere, BoJ dovish dissenter Kataoka reiterated his well-known stance re: a requirement for deeper monetary easing. The latest round of 10-Year JGB supply saw the low price match broader dealer exp. (per the BBG poll), while the price tail narrowed incrementally vs. the prev. auction and the cover ratio held steady, a touch above the 6-auction average (3.26x). A reminder that several desks suggested that 10s lacked any true outright appeal under the current market regime ahead of supply.

- Aussie bond futures have settled into a narrow range after the impetus from the early Sydney uptick faded, with YM +1.5 and XM +4.0 at typing, while the broader cash ACGB curve saw the 10- to 15-Year sector of the curve outperform. The space has looked through the latest round of local data releases, with July's trade balance registering a record surplus, while the broad headline housing finance print provided a surprise, albeit modest, uptick. Local COVID case numbers haven't had any impact on the space, with vaccinations & a new living with COVID mentality at the fore for policymakers in recent weeks. Finally, ANZ became the latest notable name to outline their expectations for the RBA to delay its tapering move come the end of next week's monetary policy decision.

JGBS AUCTION: Japanese MOF sells Y2.1127tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1127tn 10-Year JGBs:

- Average Yield 0.023% (prev. 0.009%)

- Average Price 100.75 (prev. 100.89)

- High Yield: 0.025% (prev. 0.012%)

- Low Price 100.73 (prev. 100.86)

- % Allotted At High Yield: 77.9744% (prev. 31.6719%)

- Bid/Cover: 3.357x (prev. 3.333x)

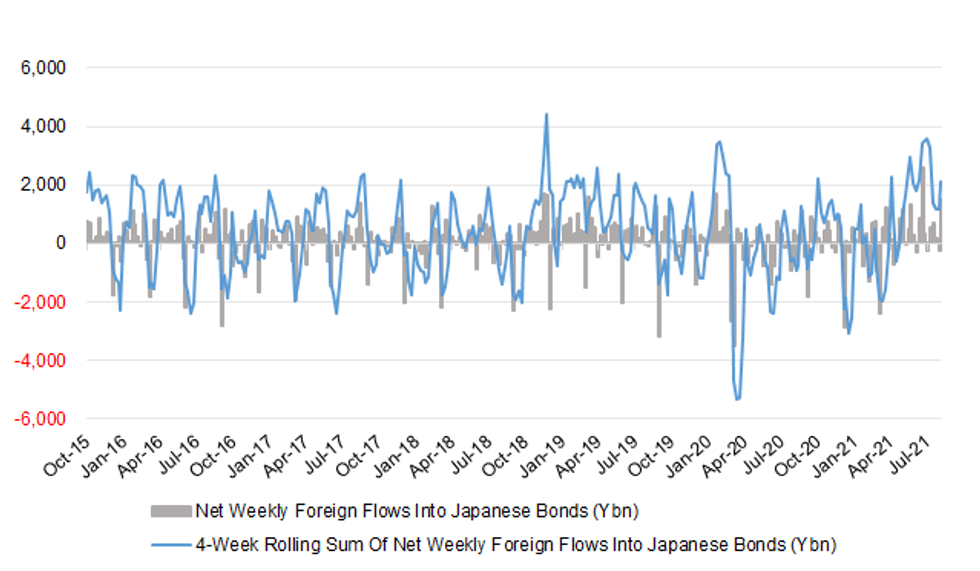

JAPAN: Foreigners Register Large Weekly Net Purchase Of Japanese Paper

Bond flows dominated the latest weekly round of Japanese international security flow data, with near enough neutral net equity flows observed.

- Japanese investors registered a 2nd consecutive week of net foreign bond sales, but it was foreign flows surrounding Japanese bonds that caught the eye. Foreign investors net purchased ~Y1.48tn of Japanese bonds last week, a level only topped in 5 weeks over the past 5 years.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -545.5 | -182.5 | -1171.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -42.6 | 55.9 | 542.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1480.7 | -225.2 | 2098.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 25.3 | -550.2 | -220.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 1: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Subdued

Equity markets moved in narrow ranges in Asia, following a broadly flat finish in the US as markets await US NFP data on Friday. The Hang Seng has seen small gains, buoyed by another record finish for the Nasdaq and a continued rebound in Chinese tech stocks. Markets in mainland China have seen small gains, helped by the PBOC's announcement that it will provide CNY 300bn of low-cost funding to banks to spur lending to SME's. In the US futures are marginally lower, treading water ahead of US labour market data on Friday, Alphabet dropped in after market trading after reports that the US Justice Department is preparing a second antitrust lawsuit.

OIL: Remains Under Pressure After OPEC+ & Inventory Data

Crude futures are lower in Asia-Pac trade on Thursday, adding to Wednesday's losses. After a positive start to the session, WTI and Brent crude futures dipped into negative territory shortly after US trade, with Russia's Novak quoted in IFX as saying the country could raise oil output above the OPEC+ quotas -pressing WTI futures to new weekly lows just above $67/bbl support before recovering some of the losses. . The OPEC+ group agreed to go ahead with the planned 400k bpd increase scheduled for October, wagering that the spread of the delta variant won't derail demand. The downside persisted headed into the weekly DoE crude oil inventories numbers, which showed a far larger draw on headline stockpiles than expected, with a drawdown of over 7mln bbls - twice that of expectations.

GOLD: Trading The Range

Bullion traded either side of unchanged on Wednesday, with the broader USD and our weighted U.S. real yield monitor nudging lower on the day. Still, participants lacked any real conviction ahead of Friday's U.S. NFP print, even as the ADP employment reading markedly missed expectations (triggering the usual round of debate re: the short-term correlation between the ADP & NFP readings). That means spot is virtually where it was 24 hours ago, last dealing just shy of $1,815/oz, with the technical overlay unchanged.

FOREX: Caution Seen In Muted Asia-Pac Trade

Defensive feel dominated in muted Asia-Pac trade, as participants prepared for Friday's NFP report out of the U.S. Risk aversion applied a modicum of pressure to commodity-tied FX amid softer crude oil prices.

- USD/CNH crept higher but remained within the confines of yesterday's range. The PBOC set their central USD/CNY mid-point at CNY6.4594, 10 pips above sell-side estimate.

- The data calendar is fairly U.S.-centric today, weekly jobless claims, factory orders & durable goods orders will grab attention. Comments are due from Fed's Bostic & Daly as well as Riksbank's Floden & Ingves.

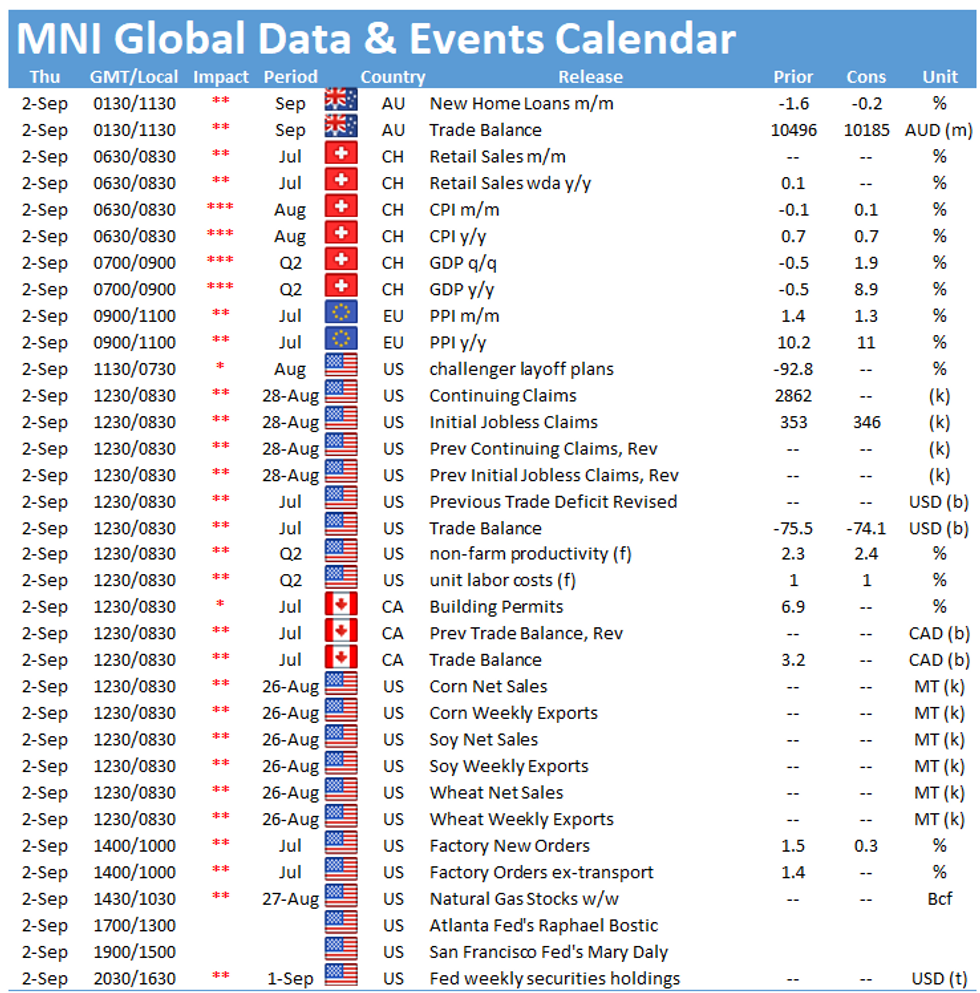

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.