-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI EUROPEAN OPEN: Chinese PMIs Comfortably Beat Expectations

EXECUTIVE SUMMARY

- FED SHOULD NOT RELY TOO MUCH ON MARKET REACTION TO GUIDE POLICY, GOOLSBEE SAYS (RTRS)

- RISHI SUNAK TELLS DUP: ‘NO CHANGES TO FRAMEWORK’ (THE TIMES)

- RUSSIAN DIESEL STUCK AT SEA AS MILD TEMPS FEND OFF ENERGY CRISIS (BBG)

- CHINA FINANCE MINISTER EXPECTS BETTER LOCAL GOV'T FISCAL SITUATION IN 2023 (RTRS)

- CHINA PAPER SHRUGS OFF WORRIES ABOUT MARKET LIQUIDITY CONCERNS (BBG)

- CHINESE PMIS COMFORTABLY TOP EXPECTATIONS

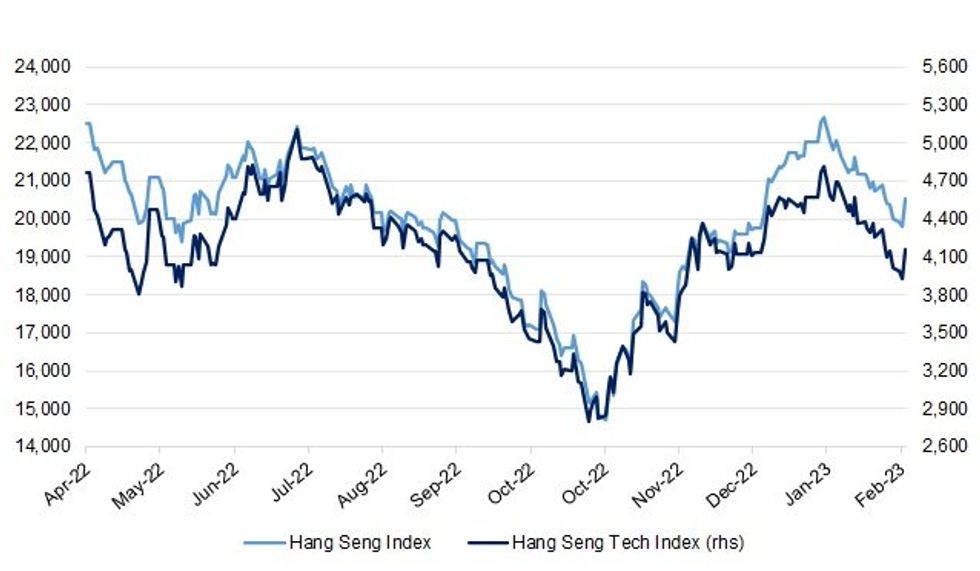

Fig. 1: Hang Seng & Hang Seng Tech Indices

Source: MNI - Market News/Bloomberg

UK

BREXIT: Rishi Sunak appealed to Tory MPs to back him and finally “get Brexit done” as he pledged yesterday to push ahead with or without the support of the DUP. (The Times)

BREXIT: Boris Johnson will not oppose Rishi Sunak’s Brexit deal because he can “see which way the wind is blowing”, allies have said. (The Times)

BREXIT: British Prime Minister Rishi Sunak will win parliamentary support for his deal on post-Brexit trade with Northern Ireland as his party realise it is as good a deal as Britain is going to get, junior minister Steve Baker said on Tuesday. (RTRS)

ENERGY/FISCAL: Chancellor Jeremy Hunt is examining plans to protect millions of British families from a looming spike in their monthly energy bills by reversing a planned cut in subsidies. (FT)

EUROPE

EU: Italy and Germany are against a European Union plan to start phasing out combustion engine cars that is pivotal to the bloc’s green agenda. (BBG)

ITALY: Italy expects a recent European Union agency's ruling on tax credits to have a small negative impact on its 2023 deficit, a Treasury official said on Tuesday, adding that stronger than expected economic growth will help offset the impact. Growth is expected at almost 1%, up from the 0.6% target set in November, the official said. (RTRS)

ITALY: Wages negotiations in Italy over the next few months should lead to pay rises averaging between 1.5%-2.5%, significantly below inflation and lower than elsewhere in Europe, officials at business lobbies and unions told MNI. (MNI)

BELGIUM: Belgium is selling about a third of its stake in BNP Paribas SA, a move that ends the country’s run as the bank’s largest shareholder. (BBG)

U.S.

FED: The Federal Reserve must supplement traditional government data and readings from financial markets with real-time, on-the-ground observations of economic conditions if it is to make good policy, Chicago Fed President Austan Goolsbee said on Tuesday. (RTRS)

FED: The board of directors of the Federal Reserve banks of Cleveland, St. Louis and Minneapolis voted in favor of a larger 50 basis point hike in the discount rate charged to banks for emergency loans before the February FOMC meeting, according to the latest discount rate meeting minutes published Tuesday. (MNI)

ECONOMY: U.S. workers in some interest-rate rate sensitive sectors are insulated from the Federal Reserve's rate hikes because of President Joe Biden's trillions in investments, although workers' leverage is moderating, Aaron Sojourner, a former member of the White House Council of Economic Advisers, told MNI. (MNI)

FISCAL: U.S. President Joe Biden said on Tuesday that his upcoming March 9 budget proposal to Congress will include some higher taxes, including on billionaires. Biden said he would not violate his pledge to not levy new fees on people making less than $400,000 a year. (RTRS)

POLITICS: Four new polls show former President Trump has received a boost in Republican support — with one survey showing him hitting 50% support in a crowded GOP field. (Axios)

OTHER

U.S./CHINA: The House Financial Services Committee on Tuesday advanced a raft of China-related sanctions bills, a sign of increasing hawkishness in the Republican-controlled chamber amid strained relations between Washington and Beijing. (BBG)

U.S./CHINA: A new U.S. congressional select committee on competition with China held its first hearing with a focus on human rights on Tuesday, amid tense bilateral ties weeks after a suspected spy balloon flying over North America was shot down. (RTRS)

U.S./CHINA: A Trump administration policy that allowed companies to ship some U.S. technology below the “5G level” to China’s blacklisted telecommunications equipment maker Huawei is “under assessment,” a key U.S. official said on Tuesday. (RTRS)

U.S./CHINA: For the first time in about 25 years, China is not a top three investment priority for a majority of US firms, with geopolitical tensions and domestic economic issues driving businesses to increasingly focus elsewhere, according to a new report. (BBG)

BOJ: Bank of Japan board member Junko Nakagawa said on Wednesday that the BOJ needs to maintain easy policy to firmly support the economy as the 2% price target hasn’t been achieved. (MNI)

BOJ: The Bank of Japan may downwardly revise its assessment on exports and industrial production from its upbeat view that both key economic components are trending higher following recent weaker-than-expected data, MNI understands. (MNI)

AUSTRALIA: Zeroing in on inflation, which “remains the No 1 challenge for the economy”, Jim Chalmers says: “While inflation is higher than we’d like, we’re cautiously hopeful that it has peaked and this is also the review of the Reserve Bank. The national accounts measure of consumer prices rose by 1.5% in the December quarter and 6.9% over the year.” (Guardian)

NEW ZEALAND: New Zealand house prices are set to fall further this year than previously thought, according to a Reuters poll of property analysts who forecast a peak-to-trough slump of over 20% as the central bank continues to hike interest rates aggressively. (RTRS)

NORTH KOREA: South Korean President Yoon Suk-yeol said on Wednesday that trilateral cooperation with the United States and Japan has become more important than ever to overcoming North Korea's growing nuclear threats and other crises. (RTRS)

BOC: The Bank of Canada will likely see weak fourth quarter GDP data released Tuesday as pointing to a welcome soft landing that will allow policymakers to follow through on the conditional commitment to pause after eight straight interest-rate hikes, former government economist Glen Hodgson told MNI. (MNI)

BRAZIL: Brazil will tax oil exports to raise an estimated 6.6 billion reais ($1.3 billion) while gradually removing fuel tax breaks in a victory for Finance Minister Fernando Haddad who’s struggling to shore up public finances. (BBG)

IRAN: Global atomic monitors reported Iran’s stockpile of highly-enriched uranium swelled to a record in the last three months and that inspectors are still trying to clarify how uranium enriched to just below weapons-grade was produced at a nuclear facility. (BBG)

CHILE: Chile’s President Gabriel Boric named Ricardo Alvarez and Eduardo Bitran as new directors of Codelco, the country’s state-owned copper supplier, according to a government statement. (BBG)

COLOMBIA: Colombia’s central bank will transfer the government 1.6 trillion pesos ($329 million) from its 2022 profits, the bank said in a statement after its monthly meeting, where it didn’t take interest rate decisions. (BBG)

OIL: A pile-up of Russian diesel stored on ships suggests buyers are shunning the sanctioned fuel as an exceptionally warm winter saps demand. (BBG)

OIL: Growth for oil production in US shale basins could slow this year amid labor shortages and supply chain snarls, according to Jesse Thompson, a senior business economist at the Federal Reserve Bank of Dallas. (BBG)

CHINA

ECONOMY: Experts expect the government to announce a GDP growth target of "above 5%" at the National People’s Congress starting this week, according to Yicai.com. (MNI)

FISCAL: China's local government fiscal situation is likely to improve as the economy rebounds this year, though debt risk for some authorities is high and repayment pressure is large, Minister of Finance Liu Kun said on Wednesday. (RTRS)

PBOC/MONEY MARKETS: There is no need to worry too much about recent liquidity tightening in the financial system as the PBOC will guide funding rates to fluctuate around policy rates, Shanghai Securities News reports, citing analysts. (BBG)

YUAN: Market sentiment towards the yuan remains strong despite the currency recently pushing up to 7 against the U.S. dollar, according to The 21st Century Herald. (MNI)

PROPERTY/BANKS: Under pressure from regulators, banks have begun accelerating the administration of mortgage prepayments and opened up previously “hidden” application channels, according to Yicai.com. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY193 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY107 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY193 billion after offsetting the maturity of CNY300 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0588% at 10:07 am local time from the close of 2.4209% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, compared with the close of 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9400 WEDS VS 6.9519 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9400 on Wednesday, compared with 6.9519 set on Tuesday.

OVERNIGHT DATA

CHINA FEB OFFICIAL MANUFACTURING PMI 52.6; MEDIAN 50.6; JAN 50.1

CHINA FEB OFFICIAL NON-MANUFACTURING PMI 56.3; MEDIAN 54.9; JAN 54.4

CHINA FEB OFFICIAL COMPOSITE PMI 56.4; JAN 52.9

CHINA FEB CAIXIN MANUFACTURING PMI 51.6; MEDIAN 50.7; JAN 49.2

Covid infections quickly reached its peak after a Covid policy shift, with the economy entering a post-Covid recovery period. But the impact of the pandemic remains far-reaching. Currently, the foundation for economic recovery is not yet solid, and it will take time to fully restore production and social order to normal. The central government said restoring and expanding consumption should be prioritized. Income and expectation are the basis of consumption. In the coming period, relevant policies should focus more on increasing household income and improving market expectations. (Caixin)

JAPAN, FEB, F JIBUN BANK MANUFACTURING PMI 47.7; PRELIM 47.4; JAN 48.9

Latest data pointed to continually deteriorating activity in the Japanese manufacturing sector midway through the first quarter of 2023. Both new orders and production levels, which make up 55% of the headline PMI figure, fell at the fastest pace since July 2020 as weak domestic demand and a global economic slowdown hindered sales and output volumes. (S&P Global)

AUSTRALIA JAN CPI +7.4% Y/Y; MEDIAN +8.1%; DEC +8.4%

AUSTRALIA Q4 GDP +0.5% Q/Q; MEDIAN +0.8%; Q3 +0.7%

AUSTRALIA Q4 GDP +2.7% Y/Y; MEDIAN +2.7%; Q3 +5.9%

AUSTRALIA, FEB, F JUDO BANK MANUFACTURING PMI 50.5; PRELIM 50.1; JAN 50.0

Australian manufacturing activity has stabilised over the summer starting 2023 on a solid footing. Most activity indicators such as output and new orders are hovering around the neutral 50 level while employment and pricing indicators remain strong. (Judo Bank)

AUSTRALIA FEB CORELOGIC HOUSE PRICE INDEX -9.1% Y/Y; JAN -8.7%

The national index declined -0.14% over the month, the smallest monthly fall since May 2022 (-0.13%), when rate hikes commenced. (CoreLogic)

NEW ZEALAND JAN BUILDING PERMITS -1.5% M/M; DEC -7.1%

NEW ZEALAND FEB CORELOGIC HOUSE PRICE INDEX -8.9% Y/Y; JAN -7.2%

The downturn in New Zealand’s property market reaccelerated last month, with values falling 1% in February, according to the CoreLogic House Price Index. (CoreLogic)

SOUTH KOREA FEB TRADE BALANCE -US$5.300BN; MEDIAN -US$6.011BN; JAN -US$12.651BN

SOUTH KOREA FEB EXPORTS -7.5% Y/Y; MEDIAN -8.8%; JAN -16.6%

SOUTH KOREA FEB IMPORTS +3.6% Y/Y; MEDIAN +4.1%; JAN -2.8%

UK FEB BRC SHOP PRICE INDEX +8.4% Y/Y; JAN +8.0%

MARKETS

US TSYS: Marginally Cheaper In Asia, Regional Data Drives Contained Two-Way Flows

TYM3 deals at 111-14, -0-07, just below the middle of its 0-06 range on volume of ~99K.

- Cash Tsys sit ~1bp cheaper across the major benchmarks.

- In early dealing Asia-Pac participants faded the month end flow-induced rally seen late in the NY session, also seemingly looking through the weak Consumer Confidence and MNI Chicago PMI prints.

- A recovery from session lows was facilitated by a bid in ACGBs in lieu of softer than expected monthly inflation data out of Australia.

- Gains were capped, with light pressure then see, in the wake of firmer than expected Chinese PMI data.

- In Europe today regional German and then national CPI, as well as final European Manufacturing PMIs headline. Further out U.S. Construction Spending and the ISM Manufacturing Survey will cross. We will also hear from Minneapolis Fed President Kashkari.

JGBS: Holding Firmer, Just

Events offshore largely drove JGBs on Wednesday. Initially, we saw cross-market spill over surrounding Australian data, as well as potential short trimming in lieu of reduced expectations for meaningful BoJ policy shifts in the immediate term (outside of YCC tweaks), support the JGB space in the Tokyo morning. Firmer than expected Chinese PMI data helped to cap the bid ahead of the lunch break, before applying some light pressure early in the Tokyo afternoon. That move extended into the close, with a lack of overt drivers present.

- Futures finished +4, comfortably shy of best levels. Technically, the contract is in a holding pattern.

- Cash JGBs sit little changed to ~1bp richer late on, with 7s leading, aided by the bid in futures. 10-Year JGB yields continue to hover incrementally below the BoJ’s YCC cap of 0.50%.

- BoJ board member Nakagawa stuck to the BoJ’s central line re: the need for continued monetary easing at present, while outlining question marks re: the scale of broad wage hikes that will be implemented in the immediate term and pointing to a fairly concentrated inflationary spike, which he expects to moderate soon.

- 10-Year JGB supply, an appearance from BoJ’s Takata and Q4 corporate performance data headline the domestic docket tomorrow.

AUSSIE BONDS: CPI & GDP Data Spark Rally, RBA Terminal Pricing Pulls Back

The market moving potential of today’s data didn’t disappoint with downside surprises from GDP and CPI sparking a short-end led ACGB rally as it threw weight behind the RBA’s forecast that inflation peaked in Q422. YM +9.0 & XM +6.5 at the close. Cash ACGBs close near session highs 6-9bp richer. AU/US cash yield differential tightens 6bp to -14bp, its lowest level since the RBA’s February meeting.

- Swaps strengthen with rates 7-9bp lower with the 3s10s curve 2bp steeper.

- Bills were +6-10bp richer (except IRH3) through the reds, with the back end of the whites leading.

- RBA-dated OIS pricing softens 7-15bp for meetings beyond May, with the front meetings -1 to -4bp. Terminal rate pricing closes at ~4.18% versus 4.35% yesterday.

- While substantial, it is important to remember that monthly CPI is volatile. Rather than a proper monthly series it is a rolling release measure, with the first month of the quarter only updating 62% of the basket.

- While largely ignored, China’s manufacturing PMIs beat. Commodity prices have to some extent factored in China’s reopening, but the RBA will be aware of the typical relationship between China PMIs, commodity demand, the terms of trade, and ultimately Australia’s nominal growth.

- With the market scaling back tightening expectations, ACGBs appear set for a period of outperformance. Nonetheless, the outright direction is still likely to be determined by events abroad.

AUSSIE BONDS: ACGB Nov-32 Auction Results

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 3.8927% (prev. 3.7520%)

- High Yield: 3.8950% (prev. 3.7575%)

- Bid/Cover: 2.7875x (prev. 2.3813x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 98.1% (prev. 5.3%)

- Bidders 61 (prev. 39), successful 22 (prev. 21), allocated in full 15 (prev. 16)

NZGBS: Mid-Session Reversal On Aussie Data

NZGBs reversed morning weakness in line with the post-data rally in ACGBs. Trans-Tasman downside surprises in Q4 GDP and more importantly, monthly CPI, sparked a short-end led rally in ACGBs as it threw weight behind the RBA’s forecast that inflation peaked in Q422. NZGBs followed suit with yields 4-5bp lower at the close, versus 4-5bp higher in early trade. The 2/10 cash curve was 1bp steeper. There was no real reaction to firmer than expected Chinese PMI data.

- NZGBs added to yesterday’s outperformance versus U.S. Tsys with the NZ/US cash yield differential narrowing 9bp for the 2-year and 5bp for the 10-year. The NZ-AU 10-year differential did however widen 3bp, unwinding yesterday’s narrowing.

- Swaps close 4-7bp lower, implying a slight narrowing in swap spreads, with the 2s10s curve 1bp flatter.

- RBNZ dated OIS ignored trans-Tasman moves to close a little firmer across meetings. April meeting pricing remains at 38bp of tightening with terminal OCR pricing back close to the RBNZ’s projected OCR peak of 5.50% at 5.47%.

- Today's local data was weak. CoreLogic’s house price index sank -8.9% Y/Y, the steepest annual decline since 2009, while January Building Permits recorded another M/M fall. Some rebound had been expected after the sharp decline in multi-unit consents in December. Today’s data pre-dated much of the recent severe weather.

- Elsewhere, the Treasury announced the appointment of JLMs for the syndication of the new May-30 NZGB, with expectations for the launch to take place next week, subject to market conditions.

EQUITIES: China/HK Shares Surge On China PMI Beats

Regional equities received a shot in the arm from the stronger than expected China PMI prints. Most of the benefit has been seen in terms of HK and China related shares, but most major indices are tracking higher at this stage. US futures are away from worst levels, with Eminis back to around flat.

- The HSI is up by 3.4% at this stage, with the high beta Tech sub-index +5% for the session so far. China mainland markets are seeing a more muted response, but the CSI 300 is still +1.50%. Northbound stock connect flows are positive, +6.5bn yuan, the first positive day of inflows since last Tuesday.

- The PMI beats point to stronger near term activity. This comes ahead of the upcoming People's Congress, which begins this weekend.

- Other markets have seen much more modest gains, with the Nikkei 225 +0.20% at this stage, while the ASX200 is around flat. Disappointing Q4 GDP data and concerns around slowed domestic spending weighing at the margins.

- Indian shares are higher, the Nifty +0.65% as it looks to move back above the 200-day MA.

GOLD: Prices Stabilising But February Was Very Negative

Gold prices are up 0.2% during APAC trading after rising 0.5% on Tuesday. This left them down 5.2% in February as Fed hawkishness and sticky US inflation weighed on the yellow metal. It is now around $1830.55/oz, close to the intraday high. The USD index is currently flat.

- Trend conditions remain bearish for gold and it continues to trade under the 50-day EMA. The next key level to watch is $1800 followed by $1787.30. A stronger-for-longer Fed pushes up the USD and Treasury yields which weigh on non-interest bearing bullion.

- Later today the February Global S&P manufacturing PMIs print and the US manufacturing ISM, which is forecast to rise to 48, and construction data. The Fed’s Kashkari is participating in a moderated discussion.

OIL: Crude Higher On China Demand Optimism Following PMIs

Oil has been steadily rising again since last week. Prices are up 0.5% during the APAC session after rising close to 1.5% on Tuesday, as China’s PMIs came in stronger than expected. WTI is currently trading around $77.45/bbl and Brent $83.90, both are close to their intraday highs. The USD index is down slightly.

- Brent has exceeded its 50-day simple moving average again and approaching the 100-day. WTI is approaching the 50-day MA, as it has underperformed Brent due to rising US crude stocks. WTI short-term support is at $73.80, the February 22 low. Moving average studies are in a bear-mode, thus the risks to WTI are pointing to the downside.

- API reported another large crude inventory build in the US of 6.2mn barrels after 9.89mn the previous week. Distillate fell 0.3mn and gasoline -1.8mn. The data reflects continued refining issues. The official EIA data is released later today. WTI reached an intraday low of $76.55 following this data and ahead of the robust February China PMI data, which bolstered commodities generally.

- Later today the February Global S&P manufacturing PMIs print and the US manufacturing ISM, which is forecast to rise to 48, and construction data. The Fed’s Kashkari is participating in a moderated discussion.

FOREX: USD Pressured, Regional Equities Firm Post China PMI

The greenback is pressured in Asia today, higher than expected Chinese PMI data saw regional equities firm and US Equity futures pared early losses weighing on the USD.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD prints at $0.6215/20, ~0.5% firmer today. The pair was pressured in the initial aftermath of weak Australian data, however losses were pared as risk appetite grew post China PMIs. The 20-day EMA at $0.6266 presents the next upside resistance.

- AUD/USD is ~0.3% firmer, printing $0.6750/55. AUD was pressured in the immediate aftermath of softer than expected Jan CPI and Q4 GDP. Support came in below $0.67, and the pair extended gains rallies in regional equities boosted risk flows. The pair sits a touch below yesterday's high at $0.6757.

- Yen is softer with risk-on flows marginally weighing. USD/JPY has observed a narrow 30 pip range and moves have been limited for the majority of the session.

- EUR and GBP are benefitting from the greenback weakness, both are ~0.2% firmer.

- Cross asset wise; S&P500 futures are flat having been down as much as 0.3%, and the Hang Seng is ~3% firmer. BBDXY is ~0.1% softer, US 10 Year Treasury Yields are ~1bp firmer.

- In Europe today regional German CPI and European Manufacturing PMIs headline. Further out US Construction Spending and the ISM Manufacturing Survey will cross.

FX OPTIONS: Expiries for Mar01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0425-35(E1.7bln), $1.0450(E793mln), $1.0495-10(E1.8bln), $1.0590-00(E1.2bln), $1.0690-05(E1.4bln), $1.0725(E913mln), $1.0850(E704mln)

- USD/JPY: Y134.85-00($1.2bln)

- EUR/GBP: Gbp0.8850(E1.2bln)

- AUD/USD: $0.6776-90(A$1.3bln)

- NZD/USD: $0.6165(N$640mln), $0.6250(N$1.2bln)

- USD/CAD: C$1.3580($500mln), C$1.3600-20($859mln)

- USD/CNY: Cny6.9000($637mln), Cny7.2500($2.0bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 01/03/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 01/03/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 01/03/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/03/2023 | 1000/1000 |  | UK | BOE Bailey Speech at Cost of Living Crisis Conference | |

| 01/03/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/03/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2023 | 1400/0900 |  | US | Minneapolis Fed's Neel Kashkari | |

| 01/03/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.