-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Stimulus Hopes Eyed

EXECUTIVE SUMMARY

- CHINA WEIGHS MEASURES TO SHORE UP ‘TOO-BIG-TO-FAIL’ DEVELOPERS (BBG)

- BATTERED BY COVID, CHINA HITS PAUSE ON GIANT CHIP SPENDING (BBG)

- EU SET TO IMPOSE COORDINATED CONTROLS ON TRAVELERS FROM CHINA (WSJ)

- WHITE HOUSE SAYS NO CAUSE FOR CHINA RETALIATION OVER COVID CURBS (BBG)

- RBA SEES SAVINGS, JOBS CUSHIONING MORTGAGE STRESS (MNI)

- CHINA DISCUSSING EASING OF BAN ON AUSTRALIA COAL IMPORTS (BBG)

- OPEC OIL OUTPUT EDGES HIGHER AS NIGERIA CRACKS DOWN ON THEFT (BBG)

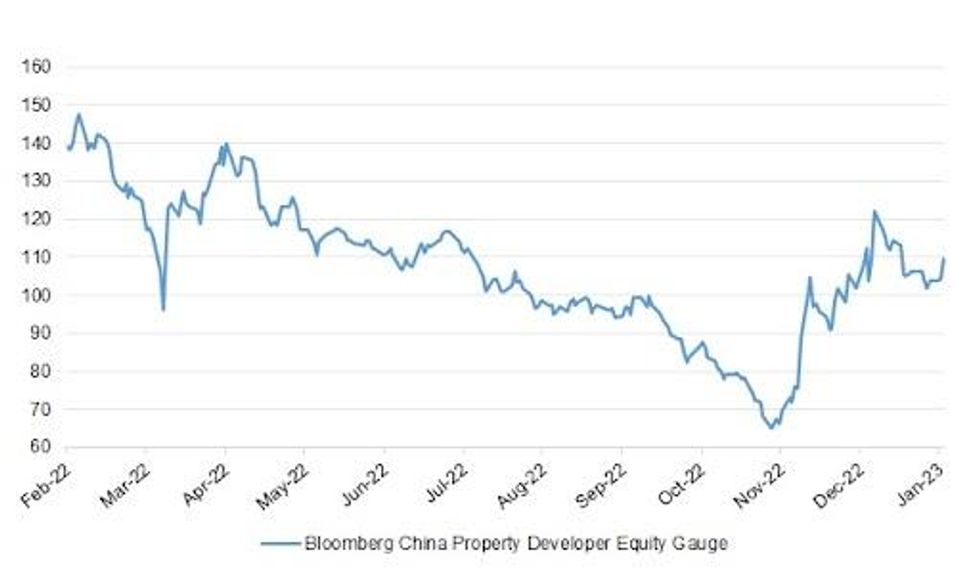

Fig. 1: Bloomberg China Property Developer Equity Gauge

Source: MNI - Market News/Bloomberg

UK

FISCAL/ENERGY: The government could afford to cancel a planned increase in household energy bills in April as falling wholesale gas and electricity prices cut the cost of its support scheme, a new analysis has suggested. (The Times)

POLITICS: Liz Truss has warned Rishi Sunak against scrapping her wide-reaching childcare reforms as senior backbenchers said it could cost the party votes at the next election. (Telegraph)

U.S.

FED: WSJ Fed watcher Timiraos tweeted the following on Tuesday: “Researchers at the Kansas City Fed say there’s evidence that the lags of monetary policy are shorter than they used to be due to more central bank guidance.” (MNI)

ECONOMY: Former Federal Reserve Chair Alan Greenspan said a US recession is the “most likely outcome” as the central bank tightens monetary policy to curb inflation. (BBG)

ECONOMY/POLICY: FOX Business correspondent Gasparino tweeted the following on Tuesday: “Talk in DC is @WhiteHouse looking for a decent decline in inflation as the trigger to make a change at @USTreasury so @SecYellen -- who touted transitory inflation -- can leave gracefully. Leading contender: @GovRaimondo followed by @BankofAmerica CEO Brian Moynihan.” (MNI)

POLITICS: The U.S. House of Representatives adjourned for the day Tuesday without a speaker, after Republican leader Kevin McCarthy, R-Calif., failed in three consecutive votes to secure enough support to be elected to the post. (CNBC)

OTHER

GLOBAL TRADE: China is pausing massive investments aimed at building a chip industry to compete with the US, as a nationwide Covid resurgence strains the world’s No. 2 economy and Beijing’s finances. (BBG)

GLOBAL TRADE: The semiconductor surplus that emerged in the second half of last year is not expected to ease until at least autumn, according to industry analysts, although a shortage impacting the automotive industry will likely remain throughout the year. The supply glut in memory chips is especially pronounced for smartphones due to a drop in demand for the devices. (Nikkei)

GLOBAL TRADE: Nearly a third of logistics managers at major companies and trade groups say they do not know how much trade they would return to the West Coast once an International Longshore and Warehouse Union, or ILWU, labor deal is reached, according to CNBC’s supply chain survey. (CNBC)

CORONAVIRUS: European Union member states set the stage for coordinated controls on passengers arriving from China, including possible mandatory pre-travel testing, as the bloc works to ensure China’s sudden reversal of its zero-Covid policy doesn’t undermine the region’s efforts to put the pandemic behind it. (WSJ)

CORONAVIRUS: Japan will require more stringent Covid-19 testing for travelers from China from Jan. 8, public broadcaster NHK reports without saying where it got the information. (BBG)

CORONAVIRUS: The White House said there’s no reason Beijing should retaliate against the US and other nations that have imposed Covid restrictions on its travelers, saying the moves were justified on public health grounds as China experiences a surge in cases. (BBG)

U.S./JAPAN: U.S. President Joe Biden will hold talks with Japan Prime Minister Fumio Kishida at the White House on Jan. 13 to discuss North Korea, Ukraine, China's tensions with Taiwan, and a "free and open Indo-Pacific," the White House said on Tuesday. (RTRS)

HONG KONG/CHINA: Hong Kong plans to set the entry quota to the mainland at 50,000 per day, local broadcaster Now TV reports, citing unidentified people. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Wednesday that the central bank would keep monetary easing in order to achieve its 2% inflation target accompanied by wage growth. (RTRS)

JAPAN: The Tokyo metropolitan government plans to give households a monthly handout of 5,000 yen per child, broadcaster TBS reports, citing Governor Yuriko Koike. (BBG)

AUSTRALIA/CHINA: Chinese bureaucrats are discussing plans to resume some imports of Australian coal after a more than two-year ban as relations between the nations improve. (BBG)

RBA: The Reserve Bank of Australia calculates accumulated savings, a tight jobs market and spending cuts will make higher interest rates manageable for most homeowners, as AUD400 billion of fixed rate mortgages mature in 2023 and home prices are set to add to eight straight months of declines, MNI understands. (MNI)

RBA: Economists expect the Reserve Bank review to recommend creating a separate monetary policy committee and introducing greater accountability when policy errors are made. (AFR)

NORTH KOREA: President Yoon Suk Yeol ordered aides to consider suspending a 2018 inter-Korean military tension reduction agreement if North Korea violates the South's territory again, an official said Wednesday. (Yonhap)

NORTH KOREA: South Korea and the U.S. are planning tabletop military exercises against a potential nuclear attack by North Korea, a senior U.S. official has said, as Pyongyang signals a push to produce more nuclear weapons in 2023. (Nikkei)

MEXICO: Bank of Mexico board member Jonathan Heath said on Tuesday that the central bank's institutional design is "very robust" and can operate well with only four board members. (RTRS)

BRAZIL: Secretaries at Brazil’s Ministry of Finance have presented to minister Fernando Haddad an assessment that a fiscal adjustment of up to 223.08b reais in 2023 is feasible, reports local newspaper Estado based on preliminary simulations. (BBG)

BRAZIL: Brazil’s Pension minister Carlos Lupi has dubbed as an “anti-reform” the country’s latest pension reform approved during the Bolsonaro Administration, reported Valor Economico. (BBG)

BRAZIL: The chief executive of Brazilian oil company Petrobras, Caio Paes de Andrade, has informed the board of directors of his resignation, two sources with knowledge of the matter told Reuters on Tuesday. (RTRS)

RUSSIA: Russia's defence ministry said on Wednesday that 89 servicemen were killed in the Ukrainian attack on Makiivka over the weekend, adding the main reason for the attack was unauthorised use of mobile phones by the troops. (RTRS)

RUSSIA/TURKEY: Russian President Vladimir Putin plans to hold talks with his Turkish counterpart, Recep Tayyip Erdogan, on Wednesday, Interfax reports, citing Kremlin spokesman Dmitry Peskov. (BBG)

ARGENTINA: Argentina extended 2.89 trillion pesos in payments of debt instruments due in 1Q, the Economy Ministry said in two separate statements. (BBG)

OIL: OPEC’s crude output edged higher last month as Nigeria partially reversed a long-term slump by cracking down on oil theft. (BBG)

CHINA

ECONOMY: Several tier two cities in China are targeting GDP growth rates of between 5.5% to 7% in 2023, as local authorities remain optimistic about the economic recovery, according to the 21st Century Herald. (MNI)

YUAN: The yuan’s recent strength can continue as China’s economy and yuan assets become investment safe havens amidst a global slowdown in 2023, according to the Securities Daily. (MNI)

PROPERTY: Chinese authorities are planning to usher in further support measures to ease liquidity stress at some of the nation’s too-big-to-fail developers as the property downturn persists, according to people familiar with the matter. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY327 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday conducted CNY3 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY327 billion after offsetting the maturity of CNY330 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6644% at 9:30 am local time from the close of 1.6448% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9131 WEDS VS 6.9475 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9131 on Wednesday, compared with 6.9475 set on Tuesday.

OVERNIGHT DATA

JAPAN DEC, F JIBUN BANK MANUFACTURING PMI 48.9; PRELIM 48.8; NOV 49.0

December PMI data saw the Japanese manufacturing sector slip further into contraction territory in the final month of 2022. The downturn was largely centred around the current demand environment which is weak both internationally and domestically. Order book volumes contracted solidly and faster than paces recorded over much of the past two-and-a-half years while new export orders decreased for the tenth month in a row. Firms reportedly mirrored the picture for demand in their production volumes, as indicated by a solid reduction in output in December. (IHS Markit)

SOUTH KOREA DEC FOREIGN RESERVES US$423.16BN; NOV US$416.10BN

UK DEC BRC SHOP PRICE INDEX +7.3% Y/Y; NOV +7.4%

MARKETS

US TSYS: Early Move Fades, Marginally Richer As Risk Assets Firm

TYH3 deals at 113-02+, +0-14, jut off the top of its 0-08+ range, on volume of ~75K.

- Cash Tsys are marginally richer in today's Asia-Pac session, running 1-2bp firmer across the major benchmarks, with the 3- to 20-Year zone leading the strength.

- Tsys initially traded cheaper as local participants faded Tuesday's richening in early Asia-Pac dealing.

- A rally in the Hang Seng, aided by hopes of Chinese policy maker support for the economy, saw some demand for risk assets and promoted weakness for the USD, helping support the Tsy space, with TYH3 eying a test of Tuesday’s highs as a result.

- A block buyer of TUH3 headlined on the flow side (+3K), with some desks reporting light Tsy selling/swap payside interest around best levels, although those flows were limited.

- In Europe today we have final services & composite PMI releases. Further out we have JOLTS Job Openings and the ISM m'fing survey, although it will be the minutes from the Fed's December meeting that provide the highlight of the day.

JGBS: Curve Twist Steepens, Various Inputs Eyed

JGB futures bounced from the lows witnessed in the final overnight session of ’22 as Tokyo returned from the NY break, +25 on the day into the bell.

- Futures have drawn support from the bid observed in the global core FI space over the break, while cash JGB trade was a little more mixed.

- The major JGB benchmarks run 1bp richer to 5bp cheaper, pivoting around 10s.

- The early twist steepening of the curve became a little more pronounced after the BoJ outlined another round of unscheduled Rinban operations and 1- to 5-Year fixed rate purchases, with a reduction in the 10- to 25-Year purchases and lack 25+-Year purchases providing weight (upticks in the offer/cover ratios provided little impetus given the reductions in 1- to 3- & 5- to 25-Year purchase sizes).

- The previously outlined hawkish press speculation surrounding the BoJ (covering possible inflation forecast tweaks and the potential successor to Governor Kuroda) may have weighed on the longer end of the curve.

- Japanese MoF data covering the week ending 23 December revealed the largest ever round of net weekly sales of Japanese bonds on the part of foreign investors (Y4.8623tn), with the BoJ’s surprise tweak to its YCC settings facilitating those particular flows.

- Policymaker rhetoric failed to impact the space, with Kuroda once again pointing to the need for continued easing, while PM Kishida highlighted the need for real wage growth.

- Looking ahead 10-Year JGB supply headlines the domestic docket on Thursday.

AUSSIE BONDS: Firmer & Flatter But Off Best Levels On Chinese Coal Import Chatter

Aussie bonds initially piggybacked the richening observed in global core FI markets in the wake of Tuesday’s local close, with a slight pullback in the RBA terminal rate pricing adding to the broader impulse.

- The space moved away from best levels late in the Sydney session on the back of a BBG source report which suggested that “Chinese bureaucrats are discussing plans to resume some imports of Australian coal after a more than two-year ban as relations between the nations improve.”

- That left YM +5.0 & XM +10.0 at the bell, after both contracts printed through their respective overnight peaks, before the aforementioned pullback.

- Wider cash ACGB trade sees the major benchmarks running 5.0-10.5bp richer across the curve, with a bull flattening theme observed all day.

- Bills finished flat to +8 through the reds, also bull flattening.

- RBA terminal cash rate pricing oscillated between 3.90-3.95% today.

- Looking ahead, final Judo Bank services & composite PMI data headlines the domestic docket on Thursday.

EQUITIES: Gains In The Hang Seng Dominate

The Hang Seng stole the headlines in Wednesday’s Asia-Pac session, benefitting from hopes re: fiscal support for the Chinese economy in lieu of comments made by the Chinese Finance Minister, BBG source reports indicating that “Chinese authorities are planning to usher in further support measures to ease liquidity stress at some of the nation’s too-big-to-fail developers as the property downturn persists” and news that Ant Group’s consumer finance unit received approval to more than double its registered capital. Gains in the property sector and tech giant Alibaba (who own Ant Group) stood out in the wake of the news flow. The benchmark Hang Seng Index trades over 2.00% higher on the day at typing.

- Wider equity market performance was a little more mixed, with the Nikkei -1.5% as Tokyo returned from holiday and adjusted to moves in U.S. equity markets since the turn of the year, alongside a slightly stronger JPY in early ‘23.

- China’s CSI 300 is little changed as we move towards the bell, after dealing either side of unchanged.

- E-mini futures are 0.1-0.3% higher, with the NASDAQ 100 leading gains after tech giants Apple & Tesla traded heavily on Tuesday.

GOLD: Bullion Remains Close To Multi-Month Highs, Waiting For Key US Events

MNI (Australia) - Gold prices are higher again today up 0.4% after Tuesday’s 0.85% rise. It is now trading around $1846/oz, close to the mid-June highs, and down slightly on the intraday high of $1847.21 but well above the low of $1836.32. The USD has been trading sideways but UST yields are lower.

- On Tuesday bullion reached a high of $1849.98 while resistance stands at $1857.60, the June 16 high. Trend conditions for gold remain bullish. The current rally is being driven by expectations of the Fed becoming less hawkish, warnings of upcoming recessions and the spread of Covid through China.

- Later today the FOMC meeting minutes are published, as well as the December manufacturing ISM. Any signals of a less hawkish Fed should be good for gold prices. The other key event for the week is Friday’s payroll data for December, which is expected to post a 200k gain and average hourly earnings are forecast to ease only slightly to 5% y/y (bbg).

OIL: Crude Prices Fall Further On Lower Demand Expectations

MNI (Australia) - Oil prices have had a soft start to the New Year, as demand concerns come to the fore. Increased talk of recession plus the Covid situation in China have made markets more wary. Fears over the northern hemisphere winter have also been calmed with milder weather forecast.

- WTI crude has been trading in a narrow range and has fallen a further 0.4% today to $76.65/bbl breaching the key support of $76.79, the December 29 low, opening up $73.40. It reached an intraday high of $77.42 and a low of $76.56. Brent is down 0.2% to $81.90/bbl not far off its intraday low of $81.81 and just above its key short-term support of $81.85, the December 29 low.

- Oil production from OPEC rose slightly in November due to Nigeria reducing oil theft which had been reducing output for a long time. The other members complied with the quota cut. (bbg)

- Later today the FOMC meeting minutes are published, as well as the December manufacturing ISM. The other key event for the week is Friday’s payroll data for December, which is expected to post a 200k gain and average hourly earnings are forecast to ease only slightly to 5% y/y (bbg).

FOREX: DXY Gives Back Some Of Tuesday’s Rally

The USD struggled in Asia-Pac dealing, with a bid in the Hang Seng, linked largely to hopes surrounding Chinese policymaker support (from both a broad fiscal and property market-specific perspective) and slightly lower U.S. Tsy yields applying pressure.

- The greenback found itself at the foot of the G10 FX performance table as a result, while the JPY lost ground against all of its G10 FX peers, save the USD.

- The AUD was at the other end of the performance table, initially benefitting from its high beta status and links between the Australian economy and China, before it advanced further on the back of BBG source reports which suggested that “Chinese bureaucrats are discussing plans to resume some imports of Australian coal after a more than two-year ban as relations between the nations improve.”

- Elsewhere, USD/CNH traded back towards Tuesday’s multi-moth low, with the aforementioned hope re: deeper policy support for the economy, the USD/CNY mid-point fixing printing at the strongest level (in CNY terms) since mid-September (although that was broadly in line with estimates, providing a marginal 3 pip difference vs. the BBG survey) and seasonal onshore CNY demand ahead of the Lunar New Year break supporting the yuan.

- Looking ahead, the ISM Manufacturing survey and JOLTS job openings out of the U.S. are main data points scheduled ahead of the release of the meeting minutes covering the December FOMC.

FX OPTIONS: Expiries for Jan04 NY cut 1000ET (Source DTCC)

- USD/JPY: Y129.30($595mln), Y130.00($640mln), Y134.30($1.4bln)

- AUD/USD: $0.6800-05(A$1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2023 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 04/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/01/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 05/01/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.