-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Policy Support Speculation Evident,Jackson Hole Eyed

EXECUTIVE SUMMARY

- FED'S KAPLAN CALLS FOR TAPERING ANNOUNCEMENT IN SEPTEMBER (YAHOO FINANCE)

- BIDEN ADVISERS WEIGH POWELL AS FED CHAIR, BRAINARD AS VICE CHAIR (BBG)

- ANALYSTS: PBOC EXPECTED TO STEP UP CREDIT SUPPLY SOON (CSJ)

- CHINA MOF ASKS TO MODERATELY SPEED UP SPECIAL BOND ISSUANCE (BBG)

- BIDEN VOWS TO PRESS AHEAD WITH AFGHAN EVACUATION DESPITE ATTACKS (FT)

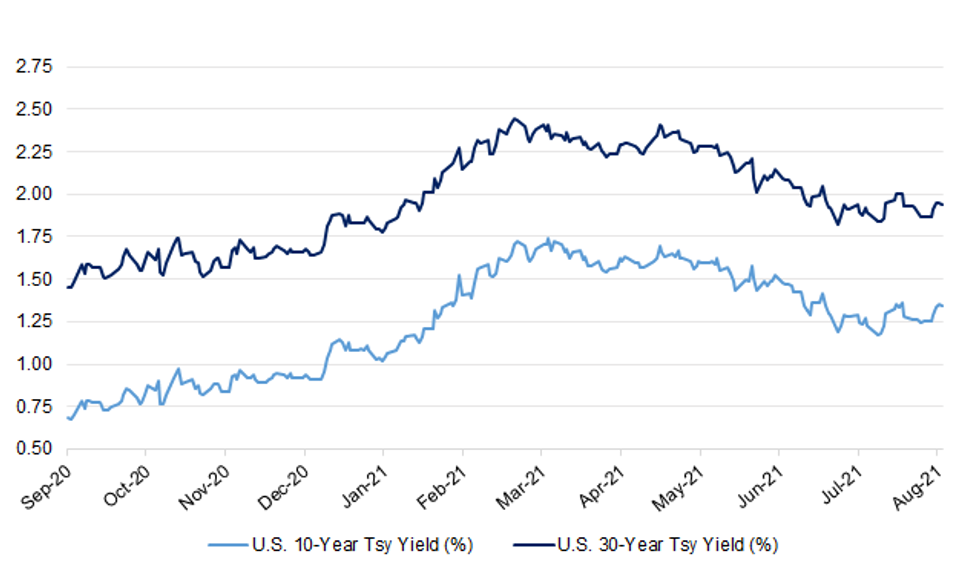

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Britain and the European Union can sensibly solve issues over Northern Ireland's post-Brexit trading arrangements with the right political will, Irish Prime Minister Micheál Martin said after meeting French President Emmanuel Macron on Thursday. (RTRS)

BREXIT: The European Union will force Britain to stick to the Northern Ireland Protocol and never abandon Dublin during tough talks over the Irish Sea border, Emmanuel Macron, the French president, warned on Thursday. (Telegraph)

EUROPE

FRANCE: Ex-Brexit negotiator Michel Barnier said he will challenge French President Emmanuel Macron in presidential polls, AFP tweeted on Thursday. (RTRS)

FRANCE: The fourth wave of COVID-19 infections is receding in France but is not over yet, French Health Minister Olivier Veran said on Thursday. (RTRS)

ITALY/BTPS: Italy plans to sell up to 2.5 billion euros ($2.9 billion) of 0 percent bonds due Aug 1, 2026 in an auction on Aug 31. Italy plans to sell up to 3.25 billion euros ($3.8 billion) of 0.95 percent bonds due Dec 1, 2031 in an auction on Aug 31. Italy plans to sell up to 2 billion euros ($2.35 billion) of floating bonds due Apr 15, 2029 in an auction on Aug 31. (BBG)

RATINGS: Potential rating reviews of note scheduled for after hours on Friday include:

- Fitch on Poland (current rating: A-; Outlook Stable)

- Moody's on The European Financial Stability Facility (current rating: Aa1; Outlook Stable), The European Stability Mechanism (current rating: Aa1; Outlook Stable) & France (current rating: Aa2; Outlook Stable)

- DBRS Morningstar on Portugal (current rating: BBB (high), Stable Trend), Slovakia (current rating: A (high), Stable Trend) & Sweden (current rating: AAA, Stable Trend)

U.S.

FED: MNI: Jackson Hole Tackles 'Uneven Economy,' Low Rates, Fiscal

- Jackson Hole will be dominated by five sessions on an "uneven" economic recovery and how monetary and fiscal policy can tackle the Covid rebound, following a keynote on the outlook from Federal Reserve Chair Jerome Powell - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Dallas President Robert Kaplan said rising concerns over the spread of the Delta variant have not materially changed his call to start the process of pulling back on the central bank's extraordinary monetary stimulus in September. "I'm going to be suggesting that we should move toward announcing a plan as early as our September meeting and begin our tapering process in October," Kaplan told Yahoo Finance in an interview on Thursday. Kaplan's comments come as the policy-setting Federal Open Market Committee weighs the timing of taking the first steps in slowing its accommodative monetary policy, which has involved near-zero interest rates and a "quantitative easing" program that is currently absorbing about $120 billion in assets every month. (Yahoo Finance)

FED: President Joe Biden's advisers are considering recommending Jerome Powell for a second term as Federal Reserve chair paired with Lael Brainard as the central bank's chief regulator, people familiar with the matter said, a plan that could assuage progressives resistant to a second term for Donald Trump's Fed chief. Biden has not yet weighed in on Fed personnel decisions and his decision is not expected until fall, the people said.

CORONAVIRUS: Texas Governor Greg Abbott deployed another 2,500 medical staff and equipment to health care facilities throughout the state as the hospitalization rate nears a record set in January. The Lone Star state had 13,928 hospitalized patients on Tuesday, close to the record 14,218 set on Jan. 11, before vaccinations became more widespread. Almost half of the state's trauma service areas had fewer than five beds available in intensive care units, with four areas having run out of them altogether. The new deployment brings the total number of additional, state-funded medical personnel to 8,100. (BBG)

CORONAVIRUS: Bed and staffing shortages could push New Mexico hospitals to ration care in a matter of days, the Santa Fe New Mexican reported. About 50 patients were on intensive care unit waiting lists as of Wednesday, according to the newspaper. "Our hospitals are virtually full" and New Mexico could implement so-called crisis care standards if nothing changes, David Scrase, state human services secretary and acting health secretary, was quoted as telling reporters on Wednesday. Faced with the delta variant, officials in Idaho also said this week they may have to ration care. (BBG)

CORONAVIRUS: Illinois Governor J.B. Pritzker, a Democrat, issued a statewide indoor mask mandate starting Monday and expanded vaccine requirements, saying "we are running out of time as our hospitals run out of beds." Pritzker's administration required this month that employees at state-run congregate facilities be vaccinated. That mandate now expands to all health-care workers, including those in public and private nursing homes; teachers and staff at Pre-K through 12th grade schools; and personnel and students at higher education institutions. Covered individuals must receive their first dose by Sept. 5 or be subject to regular testing. The shrinking hospital-bed capacity is mostly due to tight staffing, rather than space constraints, Pritzker told a news conference. (BBG)

CORONAVIRUS: Kentucky Gov. Andy Beshear (D) said Thursday that the record-high surge in COVID-19 cases would have led to a statewide mask mandate if that authority still lay with him. Kentucky's Supreme Court recently transferred authority over pandemic-related decisions, including masking, to the GOP-controlled state legislature, according to Beshear. (Axios)

PROPERTY: A divided U.S. Supreme Court lifted the Biden administration's moratorium on evictions, ending protections for millions of people who have fallen behind on rent payments during the Covid-19 pandemic. Siding with landlords who said they were being subjected to unwarranted hardships, the court said the moratorium exceeded the authority of the U.S. Centers for Disease Control and Prevention. "It strains credulity to believe that this statute grants the CDC the sweeping authority that it asserts," the court said in an unsigned opinion. (BBG)

OTHER

GLOBAL TRADE: China will extend anti-dumping investigation on certain glycol ethers imported from the U.S., given the complexity of the case, according to a statement on Ministry of Commerce website. (BBG)

U.S./CHINA: U.S. special climate envoy John Kerry plans another trip to China next week, where he will press Chinese leaders to declare a moratorium on financing international coal-fired projects, according to people familiar with the matter. Beijing hasn't funded any new foreign coal plants or investments this year—the first time that has happened since China embarked on its infrastructure Belt and Road Initiative in 2013, according to a recent study by the Beijing-based International Institute of Green Finance. U.S. officials now want Beijing to declare a formal halt to such projects, according to one of the people. (WSJ)

HONG KONG: A senior Hong Kong official has admitted that the city's stringent travel quarantine regime had caused "suffering" for international businesses as executives warned that its reputation as a global financial hub was under threat. Edward Yau, Hong Kong's secretary for commerce and economic development, has held talks with representatives from the territory's business community after the government abruptly revised plans to relax travel restrictions this month. After indicating that it would significantly ease the bulk of its travel curbs in June, Hong Kong reversed its decision last week, increasing the time that travellers must spend in quarantine from one to three weeks in most cases. The U-turn caused chaos for travellers and a shortage of designated quarantine hotel rooms for people entering the city. (FT)

JAPAN: Japan has sufficient reserve funds to deal with the latest virus wave without needing to put together an extra budget to provide more money, Finance Minister Taro Aso says. Don't see a shortage of virus-related funds at this stage, though that status depends on developments, Aso tells reporters Friday. Around 2.6 trillion yen ($23.6 billion) remains in the reserve funds to deal with the pandemic. (BBG)

AUSTRALIA: Australian children aged between 12 and 15 will be eligible to book Pfizer vaccinations from Sept. 13 after health authorities approved its use, Prime Minister Scott Morrison announced on Friday. The move follows a decision earlier this month to allow 16 to 39 year-olds to get Pfizer doses. Still, there's no guarantees younger Australians will quickly be able to get vaccinated, with the nation's rollout hampered by a lack of supply that's been blamed by health experts on Morrison failing to sign enough contracts with a broad enough range of drug-makers. About a quarter of Australians are now fully vaccinated. Morrison is trying to ramp up the program so the nation can start lifting lockdown restrictions that are currently impacting more than half its 26 million people, amid an outbreak of the delta variant that's infecting hundreds of Sydney residents a day and spreading to other parts of the continent. (BBG)

AUSTRALIA: NSW students will begin returning to school from October 25, when kindergarten and year 1 students will go back to class and year 12 will get full access to their school ahead of a delayed HSC, which will begin on November 9, school principals were told on Friday. Years 2, 6 and 11 will return on November 1, and the rest of the students will head back on November 8, which is the sixth week of term four. However, there remains a question mark over whether schools in LGAs of concern will re-open in this timeframe. Teachers must be vaccinated. "Double doses of COVID vaccinations will be mandatory for any staff on school sites from 25 October and for all school staff from 8 November," the NSW Department of Education told principals in an email. (Sydney Morning Herald)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern extended a national lockdown for a further four days as a coronavirus outbreak continues to grow, but said some restrictions outside largest city Auckland will be eased next week. The strict Level 4 lockdown will remain in place until midnight on Aug. 31. For Auckland, the epicenter of the outbreak, and the neighboring Northland region, Level 4 is likely to stay in force for another two weeks. However the rest of New Zealand can move to Level 3 -- a slightly milder lockdown in which some businesses can resume operations -- from Sept. 1, Ardern said. (BBG)

MEXICO: Mexico's president named Tabasco Governor Adan Augusto Lopez as his new interior minister Thursday, replacing Olga Sanchez Cordero, in the third cabinet change since midterm elections in June. Andres Manuel Lopez Obrador said in a video statement that the governor of his home-state would step into the cabinet role in order to help with the "country's transformation." (BBG)

MEXICO: The United States has urged Mexico to clear ad-hoc camps housing thousands of migrants in border cities due to concerns they pose a security risk and attract criminal gangs, officials familiar with the matter said. Facing domestic criticism over a jump in illegal crossings at the U.S.-Mexico border, the administration of U.S. President Joe Biden has pressed Mexico to curb the flow of migrants to help ease pressure on the nearly 2,000 mile (3,200 km) frontier. (RTRS)

BRAZIL: A majority of Brazil's Supreme Court justices have voted to uphold the constitutionality of a law granting the central bank formal autonomy, a key piece of legislation considered by investors as a victory for monetary policy making in Latin America's largest economy. Eight justices voted in support of the law on Thursday, and two against. "Countries with an independent central bank have a good experience with it," Chief Justice Luiz Fux said during an event hosted by XP Investimentos earlier on Thursday, adding that he sees the autonomy given to Brazil's policy makers as a great advance. (BBG)

BRAZIL: Some hydroelectric plants will cease to function if the hydrological crisis continues, Brazil's President Jair Bolsonaro said in a weekly live on social networks. Bolsonaro said that most hydroelectric plants are at 10-15% of storage capacity. Brazil is at the limit of the limit. Increasing electricity rates would not be fair, the president said. Bolsonaro said he expects governors to withdraw ICMS tax from a energy rate. Bolsonaro called on Brazilians to save energy at home. Bolsonaro said that food inflation is high. Mobility restrictions ordered by governors during the pandemic is the reason for the rise in inflation. (BBG)

BRAZIL: Brazil's Monetary Council authorized the Central Bank to extend the term of the swap contract with the Federal Reserve to Dec. 31 from Sept. 30, according to a statement published on the BC website. Operations are limited to $60b, central bank said in another release. On March 19, 2020, both central banks had announced the establishment of a $60b liquidity swap line, expanding the potential dollar offer in the domestic market. (BBG)

SOUTH AFRICA: South Africa's ruling African National Congress has been forced to scale back its campaigning ahead of upcoming municipal elections because it has run short of cash. "We will have to tighten the belt," Paul Mashatile, the party's treasurer-general, said in an interview on Thursday. "We will do what is economically affordable to us." (BBG)

AFGHANISTAN: Joe Biden vowed to plough ahead with the evacuation of those trying to flee Afghanistan and punish the perpetrators of an attack outside Kabul's airport that killed at least 13 US troops and scores of Afghans. At the end of what one aide called "maybe the worst day" of his eight month-old presidency, the US president attempted to appear both a sombre mourner-in-chief and a resolute leader steeling the nation for what could be a difficult final withdrawal from the Afghan capital, which he aims to complete by Tuesday. "We will not be deterred by terrorists, we will not let them stop our mission. We will continue the evacuation," Biden said in remarks at the White House on Thursday afternoon. "We will not forgive. We will not forget. We will hunt you down and make you pay." (FT)

AFGHANISTAN: The UK will continue its operation to evacuate people from Afghanistan despite the "despicable" attack at the capital's airport, Boris Johnson says. Speaking after an emergency meeting, the PM pledged the UK would be working "flat out" until "the last moment". But he also acknowledged the push was nearing its conclusion, with hours remaining. (BBC)

AFGHANISTAN: The claim of responsibility from the Islamic State for the devastating suicide bombing at Kabul airport came as little surprise to analysts. The organisation's affiliate in Afghanistan known as Islamic State Khorasan Province (ISKP), had been pointed to as the prime suspect immediately after the blast. (Guardian)

IRAN: Russian Foreign Minister Sergei Lavrov told his Iranian counterpart Hossein Amirabdollahian that talks on the Iranian nuclear deal in Vienna should restart as soon as possible, the Russian foreign ministry said on Thursday. (RTRS)

ISRAEL: A White House meeting between U.S. President Joe Biden and Israeli Prime Minister Naftali Bennett was rescheduled to Friday, a White House official and an Israeli official said on Thursday. (RTRS)

OIL: U.S. energy companies on Thursday began airlifting workers from Gulf of Mexico oil production platforms and moved vessels from the path of what could become a devastating hurricane by the weekend. A storm is brewing in the Caribbean Sea and is forecast to grind through the main oil-producing region of the Gulf this week. It could become a major hurricane ahead of landfall on the central Gulf Coast, the National Hurricane Center said. Hurricanes with winds of up to 111 miles (178 km) per hour are classified as major and can bring devastating damage onshore. (RTRS)

OIL: State-run Petroleos Mexicanos' efforts to restore oil production at an offshore cluster hit by a fatal weekend fire could lag official projections, people close to the matter said, as re-connecting wells is proving more difficult than planned. About a quarter of Mexico's oil output was halted by the accident that took over 400,000 barrels per day (bpd) offline at the country's largest production hub, Ku-Maloob-Zaap (KMZ). Seven workers were killed and six injured in the blaze, which was extinguished over the weekend. (RTRS)

CHINA

PBOC: The People's Bank of China has sent stronger signals for loosening credit with another round of RRR cut very likely, the China Securities Journal said citing analysts. The central bank, jointly with five other agencies, urged more financial support for rural revival and poverty alleviation, the latest sector to receive loose credit after innovation, manufacturing, green development and SMEs, the newspaper said. A loose-credit environment is being solidified and structural policy tools are expected to lead, the journal said. However, policies are likely to remain tight for local government financing vehicles and the property industry, said the newspaper. (MNI)

ECONOMY: China must take precautions to stabilize growth and ensure employment given the possible declines in real estate investment and exports demand in H2, especially in Q4, the Economic Information Daily said in a front-page commentary. China should speed up the issuance of local government special bonds to boost infrastructure investment and maintain a relatively loose monetary policy to support SMEs in difficulties, the newspaper said. China needs to boost demand and investment, the daily said. As longer term strategies, China should find new growth drivers and reform to activate the rural land market and develop metropolitan circles, as well as reduce the costs of raising children, further liberalize market access for power, telecommunications, railways, and petroleum, the newspaper said. (MNI)

BONDS: China will accelerate fiscal spending and moderately speed up local government special bond sales, Ministry of Finance says in a statement. MOF will guide local governments to boost project pipeline for future special bond sales. MOF will continue to focus on preventing and dissolving risks in local government implicit debt. The ministry will also support an orderly approach to achieve carbon neutrality and ecological protection. (BBG)

BONDS: China's green bond issuance scale in the first half exceeded the total of last year, including CNY67 billion in July, the 21st Century Business Herald reported. In H1, central-government SOEs accounted for about 57% of the total raised funds, while local SOEs accounted for 40%, the newspaper said. Carbon-neutral bonds launched by clean transportation and new energy industry in February were popular, the newspaper said. Other new types of green bonds emerged since this year included sustainability-linked bonds, rural revitalization bonds, and blue bonds, the newspaper said. (MNI)

MARKETS: Chinese regulator plans to launch index fund linked to negotiable certificates of deposit, Securities Times reports, without citing anyone. It shows the government's intention to curb excessive growth of money market funds. The value of China's money market funds increased 4.95% on month to 9.73t yuan at end-July, the biggest single month increase within 3 months, the report cites data from Asset Management Association of China. (BBG)

OVERNIGHT DATA

CHINA JUL INDUSTRIAL PROFITS +16.4% Y/Y; JUN +20.0%

JAPAN AUG TOKYO CPI -0.4% Y/Y; MEDIAN -0.3%; JUL -0.4%

JAPAN AUG TOKYO CORE CPI 0.0% Y/Y; MEDIAN -0.1%; JUL -0.3%

JAPAN AUG TOKYO CORE-CORE CPI -0.1% Y/Y; MEDIAN -0.2%; JUL -0.4%

AUSTRALIA JUL RETAIL SALES -2.7% M/M; MEDIAN -2.5%; JUN -1.8%

NEW ZEALAND AUG ANZ CONSUMER CONFIDENCE INDEX 109.6; JUL 113.1

Households' response to whether it was a good time to buy a major household item eased in August, but this may reflect that it's likely that a few late-sample responses were taken in a time when buying a major household item was impossible. The data is pretty hypothetical in any case, given most shops are currently shut. The mood of the consumer is better captured in this week's June quarter retail trade data, where sales volumes came in at a very strong3.3%q/q, building on impressive 2.8% growth in the first three months of this year. This spend-up reflects wealth effects from the housing boom, for those roughly two thirds who own a house, and this time, excellent job security in an exceptionally tight labour market. (ANZ)

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation injected net CNY40 billion into the market as there is CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2912% at 09:26 am local time from the close of 2.3315% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 42 on Thursday vs 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4863 FRI VS 6.4730

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4863 on Friday, compared with the 6.4730 set on Thursday.

MARKETS

SNAPSHOT: Chinese Policy Support Speculation Evident, Jackson Hole Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 133.9 points at 27608.43

- ASX 200 down 0.123 points at 7491.1

- Shanghai Comp. up 17.166 points at 3518.83

- JGB 10-Yr future down 10 ticks at 152.11, yield down 0.1bp at 0.025%

- Aussie 10-Yr future down 1.5 ticks at 98.81, yield up 1.7bp at 1.205%

- U.S. 10-Yr future -0-00+ at 133-18+, yield down 0.67bp at 1.342%

- WTI crude up $0.64 at $68.06, Gold up $6.7 at $1799.15

- USD/JPY down 12 pips at Y109.97

- FED'S KAPLAN CALLS FOR TAPERING ANNOUNCEMENT IN SEPTEMBER (YAHOO FINANCE)

- BIDEN ADVISERS WEIGH POWELL AS FED CHAIR, BRAINARD AS VICE CHAIR (BBG)

- ANALYSTS: PBOC EXPECTED TO STEP UP CREDIT SUPPLY SOON (CSJ)

- CHINA MOF ASKS TO MODERATELY SPEED UP SPECIAL BOND ISSUANCE (BBG)

- BIDEN VOWS TO PRESS AHEAD WITH AFGHAN EVACUATION DESPITE ATTACKS (FT)

BOND SUMMARY: Core FI Coils Ahead Of Jackson Hole

It was a relatively lethargic Asia-Pac session for core FI markets, with a distinct lack of meaningful headline flow evident ahead of the virtual Jackson Hole event.

- T-Notes last dealing -0-01 at 132-18, sticking to a 0-04 range thus far. Cash Tsys deal little changed to 1.0bp richer across the curve. Broader flow has been subdued once you net off the impact of rolls in the futures space. Upside exposure has provided the only real highlight on the flow side, with a 10K screen buyer of TYV1 135.50 calls seen. Fed Chair Powell's Friday address headlines the aforementioned Jackson Hole event. NY hours will also see the release of July's PCE data suite and the final UoM sentiment reading for August. A raft of Fedspeak surrounding Jackson Hole fills out the docket.

- Fairly sideways Tokyo trade for JGB futures, with the contract last -10 ticks after a very modest uptick at the re-open, which faded. Benchmark cash JGB yields are virtually unchanged across the curve. The only real local headlines of note saw Japanese Finance Minister Aso play down an "urgent need" to raise funds via a supplementary budget.

- Aussie bond futures continue to hold to tight ranges, with YM -1.0 and XM -1.5 at typing. There were no surprises in the release of the AOFM's weekly issuance slate, meanwhile the latest round of ACGB Nov '24 supply saw a steady cover ratio as the weighted average yield printed 0.67bp through prevailing mids at the time of supply (per Yieldbroker). Elsewhere, the daily COVID case count out of NSW moderated back below 1.0K, pulling back from yesterday's all-time highs. On the data front July's retail sales print was marginally softer than expected. Still, these events haven't impacted the space.

JGBS AUCTION: Japanese MOF sells Y4.0619tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0619tn 3-Month Bills:

- Average Yield -0.1202% (prev. -0.1239%)

- Average Price 100.0300 (prev. 100.0309)

- High Yield: -0.1162% (prev. -0.1162%)

- Low Price 100.0290 (prev. 100.0290)

- % Allotted At High Yield: 92.6187% (prev. 49.4865%)

- Bid/Cover: 4.566x (prev. 5.025x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 0.2599% (prev. 0.2971%)

- High Yield: 0.2625% (prev. 0.3000%)

- Bid/Cover: 4.7850x (prev. 4.7875x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 25.6% (prev. 6.8%)

- Bidders 52 (prev. 44), successful 20 (prev. 15), allocated in full 11 (prev. 7)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 1 September it plans to sell A$1.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 2 September it plans to sell A$1.0bn of the 26 November 2021 Note & A$1.0bn of the 25 March 2022 Note.

- On Friday 3 September it plans to sell A$1.0bn of the 2.75% 21 November 2027 Bond.

EQUITIES: Asian Equities Marginally Mixed, E-Minis Edge Higher Overnight

The negative lead from Wall St., which centred on Thursday's attack on Kabul airport, applied some pressure to the major local indices during early Asia-Pac dealing, although that impulse faded a little with the focus moving to the potential for an uptick in Chinese credit provisions and perceptions surrounding the chances for a targeted RRR cut. This allowed Chinese/HK indices to outperform, lodging marginal gains, although the broader ranges were generally limited ahead of Fed Chair Powell's Friday address. E-minis were marginally higher after yesterday's modest dip.

OIL: Bouncing Back In Asia

WTI and Brent futures sit ~$0.70 above their respective settlement levels after shedding somewhere in the neighbourhood of ~$1.00 come settlement time on Thursday. In terms of idiosyncratic news flow, the potential for a slower than expected resumption of a PEMEX production outage has become apparent, per RTRs sources. Elsewhere, U.S. energy companies have started airlifting workers from their Gulf of Mexico oil production platforms and shutting in production owing to the well-documented hurricane situation in the region. Speculation surrounding the potential for a looser credit situation in China may also be providing some support during Asia-Pac trade.

GOLD: Back Near $1,800/oz

Bullion continues to operate within the recently observed range after yesterday's attack on Kabul airport allowed spot to recover from $1,780/oz, with the $1,800/oz mark now within touching distance once again. Fed Chair Powell's Friday address is keenly awaited, with the technical parameters unchanged ahead of the event.

FOREX: Cautiously Awaiting Powell's Speech

Modest risk-off flows emerged in early Asia-Pac trade as regional participants reacted to headline flow surrounding deadly attacks by the Afghan affiliate of ISIS outside Kabul airport and U.S. Pres Biden's pledge to retaliate. This initial impetus moderated thereafter, as the Asia-Pac session failed to provide much in the way of notable catalysts ahead of a much awaited speech from Fed Chair Powell.

- NZD underperformed at the margin with the local outbreak of Covid-19 under scrutiny. PM Ardern extended the national level 4 lockdown through the month-end and said that Auckland will likely remain in level 4 for another two weeks. The alert level for the rest of the country may be lowered to 3 from next Wednesday.

- The yen led gains in G10 FX space, looking through marginally mixed Tokyo CPI data. Japanese FinMin Aso said that there is no urgent need to put together another extra budget.

- The virtual Jackson Hole symposium takes centre stage today, with the address from Fed Chair Powell set to provide most interest.

- Also due today are U.S. personal income/spending & final University of Michigan Sentiment as well as Swedish GDP & retail sales.

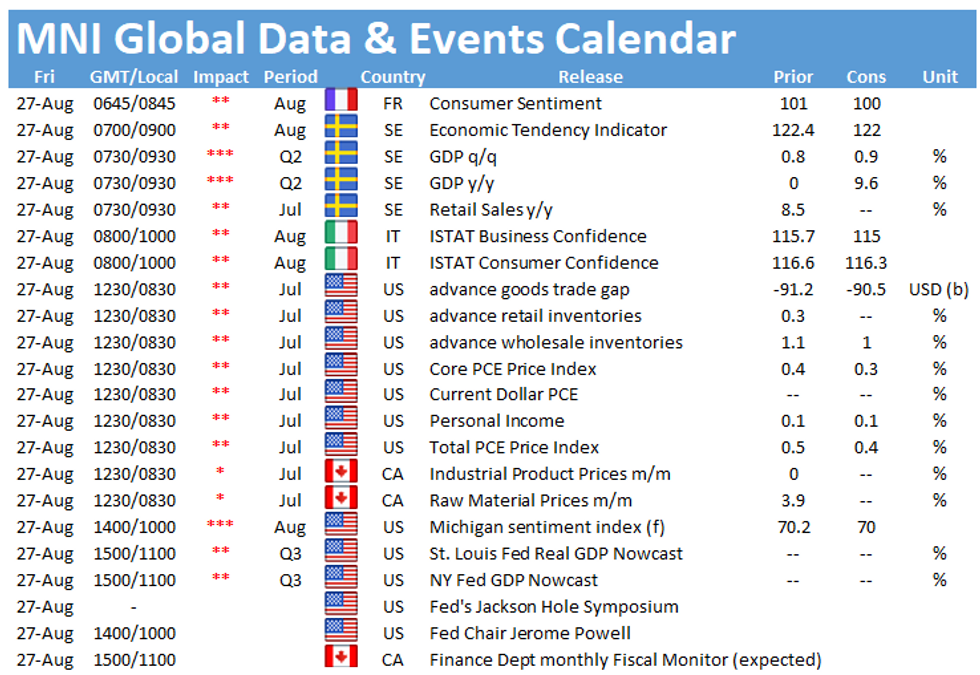

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.