-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Regulatory Scrutiny Dents Risk

EXECUTIVE SUMMARY

- CHINA SAYS U.S. TIES IN STALEMATE AT START OF TIANJIN MEETING

- CHINA STARTS CRACKDOWN ON ILLEGAL ACTIVITIES IN INTERNET SECTOR (BBG)

- CHINA BANS FOR-PROFIT EDUCATION FIRMS, SENDING SHARES TUMBLING (BBG)

- PELOSI SAYS INFRASTRUCTURE WON'T GET VOTE WITHOUT LARGER PLAN

- UK COVID CASELOAD IMPROVES AGAIN, PLENTY OF QUESTIONS REMAIN

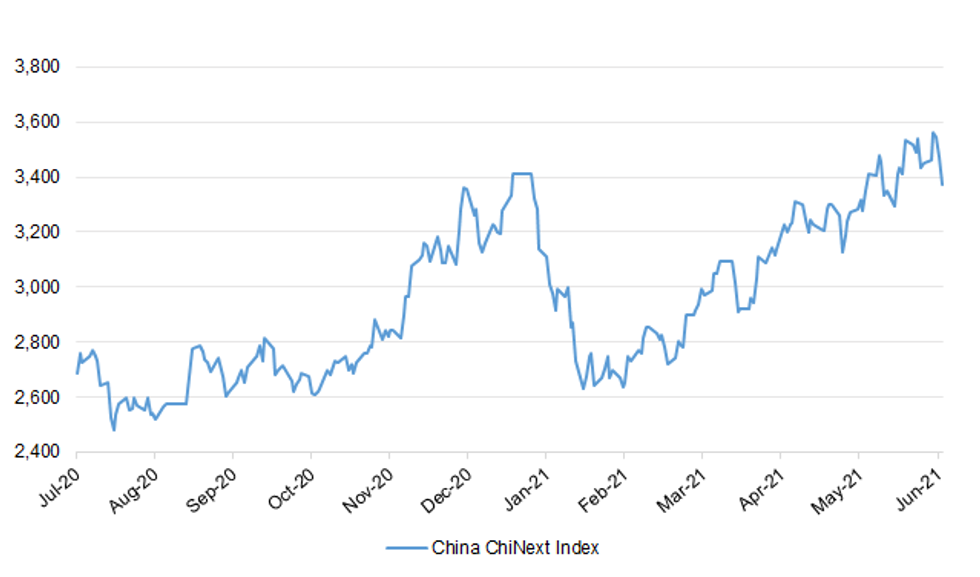

Fig. 1: China ChiNext Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The number of new COVID cases in the UK has continued to fall for a fifth day, according to government data. The country has recorded 29,173 new cases, compared to 31,795 infections recorded on Saturday, and 48,161 recorded this time last week. A total of 28 deaths within 28 days of a positive test were reported on Sunday. On Saturday, 86 deaths were reported and 58 were recorded at the same time last week. (Sky)

CORONAVIRUS: Health experts have warned the government that it needs to increase efforts to ensure more young adults are vaccinated against Covid-19 – as a matter of urgency. They fear the current low take-up of jabs among 18- to 25-year-olds could lead to a pile-up of vaccine campaigns in September, when other groups are scheduled to get booster injections and also to be inoculated against influenza. In addition, they argue that vaccines also have a crucial role to play in protecting young adults against long Covid, which is now recognised as a serious problem associated with the disease. (Observer)

CORONAVIRUS: Politicians and scientists in the UK are concerned that people are deleting the official Covid-19 mobile phone app, or at least switching off its tracing function, to avoid having to self-isolate. Just under 620,000 people in England and Wales were "pinged" by the National Health Service Covid-19 app and told to isolate in the past week -- a record, and up from around 530,000 the week before, official figures show. (BBG)

CORONAVIRUS: A scheme to allow key workers to avoid Covid self-isolation in England has been significantly expanded following criticism it did not go far enough. Police, fire, Border Force, transport and freight staff will now be able to join a daily workplace test scheme, whether they are vaccinated or not. It follows the announcement that up to 10,000 supermarket depot and food factory workers would be eligible. Warnings of staff shortages have come from several sectors in recent days. (BBC)

CORONAVIRUS: Supermarket depot workers and food manufacturers in England will be exempt from quarantine rules as the government tries to prevent food supply problems. The government had initially promised to begin testing at 15 "crucial" supermarket depots on Friday. But the BBC has learned that testing will be delayed until Monday 26 July. (BBC)

CORONAVIRUS: Ministers have been warned that the UK does not have the testing capacity to bring the "pingdemic" to an immediate end. (Telegraph)

CORONAVIRUS: Union leaders have launched a battle against Government plans to end the pingdemic in a move that threatens a summer of disruption for holidaymakers, shoppers and commuters. Critical workers are able to avoid self isolation via a Government scheme launched amid fears key infrastructure could collapse under the pressure of hundreds of thousands being told to stay at home by the NHS app. However, leaders of the UK's largest unions are now encouraging key workers, including in transport and food, to ignore the exemption and stay at home, citing fears that they could be exposed to Covid-19 in the workplace, the Telegraph can reveal. The move risks causing chaos at airports as the summer holidays begin, with a minister already forced to apologise for delays at the border which he blamed on the pingdemic. (Telegraph)

CORONAVIRUS: London Mayor Sadiq Khan urged Boris Johnson's government to relax isolation rules for vaccinated people who come into contact with a Covid-19 case, with the UK capital facing major disruption. Hospitality businesses such as pubs and restaurants face staff shortages and some are having to close due to the so-called pingdemic, Khan wrote in a letter to Johnson on Saturday. People should be exempt from self-isolating if they have had both vaccine doses and get a negative PCR test, he said. (BBG)

CORONAVIRUS: University students will have to be fully vaccinated to attend lectures or stay in halls of residence under plans being pushed by Boris Johnson. The prime minister is said to have been "raging" about the relatively low vaccine uptake among young people and is determined to apply pressure. During video meetings with colleagues while in isolation at Chequers last week, he suggested that students in higher and further education settings should face compulsory vaccination, subject to certain medical exemptions. However, The Times has been told that the Department for Education has reservations about the legality and practicability of the plans given that universities are independent and offers to study are legally binding. (The Times)

CORONAVIRUS: Premier League football fans who have not been fully vaccinated could be barred from attending matches from October under plans expected to be signed off by ministers, The Telegraph can disclose. (Telegraph)

CORONAVIRUS: Restrictions on travel from France are likely to be dropped next week as part of a review of the government's traffic light system, The Times has learnt. France is expected to be removed from the so-called amber-plus list after government officials appeared to acknowledge the threat from the Beta variant of the coronavirus had been contained. Sources said the Delta variant, which is prevalent in the UK, was spreading faster and would "out-compete" Beta in Europe in the next weeks. It is also unlikely that Spain and Greece will be added to the amber-plus list despite a rise in case rates and speculation over their statuses. (The Times)

CORONAVIRUS: Double-vaccinated expats are set to be free to travel to the UK, as the Government plans to recognise foreign jabs from August 1. (Telegraph)

BREXIT: Boris Johnson was ready to overhaul the Northern Ireland Protocol this week but was talked down by his Brexit minister Lord Frost, The Telegraph has learnt. With the UK now demanding a renegotiation of the post-Brexit arrangements for Northern Ireland, The Telegraph has been told Mr Johnson is now convinced of the need to use the so-called "nuclear option" if Brussels refuses. It is understood that the warning was issued to Dublin this week, with UK officials making clear that it is Mr Johnson, rather than Lord Frost, who is most in favour of triggering Article 16 should the EU fail to change course. (Telegraph)

BREXIT: The UK government said it will scrap a piece of planned red tape on wine imports. a move it said would save 10 pence ($0.14) on each bottle imported into Britain. From 2022, wine shipped to the UK from the EU, or about 55% of all wine consumed in Britain, was due to require a so-called VI-1 certificate, which requires laboratory analysis of the wine to prove it meets certain regulations. The wine and spirits industry had warned this paperwork would have pushed up prices. (BBG)

ECONOMY: The UK economy could face a loss of more than 4.6 billion pounds ($6.3 billion) in just four weeks if rules on self-isolation following a "ping" from the NHS app aren't relaxed, according to data from Centre for Economics and Business Research. (BBG)

ECONOMY: The UK's economy is growing at the fastest pace in 80 years and is expected to recover to pre-pandemic levels by the end of this year, according to an influential survey. The vaccination rollout has supported a bounce-back in consumer spending, prompting the UK's growth prospects to be upgraded again in the latest EY Item Club forecast. The summer prediction says that the economy is now expected to grow by 7.6 per cent this year — the fastest rate since 1941 — and higher than the 6.8 per cent predicted in April. (The Times)

BOE: Britain's biggest financial institutions are on track to meet the Bank of England's deadline to be ready for negative interest rates, giving authorities another tool to aid the economy if the recovery fades. Banks including Natwest Group Plc, HSBC Holdings Plc, Barclays Plc and Lloyds Banking Group Plc are close to completing the technical steps necessary to implement negative interest rates. The U.K. central bank in February asked for the work to be done by next month and is likely to deliver a progress report on Aug. 5. "To meet the Prudential Regulation Authority's six-month expectation our members are deploying tactical solutions to ready their Treasury systems should there be a negative base rate," said a spokesperson for UK Finance, the banking industry's main lobby group. (BBG)

FISCAL: Pensioners could lose the triple lock next year amid mounting concern in Government over the "unfairness" of hiking taxes on young people to pay for Boris Johnson's £10 billion social care reforms. (Telegraph)

FISCAL: Taxpayers will be left facing "significant financial risk for decades to come" because of the levels of emergency government spending on the pandemic, totalling more than £370bn, a powerful committee of MPs says today. In two separate reports, the all-party public accounts committee (PAC) paints a daunting picture of the lasting financial strain caused by the first 16 months of combating Covid-19, and says the government must not wait until after the official inquiry to learn the lessons of what went wrong. The MPs say that by this March the lifetime cost of the government's rescue measures had reached £372bn, government-backed loans had soared, and taxpayers had been left "on the hook" for an estimated £26bn of credit and fraud losses from the bounce-back loan scheme for small- and medium-sized enterprises alone. (Observer)

FISCAL/POLITICS: Boris Johnson is facing a cabinet revolt on two fronts as opposition grows to his plan to overhaul social care by increasing national insurance contributions while maintaining the triple lock on pensions. Five cabinet ministers have said that they oppose the proposed rise, which would hit young workers while at the same time delivering a bumper rise in the state pension next year. National insurance is not charged once state pension age is reached. (Sunday Times)

POLITICS: The Conservative Party's poll lead has slumped to its lowest in more than six months as Boris Johnson prepares to fight off a cabinet revolt on tax rises. After an unsteady week for the prime minister, the Conservative margin over Labour has fallen from 13 percentage points to four. A YouGov survey for The Times, conducted on Tuesday and Wednesday, found the Conservatives with 38 per cent support, down six points on the previous week. Labour were up three points on 34 per cent. It is Johnson's narrowest lead since mid-February, deep into the third national lockdown as Covid-19 ravaged the country, and the lowest Conservative share since late January. (The Times)

POLITICS: Boris Johnson and Dominic Raab risk losing their seats at the next election because of the chaos over foreign travel, a report backed by a former Tory party chairman warns. (Telegraph)

POLITICS: Boris Johnson's "vaccine bounce" appears to have faded as his approval ratings have slipped back into negative territory two years after he first took office. The Prime Minister has gone backwards with the public since entering No 10, with a third of voters saying their view of the Conservative leader is more negative now than it was when he came to power. A survey for i by Redfield & Wilton Strategies found just 9 per cent of all voters – and 16 per cent of Conservative supporters – "strongly approve" of Mr Johnson's performance in office. By contrast, 26 per cent say they strongly disapprove. His overall approval rating – the proportion of people in favour minus those against – now stands at -6, down from +9 just three months ago when the Government was revelling in the success of the vaccine rollout. Mr Johnson's ratings hit +39 at the start of the Covid-19 crisis but fell to -11 in the autumn as public scepticism about the pandemic response grew. Asked whether their views on the Prime Minister have changed since he took office two years ago, 34 per cent said they now think less of him with 18 per cent saying their opinion has improved. (The i)

EUROPE

ECB: The European Central Bank said it will lift a cap on how much lenders can return to shareholders with dividends and share buybacks, while urging them to remain cautious given uncertainty in the pandemic. The ECB "decided not to extend beyond September 2021 its recommendation that all banks limit dividends," the central bank said in a statement on Friday. "Instead, supervisors will assess the capital and distribution plans of each bank as part of the regular supervisory process." (BBG)

ECB: German central bank chief Jens Weidmann said he is worried at the prospect of the European Central Bank's low-interest-rate environment being extended for too long, adding that his experts anticipated inflation nearing 5% in Germany later this year. Weidmann was one of just two people on the ECB's 25-member Governing Council to oppose a new interest rates guidance on Thursday, even if the topic generated unusually intense debate. In an interview with the Frankfurter Allgemeine, extracts of which were published on Friday evening, Weidmann said that the ECB's Governing Council agreed in principle that expansive monetary policy was appropriate for now. (RTRS)

GERMANY: Some of Germany's most senior politicians have floated the possibility of tough restrictions for unvaccinated people, or even compulsory inoculation, echoing similar sentiment throughout Europe as the delta variant spreads in the region. (BBG)

GERMANY: The Christian Democratic party of outgoing German Chancellor Angela Merkel continued to lose support while its main rivals remained stable in the latest Insa poll, according to weekly Bild am Sonntag. Combined support for the Christian Democratic Union and Bavaria's CSU party, led by Merkel's successor candidate Armin Laschet, declined by 1 percentage point to 27%. While the bloc remains on track to lead the next government, the devastating floods that battered the country have shifted the dynamic in the election campaign. Conservative front-runner Laschet damaged his standing when he was caught laughing on camera in the midst of the catastrophe. The CDU/CSU will very likely need at least one coalition partner after September's election to secure a governing majority in parliament. Insa's poll showed the liberal FDP was the only party to gain ground, reaching a level of 13%, up one percentage point. The opposition Green party remained stable at 18% from a week earlier. (BBG)

GERMANY: A senior Berlin lawmaker expects the city to buy apartments from Vonovia SE and Deutsche Wohnen SE even though a tie-up of Germany's largest residential landlords is poised to fail. (BBG)

FRANCE: The French parliament on Monday approved a bill which will make COVID-19 vaccinations mandatory for health workers as well as require a bolstered health pass in a wide array of social venues as France battles with a fourth wave of coronavirus infections. (RTRS)

FRANCE: Tens of thousands of people demonstrated throughout France against mandatory vaccination for health workers and the implementation of a sanitary pass to bar people going to the cinema, sports venues and shopping malls or taking long-distance transportation if they haven't been inoculated, Agence France-Presse reported. (BBG)

ITALY/BTPS: Italy plans to sell 7 billion euros ($8.2 billion) of bills due Jan 31, 2022 in an auction on Jul 28. (BBG)

RATINGS: Rating reviews of note from Friday included:

- Moody's upgraded Cyprus to Ba1; Outlook Stable

- DBRS Morningstar confirmed the European Financial Stability Facility at AAA, Stable Trend

- DBRS Morningstar confirmed the European Stability Mechanism at AAA, Stable Trend

- DBRS Morningstar confirmed Switzerland at AAA, Stable Trend

U.S.

ECONOMY: Agriculture Secretary Tom Vilsack predicted the jump in U.S. food prices in June will quickly moderate despite rising concern about inflationary risks in the economy. "There are certain selective items in the grocery store folks may see for a period of time increased costs," Vilsack said Friday in an interview on Bloomberg Television's "Balance of Power" with David Westin. "We think this will even out as we begin to recover, as we begin to get the supply and demand in better balance." (BBG)

FISCAL: Speaker Nancy Pelosi isn't backing off her plan to hold up a bipartisan infrastructure package until the Senate delivers a larger, Democratic-only plan expected later this year, prompting a rebuke from Senate Republicans. Pelosi said Sunday on ABC's "This Week" she was "enthusiastic" about the $579 billion bipartisan package and hopes the Senate passes it. Her comments came just as bipartisan negotiators were trying wrap up the final details on their plan, which could be announced as early as Monday. (BBG)

FISCAL: Sen. Mark Warner (D-Va.), a member of the bipartisan group of senators working on a massive infrastructure bill, on Sunday said he believes the legislation will be ready on Monday after it failed a first vote on the Senate floor last week. Appearing on "Fox News Sunday," Warner was asked by host Martha MacCallum if the senators would "have that bill in place for everybody to look at" Monday. "I believe we will," Warner said. "The one thing I hear all across Virginia in the last couple of days: People want us to invest in our infrastructure." "If you step back, you know, we have actually are investing at about half the rate that we invested in our infrastructure as we did in the 1990s," he added. (The Hill)

FISCAL: Several major issues have yet to be resolved in the U.S. Senate's bipartisan talks on an infrastructure spending measure, a Democratic source said on Sunday. These included wage rates, public transit funding, water funding, broadband, spending on highways and bridges, and using unspent COVID-19 relief money as a way to pay for the program, the source said. (RTRS)

FISCAL: A key Republican in the bipartisan Senate group working on a $579 billion infrastructure package said disagreements over transit funding and revenue sources that have held up a deal should be settled and legislative language agreed to by early next week. "We're working through today and through the weekend," Louisiana Senator Bill Cassidy said Friday on Bloomberg Television's "Balance of Power With David Westin." "We hope to have language either by Monday or by early next week." (BBG)

FISCAL: Treasury Secretary Janet Yellen on Friday warned Congress that her department will need to embark on "extraordinary measures" on August 2 to prevent the U.S. government from defaulting if lawmakers are unable to strike a deal to raise or extend the debt ceiling. In a letter to House Speaker Nancy Pelosi, D-Calif., Yellen put lawmakers on notice that the Treasury Department will at the end of July suspend the sale of bonds, the avenue by which the U.S. finances its debt obligations. (CNBC)

CORONAVIRUS: NIAID director Anthony Fauci told CNN's "State of the Union" Sunday that health officials are considering revising masking guidelines for vaccinated Americans. Fauci said that the United States is "going in the wrong direction" as cases surge across the country, driven by the more contagious Delta variant. (Axios)

CORONAVIRUS: Biden administration health officials increasingly think that vulnerable populations will need booster shots even as research continues into how long the coronavirus vaccines remain effective. Senior officials now say they expect that people who are 65 and older or who have compromised immune systems will most likely need a third shot from Pfizer-BioNTech or Moderna, two vaccines based on the same technology that have been used to inoculate the vast majority of Americans thus far. That is a sharp shift from just a few weeks ago, when the administration said it thought there was not enough evidence to back boosters yet. (New York Times)

CORONAVIRUS: Senator Bill Cassidy said his Republican colleagues are increasingly voicing support for Covid-19 vaccines amid an increase in cases across the U.S. "More Republicans are coming my way on vaccination, in part driven by tragedy," Cassidy, a physician from Louisiana, said in an interview on Bloomberg Television. "There are people who should not be dying who are dying of Covid infection." (BBG)

CORONAVIRUS: The U.S. purchased 200 million more doses of the Pfizer/BioNTech vaccine for flexibility if booster shots are later needed and the shots are approved for younger children, the White House said on Friday. The vaccine makers announced the government's purchase earlier on Friday. (RTRS)

CORONAVIRUS: New York Mayor Bill de Blasio urged private companies to institute Covid-19 vaccine mandates for their workers, while stopping short of a similar citywide requirement for municipal employees. "If anyone is asking my advice, particularly large employers, move toward vaccine mandates now," de Blasio said during a WNYC radio interview. "I urge every employer to go to any form of mandate that you're comfortable with." (BBG)

CORONAVIRUS: California's intensive-care unit bed availability fell to a five-month low as hospitalizations edged higher with more infections. The number of ICU beds available dropped by 89 to 1,977. That's still twice the number compared with the peak of the pandemic in January. The positive test rate rose to 5.2%, one of the highest levels since February. (BBG)

CORONAVIRUS: A federal appeals court on Friday sided with Florida in its challenge against the Centers for Disease Control and Prevention over federal regulations for cruise ships that the state said were too onerous and were costing it millions of dollars in foregone tax revenue. The two-page ruling from the 11th U.S. Circuit Court of Appeals marks an unusual reversal from the appeals panel's ruling in the matter delivered on Saturday. (CNBC)

OTHER

GLOBAL TRADE: A resolution to the EU's Trump-era dispute with the US over steel and aluminium tariffs may fall short of removing all the barriers sheltering the industries, according to the bloc's trade enforcer. Valdis Dombrovskis, the EU executive vice-president in charge of trade policy, said that while the "ideal solution" would be the mutual suspension of tariffs, as agreed by the two sides this year in the Boeing-Airbus dispute, he was ready to look at "other possible solutions". "We understand the willingness of the US to protect its steel industry, but certainly there are ways to do it in a way which is less disruptive for EU producers," Dombrovskis said in an interview with the Financial Times. (FT)

GLOBAL TRADE: Some of the world's biggest footwear and garment companies are seeing production pinched as factories in Southeast Asia struggle to keep the lights on amid one of the world's deadliest Covid-19 resurgence. A number of firms that churn out products for global giants like Nike Inc. and Adidas AG have reported plant suspensions in Vietnam over the past few weeks as authorities impose restrictions to stop the virus. Other industries, such as Toyota Motor Corp. factories in Thailand, also are scaling back as multiple countries in the region see record high cases and deaths. (BBG)

U.S./CHINA: China lashed out at U.S. policies in a tense start to high-level talks in Tianjin, declaring the relationship between the world's two largest economies in a "stalemate." Vice Foreign Minister Xie Feng told visiting Deputy Secretary of State Wendy Sherman that some Americans seek to portray China as an "imagined enemy," according to accounts released by the Foreign Ministry as talks got underway. Still, Xie said Beijing was willing to seek common ground and deal with the U.S. on an equal footing. "The China-U.S. relationship is now in a stalemate and faces serious difficulties," Xie said, according to the ministry. "The Chinese people look at things with eyes wide open. They see the competitive, collaborative and adversarial rhetoric as a thinly veiled attempt to contain and suppress China." (BBG)

U.S./CHINA: U.S. officials said they aren't seeking to build a broad anti-China coalition despite disagreements on a range of issues ahead of high-level talks in the city of Tianjin on Monday (BBG)

U.S./CHINA: U.S. Deputy Secretary of State Wendy Sherman will tell China in upcoming talks that while Washington welcomes competition with Beijing, there needs to be a level playing field and guardrails to ensure that does not veer off into conflict, senior U.S. officials said on Saturday. The officials, briefing reporters ahead of Sherman's talks in Tianjin with Chinese State Councilor and Foreign Minister Wang Yi on Monday, said the world's two largest economies needed responsible ways to manage competition. "She's going to underscore that we do not want that stiff and sustained competition to veer into conflict," one senior U.S. administration official said ahead of the first high-ranking, face-to-face contact between Washington and Beijing in months as the two sides gauge how they can salve festering ties. "The U.S. wants to ensure that there are guardrails and parameters in place to responsibly manage the relationship," he said. "Everyone needs to play by the same rules and on a level playing field." (RTRS)

U.S./CHINA: Chinese State Councilor and Foreign Minister Wang Yi on Saturday said that China and the international community as the whole bear the responsibility to teach the U.S. a lesson. Wang made the remarks when holding the third round of China-Pakistan Foreign Ministers' Strategic Dialogue with Pakistani Foreign Minister Shah Mahmood Qureshi in Chengdu, southwest China's Sichuan Province. In response to U.S. Deputy Secretary of State Wendy Sherman's two-day visit to China starting on Sunday, Wang rejected the U.S. proposed strength-based approach of conducting international relations. There is never a country that is superior to others, and there shouldn't be one, Wang stated, stressing that China will not accept any country that thinks itself more superior than others. (CGTN)

U.S./CHINA: China's sanctions of the U.S., including former Secretary of Commerce Wilbur Ross, announced before an official's visit, may be the "new normal" in bilateral relations, the Global Times said ahead of Deputy Secretary of State Wendy Sherman's trip starting Sunday. The tough stance was a departure from the past when China often released a goodwill gesture before meeting the U.S., the newspaper said. The Biden administration's heavy pressure and cold way of dealing with China have been less effective, while the U.S. increasingly needs China's support and coordination on issues including Iran and climate change and trade, the newspaper said. Still, the two sides may be setting the stage for higher-level dialogues and issues including trade and commerce, the Global Times said. (MNI)

U.S./CHINA: White House Press Secretary Jen Psaki criticized China for imposing sanctions. "We're undeterred by these actions, we remain fully committed to implementing all relevant U.S. sanctions authorities," Psaki told reporters. (BBG)

U.S./CHINA: The Biden administration has no immediate plans to levy economic sanctions on Chinese officials in response to the Microsoft Exchange hack that the U.S. blames on Beijing, according to people familiar with the matter. Some in the administration cite concern that sanctions wouldn't be as effective as other approaches in deterring future cyber attacks by China, according to two people who spoke on condition of anonymity to describe internal deliberations. But the U.S. hasn't ruled out the possibility of sanctions in the future, they said. (BBG)

U.S./CHINA: The Justice Department on Friday dropped individual cases against five Chinese researchers accused of hiding ties to the Chinese military. (Axios)

U.S./CHINA: Huawei Technologies Co. has hired veteran Democratic lobbyist Tony Podesta —whose firm imploded in 2017 amid financial and legal troubles—as part of the Chinese company's expanded U.S. influence operation, according to people familiar with the matter. Mr. Podesta's work for Huawei is still in the early stages, and the full scope of his advocacy for the company is still being determined, according to one of these people. Mr. Podesta's resurfacing in the lobbying world comes as Democrats once again control both chambers of Congress and the White House. He has long relationships with President Biden and some top White House aides, including senior counselor Steve Ricchetti. His brother, John Podesta, is chairman of the liberal Center for American Progress and is close with the administration. Mr. Podesta is the latest in a string of Washington advisers recently hired by Huawei. (WSJ)

GEOPOLITICS: The United States is considering cracking down on Iranian oil sales to China as it braces for the possibility that Tehran may not return to nuclear talks or may adopt a harder line whenever it does, a U.S. official said. (RTRS)

GEOPOLITICS: The British government is exploring ways to remove China's state-owned nuclear energy company from all future power projects in the UK, including the consortium planning to build the new £20bn Sizewell nuclear power station in Suffolk, according to people close to the discussions. (FT)

GEOPOLITICS: The Japanese and French governments have agreed to "actively" maintain defense cooperation to secure a free and open Indo-Pacific, according to a joint statement Saturday following a summit meeting between Prime Minister Yoshihide Suga and President Emmanuel Macron. (BBG)

CORONAVIRUS: A Japanese company has started human trials of the first once-a-day pill for Covid-19 patients, joining Pfizer Inc. and Merck & Co. in the race to find treatments for the disease. Osaka-based Shionogi & Co., which helped develop the blockbuster cholesterol drug Crestor, said it designed its pill to attack the Covid-19 virus. It said the once-a-day dosing would be more convenient. The company said it is testing the drug and any side effects in trials that began this month and are likely to continue until next year. Shionogi is months behind Pfizer and Merck, which have started later-stage tests of pills to treat Covid-19. Pfizer has said its twice-daily pill could be ready to hit the market as soon as this year. It is preparing to enroll more than 2,000 patients in a test of the antiviral pill combined with a booster antiviral drug against a placebo. (WSJ)

CORONAVIRUS: Immunity against the coronavirus is waning in people who were fully vaccinated with the shot made by BioNTech SE and Pfizer Inc. in January because of the rapidly spreading Delta variant, BioNTech's chief executive said, confirming data that emerged from Israel last week. But even as antibody levels are dropping seven months after immunization among some vaccine recipients, most of them will remain protected against severe disease and might not yet need a third dose, according to Ugur Sahin, CEO of the German firm that invented the vaccine and partnered with Pfizer to develop the product for the global market. "The antibody titers are going down," Dr. Sahin said, referring to the unit of measurement for antibodies against the virus. "The vaccine protection against the new variant is considerably lower." (Dow Jones)

HONG KONG: Hong Kong will postpone for at least two weeks a plan to start antibody testing at the airport for fully vaccinated people arriving from some areas, people familiar with the matter said, a setback in easing one of the strictest quarantine restrictions in the world. The delay in the second phase of its antibody-testing plan was a result of rising infections overseas sparked by the delta variant, the people said. There's no definite timeline for introducing the tests. (BBG)

JAPAN: The approval rating of Prime Minister Yoshihide Suga's government tumbled 9 percentage points from June to 34% in a new Nikkei/TV Tokyo survey amid public disappointment in its leadership as the nation hosts the long-delayed Summer Olympics. (Nikkei)

AUSTRALIA: Sydney's daily cases climbed and are expected to keep rising after thousands took to the streets over the weekend in defiance of the lockdown restrictions sweeping parts of Australia. The city of almost 6 million people recorded 145 new cases Monday, up by a handful from the day before, with half of the people active in the community while infectious. There have been 2,226 cases since the latest outbreak began in mid-June, fueled by the contagious delta variant. (BBG)

AUSTRALIA: New South Wales has requested financial modelling for Greater Sydney's lockdown to last until mid-September. The state's crisis cabinet will meet this morning and is suspected to announce a significant extension of the lockdown. The Australian has reported while officials initially considered a September 3 end date, it is understood they are modelling several financial scenarios including a September 17 deadline. Treasurer Dominic Perrottet is also expected to request the reintroduction of Jobkeeper despite a knock back of a previous request. (Sky)

SOUTH AUSTRALIA: South Australia has recorded one new case of COVID-19 overnight. The case is an 87-year-old man linked to the Modbury cluster who has been in quarantine, bringing the total number of cases to 19. Premier Steven Marshall said South Australia was on track to end its seven-day lockdown as planned at midnight tomorrow night. From 12:01am on Wednesday, restrictions will return to similar to what they were until last Tuesday. "I'm very proud of South Australia and I am very grateful to all South Australians for the way they have adhered to the restrictions that have been put in place," the Premier said. (ABC)

AUSTRALIA: Weekend protests in Australia's largest cities, which saw thousands of maskless demonstrators breach stay-at-home orders, risk fueling new infections and causing an extension of restrictions, Prime Minister Scott Morrison said. (BBG)

AUSTRALIA: Australia has struck an agreement for 60 million additional Pfizer-BioNTech doses next year and 25 million doses in 2023, which would allow the country to offer booster shots, the government said. The country, which has struggled to accelerate inoculation efforts, on Saturday reversed previous advice on AstraZeneca Plc's vaccine. Authorities told adult residents in areas with current outbreaks, including Sydney, to seriously consider using the option. (BBG)

AUSTRALIA: Australia plans to set new vaccination targets that would allow the country to respond to future Covid-19 outbreaks without the need for lockdowns, according to Prime Minister Scott Morrison. The government will set the targets in coming weeks, Morrison said in a speech Saturday. When Australia moves to a second stage of its vaccination program, lockdowns would occur only "in extreme circumstances," and would not be implemented at all once the nation progress to a third stage, he said. (BBG)

AUSTRALIA: A federal inquiry into housing supply problems is being set up to look into the contribution of property taxes and restrictive planning and zoning regulations in driving up house prices. Treasurer Josh Frydenberg has approved a parliamentary committee inquiry into housing supply to be led by Liberal MP Jason Falinski, chairman of the House standing committee on tax and revenue. (Australian Financial Review)

SOUTH KOREA: South Korea will expand social distancing measures outside the capital Seoul from Monday and ban gatherings of more than five people. (BBG)

SOUTH KOREA: South Korea passed its sixth extra budget of the pandemic, seeking to shore up the economy as the country's worst virus wave so far shows little sign of abating. The 34.9 trillion-won ($30.3 billion) spending plan approved by lawmakers early Saturday includes a 250,000-won cash handout for most people, blunting the economic damage from a semi-lockdown affecting half the population. (BBG)

TURKEY: Two Turkish soldiers were killed and two others were wounded in an attack in northern Syria, Turkey said late Saturday. The attack against an armored vehicle occurred in the "Euphrates Shield area," a zone spanning about 2,000 square kilometers (about 770 square miles) that was taken under Turkish control in 2017, according to a statement by the Defense Ministry. The assault was carried out by "terrorists," the ministry said, without naming a specific group. (BBG)

MEXICO: Mexico City will regress to the orange Covid-19 alert as of Monday for at least two weeks, local authorities announced at a press conference Friday. The city's hospital occupancy for Covid-19 beds is at 63%, with about 3,000 beds available to be reconverted if needed. Meanwhile, an increase in cases among young people hasn't translated into a spike in hospitalizations. (BBG)

MEXICO: The U.S. and Mexico failed to resolve a dispute over trade rules for cars during a meeting this week, threatening the goal of boosting regional manufacturing under their new trade pact. U.S. Trade Representative Katherine Tai and Mexican Economy Minister Tatiana Clouthier discussed the topic Thursday afternoon in Washington but couldn't reach a resolution, according to people familiar with the talks, who asked not to be identified speaking about a private matter. Canada also shares Mexico's position in the dispute. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador proposed on Saturday replacing the Washington-based Organization of American States with what he called a more independent institution. "The substitution of the OAS can't be ruled out for a truly autonomous organization -- not a servant to anyone, but a mediator," Lopez Obrador, commonly known as AMLO, said in remarks at the annual summit for the Community of Latin American and Caribbean States. (BBG)

RUSSIA: Deputy Secretary of State Wendy Sherman will lead the U.S. delegation at nuclear arms control talks with Russia in Geneva on July 28, the State Department said on Friday. (RTRS)

RUSSIA: Russia's Ministry of Labor, together with the public health regulatorRospotrebnadzor, recommended that employers be allowed to suspend employees without pay for refusing to get vaccinated, except for medical reasons. The recommendations say an employer can allow an unvaccinated employee to work remotely. They also clarify that herd immunity at a company means that 80% of employees either have been vaccinated or had Covid. (BBG)

RUSSIA: President Vladimir Putin used a Navy Day parade to deliver his latest reminder of Russia's military muscle, touting the nation's hypersonic nuclear weapons at a ceremony in his hometown of St. Petersburg. "Today the Russian navy has everything it needs to defend our homeland, our national interests," Putin said in a speech in front of a monument to the fleet's founder, Peter the Great. "We can locate any enemy, whether they're on, under or above the water. And if required, deal them an unavoidable strike." (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa unveiled a new relief package to help businesses and individuals recover from a week of deadly riots and coronavirus curbs, as he eased lockdown restrictions amid slowing infections. The measures include reinstating a monthly welfare grant of 350 rand ($24) for the poor until the end of March, a 400 million-rand state contribution to a humanitarian relief fund and support for uninsured businesses, Ramaphosa said Sunday in a televised speech. The government will also expand an employment tax incentive, and give companies an additional three months to pay taxes collected from their workers, he said. (BBG)

SOUTH AFRICA: South Africa should aim to re-prioritize its budget to offset the cost of relief measures for businesses and individuals affected by deadly riots and accelerate reforms to foster inclusive economic growth, according to the International Monetary Fund's resident representative for the country. "This is a tragedy, but at the same time, we can't lose sight of the fiscal realities," Max Alier said Friday in an interview. At least 330 people died and thousands of businesses in the commercial hub of Gauteng and the eastern KwaZulu-Natal province were looted or burned down in unrest that erupted on July 10. The turmoil could cost the country about 50 billion rand ($3.4 billion) in lost output and has placed 150,000 jobs at risk. (BBG)

MIDDLE EAST: The Afghan government imposed a month-long curfew across almost all of the country on Saturday in a bid to stop the Taliban from invading cities. Apart from the capital Kabul and two other provinces, no movement is allowed from 22:00 to 04:00 (17:30-23:30 GMT). Fighting between the Taliban and Afghan government forces has increased over the past two months as international troops pull out of the country. The militant group is thought to have captured up to half of all territory. (BBC)

MIDDLE EAST: A Hezbollah commander and commander in the Iranian-backed Liwa Fatemiyoun militia were both killed recently, with the details of their deaths remaining unclear as of Saturday night. The Saudi news outlet Al-Arabiya reported that the two died in Syria. Hezbollah-affiliated media reported on Saturday that the Hezbollah commander Imad al-Amin, from Deir Kifa in southern Lebanon, was killed while "carrying out his jihad duty," without providing further details. (Jerusalem Post)

CHINA

YUAN: China can boost the international acceptance of the yuan given that the currency makes up only 2% of global strategic foreign exchange reserves, while its weighting in the IMF SDR is 10.9%, Guan Tao, the global chief economist at BOC International, said in a speech on Saturday, according to a blog post on his WeChat account. This low percentage isn't proportionate to China's large economy, trade and investment potential, Guan said. China should further develop more sophisticated and liquid financial markets to become more stable and predictable so as to gain foreign investors' confidence, Guan wrote. China should also stick with a normal monetary policy to ensure positive returns while its price-taker exporters need to upgrade, increase bargaining leverage and increase yuan-based settlements, Guan said.

LGFVS: China's financial institutions are working more closely with regulators to enhance monitoring systems to control the risks of local government funding vehicles, and they must check with the management platform before lending to risky borrowers, the Securities Times said citing unidentified industry participants. Some projects have been called off by the funding institutions after the investors were found to have hidden debt, the newspaper said. While China's listed government debts amount to 45.8% GDP, some of the debt raised by the local governments remain hidden and unaccounted and continues to rise to record, the newspaper said. China is still raising debt this year, though through more regulated channels, including plans to issue almost CNY3 trillion local bonds in H2, the newspaper said. (MNI)

CORONAVIRUS: China added 39 local confirmed cases in eastern province of Jiangsu and 1 infection in Liaoning province on July 25, according to a statement from National Health Commission. There were also four new local asymptomatic cases reported Sunday; provinces of Jiangsu, Anhui, Guangdong and Sichuan each had one. (BBG)

EQUITIES: China starts six-month crackdown on online activities that disrupt market order, infringe on users' rights and interests and threaten data security, according to a statement on Ministry of Industry and Information Technology. Violations of resource and qualification management rules will also be a part of the crackdown. (BBG)

EQUITIES: China said companies that offer tutoring on the school curriculum cannot go public or raise capital, imposing a new set of constraints in $100 billion education tech industry. Such companies also can't receive investment from overseas capital, according to a notice released by the State Council on Saturday. Listed firms will also probably no longer be allowed to invest in or acquire education firms teaching school subjects, it said. (BBG)

EQUITIES: China's antitrust regulator has ordered Tencent to give up its exclusive music licensing rights and slapped a fine on the company for anti-competitive behavior, as Beijing continues to crack down on its internet giants at home. The State Administration for Market Regulation (SAMR) on Saturday imposed a fine of 500,000 yuan ($77,141) on the company citing violations in its acquisition of China Music in 2016. (BBG)

EQUITIES: Some banks and brokerages have cut China Evergrande Group from their lists of shares allowed for margin trading, Hong Kong Economic Journal reports. (BBG)

OVERNIGHT DATA

JAPAN JUL, P JIBUN BANK MANUFACTURING PMI 52.2; JUN 52.4

JAPAN JUL, P JIBUN BANK SERVICES PMI 46.4; JUN 48.0

JAPAN JUL, P JIBUN BANK COMPOSITE PMI 47.7; JUN 48.9

Flash PMI data indicated that Japanese private sector businesses saw a faster reduction in activity during July. Output fell at the quickest pace for six months, while the contraction in new business inflows was the fastest since February. Survey members attributed the deterioration in business conditions to persistent rises in COVID-19 cases and state of emergency measures which dampened activity and demand. Employment levels in the Japanese private sector continued to expand, however the rate of job creation eased to the softest in the current six-month sequence and was only fractional. At the same time, input costs across the private sector rose at the fastest pace since September 2008. Short-term disruption to activity is likely to continue until the latest wave of COVID-19 infections passes and restrictions enacted under state of emergency laws are lifted. Japanese private sector firms were optimistic that business conditions would improve in the year ahead, though the degree of optimism was the softest since January. Positive sentiment stemmed from the expectation that the virus would be suppressed as the vaccination programme continues, allowing restrictions on movement and the economy to be lifted. This would trigger a broad-based recovery in both domestic and external demand for Japanese goods and services. (IHS Markit)

NEW ZEALAND JUN TRADE BALANCE +NZ$261MN; MAY +NZ$489MN

NEW ZEALAND JUN EXPORTS AT +NZ$5.95BN; MAY +NZ$5.89BN

NEW ZEALAND JUN IMPORTS AT +NZ$5.69BN; MAY +NZ$5.40BN

CHINA MARKETS

MNI: PBOC INJECTS CNY10 BLN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2032% at 09:29 am local time from the close of 2.1062% on Friday.

- The CFETS-NEX money-market sentiment index closed at 38 on Friday vs 43 on Thursday.

MNI: CHINA SETS YUAN CENTRAL PARITY AT 6.4763 MON VS 6.4650 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4763 on Monday, compared with the 6.4650 set on Friday.

MNI: CHINA CFETS YUAN INDEX UP 0.30% IN WEEK OF JULY 23

The CFETS Weekly RMB Index was 98.70 last Friday, July 23, compared with 98.40 in the week as of July 16. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has risen 4.07% this year, when compares to 94.84 on Dec. 31, 2020.

MARKETS

SNAPSHOT: Chinese Regulatory Scrutiny Dents Risk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 286.79 points at 27834.99

- ASX 200 down 2.653 points at 7391.7

- Shanghai Comp. down 77.266 points at 3473.13

- JGB 10-Yr future down 2 ticks at 152.38, yield down 0.3bp at 0.015%

- Aussie 10-Yr future up 1.0 tick at 98.815, yield down 0.8bp at 1.189%

- U.S. 10-Yr future up +0-05 at 134-09+, yield down 1.67bp at 1.2596%

- WTI crude down $0.39 at $71.68, Gold up $4.06 at $1806.21

- USD/JPY down 22 pips at Y110.33

- CHINA SAYS U.S. TIES IN STALEMATE AT START OF TIANJIN MEETING

- CHINA STARTS CRACKDOWN ON ILLEGAL ACTIVITIES IN INTERNET SECTOR (BBG)

- CHINA BANS FOR-PROFIT EDUCATION FIRMS, SENDING SHARES TUMBLING (BBG)

- PELOSI SAYS INFRASTRUCTURE WON'T GET VOTE WITHOUT LARGER PLAN

- UK COVID CASELOAD IMPROVES AGAIN, PLENTY OF QUESTIONS REMAIN

BOND SUMMARY: Core FI Generally Bid In Asia

A defensive start to the week for Chinese & Hong Kong equity indices weighed on broader risk appetite, with fears of increased regulatory burden/scrutiny from the Chinese authorities evident in the wake of the crackdown on the education sector, while deeper scrutiny surrounding broader internet based activities also became apparent. This has allowed the U.S. Tsy space to firm, with T-Notes +0-05 at 134-09+, while cash Tsys print 0.5-1.5bp richer across the curve, as 10s outperform. The opening salvos at the latest meeting between senior U.S. & Chinese officials weren't particularly warm (as was foretold). New home sales & Dallas Fed m'fing activity data headline the local docket during NY hours on Monday, although participants are clearly focused on the upcoming FOMC decision (Wednesday) and advance Q2 GDP reading (Thursday). 2-Year Tsy supply is also due on Monday.

- The latest bid in the U.S. Tsy space aided some very modest richening in areas of the cash JGB curve, with super-long paper perhaps limited by the proximity to tomorrow's 40-Year JGB supply. That leaves the major benchmarks across the cash JGB curve little changed to 0.5bp firmer on the day after the elongated Tokyo weekend. Futures last -2 after unwinding some of the losses witnessed in the final overnight session of last week during morning trade.

- Local COVID matters dominated in Australia, with suggestions in the press that NSW is conducting financial modelling for a lockdown in the Greater Sydney area through at least mid-September. There are also some suggestions that the NSW Treasurer will again request a restart of the JobKeeper scheme. The weekend also saw thousands protest the lockdowns across some of the country's major cities. On a more positive note, South Australia is set to exit its lockdown on Wednesday, although some restrictions will remain in place. Finally, Australia has signed an agreement for the purchase of 60mn additional Pfizer-BioNTech COVID vaccination doses, to be delivered in '22, and a further 25mn doses in '23, which would allow the country to conduct a vaccination "booster" scheme if needed. The A$800mn ACGB Nov '31 auction was well received, with the cover ratio jumping (even when we adjust for the downtick in notional amount on offer vs. the prev. auction of the line), while the weighted average yield printed 0.51bp through prevailing mids at the time of supply (per Yieldbroker). The structurally supportive matters we flagged ahead of the auction outweighed any valuation issues. The curve twist flattened a little as a result, with YM -0.5 and XM +1.0.

AUSSIE BONDS: A$800mn Of ACGB Nov '31 Auctioned

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 1.1879% (prev. 1.5713%)

- High Yield: 1.1900% (prev. 1.5725%)

- Bid/Cover: 6.0750x (prev. 2.6700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 18.6% (prev. 73.1%)

- bidders 52 (prev. 44), successful 20 (prev. 17), allocated in full 9 (prev. 6)

EQUITIES: Broadly Negative, Japan Bucks The Trend After Holiday

Risk sentiment is broadly negative in Asia, markets in China and Hong Kong the laggards with the Hang Seng down over 2.5%, the CSI 300 is down 2.3%. New Oriental Education saw losses of over 40% on reports of increased regulatory burden/scrutiny, while the Hang Seng tech index saw losses of over 5% . In Japan markets are higher, playing catch up after a four day long weekend. Markets in South Korea, Taiwan, New Zealand and Australia are all also lower. In the US future have declined, e-mini Dow Jones leading the way lower with losses of around 0.5%, failing to build on Friday's positive close where indices saw record highs.

GOLD: Back Above $1,800/oz After Showing Through Support

Spot gold last trades a handful of dollars higher on the day, just above $1,805/oz. Friday's brief showing below short-term technical support was reversed as our weighted U.S real yield monitor moved to fresh all-time lows, while caution surrounding regulatory matters in China and a very tepid start to the latest round of senior level Sino-U.S. talks provided support during the first Asia-Pac session of this week.

OIL: Retreats From Closing Highs

Oil is slightly lower in Asia-Pac trade, retreating from intra-day highs seen at the close on Friday. WTI is down $0.37 from settlement levels at $71.70/bbl, Brent is down $0.35 at $73.75/bbl. WTI and Brent crude futures are both holding most of last week's solid gains and the 10% rally from the Monday low, though markets will continue to assess demand worries from the spread of the delta variant. Oil supermajors earnings in the coming week will be closely eyed, with reports from ExxonMobil, ConocoPhillips among others due. Support for WTI is seen at $69.31, the 50-day EMA while Brent support is at $67.44/43 the low from Jul 20 / 76.4% of the May 21 - Jul 6 rally.

FOREX: Risk Off Session Sees High Beta Currencies Pressured

A risk off session saw AUD and NZD come under selling pressure, while JPY shook off a sluggish start to gain through the session as the greenback receded.

- AUD/USD is down 18 pips, the local COVID situation continues to weigh, there are reports that the lockdown in Sydney is set to be extended today while NSW chief health officer said there is likely to be a delay in the second Pfizer doses for non-essential workers.

- NZD/USD is down 12 pips. New Zealand's trade deficit widened in June, the 12-month ytd deficit widened to NZD 252m from a revised NZD 41m. Exports rose to NZD 5.95bn while imports rose to NZD 5.69b.

- USD/JPY is down 19 pips hovering around session lows. Data earlier showed Jibun Bank Japan manufacturing PMI fell slightly to 52.4, services dipped to 46.4 which dragged the composite further into contractionary territory at 47.7.

- Offshore yuan is weaker, USD/CNH is up 102 pips. Comments from the meeting of US and Chinese officials have not been encouraging, Sino-US relations are said to face difficulties.

- USD/CAD is up 18 pips, helped higher by slightly lower oil, the pair remains within Friday's range.

FOREX OPTIONS: Expiries for Jul26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-55(E667mln), $1.1830(E622mln), $1.1860(E584mln)

- USD/JPY: Y111.50($510mln)

- GBP/USD: $1.3895-00(Gbp561mln)

- AUD/USD: $0.7330-35(A$555mln)

- USD/CAD: C$1.2570-75($542mln), C$1.2690-00($595mln)

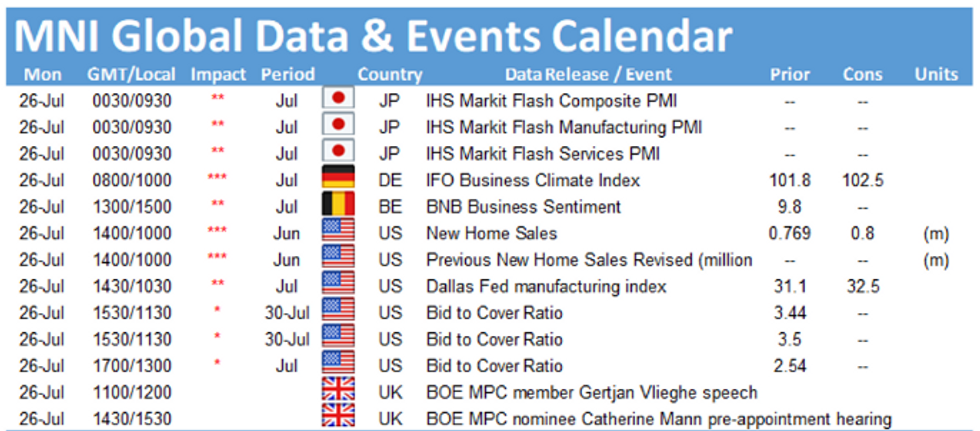

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.