-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI EUROPEAN OPEN: CPI To Add to BoE Puzzle

EXECUTIVE SUMMARY

- BIDEN, TOP DEMOCRATS CALL ON GOP TO PRESENT ‘CLEAN’ DEBT LIMIT BILL; HOLD SEPARATE BUDGET NEGOTIATIONS (THE HILL)

- US REGIONAL BANKS’ DEPOSIT GROWTH SEEN DROPPING TO JUST $73 BILLION (BBG)

- ECB’S LANE: SET FOR MAY HIKE, SIZE DATA DEPENDENT (MNI)

- YELLEN TO LAY OUT U.S. ECONOMIC PRIORITIES ON CHINA IN THURSDAY SPEECH (RTRS)

- CHINA WANTS WEAKER US DOLLAR AS RESERVE CURRENCY, SAYS BIDEN ECONOMIST NOMINEE (RTRS)

- UKRAINE AGREES WITH POLAND ON GRAIN TRANSIT, BUT BLACK SEA DEAL IN DOUBT (RTRS)

- $1 BILLION SALE MARKS FIRST MAJOR BANK’S AT1 BOND OFFER SINCE CREDIT SUISSE WIPEOUT (BBG)

- RECORD EU GAS STORAGE RAISES HOPES OF CUTTING RUSSIAN DEPENDENCE (FT)

- IRAQ TO RESTART OIL FLOWS FROM KURDISTAN THIS WEEK, PM SAYS (BBG)

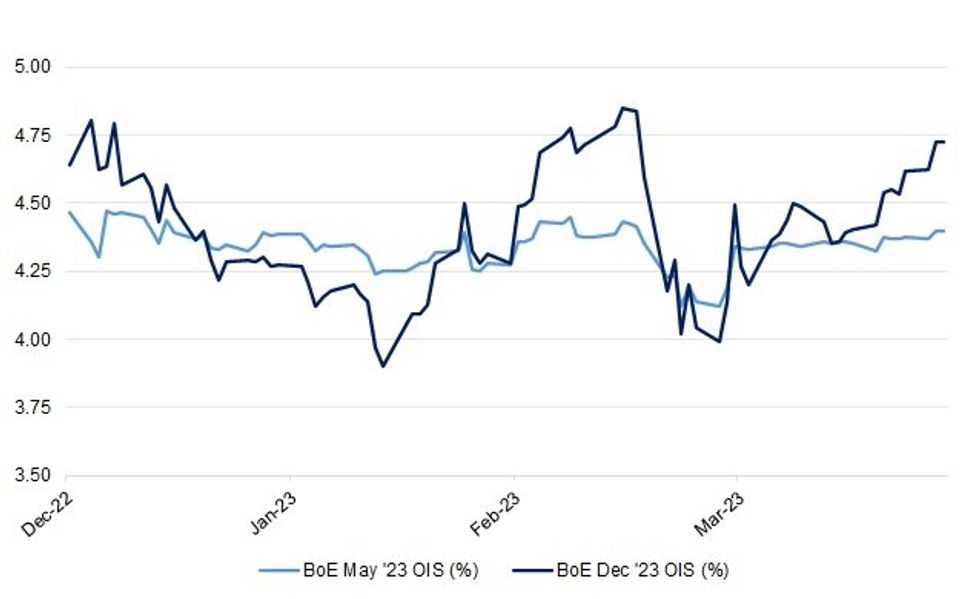

Fig. 1: BoE May '23 & Dec '23 OIS

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak will launch a charm offensive with business leaders next week, in an attempt to galvanise his growth agenda and counter Labour’s growing success in wooing corporate Britain. (FT)

EUROPE

ECB: Another European Central Bank interest rate hike in May looks likely, but, until all the relevant data is seen the scale of rise remains an ongoing debate, ECB chief economist Philip Lane said Tuesday. (MNI)

U.S.

FED: The hunt for a new president of the Federal Reserve Bank of Kansas City has turned into a marathon that’s days from becoming the longest search this century. (BBG)

FED: A so-called "wholesale" central bank digital currency could hold promise for the future settlement of certain financial market transactions and processing international payments, Federal Reserve Governor Michelle Bowman said on Tuesday. (RTRS)

FED: The boards of directors of six Federal Reserve banks voted in February for a pause in hikes in the discount rate charged to banks for emergency loans, according to the latest discount rate meeting minutes published Tuesday, but the directors of all 12 banks voted for an increase in March. (MNI)

ECONOMY: Bank of America’s customers are spending freely on dining, entertainment and other experiences, which in turn supports U.S. employment, CEO Brian Moynihan told CNBC’s Becky Quick. (CNBC)

ECONOMY: Walt Disney Co. plans to cut thousands of jobs next week, including about 15% of the staff in its entertainment division, people familiar with the matter said. (BBG)

FISCAL: President Biden and top congressional Democrats are calling on Republicans to present a “clean” debt limit bill and hold separate negotiations on a budget, as the GOP rolls out its opening pitch in the high-stakes battle to increase the borrowing limit. (The Hill)

POLITICS: The indictment of former President Donald Trump on felony charges in New York looks to be having little effect on Americans’ support for his candidacy, but a majority of Americans say bringing charges against the ex-president was “a good thing” for the rule of law in the country. The CNBC All-America Economic Survey found that 58% of participants said Trump’s indictment would have no effect on how they vote, with men ages 18 to 49 years, non-conservative Republicans and those earning less than $30,000 among those least likely to be influenced by the development. (CNBC)

BANKS: Local U.S. banks are pressing ahead with regular lending including for commercial real estate projects, an Independent Community Bankers of America executive told MNI, even after the failure of Silicon Valley Bank raised concerns about a credit squeeze. (MNI)

BANKS: US regional banks reporting first-quarter earnings over the coming weeks will barely grow their customer deposits amid turmoil that engulfed the sector, according to data compiled by Bloomberg. (BBG)

BANKS: Western Alliance Bancorp on Tuesday posted stronger-than-expected earnings and said its deposits had stabilized after the March banking crisis, news that boosted its shares and other U.S. regional banks in after-hours trading. (RTRS)

BANKS: Shares of Metropolitan Bank surged in aftermarket trading after the lender reported a higher profit and revenue. (WSJ)

EQUITIES: Netflix Inc. will begin cracking down this quarter on US viewers who share someone else’s account, predicting plans to charge such customers will boost growth in the second half of the year. The company, which reported a lower-than-expected subscriber gain for the first quarter, has been testing ways to reduce account sharing in Latin America, and rolled out a plan to charge such users in four additional territories in the first quarter. (BBG)

EQUITIES: Boeing Co. is moving ahead with plans to hike output of its cash-cow 737 jetliner while dealing with the ripple effects from a new production flaw uncovered by one of its largest suppliers. (BBG)

OTHER

GLOBAL TRADE: European Union negotiators agreed on a final version of a €43 billion ($47.2 billion) plan to make Europe a key player in a global race to ramp up the production of semiconductors. (BBG)

GLOBAL TRADE: Poland agreed on Tuesday to lift a ban on the transit of Ukrainian grain and food products, but Ukraine said a wartime deal allowing it to safely ship grain from Black Sea ports was still under threat. (RTRS)

GLOBAL TRADE: Hungary’s government banned imports of Ukrainian grains and selected agricultural products until July 1, according to a decree in the official gazette, while allowing cargo to pass through the country. (BBG)

GLOBAL TRADE: Samsung Electronics submitted Statement of Intent to US Commerce Department to apply for subsidy in accordance with the US Chips Act, DongA Ilbo newspaper reports, without citing anyone. (BBG)

U.S./CHINA: U.S. Treasury Secretary Janet Yellen on Thursday will lay out the Biden administration's principal objectives for the U.S.-China economic relationship in a speech in Washington, the Treasury said on Tuesday as tensions between the world's two largest economies has thwarted high-level meetings. (RTRS)

U.S./CHINA: Raimondo said that the Biden administration is working as quickly as possible on rules for screening and preventing US investors from putting money into sensitive sectors in China such artificial intelligence and quantum computing. (BBG)

U.S./CHINA: White House economist Jared Bernstein on Tuesday said there was "some evidence" that China wants to see the dollar weaken as the international reserve currency, and urged Congress to raise the U.S. debt ceiling to protect the value of the dollar. (RTRS)

U.S./CHINA: A chip industry conference that kicked off here Tuesday has lined up major U.S. companies as participants despite Washington's widening restrictions on sales of cutting-edge semiconductor technology to China. (Nikkei)

U.S./CHINA: The Chinese military could soon deploy a high-altitude spy drone that travels at least three times the speed of sound, according to a leaked U.S. military assessment, a development that would dramatically strengthen China's ability to conduct surveillance operations. (Washington Post)

U.S./CHINA/TAIWAN: The top US military commander in the Indo-Pacific has pushed back against colleagues that are “guessing” the date of a potential Chinese invasion of Taiwan. (FT)

AUSTRALIA: Australia’s chances of sliding into a recession have declined, according to a Bloomberg survey, as the Reserve Bank’s decision to pause an 11-month tightening cycle helps improve the economic outlook. (BBG)

NEW ZEALAND: Economists raised their inflation outlook for New Zealand and see a higher chance of the country heading into recession, according to the latest Bloomberg survey. (BBG)

NORTH KOREA: During the summit, Yoon said he will seek "tangible outcomes" on the allies' efforts to improve responses to evolving threats from North Korea, which has ramped up military tests, and launched its first solid-fuel intercontinental ballistic missile last week. Seoul, for its part, will step up its surveillance, reconnaissance and intelligence analysis capability and develop "ultra-high-performance, high-power weapons" to fend off the North's threats, Yoon said. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un has ordered officials to launch the first spy satellite as planned, saying that boosting reconnaissance capabilities is a priority to counter "threats" from the United States and South Korea, state media reported on Wednesday. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem said that Tuesday's inflation report shows price gains are fading quickly and more moderation is likely, while reiterating he's prepared to raise interest rates again. (MNI)

CANADA: Canada’s largest federal public-service union said Tuesday that some 155,000 workers will go on strike after talks with the federal government failed to produce an agreement before its deadline. (AP)

TURKEY: Turkish President Recep Tayyip Erdogan signals that low interest rate policy will continue after elections in a televised interview on Tuesday. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador ratcheted up the political infighting with the US by saying Tuesday his country has been a target of espionage by the Pentagon. (BBG)

MEXICO: Mexico’s supreme court struck down on Tuesday part of a law pushed by President Andrés Manuel López Obrador that aimed to put day-to-day public security forces under military control. (FT)

BRAZIL: President Luiz Inacio Lula da Silva sent congress a proposal to shore up Brazil’s public finances after ordering a change that added uncertainty over the government’s ability to boost its revenues — a key element for the plan’s success. The finance ministry released a draft of the bill on Tuesday and Lula personally delivered the proposal to lower house Speaker Arthur Lira during an afternoon meeting. It will set the stage for the first major test of his government’s strength in congress. (BBG)

BRAZIL: Brazil's Finance Minister Fernando Haddad said on Tuesday there is plenty of room to cut interest rates after the government formally sent to Congress a proposed fiscal framework to control the trajectory of the public debt. Speaking to journalists, Haddad said exceptions to the new fiscal rules are already in the constitution and were only reproduced in the government's bill. (RTRS)

RUSSIA: South Korea might extend its support for Ukraine beyond humanitarian and economic aid if it comes under a large-scale civilian attack, President Yoon Suk Yeol said, signalling a shift in his stance against arming Ukraine for the first time. (RTRS)

RUSSIA: The U.S. Justice Department announced new charges on Tuesday against four Americans in Florida and three Russians for allegedly working on behalf of Moscow "to conduct a multi-year foreign malign influence campaign in the United States." (RTRS)

RUSSIA: The UK government's cyber defence agency warned on Wednesday of an emerging threat to Western critical national infrastructure posed by hackers sympathetic to Russia and its war on Ukraine. (RTRS)

RUSSIA: Inflationary pressures in Russia's economy will likely increase over the coming months, analysts from the country's central bank said on Tuesday. They added the central bank faces a dilemma over whether to react pre-emptively to rising prices or wait for "clear evidence" of higher inflation. (RTRS)

PERU: Peru’s former President Alejandro Toledo’s request to delay his extradition from the US to his home country to face corruption charges was again rejected by an federal appeals court in California. (BBG)

BONDS: Sumitomo Mitsui Financial Group Inc. sold yen Additional Tier 1 bonds, becoming the first major global bank to issue such debt since the collapse of Credit Suisse Group AG last month. (BBG)

METALS: Brazilian mining giant Vale SA said output of iron ore rose in the first quarter from the previous three months due to a stronger performance at the company's giant S11D mine and amid better weather conditions in the state of Minas Gerais. (Dow Jones)

METALS: Recent rise of iron ore prices is due to expectations and other reasons, National Development and Reform Commission spokeswoman Meng Wei says in a regular briefing on Wednesday. (BBG)

ENERGY: The EU is storing record levels of natural gas after a milder-than-anticipated winter, bolstering hopes that the bloc can wean itself off imports from Russia. The bloc’s storage totalled 55.7 per cent of capacity at the start of the month according to the industry body Gas Infrastructure Europe — the highest level for early April since at least 2011. (FT)

OIL: Oil exports from Iraq’s Kurdistan region will resume this week as only technicalities remain to implement the agreement between Baghdad and Erbil, Iraqi Prime Minister Mohammed Shia Al-Sudani told Rudaw in an interview. (BBG)

OIL: The American Petroleum Institute reports US commercial inventories of crude oil fell by 2.7M barrels last week, a source citing the data says, while gasoline supplies fell by 1M barrels. The mostly- bullish results were released ahead of official EIA inventory data due tomorrow. Average forecasts in a WSJ survey indicate the EIA report will show crude stockpiles fell by just 500,000 barrels from the previous week and that gasoline decreased by 1.2M barrels. In late trading, (Dow Jones)

CHINA

ECONOMY: China’s GDP will grow between 5.5-8.0% in 2023 should Q1 trends continue, according to the 21st Century Business Herald. Local analysts said the economy shows strength, but the rebound is uneven. (MNI)

FISCAL: China’s fiscal revenue will grow faster in Q2 as the economic rebound gathers momentum, according to Xue Qian, deputy director at the National Treasury Payment Center. (MNI)

FISCAL: Beijing’s local government will continue energy vehicle subsidies to boost consumption this year, according to Yicai. (MNI)

POLICY: China is studying and drafting policies to expand consumption, National Development and Reform Commission spokeswoman Meng Wei says in a regular briefing on Wednesday. (BBG)

INFLATION: Hog prices in China are expected to rebound to reasonable range with gradual recovery of consumption, National Development and Reform Commission spokeswoman Meng Wei says at a briefing. (BBG)

PROPERTY: China’s real estate industry expanded in the first quarter for the first time since 2021, boosting the economy’s recovery. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY25 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY32 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY25 billion after offsetting the maturity of CNY7 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0092% at 09:39 am local time from the close of 2.1139% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, compared with the close of 47 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8731 WEDS VS 6.8814 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8731 on Wednesday, compared with 6.8814 set on Tuesday.

OVERNIGHT DATA

JAPAN FEB, F INDUSTRIAL PRODUCTION +4.6% M/M; PRELIM +4.5%; JAN -5.3%

JAPAN FEB, F INDUSTRIAL PRODUCTION -0.5% Y/Y; PRELIM -0.6%; JAN -3.1%

JAPAN FEB CAPACITY UTILISATION +3.9% M/M; JAN -5.5%

AUSTRALIA MAR WESTPAC LEADING INDEX -0.01% M/M; FEB -0.06%

The growth rate in the Leading Index has registered its eighth consecutive negative print, pointing to an extended period of below-trend growth in the Australian economy. The Index for March is now consistent with below-trend growth extending throughout the remainder of this year. Westpac is forecasting growth of only 1% in 2023. The IMF recently revised down its growth forecast for Australia in 2023, from 1.9% to 1.6%, while the Reserve Bank is also forecasting growth of 1.6% in 2023. While the Leading Index does not yet provide a guide for 2024, Westpac is forecasting ongoing lacklustre growth of 1.5% with the household sector again accounting for most of the weakness, weighed down by pressure on real disposable incomes. (Westpac)

MARKETS

US TSYS: Curve Marginally Flatter In Muted Asian Session

TYM3 deals at 114-13+, -0-02, with a 0-04 range observed on volume of ~82k.

- Cash tsys sit 1bp cheaper to 1bp richer across the major benchmarks. The curve has twist flattened pivoting on 30s.

- Tsys were a touch cheaper in early dealing, weakness in ACGBs spilled over into the wider space as yesterday's post-RBA minutes cheapening consolidated.

- US Equity futures and regional equities were pressured facilitating a recovery from session lows in Tsys.

- Little meaningful macro newsflow crossed in the session. Ranges were narrow with little follow through on moves in tsys.

- FOMC dated OIS price a ~22bp hike into the May meeting, the terminal rate is now seen at 5.10% in June. There are ~60bps of cuts priced for 2023.

- In Europe we have UK CPI and the final print of Eurozone inflation. Further out the Fed Beige Book will cross. We also have the latest 20-Year Supply.

JGBS: Futures Flat, Narrow Range, Curve Flatter

JGB futures sit flat, off the extremes of a narrow range after domestic economic data failed to provide a meaningly local driver for the market. US Tsys also provided little in way of a catalyst with pricing basically unchanged in Asia-Pac trade.

- JBM3 is currently trading at 147.44, within the range of 147.40-147.92, where it has remained since early April. In the past two days, the JGB futures contract briefly fell below the lower limit of this range twice, but managed to bounce back.

- Cash JGBs are mixed with yields out to the 10-year 0.5bp richer to 0.2bp cheaper and beyond 1.6-3.0bp richer. The benchmark 10-year yield is 0.1bp higher at 0.476%, below the BoJ's YCC limit of 0.50%.

- Swap spreads are wider across the curve, with the swap curve twist flattening.

- Looking ahead, trade balance and weekly international security flow data headline domestically on Thursday, with 20-Year JGB supply also due.

- Participants also remain on the lookout for some of the more sizable life insurer and pension fund investment plans, which should filter out of the coming 10 days or so (see more on that here).

JGBS AUCTION: 12-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.84767tn 12-Month Bills:

- Average Yield: -0.1515% (prev. -0.1251%)

- Average Price: 100.153 (prev. 100.126)

- High Yield: -0.1258% (prev. -0.1112%)

- Low Price: 100.127 (prev. 100.112)

- % Allotted At High Yield: 58.1818% (prev. 45.5353%)

- Bid/Cover: 3.944x (prev. 3.836x)

AUSSIE BONDS: Off Cheaps After Pricing Of New Dec-34 ACGB

ACGBs sit weaker (YM -6.0 & XM -2.0) but well off session lows seen ahead of the pricing of A$14bn of the new ACGB Dec-34 via syndication. A$61bn in bids were received at the final clearing price, pointing to more than ample demand.

- Cash ACGBs are 1-5bp cheaper on the day but 3-4bp better than worst levels with the 3/10 curve 3bp flatter.

- The AU-US 10-year yield differential is +3bp at -9bp, after touching -6bp before the pricing of the new Dec-34 bond.

- Swap rates are 1-5bp higher with EFPs little changed.

- Bills pricing is -3 to -6 with late whites the weakest.

- RBA dated OIS is 4-6bp firmer for meetings beyond July with 21bp of cumulative tightening priced for August.

- A Bloomberg News survey of 41 economists revealed an expectation that the Australian economy will expand by 1.7% in 2023, 1.6% in 2024 and 2.4% in 2025. The chance of recession happening over the next 12 months is 35%, according to 17 economists. The RBA cash is seen at 3.85% by end-2023.

- With the local calendar light for the remainder of the week, the local market will be guided by US Tsys as they navigate the US earnings season.

AUSSIE BONDS: Pricing Of New December 2034 Treasury Bond

The AOFM announces that “the issue by syndication of the new 3.50% 21 December 2034 Treasury Bond has been priced at a yield to maturity of 3.635 per cent. The issue size is $14.0 billion in face value terms.”

- “There was a total of $61.0 billion of bids at the final clearing price.”

- “Settlement of the issue will occur on 26 April 2023.”

- “Australia and New Zealand Banking Group, Commonwealth Bank of Australia, Deutsche Bank and National Australia Bank Limited were Joint-Lead Managers for the issue.”

- “The AOFM will be mindful of the performance of the bond when considering the timing of future issuance.”

NZGBS: Weaker Ahead Of Tomorrow’s Supply

NZGBs closed the day 4bp cheaper with the NZ/US 10-year yield differential 6bp wider. The NZ Treasury’s weekly supply announcement led to a 2-3 basis point increase in yields across the curve, although this move had subsided by the close. With the composition of tomorrow’s auction the same as April 6, it will be interesting to see whether the May-26 bond will receive a similarly strong bid (cover ratio of 6.25x) and whether it will deliver the same sharp steepening in the 2/10 cash curve.

- The NZ Treasury plans to sell NZ$200mn of the May-26 bond, NZ$150mn of the May-34 bond and NZ$50mn of the May-41 bond tomorrow.

- Swap rates closed 2-4bp higher with implied swap spreads 1-2bp tighter.

- RBNZ dated OIS closed 1-5bp firmer across meetings. 23bp of tightening is priced for the May meeting.

- A Bloomberg News survey of 22 economists showed the NZ economy was expected to expand by 1.0% in 2023, 1.3% in 2024 and 2.5% in 2025.

- Tomorrow sees the release of Q1 CPI. While it is expected to moderate it is likely to remain elevated driven by higher food and construction prices related to earlier severe weather. BBG consensus is expecting a print of +1.5% Q/Q and 6.9% Y/Y.

EQUITIES: Mostly In The Red

Most regional equity markets are lower, although most losses are under 0.50% at this stage. US futures have stayed in the red for much of the session, although again losses have been fairly modest, Eminis last around 4173/74 (-0.15%).

- HK and China related equity sentiment has been somewhat volatile. The HSI was down over 1% at one stage, but now sits back at -0.50%. H shares are faring slightly worse at -0.70%. On-going intervention by the HKMA to curb HKD weakness is also prompting fears of higher rates, which could be weighing on sentiment, particularly in the tech space.

- Mainland shares are also offered, with the CSI 300 down 0.40%. Stake reduction plans in A-shares and H-shares is one factor being cited for the weakness.

- Japan shares look to end a strong winning streak. The Topix is off by 0.3% at this stage. If confirmed into the close, it would be the first dip for the index since April 6.

- The Kospi is seeing some modest outperformance, up around 0.4% at this stage.

- Elsewhere, the ASX 200 is flat, while most SEA markets are weaker except for Singapore shares (+0.17%). Indonesia's market is closed for the next 5 sessions (re-opening next Wednesday).

GOLD: Consolidating Above $2000

Gold is holding above $2000, but has mostly tracked sideways for the session. Highs for the session, above $2008, coincided with early USD weakness, but as the dollar indices recovered we moved back towards $2002. We sit slightly higher at $2003.70 currently, less than 0.10% down for the Wednesday session so far.

- Gold ETF holdings are still showing positive momentum, but the rate of change has slowed compared to a few weeks ago.

- Technically, recent lows come in ahead of the $1980 level, while recent highs rest above $2047, which came prior to the recent rebound in US yields.

OIL: Drifting Sideways, US Inventory Data Eyed Later

Oil benchmarks sit slightly below NY closing levels from Tuesday. Brent is around $84.60/bbl (-0.15%), while WTI was just under $80.80/bbl. Brent got above $85/bbl in early trade but couldn't sustain the move.

- Recent lows have come in between the $83/$84/bbl range, which have held since the start of the month. A move below this region would open up a move back sub $80/bbls, levels last seen in late March. On the topside, recent highs come in around the $87.50/bbl, while the simple 200-day MA is just under $88.70/bbl.

- The main focus coming up will be the EIA weekly inventory report, out during US trade. This follows reports yesterday of a further run down in US inventories.

- Yesterday's China data, which showed a more consumption/services led recovery, likely hasn't aided sentiment around the growth outlook. The industrial side of the economy is improving but not at the same rate as the services side.

FOREX: USD Little Changed In Muted Asian Session

The Greenback is little changed in Wednesday's Asian session, ranges have been narrow with little follow through on moves. BBDXY sits at 1224.54, a 0.2% range has been observed in the index.

- AUD is marginally outperforming today, it is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6730/35, ~0.1% firmer however we have been unable as of yet to sustain a break of the 50-Day EMA and sit a touch below the measure.

- NZD/USD is a touch softer, however ranges have been narrow, with resistance seen ahead of $0.6220 and support below $0.62.

- Yen is softer, USD/JPY prints at ¥134.25/35 ~0.2% firmer today. Resistance is seen at ¥134.75, a Fibonacci retracement point, and support at ¥132.96 the 20-Day EMA.

- Elsewhere in G-10 GBP and EUR are little changed. USD/NOK is ~0.3% higher however note Asia Pac liquidity is likely to be fairly poor for this pair.

- Cross asset wise; e-minis are ~0.2% lower and the Hang Seng is down ~0.5%. US Treasury Yields are little changed across the curve.

- In Europe we have UK CPI and the final print of Eurozone inflation. Further out the Fed Beige Book will cross.

FX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E912mln), $1.0900-15(E623mln), $1.0930-40(E956mln), $1.1000(E705mln), $1.1015-30(E943mln), $1.1049-50(E1.9bln)

- GBP/USD: $1.2450(Gbp803mln)

- USD/JPY: Y132.50-60($739mln), Y132.90-00($522mln), Y133.35-45($929mln), Y135.00-10($616mln)

- NZD/USD: $0.6230-35($805mln)

- USD/CAD: C$1.3300($565mln), C$1.3445-55($1.0bln)

- USD/CNY: Cny7.00($1.0bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/04/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/04/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/04/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/04/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/04/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/04/2023 | 1035/1235 |  | EU | ECB Lane Speech at Enterprise Ireland Summit | |

| 19/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/04/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/04/2023 | 1500/1700 |  | EU | ECB Schnabel Lecture at Leibniz-Zentrum ZEW | |

| 19/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/04/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 19/04/2023 | 2130/2230 |  | UK | BOE Mann Panellist at Brandeis International Business School | |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.