-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessJapanese Life Insurer & Pension Fund Investment Intentions On The Radar

Tuesday saw Japan’s Fukoku Mutual Life Insurance (~$65bn AUM) reveal that it plans to shed the entirety of its FX-hedged foreign bond holdings during the current Japanese FY (BBG noted plans for a Y300bn reduction in the company’s offshore debt holdings, Y240bn of which is FX-hedged foreign notes).

- The head of the company’s investment planning team, Suzuki, pointed to the well-documented FX-hedging costs facing Japanese investors as the driver of the move, particularly on the USD side.

- Suzuki flagged the company deploying Y270bn into JGBs and Y50bn into Japanese corporate bonds as part of the related capital reallocation.

- This comes after the company shed Y650bn of foreign debt in the previous FY, while it ploughed Y470bn into domestic paper over that period.

- Suzuki noted that plans could change if expectations for a reduction in FX-hedging costs come into play, although Fukoku deemed the prospect of a Fed rate cut during the current Japanese FY (which runs through March ’24) as unlikely.

- Suzuki pointed to the potential for some element of surprise when it comes to the removal of the BoJ’s YCC mechanism (given Governor Ueda’s recent musings), which he believes will likely take place in the current FY, with the risk of it coming “early.”

- Accordingly, Fukoku looks for 10-Year JGB yields to end the current FY at 0.80%, with 20-Year yields seen at 1.60% over the same horizon. Suzuki pointed to the firm’s willingness to invest in JGBs at current yield levels, even as they expect the aforementioned cheapening (Suzuki deemed yields of slightly above 1% as “acceptable” in the 20+-Year zone of the JGB curve).

- Fukoku look for USD/JPY to fall to Y125 by the end of the current FY, with 10-Year U.S. Tsy yields seen at 3.40% over the same horizon.

- Expect some of the larger names in the Japanese life insurance and pension sphere to release their investment intentions over the next 10 days or so.

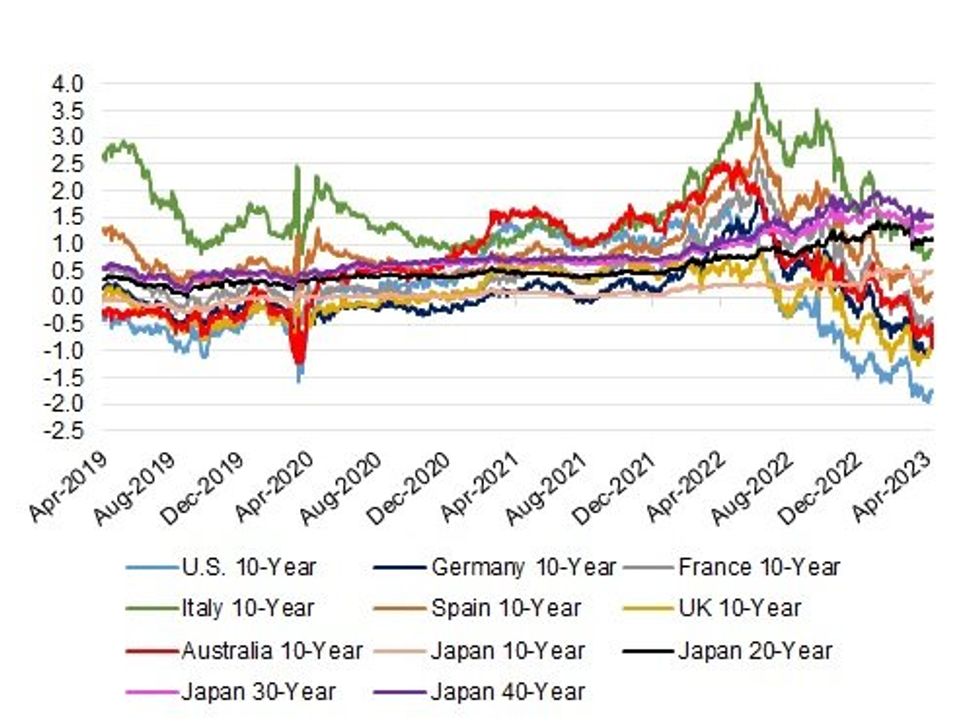

- Fukoku’s investment plan isn’t a particular surprise. Looking at the FI benchmarks that we actively chart and monitor FX-hedging costs from the perspective of a Japanese investor for, only Italian government bonds provide a pickup vs. JGBs (at the 10-Year maturity point), showing the degree of rolling down the risk curve that is required to generate a yield pickup (which of course comes with its own risks and probably isn’t worth the sub-50bp pickup on offer at present). FX-unhedged bond positions would introduce another layer of uncertainty into what is already a very volatile global marketplace (although there were signs of such positions being put into play late in the previous FY, as the banking tumult took hold).

Fig. 1: Major FX-Hedged Yields For Japanese Investors (Based On 3-Month FX-Hedged Yield Costs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

| FX-Hedged Yield (%) | Conventional Yield (%) | FX-Hedged Pickup Vs. 10-Year JGB Yields (%) | |

| U.S. 10-Year | -1.7703 | 3.5794 | -2.2473 |

| Germany 10-Year | -0.9270 | 2.4740 | -1.4040 |

| France 10-Year | -0.3780 | 3.0230 | -0.8550 |

| Italy 10-Year | 0.8975 | 4.3010 | 0.4205 |

| Spain 10-Year | 0.0907 | 3.4910 | -0.3863 |

| UK 10-Year | -0.8718 | 3.7470 | -1.3488 |

| Australia 10-Year | -0.3756 | 3.5225 | -0.8526 |

| Japan 10-Year | -- | 0.4770 | -- |

| Japan 20-Year | -- | 1.0770 | -- |

| Japan 30-Year | -- | 1.3270 | -- |

| Japan 40-Year | -- | 1.5290 | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.