-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: CNY Defence Steps Up

EXECUTIVE SUMMARY

- CHINA JULY CPI DIPS TO OVER TWO-YEAR LOW - MNI BRIEF

- US SET TO LIMIT SCOPE OF CHINA INVESTMENT BAN WITH REVENUE RULE - BBG

- ITALY SAYS WINDFALL TAX CAN’T EXCEED 0.1% OF A BANK’S ASSETS - BBG

- UK HEADS FOR FIVES OF LOST GROWTH, FAILURE OF ‘LEVELING UP’ - BBG

- NZ ONE-YEAR INFLATION EXPECTATIONS COOL FURTHER IN Q3 , SAYS RBNZ - DOW JONES

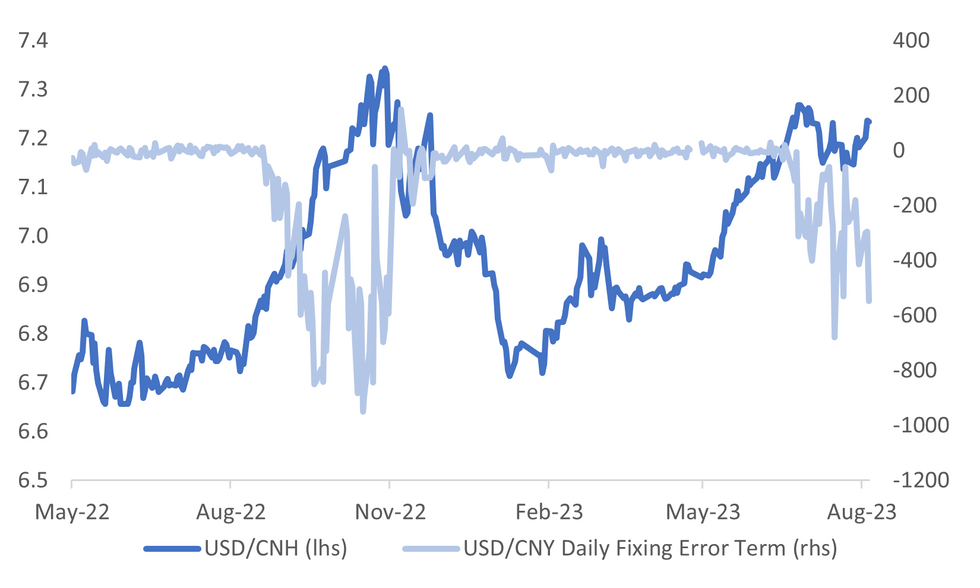

Fig. 1: USD/CNH Versus USD/CNY Fixing Error (Market Consensus - Actual Fix)

Source: MNI - Market News/Bloomberg

U.K.

GROWTH: The UK is headed for five years of lost economic growth as the government fails in its goal to “level-up” the country’s regions and reduce inequality, an influential think tank says. Gross domestic output is unlikely to return to its pre-pandemic level before 2024, according to forecasts from the London-based National Institute of Economic and Social Research. (BBG)

EUROPE.

ITALY: Italy issued a clarification of its new tax on banks’ windfall profits, saying the impact may be limited for some banks and the levy won’t exceed 0.1% of a firm’s assets. Banks that have already increased the interest rates they offer to depositors “will not have a significant impact as a consequence of the rule approved yesterday,” the finance ministry said in a statement Tuesday night. (BBG)

U.S.

US/CHINA: A US plan to restrict investment in China is likely to apply only to Chinese companies that get at least half of their revenue from cutting-edge sectors such as quantum computing and artificial intelligence, people familiar with the matter said. The revenue provision would limit the scope of an executive order the Biden administration is expected to unveil in the coming days as part of a push to limit Chinese access to sensitive technology. (BBG)

US/VIETNAM: President Joe Biden said he plans to travel to Vietnam soon as the US seeks to bolster its ties with Asian nations and reduce China’s influence on the region. “I’m going to be going to Vietnam shortly. Vietnam wants to change our relationship and become a partner,” Biden said Tuesday evening at a Democratic fundraiser in Albuquerque, New Mexico. (BBG)

MARKETS: Amazon.com Inc. is in talks to join other tech companies as an anchor investor in Arm Ltd.’s initial public offering, according to a person familiar with the situation, part of preparations for a deal that could raise as much as $10 billion. Amazon is one of several tech companies that have talked to Arm about backing the offering, which is expected next month, said the person, who asked not to be identified because the deliberations are private. Arm, a chip designer that counts the world’s biggest tech firms as its clients, also has held discussions with Intel Corp. and Nvidia Corp. (BBG)

MARKETS: For the past four years, WeWork Inc. has been trying to deliver a turnaround story — one in which the rowdy co-working startup transforms into a stable, profitable public company. It sloughed off Adam Neumann, its rambunctious co-founder and former chief executive officer, and replaced him with an industry veteran boasting a reputation of saving troubled real estate companies. (BBG)

OTHER

HONG KONG: L’Occitane International SA’s controlling shareholder is in advanced talks on a potential deal to take the skin-care company private at a valuation of around $6.5 billion, people familiar with the matter said. Billionaire Chairman Reinold Geiger has been discussing a possible offer of about HK$35 for each L’Occitane share he doesn’t already own, said the people, who asked not to be identified as the information is private. A bid at that level would represent a 37% premium to Tuesday’s closing price in Hong Kong. (BBG)

AUSTRALIA: Australia looks like it will manage to pull off a soft landing, despite slowing global trade and higher interest rates to rein in inflation, S&P says in a statement. The key risk to a soft-landing scenario is that inflation is more sticky than generally expected and the Reserve Bank of Australia has to hike interest rates more strongly. (BBG)

NEW ZEALAND: New Zealand's one-year inflation expectations continued to fall in the third quarter, taking some of the pressure off the central bank to raise the official cash rate further in the coming months. The Reserve Bank of New Zealand's latest survey of expectations showed business managers forecast annual inflation to average 4.17% over the coming year, easing from 4.28% in the previous quarter. Dow Jones (BBG)

TAIWAN: Taiwan chipmaker TSMC's 3.5 billion euros ($3.83 billion) investment in Germany will drive deeper engagement between the island and Europe, Taiwan's economy minister said on Wednesday, pitching the political benefits of the deal. For Taiwan, under increasing pressure from Beijing to accept China's sovereignty claims over the island, the investment in a new factory is a show of goodwill towards Europe, even as the European Union has shown no desire to proceed with a Bilateral Investment Agreement, or BIA, Taipei has long hoped for. (RTRS)

CHINA

INFLATION: China's Consumer Price Index fell by 0.3% y/y in July, turning negative for the first time since February 2021, compared with the -0.4% market consensus and down from June's 0.0% print, data from the National Bureau of Statistics showed Wednesday. (MNI BRIEF)

HOUSING: Local government officials from Beijing, Shanghai, Guangzhou and Shenzhen will hold a meeting in August to discuss property easing measures, The Economic Observer reports, without citing anyone. (BBG)

RATES: China’s plan to lower the interest rates on existing housing loans requires coordination between banks and borrowers, and large lenders should take the lead on the rate cuts, China Securities Journal reports Wednesday, citing experts. (CSJ)

ECONOMY: China should focus its economic efforts on driving the real economy and strengthening manufacturing sector development through innovation, the Economic Daily says in a front-page editorial, citing interviews with government officials, company executives and think tanks. (Economic Daily)

DEBT: China should ensure efforts to reduce local debt don’t cause problems for the financial sector as banks help governments ease loan repayment pressure, the Economic Daily said in an editorial. (BBG)

GROWTH: China should use economic policy to improve education, healthcare and social welfare to better people's livelihoods and enhance consumption as a driver of growth, according to Wang Xiaolu, deputy director at the National Economic Research Institute. In an interview with Caixin, Wang said China must change the mindset of “more investment the better” which has led to ineffective investment and excess capacity in various industries. (Caixin)

EXPORTS: The decline in China’s export growth will gradually narrow in H2 with the arrival of peak season, as exporters rush to produce orders for Christmas and Halloween. Exports totaled CNY2.02 trillion in July, dropping 9.2% y/y, mainly due to the slowdown in overseas demand, price factors and the high comparison base over the same period last year, said Zhou Maohua, researcher at China Everbright Bank. (21st Century Business Herald)

CARS: The intense price war in the world’s largest car market is starting to calm down. In the past two months, the proportion of cars subject to significant price cuts has fallen. In July, 428 variants of passenger cars — about 16% the market — had undergone price drops of more than 5% within a three-month period, according to Bloomberg analysis of data compiled by research provider China Auto Market. (BBG)

CHINA MARKETS

PBOC Net Drains CNY7 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday with the rate unchanged at 1.90%. The operation has led to a net drain of CNY7 billion after offsetting the maturity of CNY9 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8302% at 09:45 am local time from the close of 1.7464% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday, compared with the close of 45 on Monday.

PBOC Yuan Parity At 7.1588 Wednesday Vs 7.1565 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1588 on Wednesday, compared with 7.1565 set on Tuesday. The fixing was estimated at 7.2136 by BBG survey today.

MARKET DATA

NZ JULY CARD SPENDING RETAIL M/M 0.0%; PRIOR 0.9%

NZ JULY CARD SPENDING TOTAL M/M -0.9%; PRIOR 1.2%

NZ 2YR INFLATION EXPECTATION 2.83%; PRIOR 2.79%

SOUTH KOREA JULY UNEMPLOYMENT RATE 2.8%; MEDIAN 2.7%; PRIOR 2.6%

SOUTH KOREA BANK LENDING TO HOUSEHOLDS KR1068.1t; PRIOR 1062.2t

JAPAN JULY MONEY STOCK M2 Y/Y 2.4%; PRIOR 2.6%

JAPAN JULY MONEY STOCK M3 Y/Y 1.9%; PRIOR 2.1%

CHINA JULY CPI Y/Y -0.3%; MEDIAN -0.4%; PRIOR 0.0%

CHINA JULY PPI Y/Y -4.4%; MEDIAN -4.0%; PRIOR 5.4%

MARKETS

US TSYS: Curve Marginally Flatter In Asia

TYU3 deals at 111-15, +0-02, a 0-07 range has been observed on volume of ~71k.

- Cash tsys sit flat to 2bps richer across the major benchmarks, the curve has bull flattened.

- Tsys were firmer in early dealing as local participants digested yesterday's dovish Fedspeak by Philadelphia Fed President Harker as well as a strong 3 Year auction. Gains marginally extended alongside a recovery off early session lows in e-minis.

- The move higher didn't follow through and tsys ticked away from early session highs, a firmer than forecast Chinese CPI print weighed at the margins.

- Tsys observed narrow ranges for the remainder of the session.

- There is a thin data calendar in Europe today, further out the docket is thin with just MBA Mortgage Applications due. We also have the latest 10-Year supply.

JGBS: Futures Holding Gains, Light Calendar, 10Y Yield Below 0.60%

JGB futures are holding early session gains in the Tokyo afternoon session, + 31 compared to settlement levels.

- The local docket has been light today, with M2 & M3 money stocks as the only releases so far. Machine Tool Orders are due later.

- Accordingly, the gains through the Tokyo morning session appear linked to a richening in US tsys in Asia-Pac trade, although they are now off bests. US tsys are dealing flat to 2bp richer with the curve flatter.

- Cash JGBs have bull flattened with 0.6bp to 4.1bp lower beyond the 1-year zone. The benchmark 10-year yield is 2.1bp lower at 0.589%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The Japan 10-year real yields fell 1.1bp to -0.53% on Wednesday from the previous business day, according to Bloomberg. Real yields have risen 11bp this month. (See link)

- Swap rates are lower across the curve. Swap spreads are wider across the curve.

- Tomorrow the local calendar sees International Investment Flow, PPI and Tokyo Office Vacancies data.

- The US docket is thin later today with just MBA Mortgage Applications due.

AUSSIE BONDS: Mixed, Off Bests, Spillover From US Tsys & NZGBs

ACGBs (YM -1.0 & XM +2.0) are dealing mixed and near Sydney session lows. Without economic data or local headlines, the domestic market has been guided by US tsys in Asia-Pac trade.

- US tsys have ticked away from session highs in recent dealing after official CPI from China for July was a touch firmer than forecast. 10-year US tsy supply later today.

- Higher NZGB yields following the lift in RBNZ 2-year inflation expectations may also have weighed on short-end ACGBs at the margin.

- The latest round of ACGB Jun-35 supply sees smooth digestion with a higher outright yield and steeper curve seemingly supporting demand. However, the cover ratio was lower than the previous auction.

- The cash ACGB curve twist flattens with yields 1bp higher to 2bp lower. The AU-US 10-year yield differential is at -2bp.

- The swaps curve also twist flattens with rates 2bp higher to 1bp lower.

- Bills strip is cheaper with pricing -1 to -4, with whites leading.

- RBA-dated OIS pricing is 1-4bp firmer with ’24 meetings leading.

- Tomorrow the local calendar sees Consumer Inflation Expectations data.

- The US docket is thin today with just MBA Mortgage Applications due.

NZGBS: Richer But Off Bests After RBNZ’s 2Y Inflation Expectations Rise

NZGBs closed flat to 2bp richer, but off session bests after the RBNZ’s 2-year inflation expectations printed at 2.83% in Q3 vs 2.79% in Q2. Nevertheless, the outcomes for the two-year results fall within the central bank's designated target range of 1% to 3%. This suggests that even in the event of the RBNZ increases the OCR again, the likelihood of substantial tightening remains low.

- The RBNZ's Survey of Expectations represents respondents' expectations and not the Bank's. Additionally, 1-year inflation expectations printed at 4.17% in Q3 vs 4.28% in Q2. (See link)

- US tsys have ticked away from session highs in recent dealing after official CPI from China for July was a touch firmer than forecast weighing at the margins.

- Swap rates are 1-3bp lower, with the 3s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 2bp softer across meetings, with terminal OCR expectations at 5.65%.

- Total spending on debit and credit cards for the month of July declined 0.9% m/m, +4.7% y/y. Core retail spending printed -0.1% m/m, +4.9% y/y.

- Tomorrow the local calendar has no data.

- However, the NZ Treasury plans to sell NZ$275mn of the 0.5% May-26 bond, NZ$150mn of the 2.0% May-32 bond and NZ$75mn of the 2.75% Apr-37 bond.

EQUITIES: China & Japan Modestly Weaker, South Korea Shares Outperform

Outside of higher South Korea equities, and some pockets of strength in SEA, most regional markets are tracking lower at this stage. US equities are a touch higher but have mostly been range bound so far in Wednesday trade. Eminis were last around 4521, while Nasdaq futures are slightly outperforming in percentage terms. This follows weakness in Tuesday trade in the US for cash equities, although the major benchmarks trimmed losses into the close.

- South Korea shares were higher from the open, despite the negative tech lead from US indices on Tuesday. The Kospi is +1.2% higher at this stage, while the Kosdaq is +2%. Retail investors have reportedly supported the market, particularly in terms of the tech sector.

- China and Hong Kong markets started off weaker before recovering ground. Major indices are lower at the break but away from session lows. The HSI close to flat, with China developer Country Garden rebounding from earlier losses. Onshore media reported that tier 1 cities are to discuss easing property restrictions this month.

- In China the CSI 300 sits down -0.22%. This leaves the index very much within recent ranges. July inflation data was close to expectations and the underlying detail, coupled with base effects, suggests headline CPI deflation won't persist.

- In Japan, the major indices are off by around 0.50-0.60% at this stage, with the machinery sector weighing.

- In SEA we are seeing modest gains for Malaysian and Indonesian shares. Indian shares have opened up weaker though.

- The ASX 200 is a touch higher (+0.15%) as CBA leads bank shares higher after a strong earnings result.

FOREX: USD Marginally Lower In Asia

The greenback is sitting a touch lower in Asia today, BBDXY is down ~0.1%, ranges remain narrow with little follow through on moves.

- AUD is the strongest performer in the G-10 space at the margins, AUD/USD is ~0.2% firmer however we sit a touch below session highs. Technically AUD bears remain in the driver seat, support comes in at $0.6497 (low from Aug 8) and $0.6485 (low from Jun 1).

- Kiwi is ~0.1% firmer, gains briefly extended after 2-Year Inflation Expectations rose in Q3 however the move didn't follow through and we sit at $0.6075/80.

- Yen is firmer, however only marginally and a narrow range is persisting this morning. Bullish conditions remain intact, resistance comes in at ¥144.20 (high from Jul 7) and ¥145.07 (high from 30 Jun and bull trigger).

- Elsewhere in the G-10 space; EUR is up ~0.1% as is CHF. GBP is marginally lagging, sitting little changed from opening levels.

- Cross asset wise; e-minis are a touch firmer, the Hang Seng is little changed having pared an early ~0.6% loss. US Tsy Yields are little changed across the curve.

- The docket is thin on Wednesday, Thursday's US CPI print is the next macro risk event for G-10 FX.

OIL: Crude In Tight Range But Holding Onto Gains

Oil prices have been moving in a very narrow range during the APAC session but have held onto most of Tuesday’s gains. WTI is down 0.2% to $82.72/bbl, close to the intraday low of $82.68. Brent is also 0.2% lower at $86, which is providing support with moves below tending to be brief. The USD index is slightly lower.

- WTI is now up 1.1% in August so far and Brent +0.7%.

- Bloomberg reported API data showing a US inventory build of 4.1mn barrels in the latest week after the huge 15.4mn drawdown, according to people familiar with the data. The official EIA data print later today and last week printed at -17.05mn barrels.

- Risks to Russian crude shipments from tensions in the Black Sea remain after the Ukraine’s Zelensky said that it would choose its targets if Russia blocked Ukraine’s ports. The hostility around shipping has provided support to markets this week.

- The calendar is very quiet later with no data/events of note. The focus is on Thursday’s US CPI. OPEC+ and IEA reports are also released this week.

GOLD: Pressured By A Surging USD On Tuesday

Gold is up 0.3% in the Asia-Pac session, after closing 0.6% lower on Tuesday. USD strength proved to be a headwind for the precious metal, building on Monday's drop.

- On Tuesday, the US dollar experienced its most significant surge in almost five months, driven by apprehensions stemming from lacklustre Chinese economic data and uncertainties surrounding the US banking sector's condition.

- Moody's Investors Service's decision to downgrade 10 smaller and mid-sized American banks, along with the potential for similar actions on a few major institutions. That helped spur strength in the greenback, which typically moves in the opposite direction to bullion.

- The US tsy 10-year yield declined 7bp to around 4.02%. While lower yields would tend to support bullion, it is important to note that the 10-year yield remains some 20bp higher than month-ago levels.

- US CPI figures out on Thursday will be closely monitored.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/08/2023 | 1230/0830 | * |  | CA | Building Permits |

| 09/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 09/08/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.