-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Closer To Impeachment?

EXECUTIVE SUMMARY

- PENCE TELLS PELOSI 25TH AMENDMENT NOT IN BEST INTEREST OF U.S., SETTING UP WEDNESDAY HOUSE VOTE ON IMPEACHMENT

- MCCONNELL LEANS TOWARD CONVICTING TRUMP (AXIOS SOURCES)

- TUESDAY'S FEDSPEAK GENERALLY PUSHED BACK AGAINST IDEA OF IMMINENT TAPER

- PBOC REVERSE REPO OPERATION SHOWS POLICY INTENTION (CSJ)

- ITALY'S CONTE HEADS FOR SHOWDOWN WITH KEY ALLY READY TO QUIT (BBG)

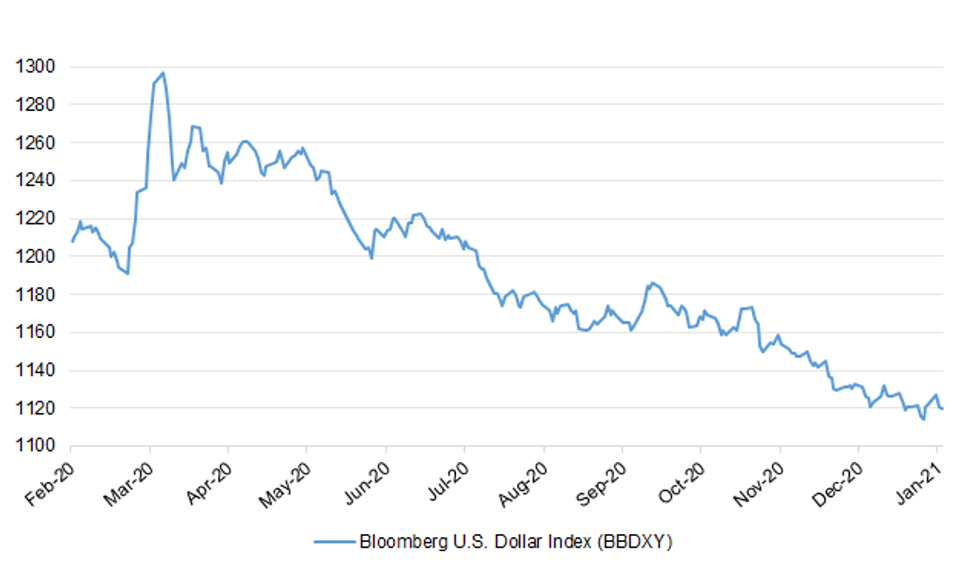

Fig. 1: Bloomberg U.S. Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Peak demand on hospitals might not be reached until "early to mid-February" leading to a "more extended period of pressure" on the NHS than had initially been hoped, MPs have been told. Chris Hopson, the chief executive of NHS Providers - which represents all NHS trusts, said it was now "pretty clear" the COVID infection rate "is not going to go down as quickly as it did" during the first lockdown last spring. (Sky)

CORONAVIRUS: The U.K. government urgently called on the public to follow lockdown rules as a continuing surge in coronavirus infections pushed the number of patients on ventilators to its highest level since April. Home Secretary Priti Patel warned police are cracking down on those "putting the health of the nation at risk by not following the rules," as she raised the prospect of a tougher lockdown in England in the coming weeks. (BBG)

CORONAVIRUS: More coronavirus patients are on mechanical ventilation in the U.K. than at any point in the pandemic. There are now 3,363 people on ventilation, compared with a previous peak of 3,301 set on April 12 last year, the latest data shows. (BBG)

CORONAVIRUS: Boris Johnson has clashed with NHS chiefs over the pace of the Covid-19 vaccination rollout, as the spread of the virus accelerates around the UK. The prime minister was frustrated by what he saw as excessive bureaucracy and a lack of data around the NHS plan, culminating last week in a series of "tough" exchanges, according to officials close to the talks. (FT)

CORONAVIRUS: Thousands of Britons who have received their coronavirus vaccine are set to be offered a health passport as part of a government-funded trial taking place this month. (Telegraph)

CORONAVIRUS/BREXIT: Customs operators have pleaded with the government to prioritise vaccinations for staff they insist are key front-line workers in the effort to keep vital supplies flowing into the UK. One operator told the BBC his staff were working flat out - often up to 16 hours a day - to help traders comply with the new post-Brexit customs requirements. (BBC)

BREXIT: The cost of shipping goods from Europe to the UK has risen sharply this year, raising the prospect of higher prices for French cheese, German sausages and other imports together worth tens of billions of pounds. The average cost of transporting a lorryload of goods to Britain from Germany was 26 per cent higher in the first week of 2021 compared with the average for the third quarter of last year, according to Transporeon, which tracks freight flows. (The Times)

BREXIT: The UK's major supermarkets have warned the government that an "urgent intervention" is needed to prevent further disruption to NI food supplies. There have been shortages of some products in NI as retailers grapple with post-Brexit arrangements for importing food products from GB. (BBC)

EUROPE

ECB: The coronavirus crisis in Spain requires a "forceful fiscal response still today," the governor of the Spanish central bank, Pablo Hernandez de Cos, says in an online event. Instruments of fiscal support might need to shift, he said, to provide more direct capitalization or subsidies since many companies have accumulated debt during the crisis. (BBG)

ITALY: The government of Italian Prime Minister Giuseppe Conte teetered on the brink of collapse as a junior ally renewed a threat to abandon the coalition, jeopardizing the country's attempt to counter the pandemic and salvage its economy. Ex-Premier Matteo Renzi, leader of the Italy Alive party which is languishing at 3% in opinion polls, said his group will decide Wednesday whether to topple Conte's government by withdrawing its ministers. "We don't want to be in government at all costs, if you want us to be in the government, listen to our ideas," Renzi said in an interview with Rai state television Tuesday night. (BBG)

NETHERLANDS: Lockdown measures in the Netherlands will be extended by three weeks until Feb. 9, Prime Minister Mark Rutte said Tuesday evening. The current lockdown, which added the shuttering of non-essential shops to the closure of bars and restaurants, was announced mid-December and had been set to last until at least Jan. 19. "The British corona variant is in the Netherlands, and this worries us greatly", Rutte said at a press conference in the Hague. (BBG)

BELGIUM: Belgium To Extend Lockdown Measures Until March 1. (HLN)

IRELAND: Ireland is set to receive more than EU1 billion from the European Union's Brexit fund, RTE reports, citing Simon Coveney, the Minister for Foreign Affairs. Funds are part of the Brexit Adjustment Reserve worth more than EU5 billion. (BBG)

IRELAND: Ireland has tightened pandemic travel rules for the second time in six days, requiring people visiting from all countries to present evidence of a negative Covid-19 test within 72 hours before arriving in the country. (FT)

U.S.

FED: MNI BRIEF: Fed's Rosengren: 'Little While' Before Taper Talk

- Boston Fed chief Eric Rosengren said Tuesday it's still too soon to begin talking about reducing the pace of central bank asset purchases. "The Fed is going to continue to be purchasing long-term assets until we see the economy is on a stronger economic footing," Rosengren said in remarks at an online event. "I expect it to be a little while before we are even talking about tapering on our purchases of government and mortgage-backed securities," he said later in Q&A - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: St. Louis Fed leader James Bullard also declined to say what the Fed could do with asset buying this year. When it comes to changing the pace of asset buying "I do think it'll be a judgmental call, and we'll have to see, but it's just too much uncertainty sitting right here today" to make a prediction, he said. (Dow Jones)

FED: Kansas City Federal Reserve President Esther George, one of the hawks at the central bank's policy table, said Tuesday that she's worried inflation is brewing and could surprise to the upside. In general terms, most Fed officials think inflation won't hit the central bank's target, for inflation to "average 2%," for the next three years. In a speech to the Central Exchange, George said that some goods prices are already moving up sharply. "Such a scenario does not suggest higher inflation is a near-term threat, but rather that inflation could approach the FOMC's average inflation objective more quickly than some might expect," George said. (MarketWatch)

FED: With virus cases still rising, it is too early to talk about adjusting monetary policy or changing the pace or scale of the Federal Reserve's asset purchases, Cleveland Federal Reserve Bank President Loretta Mester said Tuesday. When Fed officials decide to adjust the pace of purchases, the changes will be gradual and communicated well in advance, Mester said during a virtual event organized by the European Economics and Financial Centre. "I think it's very premature to think that we're getting to the point to change our policy stance," Mester said. "I think we have to get through this surge." (RTRS)

FED: MNI INTERVIEW: Chicago Fed Economist Sees Low Inflation Decade

- A depressed U.S. labor market that keeps millions of workers underemployed will likely keep a lid on inflation for years to come, Federal Reserve Bank of Chicago senior economist Leonardo Melosi told MNI, a signal that the Fed remains focused on the threat of sluggish prices rather than a potential surge in inflation - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: All of the Federal Reserve's 12 regional banks wanted to keep unchanged the rate that commercial banks are charged for emergency loans ahead of the U.S. central bank's December policy meeting, minutes from the directors' discussions of the discount rate showed on Tuesday. The recommendations from the directors, who don't set policy but do advise the presidents of the regional Fed banks, were in keeping with the Fed's decision last month to keep its benchmark overnight lending rate in a target range of between 0.00% and 0.25%. (RTRS)

FISCAL: President-elect Joe Biden will seek a deal with Republicans on another round of Covid-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter. The approach could mean a smaller initial package that features some priorities favored by Senate Republican leader Mitch McConnell. The idea is to forgo using a special budget process that would remove the need to get the support of at least 10 Republicans in the Senate, which will be split 50-50 and under Democratic control only thanks to the vice president's vote. (BBG)

FISCAL: MNI BRIEF: Yellen Senate Confirmation Hearing Scheduled Jan 19

- The Senate Finance Committee announced Tuesday it will hold a confirmation hearing for Biden's Treasury Secretary-nominee Janet Yellen on Jan. 19 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: U.S. Chamber of Commerce CEO Thomas Donohue on Tuesday called on Congress to support the U.S. economy through the end of the coronavirus pandemic, but warned lawmakers against a return to "anti-competitive" higher taxes and increased regulation. In his annual "State of American Business" speech, Donohue also called on the Biden administration to lift punitive tariffs put in place by the Trump administration and to re-engage with trade and "catch up" with other countries that are signing new trade deals. (RTRS)

CORONAVIRUS: The US on Tuesday reported more than 4,000 coronavirus fatalities in a single day for only the second time and as the death tolls in the country's two most populous states surpassed 30,000. State authorities attributed a further 4,056 deaths to coronavirus, a daily tally second only to the 4,081 fatalities reported on January 7, according to Covid Tracking Project data. (FT)

CORONAVIRUS: The federal government is changing the way it allocates coronavirus vaccine doses, now basing it on how quickly states can administer shots and the size of their elderly population, Health and Human Services Secretary Alex Azar said Tuesday. (CNBC)

CORONAVIRUS: New York plans to open pop-up sites statewide that could be used to test customers and workers in a push to reopen offices, restaurants and theaters, Governor Andrew Cuomo said Tuesday in his State of the State speech. (BBG)

CORONAVIRUS: New York will turn Citi Field into a 24/7 "mega" coronavirus vaccination site by the end of January in an effort to vaccinate thousands of residents daily, Mayor Bill de Blasio announced Tuesday. (CNBC)

CORONAVIRUS: Texas opened a field hospital in a convention center in the state's capital city, Austin, to relieve some of the strain on local hospitals. The "alternate care site" has an initial capacity of 25 beds that can be expanded if needed, Governor Greg Abbott said in a statement on Tuesday. More than 19% of hospital beds in the 11-county region that includes Austin are occupied by virus patients, state health department figures showed. (BBG)

CORONAVIRUS: Travelers flying into the United States from international destinations will be required to show proof of a negative COVID-19 test before boarding their flight. The U.S. Centers for Disease Control and Prevention announced the new policy Tuesday and said it will go into effect Jan. 26. The agency said it hopes the new testing requirement will help slow the spread of the virus, currently surging in the United States, as the vaccine rollout continues. (USA Today)

CORONAVIRUS: Shares of Regeneron were moving higher in after-hours trading after the pharmaceutical company announced a deal to supply the U.S. government with an additional 1.25 million doses of its Covid antibody therapy. (CNBC)

CORONAVIRUS: Slaoui: Novavax trial outcome expected in late March or April. (BBG)

CORONAVIRUS: Moncef Slaoui, chief advisor of Operation Warp Speed under the Trump administration, has submitted his resignation at the request of the Biden team, two sources tell CNBC's Meg Tirrell. Slaoui will stay 30 days through the transition, though his role will be significantly diminished on Jan. 20, when President-elect Joe Biden will be inaugurated. (CNBC)

POLITICS: The House approved a resolution on a late Tuesday night to encourage Vice President Mike Pence to use the 25th Amendment to remove President Donald Trump from office before his term ends on Jan. 20, a largely symbolic gesture that precedes a vote on impeachment Wednesday. (NBC)

POLITICS: President Donald Trump says the 25th amendment "is of zero risk to me, but will come back to haunt Joe Biden and the Biden administration." (BBG)

POLITICS: Vice President Mike Pence said on Tuesday that he will not invoke the 25th amendment t0 remove President Trump from office because it would "set a terrible precedent." Although Pence's announcement was expected, it paves the way for House Democrats to move forward with impeachment legislation. (Axios)

POLITICS: Vice President Mike Pence has told governors on a call about the coronavirus that "our time" is coming to an end and a "new administration" is taking over. Pence said Tuesday that the administration is in the middle of the transition and is working "diligently" with President-elect Joe Biden's team. He thanked the governors for their leadership on the coronavirus and promised them a "seamless transition." He says the objective "is that there is no interruption in our continuous efforts to put the health of the American people first." (Associated Press)

POLITICS: There's a better than 50-50 chance that Senate Majority Leader Mitch McConnell would vote to convict President Trump in an impeachment trial, sources tell Axios. "The Senate institutional loyalists are fomenting a counterrevolution" to Trump, said a top Republican close to McConnell. This would represent one of the most shocking and damning votes in the history of American politics, by the most powerful Republican in Congress. (Axios)

POLITICS: A CNBC reporter tweeted the following on Tuesday: "A former senior Trump administration official tells me he believes there are enough Republican votes in the Senate to convict and remove President Trump if they get articles of impeachment from the House."

POLITICS: Senate Democratic leader Chuck Schumer urged Senate Majority Leader Mitch McConnell to reconvene the Senate and hold an impeachment trial at a news conference in New York on Tuesday, arguing that a 2004 resolution allows the two of them to avoid the requirement for unanimous consent during an emergency. "We could come back ASAP and vote to convict Donald Trump, and get him out of office now before any further damage is done," said Schumer. (CNN)

POLITICS: House Speaker Nancy on Tuesday named Rep. Jamie Raskin (D-Md.) and eight other representatives as managers of the impeachment trial of President Trump. They will present the House's case for impeachment and attempt to convince senators to convict Trump during his Senate trial if the House votes to impeach him on Wednesday. (Axios)

POLITICS: Rep. Liz Cheney, the third-ranking House Republican, said Tuesday she will vote to impeach President Donald Trump, as at least three GOP lawmakers will move to charge the president from their own party with high crimes and misdemeanors. She is the highest-ranking Republican to call for the president's impeachment in the wake of Wednesday's deadly Capitol Hill riot, which Trump helped incite with lies and incendiary rhetoric. (CNBC)

POLITICS: In an extraordinary letter Tuesday to the U.S. military, the nation's top commanders condemned last week's acts of "sedition and insurrection" at the U.S. Capitol, while acknowledging Joe Biden's election victory. The message did not mention President Donald Trump by name, but the Joint Chiefs of Staff, led by U.S. Army Gen. Mark Milley, made it clear that the military intends to stand by the constitutional transfer of power to the next administration. (CNBC)

POLITICS: U.S. Chamber of Commerce CEO Thomas Donohue issued a stinging rebuke to President Donald Trump on Tuesday, calling Trump's actions last week in connection with pro-Trump mob at the U.S. Capitol "absolutely unacceptable and completely inexcusable." Donohue told a news conference that Trump "undermined our democratic institutions and ideals" and it was up to Vice President Mike Pence, the Cabinet and Congress to decide whether to try to oust Trump early through the Constitution's 25th Amendment or impeachment proceedings. (RTRS)

POLITICS: Federal authorities said Tuesday they expect to soon charge hundreds of people in connection with the Capitol riot. Officials added that they have directed a strike force to gather evidence for prosecutions for sedition and conspiracy. (CNBC)

POLITICS: A day before rioters stormed Congress, an FBI office in Virginia issued an explicit internal warning that extremists were preparing to travel to Washington to commit violence and "war," according to an internal document reviewed by The Washington Post that contradicts a senior official's declaration the bureau had no intelligence indicating anyone at last week's pro-Trump protest planned to do harm. (Washington Post)

OTHER

GLOBAL TRADE: China's Huawei Technologies is ramping up investment in local chip companies to plug holes in its semiconductor supply chain caused by the U.S. crackdown on the tech giant. (Nikkei)

GLOBAL TRADE: Top Chinese memory chip maker Yangtze Memory Technologies plans to double its output this year and start producing advanced chips rivaling those from Samsung and other global leaders, Nikkei Asia has learned. (Nikkei)

U.S./CHINA/TAIWAN: A cancellation of all travel by the U.S. State Department this week includes a planned visit to Taiwan by U.S. Ambassador to the United Nations Kelly Craft, a State Department spokeswoman said on Tuesday. (RTRS)

UK/CHINA: Senior Conservatives have called for a "reset" in UK policy towards China, including sanctions against officials responsible for human rights abuses. The Conservative Human Rights Commission demanded a rethink in relations after hearing evidence of abuses from torture to slavery. It urged the UK to work with allies to respond to China's behaviour. (BBC)

GEOPOLITICS: The Trump administration has declassified a report which lays out its Indo- Pacific strategy, including "accelerating India's rise," blocking China from establishing "illiberal spheres of influence," and maintaining "U.S. strategic primacy" in the region, according to a copy viewed by Axios. The strategy laid out in the ten-page report, written in early 2018, has guided the U.S. approach to China, India, North Korea and other nations in the Indo-Pacific region for the past three years. (axios)

GEOPOLITICS/CORONAVIRUS: The U.S. counter-intelligence chief said on Tuesday he was worried about threats from China and Russia to disrupt the coronavirus vaccine supply chain in the United States. William Evanina, director of the U.S. National Counterintelligence and Security Center, told an online Washington Post event that U.S. adversaries were trying to interfere with Operation Warp Speed, the U.S. government operation distributing the vaccines. "Our adversaries are trying to disrupt that supply chain," he said. Asked which adversaries he was particularly concerned about, he replied, "I would say China and Russia right now." (RTRS)

CORONAVIRUS: A new strain of the novel coronavirus has been found in Brazil's Northern state of Amazonas, G1 website reported citing information released by health foundation Fiocruz Amazonia. Institution did not say whether it is a new variant or one already found outside the country, the publication added. (BBG)

CORONAVIRUS: A mutated and more infectious coronavirus strain first identified in South Africa is "disturbing" and could pose a threat to antibody treatments that are used to prevent people from falling seriously ill from Covid-19, White House health advisor Dr. Anthony Fauci said Tuesday. (CNBC)

CORONAVIRUS: Pfizer Inc. and federal health officials are investigating the death of a health-care worker 16 days after the person received the first dose of the company's Covid-19 vaccine. So far, the evidence doesn't suggest a connection, Pfizer said in a statement on Tuesday. The Florida-based physician developed a rare disorder called severe thrombocytopenia that decreases the body's ability to clot blood and stop internal bleeding. (BBG)

CORONAVIRUS: The Australian and New Zealand Society for Immunology says the federal government should immediately pause the planned rollout of the AstraZeneca vaccine because it may not be effective enough to generate herd immunity. Phase three clinical trials of the vaccine, which is the centrepiece of Australia's vaccination strategy, show it is only 62 per cent effective in preventing COVID-19 when given in the recommended dose. Trials suggest vaccines from Pfizer and Moderna are about 95 per cent effective. (Sydney Morning Herald)

CORONAVIRUS: Hackers posted confidential documents regarding Covid-19 medicines and vaccines on the Internet after a data breach late last year at the European Medicines Agency. Timelines related to evaluating and approving Covid medicines and vaccines haven't been affected, the EMA said in a statement on Tuesday. The agency said it remains fully functional and that law enforcement authorities are taking action on the breach. (BBG)

JAPAN: Japan is set to expand the area under the coronavirus state of emergency beyond the Tokyo region, encompassing the country's three largest economic hubs as a surge in virus cases continues to grow. Prime Minister Yoshihide Suga will announce the expansion of the emergency area to seven additional prefectures later on Wednesday, according to media reports. He is set to speak at a press conference at 7 p.m. Together with Tokyo and three nearby prefectures that came under a state of emergency less than a week ago, the areas will represent more than half the nation's economy. (BBG)

BOJ: The Bank of Japan is considering cutting growth forecast for the fiscal year ending March at its two-day policy meeting starting Jan. 20, Nikkei reports, without attribution. Consumption hit by the resurgence of coronavirus in the nation and the Japanese economy seen contracting in Jan.-March period. (BBG)

AUSTRALIA/CHINA: China has accused Australia of 'weaponising the concept of 'national security' after a $300m bid to buy a construction company was scuppered by Josh Frydenberg. (The Australian)

NEW ZEALAND: New Zealand wants access to Covid-19 vaccines as soon as possible but accepts that other nations where the death toll is rising have a higher priority, Deputy Prime Minister Grant Robertson said. "We're doing every single thing that is possible to get the vaccines here as soon as we can, but I don't think it will be a surprise to anybody that countries where there are literally thousands of people dying every day, that those are countries where the vaccines are going out right now," Robertson told NewstalkZB Wednesday. (BBG)

SOUTH KOREA: South Korea expects difficult job situation to continue in Jan.-Feb. (BBG)

NORTH KOREA: The powerful sister of North Korean leader Kim Jong-un harshly criticized South Korea's military for closely tracking its military parade believed to have taken place in Pyongyang to celebrate a rare party congress. On Monday, Seoul's military officials said signs were detected that the North carried out a military parade in central Pyongyang Sunday night in time for the eighth congress of the ruling Workers' Party, which has been under way since its opening last week. (Korea Herald)

CANADA: Ontario's government declared a second provincial emergency as Covid-19 rates accelerate and a new, more transmissible variant has surfaced in Canada's most populous province. (BBG)

BOC: MNI INTERVIEW: BOC to Raise Rates Before 2023- RBC's Wright

- Canada's central bank will raise its 0.25% interest rate in the third quarter of 2022 as the economy finds its feet again, sooner than the 2023 scenario laid out by policy makers, Royal Bank of Canada chief economist Craig Wright told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: Mexican President Andres Manuel Lopez Obrador said he will challenge regulations that could prevent the government from airing his daily press conferences during campaign season, setting up a clash with the country's electoral body ahead of key midterm elections in June. (BBG)

MEXICO: Mexico could raise concerns over potential barriers to its agriculture exports to the United States in any future negotiations over the Mexican government's contentious energy policy, Economy Minister Tatiana Clouthier said in an interview. "It means we keep talking in the framework we signed, the free trade accord," she said, referring to the new United States-Mexico-Canada Agreement. "And getting into a negotiation about what bothers one side, and what bothers the other." (RTRS)

RUSSIA: The U.S. State Department this month told European companies which it suspects are helping to build Russia's Nord Stream 2 gas pipeline that they face the risk of sanctions as the outgoing Trump administration prepares a final round of punitive measures against the project, two sources said on Tuesday. (RTRS)

WORLD BANK: World Bank Chief Economist Carmen Reinhart is worried that the protracted nature of the Covid-19 pandemic may overwhelm household and business balance sheets and develop into a financial crisis. "It's a cumulative toll," Reinhart said in an interview with Bloomberg Television. "This did not start as a financial problem. This started and continues to be, first and foremost, a health crisis. But it has elements that have morphed into your classic balance sheet problems." (BBG)

OIL: Saudi Arabia slashed crude oil supplies to at least nine refiners in Asia and Europe after the kingdom volunteered to cut its production by 1 million barrels a day for February and March. Aramco will supply less crude as part of long-term contracts next month, giving some Asian processors as much as 20%-30% less than they had sought, according to company officials who received the notices but asked not to be identified as the information is private. A European refiner that typically buys small volumes from Saudi Arabia will not get any cargoes for February. (BBG)

OIL: US crude production will stay below pre-Covid-19 levels through 2022, the Energy Information Administration (EIA) said in its latest estimate. US crude production will average 11.1mn b/d this year, down from 11.3mn b/d in 2020, the agency said today in its monthly Short-Term Energy Outlook (STEO). Crude output will rise steadily next year to average 11.5mn b/d as prices and drilling conditions become more favorable. Most onshore output growth will occur in the Permian basin in Texas and New Mexico. US oil production totals for 2021 and 2022 will be down from the record level of 12.25mn b/d in 2019, signaling that the US will not return to pre-Covid-19 levels of production in the next two years. (Argus Media)

CHINA

CORONAVIRUS: China reported 107 local coronavirus infections on Jan. 12, including 90 in the northern province of Hebei, 16 in northeast China's Heilongjiang province and 1 in Shanxi province, according to a statement from the National Health Commission. The escalation has moved Hebei's total number of cases to over 600 in the recent flareup as the province imposed lockdowns in multiple cities and was set to mass test the population. Local authorities in Heilongjiang have decided to put the province in emergency status. (BBG)

CORONAVIRUS: China has locked down three cities and asked residents of Beijing, Shanghai and Guangdong province not to leave for the annual Spring Festival holiday, enacting the widest controls the country has had since the initial Covid-19 outbreak last year. (FT)

YUAN: The Chinese yuan may continue to stay strong as China keeps its normal monetary policy, including policy rates that increase the interest rate spreads against other countries which are maintaining negative or zero rates, said Li Yang, the head of National Institute for Finance and Development, a state-owned think tank. In a speech transcript carried by Sina.com, Li said that China was likely to see an increase in the flow of global capital entering its bond and stock markets. Chinese interest rates may trend lower in the years to come, narrowing the net interest margins of commercial banks. China should be more selective about inbound capital, and should require good environmental and credit standards, Li said. (MNI)

PBOC: The PBOC's CNY5 billion net OMO injection yesterday, an unusually small amount, was a gesture to the market that the central bank stands to supply more credit if needed, the China Securities Journal said. The central bank's normal starting amount of injection is CNY10 billion, and so far China's money market is well supplied with liquidity, the Journal said. However, liquidity may tighten in the days before the February Lunar New Year due to tax payments, maturing MLF and higher cash demand, according to the official securities newspaper. (MNI)

LENDING DATA: Bond issuance and credit financing were the major drivers behind China's countercyclical efforts last year, while off-balance sheet financing such as entrusted and trusted loans declined, according to an article in Securities Daily. These drivers were evidence that the pandemic had not caused regulators to ease curbs, the Daily said. Yuan-denominated loans surged to CNY 19.63 trillion in 2020, up CNY 2.82 trillion from the previous year, while total new social financing recorded CNY 34.86 trillion, up CNY 9.19 trillion from 2019, the Daily reported citing PBOC data. (MNI)

OVERNIGHT DATA

JAPAN DEC MONEY STOCK M2 +9.2% Y/Y; MEDIAN +9.2%; NOV +9.1%

JAPAN DEC MONEY STOCK M3 +7.6% Y/Y; MEDIAN +7.6%; NOV +7.6%

AUSTRALIA NOV JOB VACANCIES +23.4% Q/Q; OCT +59.5%

NEW ZEALAND DEC ANZ COMMODITY PRICE +1.8% M/M; NOV +0.9%

NEW ZEALAND DEC ANZ TRUCKOMETER HEAVY +0.4% M/M; NOV +0.1%

In broad terms, heavy traffic (trucks but also buses) primarily reflects the movement of goods, while light traffic is all about the movement of people. In normal times, light traffic provides a six-month lead on momentum in the economy, but at times of abrupt events such as seen in 2020, the Light Traffic Index will of course not see them coming, temporarily breaking the correlation. The Heavy Traffic Index is a real-time indicator of goods production. (ANZ)

SOUTH KOREA DEC UNEMPLOYMENT RATE SA 4.6%; MEDIAN 4.1%; NOV 4.1%

SOUTH KOREA NOV MONEY SUPPLY L +1.1% M/M; OCT +0.6%

SOUTH KOREA NOV MONEY SUPPLY M2 +0.9% M/M; OCT +1.1%

CHINA MARKETS

PBOC NET DRAINS CNY8 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net drain of CNY8 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

CHINA SETS YUAN CENTRAL PARITY AT 6.4605 WEDS VS 6.4823 TUES

MARKETS

BOND SUMMARY: Firmer But Off Best Levels

Asia-Pac investors were happy to participate in an extension of Tuesday's late NY Tsy rally, building on the momentum that came from a strong 10-Year Tsy auction. Flow dominated in Asia-Pac hours, with pockets of TYH1 buying and a 750 lot lift of USH1 helping support early on. Headline flow was relatively light, with the U.S. House of Reps set to vote on Trump's impeachment on Wednesday. In an interesting turn, some reports have suggested that Senate Majority Leader McConnell may vote in favour of impeaching President Trump. T-Notes last +0-03+ at 136-16+, after some light selling was seen in that contract, while cash trade has seen some modest richening, although the early bull flattening has unwound, with the long end back from Asia extremes.

- JGB futures traded back to unchanged levels in early afternoon dealing, unwinding the morning bid, with little support seen on the back of a 5-Year JGB auction which was probably a little softer than most expected. The auction saw the low price miss broader expectations (which stood at 101.05, per the BBG dealer poll), indeed the average price was in line with the expectations for the low price, while the tail widened marginally and cover ratio edged lower. A widening of the regions covered by the Japanese state emergency is set to be officially announced later today. Futures last +2, with long end outperformance at the fore in cash trade.

- Aussie bonds firmed on the broader core FI bid, resulting in bull flattening, with YM +0.5 and XM +3.5. Sino-Aussie tensions headlined local news flow.

EQUITIES: U.S. Yield Pullback Provides Support

E-minis & regional equity indices traded unchanged to higher in Asia-Pac hours, after Wall St. recovered during the NY afternoon on the back of U.S. Tsy yield dynamics.

- There was little in the way of notable headline flow evident during Asia-Pacific hours, with continued focus on all things U.S., namely the Fed, political drama and the outlook for fiscal policy.

- The Nikkei 225 was the biggest mover among the major regional indices, extending to yet another fresh, multi-decade high.

- Nikkei 225 +0.9%, Hang Seng unch., CSI 300 +0.1%, ASX 200 +0.1%

- S&P 500 futures +7, DJIA futures +64, NASDAQ 100 futures +31.

GOLD: Supported By DXY & U.S. Tsy Moves

The move away from fresh recent highs in longer dated U.S. Tsy yields and subsequent moderation of the recent DXY uptick has supported bullion since the NY afternoon, although spot continues to operate in familiar territory, with no meaningful movement on the technical front, last +$5/oz, trading around the $1,860/oz marker.

OIL: APIs & Broader Themes Support Crude In Asia

A larger than expected drawdown in the headline weekly API crude inventory estimates, a continued moderation of the DXY's recent uptick and light bid in e-minis has supported crude markets overnight with WTI & Brent sitting ~$0.70 above their respective settlement levels at typing.

- Tuesday saw crude specific headline flow dominated by questions re: Russia's compliance to the OPEC+ production pact in the month of December (which could have been one of the factors which resulted in Saudi Arabia's unilateral, voluntary output cuts, which are scheduled for the months of February and March).

- Elsewhere, the EIA slashed its projections for 2021 global crude oil demand in its latest STEO.

- Wednesday will see the release of the weekly DoE crude inventory report.

FOREX: USD Rally Falters

The greenback held its worst levels for 4 days in Asia on Wednesday as markets digest headlines the US House will vote on Trump impeachment at approximately 1500EST.

- AUD/USD last down 9 pips at 0.7763. Tensions with China resurfaced after a bid by a Chinese state-owned company to buy an Australian construction company was shut down. Data showed job vacancies rose 23.4% in Dec after a 59.5% rise in November.

- NZD/USD is faring slightly better, up around 5 pips at 0.7224. Fitch affirmed NZ's ratings and outlook after market on Tuesday.

- USD/JPY last down 14 pips. There has been little in the way of notable local headline flow for JPY, with continued focus re: the potential expansion of the areas covered by the COVID-19 state of emergency. Japanese Prime Minister Suga news conference scheduled for 1000GMT/1900JST to give an update on the situation, while EconMin Nishimura proposed adding 7 prefectures to state of emergency.

- The PBOC fixed USD/CNY at 6.4605, some 218 pips firmer for the yuan on the weaker US dollar, but significantly softer than sell side estimates of 6.4510. According to Bloomberg analysts this is the biggest upside miss for the estimate since the inception of the metric in mid-2018.

- GBP has seen a continuation of yesterday's move, cable last changing hands at 1.3865, around 22 pips higher. EUR/USD 6 pips higher having seen a subdued session, last at 1.2213; sources note the move higher was capped by offers at 1.2220 and sizable option expiries between now and Jan 19.

FOREX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-00(E543mln), $1.2200-10(E1.1bln), $1.2285-00(E985mln), $1.2350(E656mln)

- USD/JPY: Y102.00($525mln), Y103.00($1.4bln), Y103.70-80($990mln),

Y104.00-15($1.4bln) - USD/CAD: C$1.2750-65($790mln)

- USD/CNY: Cny6.45($594mln), Cny6.60($640mln)

- USD/MXN: Mxn19.85($520mln), Mxn20.00($500mln)

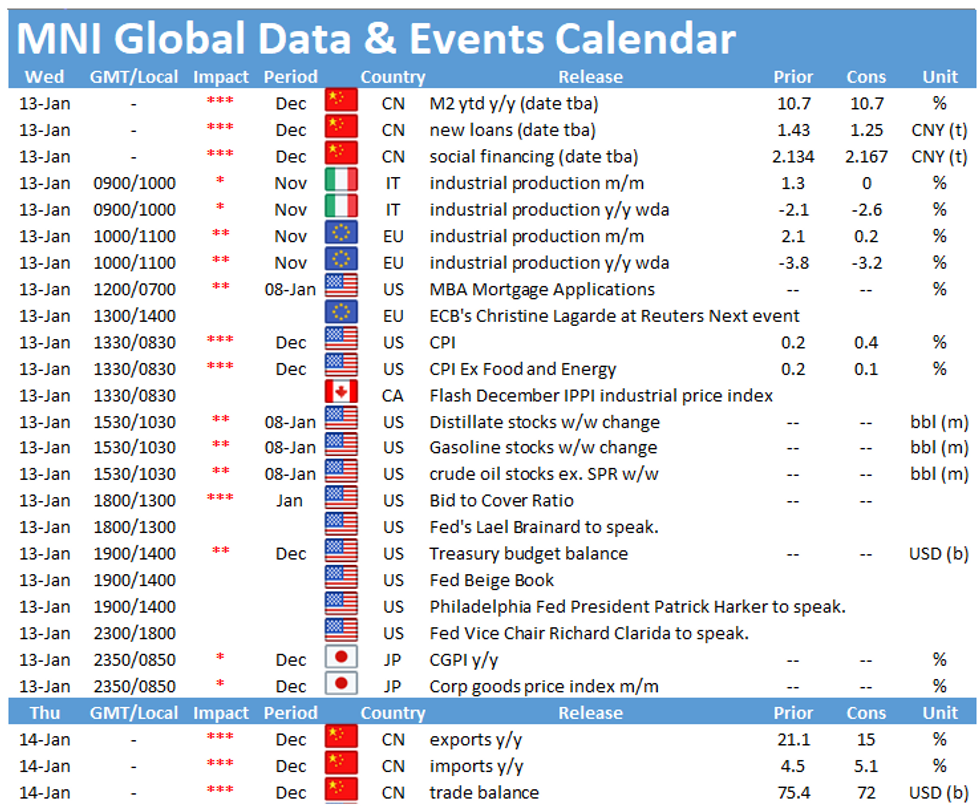

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.