-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Ouster of Barnier Leaves Little Dent

MNI EUROPEAN OPEN: Dollar Steady, US Yields Down Slightly, As Market Awaits The Fed

EXECUTIVE SUMMARY

- US SENATE CONFIRMS BERNSTEIN AS TOP WHITE HOUSE ECONOMIST - RTRS

- CHINA MAY CUT KEY POLICY RATE AND LPR, BUOYING BONDS - SHANGHAI SECURITIES

- CHINA FOREIGN MINISTER URGES BLINKEN TO STABILIZE TIES IN CALL - BBG

- JAPAN’s KISHIDA MAY DISSOLVE PARLIAMENT ON SAME DAY IF NO-CONFIDENCE VOTE SUBMITTED - FUJI TV

- NZ SHOULDN'T CUT RATES FOR ‘PROLONGED PERIOD,’ IMF SAY

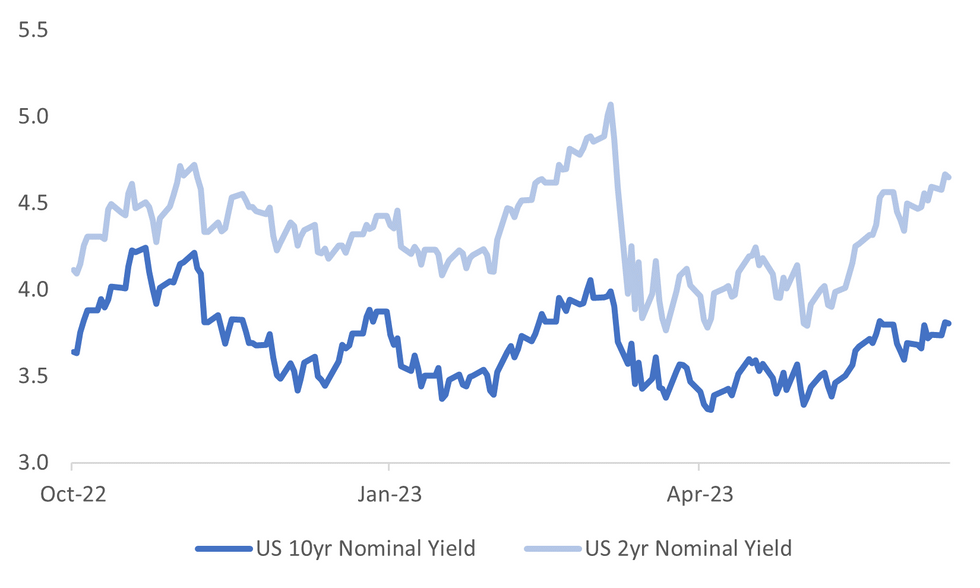

Fig. 1: US 2yr & 10yr Government Bond Yields

Source: MNI - Market News/Bloomberg

U.K.

BOE: The Bank of England was the first major central bank to start raising interest rates. Money markets are betting it may be the last to stop. Strong labor-market figures on Tuesday sparked big moves in bond markets, with two-year gilt yields jumping to the highest since 2008. They surged 26 basis points, the most since Liz Truss’s short-lived premiership. (BBG)

EUROPE

UKRAINE: Ukraine's blue and yellow flag flew over a ruined grocery store and Russian soldiers lay dead in the street of the village of Neskuchne, reached by Reuters journalists on Tuesday in the first independent confirmation of Ukraine's biggest advances for seven months against Russia's invasion. (RTRS)

U.S.

POLITICS: Former U.S. President Donald Trump pleaded not guilty on Tuesday to federal criminal charges that he unlawfully kept national-security documents when he left office and lied to officials who sought to recover them. (RTRS)

GEOPOLITICS: S National Security Adviser Jake Sullivan will travel to Tokyo to hold meetings with his counterparts from Japan, the Philippines and South Korea, according to a statement from the National Security Council. Will include “the first-ever trilateral meeting of the Japanese, Philippine, and US national security advisers”. (BBG)

GEOPOLITICS: President Joe Biden discussed democracy, trade and climate change on Tuesday with Uruguay President Luis Lacalle Pou at the White House in an unannounced visit by one of Latin America’s last centrist leaders. (BBG)

ECONOMY: The U.S. Senate on Tuesday confirmed Jared Bernstein as chairman of the Council of Economic Advisers (CEA) in a 50-49 vote, elevating a longtime adviser to President Joe Biden who began his career as a jazz musician and social worker. (RTRS)

ECONOMY: Ken Griffin, whose hedge fund churned out a record $16 billion for clients last year, is increasing his focus on credit trading as he braces for a potential US recession. “We’re much more cautious about 2024,” the billionaire founder of Citadel said in an interview in Hong Kong, referring to his outlook for the world’s largest economy. “We’ll look at the credit markets as a source of opportunity. Credit should be a meaningful contributor later this year” and next for Citadel, he said. (BBG)

OTHER

JAPAN: Japanese Prime Minister Fumio Kishida may dissolve the country's lower house of parliament if the opposition submits a no-confidence vote on Friday, and the dissolution would come the same day, Fuji TV reported. (RTRS)

SOUTH KOREA: South Korea's jobless rate fell in May to a record low, official data showed on Wednesday, indicating a still robust labour market although conditions were softer in the manufacturing sector amid slowing economic growth. (RTRS)

INDIA: Ahead of Indian Prime Minister Narendra Modi's state visit to Washington, the Biden administration is pushing New Delhi to cut through its own red tape and advance a deal for dozens of U.S.-made armed drones, two people familiar with the matter said. (RTRS)

NZ: New Zealand’s economy may have contracted for a second consecutive quarter, putting it into recession sooner than the central bank expected. Gross domestic product fell 0.1% in the first quarter from the fourth, when it dropped 0.6%, according to the median forecast in a Bloomberg survey of economists. The Reserve Bank predicts 0.3% growth. Statistics New Zealand releases the GDP report at 10:45 a.m. Thursday in Wellington. (BBG)

NZ: New Zealand’s central bank will need to hold interest rates at their current level “for a prolonged period” and should remain open to further hikes if necessary to tame inflation, the International Monetary Fund said. (BBG)

AUSTRALIA: Australian financial regulators are reviewing the nation’s preparedness and management arrangements for future banking turmoil following the speed of recent runs on lenders in Europe and the US. “The council is assessing Australia’s crisis management settings to ensure they remain robust in light of international developments,” the regulators said in a quarterly statement on Wednesday. “Communication and coordination arrangements across the council agencies have also been reviewed and updated.” (BBG)

CHINA

POLICY: China’s central bank is expected to cut its key policy rate this week and take more easing measures ahead, providing further liquidity support for its bond market, Shanghai Securities News reports, citing analysts. (BBG)

POLICY: China's central bank is widely expected to cut the borrowing cost of medium-term policy loans for the first time in 10 months on Thursday, after it lowered two key short-term policy rates, a Reuters poll showed. (RTRS)

FLOWS: Chinese investors are shifting more money into overseas assets as the Federal Reserve’s interest-rate hikes add allure to dollar deposits and bonds, putting pressure on slumping local stocks. Outflows have been growing this year through two key channels that allow investors to buy assets abroad through licensed institutions. That’s straining regulatory quotas as local firms and onshore units of global giants like JPMorgan Chase & Co. and BlackRock Inc. race to tap the demand. (BBG)

US/CHINA: Chinese Foreign Minister Qin Gang told Secretary of State Antony Blinken the US should stop hurting China’s security interests in the name of competition on a call on Wednesday before the American official’s expected arrival in Beijing this month. (BBG)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Weds; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates at 1.90%. The operation kept the liquidity unchanged after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8447% at 10:16 am local time from the close of 1.8357% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, compared with the close of 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1566 WED VS 7.1498 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1566 on Wednesday, compared with 7.1498 set on Tuesday.

OVERNIGHT DATA

SOUTH KOREA MAY IMPORT PRICE INDEX Y/Y -12.0%; PRIOR -6.0%

SOUTH KOREA MAY EXPORT PRICE INDEX Y/Y -11.2%; PRIOR -7.2%

SOUTH KOREA MAY UNEMPLOYMENT RATE 2.5%; MEDIAN 2.7%; PRIOR 2.6%

SOUTH KOREA APR MONEY SUPPLY M2 SA M/M -0.3%; PRIOR -0.2%

NZ Q1 CURRENT ACCOUNT GDP RATIO YTD -8.5%; MEDIAN -9.0%; PRIOR -9.0%

NZ Q1 BOP CURRENT ACCOUNT BALANCE NZD -5.215BN; MEDIAN -6.85BN; PRIOR -10.65BN

MARKETS

US TSYS: Marginally Richer In Asia, FOMC In View

TYU3 deals at 112-29, +0-07+, a 0-07 range has been observed on volume of ~76k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull steepening is apparent.

- Tsys firmed in early dealing, there was no obvious headline driver. Asia-Pac participants perhaps used Tuesday's cheapening as an opportunity to exit short positions/enter fresh longs.

- The moderate richening held through the remainder of the session. Narrow ranges were observed and little meaningful macro headline flow crossed. The proximity to today's FOMC meeting perhaps limiting activity.

- FOMC dated OIS remained stable, pricing no change for today's meeting with a terminal rate of 5.25% in July. There are ~10bps of cuts in 2023.

- May PPI crosses before the FOMC rate decision is due. The MNI preview of the event is here.

JGBS: Futures Down, But Holding Above Session Lows

Futures sit at 148.08, -.18. There was a slight offered tone this afternoon, as US futures edged down from session highs, but there was little follow through. Earlier session lows just under 148.00 remain intact for now.

- In the cash bond space, yields are touch firmer versus earlier lows, the 10yr creeping back up towards 0.44%, although the 20-40yr space still remains slightly lower in yield terms for the session.

- In the swap space, similar trends are evident. The 10yr is back to 0.596%, range on the day being 0.58125/0.60250%.

- The local data calendar is empty today. We get data tomorrow (May trade balance, core machine orders and weekly investment flows) ahead of Friday's BoJ decision. Tomorrow also has a 3month bill sale and BOJ bond purchase operations.

- The main domestic news today being local media reporting that PM Kishida may dissolve the lower house if the opposition submits a no-confidence motion this Friday.

AUSSIE BONDS: Curve Bear Flattens On Wednesday, May Labour Report Due Tomorrow

ACGB's sit 3-9bps cheaper across the major benchmarks, the curve has bear flattened. The spillover from Tuesday's core global FI cheapening weighed at the open and held through the session.

- Futures are a touch lower, XM (-0.035) and YM (-0.066), however ranges have been narrow thus far today.

- RBA dated OIS remains stable, pricing a terminal rate of 4.49% in December.

- Rabobank Rural Confidence Index improved slightly in Q1 to -22 from -25 as Rabobank noted that farmers are adjusting to a normalisation in economic conditions.

- Looking ahead, on the wires tomorrow we have the May Labour Market Report. The Unemployment Rate is expected to hold steady at 3.7%. June Consumer Inflation Expectations is due.

NZGBs: Cheaper On Wednesday, GDP On Tap Tomorrow

NZGB's finished dealing ~5bps cheaper across the major benchmarks. The spillover from Tuesday's core global FI cheapening weighed at the open and held through the session.

- Swap rates ticked a touch higher, with the 2s10s spread marginally flattening. RBNZ pricing remains stable with a terminal rate of 5.64% seen in October.

- The IMF noted that the RBNZ shouldnt cut rates for a prolonged period, warning that a reignition of demand would need more tightening. More here.

- The Q1 Current Account Balance was a touch narrower than expected printing a $5.215bn deficit vs $6.85bn exp.

- On the wires tomorrow we have Q1 GDP. A fall of -0.1% Q/Q is expected.

EQUITIES: Fresh Highs For Japan Stocks, Korean Shares Slide

Japan stocks again remain outperformers, following positive leads from US/EU markets during Tuesday trade. Trends are mixed elsewhere, the Kospi down, while HK share shares are around flat at the break. US futures have been fluctuating close to flat for much of the session.

- The Nikkei 225 is up a further ~1.50%, hitting fresh highs for this uptrend. Toyota was a strong performer, rising 5%, while construction equipment makers rallied on China stimulus hopes.

- The HSI is around flat, but mainland China shares are firmer, +0.52% at the break for the CSI 300. Education related stocks are higher after the authorities announced plans to improve the vocational school and public education systems. The consensus is also now for a cut in the 1yr MLF rate, announced tomorrow.

- South Korea shares bucked the more positive tech trends, with the Kospi off by 0.60% at this stage, the Kosdaq down 1.8%. The electronics sector is a source of weakness. These moves unwind some of South Korea's recent equity market outperformance. The Taiex is close to flat.

- In SEA trends are mixed, Malaysia shares are higher, with a crude palm oil bounce helping. Indonesian stocks are down though, last off 0.50%.

FOREX: USD Index Steady, NZD Outperforming Modestly

There haven't been any dramatic FX moves since the Asia Pac open. The BBDXY sits slightly above it Tuesday NY closing level, last near 1232.00. We are comfortably above post US CPI lows (near 1229). NZD and AUD are tracking higher though in earlier dealings, albeit below Tuesday session highs. US cash tsys are close to unchanged, reversing an early cheapening impetus.

- USD/JPY is tracking slightly lower, last in 140.05/10 region. EUR/USD is back to 1.0790, with gains above 1.0800 unable to be sustained.

- AUD/USD is at 0.6770/75, slightly above on NY closing levels from Tuesday. Better metals commodity price action helping to offset higher core yields.

- NZD/USD is outperforming at the margins, last in the 0.6155/60 region. Earlier data showed the current account balance for Q1, slightly better than expected (-8.5% of GDP, -9.0% expected). Food prices rose 0.3% in May, versus 0.5% in Apr.

- The data calendar remains light for the rest of the Asia Pac session, with focus likely to firmly rest on the upcoming Fed decision later in the US.

OIL: Prices Hold Onto Gains As Wait For Fed Announcement

Oil prices are in a holding pattern ahead of the Fed decision later. They have maintained gains driven by monetary stimulus in China and US plans to refill the SPR. WTI is remaining below $70 and is flat on the day at $69.45/bbl, close to the intraday high, and Brent has traded below $75 but is up 0.2% to $74.42.

- OPEC estimated in its monthly report on Tuesday that there will a crude shortfall of about 2.7mbd in July following Saudi Arabia’s announcement to cut output by a further 1mbd and based on a forecasted increase in global demand. Saudi Arabia is yet to say whether the move will be extended beyond July. The International Energy Agency’s monthly report is also released later. Previously it also expected the market to be in deficit in H2 2023. So, far these projections have done little to boost oil prices.

- Bloomberg reported that API recorded crude inventories rose 1.02mn barrels last week after a 1.7mn drawdown the previous week, according to people familiar with the data. Gasoline stocks rose 2.075mn and distillate +1.39mn. The official EIA data is published today.

- Later the Fed decision is announced and it is expected to keep rates on hold (see MNI’s Fed Preview here). An unexpected hike would likely drive oil prices sharply lower on US recession fears. There is also US PPI data for May, UK April IP/GDP and euro area IP.

GOLD: Bullion Up Moderately As Waits For Fed Decision

Gold prices finished Tuesday down 0.7% to $1943.72/oz on higher US Treasury yields. Yields fell following the close-to-expected US CPI data but then rose sharply, which weighed on bullion whereas the USD was down. Ahead of the Fed decision later, gold is up 0.3% to $1949.42/oz and the USD has traded sideways.

- Today gold reached an intraday low of $1942.26 followed by a high of $1949.47. Support lies at $1932.20, the May 31 low.

- Later the Fed decision is announced and it is expected to keep rates on hold (see MNI’s Fed Preview here), which should be supportive of gold. If it unexpectedly hikes, then gold prices are likely to fall sharply as yields rise. There is also US PPI data for May, which is forecast to moderate further.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 14/06/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 14/06/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 14/06/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 14/06/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 14/06/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/06/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 14/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/06/2023 | 1230/0830 | * |  | CA | Household debt-to-income |

| 14/06/2023 | 1230/0830 | *** |  | US | PPI |

| 14/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 14/06/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 15/06/2023 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.