-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI EUROPEAN OPEN: CPI To Set Pre-FOMC Tone

EXECUTIVE SUMMARY

- FED MUST HIKE TO 6-8% FOR 'RESTRICTIVE' - LACKER (MNI)

- EU AGREES TO UNLOCK €18BN UKRAINE AID PACKAGE AS HUNGARY DROPS VETO (FT)

- U.S. CONSULTED JAPAN, NETHERLANDS ON CHIP CURBS TO CHINA (RTRS)

- CHINA BRACES FOR ‘MASSIVE’ COVID OUTBREAK ON FASTER REOPENING (BBG)

- BEIJING’S U.S. ENVOY EXPECTS FURTHER COVID RELAXATION, EASIER TRAVEL TO CHINA (RTRS)

- HONG KONG SCRAPS CURBS ON ARRIVALS, CONTACT TRACING APP (BBG)

- CHINA-HK TO START QUARANTINE-FREE TRAVEL IN JANUARY (HK01)

- TOP CHINA FUNDS SEE DEEPENING SELLOFF IN LOCAL CREDIT MARKET (BBG)

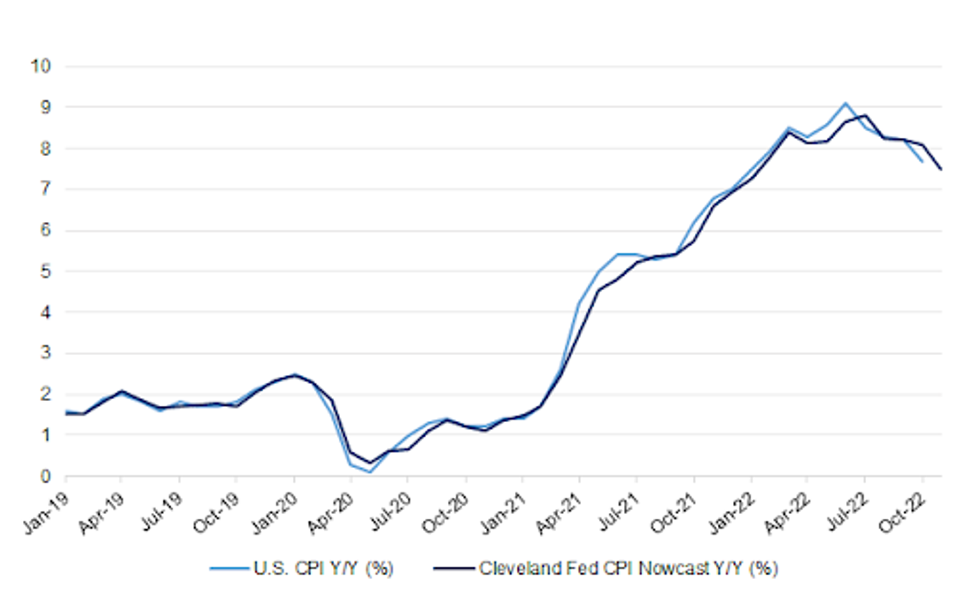

Fig. 1: U.S. CPI Vs. Cleveland Fed CPI Nowcast (Y/Y)

Source: MNI - Market News/Bloomberg

UK

FISCAL: Kwasi Kwarteng brushed aside warnings his disastrous mini-budget could trigger a backlash on the financial markets, Treasury officials have told MPs. (Sky)

EUROPE

FISCAL: EU member states have agreed to unlock an €18bn funding package for Ukraine after Hungary dropped its veto as part of a wider political bargain giving Budapest the potential to access billions of euros of EU cash. (FT)

U.S.

FED: The Federal Reserve will need to raise rates to at least 6% and as high as 8% because policymakers are underestimating the extent of an inflation problem that has already kicked off a wage-price spiral, former Richmond Fed President Jeffrey Lacker told MNI. (MNI)

ECONOMY: U.S. businesses are increasingly pushing back against higher employee wages, and expect labor market slack to help them in negotiations next year even as job growth remains robust, Chamber of Commerce Chief Economist Curtis Dubay told MNI. (MNI)

FISCAL: The House and Senate are expected to pass a short-term extension to avert a government shutdown at the end of the week, which would give negotiators more time to try to secure a broader full-year funding deal. (CNN)

FISCAL: The US government recorded a monthly budget deficit of $249 billion in November, a 30% increase from a year earlier amid increased spending and falling revenue, the Treasury Department reported Monday. (CNN)

FISCAL: The Supreme Court on Monday agreed to hear arguments in a second case challenging the legality of the Biden administration’s ambitious student loan relief program. (CNBC)

POLITICS: The Department of Justice special counsel overseeing two criminal investigations of former President Donald Trump, Jack Smith, has issued a subpoena seeking documents from Georgia Secretary of State Brad Raffensperger. (CNBC)

OTHER

GLOBAL TRADE: China took legal action against the US in the WTO over chip export control measures on Monday, China's Ministry of Commerce (MOFCOM) said in a statement posted on its website. (Global Times)

GLOBAL TRADE: The United States has spoken with its partners, including Japan and the Netherlands, to tighten chip-related exports to China, Jake Sullivan, the White House national security adviser, said on Monday. (RTRS)

U.S/CHINA: A team of US regulators is in the final stages of discussions with two Hong Kong accounting firms regarding their audits of mainland Chinese companies facing possible delisting from US exchanges, according to two sources familiar with the situation. (SCMP)

EU/CHINA/TAIWAN: Education Minister Bettina Stark-Watzinger will visit Taiwan next year, Taipei-based Central News Agency reports, citing German lawmaker Peter Heidt’s comments in a forum broadcast online. (BBG)

BOJ: Bank of Japan officials are awaiting March's Tankan survey to assess whether corporate inflation expectations continue to firm despite falling oil prices, offering the prospect of a virtuous cycle of higher prices and wages that is considered integral to any shift in the bank's easy policy settings in 2023. (MNI)

JAPAN: Japan’s ruling Liberal Democratic Party is considering placing a ~5% surtax on top of corporate tax to help fund a planned increase in defense spending, Kyodo reports without attribution. (BBG)

JAPAN: Japan’s financial regulator is examining how vulnerable lenders would be to a sudden slump in government bonds should the nation’s central bank pivot away from its ultra-loose monetary policy in future. (BBG)

JAPAN: Japan’s Finance Minister Shunichi Suzuki tells reporters that recovery funds won’t be lost to secure defense spending. (BBG)

RBA: The Australian central bank’s cheap lending facility introduced in 2020 as part of its Covid policy response failed to boost borrowing by businesses, particularly smaller firms, a Reserve Bank research paper found. (BBG)

NORTH KOREA: South Korea, Japan and the United States will coordinate sanctions and close gaps in the international sanctions regime against North Korea, Seoul's envoy for North Korea said on Tuesday. (RTRS)

HONG KONG: Hong Kong is scrapping some of its remaining Covid restrictions following China’s rapid shift away from the zero-tolerance approach. (BBG)

HONG KONG: China and Hong Kong will start quarantine-free travel as soon as January, media outlet HK01 reported, as the mainland rapidly unwinds its Covid Zero measures. (BBG)

BOC: The global economy may be entering a new era of stronger price pressures with governments pulling back on free trade and companies seeking shorter supply chains, Bank of Canada Governor Tiff Macklem said Monday, which could make it harder for the central bank to meet inflation targets. (MNI)

TURKEY: Turkey's President Tayyip Erdogan said on Monday it was "apparent" that inflation would fall to around 40% in a few months, and further to 20% in 2023. (RTRS)

BRAZIL: Supporters of far-right Brazilian President Jair Bolsonaro on Monday attempted to invade the federal police headquarters in the capital Brasilia, in a flash of post-election violence on the day the president's electoral defeat was certified. (RTRS)

BRAZIL: Brazil’s incoming Finance Minister Fernando Haddad plans to “carefully build a relationship” with the country’s autonomous central bank, holding a formal meeting with the chief of the monetary authority on Tuesday. (BBG)

RUSSIA: The Group of Seven (G7) economic powers said on Monday they would continue to work together to bolster Ukraine's military capabilities, with an immediate focus on air defence systems, according to a leaders' statement released by Britain. (RTRS)

RUSSIA: The ministers discussed a ninth package of Russia sanctions. While they agreed in principle to add about 200 Russian people and groups to a sanctions list, there are still disagreements on the package as a whole, Borrell said. (RTRS)

RUSSIA: Senior U.S. officials plan to have talks this week with Russian counterparts to discuss the case of Paul Whelan, an American imprisoned in Russia, days after attempts to gain his freedom were rebuffed by Moscow, the White House said on Monday. (RTRS)

RUSSIA/IRAN: Fearing international backlash, Iran wants to limit the range of the missiles it plans to provide Russia for the war in Ukraine, four senior Israeli officials told Axios, citing intelligence reports. (Axios)

CHILE: Chilean political parties agreed to revive the process to write a new constitution after three months of intense negotiations, following an overwhelming vote to reject a first proposal in September. (BBG)

PERU/RATINGS: S&P Affirmed Peru At BBB; Outlook Revised To Negative

PERU/RATINGS: The latest political crisis in Peru, resulting in the country’s sixth president in five years, reinforces the deeply polarized political environment that has steadily eroded governability and stability over the past several years, says Fitch Ratings. (Fitch)

METALS: The Cerro Verde copper mine in Peru is operating normally despite political protests, but is experiencing some delays in transport of people, supplies and product, operator Freeport-McMoRan Inc. said in an emailed response to questions. (BBG)

METALS: Indonesia says it currently has no plans to resume nickel ore exports, according to Irwandy Arif, special staff to the energy and mineral resources minister by text messages on Tuesday. (BBG)

OIL: Traders expressed worry on Monday about how long Canada's TC Energy Corp (TRP.TO) would take to clean up the largest U.S. crude oil spill in nearly a decade and restart its Keystone oil pipeline after more than 14,000 barrels of oil leaked last week. (RTRS)

OIL: Oil output from the Permian shale basin in January is set to touch a record 5.6 million barrels per day (bpd), the U.S. forecast on Monday, but the increase is a third of September's pace. (RTRS)

OIL: Nigeria’s oil production increased by almost 15% during November following the restoration of operations at Shell Plc’s Forcados terminal. (BBG)

CHINA

CORONAVIRUS: China is warning it faces a steep surge in Covid cases as the country rapidly dismantles pandemic controls and embraces a faster reopening than some experts had expected. (BBG)

CORONAVIRUS: China’s ambassador to the United States on Monday said he believes China’s COVID-19 measures will be further relaxed in the near future and that international travel to the country will become easier. (RTRS)

CREDIT: M2 money supply growth quickened in November due to stable economic growth, an acceleration of credit delivery to the real economy, and a decrease in fiscal deposits of 368.1 billion yuan, according to the Securities Daily. (MNI)

MARKETS: Regulators need to accelerate the introduction of financial derivatives to offer more risk hedging tools and improve policy transparency to dispel concerns about China’s opening up, and in order to attract foreign investors to increase their holdings of yuan bonds, 21st Century Business Herald reported. (MNI)

YUAN: The recent deepening of China and Saudi Arabia relations presents an opportunity to develop the petro-yuan, according to Yicai.com. (MNI)

CREDIT: One of the worst selloffs in domestic Chinese credit will likely deepen as retail investors pull more funds out of the world’s second-largest bond market. That’s the view of some of the country’s biggest mutual and private funds. Credit spreads of corporate bonds over government notes might further widen after blowing out in November, they say. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8793% at 9:34 am local time from the close of 1.5776% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9746 TUES VS 6.9565 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9746 on Tuesday, compared with 6.9565 set on Monday.

OVERNIGHT DATA

AUSTRALIA NOV CBA HOUSEHOLD SPENDING +1.9% M/M; OCT +0.9%

AUSTRALIA NOV CBA HOUSEHOLD SPENDING +3.2 Y/Y; OCT +7.5%

The CommBank Household Spending Intentions (HSI) index rose by 1.9%/mth in original terms in November 2022, to 118.2. The increase was driven by a rise in spending on Transport (higher petrol prices), Retail (with consumers taking advantage of the sales) and Health & fitness. This was partly offset by falls in Travel, Education and Motor vehicles. (CBA)

AUSTRALIA NOV NAB BUSINESS CONFIDENCE -4; OCT 0

AUSTRALIA NOV NAB BUSINESS CONDITIONS +20; OCT +22

Business confidence turned negative in November, falling below zero for the first time since December 2021, while conditions remained elevated at +20 index points despite easing 2pts in the month. Conditions remain strong across industries with only construction and finance, business & property below +20pts in trend terms, and conditions have also held up across the states. With activity holding up there are few signs of any turnaround in inflation, with cost growth largely unchanged at elevated levels on both the labour and purchase cost side, and retail prices continuing to rise at a rapid rate. Overall, the survey highlights a growing concern that the economy’s strength over 2022 is set to come to an end as we enter 2023, and forward orders have softened from +14 in September to +5 in November, reflecting a more uncertain outlook. In fact, the gap between current business conditions and business confidence is now at a record level in the history of the survey – with the exception of March 2020 – pointing to heightened concerns about the resilience of the economy in the period ahead as inflation and higher rates weigh on consumers and global growth slows. (NAB)

AUSTRALIA DEC WESTPAC CONSUMER CONFIDENCE 80.3; NOV 78.0

Despite this welcome lift the level of the Index remains comparable with the lows seen during the COVID pandemic and the Global Financial Crisis. December’s 3% rise follows a disastrous 6.9% drop in November that saw the Index collapse to just 78 – one of the weakest reads recorded outside of a recession. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 82.9; PREV 82.7

Consumer confidence increased marginally last week despite the RBA raising the cash rate 25bp on Tuesday. This was the first time in the current tightening cycle that confidence has improved after an increase in the policy rate, perhaps a sign that households expect a pause soon. (ANZ)

NEW ZEALAND NOV REINZ HOUSE SALES -36.1% Y/Y; OCT -34.7%

NEW ZEALAND NOV REINZ HOUSE PRICE INDEX -13.7% Y/Y; OCT -10.9%

Rising interest rates, access to finance and concerns around the economy have created uncertainty in the market. Across Aotearoa New Zealand, market activity through spring has been subdued and median prices continue to soften as buyers remain hesitant. (REINZ)

NEW ZEALAND NOV FOOD PRICES 0.0% M/M; OCT +0.8%

SOUTH KOREA OCT L MONEY SUPPLY +0.3% M/M; SEP +0.3%

SOUTH KOREA OCT M2 MONEY SUPPLY +0.4% M/M; SEP 0.0%

MARKETS

SNAPSHOT: CPI To Set Pre-FOMC Tone

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 115.97 points at 27958.58

- ASX 200 up 22.469 points at 7203.3

- Shanghai Comp. down 3.351 points at 3175.882

- JGB 10-Yr future down 16 ticks at 148.02, yield down 0.1bp at 0.252%

- Aussie 10-Yr future down 2.4 ticks at 96.590, yield up 2.5bp at 3.406%

- U.S. 10-Yr future up 0-02 at 113-28+, yield down 0.37bp at 3.6076%

- WTI crude up $0.99 at $74.16, Gold up $1.45 at $1782.85

- USD/JPY up 7 pips at Y137.73

- FED MUST HIKE TO 6-8% FOR 'RESTRICTIVE' - LACKER (MNI)

- EU AGREES TO UNLOCK €18BN UKRAINE AID PACKAGE AS HUNGARY DROPS VETO (FT)

- U.S. CONSULTED JAPAN, NETHERLANDS ON CHIP CURBS TO CHINA (RTRS)

- CHINA BRACES FOR ‘MASSIVE’ COVID OUTBREAK ON FASTER REOPENING (BBG)

- BEIJING’S U.S. ENVOY EXPECTS FURTHER COVID RELAXATION, EASIER TRAVEL TO CHINA (RTRS)

- HONG KONG SCRAPS CURBS ON ARRIVALS, CONTACT TRACING APP (BBG)

- CHINA-HK TO START QUARANTINE-FREE TRAVEL IN JANUARY (HK01)

- TOP CHINA FUNDS SEE DEEPENING SELLOFF IN LOCAL CREDIT MARKET (BBG)

US TSYS: Light Richening Holds, CPI In Focus

TYH3 deals at 113-29, +0-02+, just shy of the top of its 0-06 Asia-Pac range on light volume of ~51K.

- Cash Tsys are running 0.5-1.5bp richer across the major benchmarks with the short end of the curve leading the bid, resulting in some very light bull steepening.

- With little in the way of headline drivers, mild USD weakness points to cross-asset derived flows as a driver of the light richening.

- U.S. CPI release today which provides the final key input ahead of Wednesday's FOMC decision (see our full preview of the CPI release here). The proximity to that data release limited activity in Asia, with Chinese & HK COVID-related headline flow failing to entice traders into a more active posture.

- Elsewhere, on the supply front, we will see the latest 30-Year Tsy auction.

JGBS: Twist Flattening As Long End Goes Bid In The Afternoon, Futures Hold Lower

JGBs futures looked through, but failed to make a meaningful break below, their overnight base, before retracing from worst levels to finish -13, consolidating their overnight weakness.

- Broader cash JGB trade saw the major benchmarks run 1bp cheaper to 4bp richer, pivoting around 10s as the curve twist flattened, with 7s leading the weakness on the downtick in futures.

- Finance Minister Suzuki reiterated that debt isn’t considered a sustainable funding source, while stressing that no definite decisions on funding matters surrounding increased defence spending had been made in lieu of reports re: the potential deployment of construction bonds to fund some of the spending. Suzuki also noted that an extension of the redemption period for JGBs would alter the market credibility of the instruments, pushing back against calls for a review on the matter from a senior politician.

- A slight firming of U.S. Tsys and the above mixture of headline flow seemed to support long end JGBs in the Tokyo afternoon.

- Looking ahead, the latest BoJ Tankan survey headlines the domestic docket on Wednesday, with BoJ Rinban operations also slated.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 5- To 15.5-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y498.9bn of 5- to 15.5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.003% (prev. -0.047%)

- High Spread: -0.001% (prev. -0.035%)

- % Allotted At High Spread: 43.1263% (prev. 33.9130%)

- Bid/Cover: 5.495x (prev. 3.930x)

AUSSIE BONDS: Meandering Pre-U.S. CPI Session

Aussie bonds wound through the pre-U.S. CPI Sydney session after an early extension lower on the back of overnight weakness in futures, which was tied to U.S. Tsys cheapening on Monday.

- A move away from lows in Tsys and local data likely helped the space find a base, with the monthly NAB business & Westpac consumer confidence data giving further credence to the RBA’s assessment re: the narrow path that the economy is on at present. Some fresh pressure was seen into the close, as YM registered a fresh session low.

- YM finished -4.8, with XM -1.7, as the wider cash ACGB curve saw a similar degree of bear flattening.

- EFPs were narrower on the day, suggesting the cheapening move was bond, not swap, driven.

- Quarterly bond futures roll activity continued to support volumes ahead of Thursday’s Z2 contract expiry, with the YM roll biased to selling and XM roll fairly evenly split in terms of direction of trade.

- Bills were flat to -3 through the reds, with RBA dated OIS little changed on the day.

- Looking ahead, U.S. CPI data will shape matters overnight, with RBA Governor Lowe’s latest address due early Wednesday morning local time.

AUSSIE BONDS: Nov-27 I/L Auction Results

The Australian Office of Financial Management (AOFM) sells $150mn of the 0.75% 21 November 2027 Indexed Bond, issue #CAIN414:

- Average Yield: 0.4782% (prev. -0.8456%)

- High Yield: 0.4850% (prev. -0.8425%)

- Bid/Cover: 3.4333x (prev. 4.8533x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 9.1% (prev. 44.4%)

- Bidders 46 (prev. 43), successful 16 (prev. 6), allocated in full 11 (prev. 3)

NZGBS: Flatter Curve, Steeper Swaps, HYEFU In View

The early cheapening across the NZGB curve saw an extension, with some weight in the Aussie bond space and perhaps some fiscal/issuance-related caution ahead of the HYEFU applying pressure. Participants also had to adjust to Monday’s cheapening in U.S. Tsys, with one eye on the impending U.S. CPI print, which nullified any potential spill over from a modest bid in the Tsy space during Asia-Pac hours.

- That left the major benchmarks running 2.5-5.5bp cheaper at the close, as the curve bear flattened.

- Meanwhile, swap rates were 4-7bp higher as that curve steepened, resulting in mixed swap spread performance on the session, with tightening seen in the very front end and some widening further out.

- RBNZ dated OIS was little changed, pricing ~68bp of tightening for the Feb ’23 meeting and a terminal OCR of ~5.45%.

- Local data saw a flat print for food prices (M/M) and another M/M fall in the REINZ house price index as the property market adjusts to ever-tighter monetary policy.

- The HYEFU, current account data and a parliamentary address from RBNZ Governor Orr (opening remarks at the Finance and Expenditure Committee (FEC) annual review) are due Wednesday.

EQUITIES: Covid Concerns Crimp China Rally

(MNI Australia) Asia Pac equities have been mixed ahead of key event risk in US markets tonight with CPI due. US futures are down slightly (-0.10/-0.20% at this stage), while regional markets that are higher are mostly away from best levels.

- The positive lead from US markets overnight, hasn't inspired uniformed gains throughout the region. The Kospi (-0.1%) and Taiex (-0.40%) are both weaker, despite some tech outperformance during US trading. Some South East Asian markets have performed better.

- The Nikkei 225 is +0.45% at this stage. Japan is reportedly in talks with the US to tighten chip export restrictions to China. The corporate tax rate could also be raised by 5ppt.

- Mainland China stocks are lower, the CSI 300 off by 0.20% at this stage. Easier Covid restrictions are reportedly planned but some of the focus is shifting to dealing with the current outbreak, amid soaring cases and strains on the local health system.

- The HSI is slightly higher, +0.55% at this stage. China/HK will start quarantine free travel in January, while US auditors of HK companies (that also have US listings) will reportedly present their findings by year end.

GOLD: Gold Prices Range Bound As Waiting For US CPI And FOMC

Gold prices trended up during today’s session on a slightly weaker USD but have almost given up the gains to be almost flat to the NY close. It is now trading around $1782.30/oz. Gold prices fell overnight after UST yields rose.

- Bullion reached a low today of $1777.64 before rising to a high of $1796.39. Resistance remains at $1807.90, August 10 high, which could be tested again if US CPI undershoots expectations. Support is at $1761.80, the 20-day EMA.

- Tonight’s US CPI report for November will be important for gold prices given the inverse relationship with the USD. Headline CPI is expected to moderate to 7.3% y/y from 7.7% and core to 6.1% y/y from 6.3%. The FOMC announcement is Wednesday and a 50bp hike is expected.

OIL: Oil Prices Recovering On China Reopening, Pipeline Closure & European Cold

MNI (Australia) - Oil prices rose further during today’s session after increasing strongly overnight on the back of the closure of the Keystone pipeline in North America. Further easing of Covid restrictions in China have also supported crude. WTI and Brent are up just over a percent to $73.95/bbl and $78.85 respectively, close to intraday highs.

- WTI oil prices have been reversing after clearing support at $71.00. Despite the rally, resistance is still some way from current prices at $78.23, the 20-day EMA. Brent came close to testing support at $78.11, resistance is at $80.81. There is currently limited liquidity in the market coming into year end.

- The Keystone pipeline, which connects oil fields in Canada to US refiners, has now leaked more oil than any other pipeline in the US in the last 12 years. A plan to restart it is yet to be submitted.

- China is the world’s largest oil importer and so recent measures to reopen from Covid are projected to boost oil demand. There are also expectations that there will be fiscal and monetary stimulus to boost growth.

- A cold snap in Europe is also increasing demand for heating fuels.

- Tonight’s US CPI report for November will be important and headline is forecast to moderate to 7.3% y/y from 7.7% and core to 6.1% y/y from 6.3%. The FOMC announcement is Wednesday and a 50bp hike is expected. There is also US API inventory data tonight.

FOREX: Commodity FX Maintains A Positive Bias

The BBDXY hasn't drifted too far away from the 1266 level in a range bound session (last at 1265.70). The AUD and NOK have seen some outperformance, while dips in USD/JPY have been supported. The market though appears to be waiting for cues from the US CPI report before deciding on fresh direction.

- AUD/USD saw support off 0.6740, but is only back to the 0.6760 region, which is +0.25% higher for the session. Consumer and business sentiment results didn't shift the sentiment needle earlier today. NOK is around 0.2% firmer, with USD/NOK back sub 9.9800.

- NZD/USD is back to 0.6385/90, slightly off session highs. Food prices were flat for November, while the AUD/NZD cross has seen some demand emerge sub 1.0570.

- USD/JPY is holding close to 137.70, flat for the session. Early moves below 137.50 were supported, but the move towards 138.00 faltered.

- Ahead of the US CPI report tonight, UK job/wage figures print, along with the BoE financial stability report. In Germany, CPI is out, along with ZEW.

FX OPTIONS: Expiries for Dec13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E752mln), $1.0500(E717mln), $1.0550-55(E1.3bln), $1.0600-15(E1.3bln)

- AUD/USD: $0.6750(A$613mln), $0.6800(A$708mln)

- USD/CAD: C$1.3700($674mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/12/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 13/12/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/12/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 13/12/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.