-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Confusion On Threadneedle

EXECUTIVE SUMMARY

- BANK OF ENGLAND SIGNALS TO LENDERS IT IS PREPARED TO PROLONG BOND PURCHASES (FT)

- BIDEN SAYS ‘VERY SLIGHT’ RECESSION POSSIBLE, DOWNPLAYS RISK

- ECB'S VILLEROY LAYS OUT PLAN FOR SHRINKING BALANCE SHEET (RTRS)

- SNB’S JORDAN SIGNALS RATE HIKE WITH SWIPE AT LOOSE POLICY BIAS (BBG)

- BANK OF KOREA RETURNS TO OUTSIZED HIKES, WARNS OF SLOWER GROWTH (BBG)

- SAUDI ARABIA DEFIED U.S. WARNINGS AHEAD OF OPEC+ PRODUCTION CUT (WSJ)

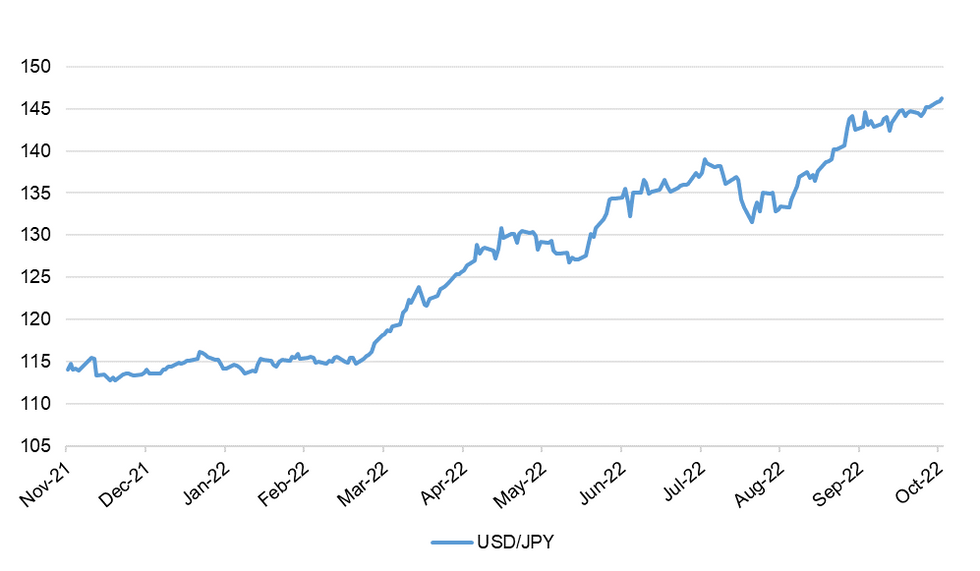

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: "The Bank of England has signalled privately to bankers that it could extend its emergency bond-buying programme past this Friday’s deadline, according to people briefed on the discussions, even as Governor Andrew Bailey warned pension funds that they “have three days left” before the support ends." (FT)

FISCAL: Chancellor Kwasi Kwarteng is facing Tory opposition to proposals to save £5bn a year from Britain’s overseas aid budget, as he begins the politically perilous task of filling in a fiscal hole estimated at up to £60bn. (FT)

FISCAL: Renewable power companies will have their revenues capped in England and Wales, after the government bowed to pressure to clamp down on runaway profits. (Guardian)

FISCAL/POLITICS: Liz Truss was challenged in the Cabinet over benefits, with four ministers understood to be backing a rise in line with inflation. (Telegraph)

ECONOMY: Robert Walters, the recruitment company, said that the UK’s “volatile political and economic backdrop” was hurting market confidence as it reported a drop in fee income for the third quarter. (The Times)

EUROPE

ECB: The European Central Bank should start shrinking its balance sheet once its interest rate is close to 2%, first by getting banks to repay their loans and then by whittling down its bond holdings, ECB policymaker Francois Villeroy de Galhau said on Tuesday. (RTRS)

FISCAL: Germany continues to resist calls for more joint European borrowing to help support consumers and businesses during the energy crisis, European Union officials told MNI, though they added that Berlin’s resolve might weaken if its economy is hit by more severe gas shortages. (MNI)

SNB: Swiss National Bank President Thomas Jordan signaled that interest rates should rise again as price pressures begin building in the economy. (BBG)

U.S.

FED: The Federal Reserve's current interest rate setting is not yet restrictive and will need to continue to move up so that real interest rates move into positive territory and then remain there for some time, Cleveland President Loretta Mester said Tuesday. (MNI)

FED: The Federal Reserve might need to raise interest rates even more than it indicated at its September meeting because inflation pressures coming from an overheating economy are likely to prove stubborn, former IMF chief economist Olivier Blanchard told MNI. (MNI)

ECONOMY: President Joe Biden said a recession in the US is possible but that any downturn would be “very slight” and that the US economy is resilient enough to ride out the turbulence. (BBG)

ECONOMY: Treasury Secretary Janet Yellen said Tuesday that the U.S. economy was “doing very well” as rising energy prices, Covid-19 variants and Russia’s war with Ukraine have caught global markets in a vice grip. (CNBC)

ECONOMY: Intel Corp. is planning a major reduction in headcount, likely numbering in the thousands, to cut costs and cope with a sputtering personal-computer market, according to people with knowledge of the situation. (BBG)

POLITICS: Central banks' fight against inflation may take another two years to play out, increasing unemployment and lowering living standards for many in the world, the International Monetary Fund's chief economist said on Tuesday. (RTRS)

OTHER

GLOBAL TRADE: “We managed to agree on a grain deal in July -- prices fell -- so we believe that we need to continue working toward an agreement. This gets results,” Russian Finance Minister Anton Siluanov said in a statement. He said Russia is a “responsible supplier” of food and is prepared to boost exports in 2023. (BBG)

U.S./CHINA/TAIWAN: Taiwanese Minister for Economic Affairs Wang Mei-Hua said on a visit to the United States on Tuesday that if Taiwan remains safe, global supply chains of vital semiconductors would also be secure. (RTRS)

UK/CHINA: China will be declared an official “threat” in a new strategic review of Britain's enemies, The Sun can reveal. (The Sun)

GEOPOLITICS: In an interview with the Financial Times, Kishida said he would carry out an extensive review of Japan’s defence capabilities in light of “an increasingly tough security environment in East Asia” including advances in North Korean missile technology, China’s growing military presence and Russia’s invasion of Ukraine. (FT)

JAPAN: Japan will take necessary steps in the foreign exchange market if needed and there is no change in the country's stance at all, the Jiji Press news agency quoted Finance Minister Shunichi Suzuki as saying on Wednesday. Suzuki also said that what was important was the speed of forex moves, and that Japan will closely watch forex moves with a sense of urgency, Jiji reported. (RTRS)

RBA: The Reserve Bank of Australia's estimate of its nominal neutral rate is "not necessarily" a prescription for what policy should do, said Assistant Governor (Economic) Luci Ellis. (MNI)

RBNZ: The Reserve Bank wants to retain its current 1%-3% inflation target in its Monetary Policy Committee remit - but is pushing to remove the current reference in the remit to house prices. (Interest NZ)

BOK: The Bank of Korea returned to outsized interest-rate increases and warned of slower growth to come as it sought to shore up a currency that has been driven to crisis-era lows by the Federal Reserve’s aggressive policy tightening. (BBG)

MEXICO: Mexico’s anti-inflation measures have prevented 300 basis points of key interest rate hikes, Finance Minister Rogelio Ramirez de la O said Tuesday. (BBG)

RUSSIA: President Biden called Russian President Vladimir Putin a “rational actor” but said he miscalculated with his decision to invade Ukraine. (The Hill)

RUSSIA: State Department spokesperson Ned Price said Washington had "very little confidence" that Russia was making a legitimate offer to talk because Lavrov's comments came within hours of Russian missile strikes that killed civilians in Ukraine. (RTRS)

RUSSIA: To speed delivery of two advanced air-defense systems for Ukraine, Raytheon Technologies Corp. will accelerate assembly by using existing parts instead of building the weapons from scratch, the Pentagon said in a statement. The US is also contracting for more parts under the Ukraine Security Assistance Initiative. (BBG)

RUSSIA: Following Russia’s strikes on Ukraine, Macron decided during a defense cabinet meeting late Monday to increase France’s military presence in Eastern Europe with the NATO military alliance, a spokesman for France’s defense minister Sebastien Lecornu said by phone. (BBG)

RUSSIA: Russian President Vladimir Putin has accepted Thailand’s invitation to attend the Asia-Pacific Economic Cooperation summit in Bangkok next month, Bangkok Post reported, citing an unidentified security official. (BBG)

SAUDI ARABIA: President Joe Biden feels that the US' relationship with Saudi Arabia needs to be re-evaluated in the wake of the OPEC+ decision last week to decrease oil production, a National Security Council spokesman said. (CNN)

IRAN: The Biden administration will not take its eye off the threat posed by Iran as it reviews Washington's relationship with Saudi Arabia after the OPEC+ decision to cut oil production, State Department spokesperson Ned Price said on Tuesday. (RTRS)

ARGENTINA: Argentina will charge a new 25% refundable duty on all purchases made in foreign currencies, a senior tax official said on Tuesday, as the government aims to protect scarce hard currency reserves amid a severe economic slump. (RTRS)

PERU: Peru’s top prosecutor filed a complaint in congress against President Pedro Castillo for alleged corruption offenses, potentially boosting the campaign of opposition lawmakers seeking to remove him from office. (BBG)

IMF: Central banks' fight against inflation may take another two years to play out, increasing unemployment and lowering living standards for many in the world, the International Monetary Fund's chief economist said on Tuesday. (RTRS)

ENERGY: Brussels wants to force member states to nominate energy companies to join a region-wide platform for joint gas purchases, as part of measures aimed at lowering energy prices across the 27-member bloc. (FT)

OIL: Days before a major oil-production cut by OPEC and its Russia-led allies, U.S. officials called their counterparts in Saudi Arabia and other big Gulf producers with an urgent appeal—delay the decision for another month, according to people familiar with the talks. The answer: a resounding no. (WSJ)

OIL: Saudi Arabian Foreign Minister Prince Faisal bin Farhan Al Saud said to Al-Arabiya channel on Tuesday that the OPEC+ decision to cut production by 2 million barrels per day was purely economic and was taken unanimously. (RTRS)

OIL: A platts reporter twitter the following on Tuesday: “Abu Dhabi's ambitious oil expansion plans have the UAE eyeing a potential renegotiation of #OPEC+ production caps. "We are hopeful that the quota will be revised in the upcoming months"” (MNI)

OIL: Nigeria’s oil output continued to fall in September as some onshore production ground almost to a halt, according to government data. (BBG)

OIL: A price cap on Russian seaborne oil deliveries being developed by the United States and G7 rich countries could significantly impact Russia's revenues while encouraging Moscow to continue to produce oil, sixteen economists from top U.S. and British universities said in a letter to U.S. Treasury Secretary Janet Yellen on Tuesday. (RTRS)

OIL: Mexico has begun its massive oil hedging program for 2023, according to people familiar with the matter. (BBG)

CHINA

PBOC: Credit expansion in infrastructure, manufacturing and real estate is expected to provide ongoing strong support for growth in credit and total social financing in Q4, the Securities Times reported after new loans and aggregate finance rebounded more than expected in September. (MNI)

PBOC: The People’s Bank of China’s recent relaunch of its pledged supplementary lending program may provide funds to ensure the delivery of unfinished housing projects, Caixin reported. (MNI)

CORONAVIRUS: China insists on maintaining its dynamic “zero-Covid” policy as it is the most effective way to manage the epidemic and avoid the potentially high costs associated with uncontrolled outbreaks, said the Party-run People’s Daily in a commentary. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY65 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY65 billion after offsetting the maturity of CNY67 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9541% at 09:34 am local time from the close of 1.5034% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday vs 56 on Monday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1103 WEDS VS 7.1075 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1103 on Wednesday, compared with 7.1075 set on Tuesday.

OVERNIGHT DATA

JAPAN AUG CORE MACHINE ORDERS -5.8% M/M; MEDIAN -2.8%; JUL +5.3%

JAPAN AUG CORE MACHINE ORDERS +9.7% Y/Y; MEDIAN +9.7%; JUL +12.8%

NEW ZEALAND SEP REINZ HOUSE SALES -10.9% Y/Y; AUG -18.3%

NEW ZEALAND AUG NET MIGRATION +47; JUL +475

MARKETS

SNAPSHOT: Confusion On Threadneedle

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 20.72 points at 26381.14

- ASX 200 up 2.514 points at 6647.5

- Shanghai Comp. down 38.836 points at 2940.956

- JGB 10-Yr future up 14 ticks at 148.39, yield down 0.3bp at 0.251%

- Aussie 10-Yr future up 9.0 ticks at 96.030, yield down 8.9bp at 3.947%

- U.S. 10-Yr future up 0-01 at 111-05+, yield down 1bp at 3.937%

- WTI crude down $0.64 at $88.71, Gold up $0.57 at $1666.92

- USD/JPY up 41 pips at Y146.27

- BANK OF ENGLAND SIGNALS TO LENDERS IT IS PREPARED TO PROLONG BOND PURCHASES (FT)

- BIDEN SAYS ‘VERY SLIGHT’ RECESSION POSSIBLE, DOWNPLAYS RISK

- ECB'S VILLEROY LAYS OUT PLAN FOR SHRINKING BALANCE SHEET (RTRS)

- SNB’S JORDAN SIGNALS RATE HIKE WITH SWIPE AT LOOSE POLICY BIAS (BBG)

- BANK OF KOREA RETURNS TO OUTSIZED HIKES, WARNS OF SLOWER GROWTH (BBG)

- SAUDI ARABIA DEFIED U.S. WARNINGS AHEAD OF OPEC+ PRODUCTION CUT (WSJ)

US TSYS: BoE Bond Buying Speculation Dominates

Cash Tsys run 1-2bp richer across the curve into London hours, with the belly leading the bid, while TYZ2 is +0-03 at 111-07+, hovering around the middle of its 0-14 overnight range on volume of ~105K (~40K of which changed hands in the last hour or so).

- The uptick in volume came as the space firmed on an FT source report suggesting that the BoE could extend its temporary Gilt purchases beyond the current Friday deadline (despite comments to the contrary from BoE Governor Bailey on Tuesday), with the Bank reportedly focused on the cash reserves of LDI pension funds in respect to potential margin call requirements.

- Still, it would seem that market participants are taking this as a case of kicking the can down the road, given the “temporary” nature of the already deployed, but ever evolving, BoE purchase scheme. This leaves the space off of richest levels at typing.

- 4x block sales of FV futures (-3.4K apiece) provided the highlight on the flow side before the FT story hit.

- Gilt gyrations will set the tone in pre-NY dealing. Further out, Wednesday’s local docket includes the minutes from the latest FOMC meeting, 10-Year Tsy supply and Fedspeak from Bowman, Barr & Kashkari. Although Thursday’s CPI print is of more interest.

JGBS: Curve Steepens, With Broader Core FI Bid Doing Little For Super-Long End

The curve was under early Tokyo steepening pressure as participants made room for this afternoon’s 30-Year JGB supply and reacted to Tuesday’s comments from BoE’s Bailey.

- It was a less than convincing round of 30-Year JGB supply which saw the tail widen notably, low price miss broader expectations and the lowest cover ratio seen at a 30-Year auction seen since March ’21.

- It would seem that ongoing market vol., the relative lack of BoJ control over this area of the curve and worry surrounding further cheapening in wider core global FI markets deterred bidders from stepping up.

- The previously flagged FT sources piece re: a potential extension of the BoE’s temporary bond buying scheme then allowed the space to firm into the bell, leaving JGB futures +15 at typing, off best levels, although the contract was fairly resilient when compared to the rest of the JGB space throughout the duration of Tokyo trade.

- Cash JGB trade sees the major benchmarks run 1.5bp richer to 5bp cheaper, with 7s outperforming on the bid in futures and super-long paper still lagging on the day.

- Note that domestic headline flow was dominated by familiar rhetoric from Japanese officials re: FX intervention matters as USD/JPY registered a fresh multi-decade high, breaching September’s intervention zone.

- Tomorrow’s domestic docket is headline by PPI data.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y725.6bn 30-Year JGBs:

- Average Yield: 1.480% (prev. 1.235%)

- Average Price: 98.32 (prev. 101.41)

- High Yield: 1.496% (prev. 1.240%)

- Low Price: 98.00 (prev. 101.30)

- % Allotted At High Yield: 91.3793% (prev. 13.8349%)

- Bid/Cover: 2.887x (prev. 3.278x)

AUSSIE BONDS: Firmer Throughout Sydney Trade

YM & XM operate off of best levels after the previously alluded to FT sources piece re: a potential extension of the BoE’s temporary bond purchase scheme allowed both contracts to briefly show through their respective overnight peaks. That leaves YM +6.5 & XM +8.0, with a fairly parallel 7-8bp of richening seen across the wider cash curve.

- There was little in the way of idiosyncratic news flow to drive the space, with comments from RBA Assistant Governor (Economic) Ellis providing a little bit more detail into the RBA’s thought process surrounding the idea of the neutral cash rate, albeit with little meaningful deviation from Governor Lowe’s previous musings and a continued insistence that the concept of a neutral rate acts more as a guide than as a required hard outcome for the Bank. The lack of hawkish surprises on this front allowed a slight bid to develop.

- A firm round of pricing in the latest round of ACGB Nov-32 supply provided little impetus for the wider ACGB space.

- Bills sit 4-8bp richer through the reds, with a terminal rate of just under 4.00% observed in RBA dated OIS, little changed on the day.

- Looking ahead., consumer inflation expectations data headlines Thursday’s domestic docket.

AUSSIE BONDS: ACGB Nov-32 Auction Results

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.75% 21 November 2032 Bond, issue #TB165

- Average Yield: 4.0029% (prev. 3.6086%)

- High Yield: 4.0050% (prev. 3.6125%)

- Bid/Cover: 3.1938x (prev. 2.7100x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 62.1% (prev. 4.3%)

- Bidders 42 (prev. 48), successful 11 (prev. 30), allocated in full 6 (prev. 23)

NZGBS: Bailey-Related Pressure & LGFA Bond Pricing Weigh On NZGBs

NZGBs cheapened on Wednesday, with the major benchmark yields running 5-6bp higher on the day, in lieu of Tuesday’s bear steepening of the U.S. Tsy curve which was aided by comments from BoE Governor Bailey, who pointed to the already outlined end to the BoE’s temporary Gilt purchases as a hard deadline (a subsequent FT story has drawn questions over that idea, but that came after the NZGB market closed).

- 2-Year swap rates hit a fresh cycle high before edging away from best levels.

- Pricing of the latest round of bond issuance from LGFA (’25 & ’29 paper) likely applied some background pressure to NZGBs.

- Note that the RBNZ showed little want to adjust its 1-3% inflation target band during the initial stages of the latest review of its monetary policy remit, although it will consult on the matter ahead of the final publication.

- RBNZ dated OIS indicate a terminal rate of just over 4.90%, little changed on the day.

- Local data was headlined by the latest REINZ house price readings, which revealed the continued impact of higher interest rates on the housing market (lower prices and reduced sales).

- Looking ahead, Thursday’s domestic docket will be headlined by the latest round of NZGB supply (which includes NZGB Apr-25, May-32 & May-41), with the latest food price index readings also due.

EQUITIES: E-Minis Tick Higher On BoE Hope, Chinese Tech Continues To Struggle

The 3 major e-mini futures contracts have added ~0.5% vs. Tuesday’s closing levels in lieu of an FT source story flagging the potential for an extension of the BoE’s temporary Gilt buying scheme, pushing back against the idea of a hard pre-weekend cessation.

- Wider Asia-Pac equities had struggled on the negative lead from Wall St., which was tied to comments from BoE Governor Bailey, after he stressed that the BoE would pullback from Gilt purchases after the upcoming weekend.

- Continued focus on China’s ZCS policy applied further weight to the major indices in China & Hong Kong.

- Continued worry re: Sino-U.S. tensions surrounding the tech sphere added a further (constant) leg of weakness to Chinese tech names,

- The ASX 200 & Nikkei 225 looked to the FT source report for support, registering very modest net gains on the day in lieu of the release.

OIL: Prices Retreating In Face Of Gloomier Demand Outlook

Oil prices continued to unwind their gains from last week after OPEC+ announced production cuts, because of a weakening demand outlook. WTI is down 0.8% from its close to be trading below $89/bbl and approaching its 50-day MA, while Brent is -0.6%, but both are off of their session lows.

- Last week’s supply concerns have been overtaken by worries about the global economy as the IMF revised down its GDP forecasts and Biden stated that a “slight recession” was possible. China’s assertion that its “Zero-covid policy” is the best way to face the virus, has added to expectations that global oil demand will weaken.

- Biden reiterated his anger at Saudi Arabia for agreeing to the OPEC+ cuts and stated that the US will be revisiting its relationship with the major oil producer.

- OPEC, the International Energy Agency and US Energy Information Administration are all scheduled to release outlooks this week. A downward revision to demand expectations is likely to put further pressure on prices.

- US data remain the focus of the week with the September PPI out today as well as the FOMC minutes followed by the CPI on Thursday.

GOLD: Coiling In Asia

Spot gold has stuck to a narrow range in Asia-Pac dealing, last printing little changed at ~$1,665/oz, after a firmer dollar and push higher in Tsy yields weighed on gold into Tuesday’s close. That move came in lieu of BoE Governor Bailey confirming the already scheduled withdrawal of the Bank’s temporary Gilt purchases.

- U.S. real yields and the broader DXY continue to operate within their recent ranges, after shunting higher during ’22.

- A lack of macro headline flow has made for subdued Asia-Pac dealing, with bears remaining focused on the cycle low at $1,615.0/oz, with the 3 Oct low ($1,659.7/oz) providing immediate intermediate support.

- U.S. CPI data (due Thursday) provides the key macro risk event this week, with U.S. PPI & the minutes from the latest FOMC meeting (both due Wednesday) also eyed.

FOREX: GBP Bid On BoE Readiness To Extend Bond-Buying, USD/JPY Past Prior Intervention Levels

Yen sellers forced their way through the pivotal Y145.90 level against the greenback, printed on Sep 22 when Japanese officials intervened in currency markets and re-tested yesterday. The initial foray above that figure was short-lived, but the rate posted another upleg at the Tokyo open. It continued to trade with bullish bias, despite the generally limited headline flow, touching a fresh 24-year high at Y146.39. USD/JPY 1-week implied volatility climbed to a two-week high.

- The move through Y145.90 put market participants on intervention watch. Officials stuck to their regular script, pledging to monitor FX moves with heightened urgency and take appropriate measures against excessive volatility. On the other hand, FinMin Suzuki suggested that the focus is on the speed of the moves rather than any specific levels.

- Early gains for the broader U.S. dollar facilitated the upswing in USD/JPY, albeit the BBDXY index pulled back into negative territory ahead of the London session. The U.S. data docket for the next two days includes a couple of key risk events, namely FOMC minutes (Wednesday) and CPI report (Thursday).

- Renewed greenback losses were driven by a spike in sterling crosses as the Financial Times reported that “the Bank of England has signalled privately to bankers that it could extend its emergency bond-buying programme past this Friday’s deadline."

- Further weakness in iron ore sapped some strength from the Aussie dollar. AUD/USD printed new cyclical lows at $0.6240.

- Other notable data releases today include UK economic activity indicators & EZ industrial output. Plenty of speeches are scheduled from Fed, ECB & BoE policymakers.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2022 | 0800/0900 |  | UK | BOE Haskel Keynote Speech at The Productivity Institute | |

| 12/10/2022 | 0900/1100 | ** |  | EU | Industrial Production |

| 12/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/10/2022 | 0930/1030 |  | UK | BOE FPC Sept 30 meet minutes | |

| 12/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/10/2022 | 1135/1235 |  | UK | BOE Pill in Conversation with SCDI | |

| 12/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 12/10/2022 | 1230/0830 | *** |  | US | PPI |

| 12/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/10/2022 | 1330/1530 |  | EU | ECB Lagarde in Conversation with Tim Adams (IIF) | |

| 12/10/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/10/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2022 | 1700/1800 |  | UK | BOE Mann Canadian Association for Economics Webinar | |

| 12/10/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/10/2022 | 1745/1345 |  | US | Fed Vice Chair Michael Barr | |

| 12/10/2022 | 2230/1830 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.