-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Crude Surges On OPEC+ Output Cut, But Off Intraday Highs

EXECUTIVE SUMMARY

- OPEC+ Announces Surprise Oil Output Cuts (RTRS)

- McDonald’s Tells Staff To Work From Home as It Eyes Layoffs (DJ)

- ECB’s Guindos Says Underlying Inflation Dynamics to Stay Strong (BBG)

- China Q2 GDP Growth Can Exceed 7% - Chief Economists (MNI)

- BOJ Eyes Orders Amid Tighter Global Conditions (MNI)

- Finland’s Sanna Marin concedes election defeat (FT)

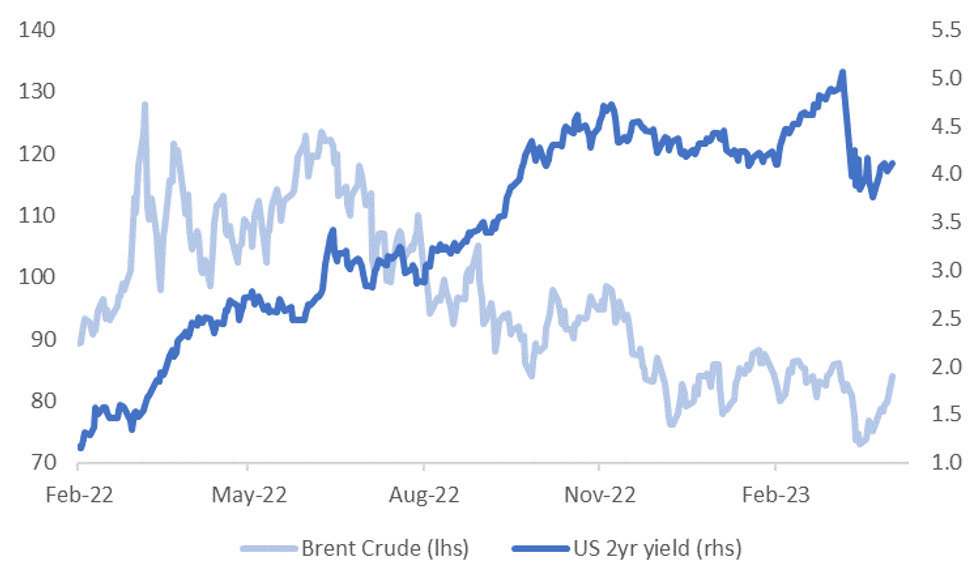

Fig. 1: US 2yr Government Bond Yield Versus Brent Crude

Source: MNI - Market News/Bloomberg

EUROPE

ECB: European Central Bank Vice President Luis de Guindos said underlying price pressures will stay elevated even as headline inflation slows. “We believe that headline inflation is likely to decline considerably this year, while underlying inflation dynamics will remain strong,” he said in a speech at the Ambrosetti workshop in Cernobbio, Italy, on Saturday. (BBG)

ECB: European Central Bank Executive Board member Fabio Panetta said company profit margins might be having a bigger impact on inflation than is generally acknowledged, according to an interview with the New York Times. (BBG)

FINLAND: Finland’s centre-right opposition clinched victory in Sunday’s parliamentary elections, inflicting defeat on centre-left prime minister Sanna Marin.(FT)

BANKING: Swiss investment bank UBS Group AG is preparing to lay off as many as 36,000 people in the wake of its takeover of rival Credit Suisse -- significantly more than first planned, according to a report Sunday.(BBG)

U.S.

US/CHINA: A bipartisan group of US lawmakers is taking their concerns about China to California next week where they plan to meet with top technology and entertainment executives, as well as with Taiwan President Tsai Ing-wen. (BBG)

ECONOMY: McDonald’s Corp. is temporarily closing U.S. offices this week as it looks to notify corporate employees about layoffs as part of a broader restructuring plan, Dow Jones reported.(BBG)

POLITICS: New York City police have thrown up metal barriers around Trump Tower and blocked roads near Manhattan Criminal Courthouse as they brace for potential protests ahead of Donald Trump's expected surrender to prosecutors on Tuesday. (RTRS)

POLITICS: Former President Donald Trump says he will leave Mar-a-Lago at 12pm on Monday to head to Trump Tower in New York, according to a post on Truth Social. (BBG)

OTHER

OIL: Saudi Arabia and other OPEC+ oil producers on Sunday announced further oil output cuts of around 1.16 million barrels per day, in a surprise move that analysts said would cause an immediate rise in prices and the United States called inadvisable. (RTRS)

OIL: OPEC+ announced a surprise oil production cut of more than 1 million barrels a day, abandoning previous assurances that it would hold supply steady and posing a new risk for the global economy. (BBG)

OIL: Kurdistan Regional Government and Iraq’s federal government have reached an initial agreement to resume oil exports through Ceyhan this week, Lawk Ghafuri, the KRG’s head of foreign media affairs, says in a tweet. (BBG)

JAPAN: Bank of Japan (BOJ) officials are concerned high levels of order backlogs for automobiles and capital goods are not sustainable and may present risks, as overseas economic conditions tighten, MNI understands. (MNI)

SOUTH KOREA: South Korea’s export slump extended through March, highlighting tepid demand in a global economy battered by banking-sector turmoil. (BBG)

NORTH KOREA: Satellite images show a high level of activity at North Korea's main nuclear site, a U.S. think tank reported on Saturday after the North Korean leader ordered an increase in production of bomb fuel to expand the country's nuclear arsenal. (RTRS)

AUSTRALIA: Australian Prime Minister Anthony Albanese won a historic victory at a by-election in the state of Victoria, becoming the first government in more than 100 years to take a district off the opposition outside a national vote. (BBG)

AUSTRALIA/CHINA: Chinese and Australian officials will meet in Beijing next week for talks related to their trade dispute, Guardian Australia reported. (BBG)

NZ: Seven of nine members of the RBNZ Shadow Board recommend a 25 basis point increase in the Official Cash Rate at the April 5 decision cited strong inflation pressures, the NZ Institute of Economic Research says in statement. (BBG)

NZ: New Zealand’s residential property listings in March were the lowest for that month since 2007, according to data from the nation’s largest property listing website realestate.co.nz. (BBG)

CHINA

ECONOMY: GDP growth in China can exceed 7.0% y/y, as the low-base effect from last year and recovering aggregate demand leads to accelerated growth, according to several chief economists interviewed by the Securities Daily. However, the m/m growth trend should be of concern, as this could slow in Q2. The economists called for proactive fiscal policy to implement subsidies and concessions, and for monetary policy to reduce the cost of personal consumer credit, encouraging demand. One expert expects further cuts to the reserve requirement ratio later this year, but the possibility of a loan prime rate decrease was declining. (MNI)

HOUSING: China’s home sales rose for a second month in March, according to a private data provider, signaling a recovery after policymakers expanded support for the sector. (BBG)

GEOPOLITICS: China is ready to work with Malaysia and other Southeast Asian nations to speed up consultation for a South China Sea code of conduct, Xinhua reported, citing Premier Li Qiang. (BBG)

TECH: China’s Foreign Minister Qin Gang urged Japan to refrain from supporting US efforts to suppress the Chinese semiconductor industry, while his counterpart pressed for the swift return of a Japanese citizen detained by Beijing. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY253 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY253 billion after offsetting the maturity of CNY255 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9790% at 10:04 am local time from the close of 2.3877% on Friday.

- The CFETS-NEX money-market sentiment index closed at 48 on Friday, compared with the close of 49 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8805 MON VS 6.6.8717 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8805 on Monday, compared with 6.8717 set on Friday.

OVERNIGHT DATA

CHINA MAR CAIXIN MANUFACTURING PMI 50.0; MEDIAN 51.4; FEB 51.6

JAPAN Q1 TANKAN LARGE MFG INDEX 1; MEDIAN 3; Q4 7

JAPAN Q1 TANKAN LARGE MFG OUTLOOK 3; MEDIAN 3; Q4 6

JAPAN Q1 TANKAN LARGE NON-MFG INDEX 20; MEDIAN 20; Q4 19

JAPAN Q1 TANKAN LARGE NON-MFG OUTLOOK 15; MEDIAN 17; Q4 11

JAPAN Q1 TANKAN LARGE ALL INDUSTRY CAPEX 3.2%; MEDIAN 14.2%; Q4 19.2%

JAPAN Q1 TANKAN SMALL MFG INDEX -6; MEDIAN -6; Q4 -2

JAPAN Q1 TANKAN SMALL MFG OUTLOOK -4; MEDIAN -6; Q4 -5

JAPAN Q1 TANKAN SMALL NON-MFG INDEX 8; MEDIAN 7; Q4 6

JAPAN Q1 TANKAN SMALL NON-MFG OUTLOOK 3; MEDIAN 2; Q4 -1

JAPAN MAR JIBUN PMI MFG 49.2; Feb 47.7

AUSTRALIA MAR JUDO BANK PMI MFG 49.1; FEB 50.5

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION GAUGE 0.3% M/M; FEB 0.4%

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION GAUGE 5.7% Y/Y; FEB 6.3%

AUSTRALIA FEB HOME LOANS -1.8% M/M; MEDIAN -0.9%; JAN -2.4%

AUSTRALIA FEB INVESTOR LOANS -0.5% M/M; JAN -3.0%

AUSTRALIA FEB OWNER-OCCUPIER LOANS -1.2% M/M; JAN -2.1%

AUSTRALIA FEB BUILDING APPROVALS 4.0% M/M; MEDIAN 10.0%; JAN -27.1%

AUSTRALIA FEB PRIVATE SECTOR HOUSES 11.3% M/M; JAN -13.5%

SOUTH KOREA MAR TRADE BALANCE -$6.0bn; MEDIAN -$4.62bn; FEB -$5.268bn

SOUTH KOREA MAR EXPORTS -13.6%Y/Y ; MEDIAN -16.0%; FEB -7.5%

SOUTH KOREA MAR IMPORTS -6.4% Y/Y; MEDIAN –6.5%; FEB 3.5%

SOUTH KOREA MAR PMI MFG 47.6; FEB 48.5

MARKETS

US TSYS: Cheaper In Asia, OPEC+ Cuts Oil Production

TYM3 deals at 114-23, -0-06+, with an observed range of 0-13 on volume of ~56k.

- Cash tsys sit 4-8bps cheaper across the major benchmarks, the curve has bear flattened.

- Tsys were pressured in early trade as OPEC+ announced a surprise oil production cut of more than 1 million barrels a day abandoning previous assurances it would hold supply steady linkhere.

- In the wake of the weaker than expected Caixin Mfg PMI print tsys were marginally pressured, however daily ranges remained intact in TU and TY.

- Fed dated OIS price a ~16bp hike into the May meeting with the terminal rate at 4.98%, there are ~55bps of cuts priced for 2023.

- On the wires today in Europe we have Swiss CPI, further out the ISM Manufacturing Survey and the final print of Manufacturing PMI headline. Fedspeak from Governor Cook will cross.

AUSSIE BONDS: Slightly weaker, Pressured by U.S. Tsys

ACGBs sit near session cheaps (YM -3.0 & XM -1.0) ahead of the bell with U.S Tsys pressured in Asia-Pac trade by news of a surprise oil production cut of more than a 1milllion barrels a day by OPEC+. The local data drop today had failed to provide a domestic catalyst for a market that has shifted its focus to tomorrow’s RBA rates decision.

- Cash ACGBs are 1-2bp cheaper with the 3/10c curve 1bp flatter with the AU-US 10-year yield differential +4bp at -21bp.

- Swaps are flat to 1bp richer with the 3s10s curve flatter and EFPs 2bp narrower.

- Bills pricing is 2-3bp weaker across the strip.

- Ahead of the RBA policy decision tomorrow, RBA dated OIS is 1-4bp firmer for meetings beyond April with a 15% chance of a 25bp hike priced for tomorrow.

- On the local data front, the Inflation Gauge eased to 5.7% in March from 6.3%, indicating that it likely peaked at 6.4% in January. Building Approvals showed a weaker-than-expected increase of 4.0% M/M (+10.0% expected) in February, while Home Loan data for February surprised on the upside with a fall of 0.9% M/M versus expectations of -1.8%.

- Further afield, today’s calendar is scheduled to deliver final prints for March Manufacturing PMIs globally along with the ISM Manufacturing Survey.

NZGBS: Late Session Bull Flattening

The NZGB 10-year benchmark closed at session bests despite weaker U.S Tsys in Asia-Pac trade. Without an obvious catalyst, late session strength in the long end appeared to be driven by the local market playing catch-up to U.S. Tsy strength ahead of the weekend. At the bell benchmark yields were 2-9bp lower with the 2/10 curve 7bp flatter and the NZ/US 10-year yield differential 4bp narrower at +60bp.

- 2s10s swaps curve bull steepened sharply into the close with rates flat to 10bp richer. The implied swap spread box curve flattened.

- RBNZ dated OIS closed little changed today with 28bp of tightening priced for Wednesday’s meeting and terminal OCR expectations at 5.28% (28bp of additional tightening assuming a 25bp hike this week).

- The RBNZ released a Debt-to-Income (DTI) framework that set the specifications that banks need to comply with if a DTI tool is activated. The publication does not immediately activate DTI restrictions.

- The local calendar is light ahead of the RBNZ decision on Wednesday with the NZIER Quarterly Business Opinion Survey tomorrow as the highlight.

- In Australia, the RBA policy is slated for tomorrow with a no-change outcome expected.

- Further afield, today’s calendar is scheduled to deliver final prints for March Manufacturing PMIs globally along with the ISM Manufacturing Survey.

EQUITIES: China Shares Outperform, Mixed Trends Elsewhere As Oil Price Spike Assessed

Much of the focus today has been on the fallout from the oil price spike post the weekend news of OPEC+ cutting production. Sentiment around the region is mixed, with still some positive carry over from last week's gains in US and EU bourses helping at the margin. Still, futures for both these markets are lower today, led by the Nasdaq (-0.57%).

- This backdrop has seen some modest underperformance of tech related plays, but only at the margins. The HSI is off by 0.59%, with the tech sub index off by -1.2% at this stage. The Kospi, in South Korea is also weaker, down 0.15%.

- China shares have fared better. The CSI up nearly 0.90%, the Shanghai Composite +0.56%. Optimism around the Q2 recovery from onshore equities, along with positive housing market data likely positive catalysts. This has offset the weaker than expected Caixin manufacturing PMI for March (50.0 versus 51.4).

- Japan stocks are outperforming modestly, up close to 0.60% for the Topix index at this stage.

- Elsewhere there has been some divergence around commodity exposure. The ASX 200 up around 0.60%, while the JCI in Indonesia has risen 0.20% and Malaysia's bourse 0.34%. These markets have outperformed Thai and Indian equities, but the divergences haven't been large.

GOLD: Threatening Downside Break Of $1950, Amid Broad USD Gains

Gold has spent the first part of the Monday session mostly on the back foot. The precious found some support under $1950, but hasn't been able to rebound far, last near $1951.50. This leaves us still around 0.9% lower from closing levels at the end of last week (above $1969). Gold weakness has predominantly been driven by the firmer dollar backdrop. The DXY is up 0.50%, last above 103.00.

- The spill over from the oil price surge (following the weekend OPEC+ supply cut) is evident in terms of higher US yields, which has aided the USD and weighed on equity futures.

- Still, there hasn't been any safe haven demand for gold at this stage.

- On the downside, March 27 lows came in close to $1943, below that is 22nd lows near $1934.

OIL: Crude Surges On OPEC+ Output Cut News, But Off Intraday Highs

Oil prices have jumped during APAC trading today following OPEC’s surprise announcement on Sunday that it will cut output by 1.1mbd from May following October’s 2mbd reduction. Prices are off their peaks but are still up over 5.5%. WTI is around $79.67/bbl and Brent $84.00 following intraday highs of $81.69 and $86.44 respectively. The USD index is 0.5% higher.

- Today’s rally has seen Brent break through both the 50- and 100-day simple moving averages and it is now heading towards the 200-day at $84.77.

- Saudi Arabia will account for 500kbd of the output reduction with UAE, Kuwait and Algeria making up the rest. Russia also announced that its production cuts will be extended to year end from June. Goldman Sachs has increased its forecast for end-2023 Brent to $95 and end-2024 to $100. There is a chance now that Q2 will post a deficit when a crude surplus had been expected.

- The announcement is likely to weigh on already strained US-Saudi relations and make it harder for central banks to bring inflation down.

- Later today March manufacturing PMIs print in the US and Europe and the US ISM is also released.

FOREX: USD Firmer In Asia as OPEC+ Cuts Oil Production

The greenback is firmer in the Asian session on Monday. Over the weekend OPEC+ announced a surprise oil production cut of more than 1 million barrels a day abandoning previous assurances it would hold supply steady linkhere.

- Kiwi is pressured, NZD/USD is down ~0.6%. The pair is dealing a touch below its 20-Day EMA ($0.6227). NZ Residential Property listings in March were the lowest since 2007 falling 18% Y/Y. Fonterra has lowered FY23 forecast farmgate milk prices to NZ$8.00-8.60/kg down from NZ$8.20-8.80/kg, as Chinese demand has not returned to expected levels and supply is increasing as the Northern Hemisphere entered spring.

- AUD/USD prints at $0.6660/70, ~0.3% softer. Judo Bank Manufacturing PMI printed its lowest level since May 2020 at 49.1.

- Yen is pressured as rising US Treasury Yields weigh, USD/JPY is up ~0.3% last printing at ¥133.35/45. Resistance comes in at ¥133.59, the high from 31 March.

- Elsewhere in G10 NOK was ~0.4% firmer in early dealing, however gains have been pared and USD/NOK is flat. EUR and GBP are both ~0.4% softer.

- Cross asset wise; WTI futures are ~5.5% firmer, they were however ~7% firmer in early dealing. BBDXY is ~0.4% higher, 10 Year US Treasury Yields are up ~5bps.

- On the wires today in Europe we have Swiss CPI, further out the ISM Manufacturing Survey and the final print of US Manufacturing PMI headline.

FX OPTIONS: Expiries for Apr03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850-55(E672mln), $1.0900(E1.1bln), $1.1000-10(E1.1bln)

- USD/JPY: Y128.00($1.5bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/04/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/04/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/04/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/04/2023 | 1400/1000 | * |  | US | Construction Spending |

| 03/04/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/04/2023 | 2015/1615 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.