-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Clarida's Comments Get Most Of The Focus In Asia, BoE Due

EXECUTIVE SUMMARY

- FED'S KAPLAN WANTS BOND-BUYING TAPER TO START SOON AND BE GRADUAL (RTRS)

- FED'S DALY SEES BOND PROGRAM TAPER LATER THIS YEAR OR EARLY 2022 (RTRS)

- U.S. DEVELOPING PLAN TO REQUIRE FOREIGN VISITORS TO BE VACCINATED (RTRS)

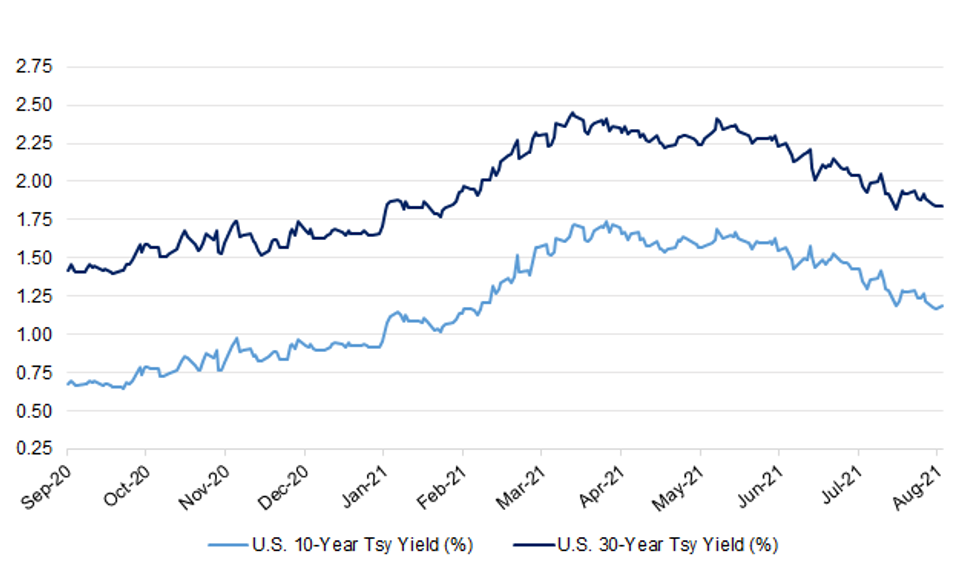

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Hundreds of vaccinators are being hired to go into schools from next month, it has emerged, as officials indicated the Covid jab could be rolled out to all teenagers. (Telegraph)

CORONAVIRUS: Fully vaccinated travellers and under 18s arriving in England from France will no longer need to isolate, while India is coming off the red list. The Department for Transport has set out the government's latest COVID-19 travel update, with all of the changes taking effect from 4am on Sunday. There were worries that Spain - where it is thought up to a million Britons are currently on holiday - could have been added to the red list. The country will remain in the amber category, although travellers arriving back from Spain are being urged to take a PCR test before flying home "as a precaution against the increased prevalence of the virus and variants in the country". Many people currently use lateral flow tests, which are cheaper, to meet the testing requirement. In a surprise move, the cost for solo travellers staying at a quarantine hotel will go up from 12 August, from £1,750 to £2,285. (Sky)

ECONOMY: U.K. Prime Minister Boris Johnson issued a rallying cry for the nation's institutional investors to plow money into British companies and create a "big bang" that powers a recovery from the pandemic. In a joint letter with Chancellor of the Exchequer Rishi Sunak, Johnson calledfor "hundreds of billions of pounds" to be unleashed into longer-term U.K. assets, including "pioneering firms and infrastructure." That would help secure better retirements for pensioners and support an "innovative, greener future," he said. (BBG)

EUROPE

GERMANY: Angela Merkel's CDU/CSU bloc slides 3 percentage points to 24% in the weekly Kantar poll for Focus magazine, while the Green Party rose, narrowing the Conservatives' lead to 2 points. Greens climb 3 points to 22%. SPD gains 1 point to 18%. FDP unchanged at 13%, AfD unchanged at 11%, Left Party unchanged at 6%. 1,413 people surveyed from July 28-Aug. 3. (BBG)

ITALY: Italian Economy Minister Daniele Franco said on Wednesday the government will take care to safeguard jobs and the local economy in the case of a takeover of struggling bank Monte dei Paschi di Siena by larger rival UniCredit. UniCredit last week agreed to enter into exclusive talks with the Treasury to buy "selected parts" of Monte dei Paschi (MPS), which is 64% state-owned after a 5.4 billion euro ($6.39 billion) bailout in 2017. Trade unions and politicians immediately expressed concern over the possible impact on jobs and the economy of Siena, a city where MPS is a major employer, and the surrounding region of Tuscany. "I strongly hope we can close (a deal), but we won't do so at any cost," Franco told parliament. (RTRS)

IRELAND: Ireland posts end-July fiscal deficit of EU5.8b compared to EU7.4b deficit a year earlier, finance ministry says in emailed statement. July tax receipts EU5.7b; 12% ahead of target +33% y/y. Tax receipts to end-July EU35.2b; 3.4% ahead of target, +13% y/y. Fiscal deficit stands at EU10.7b on 12 month rolling basis. (BBG)

U.S.

FED: The U.S. central bank should start reducing its bond-buying program "soon" and gradually, Dallas Federal Reserve President Robert Kaplan said on Wednesday, adding that doing so would give it more flexibility to be "patient" on raising interest rates. "As long as we continue to make progress in July (jobs) numbers and in August jobs numbers, I think we'd be better off to start adjusting these purchases soon," Kaplan told Reuters in an interview. Doing so gradually - over a time frame of "plus or minus" about eight months - will help "give ourselves as much flexibility as possible to be patient and be flexible on the Fed funds rate," allowing more progress on the labor market front, he said, referring to the central bank's benchmark overnight interest rate. "I think it's very important to divorce discussion of the Fed funds rate from discussion of our purchases," he said. "My comments on purchases are not intended to suggest I want to take more aggressive action on the Fed funds rate." (RTRS)

FED: San Francisco Federal Reserve President Mary Daly on Wednesday said that mostly likely the U.S. central bank will be in position to begin to reduce its massive asset-buying program later this year or early next year. "I'm looking for continued progress in the labor market, continued putting COVID behind us, rising vaccination rates, the things that are so fundamental to us saying that the economy has achieved that metric of substantial further progress," Daly said in an interview on the PBS NewsHour. "Right now my modal outlook is that we will achieve that metric later this year or early next." Fed officials have largely downplayed the impact of the highly transmissible Delta variant on the course of the recovery. Daly was less sanguine. (RTRS)

FED: Senator Elizabeth Warren praised Federal Reserve Governor Lael Brainard on Wednesday for her approach to financial regulation while criticizing Chairman Jerome Powell as too protective of big financial institutions. "My concern is that over and over he has weakened the regulation here," she said of Powell on Bloomberg TV's "Balance of Power with David Westin." "We need someone who understands and uses the monetary policy tools and the regulatory tools to keep our economy safe. Let's not forget what happened in 2008." (BBG)

INFLATION: Treasury Secretary Janet Yellen said that by the end of this year, monthly price changes will be running at a level consistent with the Federal Reserve's target, even if year-over-year numbers continue to show uncomfortably high inflation. Inflation as measured on an annual basis will be elevated "for some time," Yellen told reporters in Atlanta Wednesday following several local meetings and events. "But my expectation is that by the end of the year that monthly rates will come down to a pace consistent with the Fed's interpretation of price stability." Yellen's comments imply a return to monthly readings of 0.1% or 0.2% by December. The Fed targets 2% average inflation over time based on the Commerce Department's personal consumption expenditures price index. That gauge rose 4% in June from a year earlier, the fastest pace since 2008. (BBG)

ECONOMY: MNI INTERVIEW: Shortages More Worrisome Than Delta -ISM Svcs

- The highly infectious Delta variant of Covid-19 has the potential to cause consumers to pull back spending on services, according to businesses surveyed by the ISM, but firms see partial shutdowns at worst and pent-up demand continuing to propel service sector activity, survey chair Anthony Nieves told MNI Wednesday. High demand for in-person services is driving business activity, spending and prices, and businesses have yet to feel any slowdown as infections rise, Nieves said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The Senate moved through a series of amendments to the roughly $1 trillion infrastructure package on Wednesday, with lawmakers anticipating a vote on final passage of the bill this weekend or early next week. Since negotiators finished the 2,702-page bill last weekend, lawmakers have considered amendments offered by a mix of Republicans and Democrats to fine-tune elements of the bill. Republicans have pushed for an open-ended amendment process, while Senate Majority Leader Chuck Schumer (D., N.Y.) has called for the chamber to move quickly. Democrats are seeking to approve a budget outline for a $3.5 trillion climate and antipoverty package before the chamber departs for its August recess. "The longer it takes to finish this bill, the longer we'll be here," Mr. Schumer said. (WSJ)

FISCAL: Senate Minority Whip John Thune on Wednesday said Senate Republicans likely would not pursue Sen. Lindsey Graham's (R-S.C.) idea of fleeing Washington, D.C., to try to block Democrats from passing a massive spending bill without GOP support – buoying the chances of the bill passing if all Democrats get onboard. (Forbes)

FISCAL: The U.S. Congressional Budget Office said it will release on Thursday its cost estimate for the bipartisan infrastructure bill now being debated in the U.S. Senate, according to a posting on the CBO's website. The estimate of the Infrastructure Investment and Jobs Act's budgetary costs over the next 10 years could heavily influence the level of support it has in both the Senate and the House of Representatives. Summaries of the bill highlight $550 billion in new spending over a decade, but revenue offsets totaling only $480 billion. (RTRS)

FISCAL: Democrats are likely to pass up their best chance to avoid a standoff over the debt limit without GOP votes, a move that will thrust Congress into risky territory this fall as the threat of economic ruin approaches. There will be no language on raising or suspending the debt ceiling in the budget measure Senate Democrats expect to unveil within days to advance a $3.5 trillion spate of liberal spending plans without Republican buy-in, according to a Democratic aide close to budget talks. Instead, the party is looking to a short-term funding bill designed to avert a government shutdown at the end of September as the next opportunity for debt limit action, one top lawmaker said — an approach that would require Republican support. (POLITICO)

CORONAVIRUS: If America's current COVID-19 surge continues unabated into the fall and winter, the country will likely face an even more deadly strain of the virus that could evade the current coronavirus vaccines, NIAID director Anthony Fauci told McClatchy Wednesday. (Axios)

CORONAVIRUS: The Biden administration is developing a plan to require nearly all foreign visitors to the United States to be fully vaccinated against COVID-19 as part of eventually lifting travel restrictions that bar much of the world from entering the United States, a White House official told Reuters on Wednesday. The White House wants to re-open travel, which would boost business for the airlines and tourism industry, but is not ready to immediately lift restrictions because of the rising COVID-19 case load and highly transmissible COVID-19 Delta variant, the official said. The Biden administration has interagency working groups working "to have a new system ready for when we can reopen travel," the official said, adding it includes "a phased approach that over time will mean, with limited exceptions, that foreign nationals traveling to the United States (from all countries) need to be fully vaccinated." (RTRS)

CORONAVIRUS: When it comes to vaccine mandates, Americans want them when they fly, but not when they rock. The latest CNBC All-America Economic Survey found the public nearly evenly divided on the issue of vaccine mandates countrywide — whether they should exist at all and especially where they should exist. The poll of 802 Americans taken from July 24-28 found 49% favoring vaccine mandates and 46% opposing — a difference that's within the survey's 3.5 percentage point margin of error. Five percent said they were unsure. (CNBC)

CORONAVIRUS: CVS Health Chief Executive Karen Lynch said Wednesday that the peak of Covid-19 vaccinations is behind the company. On an earnings call, she said the drugstore chain has administered 30 million shots and continues to provide them in stores across the country. Yet she said vaccination rates have slowed since April — even as the coronavirus delta variant has led to a new surge of cases in parts of the country with large unvaccinated populations. The company lowered its outlook for the number of vaccines it plans to administer this year, after the number that it provided dropped off in May and June, CVS' chief financial officer, Shawn Guertin, said on the call. He said the company now expects to give between 32 million and 36 million doses this year. That's lower than the 29 million to 44 million doses that it said it anticipated in February. (CNBC)

CORONAVIRUS: Florida hospitals are struggling to get oxygen due to a rise in Covid-19 cases attributable to the delta variant and Florida Governor Ron DeSantis's decision not to declare another state of emergency. A shortage of drivers who are qualified to transport oxygen, as well as restrictions around how long truck drivers can be on the road — which went back into effect following the expiration of the public health emergency in the state — means that the supply isn't getting to the hospitals that need it most. (BBG)

CORONAVIRUS: Illinois Gov. JB Pritzker announced a mask mandate for all state students regardless of their vaccination status at a press conference Wednesday, requiring facial coverings in all indoor settings from preschool through high school. (CNBC)

CORONAVIRUS: Massachusetts will require that all staffers at nursing homes and other long-term care venues get a Covid vaccine by Sept. 1 and be fully vaccinated by Oct, 10, state officials announced Wednesday. The mandate includes exemptions for medical or religious reasons. (BBG)

CORONAVIRUS: Organizers of the New York International Auto Show on Wednesday canceled the event due to concerns about the coronavirus delta variant. The show was scheduled to open to the public on Aug. 20. It had been postponed since April of last year due to the global health crisis. It was the first time the show had been rescheduled since WWII. (CNBC)

OTHER

GLOBAL TRADE: Ireland's Finance Minister Paschal Donohoe predicted that world leaders will agree on a global tax accord that includes a minimum corporate rate, signaling that his country, a holdout for now, may accept an eventual compromise. "It is more likely than ever" that a deal will be struck, Donohoe told the Aspen Security Forum on Wednesday. He added that "we do have some work and some engagement to do" and that it's somewhat less likely that a plan will actually be implemented. (BBG)

U.S./CHINA/TAIWAN: The lack of curbs on use of Chinese drones in the SMART Grant Program is a problem that needs to be fixed, Republican Senator Marco Rubio says. Rubio's comment refers to grant program in infrastructure bill that Senate is working on. (BBG)

U.S./CHINA/TAIWAN: The Biden administration has approved its first arms sale to the island democracy of Taiwan, a potential $750 million deal, amid rising tensions with China. It calls for selling Taiwan 40 new M109 self-propelled howitzers and almost 1,700 kits to convert projectiles into more precise GPS-guided munitions, according to a State Department notification to Congress on Wednesday. The proposed sale must go through a congressional review process and then through negotiations between Taiwan and contractor BAE Systems Plc, which is also providing the U.S. Army with the latest version of the howitzer, before a contract is signed and delivery times are hashed out. (BBG)

GEOPOLITICS: U.S. President Joe Biden's administration is preparing an overhaul of arms export policy to increase the emphasis on human rights, a departure from former President Donald Trump's prioritization of economic benefits to U.S. defense contractors, four people familiar with the initiative said. (RTRS)

CORONAVIRUS: The World Health Organization has called for a global moratorium on booster shots until at least the end of September amid a severe shortage of vaccines in lower-income countries, where at-risk populations remain vulnerable to Covid-19. Tedros Adhanom Ghebreyesus, the director-general of the WHO, told reporters on Wednesday that the Geneva-based health body was calling for the delay to allow at least 10 per cent of people in every country in the world to be vaccinated. "To make that happen, we need everyone's co-operation, especially the handful of countries and companies that control the global supply of vaccines," he said. (FT)

CORONAVIRUS: The White House said on Wednesday it is prepared to provide COVID-19 booster shots, if needed, suggesting it would not heed a call by the World Health Organization to delay providing additional vaccinations. WHO chief Tedros Adhanom Ghebreyesus said on Wednesday that high-income countries like the United States should hold off on giving more doses until more poor countries are able to inoculate their own populations. But White House press secretary Jen Psaki said that was a "false choice" and Washington can both provide booster shots, if they are approved for use in the country, and donate excess supplies to other countries. (RTRS)

JAPAN: Japan proposed on Thursday expanding emergency restrictions to eight more prefectures to fight a surge in COVID-19 cases, a cabinet minister said, as worries grow about strains on the nation's medical system in Olympics host Tokyo and elsewhere. Officials have warned that coronavirus infections were surging at an unprecedented pace as new cases hit record highs in Tokyo, overshadowing the Olympics and adding to doubts over the government's handling of the pandemic. Economy Minister Yasutoshi Nishimura, who is leading Japan's pandemic response, made the proposal at a meeting of experts, who were expected to sign off. Six prefectures including Olympic host city Tokyo are already under full states of emergency to last through Aug. 31 while another five are under less strict "quasi-emergency" directives. (RTRS)

AUSTRALIA: Sydney reported a record number of new daily delta variant cases on Thursday, with authorities to enforce stay-at-home orders beyond Australia's largest city as Covid-19 spreads north into other regions. New South Wales state recorded 262 new cases, the vast majority in Sydney, which has been in lockdown for almost six weeks. Five more people died, and four of them weren't vaccinated, Premier Gladys Berejiklian told reporters. "Every jurisdiction around the world is finding delta challenging," Berejiklian said. "We can try and eliminate it but we know the vaccine is critical to stopping the spread." (BBG)

AUSTRALIA: The ABS notes that "payroll jobs fell by 2.4% nationally in the fortnight to 17 July 2021, following a 0.2% fall in the previous fortnight. The latest fortnight of data coincided with school holidays in every state and territory, the second and third weeks of the Greater Sydney lockdown, increased COVID-19 restrictions in other parts of New South Wales and the first two days of lockdown in Victoria. While every state and territory saw a fall in payroll jobs across the fortnight, the falls were much larger in New South Wales (down 4.4%) and neighbouring Australian Capital Territory (down 2.4%). New South Wales usually accounts for around a third (32.0%) of total payroll jobs and Victoria around a quarter (26.2%). As a result, lockdowns in these two states contributed to a strong fall in payroll jobs nationally." (MNI)

BOK: The only Bank of Korea board member to call for an interest-rate hike at last month's meeting has been appointed to head the nation's financial watchdog, a job transfer that comes as the bank moves toward reining in stimulus. South Korea's three-year bond futures edged up as much as eight ticks to to 110.38 before erasing gains after the announcement was made by the office of President Moon Jae-in. Economists took the move in stride. Chang Min, a former BOK official now at the Korea Institute of Finance, said the central bank would remain willing to raise rates without Koh Seungbeom on its seven-member board. (BBG)

TURKEY: President Tayyip Erdogan said on Wednesday Turkey's economy would grow more than 7% this year, driven by a 20% leap in the second quarter, and he expected inflation to fall after August. The government and International Monetary Fund have forecast the economy to grow 5.8% this year as the country steers a rapid economic recovery after the coronavirus outbreak. "We will reach more than 7% growth this year...We think there will be around 20% growth in the second quarter," Erdogan said in a broadcast interview. Erdogan also said Turkish inflation, which hit 18.95% in July, will start falling after August and the interest rates will also be lowered. "It is not possible for inflation to go further up. We will start to see a fall in interest rates too," Erdogan said reiterating his longstanding opposition to high interest rates, which he blames for causing inflation. (RTRS)

TURKEY: Turkey is battling the worst wildfires in its history, President Tayyip Erdogan said on Wednesday, as fires spread to a power station in the country's southwest after reducing swathes of coastal forest to ashes. (RTRS)

MEXICO: Banxico's key rate hike in June was a message to the market after the bank "screwed up" its inflation path forecast, said Deputy Governor Jonathan Heath in a Natixis podcast interview released on Wednesday. Holding the rate in June would have "disappointed" the market more than the hike. No merit to argument that members will accelerate hiking cycle based on the proposed makeup of the board next year. (BBG)

MEXICO: Mexico sued several gun makers in a U.S. federal court on Wednesday, accusing them of reckless business practices that supplied what it called a "torrent" of illegal arms to violent Mexican drug cartels, leading to thousands of deaths. (RTRS)

BRAZIL: Brazil's central bank raised its benchmark lending rate by a full percentage point, picking up the pace of its increases after inflation accelerated and the economy showed unexpected strength, and said it expects to increase it by the same amount at its next meeting. The bank raised the rate, known as the Selic, to 5.25% on Wednesday from 4.25%, the fourth increase in as many policy meetings. The Selic started the year at a record low of 2%, and the bank raised it by three-quarters of a percentage point at each of the previous three meetings. The bank's monetary policy committee, known as the Copom, said it expects to raise the Selic by another point at its next meeting and indicated more rate increases after that. (Dow Jones)

BRAZIL: Brazil's government is drawing up a constitutional amendment to create a fund from privatizations and state asset sales to pay down debt, meet court-ordered payment obligations and help the country's poorest people, a government source said on Wednesday. Crucially, from a fiscal perspective, the fund will not be subject to the 'spending cap', the government's most important fiscal rule which limits growth in public spending to the previous year's rate of inflation. (RTRS)

BRAZIL: Brazil's incoming presidential chief of staff Ciro Nogueira said on Wednesday the government will relaunch an ambitious social program to fight hunger and poverty ahead of next year's elections. (RTRS)

BRAZIL: Brazil's Supreme Court opened a criminal investigation into Jair Bolsonaro's unsubstantiated claims of voter fraud, aalleging the president threatens the nation's democracy by seeking to undermine the electoral system. Justice Alexandre de Moraes included the far-right president on Wednesday in an ongoing federal probe into the spread of fake news and misinformation on social media, after Bolsonaro intensified attacks on the country's electoral authority and its president in recent weeks. The president's behavior seeks to "complicate, frustrate or impede the electoral process with institutional attacks," de Moraes wrote in his decision, adding that Bolsonaro could face charges of defamation and incitement. "I'm sorry the electoral court sees the need to investigate, to accuse me of anti-democratic acts. It's possible I make mistakes. But we're not wrong," Bolsonaro said in an interview with a radio show on Wednesday evening. the president also said it's "extremely grave" that de Moraes accused him of lying, and that the judge should not be leading the investigation. (BBG)

IRAN: Iran is ten weeks away from acquiring enough enriched uranium to build a nuclear bomb, Israeli Defense Minister Benny Gantz said on Wednesday. "Iran has violated all of the guidelines set in the JCPOA and is only around 10 weeks away from acquiring weapons-grade materials necessary for a nuclear weapon," Gantz told ambassadors from countries on the United Nations Security Council during a briefing at the Foreign Ministry in Jerusalem. "Now is the time for deeds – words are not enough," he added. "It is time for diplomatic, economic and even military deeds, otherwise the attacks will continue." (Jerusalem Post)

MIDDLE EAST: The Arab coalition said on Wednesday that Saudi air defenses intercepted an explosive-laden drone launched by the Iran-backed Houthi militia in Yemen, state TV reported. (Arab News)

MIDDLE EAST: Israeli fighter jets attacked targets in southern Lebanon early on Thursday morning, the IDF Spokesperson has confirmed. The IDF statement confirmed that the air force targeted areas "from which rockets were fired during the day at the State of Israel...another target was also attacked in the area from which rockets were fired in the past. (Jerusalem Post)

CHINA

FISCAL: China must ensure its proactive fiscal policies produce more results, including using fiscal measures to support small businesses and manage the pace of budget investments and local government bond issuances, ensuring substantial work at the yearend and the beginning of next year, the People's Daily said citing Liu Yuanchun, the vice president of Renmin University. Policymakers should ensure liquidity is reasonably abundant and that real lending rate steadily declines, Liu was cited in the article, one of the frontpage series that focus on the economy. China will also accelerate the development of new-energy vehicles, investing in more charging facilities as part of its measures stimulating internal demand while also reducing carbon emission, the daily said. (MNI)

POLICY: China is drawing up a policy paper on data industry, an effort to accelerate the country's economic digitalization while strengthening protection of data security, two industry observers told the Global Times. The document will be made public later this year at the earliest, according to Chinese financial media caijing.com. "The effective use of big data is vital to China's economic development. Developing data trading markets can help the country to mature its efficient allocation of resources and create more value," Liu Gang, director of the Nankai Institute of Economics, and chief economist at the Chinese Institute of New Generation Artificial Intelligence Development Strategies, told the Global Times on Wednesday. (Global Times)

YUAN: The PBOC is expected to accelerate the development of the offshore yuan market as said in its major work report for 2H, while analysts believe this should include deepening the market-based reform of the yuan as well as increasing FX derivatives trading products in major offshore yuan markets such as Hong Kong and London, the Securities Times reported. Though the Federal Reserve's future moves may upset global markets and cross-border liquidity, the PBOC should control the pace of injecting liquidity into the offshore yuan market to prevent risks, the newspaper said citing analysts. (MNI)

CORONAVIRUS: China imposed new travel and movement restrictions across the nation, including in its highly protected capital of Beijing, as a delta-driven outbreak grew to over 500 symptomatic cases scattered across 15 provinces and municipalities. Public transport and taxi services were curtailed in 144 of the worst-hit areas nationwide, while officials curbed train service and subway usage in Beijing, where three new cases were reported Wednesday. Hong Kong re-imposed quarantine on travelers from the mainland, though an exception remained for the southern Guangdong province which neighbors the financial city. In just two weeks, confirmed cases -- people infected and sickened by the virus -- have grown to more than 500. The infections can be traced back to three cluster areas in China: an outbreak among airport cleaning staff in eastern city Nanjing, another found at a hospital treating Covid patients in Zhengzhou and sporadic cases detected in Yunnan, the province bordering Myanmar. (BBG)

CORONAVIRUS: Chinese Vice Premier Sun Chunlan ordered officials to step up their sense of responsibilities and strictly enforce pandemic control measures, according to a statement on Gov.cn. Local authorities must treat the anti-pandemic efforts a priority, including the separation of workers who handle international cargos and passengers from those with domestic duties, the government said. A spate of resurging cases has made the outlook uncertain, Sun said. (MNI)

EQUITIES: There is no need for the government to continue tax incentives for the game industry as the sector has now grown big competitive edge, state media Securities Times says in a commentary. Game companies should be treated the same as other industries in terms of taxation as it's been criticized that they enjoy tax break. Game companies should assume more social responsibility and give back to the society via tax payments. Games have become an important way for public to entertain and relax, and the sector will continue to grow. (BBG)

EQUITIES: China Fund News, a People's Daily affiliate, said on its Wechat account that liquor stock investors were panic after reading an article posted on Ministry of Science and Technology's website warning drinking alcohol could lead to cancer. The ministry reposted a study result from IARC, saying a study showed that 7000 cancer cases in Canada in 2020 were related with heavy drinking. (BBG)

PROPERTY: Hangzhou city in eastern China's Zhejiang province places stricter home purchase restrictions and strengthens supervision on new home sales to curb speculation, the city's housing authority says in a statement. 24-month consecutive social insurance payment is required for first home purchase by people who have household registration in the city for less than five years. Non-residents are allowed to make one home purchase if they have paid social insurance or individual income tax for consecutive 48 months. Home buyers will be disqualified for three years if they provide fake information or "maliciously" disrupt lottery process for home sales. (BBG)

OVERNIGHT DATA

AUSTRALIA JUN TRADE BALANCE +A$10.496BN; MEDIAN +A$10.450BN; MAY +A$9.269BN

AUSTRALIA JUN EXPORTS +4% M/M; MEDIAN +6%; MAY +4%

AUSTRALIA JUN IMPORTS +1% M/M; MEDIAN +4%; MAY +3%

CHINA MARKETS

PBOC NET DRAINS CNY20BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 1.9749% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 33 on Wednesday vs 39 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4691 THURS VS 6.4655

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4691 on Thursday, compared with the 6.4655 set on Wednesday.

MARKETS

SNAPSHOT: Clarida's Comments Get Most Of The Focus In Asia, BoE Due

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 107.57 points at 27691.61

- ASX 200 up 16.922 points at 7520.5

- Shanghai Comp. up 3.173 points at 3480.392

- JGB 10-Yr future down 10 ticks at 152.39, yield up 0.4bp at 0.010%

- Aussie 10-Yr future down 0.5 ticks at 98.855, yield up 0.7bp at 1.152%

- U.S. 10-Yr future -0-04 at 134-22+, yield up 1bp at 1.192%

- WTI crude up $0.24 at $68.39, Gold down $0.65 at $1810.98

- USD/JPY up 18 pips at Y109.66

- FED'S KAPLAN WANTS BOND-BUYING TAPER TO START SOON AND BE GRADUAL (RTRS)

- FED'S DALY SEES BOND PROGRAM TAPER LATER THIS YEAR OR EARLY 2022 (RTRS)

- U.S. DEVELOPING PLAN TO REQUIRE FOREIGN VISITORS TO BE VACCINATED (RTRS)

BOND SUMMARY: Activity Peaks At Cash Tsy Re-open As Asia Reacts To Clarida

Most of the Asia-Pac session's meaningful price action came around the cash Tsy re-open, and looked to be a result of the Asia-Pac region's reaction to Wednesday's comments from Fed Vice Chair Clarida on tapering/rate hikes and, to a lesser degree, the strong ISM services print out of the U.S. The contract last prints -0-04 at 134-22+, 0-01 off worst levels, on volume of ~80K. Cash Tsys sit 0.5-1.5bp cheaper as 5s lead the weakness. San Francisco Fed President Daly ('21 voter) reiterated her view re: the potential for tapering later this year/in early '22. A 7.0K screen seller of EDU3 provided the highlight on the flow side. Elsewhere, a 5.0K screen buyer of the FVU1 123.75 puts was seen. Pre-NY focus will fall on the latest BoE decision, where the vote split surrounding the Bank's asset purchase facility and any comments on the sequencing review re: normalisation will be eyed. NY hours will be headlined by comments from Fed Governor Waller and Minneapolis Fed President Kashkari ('23 voter). We will also get the latest round of weekly jobless claims data.

- The broader weakness in global core FI markets has weighed on JGB futures during Tokyo trade, with the contract last printing 10 ticks lower on the day. The cash curve has seen some twist steepening, with 10s back to the 0.01% marker in yield terms. The shorter end of the cash curve trades ~1.5bp richer, while 40s run ~1.0bp cheaper. The combination of the global core FI impulse, a softer JPY and a modest uptick for domestic equities has negated any risk-off flows surrounding the longer end of the curve. There has been a lack of notable domestic news flow, outside of confirmation of the previously outlined story re: the expansion of the quasi state of emergency to cover a further 8 prefectures. Wage data headlines the local docket on Friday.

- Over in Australia, YM & XM both sit -0.5 at typing, with the modest overnight twist flattening unwound. Local COVID matters dominated headline flow as NSW recorded a new daily record for COVID cases (262), with the Hunter & Upper Hunter areas set to enter a 1-week lockdown from 17:00 local time. The release of the RBA's SoMP, RBA Governor Lowe's semi-annual testimony in front of the House of Representatives Standing Committee on Economics, A$700mn of ACGB 0.25% 21 November 2025 supply and the release of the AOFM's weekly issuance slate headline locally on Friday.

JGBS AUCTION: Japanese MOF sells Y199.6bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y199.6bn 10-Year JGBis:

- High Yield: -0.174% (prev. -0.185%)

- Low Price 101.75 (prev. 101.90)

- % Allotted At High Yield: 79.0909% (prev. 30.2491%)

- Bid/Cover: 2.878x (prev. 3.818x)

JGBS AUCTION: Japanese MOF sells Y2.7641tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7641tn 6-Month Bills:

- Average Yield -0.1189% (prev. -0.1703%)

- Average Price 100.060 (prev. 100.085)

- High Yield: -0.1189% (prev. -0.1643%)

- Low Price 100.060 (prev. 100.082)

- % Allotted At High Yield: 67.4071% (prev. 23.7265%)

- Bid/Cover: 4.377x (prev. 3.869x)

JAPAN: Generally Reserved Net International Security Flows Witnessed Last Week

As is the norm, the bond flows provided the highlights in the latest round of weekly international security flow data.

- Japanese investors reverted back to net purchases of foreign bonds, albeit at rather limited levels. 2 of the 3 latest weeks have seen net purchases and have effectively negated the net selling witnessed in the middle of those 3 weeks, in net rolling terms.

- Foreign investors registered net purchases of Japanese bonds for the 4th time in 5 weeks, even with 10-Year JGB yields tending towards 0 (perhaps another sign that x-ccy basis swaps were once again deployed), reverting from the net sales seen in the previous week. Once again, the weekly net level witnessed wasn't particularly large.

- Overall Japanese outflows weren't too far from neutral last week, while investors bought a net ~Y550bn of Japanese assets based on this dataset.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 225.6 | -1087.4 | -1297.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -190.6 | 134.4 | -274.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 547.8 | -227.8 | 3248.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 3.2 | -58.5 | -382.8 |

EQUITIES: China Markets Steady

Equity moves were muted in the Asia-Pac session on Thursday, mulling over a mostly negative lead from the US and hawkish comments from Fed speakers. Markets in Japan were higher, the Nikkei 225 up around 0.3%; Japan extended its Covid-19 quasi-emergency measures to 8 prefectures after recording more than 14,000 new infections for the first time on Wednesday. In China bourses are slightly lower, but have recovered the bulk of opening losses. Liquor stocks came under pressure after a piece from the Ministry of Science and Technology warning drinking alcohol could lead to cancer. Other markets in the region swung between minor gains and minor losses. In the US futures are higher to the tune of around 0.15%, participants will already have one eye on the US NFP figure on Friday after a number of Fed speakers this week.

OIL: Crude Futures Bounce From Closing Lows

Crude futures are slightly higher in Asia-Pac trade on Thursday, picking up from closing lows on Wednesday. Major benchmarks are down almost 8% from the start of the week. WTI is up $0.26 from settlement at $68.41/bbl, Brent is up $0.020 at $70.58/bbl. The fall yesterday came as US DoE inventories unexpectedly rose and a hawkish set of comments from Fed officials. The latest declines have benchmarks through support levels, WTI now has support at $65.01/64.60 the low from Jul 20 / 76.4% of the May 21 - Jul 6 rally, Brent has support at $66.91/43 the July 20 low and the bear trigger. Sentiment in China has been broadly neutral today, stock markets treading water after losing ground earlier this week. In terms of demand concerns remain that the delta variant will affect the outlook, CNPC warned earlier of a 5% decline in short term oil demand.

GOLD: Back To Where We Started

After Wednesday's 2-way fluctuations (rallying on much softer than expected U.S. ADP employment data, before turning negative on a record rate of expansion for the headline ISM services survey and comments from Fed Vice Chair Clarida that we have documented elsewhere) bullion managed to settle back into familiar territory, sticking to the $1,810/oz level in Asia-Pac hours.

- The well-defined technical overlay remains intact, with initial support located at the July 23 low ($1,790.0/z) and initial resistance located at the July 15 high/bull trigger ($1,834.1/oz).

- Friday's U.S. NFP print presents the next major round of event risk.

FOREX: Yen Falters On Firmer E-Minis, Gotobi Day Flows

The yen went offered into the Tokyo fix and continued to underperform G10 peers thereafter. Gotobi day flows were the usual local suspect, but it is worth noting that Japan moved to extend quasi-emergency measures to eight more prefectures after reporting another record increase in daily Covid-19 cases. USD/JPY moved past yesterday's high, as U.S. e-minis and Japanese equity benchmarks edged higher in relatively muted Asia-Pac trade.

- Fed's Daly said inflation readings don't suggest that the Fed should change course and she expects later this year or early next year to be the appropriate time to taper. The DXY ground higher, building on gains registered after yesterday's round of hawkish comments from Fed Vice Chair Clarida.

- G10 high betas drew support from a generally firmer commodity complex and better risk appetite. The AUD outperformed even as iron ore retreated amid recent signs that China could tighten output curbs at steel mills.

- Spot USD/CNH remained rangebound, with an in-line PBOC fix giving it no clear directionality.

- The main risk even today is the Bank of England MPC meeting, with German factory orders and U.S. weekly jobless claims also due. Fed's Waller and Kashkari are set to speak.

FOREX OPTIONS: Expiries for Aug05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.2bln), $1.1825-30(E1bln), $1.1850-60(E3.4bln), $1.1885-00(E1.5bln), $1.1905-25(E958mln), $1.2000(E602mln)

- USD/JPY: Y109.00-05($878mln), Y109.15-30($1.3bln), Y109.35-50($1.4bln), Y110.00($584mln)

- AUD/USD: $0.7480-90(A$532mln)

- USD/CAD: C$1.2470($658mln), $C1.2525($721mln), C$1.2550($1.1bln)

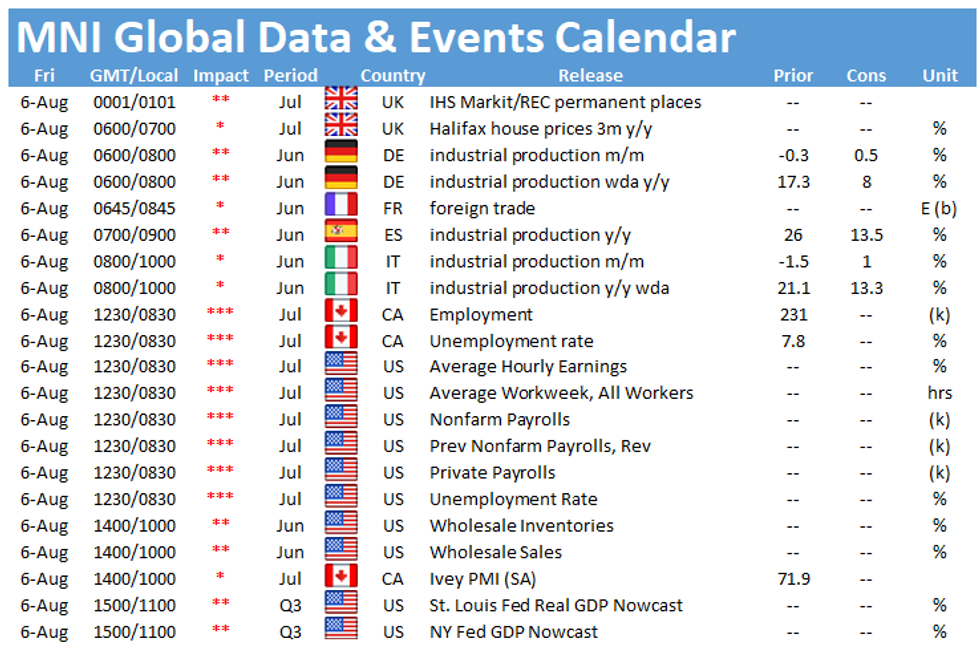

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.